Market Overview:

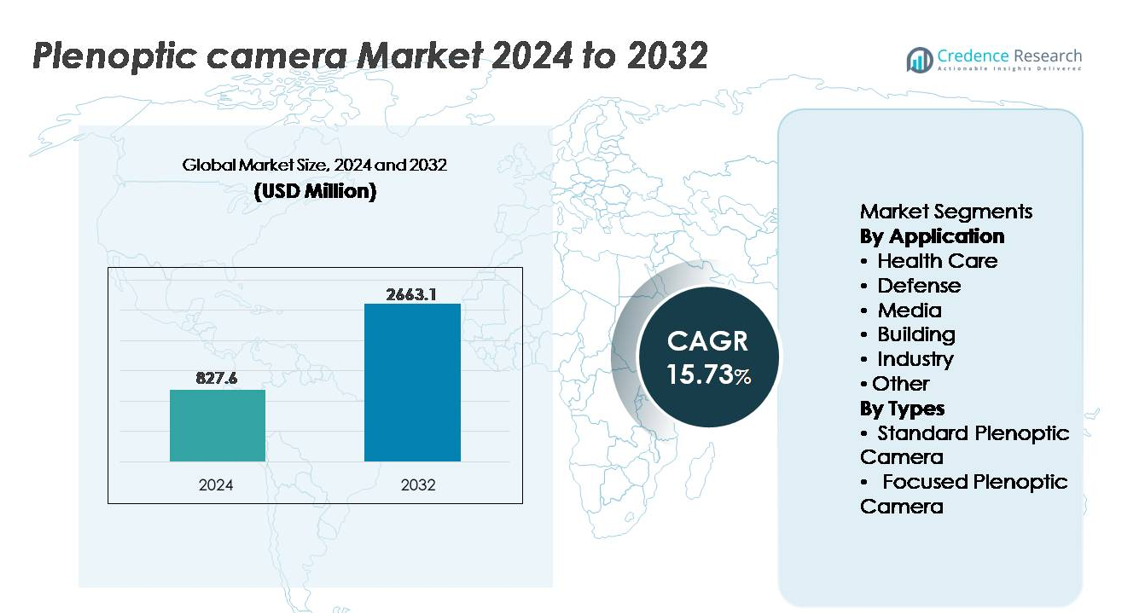

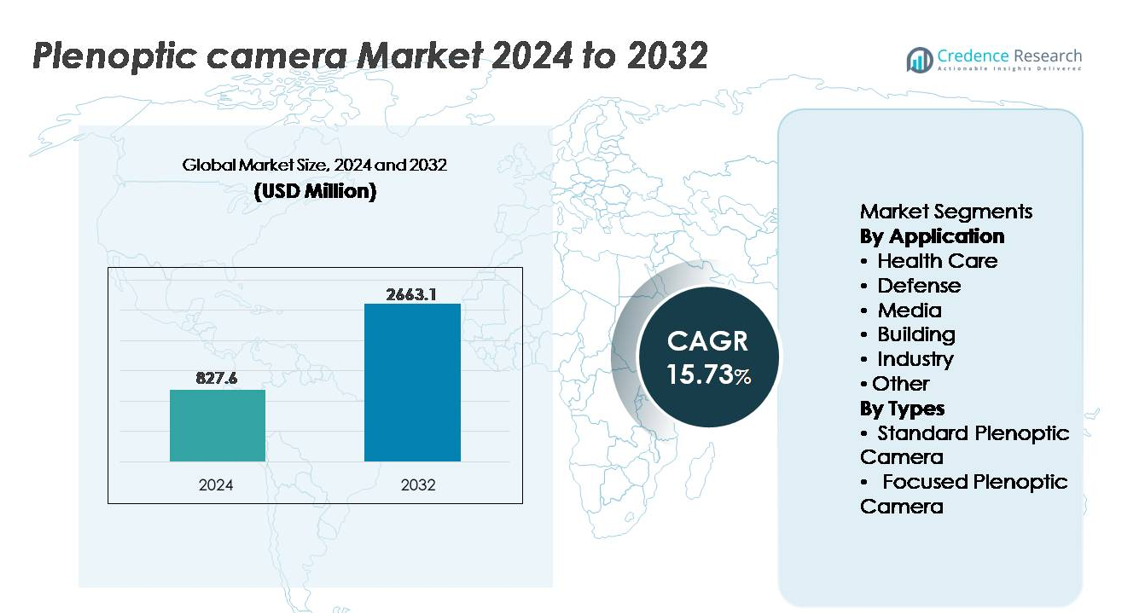

The global plenoptic camera market was valued at USD 827.6 million in 2024 and is projected to reach USD 2,663.1 million by 2032, expanding at a CAGR of 15.73% throughout the forecast period (2025-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plenoptic Camera Market Size 2024 |

USD 827.6 million |

| Plenoptic Camera Market, CAGR |

15.73% |

| Plenoptic Camera Market Size 2032 |

USD 2,663.1 million |

The plenoptic camera market features strong participation from technology innovators such as Light Field Lab, Leia, Raytrix, OTOY, Lytro, Lumii, Japan Display Inc. (JDI), FoVI 3D, Avegant, and Holografika, each focusing on advancements in computational imaging, immersive visualization, and light-field display solutions. These companies compete through sensor innovation, AI-supported depth processing, and volumetric content production capabilities to address opportunities across media, simulation, healthcare imaging, and autonomous systems. North America leads the global plenoptic camera market with an approximate 34% share, driven by the presence of pioneering imaging technology firms and significant investments in AR/VR, defense, and digital content creation.

Market Insights:

- The global plenoptic camera market was valued at USD 827.6 million in 2024 and is projected to reach USD 2,663.1 million by 2032, registering a CAGR of 15.73% during the forecast period.

- Increasing demand for immersive content creation, volumetric video, and AR/VR experiences drives market growth, particularly within media and simulation platforms that require dynamic refocusing and depth-rich imagery.

- Key trends include AI-driven computational imaging, integration of light-field capture in autonomous navigation, and expanding applications across medical imaging and precision industrial inspection.

- The competitive landscape features firms such as Light Field Lab, Leia, Raytrix, and OTOY, focusing on resolution enhancement, software ecosystems, and volumetric display innovations, intensifying technology-led differentiation.

- North America holds approximately 34% market share, followed by Europe at 28% and Asia Pacific at 27%, while the Media segment remains the largest application segment, supported by adoption in filmmaking, virtual production, and digital content engineering.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application:

The Media segment holds the dominant share in the plenoptic camera market, driven by growing demand for computational imaging, immersive cinematography, and light-field visual effects that allow refocusing after capture and multi-angle content generation. Production studios increasingly adopt plenoptic technology to reduce post-production time and create volumetric video for AR/VR platforms. In healthcare, adoption is accelerating for minimally invasive procedures and depth-guided imaging, while defense agencies leverage light-field cameras for enhanced target recognition. Building and industrial applications benefit from 3D structural mapping, predictive maintenance, and machine vision integration, supported by the expanding digital-twin ecosystem.

- For instance, Leia Inc.’s Lightfield Display panels for industrial visualization, such as the 12.3-inch automotive display developed with Continental, incorporate nanotechnology-based diffraction gratings, enabling real-time 3D visualization for applications like navigation and driver safety interfaces in vehicle cockpits.

By Types:

The Standard Plenoptic Camera segment currently leads the market share due to its broad use in cinematography, scientific imaging, and photography, offering cost-effective depth capture and computational refocus capabilities. These systems remain the preferred choice for commercial deployments, training environments, and visual content studios. However, Focused Plenoptic Cameras are gaining momentum, particularly in precision measurements, robotics, and medical imaging, because they provide higher spatial resolution and superior depth accuracy. Their role is expanding as autonomous navigation, surgical robotics, and industrial inspection platforms increasingly require real-time light-field data processing.

- For instance, Raytrix’s R12 standard plenoptic camera employs a 12-megapixel sensor combined with a micro-lens array consisting of more than 40,000 lenslets, enabling depth reconstruction starting from as close as 5 millimeters for laboratory and scientific object imaging.

Key Growth Drivers:

Growing Demand for Immersive Imaging and Content Digitization

The rapid shift toward immersive content formats, including augmented reality (AR), virtual reality (VR), and mixed reality (MR), is a major driver of plenoptic camera adoption. The ability to capture volumetric depth, refocus images post-capture, and generate multi-perspective visual assets makes plenoptic cameras integral to next-generation content pipelines. Production houses, gaming environments, simulation platforms, and live broadcast technology providers increasingly leverage these systems to streamline CGI integration and eliminate costly multi-camera setups. Furthermore, rising consumer appetite for 3D interactive media, digital exhibitions, photogrammetry-driven virtual tours, and experiential marketing continues to expand demand. As industries prioritize digital-first engagement strategies, plenoptic imaging is evolving from experimental innovation to a commercial necessity, accelerating deployment in entertainment, advertising, and educational ecosystems.

- For instance,OTOY’s OctaneRender engine leverages GPU acceleration and supports multiple rendering algorithms (known as kernels, including Path Tracing and Direct Lighting). It enables real-time light-field and volumetric rendering for cinematic VR and holographic media, often utilizing large-scale network or cloud rendering configurations (including configurations with dozens of GPUs, such as 64-GPU clusters) without needing traditional multi-array camera rigs.

Advancements in Computational Photography and AI-Based Processing

Continuous improvements in computational algorithms, GPU acceleration, neural rendering, and machine-learning-based image reconstruction significantly enhance plenoptic camera capabilities. Modern systems integrate AI-driven super-resolution, automatic depth correction, and noise elimination, enabling sharper outputs with reduced manual adjustments. These advancements open opportunities across scientific research, medical diagnostics, industrial automation, and real-time surveillance. Edge AI further supports plenoptic cameras in robotics and autonomous vehicles, enabling faster decision-making from multidimensional visual data. As chipsets evolve to support higher frames-per-second light-field processing and low-power embedded computing, more compact and commercially viable plenoptic modules enter the market. The convergence of plenoptic imaging and AI is redefining performance benchmarks and reshaping competitive dynamics through scalable, software-driven differentiation.

- For instance, NVIDIA’s Instant NeRF technology demonstrated the ability to generate a fully rendered neural radiance field representation of a 3D scene in under 5 seconds using its RTX GPU platform powered by third-generation Tensor Cores, drastically reducing photogrammetry and light-field data reconstruction timelines previously measured in hours.

Expanding Application in Precision-Based Industrial and Healthcare Systems

The adoption of plenoptic cameras is increasing across industrial inspection, robotics, and healthcare due to their ability to generate 3D depth and surface measurements without mechanical scanning. In minimally invasive surgery, light-field imaging enables better navigation and anatomical mapping, enhancing outcomes and reducing procedural risk. Similarly, factory automation platforms utilize plenoptic cameras for defect detection, assembly verification, and predictive maintenance operations. The technology supports automated handling in logistics and strengthens machine vision in warehouse robotics. As the shift toward smart manufacturing and medical imaging modernization intensifies, plenoptic cameras address the market need for real-time, high-accuracy, data-rich visualization—positioning them as a key enabler in Industry 4.0 and next-generation clinical diagnostics.

Key Trends & Opportunities:

Emergence of Volumetric Video and Metaverse-Ready Imaging

One of the most prominent trends is the adoption of plenoptic devices for volumetric recording, enabling immersive content compatible with metaverse, simulation training, and collaborative digital environments. Light-field capture allows creators to generate 360-degree perspectives, holographic projections, and navigable digital twins without traditional green-screen captures or motion rigs. As the entertainment ecosystem expands toward spatial content, real-time rendering engines and holographic communication platforms present a new growth frontier. The technology aligns with evolving markets for remote interaction, digital avatars, and AI-assisted content production, establishing strong opportunities for camera manufacturers and software stack developers.

- For instance, Light Field Lab’s SolidLight holographic platform demonstrated modular display units capable of producing over 10 billion pixels per square meter with sub-millimeter pitch precision below 2.5 microns, enabling freestanding holographic objects exceeding 28 inches in size without headsets or wearable devices, supporting future metaverse-ready live volumetric communication.

Integration of Plenoptic Imaging in Autonomous Platforms

Rising demand for high-precision imaging in driverless vehicles, agricultural drones, inspection robots, and unmanned defense systems creates new opportunities for focused plenoptic cameras. These devices deliver accurate object recognition in low light, cluttered backgrounds, and fast-motion environments—where conventional cameras struggle. Integration with SLAM (Simultaneous Localization and Mapping), sensor fusion modules, and onboard computing makes plenoptic technology an attractive upgrade pathway for autonomy engineers. As regulatory approval for unmanned operations accelerates and industries replace manual navigation with intelligent systems, plenoptic imaging is positioned to become a standard component within high-level automation stacks.

- For instance, Japan Display Inc. (JDI) introduced its automotive light-field imaging module built around a 12.3-inch display panel featuring 1,920 × 720 resolution supported by proprietary backlight control using 5,000 mini-LEDs, enabling multi-view volumetric visualization required for ADAS perception validation and cockpit simulation without headset-based augmentation.

Key Challenges:

High System Cost and Limited Commercial-Level Manufacturing Scalability

Despite accelerating innovation, plenoptic cameras face challenges related to complex design, advanced optics, computational hardware requirements, and specialized image processing software. High acquisition and integration costs restrict adoption among small and mid-sized production studios and limit penetration in cost-sensitive industrial segments. The lack of large-scale mass manufacturing channels keeps unit pricing elevated compared to conventional or stereo-based imaging systems. Additionally, the need for specialized HDR light-field sensors, bespoke calibration, and heat-optimized chipsets contributes to expensive research and manufacturing cycles. Cost barriers slow market expansion and delay broad consumer-level adoption.

Data Processing Complexity and Integration Barriers Across Legacy Systems

Plenoptic cameras generate large multidimensional datasets that demand robust storage, edge computing, and advanced software optimization. Existing industrial and medical imaging infrastructure often lacks compatibility with light-field formats, creating integration friction and additional system investment. The complexity of processing refocusing algorithms, real-time depth reconstruction, and AI-driven rendering presents a steep learning curve for end users. Without standardized output formats and universal software platforms, adoption may remain limited to organizations with advanced digital maturity. The market must address operational complexity and workflow fragmentation to ensure scalable growth across mainstream applications.

Regional Analysis:

North America

North America holds the largest share of the plenoptic camera market at approximately 34%, driven by rapid adoption across media production, defense intelligence, and research institutions. The region hosts leading technology developers specializing in computational imaging and AI-assisted light-field processing, strengthening commercialization. Growth is supported by film studios adopting volumetric capture and defense agencies investing in next-generation situational awareness systems. Widespread integration within AR/VR simulation platforms across aerospace and medical training further contributes to market expansion. Federal funding for digital imaging innovation and strong enterprise adoption of immersive content technologies reinforce North America’s dominant market position.

Europe

Europe accounts for around 28% of the market, supported by strong academic research infrastructure and extensive penetration in industrial inspection, robotics, and healthcare imaging. Countries such as Germany, France, and the U.K. are at the forefront of computational optics, supported by collaborative R&D initiatives. Demand increases from medical visualization and automotive engineering, particularly autonomous vehicle testing and digital-factory environments. Regulatory support for advanced manufacturing and digital twin adoption strengthens deployment. The region’s expanding medical device ecosystem and high-value engineering sectors underpin sustained demand for high-resolution depth capture provided by plenoptic cameras.

Asia Pacific

Asia Pacific represents approximately 27% of the global market and is the fastest-growing region due to expanding adoption in electronics manufacturing, robotics automation, surveillance, and emerging content studios. China, Japan, and South Korea lead in advanced imaging sensors and semiconductor integration, enabling cost-efficient plenoptic components. The region benefits from large-scale investment in industrial automation and smart factory initiatives. Additionally, the accelerating gaming and cinematic content market creates opportunities for volumetric and AR-supported production. Expansion in healthcare imaging modernization and adoption in minimally invasive procedures support further penetration across high-growth economies in Southeast Asia.

Latin America

Latin America holds around 6% market share, with growth led by increasing adoption of digital imaging tools in media production, architectural reconstruction, and industrial inspection. Brazil and Mexico drive demand through expanding broadcast and advertising ecosystems and modernization of manufacturing capabilities. Limited technological infrastructure and higher system acquisition costs moderately restrict adoption; however, rising interest in 3D mapping for mining, oil, and construction presents new opportunities. Government-driven digital transformation strategies and uptake of aerial imaging for agriculture monitoring create early-stage but promising growth potential for plenoptic camera deployment.

Middle East & Africa

The Middle East & Africa region accounts for approximately 5% of the global market, supported by growing investments in smart cities, security surveillance, and infrastructure visualization. The UAE and Saudi Arabia lead adoption, leveraging plenoptic cameras for digital twin development, defense observation, and intelligent monitoring. Expansion in megaproject construction drives increased demand for 3D structural mapping and immersive walkthrough imaging. However, limited local manufacturing and technical integration capabilities challenge wider penetration. Rising innovation hubs, government-backed technology clusters, and adoption of AR/VR simulation in training environments are expected to create steady long-term opportunities.

Market Segmentations:

By Application

- Health Care

- Defense

- Media

- Building

- Industry

- Other

By Types

- Standard Plenoptic Camera

- Focused Plenoptic Camera

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the plenoptic camera market is defined by a mix of specialized imaging technology developers, computational optics innovators, and software-focused light-field solution providers. Companies compete through advancements in sensor resolution, depth-mapping accuracy, AI-driven image reconstruction, and compact hardware architecture designed for industrial and medical applications. Strategic partnerships with film production studios, robotics manufacturers, and semiconductor companies are increasingly common as firms seek to expand application versatility and accelerate commercialization. Investments in volumetric capture platforms, cloud-based processing, and AR/VR content pipelines differentiate offerings and strengthen brand positioning. However, the market remains price-sensitive, prompting players to focus on modular designs and software-led value creation to enhance affordability. Continuous improvement in GPU performance and neural rendering models has intensified competition, favoring organizations with integrated hardware–software ecosystems. Additionally, emerging startups targeting niche use cases—such as surgical visualization, real-time inspection, and autonomous navigation—contribute to a dynamic and innovation-centric market environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Light Field Lab

- Leia

- Raytrix

- OTOY

- Lytro

- Lumii

- Japan Display Inc (JDI)

- FoVI 3D

- Avegant

- Holografika

Recent Developments:

- In Oct 2025, Raytrix A new research dataset and benchmark called LiFMCR was released, based on two high-resolution Raytrix R32 plenoptic cameras, along with associated high-precision 6-DoF pose ground truths (via motion-capture). This enables rigorous evaluation of multi-camera light-field registration.

- In Jan 2025, Avegant announced a new technology called ZeroMount™ for binocular alignment of waveguide and light-engine in AR glasses.

- In 2025, Leia Inc., a significant player in the light-field and 3D display technology market, is a leading provider of glasses-free 3D display hardware and software solutions that leverage proprietary nanotechnology and AI. The company develops cost-optimized, switchable light-field displays designed for integration into a variety of OEM consumer devices, including mobile phones and automotive dashboards via strategic partnerships with major industry players like Continental AG. The company has consolidated its platform under the brand name Immersity AI, and its former flagship consumer product, the Lume Pad 2tablet, was officially discontinued in August 2025 to focus on software and OEM integrations.

Report Coverage:

The research report offers an in-depth analysis based on Application, Types and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Plenoptic cameras will gain broader adoption in media production to enable real-time volumetric capture and immersive visual storytelling.

- Integration with AR, VR, and MR platforms will accelerate, supporting next-generation simulation and training ecosystems.

- AI and neural rendering advancements will significantly improve image clarity, resolution, and depth analytics.

- Medical imaging will increasingly utilize plenoptic systems for enhanced minimally invasive procedures and anatomical mapping.

- Autonomous robots and vehicles will incorporate plenoptic cameras for reliable 3D perception and navigation.

- Compact and modular plenoptic designs will make integration easier for consumer electronics and smart devices.

- Software-driven capabilities will become a critical competitive differentiator across vendors and applications.

- Cloud and edge processing will enable real-time depth computation and spatial content streaming.

- Adoption in architecture and construction will grow for digital twins and project visualization.

- Cost optimization and scalability improvements will expand commercial and industrial deployment opportunities.