Market Overview

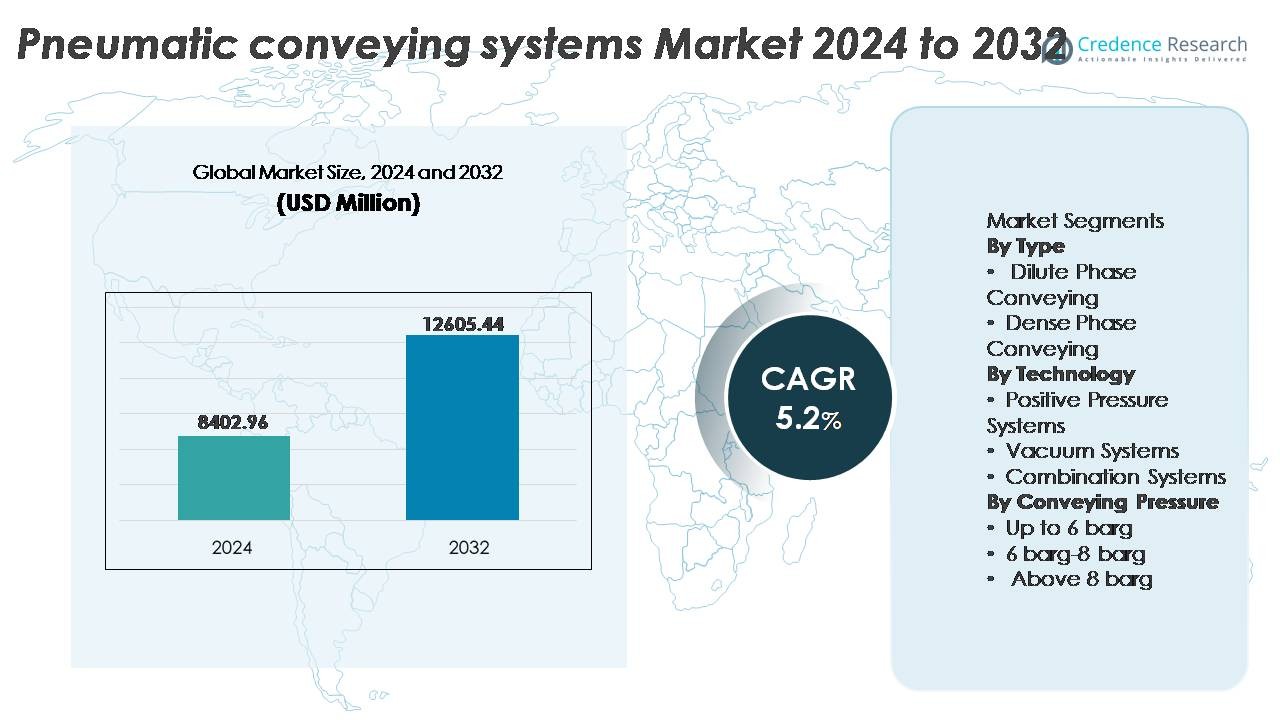

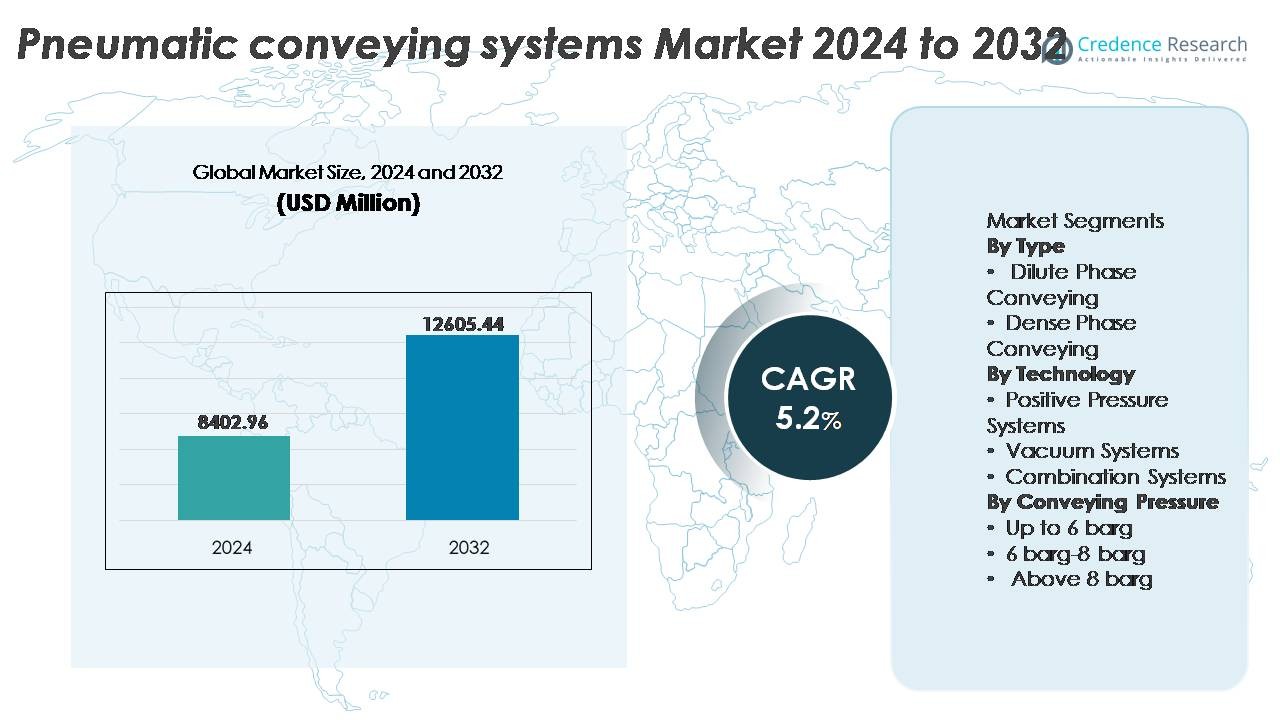

The global pneumatic conveying systems market was valued at USD 8,402.96 million in 2024 and is projected to reach USD 12,605.44 million by 2032, expanding at a CAGR of 5.2% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pneumatic Conveying Systems Market Size 2024 |

USD 8,402.96 Million |

| Pneumatic Conveying Systems Market, CAGR |

5.2% |

| Pneumatic Conveying Systems Market Size 2032 |

USD 12,605.44 Million |

The pneumatic conveying systems market is shaped by global engineering leaders and specialized material-handling solution providers, including Compass Systems & Sales, GEA Group, Dynamic Air, Macawber Engineering, Bratney Companies, Coperion GmbH, Atlas Copco AB, Delfin Industrial Vacuums, Claudius Peters Americas, and Gericke AG. These companies focus on technological differentiation through energy-efficient blowers, dense-phase solutions, IoT-enabled monitoring, and modular conveying architectures suited for multi-material processing. North America leads the market with approximately 34% share, driven by high automation penetration and regulatory compliance requirements, while Europe and Asia-Pacific follow, supported by sustainability mandates and growing industrialization in bulk material-handling sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global pneumatic conveying systems market was valued at USD 8,402.96 million in 2024 and is projected to reach USD 12,605.44 million by 2032, advancing at a CAGR of 5.2% during the forecast period.

- Market growth is driven by rising automation, operational safety, and contamination-free material handling, particularly in food, pharmaceuticals, cement, and chemical processing operations adopting enclosed conveying for higher hygiene and regulatory compliance.

- Key trends include IoT-enabled monitoring, predictive maintenance, modular installations, and energy-efficient low-pressure conveying technologies gaining adoption across medium and large-scale manufacturing facilities.

- Competition remains defined by engineering capabilities, custom system integration, aftermarket service, and energy optimization features, with leading companies investing in automation-driven upgrades and digital diagnostics to strengthen market presence.

- Regionally, North America leads with 34% share, followed by Europe at 29% and Asia-Pacific at 28%, while Dilute Phase Conveying dominates the type segment, driven by cost efficiency and widespread suitability for high-velocity bulk material transport.

Market Segmentation Analysis:

By Type

The pneumatic conveying systems market by type is led by Dilute Phase Conveying, holding the dominant market share driven by its flexibility, lower capital cost, and suitability for high-velocity transportation of non-fragile materials across food, plastics, and cement applications. Its ability to handle large volumes of low-to-medium-density products, along with simplified pipeline layout requirements, further increases adoption in continuous production environments. In comparison, Dense Phase Conveying continues to gain traction in sectors handling abrasive, fragile, or high-value powders due to reduced material degradation and minimized pipeline wear, making it a preferred choice for specialty chemical and pharmaceutical operations.

- For instance, conveying system specifications published by Coperion indicate that their dilute-phase vacuum and pressure systems are designed to move dry bulk solids through pipelines at velocities approaching 30 m/s using positive displacement blowers and rotary valves to maintain steady flow for free-flowing ingredients in food and plastics compounding environments.

By Technology

Among technology segments, Positive Pressure Systems account for the largest market share, primarily due to their ability to transport materials over long distances, support higher throughput, and integrate efficiently into large-scale industrial conveying lines. These systems are widely deployed in cement plants, grain terminals, power stations, and chemical production lines where bulk materials require distribution to multiple discharge points. Vacuum Systems remain important for short-distance conveying and dust-sensitive environments, whereas Combination Systems, integrating both push and pull mechanisms, are emerging as an optimal solution for hybrid logistics, multi-level plants, and space-restricted manufacturing layouts.

- For instance, Coperion’s pressure-based conveying systems are engineered to transport bulk solids at capacities up to 100 metric tons per hour while integrating rotary valves and blowers for continuous movement of polymers, starches, and minerals within complex process networks a specification documented in Coperion’s bulk-solids conveying material datasheets.

By Conveying Pressure

The Up to 6 barg conveying pressure segment dominates the market, attributed to extensive use in dilute phase operations and its alignment with majority low-pressure industrial applications involving food ingredients, plastics granules, and lightweight powders. Systems in this pressure range offer lower energy consumption, cost-effective installation, and reduced structural reinforcement requirements. The 6 barg – 8 barg category serves medium-pressure applications, while Above 8 barg represents a niche yet growing segment for specialized operations such as metallic powder handling, high-density material flow, and long-distance heavy-duty conveying in mining and foundry industries.

Key Growth Drivers

Growing Demand for Automation and Smart Manufacturing

The pneumatic conveying systems market is experiencing significant growth due to the rising integration of automation and intelligent material-handling ecosystems across manufacturing sectors. As industries transition toward Industry 4.0, pneumatic conveying serves as a critical enabler of continuous, dust-free, and high-throughput transport of powders and granules. Automated monitoring systems equipped with variable-speed controls, SCADA connectivity, and real-time diagnostics improve process efficiency and minimize downtime. Additionally, labour shortages, stringent occupational safety requirements, and rising energy optimization goals are compelling industries to replace manual or mechanical conveying methods. The adoption of automated pneumatic conveying is expanding across pharmaceuticals, food and beverages, plastics compounding, and cement plants, where precision, hygiene, and consistency of flow are essential. The capability of pneumatic systems to seamlessly integrate with robotic packaging, batching systems, and automated storage solutions reinforces their role in next-generation production environments, making automation a core growth catalyst.

- For instance, a recent industry article highlights that automated pneumatic-conveying systems equipped with control-system integration can continuously monitor and adjust conveying air pressure and flow rate in real time, thereby maintaining stable suction or pressure for powders throughout a shift without manual intervention.

Increasing Focus on Hygiene, Safety, and Contamination-Free Transport

A key driver accelerating market expansion is the stringent global focus on hygiene and contamination control in material handling. Pneumatic conveying systems eliminate direct human contact, prevent product spillage, and reduce airborne particulate hazards, making them highly preferred in food processing, nutraceuticals, dairy, and pharmaceutical industries. Regulatory compliance frameworks such as HACCP, FDA, and EU food safety legislation push manufacturers toward enclosed, cleaner conveying solutions. The technology ensures minimal degradation and preserves product purity during transport, which is critical for fragile powders, chemical blends, and specialty materials. Moreover, improved filtration, explosion protection features such as flameless vents, and antistatic pipeline designs enhance safety in combustible environments. The transition from traditional mechanical conveyors to pneumatic solutions is further reinforced by environmental concerns tied to dust emissions and energy-intensive material handling practices, creating lasting adoption momentum.

- For instance, Coperion’s WYK-CIP diverter valve developed specifically for sanitary powder processing features a fully automated Clean-in-Place (CIP) design that allows complete flushing of internal product-contact surfaces without disassembly, supporting validated cleaning cycles in food and pharmaceutical production lines.

Expansion of Bulk Material Handling in Cement, Mining, and Power Sectors

The rising demand for efficient bulk material handling in heavy industries such as cement production, mining operations, and thermal power generation stands as another major growth driver. Pneumatic conveying offers advantages over mechanical systems by supporting long-distance transfer, enabling vertical lifts, and offering flexible routing without structural overhaul. These systems reduce maintenance requirements by eliminating wear-prone moving components and enabling fully enclosed transport of abrasive or toxic materials. In coal-fired power plants, pneumatic systems facilitate ash handling, fly ash utilization, and material distribution to silos with lower contamination risk. In cement plants, they support kiln feeding, clinker movement, and raw meal distribution. As material usage volumes rise across infrastructure and mining projects globally, the scalability and durability of pneumatic conveying systems position them as vital infrastructure in heavy industry modernization.

Key Trends & Opportunities

Integration of IoT, AI-Based Monitoring, and Predictive Maintenance

Digital transformation is unlocking new opportunities in pneumatic conveying through IoT-enabled sensors, AI predictive analytics, and remote operational monitoring. These advancements help operators track airflow consistency, temperature fluctuations, material buildup, and pressure variations in real time. Predictive maintenance algorithms forecast component failures, reducing unexpected downtime and extending equipment lifespan. Cloud-based dashboards enable cross-site asset visibility, which is especially valuable for global manufacturers managing multiple plants. Additionally, digital twins are emerging as simulation tools that optimize pipeline design, material flow behaviour, and energy consumption before installation. The integration of analytics-based maintenance models represents a high-value service opportunity for OEMs and significantly enhances system reliability and customer retention.

- For instance, Coperion has introduced its Smart Performance Solution, a cloud-connected monitoring platform that collects over 200 operating parameters per minute from feeders, rotary valves, and conveying equipment while applying machine-learning models to detect deviations and recommend corrective actions improving process stability in bulk-solid handling lines.

Growing Opportunity in Energy-Efficient and Low-Carbon Conveying Solutions

Sustainability continues to shape investment decisions as industries work to reduce energy footprints and meet carbon compliance standards. Pneumatic conveying manufacturers are developing technologies such as regenerative blowers, optimized airlock designs, and low-pressure transport modes to reduce power consumption. Opportunities exist in recovering system heat, using variable-frequency drives, and integrating renewable-powered compressors. Circular manufacturing models, including recycling of fly ash, bio-based feedstocks, and reprocessed plastics, are creating new conveying requirements tailored to lightweight or moisture-sensitive materials. Companies that provide energy benchmarking software, process audits, and hybrid pneumatic–mechanical setups are positioned to capture value as sustainability becomes both a regulatory requirement and a competitive differentiator.

- For instance, Atlas Copco reports that its oil-free ZS rotary screw blower technology achieves up to 30% lower energy consumption compared with lobe blower designs by using internal compression instead of external compression, with flow capacities ranging from 250 to 8,000 m³/hour enabling significant reductions in conveying air demand for dilute-phase systems operating below 1 bar(g).

Adoption of Customized and Modular Conveying Solutions

Customization and modularity are emerging as key market opportunities as industries demand systems tailored to space constraints, material characteristics, and batch production flexibility. Modular configurations enable phased investments, easier relocation, and simplified integration into legacy facilities. Sectors producing specialty chemicals, nutraceutical blends, and additive manufacturing powders require customized flow rates, lining materials, and contamination-proof features. Rapid expansion of multi-product facilities and contract manufacturing encourages configurable conveying lines that can be adjusted without major downtime. Suppliers offering turnkey engineering, retrofitting services, and plug-and-play modular assemblies gain a strategic advantage in winning long-term contracts.

Key Challenges

High Installation Cost and Energy Consumption Constraints

Despite its operational benefits, the high initial capital investment and ongoing energy cost of pneumatic conveying systems present significant barriers for small and mid-sized enterprises. Compressors, blowers, vacuum pumps, and pipeline customization require substantial setup expenditure compared to screw or belt conveyors. Persistent energy use due to compressed air requirements further impacts ROI, especially in continuous-flow high-pressure systems. Many cost-sensitive industries hesitate to migrate from mechanical systems unless clear performance gains justify investment. Energy volatility and rising electricity tariffs add additional complexity, pushing manufacturers to evaluate hybrid or optimized designs. Overcoming cost constraints requires innovations that reduce power draw, enhance compressor efficiency, and simplify installation footprints.

Material Degradation, Flow Efficiency, and Wear Management

Technical challenges related to material integrity, pipeline wear, and flow inconsistency remain obstacles in adoption, particularly for fragile, abrasive, or sticky materials. High-velocity dilute phase conveying can cause product breakage in food grains, catalysts, and pharmaceutical formulations, while abrasive minerals accelerate pipeline erosion and reduce operational lifespan. Moisture-sensitive and cohesive powders risk blockages, requiring advanced air control strategies and regular maintenance. The need for precise handling parameters increases engineering complexity and cost. Manufacturers must invest in improved lining materials, flow modelling tools, and low-velocity conveying to address wear and degradation issues and unlock adoption in specialty markets.

Regional Analysis

North America

North America holds the largest market share of approximately 34% in the pneumatic conveying systems industry, supported by high automation adoption and advanced manufacturing infrastructure across food processing, pharmaceutical packaging, and chemical production. Strong regulatory standards related to workplace safety, dust emission control, and hygienic material handling further accelerate replacement of mechanical conveyors with closed pneumatic systems. The U.S. leads the regional demand, driven by modernization investments in plastics compounding, cement handling, and biomass utilization. Ongoing digitalization initiatives and rising demand for predictive maintenance solutions strengthen the growth outlook across medium- and large-scale industrial facilities.

Europe

Europe accounts for around 29% of the global market share, driven by stringent environmental and worker safety regulations under EU directives promoting dust-free, energy-efficient material handling solutions. Demand remains strong in Germany, Italy, and the UK, supported by established chemical, food processing, and pharmaceutical industries. The region’s emphasis on sustainability, carbon footprint reduction, and circular material logistics fuels adoption of low-pressure and hybrid pneumatic conveying solutions. The increasing penetration of smart factories and equipment IoT integration across Western Europe continues to create opportunities for advanced control systems and retrofitting of existing conveying infrastructure.

Asia-Pacific

Asia-Pacific represents approximately 28% of the market share and remains the fastest expanding regional segment, supported by rapid industrialization and investment in cement production, mining, food manufacturing, and plastics processing. China, India, Japan, and South Korea are major contributors, driven by large-scale infrastructure development and expansion of bulk material handling facilities. Growing adoption of automation in high-volume manufacturing plants and evolving safety norms in emerging economies are reshaping traditional material transport systems. Foreign direct investments and the scaling of pharmaceutical and specialty chemical exports accelerate demand for efficient, enclosed pneumatic conveying technologies across the region.

Latin America

Latin America holds around 6% market share, primarily driven by developments in food processing, mining, and cement manufacturing across Brazil, Mexico, and Chile. The region is witnessing a gradual shift from manual and mechanical conveying toward automated systems to reduce material loss, enhance safety, and maintain consistency in bulk transport. Economic reforms and rising investment in mineral handling and packaging industries support new deployment opportunities. While cost sensitivity limits large-scale adoption, government-backed infrastructure development and growing industrial automation interest are gradually fueling installations of energy-efficient and low-maintenance pneumatic conveying solutions.

Middle East & Africa

The Middle East & Africa region represents approximately 3% of the market share, with growth concentrated in petrochemical, fertilizer, and cement industries across the UAE, Saudi Arabia, and South Africa. Ongoing megaprojects in construction and industrial diversification under national development plans create opportunities for bulk solids and powder-handling systems. However, adoption remains moderate due to limited manufacturing base and high capital investment barriers. The need to enhance plant reliability in harsh operating environments opens potential for robust, corrosion-resistant, and pressure-rated pneumatic conveying systems, particularly within mining, power generation, and material export operations.

Market Segmentations:

By Type

- Dilute Phase Conveying

- Dense Phase Conveying

By Technology

- Positive Pressure Systems

- Vacuum Systems

- Combination Systems

By Conveying Pressure

- Up to 6 barg

- 6 barg-8 barg

- Above 8 barg

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The pneumatic conveying systems market is moderately consolidated, with global engineering firms and specialized conveying solution providers competing based on efficiency, automation capability, energy performance, and customized engineering services. Leading companies include Atlas Copco, Schenck Process, Flexicon Corporation, Coperion GmbH, Dynamic Air, Nilfisk Group, Gericke AG, and Hillenbrand subsidiaries such as Coperion and Schenck Process. These players prioritize product innovation in intelligent flow control, IoT-enabled predictive maintenance, modular pipeline solutions, and advanced airlock technologies to meet diverse industrial requirements. Strategic initiatives such as capacity expansion, acquisition of engineering contractors, and regional partnerships strengthen portfolios in sectors such as cement, chemicals, food processing, and pharmaceutical manufacturing. Additionally, manufacturers increasingly integrate digital dashboards and simulation tools to optimize system design, reduce downtime, and support lifecycle management services. As industrial automation advances and sustainability expectations intensify, competition is shifting toward high-efficiency, customizable, and low-emission conveying technologies that support compliance and operational modernization across global production environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Macawber Engineering, Inc. their India division (or a related site) published a blog post about “Dense Phase Conveying Systems for Blast Furnaces,” describing their design features, heavy-duty bends/linings, and application for blast-furnace dust/coal injection.

- In 2025, Macawber participated in the IPBS Trade Show in Rosemont, IL, showcasing their “low velocity, dense phase pneumatic conveying” system.

- In 2023, Atlas Copco AB Their communications reference pneumatic conveying systems as part of their “right-sized” compressed-air solutions indicating they are actively marketing to pneumatic-conveying customers.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Conveying pressure and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Pneumatic conveying systems will increasingly integrate IoT sensors for real-time performance monitoring and predictive maintenance.

- Energy-efficient compressor technologies and low-pressure conveying modes will gain stronger adoption to reduce operational costs.

- Manufacturers will expand modular and customizable solutions to meet space constraints and multi-material production requirements.

- Digital twin simulations will be used to optimize system design, airflow performance, and energy consumption.

- Compliance-driven investments will rise across food, pharmaceuticals, and chemical sectors to ensure contamination-free material handling.

- Dense-phase conveying will grow in adoption for handling abrasion-prone or fragile materials with minimal degradation.

- Remote automation and centralized plant control will become standard features to support Industry 4.0 ecosystems.

- Regions undergoing rapid industrialization will increase demand for bulk handling systems in cement, mining, and power generation.

- Hybrid pneumatic–mechanical solutions will emerge as alternatives to reduce wear and energy demand.

- Sustained focus on environmental sustainability will accelerate development of low-emission, dust-free conveying technologies.