Market Overview

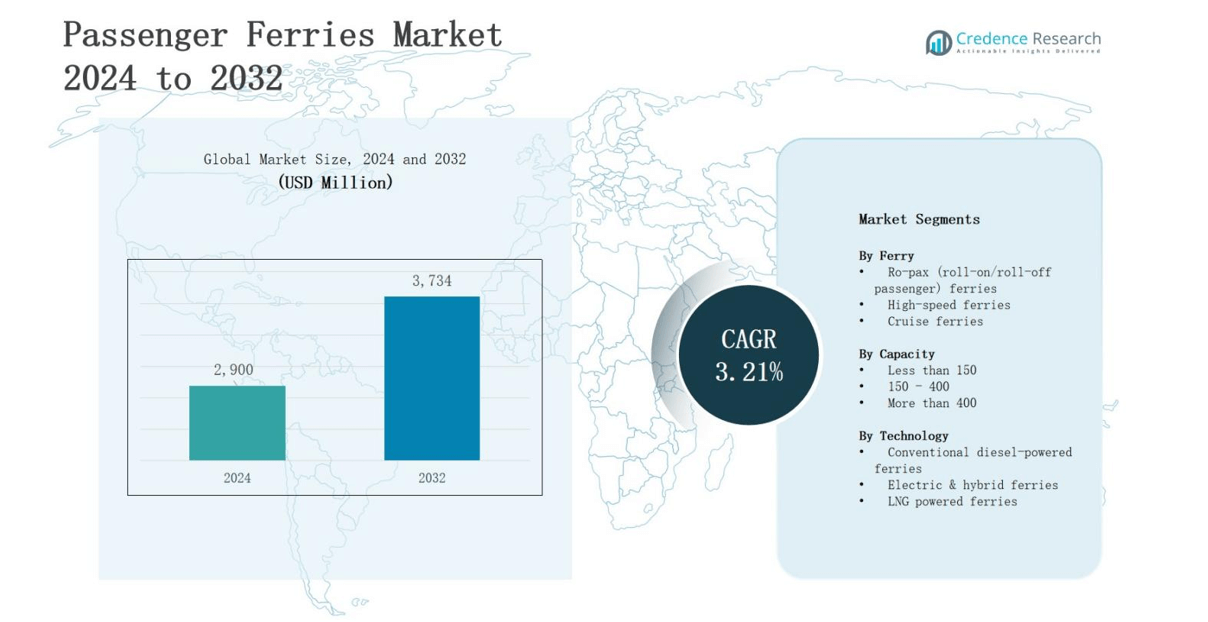

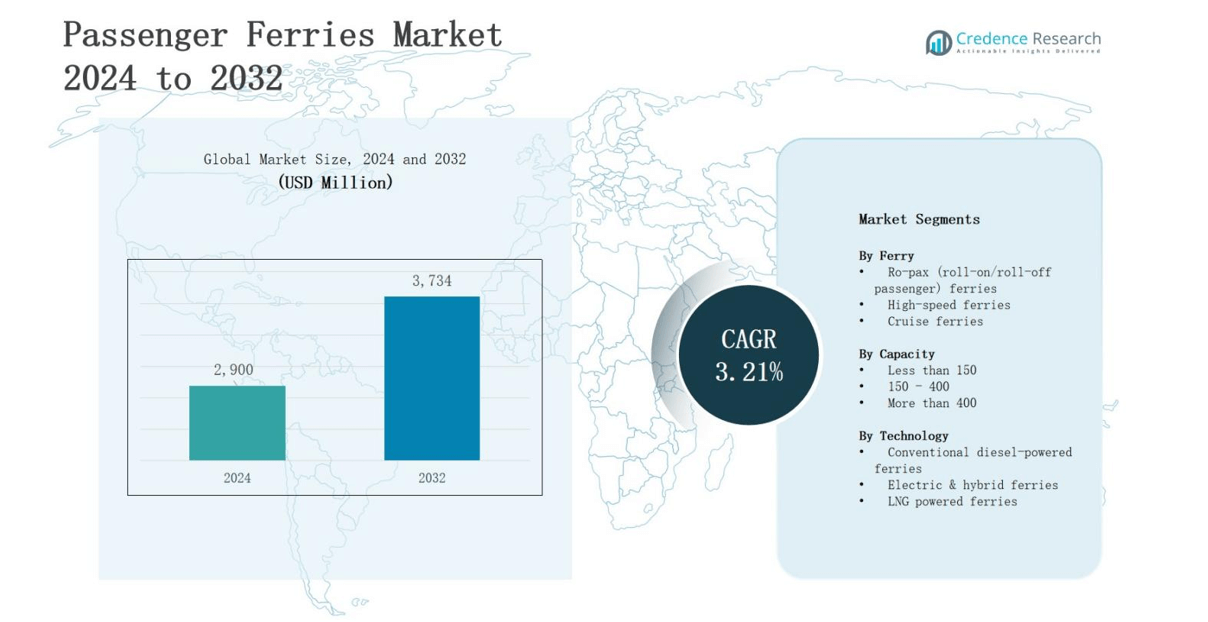

The passenger ferries market is projected to grow from USD 2,900 million in 2024 to USD 3,734 million by 2032, registering a CAGR of 3.21% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Passenger Ferries Market Size 2024 |

USD 2,900 million |

| Passenger Ferries Market, CAGR |

3.21% |

| Passenger Ferries Market Size 2032 |

USD 3,734 million |

The passenger ferries market is driven by rising demand for cost-effective and eco-friendly maritime transport, supported by increasing tourism, urban mobility needs, and expansion of coastal routes. Governments and operators are investing in modern fleets with enhanced fuel efficiency and lower emissions to meet environmental regulations. Trends highlight the adoption of electric and hybrid ferries, integration of digital ticketing and onboard connectivity, and growing emphasis on passenger safety and comfort. Expansion of ferry networks in emerging economies and partnerships between private operators and governments further strengthen the market’s long-term growth outlook.

The passenger ferries market shows diverse geographical dynamics, with Europe leading at 33% supported by advanced infrastructure and tourism demand. Asia-Pacific follows with 28%, driven by urbanization and coastal connectivity, while North America holds 26% with strong reliance on commuter and tourist routes. Latin America captures 7% through growing coastal tourism, and the Middle East & Africa account for 6% with rising urban mobility initiatives. Key players include BC Ferries, Brittany Ferries, DFDS Seaways, Irish Ferries, Jadrolinija, Minoan Lines, P&O Ferries, Stena Line, Tallink Grupp, and Washington State Ferries.

Market Insights

- The passenger ferries market is projected to grow from USD 2,900 million in 2024 to USD 3,734 million by 2032, registering a steady CAGR of 3.21% during the forecast period.

- By ferry type, Ro-pax ferries dominate with 48% share, followed by high-speed ferries at 32% and cruise ferries at 20%, reflecting strong demand across commuter and tourism sectors globally.

- By capacity, ferries with more than 400 seats lead at 44%, 150–400 capacity ferries account for 37%, while less than 150 seats contribute 19%, serving regional and community routes.

- By technology, conventional diesel-powered ferries still command 55% share, while electric and hybrid ferries rise to 28%, and LNG-powered ferries secure 17%, highlighting transition toward sustainable transport solutions.

- Europe leads regionally with 33% share, followed by Asia-Pacific at 28% and North America at 26%, while Latin America holds 7% and Middle East & Africa contribute 6%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Tourism and Coastal Connectivity Demand

The passenger ferries market benefits strongly from the surge in global tourism and expansion of coastal transport services. Rising international travel and domestic leisure activities increase reliance on ferries as affordable and scenic transport options. Governments are expanding maritime routes to connect islands, coastal towns, and metropolitan hubs, enhancing regional accessibility. It creates sustainable demand for ferries that cater to both daily commuters and seasonal travelers. Operators invest in advanced vessels to meet growing passenger expectations.

- For instance, Thames Clippers launched Earth Clipper, Europe’s first hybrid high-speed passenger ferry in Central London, achieving nearly 90% reduction in CO2 emissions.

Focus on Sustainable and Eco-Friendly Transportation

The passenger ferries market is gaining traction with a strong push toward reducing carbon emissions and promoting sustainable transport solutions. Governments enforce stricter environmental regulations, prompting operators to adopt eco-friendly ferries powered by hybrid and electric propulsion. It positions ferries as a sustainable alternative to road or air travel in short-distance routes. Growing public awareness of climate issues also drives acceptance of greener solutions. Manufacturers actively develop fuel-efficient technologies to enhance market adoption.

- For instance, Brittany Ferries’ fleet includes hybrid-electric deep-water vessels like the Guillaume de Normandie, which features a modular propulsion system capable of running on batteries alone at speeds up to 17.5 knots, significantly reducing fossil fuel usage and emissions.

Government Investments and Infrastructure Development

The passenger ferries market receives significant support from public investments in port infrastructure and fleet modernization. Governments fund expansion of ferry terminals, docking facilities, and navigation systems to improve efficiency and safety. It ensures reliable services that promote public preference for ferries in coastal and urban transport. Subsidies and partnerships with private operators further boost fleet upgrades. Enhanced infrastructure enables ferries to handle larger passenger volumes and ensures long-term service reliability across multiple regions.

Advancement in Technology and Passenger Experience

The passenger ferries market is shaped by technological upgrades that enhance safety, efficiency, and passenger comfort. Operators adopt digital ticketing, GPS navigation, and real-time scheduling to improve operations. It strengthens customer trust and convenience, particularly in urban and tourist-heavy areas. Introduction of luxury seating, Wi-Fi, and entertainment systems increases passenger satisfaction. Integration of smart systems also improves energy efficiency and vessel performance. These advancements help operators remain competitive in global maritime transportation.

Market Trends

Adoption of Electric and Hybrid Ferry Solutions

The passenger ferries market is witnessing a strong shift toward electric and hybrid propulsion systems to reduce fuel costs and emissions. Operators are investing in vessels equipped with battery storage and hybrid engines to comply with stricter emission standards. It creates opportunities for manufacturers to develop advanced propulsion technologies. Growing environmental awareness among travelers supports adoption of green transport solutions. Ports are also upgrading charging infrastructure to accommodate this emerging demand, further driving momentum globally.

- For instance, Washington State Ferries recently converted the Wenatchee, North America’s largest hybrid-electric passenger ferry, which is expected to reduce fuel consumption by 25% and climate pollution by up to 20% while providing a quieter and cleaner passenger experience.

Integration of Digitalization and Smart Ticketing

The passenger ferries market is increasingly shaped by digital transformation, with operators implementing online booking systems and contactless ticketing. Real-time tracking, mobile apps, and automated scheduling improve service efficiency and passenger convenience. It allows ferry operators to optimize routes and manage capacity effectively. Enhanced data analytics also supports predictive maintenance and cost savings. These developments strengthen customer loyalty while ensuring operational transparency, positioning digitalization as a critical trend in the maritime passenger sector worldwide.

Expansion of Luxury and Tourism-Oriented Services

The passenger ferries market is evolving with growing focus on enhancing passenger experience through premium services. Operators are introducing modern interiors, Wi-Fi connectivity, dining options, and entertainment systems to meet rising expectations of tourists. It aligns ferries with cruise-like experiences for short to medium routes. Luxury-focused investments are attracting high-value customers and expanding market reach. The trend supports strong growth in regions with vibrant tourism, particularly Europe, Southeast Asia, and island economies worldwide.

- For instance, Damen Shipyards launched the Ferry 3508 electric, which combines eco-friendly design with spacious seating and sophisticated climate control systems to elevate passenger comfort in an environmentally conscious product.

Strategic Partnerships and Fleet Modernization

The passenger ferries market reflects increasing collaborations between governments, private operators, and shipbuilders to modernize fleets. Joint ventures and public-private partnerships aim to expand ferry routes and improve service efficiency. It fosters innovation in vessel design, safety standards, and sustainability. Operators are replacing aging fleets with advanced models that meet modern regulations. This collaborative approach ensures resilience against rising passenger demand and positions ferries as a reliable transport mode in global maritime infrastructure.

Market Challenges Analysis

High Operating Costs and Fuel Price Volatility

The passenger ferries market faces challenges due to high operating expenses and unpredictable fuel costs. Operators struggle to maintain profitability while meeting environmental standards and offering competitive fares. It increases financial pressure on companies operating older fleets with lower efficiency. Rising maintenance costs, crew wages, and insurance premiums further strain margins. Many operators delay investments in fleet modernization due to limited funding, creating inefficiencies that restrict growth. These challenges hinder long-term expansion prospects.

Regulatory Pressures and Infrastructure Limitations

The passenger ferries market must comply with stringent safety and environmental regulations, which require costly upgrades. Smaller operators find it difficult to meet international standards on emissions and safety equipment. It restricts market participation and limits service expansion in underdeveloped regions. Inadequate port infrastructure and limited charging facilities for hybrid or electric ferries also slow adoption of sustainable solutions. Delays in government approvals for new routes add operational barriers. These issues collectively challenge the sector’s scalability.

Market Opportunities

Expansion of Green and Sustainable Ferry Solutions

The passenger ferries market holds strong opportunities through adoption of electric, hybrid, and alternative fuel-powered vessels. Governments and operators are prioritizing decarbonization efforts, creating demand for sustainable propulsion technologies. It allows manufacturers to innovate in energy-efficient engines, battery storage, and hydrogen-based systems. Growing investment in charging and refueling infrastructure further accelerates this transition. Operators offering eco-friendly solutions gain regulatory advantages and attract environmentally conscious passengers. This shift positions ferries as a sustainable alternative to road or air travel.

Rising Tourism and Emerging Coastal Economies

The passenger ferries market benefits from growing tourism and increasing development of coastal economies in Asia-Pacific, Latin America, and island nations. Expanding middle-class populations and rising disposable incomes create demand for affordable and scenic transport options. It enables operators to launch new routes that connect islands, ports, and metropolitan hubs. Governments encourage ferry adoption to ease urban congestion and strengthen regional connectivity. Opportunities also lie in luxury tourism services, combining convenience with premium passenger experiences across developing regions.

Market Segmentation Analysis:

By Ferry Type

The passenger ferries market is segmented into Ro-pax ferries, high-speed ferries, and cruise ferries. Ro-pax ferries hold the largest share at around 48%, driven by their dual role in transporting passengers and vehicles. High-speed ferries account for nearly 32%, supported by urban mobility and tourism demand. Cruise ferries represent 20%, appealing to travelers seeking leisure-focused short journeys. It highlights diversified demand across commuter, logistics, and tourism applications in global markets.

- For instance, Damen, a leading shipbuilder, offers Ro-pax ferries such as the Fast RoPax series that can carry 60 passengers on the upper deck and 10 cars below, tailored for coastal and seagoing routes.

By Capacity

The passenger ferries market by capacity includes vessels with less than 150 seats, 150–400 seats, and more than 400 seats. Ferries with more than 400 seats dominate with a 44% share, serving dense urban routes and tourism hubs. The 150–400 segment holds 37%, balancing affordability and flexibility for regional operators. Ferries with less than 150 seats contribute 19%, mainly serving smaller coastal or island communities. It reflects varying regional demand patterns.

- For instance, Balearia in Spain deployed its 390-passenger eco-efficient ferry Eleanor Roosevelt, powered by dual engines designed to cut emissions on Mediterranean routes.

By Technology

The passenger ferries market by technology is divided into conventional diesel-powered ferries, electric & hybrid ferries, and LNG-powered ferries. Conventional diesel ferries still command 55% share, though operators face emission regulation pressures. Electric and hybrid ferries account for 28%, expanding quickly with strong sustainability focus and government support. LNG-powered ferries represent 17%, gaining traction in environmentally sensitive routes. It underscores a gradual industry transition toward cleaner and more efficient propulsion systems worldwide.

Segments:

Based on Ferry

- Ro-pax (roll-on/roll-off passenger) ferries

- High-speed ferries

- Cruise ferries

Based on Capacity

- Less than 150

- 150 – 400

- More than 400

Based on Technology

- Conventional diesel-powered ferries

- Electric & hybrid ferries

- LNG powered ferries

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The passenger ferries market in North America holds 26% share, driven by strong demand for coastal and inter-island transport. The United States and Canada emphasize modernization of ferry fleets to meet environmental standards. It benefits from significant investments in hybrid and electric ferries across urban regions. High reliance on ferries in Alaska, Washington, and British Columbia sustains consistent ridership. Tourism growth also supports services in coastal and island destinations. Regulatory frameworks continue to encourage sustainable vessel adoption.

Europe

Europe accounts for 33% share of the passenger ferries market, making it the largest regional contributor. Countries like Greece, Italy, Norway, and the United Kingdom rely heavily on ferries for connectivity. It benefits from advanced port infrastructure and strong integration with tourism sectors. Europe leads in adoption of LNG, hybrid, and electric ferries due to strict emission regulations. Government support accelerates replacement of older fleets with sustainable alternatives. Tourism-driven traffic in the Mediterranean further strengthens demand across this region.

Asia-Pacific

Asia-Pacific represents 28% share of the passenger ferries market, supported by growing urbanization and expanding coastal economies. High demand in countries such as Japan, China, and Indonesia drives fleet expansion. It reflects both commuter-based services and international tourism. Governments invest in ferry terminals and modern fleets to reduce congestion in urban centers. Expanding middle-class populations prefer ferries for affordable leisure and travel. The region also witnesses rising interest in eco-friendly ferries to meet environmental commitments.

Latin America

Latin America holds 7% share of the passenger ferries market, driven by growing coastal tourism and inter-island transport. Countries such as Brazil, Mexico, and Chile are expanding ferry operations to enhance regional connectivity. It faces challenges from limited port infrastructure, but rising tourism encourages investments in fleet modernization. Operators explore hybrid solutions for sustainable growth. Government initiatives aim to improve accessibility across islands and coastal regions. The region shows steady growth potential in both passenger and tourism services.

Middle East & Africa

The passenger ferries market in the Middle East & Africa accounts for 6% share, supported by tourism, urban mobility, and island transport services. Gulf nations invest in ferry services to diversify transport and attract visitors. It benefits from government-backed infrastructure projects in coastal cities. Africa shows rising adoption in countries with significant island communities such as Tanzania and Kenya. Limited infrastructure remains a challenge, but growth prospects improve with tourism and urbanization. Fleet expansion continues to emerge gradually across both regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Jadrolinija

- Washington State Ferries

- Stena Line

- Irish Ferries

- Tallink Grupp

- P&O Ferries

- DFDS Seaways

- Minoan Lines

- BC Ferries

- Brittany Ferries

Competitive Analysis

The passenger ferries market is highly competitive with global and regional players focusing on fleet modernization, sustainability, and customer experience to strengthen market presence. Leading operators such as BC Ferries, Brittany Ferries, DFDS Seaways, Irish Ferries, Jadrolinija, Minoan Lines, P&O Ferries, Stena Line, Tallink Grupp, and Washington State Ferries emphasize investments in hybrid and electric propulsion systems to meet strict emission norms. It demonstrates steady innovation in vessel design, onboard amenities, and digital services to attract passengers across commuter and tourism segments. Strategic alliances, government partnerships, and route expansions enable operators to enhance capacity while maintaining compliance with environmental regulations. Competition also intensifies in regions with strong tourism demand, where companies differentiate through premium services, faster transit times, and integrated ticketing solutions. Sustainability initiatives, such as LNG-powered vessels and electrification, are reshaping competitive strategies, positioning operators to capture long-term growth opportunities. The market reflects a balance of established companies and emerging players focusing on cost efficiency, route accessibility, and passenger safety to secure competitive advantage.

Recent Developments

- In May 2025, BC Ferries welcomed the launch of another Island Class ferry built by Damen Shipyards Galati, the first of four battery-equipped diesel-hybrid vessels planned for fleet expansion.

- In June 2025, Maritime Partners, LLC completed refinancing for the hydrogen-powered passenger ferry “Sea Change,” developed by SWITCH Maritime LLC. This deal supports SWITCH’s expansion to build next-generation zero-emission vessels for major U.S. markets like San Francisco and Seattle.

- In August 2025, Baleària will launch its third natural gas–powered fast ferry, Mercedes Pinto, from the Armón shipyard on September 19. The eco-efficient vessel will serve in 2026.

- In 2025, Brittany Ferries introduced two hybrid‑electric E‑Flexer vessels: Saint‑Malo and Guillaume de Normandie, both operating partially or fully on battery power.

Market Concentration & Characteristics

The passenger ferries market demonstrates moderate concentration, with a mix of global operators and strong regional players competing across commuter and tourism segments. Established companies such as BC Ferries, Stena Line, DFDS Seaways, Tallink Grupp, and P&O Ferries dominate key routes with large fleets and advanced infrastructure. It reflects high barriers to entry due to capital-intensive investments, regulatory compliance, and environmental standards. Operators are increasingly focusing on hybrid and electric propulsion, digital ticketing, and enhanced passenger services to remain competitive. Government support through subsidies, partnerships, and infrastructure development strengthens industry stability while encouraging sustainability. The market is characterized by diverse service models ranging from short-distance urban ferries to luxury cruise ferries, catering to both mass transit and premium travel demand. Strong emphasis on fleet modernization, safety compliance, and emission reduction underpins the competitive environment, positioning established players to retain dominance while offering scope for innovation-driven entrants to gain market presence.

Report Coverage

The research report offers an in-depth analysis based on Ferry, Capacity, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Passenger ferries will adopt electric and hybrid propulsion systems to reduce emissions and improve efficiency.

- Operators will expand routes connecting urban centers, islands, and coastal towns to meet rising mobility demand.

- Governments will increase investments in ferry terminals, docking facilities, and charging infrastructure for sustainable transport growth.

- Digital ticketing, mobile applications, and real-time scheduling will become standard to enhance passenger convenience and efficiency.

- Fleet modernization programs will replace aging vessels with advanced designs focused on safety, speed, and sustainability.

- Tourism-driven demand will support luxury ferries offering premium seating, onboard dining, entertainment, and cruise-like experiences.

- LNG-powered ferries will gain momentum in environmentally sensitive regions, complementing hybrid and battery-electric vessel adoption.

- Collaborations between governments and private operators will expand ferry networks and improve accessibility in emerging economies.

- Rising urban congestion will drive greater reliance on ferries as efficient alternatives to road transport.

- Advanced navigation systems and predictive maintenance technologies will improve operational efficiency and fleet reliability worldwide.