Market Overview:

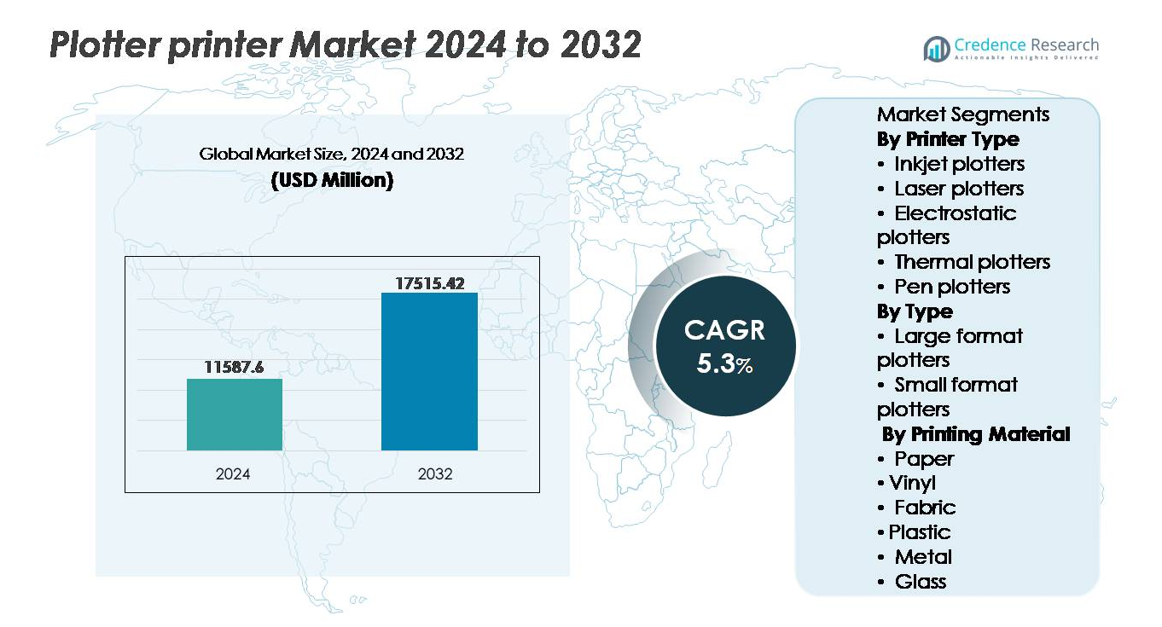

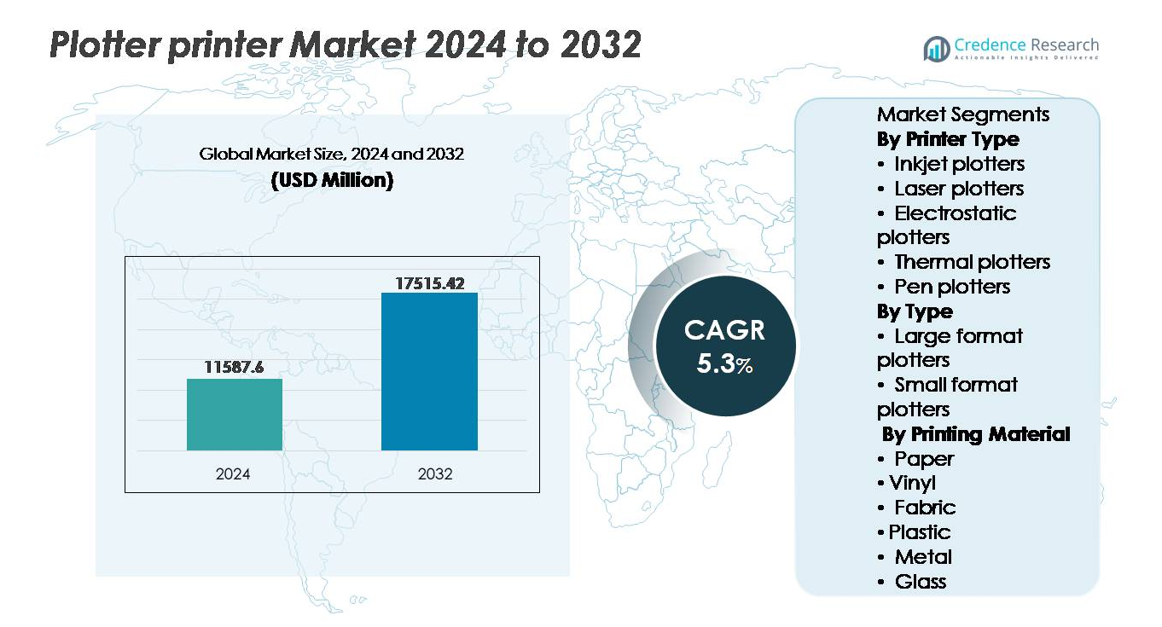

The global plotter printer market was valued at USD 11,587.6 million in 2024 and is projected to reach USD 17,515.42 million by 2032, growing at a CAGR of 5.3% during the forecast period (2025-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plotter Printer Market Size 2024 |

USD 11,587.6 million |

| Plotter Printer Market, CAGR |

5.3% |

| Plotter Printer Market Size 2032 |

USD 17,515.42 million |

The plotter printer market is shaped by major players including Ricoh, Roland DG, Canon, Seiko Instruments, Epson, Oki Data, Mimaki, Kyocera, Mutoh, and Xerox, each competing on printing precision, substrate diversity, and workflow automation. Asia Pacific leads the market with 34% share, driven by manufacturing scale, textile prototyping adoption, and expanding advertising infrastructures. North America follows with 32% share, supported by construction digitization and wide-format commercial printing demand. Europe maintains nearly 27% share, reinforced by strong industrial design, automotive engineering, and environmental compliance driving upgrades toward eco-friendly ink and material technologies.

Market Insights:

- The global plotter printer market was valued at USD 11,587.6 million in 2024 and is projected to reach USD 17,515.42 million by 2032, expanding at a 5.3% CAGR during the forecast period.

- Market growth is driven by rising demand for large-format printing in construction planning, CAD mapping, signage, and customized textile applications, supported by multi-material printing capabilities across paper, vinyl, fabric, plastic, metal, and glass.

- Key trends include adoption of eco-solvent and UV-curable inks, software-enabled automation, AI-based color calibration, and growing textile personalization, enhancing productivity and waste reduction.

- The market remains competitive with players focusing on cost-per-print reduction, workflow integration, and service-based subscription models, while high operational and consumable costs remain a restraint for SMEs and low-volume users.

- Asia Pacific leads with 34% share, followed by North America at 32% and Europe at 27%, while large-format plotters dominate by type, driven by infrastructure expansion and outdoor advertising demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Printer Type

Inkjet plotters represent the dominant sub-segment, holding the largest market share due to superior color reproduction, adaptability to multiple substrates, and compatibility with wide-format output for CAD drawings, GIS mapping, textiles, and indoor advertising. Laser plotters continue to gain traction in high-volume architectural and engineering environments where fast black-and-white precision is critical. Meanwhile, electrostatic and thermal plotters retain relevance in industrial settings for blueprinting and barcode imaging. Pen plotters maintain niche adoption for artistic drafting and circuit patterning. LED-based systems in the “Others” category are emerging, driven by demand for fast monochrome technical documents.

- For instance, Canon’s imagePROGRAF PRO-6600 supports print widths up to 60 inches with a 12-colorpigment ink system, enabling high-fidelity photographic output”.

By Type

Large-format plotters dominate the market, supported by expanding applications in construction plan digitization, commercial signage, industrial prototypes, and wide-format promotional displays. Their ability to produce outputs exceeding 24 inches positions them as a preferred solution for industries requiring scalable, detailed visualization. Small-format plotters serve SMEs, design studios, and photo labs seeking compact, cost-efficient printing solutions with lower consumable cost structures. However, the increasing global investment in infrastructure planning, land administration, and design visualization strongly reinforces the growth trajectory of large-format systems.

- For instance, Epson’s SureColor SC-T5405 supports print speeds of 22 seconds per A1 sheet and incorporates a 1.33-inch MicroTFP PrecisionCore printhead with 800 nozzles per color channel, enabling rapid output for survey maps and construction documentation aligned with high-volume infrastructure workflows.

By Printing Material

Paper remains the dominant sub-segment, driven by its extensive use in advertising posters, CAD drawings, educational charts, and commercial documentation. Vinyl is expanding rapidly, fueled by outdoor durable signage, vehicle wraps, and retail display branding. Fabric applications continue to grow within apparel prototyping, décor prints, and customized textiles. Plastic, metal, and glass substrates support niche industrial functions including component marking, UV-cured labeling, and rigid promotional prints. The adoption of material-flexible plotters aligns with customer demand for customized output solutions and the diversification of printing for both commercial and industrial applications.

Key Growth Drivers:

Rising Demand for Large-Format Technical and Commercial Printing

The surge in infrastructure development, smart-city initiatives, and digitalization of land records is driving increased adoption of large-format plotter printers for technical drawings, GIS mapping outputs, and blueprints. Engineering firms and architectural consultancies depend on plotters for high-resolution, scalable visualization that standard printers cannot replicate. In parallel, the retail and advertising sectors require wide-format prints for storefront displays, banners, trade show graphics, and promotional campaigns. Plotters enable printing on diverse substrates, including vinyl and fabric, enriching commercial branding outcomes. The consistent expansion of construction, urban planning, and consumer-facing marketing are primary forces sustaining market growth, as plotters remain integral to both physical design and customer engagement workflows.

- For instance, Canon’s ColorWave 3800 technical wide-format system prints at speeds up to 225 A1/D-size pages per hour and supports media rolls up to 42 inches, enabling fast output of engineering drawings for large-scale infrastructure projects with strict turnaround requirements.

Advancements in Printing Materials and Substrate Compatibility

Modern plotter printers are engineered to support multi-material printing, enabling output on paper, acrylic, fabrics, plastics, metal, and glass. This flexibility unlocks opportunities in interior décor, textile prototyping, industrial labeling, and durable outdoor signage, aligning with customer expectations for customization, aesthetics, and functional performance. Enhanced ink formulations UV-curable, eco-solvent, and pigment-based support fade resistance and weatherproofing for long-term deployment. The growing preference for sustainable and recyclable substrates is also encouraging manufacturers to introduce environmentally responsible material options. As industries adopt branding, product imaging, and décor elements as core strategic tools, demand for multifunction plotters strengthens across commercial, industrial, and creative applications.

- For instance, Mimaki’s UJF-7151 plusII industrial flatbed printer supports direct printing on substrates up to 710 mm × 510 mm with a maximum media thickness of 153 mm and achieves resolutions up to 1,800 × 1,800 dpi, making it viable for metal plates, acrylic signage, and molded parts used in manufacturing and retail branding.

Expansion of Digital Textile and Customization Printing

The accelerating transformation of the textile and fashion sectors toward on-demand production and rapid prototyping promotes plotter printer uptake. Designers and manufacturers rely on plotters to print patterns, sublimation transfers, and customized visuals for apparel, furnishings, and interior textiles. The shift to micro-manufacturing, personalized fashion, and localized production reduces inventory risk and shortens time-to-market, further supporting automation in textile printing workflows. Sportswear, events merchandising, and corporate branding demand vivid, fabric-compatible prints in low volumes yet with high detail precision requirements efficiently met by modern plotter systems. As consumer preference shifts toward unique, custom-tailored products, plotter printers become essential tools enabling design freedom and production flexibility.

Key Trends & Opportunities:

Integration of Software Automation and AI-Assisted Printing

Plotter printers are increasingly integrated with intelligent software for layout optimization, color accuracy management, and remote workflow orchestration. AI-based print correction reduces waste, recalibration downtime, and test-print iterations critical in high-cost substrates like vinyl and metal. Cloud-based platforms allow cross-location teams to review, annotate, and schedule print jobs directly, supporting hybrid work environments in design, engineering, and marketing. Plugins for CAD, BIM, and 3D visualization platforms expand compatibility and accelerate print preparation. This trend creates opportunities for manufacturers to bundle hardware, software, and service as subscription-based solutions, appealing to enterprises seeking predictable cost structures and streamlined production cycles.

- For instance, HP’s PrintOS platform connects to more than 30 types of HP large-format devices and executes automated job nesting that can reduce media consumption by up to 25 millimeters per linear job, while its AI-assisted color profiling recalibrates printheads in under 4 minutes, minimizing manual intervention during long-run production.

Growth of Eco-Friendly Printing and Sustainable Consumables

Sustainability represents a rising opportunity as organizations reduce emissions and comply with waste-management regulations. Plotter manufacturers are developing water-based inks, recyclable media, and energy-efficient machines to support eco-conscious buyers. Green signage materials, biodegradable vinyl substitutes, and low-VOC ink formulations are gaining traction in retail, transport, and construction sectors. The demand for environmentally responsible branding materials is driven by consumer expectations and corporate ESG mandates. Manufacturers offering sustainable solutions can differentiate in a competitive market, especially as governments and large enterprises prioritize procurement policies that mandate reduced environmental impact across printing and advertising supply chains.

- For instance, HP confirms that its Latex water-based ink formulation contains zero hazardous air pollutants as per U.S. Clean Air Act standards and maintains VOC emissions below 0.03 mg/m³ in third-party certified environmental chamber testing. Additionally, HP reports that its LX610 printers support PVC-free media rolls up to 1.63 meters wide, providing recyclable alternatives for indoor commercial graphics.

Key Challenges:

High Operational and Consumable Costs

While plotter printers deliver professional-grade output, their ownership costs can hinder adoption among smaller businesses. Ink cartridges, specialty substrates, maintenance packs, and printhead replacements cumulatively elevate total cost of ownership. Outdoor-durable and textile-compatible inks often command a premium. Energy usage and climate control around sensitive printing environments further add to operational expenses. Organizations with limited or irregular printing requirements struggle to justify investment compared to outsourcing. This challenge pressures manufacturers to innovate cost-efficient systems, ink management technologies, and leasing models to support entry-level and mid-market customers.

Technical Skill Requirements and Limited Workforce Expertise

Operating advanced plotter printers demands knowledge of color profiling, substrate characteristics, layout alignment, and maintenance procedures. Incorrect handling results in material wastage, nozzle clogging, inconsistent output, and extended downtime. Many SMEs lack trained personnel to integrate plotters within their production or design workflows. Additionally, compatibility issues across design software, RIP systems, and multi-format files contribute to operational complexity. Skill scarcity slows adoption in emerging markets and non-traditional applications. As plotters evolve with automation and multi-material capabilities, training, certification programs, and simplified user interfaces become essential to mitigate this constraint.

Regional Analysis:

North America

North America holds approximately 32% of the plotter printer market, supported by strong demand from the engineering, architectural, and construction sectors, as well as thriving advertising and signage industries. The U.S. remains the major revenue contributor due to rapid adoption of large-format and multi-material printers for infrastructure planning, CAD drawings, and commercial branding. Growth is reinforced by technology-driven marketing activities, digital textile customization, and expansion of industrial design labs in universities and enterprises. Investments in sustainable printing materials and eco-solvent inks further strengthen market penetration as corporate brands prioritize low-emission printing processes.

Europe

Europe accounts for nearly 27% of the global market, driven by strong design, automotive, and industrial manufacturing ecosystems that rely on precision large-format printing for prototyping, simulation visualization, and documentation. Germany, Italy, and France lead adoption, supported by advanced engineering and fashion industries incorporating textile and vinyl printing. EU regulations encouraging sustainable ink use and recyclable substrates influence purchasing patterns across print shops and corporate facilities. Growth opportunities center on green signage materials, heritage-building documentation, and digital twin printing for architectural restoration, reinforcing Europe’s position as a technology-conscious and environmentally progressive market.

Asia Pacific

Asia Pacific dominates the plotter printer market with around 34% share, propelled by rapid industrialization, expanding construction activity, and fast-growing advertising and media sectors across China, India, Southeast Asia, and South Korea. Rising demand for cost-efficient wide-format printers in textile prototyping, garment printing, retail branding, and e-commerce packaging fuels adoption. Local manufacturers offer competitively priced machines and consumables, accelerating penetration among SMEs and print service providers. Government-led urban development initiatives, smart city execution, and education institution digitization further drive consumption, positioning the region as the nucleus for both manufacturing scale and end-use expansion.

Latin America

Latin America represents nearly 4% of the market, with Brazil and Mexico leading adoption driven by expanding advertising, construction documentation, and export-oriented textile sectors. Increasing use of outdoor vinyl signage, point-of-sale displays, and customized merchandise supports demand for versatile substrate printing. Budget-sensitive enterprises prioritize affordable plotter models with low operational costs, as economic fluctuations impact capital equipment purchases. Opportunities are emerging in urban transportation map printing, municipal planning projects, and academic technical programs. However, regional dependence on imported hardware and consumables influences pricing, creating opportunities for leasing and subscription-based service models.

Middle East & Africa

The Middle East & Africa region holds approximately 3% share, supported by infrastructure megaprojects, hospitality development, and retail expansion across the Gulf states. Large-format plotters serve critical applications in architectural drafting, site planning, and commercial signage for malls, airports, and entertainment districts. In Africa, growth is more gradual but supported by rising urbanization and government digitization of public infrastructure records. Climatic conditions requiring durable, UV-resistant materials create demand for solvent-based and weatherable inks. Market expansion is challenged by limited technical expertise and maintenance availability, making vendor support and training programs essential to adoption.

Market Segmentations:

By Printer Type

- Inkjet plotters

- Laser plotters

- Electrostatic plotters

- Thermal plotters

- Pen plotters

By Type

- Large format plotters

- Small format plotters

By Printing Material

- Paper

- Vinyl

- Fabric

- Plastic

- Metal

- Glass

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the plotter printer market is characterized by a mix of global technology manufacturers, specialized industrial printing firms, and regional OEMs offering cost-efficient solutions. Leading players focus on innovation in substrate compatibility, energy-efficient systems, and eco-conscious ink formulations to meet regulatory and customer sustainability demands. The market remains highly competitive, with differentiation driven by printing speed, multi-material capability, cost per print, and integration with CAD, BIM, and workflow automation software. Strategic moves such as acquisitions, technology partnerships with design and construction platforms, and subscription-based service models are reshaping customer retention strategies. Manufacturers are increasingly targeting high-growth sectors including textile prototyping, outdoor signage, décor applications, and industrial labeling, while regional players compete on affordability and after-sales service. As digital customization continues to influence purchasing decisions, vendors investing in intelligent print management software, cloud collaboration features, and reduced consumable waste are positioned to strengthen their competitive foothold.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Recent Developments:

- Mutoh: In October 2025, Mutoh released the new eco-solvent printer model XpertJet 1641SR Pro II, marking the latest expansion in its wide-format product line. This statement is correct. Sales for the printer began on October 22, 2025, featuring a new print head and improved print speeds.

- Roland DG: In June 2025, the company introduced the new DIMENSE DA-640, a wide-format dimensional surface printer that integrates full-color printing with unique embossing effects. This printer uses a structural ink and specialized media to achieve textured finishes, opening up new opportunities in interior decor and custom surfaces. The original statement is correct in its description of the product and release date.

- Canon: In January 2025, Canon launched a new series of large-format plotters in India—imagePROGRAF TZ-5320 and TX-series (TX-5420/TX-5320/TX-5220)—enhancing print speed, ink sensing reliability, and efficiency for architectural and design workflows. This statement is correct, as the printers were made available at authorized dealers from January 13, 2025.

Report Coverage:

The research report offers an in-depth analysis based on Printer type, Type, Printing material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Plotter printers will see increasing demand from large-format technical and commercial printing applications.

- Adoption of AI and automation will enhance accuracy, color management, and workflow efficiency.

- Eco-friendly inks and recyclable substrates will gain traction due to sustainability commitments.

- Textile prototyping and customized apparel printing will continue to expand market opportunities.

- Integration with cloud platforms will support real-time collaboration and remote job scheduling.

- Software-driven predictive maintenance will reduce downtime and extend equipment lifecycle.

- Multi-material capability will broaden usage across industrial marking, décor, and signage.

- Subscription-based service and leasing models will improve affordability for SMEs.

- Print shops and enterprises will prioritize machines with lower consumable waste.

- Emerging markets will witness accelerated adoption through infrastructure development and retail branding growth.