Market Overview

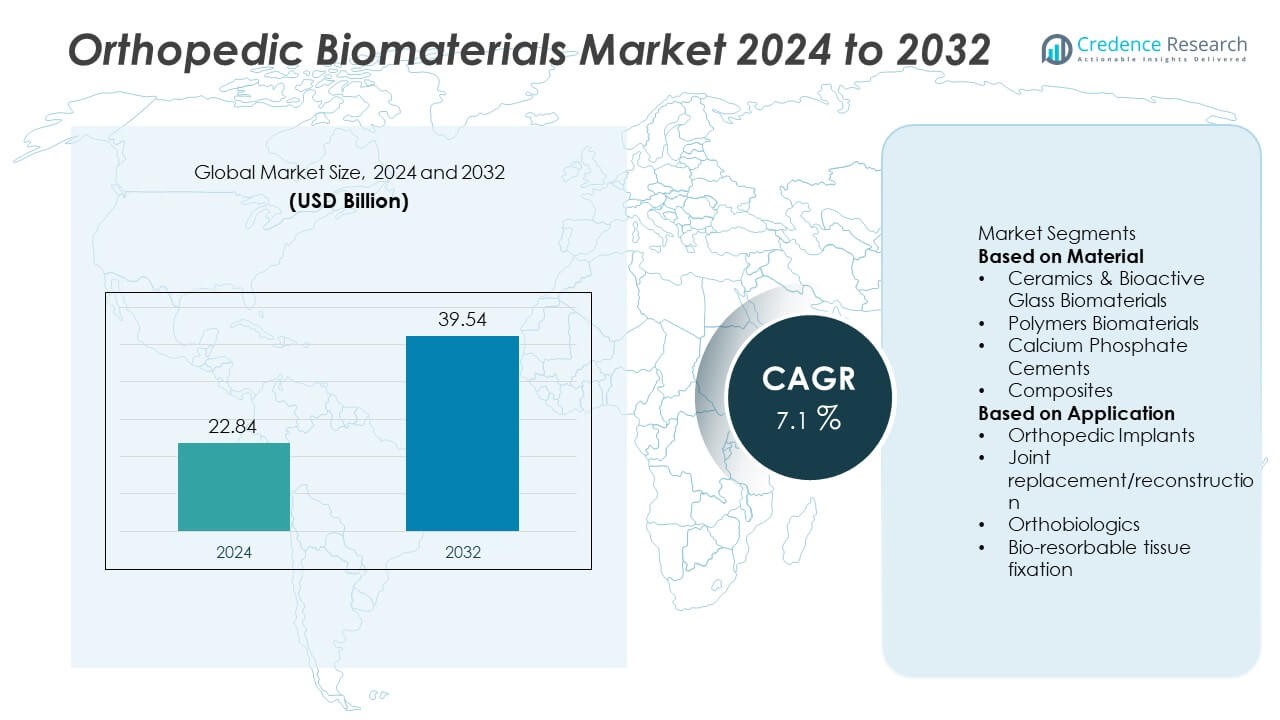

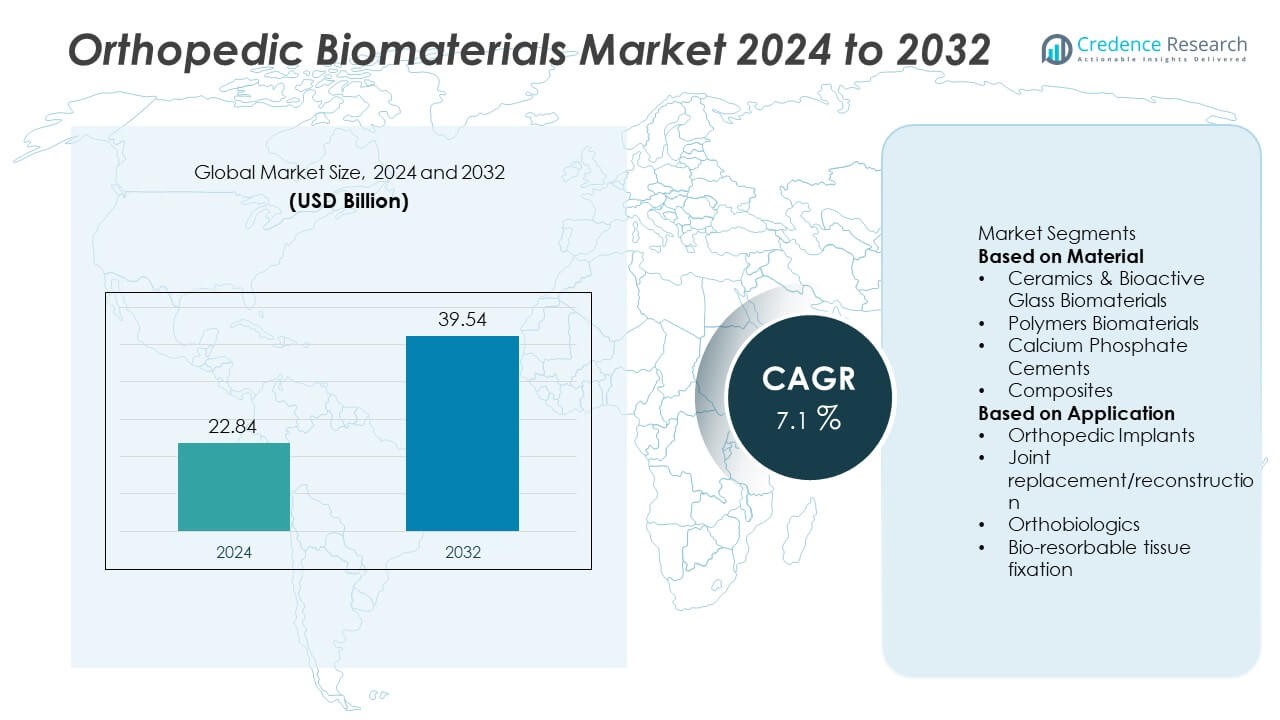

The global Orthopedic Biomaterials Market was valued at USD 22.84 billion in 2024 and is projected to reach USD 39.54 billion by 2032, expanding at a CAGR of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Orthopedic Biomaterials Market Size 2024 |

USD 22.84 Billion |

| Orthopedic Biomaterials Market, CAGR |

7.1% |

| Orthopedic Biomaterials Market Size 2032 |

USD 39.54 Billion |

The orthopedic biomaterials market is led by key players such as Stryker Corp, Zimmer Biomet, Depuy Synthes Inc., Evonik Industries AG, DSM Biomedical, Globus Medical, Invibo Ltd., Exactech Inc., Matexcel, and AdvanSource. These companies dominate through extensive product portfolios, strong R&D capabilities, and global distribution networks. North America leads the market with a 39.4% share in 2024, supported by high surgical volumes, advanced healthcare infrastructure, and early adoption of innovative biomaterials. Europe follows with a 28.7% share, while Asia-Pacific exhibits the fastest growth driven by expanding medical infrastructure and increasing orthopedic surgery rates.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The orthopedic biomaterials market was valued at USD 22.84 billion in 2024 and is projected to reach USD 39.54 billion by 2032, growing at a CAGR of 7.1%.

- Rising cases of musculoskeletal and joint disorders, along with an aging global population, are driving strong demand for advanced implant materials and bioresorbable polymers.

- The market is witnessing trends toward smart biomaterials, 3D printing integration, and personalized implant solutions that enhance surgical precision and recovery outcomes.

- Leading players such as Stryker Corp, Zimmer Biomet, and DSM Biomedical focus on innovation, product expansion, and strategic collaborations to strengthen market presence.

- North America dominates with a 39.4% share, followed by Europe at 28.7%, while ceramics and bioactive glass biomaterials hold the leading 38.2% segment share due to superior bone integration and biocompatibility.

Market Segmentation Analysis:

By Material

Ceramics & bioactive glass biomaterials dominate the orthopedic biomaterials market, accounting for nearly 38.2% share in 2024. Their dominance is driven by superior osteoconductivity, biocompatibility, and integration with natural bone tissue, making them ideal for bone grafts and coatings in implants. Growing use of hydroxyapatite and bioactive glass in dental and spinal applications further boosts their adoption. Polymers biomaterials such as PEEK and PMMA are also witnessing strong demand due to their flexibility, radiolucency, and suitability in joint replacement and fixation systems.

- For instance, Evonik Industries AG introduced its VESTAKEEP® Fusion PEEK filament for 3D-printed implants, achieving a tensile strength of 110 MPa and elastic modulus of 3.2 GPa, tailored for load-bearing orthopedic applications.

By Application

Orthopedic implants lead the market, holding about 41.7% share in 2024. The segment benefits from the increasing prevalence of trauma injuries, osteoporosis, and joint disorders requiring reconstructive procedures. Rising adoption of bioresorbable implants and 3D-printed solutions enhances growth potential. Joint replacement and reconstruction applications are expanding rapidly with growing geriatric populations and advancements in implant design. Meanwhile, orthobiologics and bioresorbable tissue fixation are gaining traction due to their role in accelerating healing and reducing secondary surgeries.

- For instance, Zimmer Biomet Holdings, Inc. obtained Japan’s PMDA approval for its iTaperloc® Complete and iG7™ Hip System incorporating iodine-treated implant surfaces that inhibit bacterial adhesion on the implant surface.

Key Growth Drivers

Rising Musculoskeletal Disorders

The increasing prevalence of musculoskeletal disorders such as osteoarthritis, osteoporosis, and spinal injuries drives strong demand for orthopedic biomaterials. Aging populations and lifestyle-related conditions are fueling surgical volumes for bone repair and joint replacement. Advancements in biocompatible materials like hydroxyapatite and PEEK enhance implant longevity and functionality. The growing need for reconstructive procedures in both trauma and elective surgeries supports consistent growth across hospitals and specialized orthopedic centers worldwide.

- For instance, Evonik Industries AG reports that its bioresorbable polymer biomaterial line (RESOMER®) has been used in over 500,000 orthopedic trauma implants worldwide, providing mechanical stability while being absorbed by the body

Technological Advancements in Material Science

Continuous innovation in biomaterial engineering is transforming implant design and performance. Developments in bioresorbable polymers, hybrid composites, and surface-modified ceramics have improved bone integration and reduced rejection risks. Manufacturers are increasingly adopting 3D printing and nanotechnology to create patient-specific implants with superior biomechanical properties. These material innovations are expanding clinical applications, reducing recovery times, and strengthening the market position of advanced orthopedic solutions globally.

- For instance, Exactech, Inc. achieved FDA 510(k) clearance for its Truliant® Porous Tibial Tray featuring a 3D-printed structure that mimics cancellous bone and allows optional cancellous-bone screws designed for enhanced fixation in knee replacements.

Growing Demand for Joint Reconstruction and Replacement

Rising global rates of joint degeneration and trauma injuries are accelerating adoption of orthopedic biomaterials in knee, hip, and shoulder replacements. Advancements in minimally invasive surgical techniques and implant customization improve patient recovery and implant success rates. Increased healthcare spending and insurance coverage in emerging economies further boost procedural volumes. Demand for bioactive and load-bearing materials continues to rise, enabling better long-term performance and structural stability in orthopedic reconstruction.

Key Trends and Opportunities

Shift Toward Bioresorbable and Smart Biomaterials

The market is witnessing a notable shift toward bioresorbable materials that eliminate the need for secondary surgeries. Smart biomaterials with controlled drug release and self-healing properties are emerging as key innovations. Research into biodegradable composites and polymer-ceramic hybrids enhances bone regeneration and reduces infection risks. These trends create opportunities for manufacturers to develop next-generation materials aligned with regenerative medicine and personalized healthcare approaches.

- For instance, Stryker Corporation launched its Citrelock™ Tendon Fixation Device System which utilises its Citregen™ bioresorbable material; the material exhibits compressive strength comparable to cortical bone and a modulus similar to cancellous bone during the healing phase.

Integration of 3D Printing and Regenerative Techniques

The integration of 3D printing with regenerative technologies is reshaping orthopedic material production. Customized scaffolds and implants designed through additive manufacturing improve fit, reduce complications, and shorten surgery times. Collaboration between material scientists and orthopedic surgeons accelerates innovation in patient-specific implants. The trend supports cost efficiency and sustainability, offering strong growth potential in advanced healthcare systems worldwide.

- For instance, developed its Tapestry® RC Biointegrative Implant System featuring a porous scaffold with 38% of pore volume within the 50-300 µm range, designed for arthroscopic rotator cuff augmentation in under 5 minutes.

Key Challenges

High Cost of Advanced Biomaterials and Implants

Despite technological progress, the high cost of advanced orthopedic biomaterials limits accessibility in developing regions. Production expenses linked to precision manufacturing, sterilization, and quality assurance elevate overall implant prices. Hospitals in low-income economies often rely on conventional metal implants instead of newer bioactive alternatives. This cost disparity hinders widespread adoption and poses a challenge for achieving equitable access to modern orthopedic care.

Stringent Regulatory and Clinical Approval Processes

Orthopedic biomaterials face rigorous regulatory scrutiny to ensure long-term safety and efficacy. Lengthy approval timelines and complex clinical testing requirements delay commercialization and increase development costs. Manufacturers must meet diverse regional standards, from FDA and EMA guidelines to ISO certifications, creating additional compliance burdens. These challenges slow product launches and limit smaller companies’ ability to compete in global markets.

Regional Analysis

North America

North America dominates the orthopedic biomaterials market with a 39.4% share in 2024. Strong demand is driven by a high prevalence of orthopedic disorders, rising adoption of advanced implants, and a well-established healthcare infrastructure. The United States leads regional growth due to extensive R&D investments and favorable reimbursement frameworks. The presence of major manufacturers and early adoption of technologies such as 3D-printed implants and bioresorbable materials further strengthen market leadership across hospitals and surgical centers in the region.

Europe

Europe holds a significant 28.7% share in the orthopedic biomaterials market in 2024. Increasing cases of joint reconstruction and spinal injuries, along with the rising elderly population, support steady demand. Germany, the United Kingdom, and France are key contributors due to robust medical device regulations and advanced clinical practices. Government initiatives promoting minimally invasive surgeries and bio-compatible materials are boosting adoption. Continuous innovation in bioactive ceramics and polymer-based implants enhances the region’s market competitiveness.

Asia-Pacific

Asia-Pacific accounts for 23.5% of the global orthopedic biomaterials market in 2024, making it the fastest-growing region. Rapid urbanization, improving healthcare infrastructure, and rising awareness about advanced orthopedic procedures drive regional expansion. China, Japan, and India lead growth due to increasing surgical volumes and government investments in healthcare modernization. The growing middle-class population and availability of cost-effective biomaterials stimulate demand. Local manufacturing advancements and collaborations with international firms further accelerate market penetration.

Latin America

Latin America captures around 5.2% share of the orthopedic biomaterials market in 2024. Rising cases of trauma injuries and orthopedic disorders, combined with expanding access to healthcare services, are fueling demand. Brazil and Mexico dominate due to the rising number of orthopedic surgeries and improved hospital infrastructure. Market growth is supported by increasing imports of bioresorbable implants and training programs for orthopedic surgeons. However, limited reimbursement policies and high product costs slightly restrain wider adoption across smaller markets.

Middle East & Africa

The Middle East & Africa region holds a 3.2% share in the orthopedic biomaterials market in 2024. Growth is driven by the rising burden of musculoskeletal disorders, healthcare modernization, and expanding orthopedic clinics. The United Arab Emirates and Saudi Arabia lead regional adoption through investments in advanced medical technologies and surgical care facilities. Africa shows gradual progress due to improved healthcare access and foreign medical collaborations. Despite strong growth potential, high treatment costs and limited awareness continue to challenge market expansion.

Market Segmentations:

By Material

- Ceramics & Bioactive Glass Biomaterials

- Polymers Biomaterials

- Calcium Phosphate Cements

- Composites

By Application

- Orthopedic Implants

- Joint replacement/reconstruction

- Orthobiologics

- Bio-resorbable tissue fixation

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the orthopedic biomaterials market is characterized by the strong presence of leading companies such as Stryker Corp, Zimmer Biomet, Depuy Synthes Inc., Evonik Industries AG, DSM Biomedical, Globus Medical, Invibo Ltd., Exactech Inc., Matexcel, and AdvanSource. These players focus on continuous product innovation, advanced material development, and strategic collaborations to strengthen their global market position. Companies are investing in biocompatible and bioresorbable materials to enhance implant longevity and patient outcomes. Technological advancements in 3D printing, nanostructured coatings, and regenerative biomaterials are driving product differentiation. Strategic mergers, acquisitions, and partnerships with healthcare providers and research institutions are expanding product portfolios and geographic reach. Growing emphasis on sustainable production processes and precision manufacturing further intensifies competition, as key players aim to meet stringent regulatory standards and rising global demand for high-performance orthopedic solutions.

Key Player Analysis

- Invibo Ltd.

- Stryker Corp

- Evonik Industries AG

- Matexcel

- Globus Medical

- Depuy Synthes Inc.

- AdvanSource

- DSM Biomedical

- Exactech, Inc.

- Zimmer Biomet

Recent Developments

- In July 2025, Zimmer Biomet Holdings, Inc. announced a definitive agreement to acquire Monogram Technologies Inc. to expand its robotic and navigation-enabled orthopedic biomaterials and implant technologies.

- In September 2024, Maxx Orthopedics, in partnership with Invibio Biomaterial Solutions (a division of Victrex plc), secured U.S. Food and Drug Administration (FDA) Investigational Device Exemption (IDE) approval to begin a clinical study for the use of the Invibio PEEK-OPTIMA™ femoral component within the Freedom® Total Knee System.

- In March 2023, Invibio launched its PEEK-OPTIMA™ AM Filament, an implantable-grade PEEK polymer optimized for fused filament additive manufacturing (FFF) medical devices.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing adoption of bioresorbable and bioactive materials will enhance implant performance and healing.

- Growing focus on personalized orthopedic implants will drive demand for 3D printing and digital modeling.

- Expansion in aging populations worldwide will continue to raise joint reconstruction surgeries.

- Technological integration with nanomaterials will improve bone regeneration and reduce post-surgical complications.

- Partnerships between medical device firms and research institutes will accelerate product innovation.

- Emerging economies will see rapid growth due to improved healthcare infrastructure and accessibility.

- Regulatory harmonization across major regions will support faster product approvals.

- Sustainability trends will encourage the development of eco-friendly and recyclable biomaterials.

- Increased R&D funding will foster breakthroughs in regenerative and hybrid orthopedic materials.

- Competitive intensity will rise as global players expand product portfolios through acquisitions and collaborations.