Market Overview:

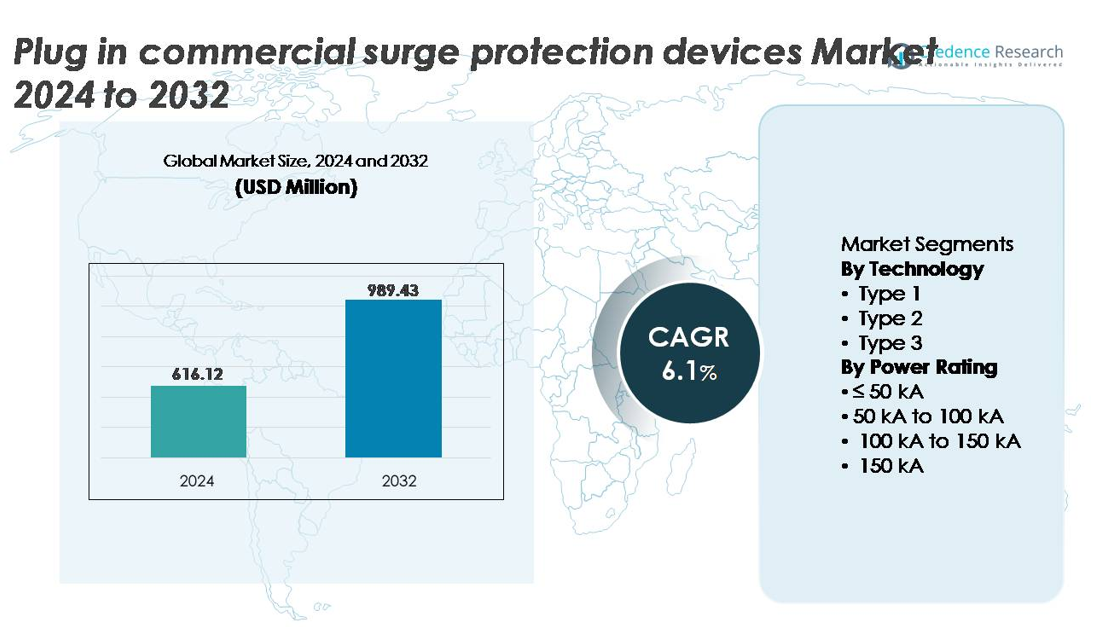

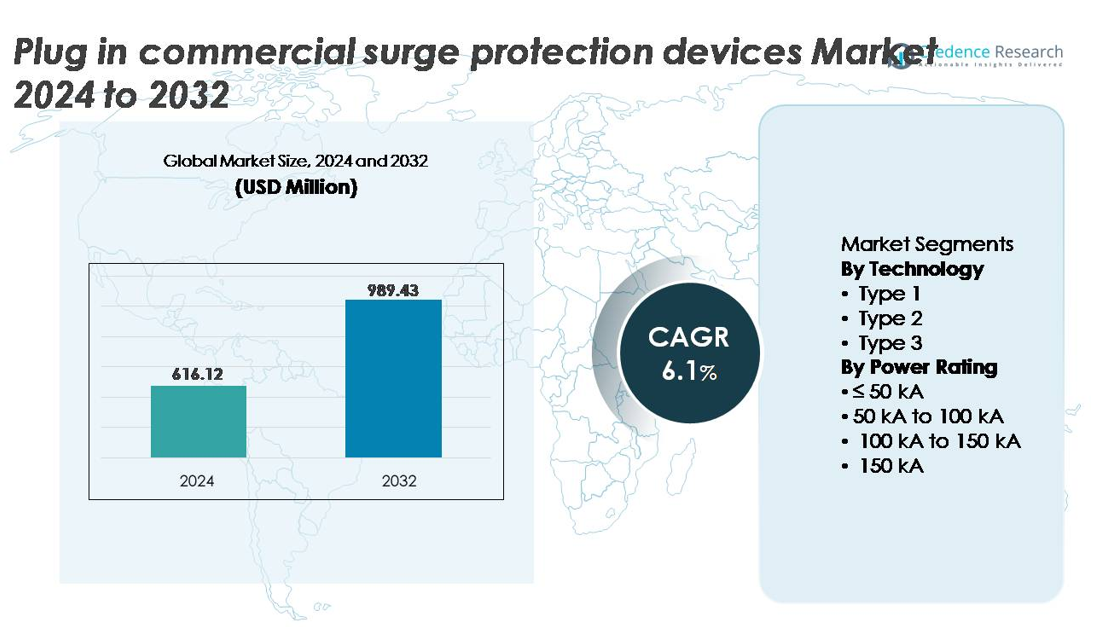

The plug-in commercial surge protection devices market was valued at USD 616.12 million in 2024 and is projected to reach USD 989.43 million by 2032, advancing at a CAGR of 6.1% over the forecast period (2025-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plug-In Commercial Surge Protection Devices Market Size 2024 |

USD 616.12 million |

| Plug-In Commercial Surge Protection Devices Market, CAGR |

6.1% |

| Plug-In Commercial Surge Protection Devices Market Size 2032 |

USD 989.43 million |

The plug-in commercial surge protection devices market features strong competition among global and regional manufacturers, including Emerson Electric, JMV, Legrand, Belkin, Hubbell, Infineon Technologies, ABB, Havells India, and Eaton. These companies compete through advancements in compact modular protection, improved surge suppression capacity, and integration with smart facility management systems. Strategic moves such as expanding distribution networks, compliance-focused product lines, and solutions tailored for EV charging and renewable installations strengthen their market position. North America leads the global market with approximately 35% share, driven by stringent electrical safety regulations, grid modernization, and high adoption of digital commercial infrastructure.

Market Insights:

- The plug-in commercial surge protection devices market was valued at USD 616.12 million in 2024 and is projected to reach USD 989.43 million by 2032, expanding at a 6.1% CAGR during the forecast period.

- Market growth is driven by rising dependence on digital infrastructure, increasing surge-related equipment failures, and modernization of commercial power systems supporting EV charging and renewable installations.

- Smart, network-enabled surge protection with remote monitoring and predictive maintenance represents a key emerging trend, alongside demand for modular retrofit-friendly plug-in devices.

- The market is moderately competitive, with major players including Emerson Electric, Legrand, Eaton, ABB, Hubbell, Belkin, Havells India, Infineon Technologies, and JMV, focusing on compliant, high-performance surge protection portfolios.

- North America holds around 35%, Europe 30%, Asia Pacific 25%, and LAMEA 10%, while the 50 kA to 100 kA power rating segment dominates due to its suitability for commercial facilities and balance of cost and protection capability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

Type 2 plug-in commercial surge protection devices hold the dominant share in this segment, driven by their suitability for panel-level protection across commercial buildings, data rooms, industrial units, and retail infrastructure. These devices balance cost, performance, and installation flexibility, making them preferred for safeguarding sensitive digital assets and continuous-operation systems. Type 1 solutions are gaining traction in facilities exposed to frequent lightning strikes, while Type 3 models serve as supplementary protection for end-equipment. Regulatory emphasis on electrical safety and rising dependence on IoT-enabled machinery continue to propel demand for Type 2 SPDs.

- For instance, Eaton’s SP2 Series Type 1surge devices provide protection ratings up to 45 kA per phase and are tested to withstand 10 kA of nominal discharge current (In) according to UL standards, supporting operational continuity in light commercial and industrial electrical panels. These devices are also suitable for use in Type 2 applications.

By Power Rating

The 50 kA to 100 kA power rating segment leads the market, capturing the largest share owing to its optimal performance for commercial facilities, office complexes, and medium-scale industrial operations. Its balance of surge handling capacity and affordability aligns with risk-based electrical protection strategies increasingly adopted in facility management. Devices rated above 100 kA are gaining adoption in critical utilities and heavy-load industrial zones, while ≤ 50 kA units remain suitable for small businesses. Expanding commercial operations and the modernization of electrical distribution networks support the continued dominance of the 50 kA to 100 kA segment.

- For instance, Schneider Electric’s Acti9 iPRF1 Type 2 surge protection device is engineered with an 8/20 μs waveform and offers a maximum discharge current capacity of 100 kA, along with a residual voltage below 1.5 kV, enabling protection for electrical distribution frameworks in medium-load commercial infrastructure.

Key Growth Drivers:

Rising Dependence on Sensitive Electronic and Digital Infrastructure

The accelerated deployment of automation, cloud servers, data processing terminals, payment systems, and digital building management tools has intensified the need for reliable surge protection in the commercial landscape. Plug-in surge protection devices prevent costly downtime and equipment failure caused by electrical spikes originating from grid fluctuations, lightning strikes, switching surges, and short circuits. As industries transition toward digitally managed operations especially in retail franchises, logistic hubs, and co-working environments the risk exposure widens due to dense interconnected networks. Businesses increasingly prioritize protection for operational continuity, asset longevity, and compliance with modern safety standards. The proliferation of edge computing systems, distributed IoT modules, and small-scale robotic systems further reinforces demand for plug-in commercial surge protection devices.

- For instance, APC by Schneider Electric’s P11VT3 professional surge protectoris designed with a response time of less than 1 nanosecond and incorporates noise filtering (EMI/RFI), supporting up to 3,020 joules of absorption capacity, enabling protection for professional computers, home theater systems, payment terminals, and networked peripherals installed within commercial workspaces.

Modernization of Electrical Infrastructure and Regulatory Safety Enforcement

Government-led grid modernization initiatives, smart grid upgrades, and mandatory compliance with safety standards are key drivers encouraging installation of surge protection solutions. Regulations addressing power quality, building electrical safety, and risk assessment practices compel commercial establishments to adopt certified surge protection devices. Insurance frameworks increasingly require risk-mitigating hardware in commercial electrical infrastructure, reducing liability linked to power surge–related claims. The replacement of aging electrical networks worldwide has exposed surge vulnerabilities, leading facility managers to adopt preventive solutions rather than reactive maintenance strategies. Additionally, sustainability-driven retrofits, including energy-efficient lighting and renewable integration, create new surge pathways requiring advanced protective equipment.

- For instance, Siemens’ Surge Protective Devices (SPD)are certified to UL 1449 4th Edition (and often 5th Edition) standards and feature protection levels below 1.5 kV in some configurations, with surge current ratings up to 160 kA (or higher, e.g., 200kA per phase for some models).

Expansion of EV Charging Infrastructure and On-Site Renewable Power Systems

The rapid expansion of solar PV installations, EV charging hubs, and commercial-scale renewable integration significantly increases demand for plug-in surge protection devices. Electrical disturbances intensify when variable generation assets, bidirectional inverters, or DC fast-charging stations interact with grid-fed systems. Surge protection becomes essential to safeguard chargers, power electronics, commercial energy storage units, and load control hardware. Retail chains, hospitality groups, and industrial campuses investing in clean energy and EV adoption face new surge exposure not present in legacy systems. As renewable penetration intensifies, surge protection devices play a critical role in stabilizing power quality and protecting mission-critical electronic interfaces.

Key Trends & Opportunities:

Emergence of Smart and Networked Surge Protection Devices

Digital monitoring features integrated into surge protection devices represent a major trend, offering real-time surge event logs, status monitoring, failure alerts, and predictive maintenance analytics. As commercial buildings transition to IoT-based asset management, smart SPDs align with centralized building management and remote supervision. Wireless-enabled modules support seamless integration into preventive maintenance programs, reducing unplanned outages and improving asset safety compliance. This trend creates opportunities for manufacturers to introduce self-diagnostics, cloud reporting, and configurable relay outputs, addressing the rising expectations of risk-aware commercial customers who seek visibility and transparency over electrical system performance.

- For instance, the broader ABB OVRsurge protection product family includes devices capable of handling surge currents up to 40 kA (using the 8/20 µs waveform) per module in certain configurations.

Increasing Opportunity in Modular, Retrofit-Friendly Plug-In Solutions

Commercial facilities prefer retrofit-friendly surge protection devices that minimize installation downtime and avoid major rewiring costs. Plug-in SPDs enable scalable protection that aligns with phased expansion rather than requiring upfront full-system upgrades. Growth of leasing-based commercial spaces, co-working hubs, and multi-tenant buildings magnifies the need for adaptable surge solutions. Modular form factors create opportunities for manufacturers to deliver compact, interchangeable, and application-specific products. The rising aftermarket and replacement cycles driven by updated standards and performance degradation present a recurring opportunity for revenue growth in maintenance-driven markets.

- For instance, Legrand’s DX³ Type 2 modular surge protection units are built with removable cartridges that can be replaced in less than 10 seconds without disconnecting wiring, and are rated to withstand up to 40 kA discharge capacity per pole, allowing retrofit upgrades in energized commercial panels with minimal operational interruption.

Key Challenges:

Limited Awareness and Low Adoption in Cost-Sensitive Markets

Despite growing awareness of electrical risks, many cost-sensitive businesses continue to underestimate the financial and operational consequences of surge-related failures. The intangible nature of surge protection where the benefit is preventive rather than directly visible hinders adoption in markets focused solely on upfront costs. Small commercial owners often opt for basic power strips or uncertified devices that provide insufficient or misleading protection. Lack of structured awareness programs and inconsistent enforcement of electrical safety codes create fragmented adoption, slowing the market’s penetration rate in developing regions.

Performance Degradation and Misconceptions Around Replacement Cycles

Surge protection devices gradually degrade after repeated exposure to transient events, requiring timely replacement. However, misconceptions persist regarding device longevity and maintenance cycles, leading businesses to unknowingly operate with reduced protection. The absence of monitoring indicators in conventional SPDs makes degradation difficult to detect until equipment failure occurs. Additionally, commercial operators may struggle to differentiate between consumer-grade and industrial-grade solutions, resulting in inappropriate device selection. Addressing this challenge requires improved educational outreach, standardization clarity, and broader adoption of self-diagnostic or smart surge protection technologies.

Regional Analysis:

North America

North America accounts for approximately 35% of the global market, driven by advanced commercial infrastructure, high adoption of smart building technologies, and stringent electrical safety regulations. The U.S. plays a central role due to widespread deployment of data centers, retail chains, EV charging hubs, and renewable energy installations requiring surge protection at distribution and equipment levels. Insurance compliance and facility risk audits further accelerate implementation of plug-in commercial surge protection devices. Continuous modernization of electrical grids and increasing vulnerability to weather-related outages reinforce sustained demand across commercial and industrial facilities.

Europe

Europe holds around 30% of the market, supported by strong regulatory enforcement, sustainability-driven building renovations, and high penetration of distributed energy resources. Countries including Germany, the U.K., and France prioritize standardized surge protection integration within commercial construction codes. Growth in add-on devices for solar inverters and automation systems strengthens market expansion. The region’s commitment to carbon reduction and electrification of transportation introduces new surge sensitivity points, particularly in charging stations and smart building components. Rising replacement cycles for aging electrical infrastructure further contribute to consistent market demand.

Asia Pacific

Asia Pacific represents approximately 25% of global share, emerging as the fastest-growing region driven by rapid commercial construction, expanding manufacturing bases, and heightened adoption of digital retail and logistics networks. China, India, Japan, and Southeast Asian economies are upgrading commercial electrical safety protocols to support high-density urban infrastructure. Increased deployment of telecommunications towers, server facilities, hospitality assets, and mall developments creates opportunities for plug-in surge protection devices. The transition toward renewable energy usage and industrial automation further emphasizes the need for reliable surge protection to mitigate grid instability.

Latin America, Middle East & Africa (LAMEA)

The LAMEA region contributes around 10% of the market, with demand concentrated in commercial modernization projects, oil and gas infrastructure, and utility expansions. Middle Eastern economies invest in high-value commercial real estate and smart-city ambitions, driving surge protection requirements for sensitive electrical systems. Latin America experiences increasing power fluctuation incidents, resulting in growing awareness of surge mitigation solutions. Africa’s market is shaped by pilot-scale commercial electrification and renewable integration. However, cost sensitivity, inconsistent standards, and limited awareness remain barriers, though long-term growth potential remains notable.

Market Segmentations:

By Technology

By Power Rating

- ≤ 50 kA

- 50 kA to 100 kA

- 100 kA to 150 kA

- 150 kA

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the plug-in commercial surge protection devices market is characterized by the presence of global electrical solution providers, regional safety equipment manufacturers, and specialized surge protection brands focused on industrial and commercial applications. Leading companies compete through advancements in modular design, enhanced surge handling capacity, integration of smart monitoring features, and compliance with evolving electrical safety standards. Product differentiation centers on durability, response speed, form factor, and compatibility with commercial electrical architectures. Strategic initiatives such as portfolio diversification for EV charging protection, partnerships with facility management service providers, and expansion into retrofit markets influence market positioning. Companies increasingly emphasize certified products aligned with national and international regulatory frameworks to strengthen their credibility among risk-sensitive commercial users. Growing demand for cost-optimized, high-performance devices encourages continuous R&D investment, particularly in intelligent surge protection and predictive maintenance technologies, shaping the long-term competitive dynamics of the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Recent Developments:

- In October 2024, Hubbell refreshed its “SpikeShield™” surge protective device (SPD) lineup, adding new products designed for installation either at the service entrance (Type 1) or on the load side (Type 2), to better protect buildings such as hotels, dormitories, and multi-unit residences from residential and commercial surge risks.

- In August 2024, ABB revealed its strategic purchase of SEAM Group for its Electrification portfolio in Electrical Safety, renewables, and Asset Management Advisory Services. With this acquisition, ABB intends to capitalize on the rising requirements related to asset modernization and optimization, thus positioning ABB to deliver safer, smarter, and sustainable operational solutions

Report Coverage:

The research report offers an in-depth analysis based on Technology, Power rating and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will rise as commercial facilities adopt more automation, digital equipment, and sensitive electronic assets.

- Integration with smart monitoring and predictive maintenance platforms will become standard.

- Increased EV charging infrastructure will drive specialized surge protection for power electronics.

- Renewable energy adoption will require advanced surge mitigation for grid-interactive systems.

- Retrofit-friendly and modular plug-in devices will gain larger preference in commercial modernization projects.

- Regulatory tightening on electrical safety standards will accelerate device adoption.

- Manufacturers will enhance compact design, faster response times, and higher surge endurance.

- Replacement cycles will shorten as awareness of performance degradation improves.

- Emerging economies will contribute stronger growth due to expanding commercial construction.

- AI-enabled diagnostics and cloud connectivity will reshape product differentiation and lifecycle management.