Market Overview:

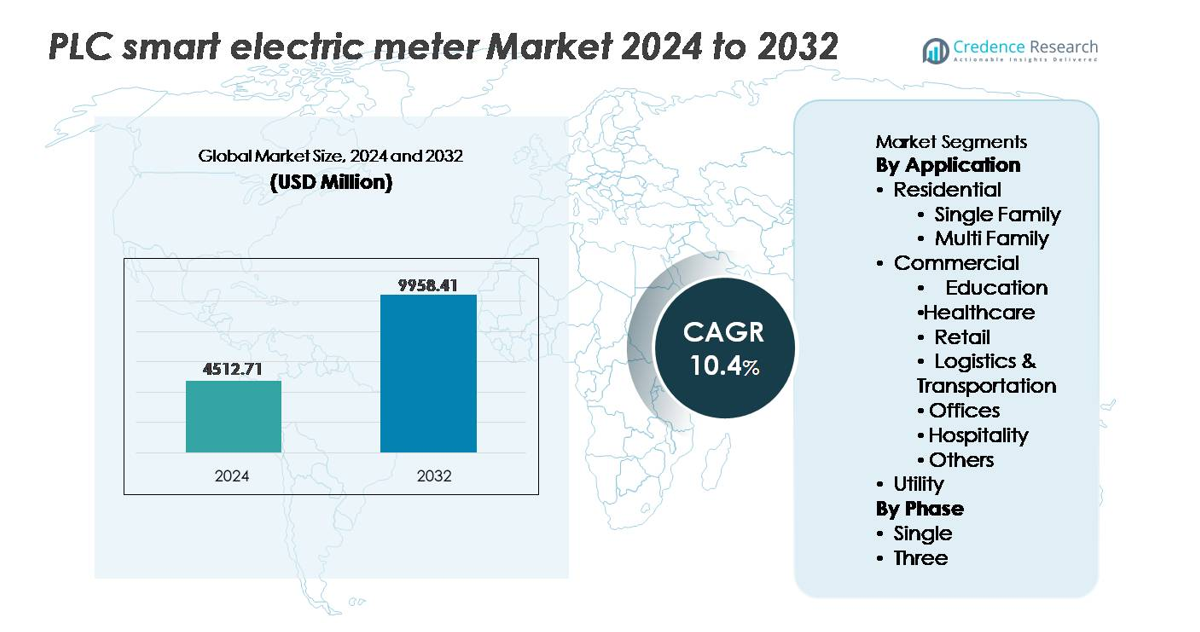

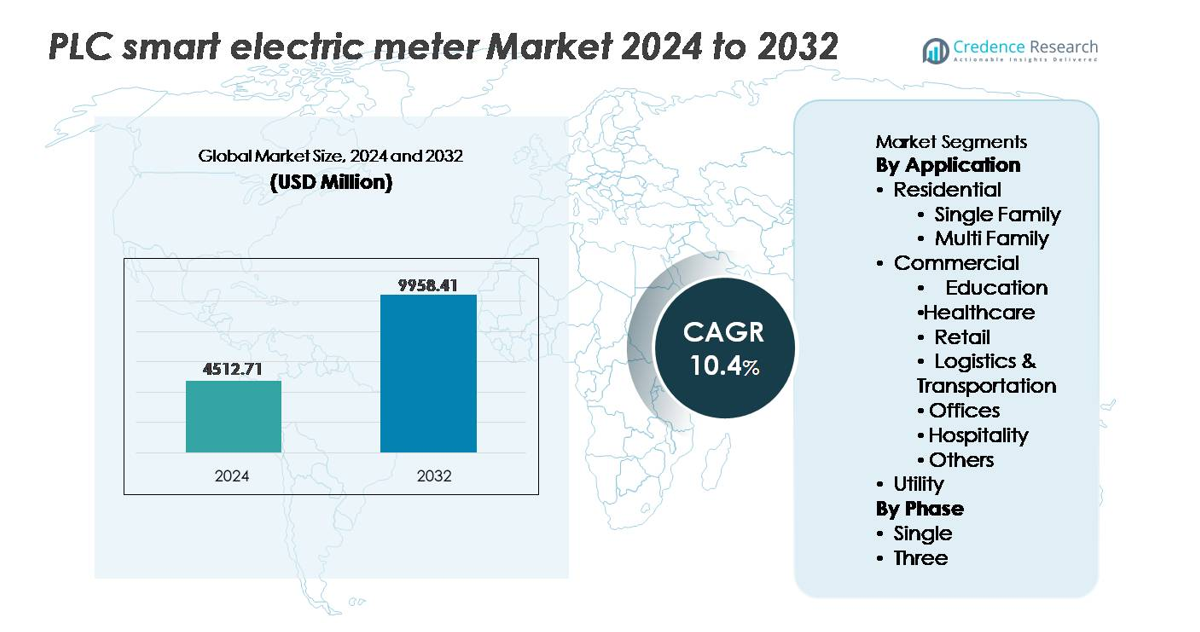

The PLC smart electric meter market, valued at USD 4,512.71 million in 2024, is projected to reach USD 9,958.41 million by 2032, expanding at a CAGR of 10.4% throughout the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| PLC Smart Electric Meter Market Size 2024 |

USD 4,512.71 million |

| PLC Smart Electric Meter Market, CAGR |

10.4% |

| PLC Smart Electric Meter Market Size 2032 |

USD 9,958.41 million |

The PLC smart electric meter market is shaped by established technology providers and specialized communication solution developers offering advanced AMI capabilities. Key players include Cisco Systems, Circutor, Honeywell International, Aclara Technologies, Apator, General Electric, Itron, CyanConnode, Advanced Electronics Company, and Iskraemeco Group, each strengthening portfolios through communication modules, data intelligence platforms, and grid-interoperability solutions. Asia Pacific leads the market with approximately 39-40% share, driven by high-volume government rollouts and grid modernization initiatives, while Europe follows with around 21-22% supported by regulatory mandates for efficiency and renewable integration. North America remains a mature but steady adopter, emphasizing digital grid optimization and enhanced consumer energy insights.

Market Insights:

- The PLC smart electric meter market was valued at USD 4,512.71 million in 2024 and is projected to reach USD 9,958.41 million by 2032, registering a CAGR of 10.4% during the forecast period.

- Market growth is driven by smart grid modernization, time-of-use billing adoption, demand response programs, and utilities targeting reduced technical and revenue losses through accurate real-time metering.

- Key trends include integration with AI-enabled grid analytics, predictive maintenance dashboards, hybrid PLC–RF communication, and scalability for EV charging, rooftop solar, and distributed generation ecosystems.

- The competitive landscape features global leaders and regional manufacturers offering advanced AMI platforms, PLC communication firmware, and cybersecurity-enhanced solutions aligned with national rollout mandates.

- Asia Pacific holds the dominant regional share at around 40%, followed by Europe with about 22% and North America at 15%, while the residential segment leads by application due to high-volume deployments and government-driven replacement programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

By application, the PLC smart electric meter market is led by the residential segment, with single-family units holding the dominant share due to higher per-household energy consumption and rapid adoption of smart grid programs that promote accurate billing and real-time usage optimization. Multi-family dwellings are experiencing incremental growth supported by centralized monitoring systems for tenant billing and efficiency tracking. In the commercial category-covering education, healthcare, retail, logistics and transportation, offices, hospitality, and others-retail and hospitality lead as energy-intensive operations rely on PLC metering to manage HVAC, refrigeration, and 24/7 loads, while logistics and transportation gain traction with the expansion of EV charging and automated warehousing. The utility segment remains a critical adopter as grid operators integrate PLC meters for outage localization, non-technical loss reduction, and demand response management to enhance infrastructure reliability and operational economics.

- For instance, Landis+Gyr’s E360 PLC-enabled meter supports bidirectional communication over CENELEC A-band and is deployed in over 6 million residential installations across Europe, enabling remote firmware upgrades and daily consumption interval reads at a resolution of 15 minutes.

By Phase

By phase, the single-phase PLC smart electric meter segment accounts for the majority share, driven by large-scale deployment across single-family residences, small businesses, and rural electrification programs that prioritize cost-effective and scalable smart metering infrastructures. The segment benefits from rising solar rooftop adoption, time-of-day pricing models, and government-funded meter replacements. The three-phase segment is expanding steadily, supported by industrial plants, commercial complexes, EV charging networks, and high-load facilities requiring advanced power quality analytics and voltage regulation. The ability of three-phase PLC meters to manage distributed energy resources and safeguard sensitive electrical assets positions the segment for continued growth.

- For instance, Schneider Electric’s three-phase iEM3xxx series meters provide Class 1 (or 0.5S, depending on model)accuracy for active energy metering with onboard Modbus RTU, BACnet, M-bus, or LON communication options via RS485 connections.

Key Growth Drivers:

Government-Led Smart Grid Modernization and Mandatory Meter Rollouts

Government mandates remain the most influential growth driver for PLC smart electric meters, as national utilities embark on multi-year grid modernization and digitalization programs. Regulators increasingly enforce AMI adoption to reduce non-technical losses, improve billing transparency, and optimize peak/valley load management. Policy-backed funding mechanisms accelerate replacement of legacy meters, while utility incentive schemes encourage voluntary consumer upgrades. PLC-based smart meters are preferred in regions with existing grid infrastructure, offering faster deployment and lower retrofitting costs compared to wireless alternatives. Additionally, climate and energy transition commitments require governments to enhance grid efficiency, integrate renewable generation, and support electrification of mobility, all of which depend on real-time distributed consumption data. As utilities transition from periodic meter reading to continuous digital monitoring, PLC-enabled systems ensure scalable, secure, and cost-aligned communication, reinforcing long-term demand momentum across residential, commercial, and public infrastructure networks.

- For instance, Aclara’s PLC AMI solution deployed by the Puerto Rico Electric Power Authority covers more than 200 substations and provides outage detection alerts within approximately 60 seconds via substation-level data concentration.

Rising Energy Efficiency Demands and Time-of-Use Billing Adoption

Increasing focus on energy conservation and dynamic tariff structures significantly boosts PLC smart meter deployment. Time-of-use and real-time pricing models require precise consumption data, enabling utilities to balance loads and consumers to reduce peak-hour usage or shift consumption to off-peak periods. The global push to curb carbon emissions drives the integration of smart energy management platforms in homes, retail facilities, and industrial assets. PLC meters enable two-way communication, supporting remote connect-disconnect, tamper detection, outage alerts, and demand response automation. Growing consumer adoption of smart appliances and connected home systems further increases reliance on accurate consumption analytics. As organizations align with ESG frameworks, they require detailed reporting on electricity usage intensity and emissions, positioning PLC-enabled metering as a core component of energy monitoring strategies. These benefits collectively promote adoption across cost-sensitive and infrastructure-constrained markets.

- For instance, Hexing Electrical’s HXE310 series PLC meters feature integrated disconnection relays, often rated for up to 100 A, and are designed with multiple anti-tampering features to detect events like neutral disturbances or magnetic influences. These events are logged with a date and time stamp for later retrieval or transmission to the utility control center.

Expansion of Distributed Energy Resources and EV Charging Infrastructure

The rapid expansion of rooftop solar, microgrids, battery storage, and electric vehicle charging infrastructure accelerates demand for PLC-based smart meters. Distributed energy resources require precise grid synchronization, bidirectional energy measurement, and voltage quality monitoring, functions enabled effectively by PLC communication. EV charging stations introduce high-load variability, necessitating real-time demand balancing to prevent transformer stress and feeder congestion. Utilities use PLC meters to manage reverse power flows and preserve grid stability while enabling net-metering and renewable incentive programs. Commercial properties, logistics hubs, and residential townships deploying multi-charger networks benefit from centralized PLC-enabled analytics that optimize load allocation and minimize power wastage. As prosumer participation increases and DER penetration rises, PLC smart meters serve as foundational tools to integrate decentralized generation and support the evolving power market ecosystem.

Key Trends and Opportunities:

Integration with AI-Based Grid Analytics and Predictive Maintenance

A significant trend reshaping the PLC smart electric meter landscape is integration with AI, machine learning, and predictive maintenance platforms. These systems analyze consumption patterns, voltage fluctuations, feeder outages, and technical losses to improve grid resilience and enable near-autonomous grid management. AI-driven models forecast peak demand, optimize electricity procurement, and identify high-loss corridors. For consumers, AI-supported dashboards provide cost-saving recommendations, appliance-level analytics, and personalized tariff optimization. Utilities leverage digital twins and network simulations to accelerate planning and identify stress points before failures occur. This growing digital intelligence layer unlocks value beyond metering, creating recurring service-based revenue streams.

- For instance, Schneider Electric’s EcoStruxure Grid platform processes more than 2.6 billion grid data points annually and integrates AI algorithms capable of predicting feeder overloads up to 48 hours in advance based on PLC smart meter inputs.

Emerging Commercial Opportunities in EV, Smart Buildings & Microgrids

Rapid electrification of transportation and the proliferation of smart buildings present lucrative adoption opportunities for PLC smart meters. Commercial EV charging hubs require load balancing and rapid anomaly detection, making PLC a practical choice due to grid-based communication. Smart commercial properties implement PLC meters to track zonal loads, automate building energy systems, and reduce operational overhead. Microgrids gain traction in industrial parks, campuses, and remote communities, where PLC meters support real-time control, peer-to-peer energy trading, and power islanding modes. The convergence of automation, AI, and decentralized generation positions PLC metering as a core component of future grid architectures.

- For instance, Siemens reports that its VersiCharge Ultra 175EV charging system integrates with grid monitoring equipment and building energy management systems (BEMS), supporting a maximum total charging output of 175 kW (or 178 kW) DC.

Key Challenges:

Communication Noise and Interference in Complex Grid Environments

Despite its advantages, PLC communication is susceptible to signal attenuation, noise, and interference caused by switching devices, industrial machinery, or poorly insulated wiring. Urban environments with heterogeneous electrical networks and legacy infrastructure pose integration challenges. Maintaining signal reliability across long feeder lines requires repeaters and noise-filtering equipment, increasing deployment complexity. While technology advancements improve modulation resilience and multi-carrier techniques, performance can still vary across utility networks. Addressing communication reliability is essential for applications requiring real-time responsiveness, such as EV charging and dynamic demand response.

Cybersecurity, Data Privacy, and Regulatory Compliance Pressures

With two-way communication and cloud-connected platforms, PLC smart meters introduce cybersecurity and data governance challenges. Unauthorized access, tampering, customer profiling risks, and potential system shutdowns elevate the need for robust encryption, authentication, and threat monitoring. Compliance with evolving data protection regulations requires utilities to implement secure data handling and transparency measures for consumers. Integrating cybersecurity frameworks across millions of endpoints increases cost and operational oversight. As cyberattacks on critical infrastructure intensify globally, utilities must continually upgrade security protocols, creating persistent financial and operational burdens for smart metering ecosystems.

Regional Analysis:

Asia Pacific

Asia Pacific remains the dominant region, holding about 40% of the global smart-meter revenues in 2024. Rapid urbanization, expanding power demand, and large-scale grid modernization initiatives drive extensive smart-meter deployments in countries such as China, India, Japan, and South Korea. Government-led smart-grid programs and smart-city projects favour grid-based solutions like PLC meters for their cost-effectiveness and infrastructure compatibility. Strong residential and commercial electricity consumption growth, alongside rising rooftop solar and distributed energy resources, further boost demand. The region’s scale and diversity make it the primary growth engine for global smart-meter adoption.

Europe

Europe accounts for a significant portion of the worldwide smart-meter market roughly 22% as of the mid-2020s – underpinned by strong regulatory mandates for energy efficiency, grid digitalization, and renewable integration. Utilities across the EU and neighbouring countries increasingly deploy smart-electric meters, often favouring wired PLC communication to ensure stable two-way data exchange over varied grid topologies. Demand stems both from residential upgrades under energy-efficiency directives and commercial/industrial conversions to support demand-side management and renewable integration. Europe’s mature infrastructure and stringent regulatory standards assure steady and sustained demand.

North America

North America contributes around 15% to the global smart-electric meter market as of 2023. The region benefits from established grid infrastructure, high penetration of AMI systems and widespread regulatory support for modernization of distribution networks. Utilities in the U.S. and Canada continue replacing legacy meters and expanding advanced metering capabilities to enable real-time usage tracking, dynamic pricing, and demand response. Although growth is slower compared to emerging regions, stable demand persists for smart meters including PLC-based ones mostly in residential and small-to-medium commercial sectors because of reliability, compliance, and efficient grid management requirements.

Latin America

Latin America represents a smaller but emerging share roughly 8% of the global smart-meter market in 2024. Many countries still operate with manual or outdated analog meters, creating substantial replacement potential. Utilities in Brazil, Mexico, and other urbanizing economies begin investing in grid modernization to reduce losses, improve billing accuracy, and support rising electricity demand. PLC-based smart meters present a cost-effective option where wired communication simplifies deployment over vast, heterogeneous grids. As more utilities commit to full-scale meter rollouts, Latin America offers a growing frontier for smart-meter suppliers over the coming years.

Middle East & Africa (MEA)

MEA currently holds a modest but growing portion of global smart-meter installations estimated around 2-4% in 2024 -yet demonstrates high growth potential. Rapid urbanization, rural electrification efforts, and expansion of commercial and industrial infrastructure fuel rising energy demand. Many utilities opt for PLC-based smart meters due to grid wiring availability and the need for robust, two-way communication in regions with limited wireless infrastructure. The region’s push for loss reduction, billing transparency, and improved distribution efficiency, combined with rising renewable and off-grid projects, positions MEA as a strategic growth frontier for smart-meter adoption.

Market Segmentations:

By Application

- Residential

- Single Family

- Multi Family

- Commercial

- Education

- Healthcare

- Retail

- Logistics & Transportation

- Offices

- Hospitality

- Others

- Utility

By Phase

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the PLC smart electric meter market is characterized by a blend of global AMI technology leaders and region-specific manufacturers competing to secure large-scale utility contracts. Established companies focus on integrated smart grid platforms, offering end-to-end solutions combining meters, PLC communication modules, data management, and analytics software. Strategic priorities include strengthening interoperability, enhancing cybersecurity resilience, and supporting renewable and EV-charging integration through advanced grid-edge intelligence. Regional players differentiate through cost-effective PLC meter production, localization of manufacturing, utility-tailored firmware, and after-sales service models aligned with national rollout programs. Vendor competitiveness is increasingly defined by the ability to deliver hybrid PLC-RF communication, scalable device management platforms, and AI-enabled analytics, positioning providers not just as meter suppliers but as ecosystem partners in grid digitalization. Partnerships, acquisitions, and technology licensing remain critical as utilities demand future-proof, interoperable, and tariff-flexible solutions to support evolving grid modernization roadmaps.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cisco Systems

- Circutor

- Honeywell International

- Aclara Technologies

- Apator

- General Electric

- Itron

- CyanConnode

- Advanced Electronics Company

- Iskraemeco Group

Recent Developments:

- In January 2025, Iskraemeco established a new entity, “Iskraemeco India Technology Development Centre private limited,” that became officially operational from 1 January 2025. This marks a strategic step in strengthening its development and support capabilities related to electricity metering, data processing and related smart-meter technologies.

- In October 2024, In a business restructuring move, Iskraemeco sold its India-based electricity meter manufacturing operations to Kaynes Technology

Report Coverage:

The research report offers an in-depth analysis based on Application, Phase and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Utilities will expand PLC smart meter deployments to support full-scale smart grid digitalization and real-time load management.

- Integration with AI and predictive analytics will enhance fault detection, outage prevention, and asset optimization.

- Hybrid PLC-RF communication architectures will gain momentum to improve flexibility in dense and complex grid environments.

- Demand response automation will grow as consumers adopt dynamic pricing and energy optimization tools.

- Residential adoption will accelerate with the rise of smart homes, connected appliances, and rooftop solar monitoring.

- Commercial and industrial uptake will increase to support power quality analytics and equipment protection.

- Cybersecurity frameworks will strengthen to safeguard grid communication and consumer data privacy.

- PLC meters will play a central role in EV charging networks through load balancing and bidirectional energy management.

- Developing regions will drive future volume growth through electrification and grid modernization programs.

- Vendors will focus on scalable platforms, cloud-based data services, and interoperability standards to expand long-term value.