Market Overview

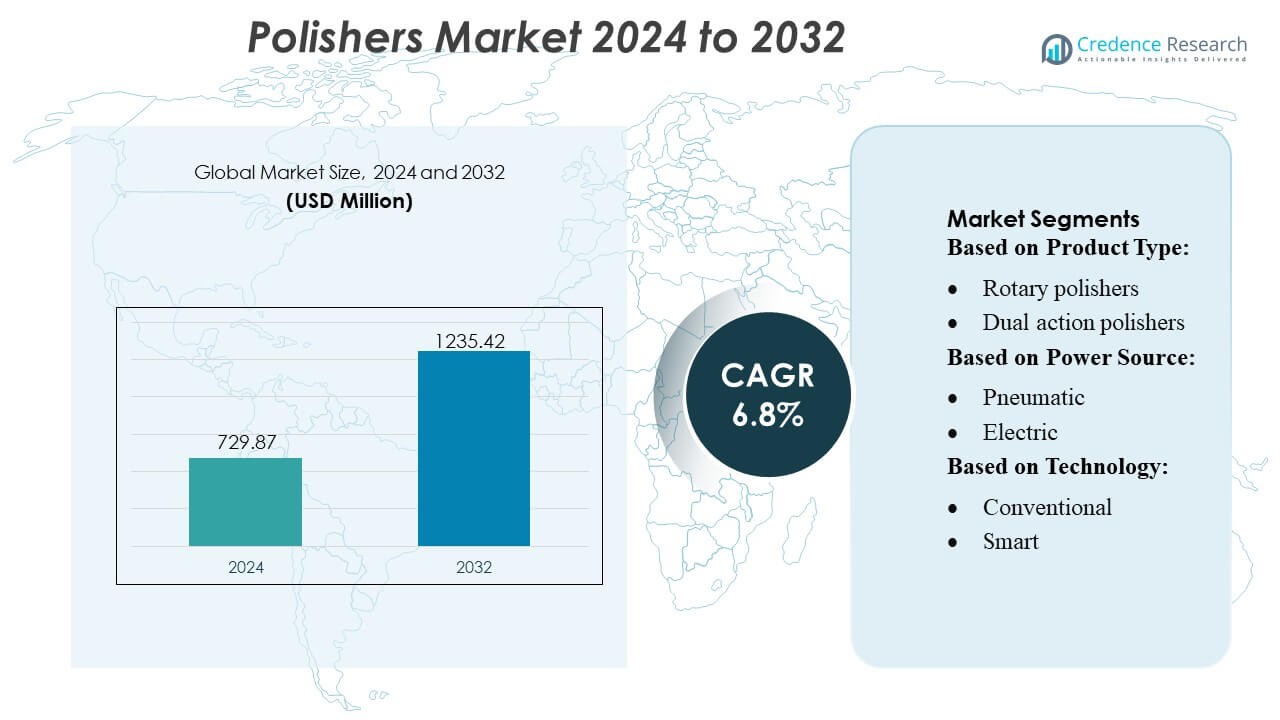

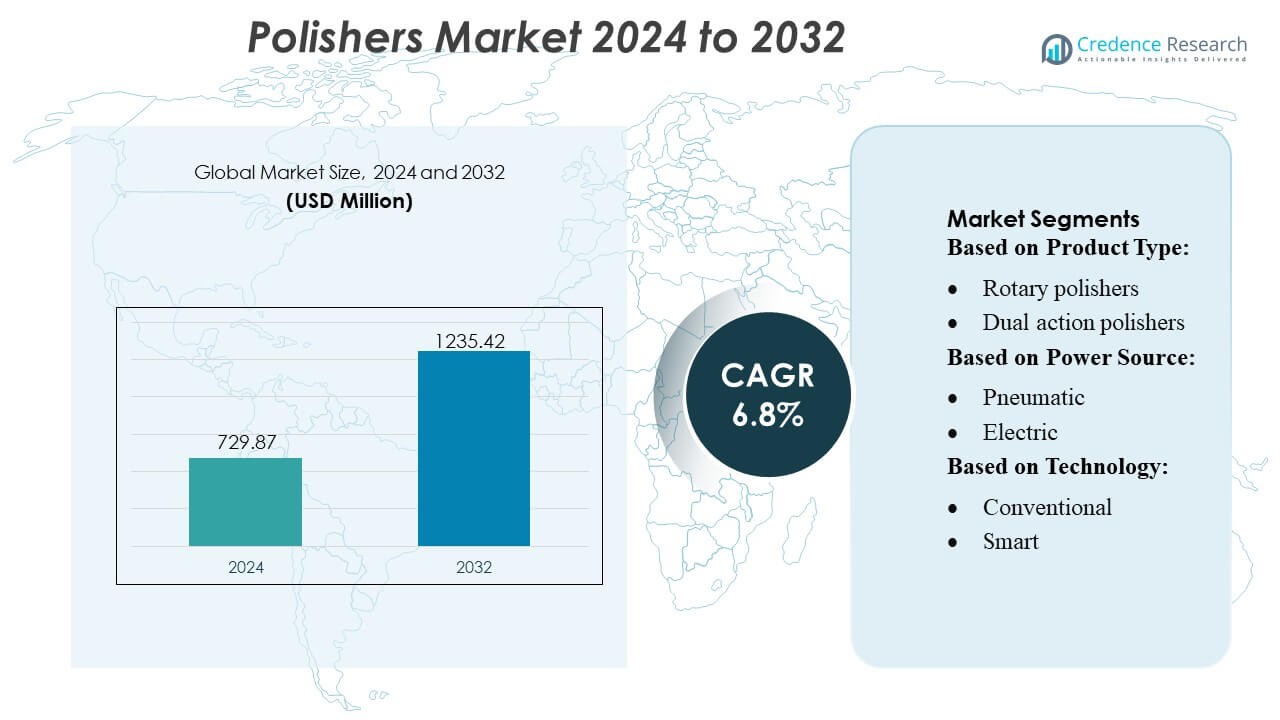

Polishers Market size was valued USD 729.87 million in 2024 and is anticipated to reach USD 1235.42 million by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polishers Market Size 2024 |

USD 729.87 Million |

| Polishers Market, CAGR |

6.8% |

| Polishers Market Size 2032 |

USD 1235.42 Million |

The Polishers Market features a mix of global manufacturers and specialized brands that compete through advancements in motor efficiency, ergonomic designs, and precision control technologies. Leading companies focus on expanding portfolios of rotary, dual-action, and random-orbital models tailored for automotive detailing, metal fabrication, woodworking, and marine applications. Innovation centers on smart-enabled systems, brushless motors, and vibration-reduction mechanisms that enhance operator safety and surface consistency. Strategic growth accelerates through strengthened distribution networks, e-commerce expansion, and performance-driven product upgrades. North America leads the market with an exact 38% share, supported by mature detailing ecosystems, strong industrial demand, and high adoption of premium power-tool solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Polishers Market reached USD 729.87 million in 2024 and is projected to hit USD 1235.42 million by 2032 at a 8% CAGR, reflecting strong global demand for advanced finishing solutions.

- Growing adoption of electric, smart-enabled, and brushless motor polishers drives market expansion as users prioritize precision finishing, reduced vibration, and improved operator safety across industrial and automotive applications.

- Rising investments in ergonomic designs, cordless technologies, and multi-speed systems shape market trends, while e-commerce channels strengthen product accessibility for professionals and DIY consumers.

- Competitive intensity increases as manufacturers enhance product durability, integrate digital diagnostics, and expand distribution networks, though high maintenance costs and operator skill requirements act as key restraints.

- North America holds 38% share, remaining the leading region, while rotary polishers account for the dominant segment share, supported by strong usage in detailing studios, metalworking facilities, and restoration workshops.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

Rotary polishers dominate the segment with an estimated 42% market share, driven by their high torque output and suitability for heavy correction tasks across automotive, marine, and industrial surfaces. Their ability to remove deep imperfections efficiently supports strong adoption among professional detailing centers and manufacturing units. Dual-action polishers gain traction for balanced precision and reduced burn risk, while random orbital models expand usage among DIY consumers due to ease of handling. Growing demand for high-performance surface finishing tools continues to strengthen rotary polisher leadership across global markets.

- For instance, Under Armour integrates Celliant uses a proprietary blend of 13 active minerals (including titanium dioxide and silicon oxide) embedded into the core of the polyester fibers.

By Power Source

Electric polishers lead this segment with an approximate 58% market share, supported by advancements in brushless motors, improved heat management, and consistent performance across professional and household applications. Their plug-and-play convenience, wider availability, and compatibility with multiple speed settings contribute to strong dominance. Pneumatic models maintain relevance in industrial environments requiring continuous operation, while gas-powered units serve niche outdoor or remote-use cases. Rising emphasis on energy-efficient tools and the shift toward compact, lightweight electric platforms reinforce the sustained leadership of electric polishers globally.

- For instance, Lululemon leverages its Silverescent™ technology powered by X-STATIC® fibers that contain a bonded layer of 99.9% pure silver to inhibit odor-causing bacteria in high-sweat training tops.

By Technology

Conventional polishers retain the largest share in this category with nearly 64% market share, driven by their affordability, widespread availability, and proven reliability in routine finishing and correction tasks. They remain the preferred choice among automotive workshops and small enterprises seeking robust performance without advanced control systems. Smart polishers, equipped with digital speed regulators, load sensors, and Bluetooth-enabled monitoring, show rising adoption as professional users prioritize precision and workflow automation. Increasing demand for data-driven maintenance and enhanced user control supports the gradual shift toward smart technologies while conventional units continue to dominate due to cost-efficiency.

Key Growth Drivers

Rising Demand for High-Precision Surface Finishing

The market benefits from rising demand for high-precision finishing across automotive, aerospace, and metal fabrication industries. Manufacturers adopt advanced polishers to achieve uniform texture, enhanced gloss, and tighter dimensional tolerances essential for premium components. Growth accelerates as OEMs emphasize defect-free surfaces for improved performance, visual appeal, and durability. Expanding industrial automation and adoption of CNC-based polishing solutions further strengthen demand by improving throughput, reducing manual errors, and ensuring consistent quality across complex geometries and high-volume production environments.

- For instance, Umbro incorporates a thin synthetic upper with key models like the original Velocita Pro weighing approximately 165 grams (for a UK size 8)to deliver enhanced breathability and rapid directional movement in its high-performance football boots.

Expansion of Automotive Detailing and Restoration Services

The rapid expansion of automotive detailing studios, restoration centers, and DIY car-care culture significantly drives polisher adoption. Rising vehicle personalization trends and increasing consumer focus on paint correction, scratch removal, and protective coatings amplify the need for efficient rotary, dual-action, and random-orbital systems. Professional detailing networks prefer tools that offer reduced vibration, higher motor efficiency, and multi-speed control to handle diverse paint surfaces. Growing sales of premium and luxury vehicles further strengthen demand for polishers that support consistent finish quality and prolonged surface protection.

- For instance, Adidas reports producing approximately 17 million pairs of shoes made with Parley Ocean Plastic® in a single year, and its Futurecraft Loop initiative uses a 100% reusable TPU composite that can be continuously remade into new footwear, demonstrating measurable progress toward circular product engineering.

Increasing Penetration of Electric and Smart Power Tools

Growth accelerates as electric and smart-powered polishers gain widespread acceptance in construction, marine, woodworking, and industrial repair activities. Users prefer electric variants for their improved torque delivery, reduced operating noise, and energy efficiency. Smart polishers equipped with digital speed regulation, overload protection, and real-time vibration monitoring enhance operator safety and tool longevity. Integration of brushless motors and battery platforms within cordless models expands usage across mobility-constrained worksites. These advancements encourage both professionals and hobbyists to upgrade to performance-driven polishing systems.

Key Trends & Opportunities

Adoption of Ergonomic and Low-Fatigue Designs

Manufacturers increasingly invest in ergonomic polisher designs featuring lightweight housings, improved grip contours, and optimized weight distribution. This shift reduces operator fatigue during prolonged operations and enhances tool maneuverability across curved or delicate surfaces. Opportunities arise for brands offering vibration-dampening handles, noise-reduction technology, and compact motor assemblies. The trend responds to rising safety awareness and regulatory guidelines promoting user-centric power tool design. As professional and consumer markets prioritize comfort and precision, demand for ergonomic premium models strengthens globally.

- For instance, Columbia Sportswear integrates product-level technologies such as Omni-Heat™ Infinity which uses a pattern of gold metallic dots that deliver up to 40% increased thermal reflectivity compared with earlier Omni-Heat™ systems into its digitally merchandised outerwear lines, enabling consumers to evaluate quantified performance benefits during online product selection.

Growing Preference for Cordless and Battery-Efficient Models

Cordless polishers represent a strong growth opportunity as users seek mobility, reduced cable clutter, and enhanced safety in workshops and outdoor applications. Improvements in lithium-ion battery density, thermal management, and fast-charging systems enable longer continuous operation without performance drop. Manufacturers that align polisher platforms with existing universal battery ecosystems gain competitive advantage. The trend supports professionals working in automotive detailing, construction, and marine finishing where unrestricted tool movement is critical. Rising adoption of portable, high-torque cordless models fuels category expansion.

- For instance, FLSmidth’s HPGR Pro line offers large models (e.g., “PM10 30/20”) with roll widths of 2,000 mm and designed capacity of up to 25,000 tonnes per hour, depending on material characteristics.

Integration of IoT and Smart Diagnostics

The market sees rising interest in IoT-enabled polishers offering real-time tool diagnostics, predictive maintenance, and digital performance logs. Smart interfaces allow operators to monitor speed consistency, motor load, and temperature levels, reducing burnout risk and maintaining surface quality. Opportunities emerge for manufacturers developing app-connected systems targeted at industrial workshops and detailing professionals seeking measurable workflow efficiency. As digital transformation spreads across the power tools industry, integrating connectivity into polishing equipment becomes a key differentiator for premium product lines.

Key Challenges

Operator Skill Requirements and Risk of Surface Damage

A major challenge stems from the skill intensity required to operate high-speed polishers without causing swirl marks, overheating, or paint thinning. Inexperienced users may damage sensitive surfaces, discouraging adoption among hobbyists and small workshops. Manufacturers respond by introducing dual-action and smart-controlled systems with reduced burn-through risk, yet professional handling remains essential for certain tasks. Training gaps and inconsistent user proficiency limit market penetration in regions lacking structured detailing and finishing courses.

High Maintenance and Replacement Costs

Frequent wear of backing pads, brushes, bearings, and discs increases long-term ownership costs, particularly for workshops operating multiple polishers daily. Heavy-duty industrial applications accelerate component degradation, prompting recurring replacements and downtime. Higher upfront prices for premium electric or smart models further deter cost-sensitive buyers. Manufacturers attempt to address the challenge by offering modular components, durable brushless motors, and extended warranty programs, yet maintenance burden remains a key restraint affecting purchasing decisions.

Regional Analysis

North America

North America leads the Polishers Market with an exact 38% share, supported by mature automotive detailing networks, strong DIY culture, and widespread adoption of high-performance power tools across industrial workshops. The region benefits from advanced manufacturing capabilities, extensive distribution channels, and rapid uptake of electric and smart-enabled polishing systems. Demand strengthens as automotive restoration, marine maintenance, and woodworking sectors prioritize high-precision finishing. Investments in ergonomic and low-vibration solutions drive replacement cycles, while professional detailing studios accelerate consumption of rotary, dual-action, and random-orbital models across both commercial and consumer applications.

Europe

Europe holds a significant 27% share, driven by strong automotive manufacturing hubs, stringent surface-quality standards, and rising adoption of eco-efficient electric polishers across industrial and marine environments. Demand grows as professional detailing services expand in Germany, the UK, Italy, and France, where premium vehicle ownership and restoration culture remain high. European regulations promoting low-emission tool designs encourage manufacturers to integrate brushless motors and energy-efficient components. The region’s strong craftsmanship heritage in metal fabrication and woodworking further supports market growth, strengthening the uptake of precision polishing equipment for both heritage restoration and modern industrial processes.

Asia-Pacific

Asia-Pacific accounts for 31% share, experiencing the fastest growth due to expanding automotive production, rising consumer spending, and rapid industrialization across China, India, Japan, and Southeast Asia. Local workshops increasingly adopt cost-efficient electric and pneumatic polishers for vehicle refinishing, construction, and metal fabrication. The region’s strong aftermarket ecosystem and booming detailing services contribute to escalating tool demand. Manufacturers benefit from large-scale manufacturing capabilities, enabling affordable product availability. Growing interest in cordless and battery-efficient models aligns with expanding DIY communities and professional detailing businesses, positioning APAC as a high-potential market for next-generation polishing technologies.

Latin America

Latin America captures an estimated 2% share, driven by gradual expansion of automotive repair and detailing services in Brazil, Mexico, Argentina, and Colombia. Market growth remains moderate due to limited high-end tool penetration and price sensitivity among small workshops. Adoption rises as electric polishers become more affordable and regional distributors strengthen product availability. Increased vehicle ownership and growing interest in paint correction services support steady demand. Industrial sectors such as metal fabrication and furniture manufacturing create additional opportunities, though overall growth remains constrained by economic fluctuations and inconsistent access to advanced smart-enabled polishers.

Middle East & Africa

The Middle East & Africa region holds around 2% share, supported by emerging automotive customization trends, expanding construction activities, and rising investments in metalworking facilities across the UAE, Saudi Arabia, South Africa, and Nigeria. Growth accelerates as detailing studios and car-care centers gain popularity in urban markets prioritizing premium vehicle maintenance. Demand for electric and cordless polishers increases with rising awareness of professional-grade finishing standards. However, limited skilled labor availability and high import dependence restrict broader adoption. Ongoing infrastructure development and growing aftermarket activity create steady but modest opportunities for manufacturers.

Market Segmentations:

By Product Type:

- Rotary polishers

- Dual action polishers

By Power Source:

By Technology:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Polishers Market players such as Angelus Shoe Polish, Schuhhaus Klauser GmbH & Co. KG, GRANGERS, Shinola, Caleres, Implus, Charles Clinkard, Griffin Shoe Care, S. C. Johnson & Son, Inc., and Payless ShoeSource Inc. The Polishers Market features a mix of established manufacturers and emerging brands that focus on expanding product performance, durability, and usability across consumer and industrial applications. Companies prioritize innovation in ergonomic designs, brushless motor technology, and multi-speed control systems to deliver consistent surface finishing results. The rise of electric and smart-enabled polishers intensifies competition as brands integrate digital diagnostics, overload protection, and vibration-reduction features to strengthen differentiation. Market players also expand global presence through e-commerce, dealer networks, and category-specific product lines for automotive, construction, marine, and woodworking sectors. Sustainability, warranty support, and aftersales service remain key competitive levers.

Key Player Analysis

- Angelus Shoe Polish

- Schuhhaus Klauser GmbH & Co. KG

- GRANGERS

- Shinola

- Caleres

- Implus

- Charles Clinkard

- Griffin Shoe Care

- C. Johnson & Son, Inc.

- Payless ShoeSource Inc.

Recent Developments

- In 2025, Mirka AIRP 300 is a game-changer, providing users with a high-performance rotary polisher that integrates effortlessly into automation.This tool integrates with industrial robots for consistent, high-quality results, enhancing production capacity through automation.

- In September 2024, JEOL’s Cross Section Polishers are widely used in electronics/semiconductor, ceramics, metallurgy, battery, polymer and life science. The developed product helps in processing complex materials and fragile specimens.

- In October 2023, Dynabrade partnered with Renny Doyle, to launch a geared dual-action polisher that cuts like a rotary and finishes. The developed tool is lightweight and features precision balanced design and single action lock trigger.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Power Source, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising adoption of cordless polishers as battery efficiency and motor performance continue to improve.

- Manufacturers will integrate more smart diagnostics and IoT features to support predictive maintenance and precision output.

- Demand will grow for ergonomic, low-vibration designs that enhance operator comfort during extended use.

- Automotive detailing, restoration services, and premium vehicle ownership will remain strong demand contributors.

- Industrial sectors will increasingly adopt high-precision polishers to meet advanced surface finishing requirements.

- Eco-friendly and low-noise electric models will gain preference over older pneumatic alternatives.

- Global brands will expand e-commerce presence to capture rising DIY and consumer-level usage.

- Emerging markets in Asia-Pacific and Latin America will experience faster growth due to urbanization and workshop expansion.

- Replacement cycles will shorten as users shift to advanced brushless motor systems with higher durability.

- Innovation in accessories, pads, and multi-material compatibility will influence competitive differentiation.

Market Segmentation Analysis:

Market Segmentation Analysis: