Market Overview:

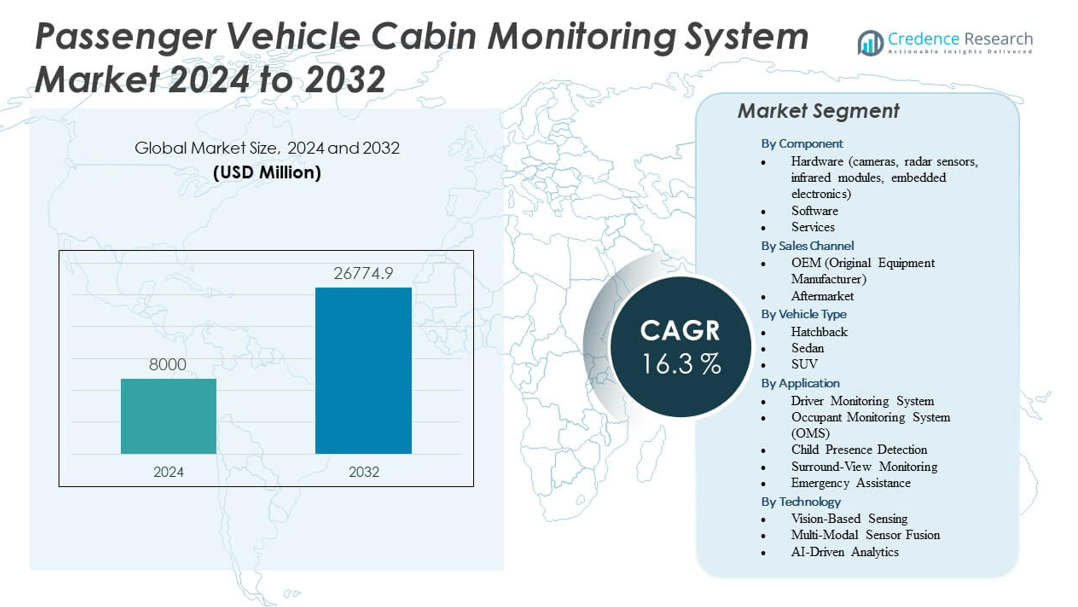

The Passenger vehicle cabin monitoring system market is projected to grow from USD 8000 million in 2024 to an estimated USD 26774.9 million by 2032, with a compound annual growth rate (CAGR) of 16.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Passenger Vehicle Cabin Monitoring System Market Size 2024 |

USD 8000 million |

| Passenger Vehicle Cabin Monitoring System Market, CAGR |

16.3% |

| Passenger Vehicle Cabin Monitoring System Market Size 2032 |

USD 26774.9 million |

The market growth is driven by rising demand for advanced safety features, regulatory mandates for occupant monitoring, and growing consumer awareness regarding in-vehicle security. Automakers are integrating these systems to detect driver drowsiness, monitor passenger activity, and ensure child safety. Increasing adoption of artificial intelligence, facial recognition, and sensor technologies enhances system accuracy, making cabin monitoring more reliable. Additionally, the growth of connected vehicles and autonomous driving trends is further fueling adoption, as in-cabin monitoring becomes critical for safe and seamless mobility.

Regionally, North America and Europe lead the market due to strong regulatory frameworks, high consumer safety awareness, and rapid adoption of automotive innovations. The U.S. and Germany remain at the forefront, supported by leading OEMs and technology providers. Meanwhile, Asia Pacific is emerging as the fastest-growing region, with China, Japan, and South Korea accelerating adoption through government initiatives and high vehicle production rates. Developing markets in Latin America and the Middle East are gradually adopting these systems, supported by increasing passenger vehicle sales and a shift toward advanced safety technologies.

Market Insights:

- The Passenger vehicle cabin monitoring system market is projected to grow from USD 8000 million in 2024 to USD 26774.9 million by 2032, at a CAGR of 16.3%.

- Strict safety regulations and mandates for driver monitoring systems are driving large-scale adoption across global markets.

- Rising consumer demand for child presence detection, fatigue monitoring, and occupant safety strengthens integration in new vehicles.

- High implementation costs and complex system integration remain key restraints, particularly in price-sensitive regions.

- North America leads through strong regulatory enforcement, while Europe benefits from Euro NCAP safety standards.

- Asia Pacific commands the largest market share, supported by high vehicle production and rapid adoption in China, Japan, and South Korea.

- The market reflects a balance of scale from tier-1 suppliers and innovation from AI-focused specialists, shaping long-term growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Regulatory Mandates Driving Integration of Safety-Oriented Cabin Monitoring Systems

Governments worldwide continue to enforce strict automotive safety regulations, creating strong momentum for adoption of advanced monitoring systems in passenger vehicles. Regulatory bodies in Europe and North America have mandated driver monitoring solutions to address fatigue-related accidents and child safety concerns. Automakers now integrate cabin monitoring features to comply with safety standards and remain competitive in regulated markets. The Passenger vehicle cabin monitoring system market benefits directly from these compliance requirements that accelerate integration across mid-range and premium vehicles. It encourages automotive players to prioritize system development and invest in scalable solutions. Regulatory initiatives expand opportunities for suppliers that provide validated technology platforms. Partnerships between automakers and technology firms gain prominence under these mandates.

- For instance, Volvo Cars integrated Smart Eye’s Driver Monitoring System into its EX90 SUV, using dual cameras within its Driver Understanding System to track driver eye, face, head, and body movements for enhanced safety.

Growing Consumer Demand for Personalized and Safe In-Vehicle Experiences

Consumers increasingly value passenger comfort, personalization, and safety features that ensure secure driving and riding experiences. Families seek technologies that monitor child presence, seat belt usage, and cabin temperature to prevent potential hazards. Rising disposable incomes across emerging markets allow buyers to invest in vehicles equipped with advanced in-cabin technologies. The Passenger vehicle cabin monitoring system market responds to this shift by offering features beyond safety, including convenience and comfort monitoring. It helps manufacturers strengthen brand loyalty and appeal to tech-savvy customers who expect sophisticated systems. Automakers highlight these benefits in marketing strategies to differentiate their models. Rising awareness about driver fatigue-related risks also strengthens consumer adoption. Integration of health monitoring features further aligns with consumer expectations for holistic safety.

Rapid Technological Advancements Enhancing System Accuracy and Functionality

Continuous innovation in AI, facial recognition, and biometric sensing technologies significantly improves the accuracy and reliability of cabin monitoring solutions. Automakers and technology providers collaborate to integrate multifunctional systems capable of detecting emotions, stress levels, and driver attentiveness. The Passenger vehicle cabin monitoring system market leverages these advancements to expand applications beyond compliance, entering areas of driver wellness and real-time analytics. It benefits from falling costs of sensors and computing hardware, which make integration more feasible for mass-market vehicles. Companies invest heavily in R&D to push the boundaries of monitoring technology. Competitive pressure compels firms to accelerate product innovation cycles. Enhanced functionality positions cabin monitoring as an indispensable safety and comfort feature. Adoption spreads faster when technologies prove efficient across diverse road conditions.

Strong Growth in Connected and Autonomous Vehicle Ecosystems Supporting Adoption

The emergence of connected vehicles and the gradual shift toward autonomous driving create new applications for in-cabin monitoring. Automakers design vehicles where monitoring systems ensure driver readiness to take control in semi-autonomous modes. The Passenger vehicle cabin monitoring system market benefits from this ecosystem that views cabin monitoring as critical for transitioning to higher automation levels. It reinforces trust in autonomous mobility by ensuring driver and passenger safety. It also links with telematics platforms to provide real-time alerts and data-driven insights. Automakers prioritize these systems to meet future mobility demands. Suppliers develop solutions compatible with connected infrastructures, creating long-term growth opportunities. Rising adoption of shared mobility services further drives demand for advanced cabin monitoring systems.

- For instance, BMW partnered with Seeing Machines to integrate its Guardian driver monitoring technology, which employs a forward-facing camera capturing 60 frames per second to ensure driver attention during Level 2 autonomous driving.

Market Trends

Expansion of Artificial Intelligence and Biometric Integration in Cabin Monitoring

Artificial intelligence continues to play a transformative role in shaping cabin monitoring systems, allowing precise interpretation of driver and passenger behavior. Biometric authentication enables personalization of infotainment and access controls, enhancing convenience and safety. Automakers focus on integrating features that detect fatigue, stress, or health anomalies in real time. The Passenger vehicle cabin monitoring system market leverages AI to extend system functionality across diverse user scenarios. It gains strength from rising demand for predictive analytics that support proactive safety interventions. Automakers highlight AI-driven insights as premium features. Biometric integration also improves security against unauthorized access. Growing collaborations with AI firms strengthen product portfolios of automotive companies.

Integration of Cabin Monitoring Systems with Advanced Infotainment Platforms

Automakers increasingly integrate cabin monitoring with infotainment systems, creating seamless in-vehicle experiences for drivers and passengers. Monitoring solutions now adjust music, lighting, and climate settings based on occupant mood and presence. The Passenger vehicle cabin monitoring system market benefits from this convergence that aligns with consumer expectations of personalization. It strengthens differentiation strategies for automakers seeking competitive advantage. The trend expands opportunities for suppliers of human-machine interface technologies. Automakers position such integrated platforms as value-added features to justify premium pricing. Infotainment integration also promotes ecosystem partnerships between OEMs and software providers. Rising interest in luxury and premium vehicles accelerates this trend further.

- For instance, Mercedes-Benz MBUX supports up to seven distinct occupant profiles each with over 800 personalized parameters, including seat, infotainment, and ambient lighting settings linked via cloud-based “Mercedes me” profiles for seamless user transfer between vehicles.

Development of Multi-Modal Sensing Systems Enhancing Accuracy and Coverage

Cabin monitoring solutions are evolving into multi-modal platforms that combine cameras, infrared sensors, and radar technologies. This development improves detection accuracy across diverse lighting and environmental conditions. Automakers seek systems capable of providing continuous performance in complex driving scenarios. The Passenger vehicle cabin monitoring system market gains momentum from these technical improvements that strengthen reliability. It helps manufacturers meet stringent safety expectations in both mature and emerging markets. Companies invest in sensor fusion technologies to enhance system versatility. Competitive landscapes shift toward players with integrated sensing portfolios. Adoption rates increase when systems demonstrate proven resilience in real-world driving.

Rising Adoption of Cloud Connectivity and Data Analytics in Cabin Monitoring

Cloud-based connectivity enhances cabin monitoring by enabling real-time data sharing, predictive diagnostics, and remote feature updates. Automakers leverage data analytics to refine driver assistance and passenger management capabilities. The Passenger vehicle cabin monitoring system market capitalizes on this trend to expand services beyond hardware offerings. It creates recurring revenue opportunities through software updates and data-driven insights. Automakers integrate cloud platforms with monitoring systems to strengthen fleet management and shared mobility services. Suppliers focus on secure data management to meet privacy concerns. Real-time monitoring also enhances customer experience by providing personalized safety recommendations. Cloud adoption supports the long-term evolution of vehicle ecosystems.

- For example, Tesla activated its first-row in-cabin radar across 2022+ Model Y units via software update 2025.2.6, enabling object classification and deploying alerts for potential occupants, including remote app notifications and automated HVAC or emergency calls based on sensor analytics.

Market Challenges Analysis

High Implementation Costs and Complex Integration Restricting Broader Adoption

The cost of advanced sensors, AI-enabled cameras, and biometric systems continues to challenge mass-market adoption. Automakers face pressure to balance affordability with the integration of sophisticated cabin monitoring technologies. The Passenger vehicle cabin monitoring system market encounters difficulties when buyers in price-sensitive regions hesitate to invest in premium features. It faces additional challenges in integrating new systems with existing electronic architectures. System reliability requires extensive validation, which increases costs and time-to-market. Suppliers must address these barriers by offering scalable and modular solutions. Cost competitiveness becomes essential for penetration in emerging markets. Complex supply chains add further challenges to consistent product delivery.

Data Privacy and Regulatory Compliance Issues Creating Adoption Barriers

Cabin monitoring systems capture sensitive biometric and behavioral data, raising concerns about misuse and compliance with global data protection laws. Automakers must ensure secure storage, transmission, and usage of collected information. The Passenger vehicle cabin monitoring system market faces risks when data protection standards vary across regions. It must align with evolving frameworks such as GDPR and upcoming data security mandates in Asia. Privacy concerns may reduce consumer trust if automakers fail to implement robust safeguards. Companies need strong encryption and transparent data policies to reassure customers. System vulnerabilities could create reputational risks and hinder large-scale deployment. Achieving global compliance requires significant investment and technical expertise.

Market Opportunities

Growing Demand for Health-Oriented Monitoring Features Expanding Market Potential

Consumers increasingly value health monitoring features that track vital signs such as heart rate, stress levels, and fatigue. Automakers explore applications that alert drivers during medical emergencies or health anomalies. The Passenger vehicle cabin monitoring system market can leverage this trend to expand its role beyond safety compliance. It allows companies to develop solutions aligned with holistic well-being. Partnerships with healthcare technology firms strengthen product offerings. It supports differentiation for premium automakers who market health-centric mobility experiences. Rising awareness of wellness-focused features boosts adoption in urban markets. Integration of predictive health analytics expands opportunities for continuous innovation.

Emerging Markets Offering Significant Growth Opportunities for Cabin Monitoring Systems

Emerging economies present large-scale opportunities due to rising vehicle ownership, growing middle-class populations, and government focus on road safety. Automakers target these regions by offering affordable variants of advanced monitoring systems. The Passenger vehicle cabin monitoring system market gains momentum from localized strategies that adapt technology to regional needs. It enables suppliers to tap into fast-growing vehicle production hubs. Demand rises in Asia Pacific, Latin America, and the Middle East as consumer safety awareness increases. Automakers position these systems as value-driven investments in developing regions. Partnerships with local players strengthen distribution and adoption. Emerging markets become critical in shaping long-term global growth strategies.

Market Segmentation Analysis:

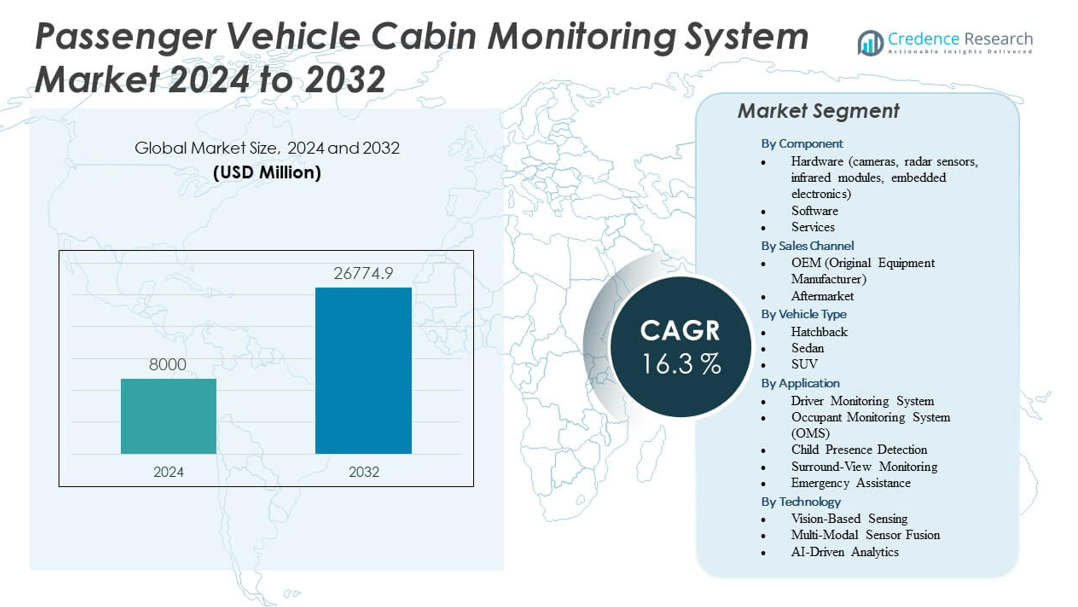

In the Passenger vehicle cabin monitoring system market,

By components play a central role in defining system performance. Hardware, including cameras, radar sensors, infrared modules, and embedded electronics, remains the largest contributor due to its function in capturing real-time data. Software complements hardware by enabling facial recognition, driver attentiveness assessment, and integration with infotainment systems. Services such as maintenance, upgrades, and cloud-based monitoring add value to end users, supporting long-term system reliability and performance. It reflects balanced growth across hardware, software, and services.

By sales channel, OEMs dominate due to early integration of cabin monitoring technologies during vehicle manufacturing, ensuring compliance with safety standards and enhancing consumer trust. OEM partnerships with technology suppliers drive innovation and mass adoption across premium and mid-range vehicles. The aftermarket segment also expands, supported by rising retrofitting demand and adoption of advanced monitoring solutions in older vehicle fleets. It creates opportunities for service providers and component suppliers seeking recurring revenue streams.

By vehicle type outlook highlights SUVs as the leading category due to their higher adoption of premium safety and convenience features. Sedans follow closely, benefiting from strong demand in both developed and emerging markets. Hatchbacks show gradual adoption in cost-sensitive regions where affordability influences buying decisions. It emphasizes how vehicle preferences shape the adoption rate of advanced in-cabin systems.

- For instance, Renesas Electronics introduced a cost-optimized SoC for cabin monitoring in hatchbacks, streamlining affordable sensing hardware integration for emerging markets.

By application, driver monitoring systems form the core of adoption, supported by regulations mandating drowsiness and distraction detection. Occupant monitoring systems strengthen passenger safety, while child presence detection gains critical importance. Surround-view monitoring enhances driver visibility, and emergency assistance features improve response in hazardous situations. It reflects how applications evolve from compliance-based adoption to value-added services.

By technology, vision-based sensing dominates due to cost-effectiveness and proven reliability in vehicle environments. Multi-modal sensor fusion enhances accuracy by combining inputs from cameras, radar, and infrared systems. AI-driven analytics emerges as a breakthrough, enabling predictive safety insights and real-time decision-making. It positions cabin monitoring as a critical component of future intelligent mobility solutions.

- For instance, Cipia and MulticoreWare’s CES 2025 demo fused 60 GHz radar and IR cameras in a next-gen system precisely monitoring driver and occupant vital signs even in occluded or low-light conditions for advanced emergency response.

Segmentation:

By Component

- Hardware (cameras, radar sensors, infrared modules, embedded electronics)

- Software

- Services

By Sales Channel

- OEM (Original Equipment Manufacturer)

- Aftermarket

By Vehicle Type

By Application

- Driver Monitoring System

- Occupant Monitoring System (OMS)

- Child Presence Detection

- Surround-View Monitoring

- Emergency Assistance

By Technology

- Vision-Based Sensing

- Multi-Modal Sensor Fusion

- AI-Driven Analytics

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America holds a market share of 32% and remains a leading region, supported by stringent safety regulations and strong consumer awareness of advanced in-cabin features. Automakers in the U.S. actively integrate monitoring technologies into premium and mid-range vehicles, strengthening adoption rates. Canada follows similar patterns with emphasis on driver safety initiatives and connected vehicle technologies. The Passenger vehicle cabin monitoring system market benefits from partnerships between automakers and technology suppliers across this region. It demonstrates steady innovation as regulatory bodies mandate driver monitoring systems for fatigue detection. Growing adoption of SUVs further amplifies demand, given their popularity in North American markets.

Europe accounts for 28% of the market share, with Germany, France, and the UK leading integration across luxury and high-performance vehicles. Strict EU directives requiring advanced driver monitoring and occupant safety accelerate deployment across multiple vehicle classes. Automakers in Europe collaborate with AI and sensor technology providers to refine cabin monitoring capabilities. It experiences rapid system upgrades as OEMs align with Euro NCAP safety requirements. Regional consumer preference for vehicles with integrated safety features supports long-term adoption. Strong R&D investments across Germany and France strengthen the competitive landscape, while Eastern Europe gradually expands adoption through OEM expansion.

Asia Pacific captures the largest share at 35%, driven by high vehicle production volumes and rapid adoption in China, Japan, and South Korea. Automakers in these markets invest in advanced monitoring solutions to differentiate products and comply with evolving safety norms. It shows the fastest growth rate, supported by government incentives for intelligent safety technologies and rising middle-class demand for secure mobility. India also emerges as a strong growth hub due to rising SUV sales and heightened awareness of driver fatigue risks. Regional suppliers focus on cost-efficient cabin monitoring systems for wider deployment across mid-range vehicles. Global players strengthen presence in Asia Pacific through joint ventures and localized production strategies, reinforcing its dominance in this industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Magna International Inc.

- Panasonic Corporation

- Robert Bosch GmbH

- Continental AG

- Valeo S.A.

- Denso Corporation

- Visteon Corporation

- Autoliv

- Omron Corporation

- Aisin Seiki

- Hyundai Mobis

- Veoneer

- Harman

- LG

- Tobii

- Seeing Machines

- Smart Eye

- Vayyar Imaging

Competitive Analysis:

In the Passenger vehicle cabin monitoring system market, competition is defined by the presence of global tier-1 suppliers and specialized technology providers. Leading companies such as Bosch, Continental, Magna, and Valeo leverage strong OEM relationships to secure large-scale contracts and integrate advanced sensing platforms into new vehicle models. It benefits from their ability to deliver end-to-end solutions combining hardware, software, and system integration. Specialists like Seeing Machines, Smart Eye, Tobii, and Cipia focus on AI-driven software and vision-based analytics, strengthening product intelligence and adaptability. Strategic moves such as partnerships, acquisitions, and product launches highlight the industry’s push toward expanding application scope from driver monitoring to occupant safety and child detection. It demonstrates a competitive environment where established suppliers dominate scale, while niche innovators shape next-generation cabin monitoring through advanced algorithms and sensor fusion technologies.

Recent Developments:

- In June 2025, HARMAN International completed the acquisition of assets from Cipia, a specialist in driver and occupant monitoring systems. This move enhances its in-cabin experience portfolio by embedding Cipia’s edge-based computer vision and AI technologies into its Ready Care product. HARMAN’s enhanced capabilities aim to drive personalization, safety, and responsiveness across its automotive offerings.

- In April 2025, Seeing Machines launched a next‑generation 3D camera technology for in‑cabin monitoring in partnership with Airy3D. The solution offers high-precision eye‑tracking by combining 3D range data with 5 MP RGB and infrared imaging in a single sensor module, maintaining compatibility with existing 2D in‑cabin software.

- In February 2025, Hyundai Mobis announced the launch of a new movable sound system and showcased enhanced cabin monitoring systems focused on occupant safety and comfort, as part of their interior innovation lineup. This new offering channels cutting-edge in-cabin radar and sensing technologies to optimize the detection of seat occupancy and micro-movements, advancing automated safety interventions.

Market Concentration & Characteristics:

The Passenger vehicle cabin monitoring system market is moderately concentrated, with tier-1 suppliers and specialized technology firms shaping its competitive structure. Leading companies such as Bosch, Continental, Magna, and Valeo dominate through established OEM relationships and global production networks. It features strong participation from niche players like Seeing Machines, Smart Eye, and Tobii, which contribute advanced AI-driven analytics and vision technologies. Market concentration reflects a balance between scale-oriented suppliers and innovation-driven specialists. It demonstrates high entry barriers due to regulatory compliance, technological complexity, and integration requirements with vehicle electronic architectures. The industry shows dynamic characteristics driven by rapid innovation, strategic partnerships, and rising demand for safety compliance.

Report Coverage:

The research report offers an in-depth analysis based on Component, Sales Channel, Vehicle Type, Application and Technology. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will expand with stronger regulatory enforcement requiring driver and occupant monitoring across multiple vehicle categories.

- Adoption will rise in mid-range vehicles as falling sensor costs and modular designs make integration more affordable.

- AI-driven analytics will enhance predictive safety features, allowing systems to detect fatigue, stress, and health anomalies with higher accuracy.

- Partnerships between automakers and technology firms will accelerate system innovation and ensure faster time-to-market.

- Growing demand for connected and semi-autonomous vehicles will strengthen the role of cabin monitoring as a critical safety enabler.

- Regional growth will intensify in Asia Pacific, supported by high vehicle production and government-backed safety initiatives.

- Cloud-based platforms will expand system capabilities through real-time updates, fleet insights, and predictive maintenance applications.

- Consumer demand for personalization and wellness features will push development of advanced occupant-centric monitoring functions.

- Competition will intensify between global tier-1 suppliers and niche innovators focusing on AI and sensor fusion.

- Long-term adoption will be shaped by standardization of in-cabin monitoring technologies across global automotive markets.