Market Overview

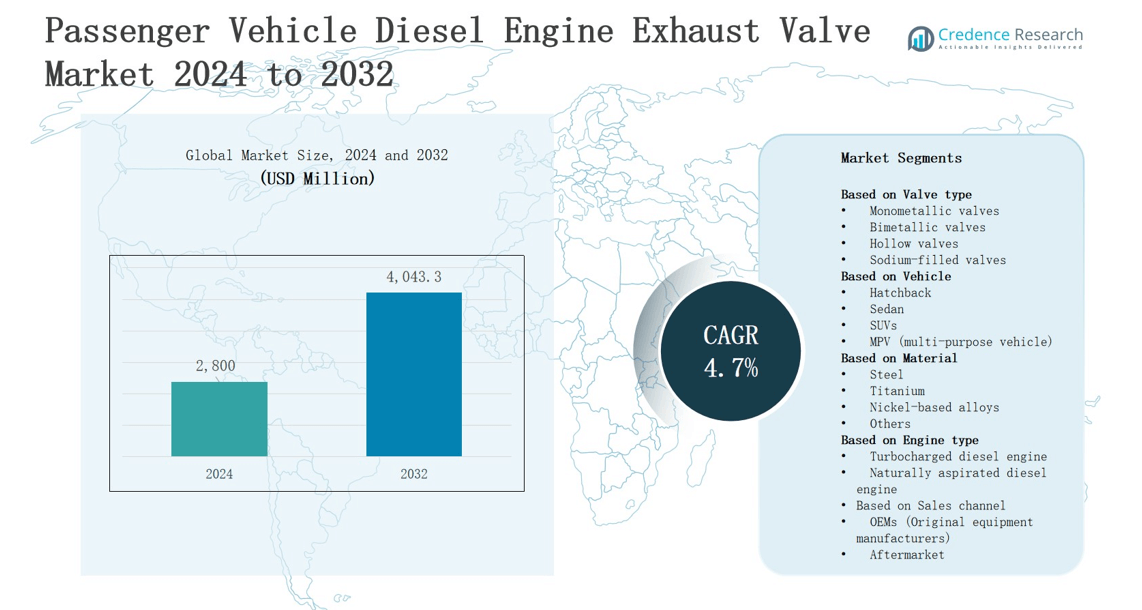

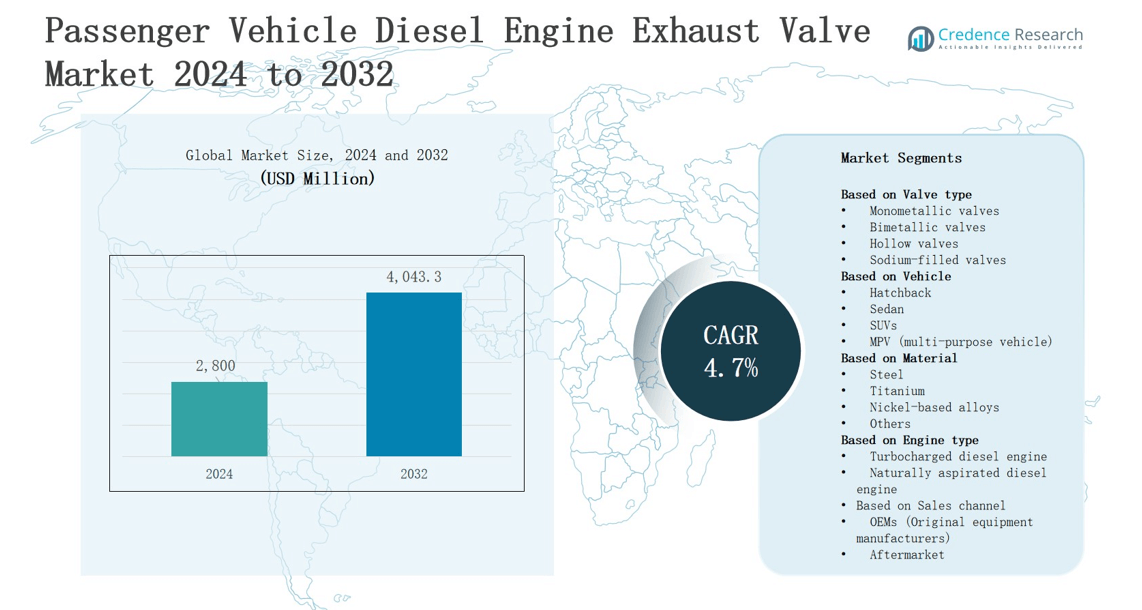

The passenger vehicle diesel engine exhaust valve market is projected to grow from USD 2,800 million in 2024 to USD 4,043.3 million by 2032, registering a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Passenger Vehicle Diesel Engine Exhaust Valve Market Size 2024 |

USD 2,800 million |

| Passenger Vehicle Diesel Engine Exhaust Valve Market, CAGR |

4.7% |

| Passenger Vehicle Diesel Engine Exhaust Valve Market Size 2032 |

USD 4,043.3 million |

The passenger vehicle diesel engine exhaust valve market is driven by rising demand for fuel-efficient engines, stricter emission regulations, and growing adoption of advanced valve technologies that enhance performance and reduce environmental impact. Increasing production of diesel-powered passenger vehicles in emerging economies further strengthens market growth. Trends include the integration of lightweight, heat-resistant materials to improve durability, alongside the adoption of precision manufacturing techniques for better reliability. Manufacturers are also focusing on developing cost-effective solutions and partnering with automakers to meet evolving regulatory standards. Rising investments in R&D and emphasis on sustainable mobility continue to shape the market outlook.

The passenger vehicle diesel engine exhaust valve market shows diverse regional dynamics, with Europe leading at 33%, followed by Asia-Pacific at 28% and North America at 22%, while Latin America and the Middle East & Africa hold 9% and 8% respectively. It grows through strong manufacturing hubs, emission regulations, and rising vehicle ownership. Key players include Eaton, Mahle, Tenneco, Aisan, Fuji Oozx, Nittan, Rane, SSV, Dengyun Autoparts, and Yangzhou Guanghui, focusing on innovation, durability, and strategic partnerships to expand presence across both mature and emerging markets.

Market Insights

- The passenger vehicle diesel engine exhaust valve market will grow from USD 2,800 million in 2024 to USD 4,043.3 million by 2032, registering a CAGR of 4.7% during the forecast period.

- Monometallic valves lead with 42% share, while bimetallic valves hold 28%, hollow valves 18%, and sodium-filled valves 12%, driven by durability, efficiency, and performance needs across passenger vehicles.

- SUVs dominate with 38% share, followed by sedans at 30%, hatchbacks at 22%, and MPVs at 10%, reflecting consumer demand for utility, affordability, and urban driving adaptability.

- Steel holds the largest share at 46%, with nickel-based alloys at 26%, titanium at 20%, and others at 8%, driven by affordability, thermal resistance, and adoption in premium performance vehicles.

- Regionally, Europe leads with 33%, Asia-Pacific follows with 28%, North America holds 22%, Latin America 9%, and the Middle East & Africa 8%, supported by manufacturing hubs, regulations, and vehicle demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Fuel Efficiency and Performance Optimization

The passenger vehicle diesel engine exhaust valve market benefits from the increasing need for fuel-efficient engines and better performance across automotive segments. Automakers focus on developing advanced valve systems that optimize combustion and airflow, directly improving power output and fuel savings. Consumers seek vehicles that balance performance with efficiency, encouraging manufacturers to adopt precision-engineered exhaust valves. It supports reduced fuel consumption and enhances reliability, aligning with evolving mobility preferences and consumer expectations for long-term performance benefits.

- For instance, Bosch introduced its “Denoxtronic” exhaust management systems, which integrate advanced valve control to improve fuel efficiency and reduce nitrogen oxide emissions in diesel vehicles.

Stringent Emission Regulations and Environmental Standards

Governments worldwide enforce strict emission norms that require automakers to integrate advanced exhaust valve technologies. The passenger vehicle diesel engine exhaust valve market grows as compliance with Euro 6, BS-VI, and EPA standards becomes mandatory. Valves designed for better sealing and higher thermal resistance support emission reduction goals. It compels manufacturers to innovate with heat-resistant alloys and advanced designs. Environmental regulations drive investments in cleaner technologies, ensuring sustained demand and adoption in regulated markets.

- For instance, Mahindra & Mahindra upgraded its diesel engine lineup in 2020 to meet India’s BS-VI norms, using exhaust valve materials with higher thermal conductivity to withstand elevated combustion temperatures.

Growing Vehicle Production in Emerging Economies

Emerging economies experience rapid growth in passenger vehicle production, fueling demand for high-performance engine components. The passenger vehicle diesel engine exhaust valve market gains momentum from expanding automotive sectors in Asia-Pacific, Latin America, and parts of Africa. Rising disposable incomes and urbanization increase diesel vehicle adoption. It accelerates exhaust valve demand to ensure durability and compliance with regional standards. Localized manufacturing and supply chain expansion strengthen component availability, supporting steady market growth worldwide.

Technological Advancements and Material Innovations

The passenger vehicle diesel engine exhaust valve market witnesses strong growth due to continuous innovation in materials and manufacturing techniques. Lightweight alloys, ceramic coatings, and advanced heat-resistant metals enhance valve durability under extreme conditions. Precision machining and automated production ensure consistent quality, reducing failure rates. It enables manufacturers to meet evolving engine design requirements. Continuous R&D investment supports the development of sustainable, cost-effective solutions, securing long-term adoption across global automotive production networks.

Market Trends

Adoption of Lightweight and Heat-Resistant Materials

The passenger vehicle diesel engine exhaust valve market is experiencing a strong trend toward lightweight and durable materials. Manufacturers focus on titanium alloys, nickel-based alloys, and ceramic coatings to withstand extreme temperatures and reduce overall engine weight. It helps improve vehicle efficiency and reduce emissions while extending valve life. Automakers integrate such solutions to meet fuel economy targets. Rising demand for advanced materials drives innovation and strengthens supplier collaborations with OEMs.

- For instance, Mitsubishi Heavy Industries has developed nickel-based alloy exhaust valves capable of withstanding combustion temperatures above 800 °C, improving durability in diesel applications.

Integration of Precision Manufacturing and Automation

Advanced manufacturing processes are reshaping the passenger vehicle diesel engine exhaust valve market. Precision machining, 3D printing, and automated assembly lines enhance quality, consistency, and production efficiency. It enables manufacturers to meet growing volumes while maintaining durability standards. Automation reduces human error and optimizes cost structures for suppliers. The adoption of smart manufacturing aligns with global industry shifts toward digitalization. Continuous improvements in machining technology ensure better sealing and performance under demanding engine conditions.

- For instance, Siemens uses its Digital Twin and MindSphere IoT platform to simulate valve performance under high-heat diesel engine conditions, reducing prototype development times by nearly 30%.

Focus on Emission Reduction and Sustainability

The passenger vehicle diesel engine exhaust valve market reflects the growing emphasis on emission reduction and sustainable solutions. Stricter emission standards encourage manufacturers to develop valves that optimize combustion efficiency and lower particulate emissions. It drives innovations in valve design and thermal resistance. Automakers seek exhaust systems that comply with evolving regulations while minimizing environmental impact. The focus on sustainability enhances R&D investments and accelerates partnerships across the supply chain to deliver eco-friendly solutions.

Shift Toward Collaborative Partnerships and R&D Investments

The passenger vehicle diesel engine exhaust valve market is moving toward greater collaboration between component manufacturers and automakers. Strategic partnerships enable faster integration of innovative valve technologies into production vehicles. It allows shared R&D efforts that reduce costs and accelerate product development cycles. Companies prioritize joint research to address durability, performance, and compliance challenges. Rising demand for specialized valve solutions encourages suppliers to expand technical capabilities, strengthening their competitive edge in global markets.

Market Challenges Analysis

High Manufacturing Costs and Material Limitations

The passenger vehicle diesel engine exhaust valve market faces significant challenges due to the high costs of advanced materials and precision manufacturing processes. Heat-resistant alloys, coatings, and lightweight composites improve performance but increase production expenses. It creates pressure on suppliers to balance quality with affordability, especially in price-sensitive markets. Smaller manufacturers struggle to invest in costly R&D or large-scale automation. Volatility in raw material prices further complicates procurement strategies. These challenges limit profit margins and slow down the adoption of advanced valve technologies.

Impact of Electrification and Regulatory Pressures

The passenger vehicle diesel engine exhaust valve market is under pressure from the global shift toward electric vehicles and hybrid alternatives. Growing adoption of EVs reduces long-term demand for diesel engines, directly impacting exhaust valve sales. It forces manufacturers to reassess production strategies and diversify product portfolios. Strict regulatory frameworks further increase compliance costs for diesel-based components. Rising emphasis on clean mobility compels the industry to innovate while facing shrinking volumes. This transition period creates uncertainty for both automakers and component suppliers worldwide.

Market Opportunities

Rising Demand in Emerging Automotive Markets

The passenger vehicle diesel engine exhaust valve market holds strong opportunities in emerging economies where diesel-powered cars maintain high demand. Rapid urbanization, rising incomes, and growing middle-class populations drive vehicle ownership across Asia-Pacific, Latin America, and parts of Africa. It creates increased demand for durable and efficient exhaust valves that can withstand diverse driving conditions. Local manufacturing initiatives and government incentives to strengthen automotive production provide suppliers with growth avenues. Expanding dealer networks and aftermarket sales further enhance revenue streams.

Innovation in Materials and Advanced Valve Technologies

The passenger vehicle diesel engine exhaust valve market presents opportunities through innovations in lightweight alloys, advanced coatings, and automated production techniques. Automakers prioritize solutions that improve engine durability, lower emissions, and meet evolving global standards. It encourages suppliers to invest in R&D partnerships with OEMs, driving the adoption of cutting-edge technologies. Growing focus on sustainable mobility fuels demand for cost-effective and eco-friendly valve systems. Expanding aftermarket services and customized solutions create long-term potential for value-driven growth worldwide.

Market Segmentation Analysis:

By Valve Type

Monometallic valves dominate the passenger vehicle diesel engine exhaust valve market with a share of 42%, driven by their cost-effectiveness, durability, and wide adoption in mass-market vehicles. Bimetallic valves hold around 28%, supported by their better thermal resistance. Hollow valves account for 18%, favored for lightweight designs and improved fuel efficiency. Sodium-filled valves capture 12%, mainly in high-performance and premium vehicles where enhanced cooling and heat dissipation are critical.

- For instance, Mahle has highlighted the use of hollow valves in turbocharged passenger cars, where weight reduction of up to 20% improves valve dynamics and fuel economy.

By Vehicle

SUVs lead the passenger vehicle diesel engine exhaust valve market with a share of 38%, supported by rising consumer demand for utility and off-road capability. Sedans follow with 30%, driven by their widespread use in urban and family segments. Hatchbacks hold 22%, benefiting from affordability and compact design suitable for city driving. MPVs account for 10%, reflecting their limited but stable demand in niche family and commercial applications.

- For example, the Hyundai Elantra and Honda Civic were both offered with diesel engines in the Indian market until 2022, catering to fuel-efficient long-distance driving needs.

By Material

Steel dominates the passenger vehicle diesel engine exhaust valve market with a share of 46%, due to its affordability, strength, and widespread compatibility with conventional engines. Nickel-based alloys hold 26%, driven by their superior thermal resistance and longer lifecycle in heavy-duty operations. Titanium accounts for 20%, gaining traction in performance-oriented and premium vehicles where weight reduction is critical. Other materials, including composites and experimental alloys, make up 8%, reflecting ongoing innovation and specialized applications.

Segments:

Based on Valve type

- Monometallic valves

- Bimetallic valves

- Hollow valves

- Sodium-filled valves

Based on Vehicle

- Hatchback

- Sedan

- SUVs

- MPV (multi-purpose vehicle)

Based on Material

- Steel

- Titanium

- Nickel-based alloys

- Others

Based on Engine type

- Turbocharged diesel engine

- Naturally aspirated diesel engine

Based on Sales channel

- OEMs (Original equipment manufacturers)

- Aftermarket

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 22% share in the passenger vehicle diesel engine exhaust valve market, driven by the steady demand for light trucks, SUVs, and diesel-powered passenger vehicles. Automakers in the region emphasize fuel efficiency and regulatory compliance, leading to greater adoption of advanced exhaust valve technologies. It benefits from strong R&D capabilities, integration of heat-resistant materials, and technological innovations by leading suppliers. Stricter EPA emission standards support the need for reliable exhaust valves. Growth is reinforced by investments in manufacturing capacity and aftermarket services across the U.S. and Canada.

Europe

Europe accounts for the largest share of 33% in the passenger vehicle diesel engine exhaust valve market, supported by established automotive manufacturing hubs and high diesel vehicle penetration. OEMs prioritize emission reduction, creating demand for bimetallic and sodium-filled valves that withstand high thermal loads. It thrives under Euro 6 regulations, compelling manufacturers to invest in advanced exhaust valve designs. Partnerships between component suppliers and automakers strengthen supply chain integration. Germany, France, and Italy remain leading contributors. Strong consumer demand for fuel-efficient and durable diesel vehicles further sustains market expansion in the region.

Asia-Pacific

Asia-Pacific secures 28% share in the passenger vehicle diesel engine exhaust valve market, fueled by high production volumes and rising vehicle ownership in China, India, and Southeast Asia. Growing disposable incomes and urbanization encourage the adoption of hatchbacks, sedans, and SUVs, creating strong demand for durable engine components. It benefits from localized manufacturing, competitive labor costs, and government incentives supporting domestic automotive production. Rapid growth in export-oriented vehicle manufacturing enhances the region’s role in the global supply chain. Suppliers invest heavily in R&D partnerships with OEMs to cater to evolving performance and emission standards.

Latin America

Latin America holds 9% share in the passenger vehicle diesel engine exhaust valve market, supported by steady growth in Brazil and Mexico. Rising demand for affordable passenger vehicles drives the use of steel-based exhaust valves. It faces challenges related to supply chain disruptions and limited access to advanced materials, yet strong aftermarket services contribute to overall revenue. Government policies encouraging localized production further support adoption. Increasing vehicle fleet size ensures stable demand for replacement valves. Regional manufacturers collaborate with global players to strengthen market presence.

Middle East & Africa

The Middle East & Africa captures 8% share in the passenger vehicle diesel engine exhaust valve market, led by demand in Gulf countries and South Africa. SUVs and MPVs dominate the vehicle mix, driving steady consumption of durable exhaust valves. It faces infrastructure and regulatory limitations but benefits from rising imports of diesel passenger vehicles. Growing preference for high-performance vehicles in premium segments also stimulates adoption of titanium and nickel-based valves. Strategic distribution networks and aftermarket growth play a key role in regional expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Eaton

- Rane

- Yangzhou Guanghui

- Nittan

- Aisan

- Dengyun Autoparts

- SSV

- Mahle

- Tenneco

- Fuji Oozx

Competitive Analysis

The passenger vehicle diesel engine exhaust valve market is highly competitive, with global and regional players focusing on innovation, cost efficiency, and compliance with emission standards. Companies such as Eaton, Mahle, Tenneco, Aisan, and Fuji Oozx leverage strong R&D capabilities to develop advanced valves with improved thermal resistance and durability. It emphasizes lightweight materials and precision manufacturing to meet performance demands of modern diesel engines. Players like Nittan, Rane, SSV, Dengyun Autoparts, and Yangzhou Guanghui strengthen their positions through localized production, cost-effective solutions, and strong partnerships with OEMs. Intense competition drives continuous investment in advanced alloys, automated processes, and sustainable solutions to meet evolving global regulatory requirements. Market leaders focus on balancing innovation with affordability to capture share in both mature and emerging regions, while regional firms gain ground by serving aftermarket demand and offering tailored solutions. The industry remains shaped by consolidation trends, collaborations, and technological advancements that determine long-term competitive advantage.

Recent Developments

- In February 2024, Rane Group announced that the boards of Rane (Madras) Ltd, Rane Brake Lining Ltd, and Rane Engine Valve Ltd had approved a merger through a scheme of arrangement.

- In October 2023, Cummins acquired parts of Faurecia’s commercial vehicle exhaust aftertreatment business in the U.S. and Europe. The deal includes two manufacturing sites one in Indiana and one in the Netherlands.

- In September 2024, BRP secured a patent for an engine assembly featuring a dual-path exhaust system with selective valve control.

- In August 2024, Rheinmetall won a contract to supply exhaust gas recirculation (EGR) valves (distinct from exhaust valves but related in exhaust system function). The order begins in January 2026 and runs through 2031, with spare-parts support for 15 years after that.

Market Concentration & Characteristics

The passenger vehicle diesel engine exhaust valve market shows moderate concentration, with a mix of global leaders and regional manufacturers competing on innovation, cost, and quality. Established companies such as Eaton, Mahle, Tenneco, and Aisan dominate with strong OEM partnerships, advanced materials, and consistent technological upgrades. It reflects a market where large players focus on R&D and emission compliance while regional firms like Dengyun Autoparts, Rane, SSV, and Yangzhou Guanghui strengthen presence through localized production and aftermarket services. The industry is characterized by steady demand across SUVs, sedans, and hatchbacks, with monometallic and steel-based valves holding the largest shares due to affordability and wide application. Increasing regulatory pressures push manufacturers toward lightweight alloys, bimetallic designs, and precision manufacturing, raising entry barriers for smaller firms. Competition centers on balancing cost efficiency with performance and environmental compliance, shaping a market where strategic collaborations and sustainable solutions play a decisive role in long-term growth.

Report Coverage

The research report offers an in-depth analysis based on Valve Type, Vehicle, Material, Engine Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise for lightweight, heat-resistant valves to improve performance and meet emission standards.

- Automakers will adopt advanced valve technologies to enhance fuel efficiency and reduce environmental impact globally.

- Emerging economies will drive growth through rising vehicle ownership and expanding localized manufacturing capabilities.

- Precision manufacturing and automation will strengthen product consistency, durability, and efficiency in large-scale production.

- Regulatory compliance will remain a critical driver, pushing adoption of advanced designs and durable materials.

- Aftermarket demand will grow steadily, supported by increasing vehicle fleets and replacement requirements worldwide.

- Partnerships between OEMs and suppliers will accelerate innovation and integration of new exhaust valve technologies.

- Material innovations like titanium and nickel-based alloys will expand adoption in premium and performance vehicles.

- Regional players will enhance competitiveness through cost-effective production and strong distribution networks in emerging markets.

- Long-term market outlook will rely on sustainable solutions aligned with evolving clean mobility initiatives globally.