Market Overview

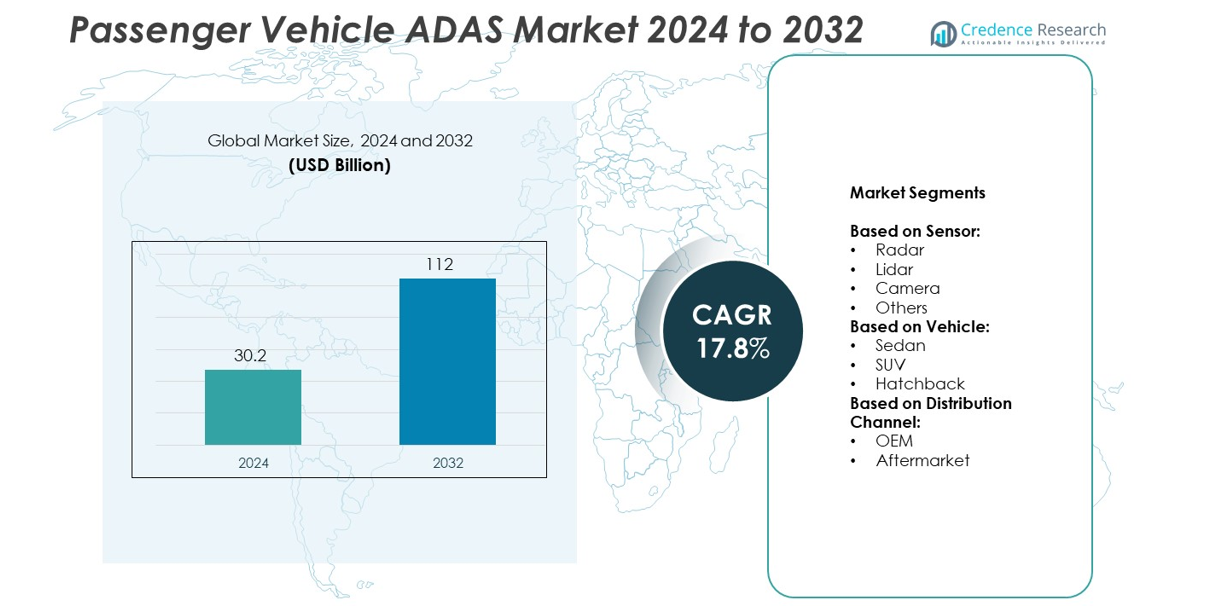

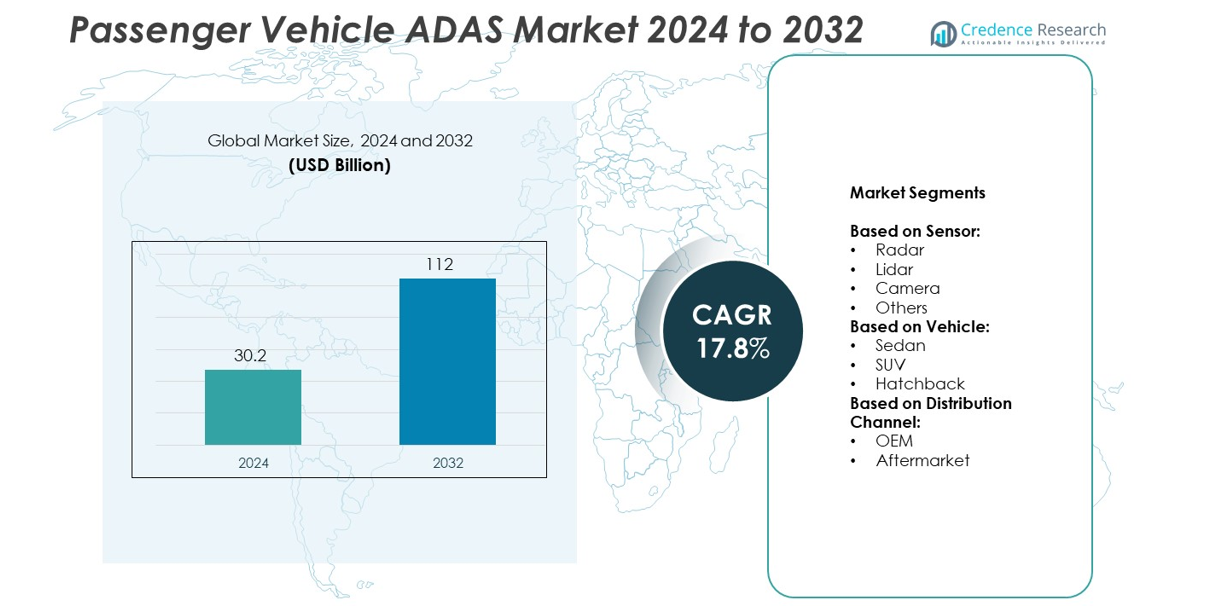

Passenger Vehicle ADAS Market size was valued at USD 30.2 billion in 2024 and is anticipated to reach USD 112 billion by 2032, at a CAGR of 17.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Passenger Vehicle ADAS Market Size 2024 |

USD 30.2 billion |

| Passenger Vehicle ADAS Market, CAGR |

17.8% |

| Passenger Vehicle ADAS Market Size 2032 |

USD 112 billion |

The Passenger Vehicle ADAS market grows due to rising demand for advanced safety features and regulatory mandates. Automakers integrate radar, LiDAR, cameras, and AI-driven systems to enhance driving assistance and reduce accidents. It benefits from increasing consumer preference for comfort, automation, and connected solutions. Expanding adoption of semi-autonomous technologies and real-time data processing drives innovation. Rising awareness of road safety and the shift toward intelligent transportation systems further accelerate market expansion across premium, mid-range, and entry-level passenger vehicles globally.

North America leads the Passenger Vehicle ADAS market due to strong technological adoption and strict safety regulations, while Europe focuses on innovation and regulatory compliance. Asia Pacific shows the fastest growth driven by rising vehicle production and increasing safety awareness. It benefits from expanding infrastructure and government-led initiatives supporting advanced driver-assistance systems. Key players driving innovation and competitiveness in the market include Mobileye, Bosch, Aptiv, and Valeo, with continuous investments in AI, sensors, and autonomous driving technologies shaping industry advancements.

Market Insights

- The Passenger Vehicle ADAS market was valued at USD 30.2 billion in 2024 and is projected to reach USD 112 billion by 2032, growing at a CAGR of 17.8% during the forecast period.

- Rising demand for advanced safety features and regulatory mandates drive the adoption of ADAS technologies across passenger vehicles globally.

- Increasing integration of AI, radar, LiDAR, and camera-based systems enhances real-time decision-making and predictive safety capabilities.

- The market remains highly competitive, with leading players like Mobileye, Bosch, Aptiv, Valeo, Continental, Denso, Ambarella, Autoliv, and Aisin focusing on innovation and strategic collaborations.

- High development costs, complex system integration, and infrastructure limitations in emerging markets act as significant restraints for broader adoption.

- North America dominates due to advanced infrastructure and strong regulations, Europe focuses on innovation and compliance, while Asia Pacific records the fastest growth supported by rising vehicle production and safety awareness.

- Growing adoption of connected and semi-autonomous features, coupled with government-driven safety initiatives, shapes future opportunities, expanding ADAS integration across mid-range and entry-level vehicle segments worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Advanced Safety Features

The Passenger Vehicle ADAS market grows due to increasing demand for advanced safety technologies. Consumers prefer vehicles equipped with systems like adaptive cruise control, automatic emergency braking, and lane-keeping assist. Automakers integrate these solutions to comply with strict global safety regulations. It enhances passenger protection and reduces accident risks, boosting adoption among leading manufacturers. Growing awareness about driver assistance technologies drives customer preferences in both premium and mid-range vehicles. The inclusion of advanced systems improves vehicle competitiveness and market acceptance.

- For instance, Volvo equips its cars with Pilot Assist, which can provide steering assistance up to 130 km/h (about 80 mph) while automatically maintaining a set speed and distance to the vehicle ahead. This function, which is a combination of Adaptive Cruise Control and Lane Keeping Aid, helps to keep the car centered within lane markings. Automakers integrate ADAS like this for enhanced safety and to comply with specific, increasingly stringent safety regulations, such as autonomous emergency braking (AEB) mandates in some countries.

Technological Advancements Driving System Integration

Innovations in sensors, cameras, and radar systems support rapid ADAS development in the Passenger Vehicle ADAS market. Automakers implement AI-powered algorithms for better object detection and predictive decision-making. It improves system accuracy and reliability under diverse driving conditions. Advanced connectivity solutions enable real-time data sharing between vehicles and infrastructure. The integration of machine learning enhances adaptive features, optimizing user experience and safety. Continuous upgrades in autonomous technologies position ADAS as a core component of future vehicle designs.

- For instance, as of January 2025, Tesla has sold over 7.25 million vehicles in total, and since 2021, all of its new cars have been equipped with its Vision-based ADAS, referred to as “Autopilot” and “Full Self-Driving.

Rising Regulatory Support for Road Safety Initiatives

Global governments mandate strict policies to improve passenger and pedestrian safety, impacting the Passenger Vehicle ADAS market positively. Regulatory bodies enforce requirements for collision avoidance and lane departure warning systems. It encourages automakers to adopt standardized technologies across multiple vehicle categories. Incentives and compliance frameworks accelerate investments in smart driving assistance systems. Expanding support for zero-fatality road strategies promotes mass deployment of ADAS features. Safety-driven legislation strengthens partnerships between OEMs and technology providers.

Shifting Consumer Preferences Toward Premium Features

Increasing consumer expectations for comfort and safety influence the Passenger Vehicle ADAS market significantly. Buyers prefer vehicles equipped with intuitive driver assistance features, even in lower-priced segments. It motivates automakers to integrate advanced capabilities into wider product lines. Growth in electric and connected vehicles further supports ADAS adoption. Rising disposable incomes encourage spending on high-tech automotive solutions globally. Manufacturers leverage personalization and user-friendly interfaces to improve customer satisfaction and strengthen brand loyalty.

Market Trends

Integration of Artificial Intelligence and Machine Learning

The Passenger Vehicle ADAS market witnesses strong adoption of AI and machine learning technologies. Automakers deploy predictive analytics to enhance decision-making and improve driver assistance accuracy. It enables real-time detection of vehicles, pedestrians, and obstacles with higher precision. AI-powered vision systems improve system responsiveness in complex traffic scenarios. Machine learning models process large datasets to refine adaptive features continuously. Automakers invest in intelligent algorithms to deliver safer, more reliable, and personalized driving experiences.

- For instance, BMW bundles its suite of driver assistance and automated driving technologies under the BMW Personal CoPilot umbrella. The development of these systems relies on a centralized, high-performance data platform that uses massive amounts of information. In 2019, BMW’s platform handled over 230 petabytes of storage capacity to process data for the development of its autonomous driving systems.

Expansion of Sensor and Camera-Based Systems

Innovations in LiDAR, radar, ultrasonic sensors, and high-resolution cameras drive progress in the Passenger Vehicle ADAS market. Automakers integrate multi-sensor fusion to provide comprehensive environmental awareness. It ensures improved performance in lane detection, traffic sign recognition, and parking assistance. Advancements in optical imaging allow systems to perform effectively under low-light and adverse weather conditions. Increasing demand for 360-degree visibility enhances safety and driver confidence. High-accuracy sensing technologies continue to dominate next-generation ADAS development strategies.

- For instance, as of mid-2025, Tesla has a fleet of well over 6 million vehicles equipped with Level 2 ADAS features like Autopilot and “Full Self-Driving (Supervised)”

Growing Role of Connected and Autonomous Features

Rising integration of vehicle-to-everything (V2X) communication shapes trends in the Passenger Vehicle ADAS market. Connected systems enable data sharing between vehicles, infrastructure, and cloud platforms to predict hazards. It strengthens collision avoidance capabilities and optimizes route planning. Automation-focused features like adaptive driving modes and traffic-jam assistance gain popularity. Automakers invest in developing Level 2 and Level 3 semi-autonomous capabilities to improve driver convenience. Advancements in connectivity accelerate the transition toward smarter, self-learning assistance systems.

Increasing Adoption Across Mid-Segment and Economy Vehicles

The Passenger Vehicle ADAS market observes broader deployment of advanced features in affordable vehicle segments. Manufacturers reduce component costs through scalable platforms and efficient production models. It supports widespread integration of features like lane-keeping assist, adaptive cruise control, and blind-spot detection. Growing consumer awareness drives demand for safety-focused technologies beyond premium categories. Emerging markets contribute significantly to higher adoption rates across entry-level and mid-range passenger vehicles. Automakers expand accessibility to create competitive differentiation and strengthen brand positioning.

Market Challenges Analysis

High Development Costs and Complex Integration Issues

The Passenger Vehicle ADAS market faces challenges due to the high cost of advanced components and system integration. Automakers invest heavily in sensors, radars, cameras, and AI-driven software to enhance accuracy and reliability. It increases overall vehicle pricing, limiting adoption in budget-sensitive markets. Integrating multiple technologies across diverse platforms requires advanced engineering and significant R&D spending. Manufacturers must ensure seamless compatibility between hardware and software while maintaining performance standards. Balancing innovation with affordability remains a critical challenge for industry players.

Regulatory Uncertainty and Operational Limitations

The Passenger Vehicle ADAS market experiences hurdles from varying global safety regulations and compliance standards. Automakers face difficulties adapting technologies to meet region-specific mandates and testing requirements. It delays product launches and increases development timelines. Operational reliability also remains a concern, as systems must perform accurately under extreme weather and complex road conditions. Inconsistent infrastructure in emerging economies limits the effectiveness of connected and semi-autonomous features. Industry stakeholders must address these limitations to improve consumer trust and encourage broader adoption.

Market Opportunities

Rising Demand for Autonomous and Semi-Autonomous Driving Technologies

The Passenger Vehicle ADAS market presents significant opportunities with the growing shift toward autonomous and semi-autonomous driving. Automakers focus on developing advanced Level 2 and Level 3 systems to enhance driver convenience and safety. It creates demand for innovative solutions combining AI, machine learning, and high-precision sensors. Increasing investments in autonomous driving infrastructure accelerate ADAS feature deployment across multiple vehicle segments. Enhanced consumer acceptance of driver-assistance capabilities expands market penetration globally. Collaboration between automakers and technology providers strengthens the innovation ecosystem and drives next-generation development.

Growing Adoption Across Emerging Markets and Mass Segments

The Passenger Vehicle ADAS market benefits from increasing demand in emerging economies driven by rising vehicle sales and safety awareness. Automakers introduce cost-effective ADAS solutions tailored for mid-range and entry-level passenger vehicles. It supports broader accessibility while meeting consumer preferences for safety and comfort. Expanding urbanization and government-led road safety initiatives fuel adoption across new regions. Integration of connected vehicle technologies further improves feature scalability and enhances market competitiveness. Strategic partnerships and localized manufacturing enable companies to capture untapped demand in high-growth markets.

Market Segmentation Analysis:

By Sensor:

The Passenger Vehicle ADAS market sees strong growth in radar, LiDAR, camera, and other sensing technologies. Radar dominates due to its accuracy in detecting objects and supporting adaptive cruise control and collision avoidance systems. LiDAR adoption rises with the increasing demand for high-resolution mapping and enhanced environmental perception. It enables advanced driver-assistance features, particularly in premium and semi-autonomous vehicles. Camera-based systems gain traction for lane-keeping, traffic sign recognition, and 360-degree monitoring. Other sensors, including ultrasonic and infrared, complement core technologies to improve overall system performance and safety levels.

- For instance, in 2024, Li Auto sold 500,508 vehicles, all of which were equipped with L2+ intelligent driving features.

By Vehicle:

Sedans hold a significant share due to their widespread adoption of mid-range ADAS features, supported by cost-effective integration. SUVs are the fastest-growing segment, driven by consumer preference for larger vehicles with enhanced safety and comfort technologies. It benefits from advanced features like lane-centering assist, blind-spot detection, and adaptive driving modes. Hatchbacks increasingly integrate basic driver-assistance systems to meet rising safety demands in budget-sensitive markets. Automakers focus on expanding ADAS offerings across vehicle categories to improve competitiveness and attract broader consumer bases.

- For instance, recent Honda news highlights achievements in individual markets, such as reaching 50,000 ADAS-enabled cars on Indian roads in March 2025.

By Distribution Channel:

The Passenger Vehicle ADAS market relies on both OEM and aftermarket channels for feature deployment. OEMs lead the segment by integrating ADAS solutions during manufacturing to meet safety regulations and consumer expectations. It drives mass adoption of standardized technologies across vehicle models and price segments. The aftermarket segment grows steadily as consumers upgrade existing vehicles with advanced driver-assistance systems. Demand for retrofitted features like parking sensors, collision warning, and blind-spot detection expands product accessibility. Continuous innovation and partnerships between suppliers and manufacturers enhance system availability through both channels.

Segments:

Based on Sensor:

- Radar

- Lidar

- Camera

- Others

Based on Vehicle:

Based on Distribution Channel:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

The Passenger Vehicle ADAS market in North America holds a 36% share in 2024, making it the leading region. Strong consumer demand, strict safety mandates, and high investments in innovation drive adoption. Automakers integrate advanced technologies like adaptive cruise control, lane-keeping assist, and automatic emergency braking in mid-range and luxury vehicles. It benefits from collaborative efforts between OEMs and tech providers to meet regulatory deadlines and consumer preferences. U.S. and Canada lead advancements in semi-autonomous capabilities, supported by robust infrastructure and early deployment of connected solutions. The presence of global automotive giants accelerates new feature launches and increases market competitiveness.

Europe

Europe captures around 30% of the Passenger Vehicle ADAS market, driven by advanced automotive engineering and stringent safety regulations. The European Union mandates ADAS technologies like lane-departure warnings, forward-collision alerts, and emergency braking in new passenger vehicles. It drives significant investments by automakers in next-generation sensor technologies and validation processes. Germany leads adoption with strong R&D efforts, while France, the UK, and Italy show rapid integration across premium and mid-tier vehicles. Advanced road infrastructure and smart transportation systems improve ADAS performance. Collaboration between local OEMs and technology firms continues to strengthen the region’s competitive position.

Asia Pacific

The Passenger Vehicle ADAS market in Asia Pacific holds nearly 25% of the global share and records the fastest growth rate. Rising vehicle production in China, Japan, India, and South Korea drives widespread system integration. It benefits from government-led safety mandates and growing consumer awareness of advanced driving features. Automakers deploy cost-effective radar, LiDAR, and camera-based solutions to address varying price sensitivities. China dominates adoption with large-scale manufacturing, while India shows strong potential in expanding mid-range deployments. Rapid digital infrastructure upgrades, combined with increasing electric vehicle penetration, accelerate ADAS integration in diverse vehicle categories.

Latin America

Latin America accounts for roughly 5% of the Passenger Vehicle ADAS market, with Brazil and Mexico leading regional demand. Growing awareness of vehicle safety and rising disposable incomes push adoption across mid-range models. It faces challenges due to limited infrastructure and higher system costs in price-sensitive markets. Automakers introduce affordable ADAS packages with basic functionalities like parking sensors and lane-assist features. Government-led initiatives to improve road safety encourage gradual integration. Partnerships between global OEMs and regional manufacturers further support market development.

Middle East & Africa

The Passenger Vehicle ADAS market in the Middle East & Africa also holds around 5% of the global share. Demand primarily concentrates in Gulf nations such as the UAE and Saudi Arabia, where premium vehicle purchases dominate. It grows due to rising smart-city projects and investments in intelligent transportation systems. Automakers focus on equipping SUVs and sedans with features like adaptive cruise control and collision avoidance. Variations in regulatory requirements across countries create uneven adoption rates. Collaborative efforts with international technology providers help expand access to advanced driver-assistance systems across urbanized regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mobileye

- Bosch

- Aptiv

- Valeo

- Continental

- Denso

- Ambarella

- Autoliv

- Aisin

Competitive Analysis

The competitive landscape of the Passenger Vehicle ADAS market is shaped by leading players such as Mobileye, Bosch, Aptiv, Valeo, Continental, Denso, Ambarella, Autoliv, and Aisin. These companies focus on developing innovative solutions to enhance vehicle safety, automation, and driver convenience. Intense competition drives continuous investments in advanced technologies, including AI-powered vision systems, radar, Lidar, and sensor integration. It pushes manufacturers to strengthen product portfolios and deliver customized solutions for different vehicle segments. Strategic collaborations between automakers and technology providers accelerate ADAS deployment across global markets. Companies invest heavily in research and development to improve system performance and ensure compliance with evolving safety regulations. Expanding partnerships support seamless integration of hardware and software components, improving reliability and efficiency. Growing demand for semi-autonomous and connected features drives players to explore data-driven innovations and predictive safety systems. Global expansion strategies, combined with competitive pricing models, enable manufacturers to capture emerging market opportunities and secure a stronger industry position.

Recent Developments

- In March 2025, the Volkswagen Group, in collaboration with Valeo and Mobileye, announced their plan to upgrade Advanced Driver Assistance Systems (ADAS) to Level 2+ in their upcoming MQB-platform vehicles, improving safety and comfort with hands-free driving capabilities on approved roads.

- In 2025, Aptiv debuted a combined bird’s-eye-view camera and ultrashort-range radar perception solution at CES 2025, specifically their PULSE (Parking, Urban, Localization, and Surround Enhancement) Sensor.

- In 2025, Valeo earned GM’s ADAS Supplier of the Year award for the third consecutive time.

Report Coverage

The research report offers an in-depth analysis based on Sensor, Vehicle, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of ADAS will expand rapidly across mid‑range and economy vehicles.

- Integration of AI and sensor fusion will enhance predictive safety capabilities.

- Partnerships between OEMs and tech firms will accelerate innovation cycles.

- Regulators will introduce stricter global mandates for driver‑assistance systems.

- Sensor costs will decline through scalable design and mass production.

- Connectivity and V2X will improve system responsiveness to external hazards.

- Semi‑autonomous driving features like traffic‑jam assist will gain traction.

- Regional growth in developing markets will drive global industry expansion.

- Standardized platforms will enable modular upgrades across vehicle models.

- Consumer demand for personalized safety tech will shape future product offerings.