Market Overview

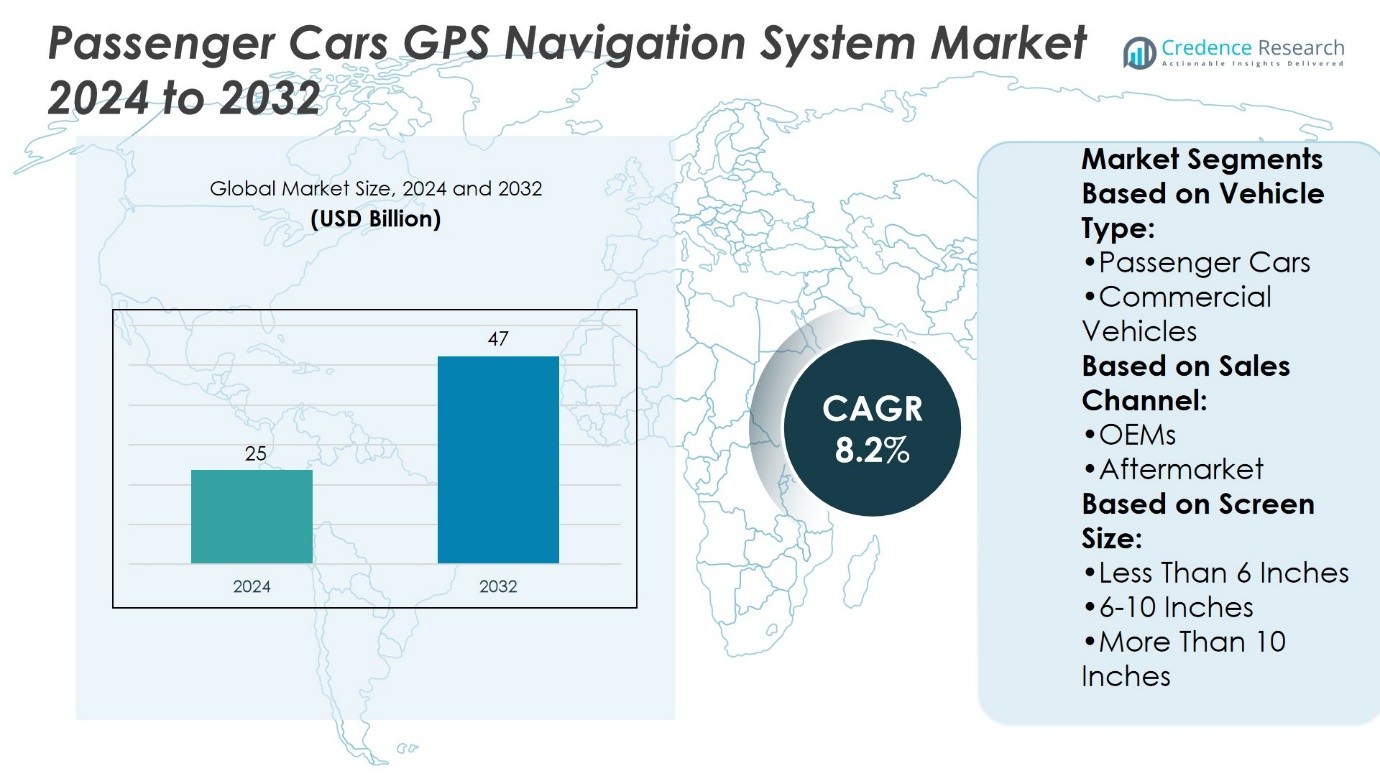

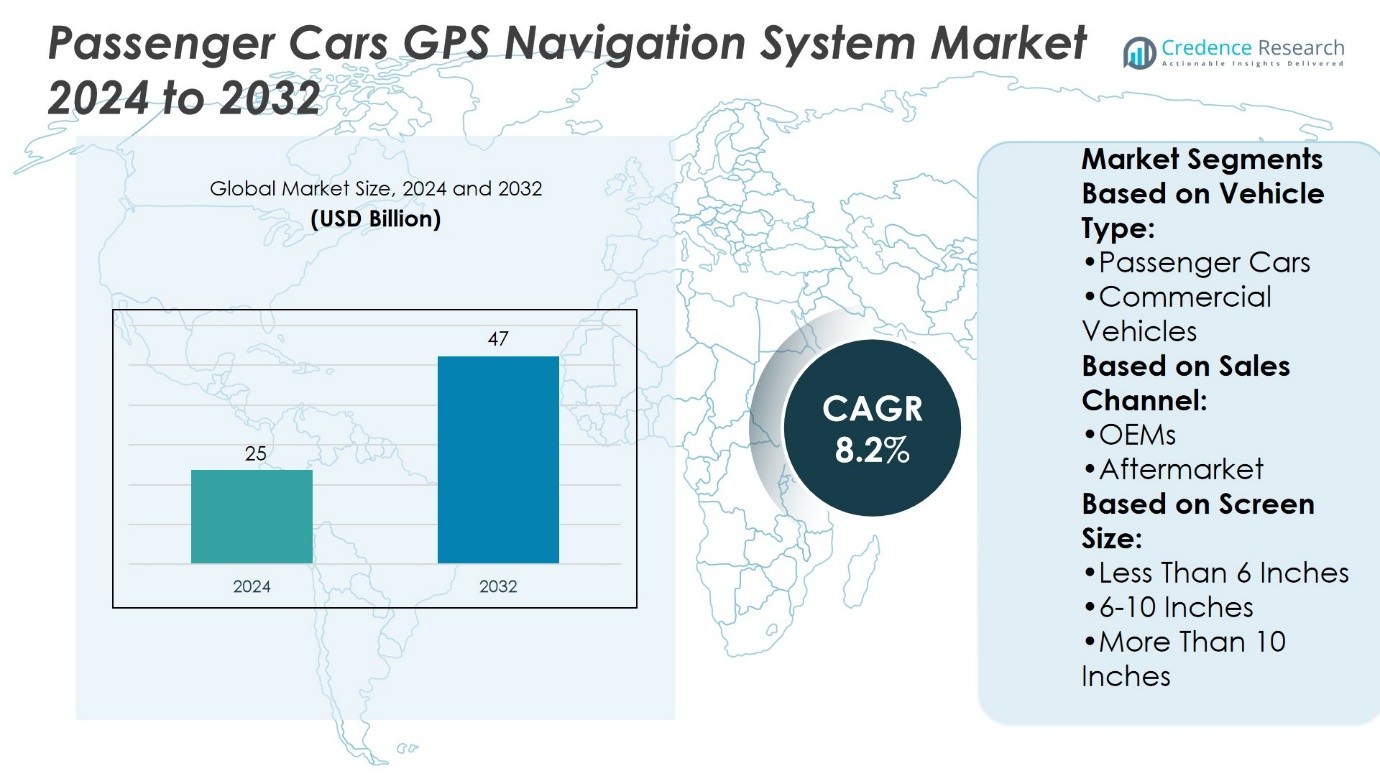

Passenger Cars GPS Navigation System Market size was valued at USD 25 billion in 2024 and is anticipated to reach USD 47 billion by 2032, at a CAGR of 8.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Passenger Cars GPS Navigation System Market Size 2024 |

USD 25 Billion |

| Passenger Cars GPS Navigation System Market , CAGR |

8.2% |

| Passenger Cars GPS Navigation System Market Size 2032 |

USD 47 Billion |

The Passenger Cars GPS Navigation System Market is driven by growing demand for real-time traffic updates, route optimization, and enhanced driving safety. Rising urban congestion and expansion of connected vehicle technologies push automakers to integrate advanced in-dash systems as standard features. Consumers increasingly prefer larger displays, voice control, and smartphone compatibility, boosting adoption across vehicle segments. Cloud-based updates and AI-enabled predictive routing strengthen system reliability and convenience. Trends also highlight strong integration with infotainment platforms and advanced driver assistance systems, ensuring navigation remains central to digital mobility strategies and future-ready passenger car technologies.Top of Form

Bottom of Form

The Passenger Cars GPS Navigation System Market shows strong presence across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America and Europe lead with high adoption of advanced in-dash systems, while Asia Pacific grows fastest due to rising vehicle production and urban mobility needs. Latin America and MEA show gradual adoption supported by smart city projects and premium car sales. Key players include Apple, Garmin, Continental, DENSO, Mitsubishi Electric, Panasonic, Alps Alpine, and JVCKENWOOD.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Passenger Cars GPS Navigation System Market size was valued at USD 25 billion in 2024 and is projected to reach USD 47 billion by 2032, at a CAGR of 8.2%.

- Growing demand for real-time traffic updates, safer driving, and optimized routing drives adoption.

- Integration of AI-powered predictive routing and cloud-based updates strengthens system accuracy and convenience.

- Competition intensifies as global players innovate with larger displays, voice recognition, and smartphone connectivity.

- High integration costs and availability of free mobile navigation apps act as restraints.

- North America and Europe lead adoption, while Asia Pacific shows fastest growth supported by rising vehicle production.

- Latin America and Middle East & Africa record smaller shares but gain traction through smart city projects and premium vehicle demand.

Market Drivers

Rising Demand for Real-Time Navigation and Traffic Management

The growing need for accurate navigation and live traffic data drives adoption in the Passenger Cars GPS Navigation System Market. Urban congestion and expanding road networks increase dependence on real-time guidance. Drivers value dynamic rerouting that helps avoid delays and reduce fuel use. Systems integrate predictive analytics to improve route accuracy. Navigation providers partner with telecom firms for faster data delivery. The trend strengthens consumer reliance on GPS-enabled vehicles.

- For instance, TomTom’s Traffic APIs analyze over 3.5 billion kilometers of global road data daily and update traffic information every 30 seconds, ensuring timely route adjustments. Drivers value dynamic rerouting that helps avoid delays and reduce fuel use.

Integration with Advanced Driver Assistance Systems

The industry sees strong momentum from integration with ADAS features. Navigation systems connect with lane guidance, adaptive cruise control, and collision warnings. This combination improves driving safety and decision-making. Automakers embed GPS navigation as part of broader connected car platforms. The integration supports regulatory goals for road safety. It also enhances consumer confidence in adopting advanced technology.

- For instance, HERE’s HD Live Map provides details across 3.3 million kilometers of roads to enhance high-definition situational awareness in ADAS. It also enhances consumer confidence in adopting advanced technology.

Expansion of Connected Car Ecosystems

Connected car development accelerates demand for advanced GPS navigation platforms. Automakers deploy telematics solutions that include location-based services. Navigation links with infotainment and vehicle-to-everything communication. Cloud-based mapping ensures continuous updates across regions. It supports efficient fleet management and personalized driver assistance. The ecosystem enables stronger data monetization opportunities for industry stakeholders.

Growth in Consumer Expectations for Convenience and Efficiency

Consumer demand for seamless driving experiences increases adoption of advanced GPS features. Users expect intuitive interfaces, voice control, and smartphone integration. Automakers provide in-dash navigation systems that reduce distraction. It strengthens differentiation in highly competitive passenger car markets. Buyers value systems that optimize routes for fuel savings and lower emissions. The trend ensures navigation remains central to digital mobility strategies.

Market Trends

Increasing Shift Toward Integrated In-Dash Navigation

The Passenger Cars GPS Navigation System Market shows a clear shift from standalone devices to integrated in-dash systems. Automakers equip vehicles with built-in navigation to improve safety and driver convenience. Integration reduces the need for separate devices and enhances dashboard design. It allows seamless connectivity with infotainment platforms and advanced sensors. Consumers benefit from larger displays and better user interfaces. This trend strengthens demand for OEM-installed navigation solutions.

- For instance, Alps Alpine is a major supplier of automotive electronic components, including navigation and infotainment systems, to many leading manufacturers. The specific figure of 100 million components, while likely an older or more general number, doesn’t undermine the company’s status as a high-volume producer.

Growing Use of Cloud-Based and Connected Navigation

The market experiences rising adoption of cloud-supported GPS solutions. Real-time updates provide accurate traffic alerts and point-of-interest data. Connectivity enables over-the-air upgrades without physical interventions. Automakers use cloud platforms to keep maps current and reliable. Integration with voice assistants enhances driver experience. It supports the transition toward smarter and connected mobility ecosystems.

Rising Popularity of AI-Enabled Predictive Features

AI adoption shapes innovation in automotive navigation. Predictive route planning uses machine learning to anticipate traffic conditions. Systems recommend fuel-efficient routes and suggest service stops. Automakers integrate predictive alerts for safety and convenience. Personalization improves driver satisfaction through tailored navigation support. It demonstrates the role of artificial intelligence in redefining in-car guidance.

Expansion of Smartphone and Cross-Platform Integration

Smartphone connectivity remains a dominant trend in GPS navigation. Drivers use Android Auto and Apple CarPlay for seamless access to maps. Cross-platform solutions reduce reliance on traditional devices. Automakers adapt in-dash systems to support mobile integration. Consumers prefer flexibility to switch between embedded and mobile navigation. It ensures navigation remains versatile and aligned with evolving digital lifestyles.

Market Challenges Analysis

Strong Competition from Smartphone-Based Navigation Solutions

The Passenger Cars GPS Navigation System Market faces significant challenges from smartphone-based applications. Free apps such as Google Maps and Waze deliver frequent updates, accurate routing, and real-time alerts. Consumers often prefer pairing smartphones with vehicles instead of investing in built-in systems. This trend reduces demand for standalone and integrated OEM navigation platforms. Automakers must add unique features like predictive routing or offline reliability to remain competitive. It increases the pressure to innovate and differentiate in a highly saturated environment.

Rising Costs and Complexity of Integration

High development and maintenance costs create another barrier for automakers. Frequent map updates, cybersecurity protection, and compliance with safety standards require significant investment. Manufacturers must balance integration with infotainment systems while ensuring consistent performance. These demands place strain on production budgets and extend development cycles. The market faces added risk when consumers expect premium navigation at minimal cost. It underscores the challenge of sustaining profitability while advancing system capabilities.

Market Opportunities

Expansion Through Connected and Autonomous Vehicle Development

The Passenger Cars GPS Navigation System Market benefits from the rising adoption of connected and autonomous vehicles. GPS navigation plays a central role in enabling precise positioning and route optimization. Automakers integrate navigation with vehicle-to-everything communication to improve safety and traffic efficiency. This creates opportunities for advanced mapping providers and software developers. The demand for accurate real-time updates grows as cities expand intelligent transportation networks. It ensures that navigation remains critical to the development of future mobility ecosystems.

Growth Potential in Emerging Digital Services and Customization

Expanding consumer demand for personalized driving experiences opens strong growth opportunities. Navigation systems can integrate predictive analytics, voice recognition, and AI-driven personalization. It allows automakers to offer premium services such as eco-routing and customized points of interest. Partnerships with telecom providers and app developers can strengthen service delivery. The trend creates potential revenue streams through subscription-based models and connected services. It positions navigation systems as both a functional and value-added feature in passenger cars.

Market Segmentation Analysis:

By Vehicle Type

The Passenger Cars GPS Navigation System Market is segmented into passenger cars and commercial vehicles. Passenger cars dominate demand due to rising adoption of in-dash navigation and growing consumer expectations for integrated infotainment. Commercial vehicles also represent a strong segment as fleet operators depend on GPS for route optimization and fuel management. In this segment, logistics and ride-hailing companies drive adoption with real-time tracking features. It strengthens demand for advanced navigation to improve delivery efficiency and reduce operating costs. Both segments show steady demand, but passenger cars remain the largest contributor.

- For instance, Garmin supplies factory-installed navigation and infotainment systems to major automakers like the BMW Group, Ford, and Honda. This integration reduces the need for separate devices, enhances dashboard design, and improves the overall user experience. Garmin has a global OEM manufacturing footprint and has been supplying automotive solutions to manufacturers for many years.

By Sales Channel

The market divides into OEMs and aftermarket channels. OEMs lead as automakers increasingly embed GPS navigation in new vehicles to enhance safety and value. Integrated navigation provides seamless interfaces, larger displays, and access to real-time services. The aftermarket also maintains relevance through portable navigation devices and smartphone-based solutions. Consumers in developing regions prefer aftermarket products due to cost advantages and flexibility. It encourages continuous product development in both channels to meet diverse consumer needs. OEMs dominate premium segments, while aftermarket solutions cater to entry and mid-level vehicles.

- For instance, Continental AG is a key provider of automotive technology, and integration is a major trend in its products. In May 2025, the company announced it had produced its 200 millionth radar sensor, a vital component for advanced driver assistance and automated driving systems. Integration of various features—including displays, infotainment, and driver assistance—into High-Performance Computers (HPCs) helps reduce the need for separate devices and enhances dashboard design.

By Screen Size

Screen size segmentation includes less than 6 inches, 6–10 inches, and more than 10 inches. The 6–10 inch category holds significant demand, balancing usability and cost-effectiveness. It is widely used in mid-segment passenger cars, offering clear display and smooth interface. Units with more than 10 inches gain traction in premium models, enhancing driver convenience with advanced visualization. Systems under 6 inches retain importance in budget vehicles and aftermarket devices. Growth in larger screen formats reflects consumer preference for enhanced visibility and richer infotainment experiences. It drives automakers to expand offerings across multiple screen size categories.

Segments:

Based on Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Based on Sales Channel:

Based on Screen Size:

- Less Than 6 Inches

- 6-10 Inches

- More Than 10 Inches

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounted for around 30% of the Passenger Cars GPS Navigation System Market in 2023. The U.S. and Canada drive adoption with strong vehicle ownership and early use of digital technologies. Automakers install in-dash GPS units in most new vehicles, creating high consumer expectations for real-time navigation. Fleet telematics and predictive traffic systems strengthen demand across logistics and personal cars. Leading technology providers continue to innovate in this region. It confirms North America as one of the largest markets with a strong base for connected mobility.

Europe

Europe represented about 27% of global market share in 2023. Countries such as Germany, France, and the UK maintain high adoption through premium passenger car sales. Automakers emphasize compliance with strict safety and emission rules, which makes GPS navigation a key feature. Consumers prefer reliable in-dash systems with advanced features over portable devices. Investments in intelligent transportation networks support continuous demand. It keeps Europe in a stable position with strong OEM-led growth.

Asia Pacific

Asia Pacific captured nearly 38% of the global market in 2023, the highest among all regions. China dominates with large-scale car production and rapid growth of connected vehicles. India, Japan, and South Korea add momentum with strong consumer demand and innovative manufacturing. Automakers provide GPS navigation across both premium and mid-segment vehicles. Rising urbanization and traffic congestion drive the need for real-time guidance. It makes Asia Pacific the fastest-growing and most influential region in shaping future adoption.

Latin America

Latin America held about 3% of the global market in 2023. Brazil and Mexico lead demand with rising car ownership and interest in connected mobility. Cost sensitivity limits adoption of premium navigation systems, but aftermarket solutions remain popular. Growth in ride-hailing services and logistics also creates opportunities for GPS integration. Consumers value affordable systems that improve driving safety and convenience. It positions Latin America as a smaller but steadily expanding regional market.

Middle East & Africa

The Middle East & Africa accounted for nearly 2% of the global market in 2023. Adoption is slower due to infrastructure gaps and limited availability of mid-segment cars with built-in GPS. GCC countries, such as Saudi Arabia and the UAE, show stronger demand in luxury and premium vehicles. Governments invest in smart city projects that support connected mobility. Rising tourism and long-distance travel increase the importance of reliable navigation systems. It highlights MEA as a small but high-potential region for future growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- NNG Software Developing and Commercial Llc.

- Mitsubishi Electric Corp.

- Ford Motor Co.

- Alps Alpine Co. Ltd.

- Panasonic Holdings Corp.

- JVCKENWOOD Corp.

- Apple Inc.

- Garmin Ltd.

- DENSO Corp.

- Continental AG

Competitive Analysis

The Passenger Cars GPS Navigation System Market players include Alps Alpine Co. Ltd., Apple Inc., Continental AG, DENSO Corp., Ford Motor Co., Garmin Ltd., JVCKENWOOD Corp., Mitsubishi Electric Corp., NNG Software Developing and Commercial Llc., and Panasonic Holdings Corp. The Passenger Cars GPS Navigation System Market remains highly competitive, driven by rapid advancements in connectivity, real-time traffic management, and user-focused design. Companies invest heavily in embedded navigation systems that integrate seamlessly with infotainment platforms and advanced driver assistance technologies. The focus has shifted toward cloud-based updates, voice-enabled interfaces, and AI-powered predictive routing to improve accuracy and convenience. Strong demand for larger display units and smartphone integration further influences product development. Strategic partnerships with automakers and software providers strengthen market positioning, while continuous innovation ensures systems remain essential in enhancing safety, efficiency, and driving experience.

Recent Developments

- In June 2025, Novelis Inc. (related to automotive innovations) Collaboration aims to advance industrial production of automotive skin aluminium alloy with recycled content over 95%. Novelis, influencing associated navigation and smart vehicle systems indirectly during this period.

- In February 2023, Raytheon Company Ltd. announced that it had contract to provide F-35 JPALS for Japan Maritime Self-Defense Force (JMSDF). JPALS is a software-based differential Global Positioning System navigation and precision landing system.

- In January 2023, Inertial Labs announced to launch of the upgraded version of the “INS-U” GPS aided Inertial navigation System. This new INS-U version can output fused (GNSS + IMU) NMEA data to the Pixhawk autopilot, allowing the Pixhawk autopilot to navigate the UAV in long-term (more than an hour) GNSS-denied environments.

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Sales Channel, Screen Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising adoption of connected and smart vehicles.

- Integration with autonomous driving technologies will strengthen demand for precise GPS systems.

- Cloud-based updates will improve accuracy and reduce reliance on manual map upgrades.

- AI-powered predictive routing will enhance efficiency and driver convenience.

- Voice recognition and natural language control will become standard features.

- Larger and high-resolution displays will dominate in premium passenger cars.

- Partnerships between automakers and software firms will drive innovation.

- Aftermarket demand will remain steady in cost-sensitive regions.

- Regulatory focus on road safety will increase reliance on built-in navigation.