Market Overview

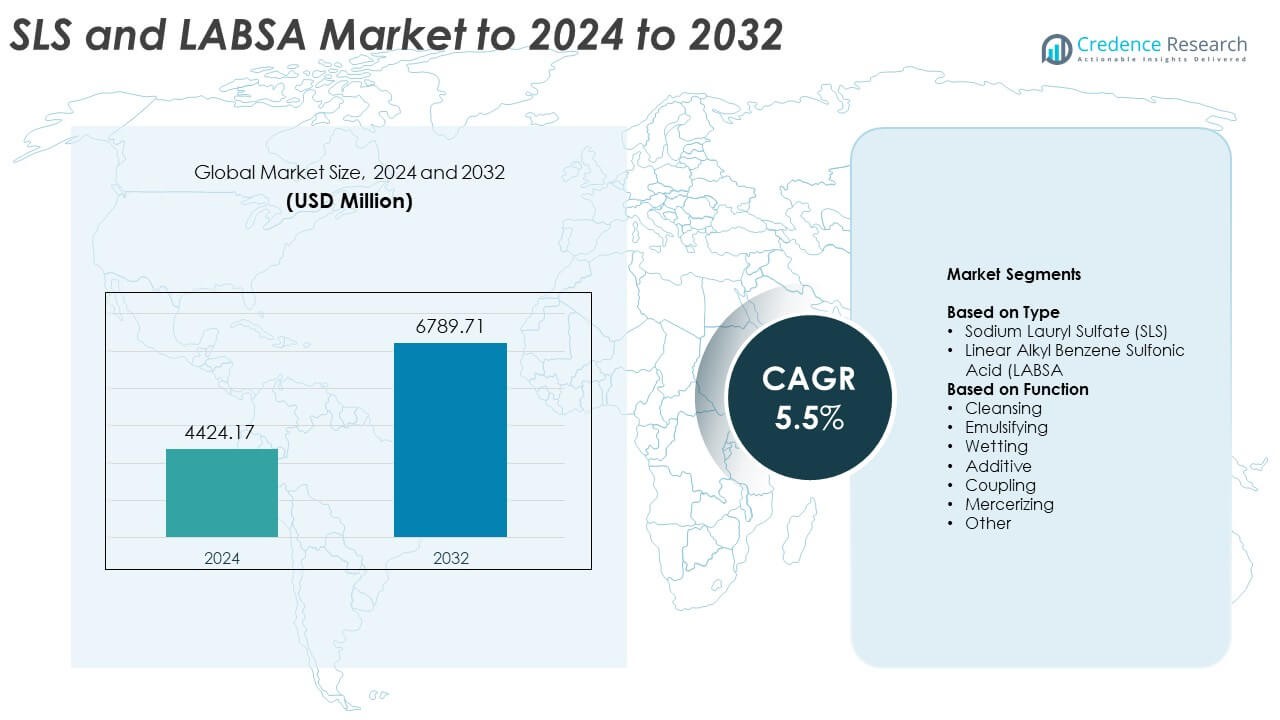

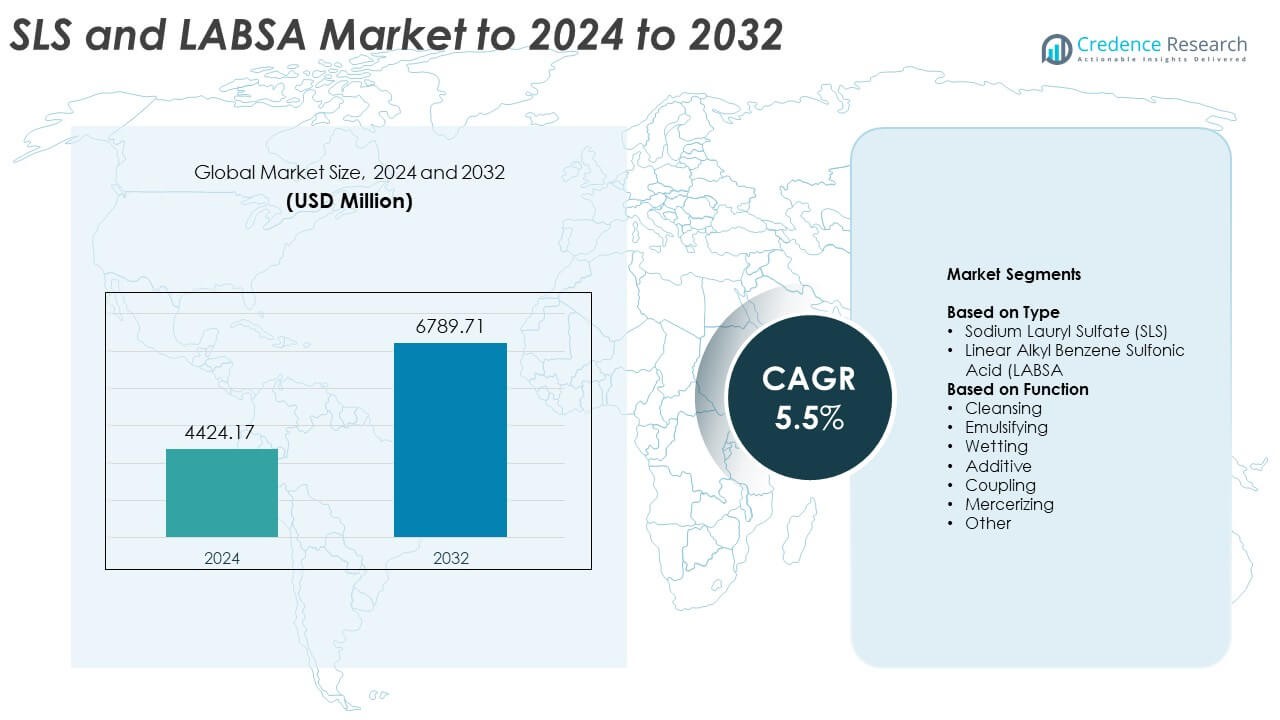

SLS and LABSA Market size was valued USD 4424.17 million in 2024 and is anticipated to reach USD 6789.71 million by 2032, at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| SLS and LABSA Market Size 2024 |

USD 4424.17 Million |

| SLS and LABSA Market , CAGR |

5.5% |

| SLS and LABSA Market Size 2032 |

USD 6789.71 Million |

The SLS and LABSA market is driven by major players including Fogla Group, Cepsa, BASF SE, Stepan Company, Sasol Chemicals LLC, Galaxy Surfactants Ltd, Solvay Vishnu Barium Pvt Ltd, Sinopec Jinling Petrochemical Co. Ltd, Arabian Sulfonates Company, and Kao Corporation. These companies compete through high-capacity production, diversified surfactant portfolios, and strong supply networks serving detergent, home-care, and industrial cleaning brands. Asia Pacific leads the global market with about 34% share in 2024, followed by North America with 28% and Europe with nearly 26%, while Latin America and Middle East & Africa account for 7% and 5% respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The SLS and LABSA market was valued at USD 4424.17 million in 2024 and is projected to reach USD 6789.71 million by 2032, growing at a CAGR of 5.5%.

- Strong demand for detergents, shampoos, personal care products, and industrial cleaners drives market expansion, with cleansing applications holding the largest share at about 46% in 2024.

- Trends focus on biodegradable surfactants, sustainable production, and sulfate-reduced formulations, supported by rising hygiene awareness and growing FMCG output across emerging markets.

- Competition remains high as global manufacturers expand capacity, improve supply reliability, and develop high-purity grades, while cost pressure and raw-material volatility act as key restraints.

- Asia Pacific leads with nearly 34% share in 2024, followed by North America at 28% and Europe at 26%, while Latin America and the Middle East & Africa hold 7% and 5% respectively, reflecting strong regional consumption patterns.

Market Segmentation Analysis:

By Type

Sodium Lauryl Sulfate holds the dominant position in 2024 with about 58% share. Manufacturers choose SLS for its strong foaming behavior, high detergency, and low production cost. Demand remains high across personal care, home care, and industrial cleaning chemicals. LABSA follows with rising usage in heavy-duty detergents and institutional cleaners, driven by its strong biodegradability profile and suitability for high-volume detergent plants. Growth across both categories is supported by expanding FMCG output in Asia Pacific and increasing demand for affordable surfactant formulations.

- For instance, Stepan Company expanded its alkoxylation capacity in Pasadena, Texas, adding a new plant with an annual capacity of 75,000 metric tons of alkoxylates, which started production in April 2025.

By Function

Cleansing leads this segment with nearly 46% share in 2024. The cleansing function dominates due to its essential role in shampoos, liquid soaps, laundry detergents, and household cleaners. Growth is supported by rising hygiene awareness and strong demand for foam-rich products in both residential and commercial markets. Emulsifying and wetting functions expand steadily as industries adopt SLS and LABSA in textile processing, paints, and agrochemicals. Additive, coupling, and mercerizing functions show moderate growth as manufacturers develop surfactant-enhanced formulations for niche industrial applications.

- For instance, Galaxy Surfactants’ total volume stood at 55,272 metric tons for Q1 FY23 as per an earnings call transcript.

Key Growth Drivers

Rising Demand for Household and Personal Care Products

Growing use of shampoos, liquid soaps, dishwashing liquids, and laundry detergents drives strong consumption of SLS and LABSA. Urban households buy more cleaning and hygiene products due to lifestyle changes and higher sanitation awareness. Manufacturers expand output to meet rising FMCG demand in Asia Pacific, Africa, and Latin America. Strong penetration of value-priced detergent brands supports higher surfactant usage. Product launches in foam-rich and deep-clean formulations further strengthen this driver and widen adoption across mass-market segments.

- For instance, Unilever states that its products are sold in 190 countries and used daily by 3.4 billion people.

Expansion of Industrial and Institutional Cleaning Applications

Industries use SLS and LABSA for degreasing, surface cleaning, and emulsification, driven by growth in manufacturing, hospitality, and food processing units. Rising infrastructure development increases demand for construction cleaning agents and industrial detergents. Institutional users prefer anionic surfactants due to reliable performance, strong wetting action, and affordability. The growth of commercial laundries and facility management services boosts consumption further. This expansion raises bulk demand from B2B sectors, firmly establishing it as a core growth driver.

- For instance, Ecolab notes it serves nearly three million customer locations across more than 170 countries.

Cost-Effectiveness and High Formulation Versatility

SLS and LABSA remain preferred ingredients because they deliver strong cleaning efficiency at low cost. Their compatibility with builders, fillers, fragrances, and other surfactants supports flexible formulation for detergents, soaps, and specialized cleaners. Producers continue to scale manufacturing capacity, lowering per-unit costs and supporting wide market adoption. This versatility allows brands to design low-cost and premium cleaning products across multiple applications. The combination of performance and affordability positions this as a key growth driver across global markets.

Key Trends and Opportunities

Shift Toward Biodegradable and Sustainable Surfactant Solutions

Producers invest more in eco-friendly and low-impact surfactant technologies to meet tightening environmental norms. Demand grows for biodegradable variants of LABSA and cleaner SLS blends, supported by regulatory pressure in Europe and rising sustainability commitments from major FMCG companies. This trend encourages innovation in greener raw materials and energy-efficient production processes. Emerging brands market sulfate-reduced and mild-cleaning formulations, opening new opportunities for manufacturers targeting natural and sustainable product lines.

- For instance, Clariant reports its catalysts enabled avoidance of 40 million tons of CO₂-equivalent emissions in 2023.

Growing Penetration of Emerging Markets and Bulk Detergent Manufacturing

Rapid urbanization in Asia Pacific, the Middle East, and parts of Africa supports higher per-capita consumption of laundry and home-care products. Governments promote hygiene programs and affordable cleaning solutions, increasing market reach. Many detergent plants expand bulk production to meet rising local and export demand. This trend creates strong opportunities for surfactant suppliers, especially where low-cost, high-volume formulations dominate. Market participants leverage this expansion to strengthen distribution networks and long-term supply partnerships.

- For instance, Godrej Consumer Products states its products are available in over 80 countries through its global exports network.

Key Challenges

Volatility in Raw Material Prices and Supply Chain Pressure

Fluctuating crude oil and petrochemical feedstock prices impact production costs for both SLS and LABSA. Tight supply situations in linear alkylbenzene and ethoxylates cause pricing instability. Global logistics disruptions, shipping delays, and regional capacity constraints add further pressure. These shifts force manufacturers to adjust pricing and manage thin margins. Maintaining consistent supply at stable cost becomes challenging, especially for small and mid-scale producers dependent on imported materials.

Regulatory Scrutiny and Rising Preference for Sulfate-Free Formulations

Stricter environmental policies challenge manufacturers to reduce emissions, effluents, and non-biodegradable waste from surfactant production. Growing consumer interest in sulfate-free personal care products affects demand for traditional SLS formulations. Brands expand mild-cleansing and sulfate-alternative product lines to meet skin-sensitivity preferences. Compliance with international safety standards also increases operational costs. These shifts pressure producers to upgrade technologies, optimize processes, and diversify into safer and more sustainable surfactant systems.

Regional Analysis

North America

North America accounts for about 28% share of the SLS and LABSA market in 2024, supported by strong demand for personal care, household cleaners, and institutional cleaning chemicals. The region benefits from high consumption of premium shampoos, detergents, and surface-cleaning products with consistent formulations. Growth remains stable due to rising hygiene awareness and steady industrial cleaning activity across manufacturing and healthcare. Established FMCG brands and strong retail penetration drive higher use of anionic surfactants. Regulatory encouragement for cleaner formulations pushes producers to enhance product efficiency and sustainability, supporting continued market expansion.

Europe

Europe holds nearly 26% share in 2024, driven by mature detergent consumption and strict environmental standards that influence surfactant formulation upgrades. The region shows strong demand for home care, fabric care, and personal hygiene products, supported by high purchasing power and well-developed distribution channels. Industrial cleaning chemicals also contribute to steady market usage. Regulations under REACH and sustainability targets push suppliers toward cleaner production and biodegradable surfactant blends. Market growth remains moderate but stable, strengthened by innovation in sulfate-reduced personal care products and strong adoption of high-performance detergent ingredients.

Asia Pacific

Asia Pacific leads the global market with around 34% share in 2024, driven by rapid urbanization, population growth, and rising consumption of affordable cleaning and personal care products. Strong FMCG manufacturing capacity and expanding detergent plants in China, India, and Southeast Asia increase demand for SLS and LABSA. Growing middle-income households support higher usage of shampoos, fabric cleaners, and dishwashing liquids. Local brands rely heavily on cost-effective surfactants, pushing bulk procurement. Industrial cleaning demand also rises due to manufacturing expansion. The region continues to show the fastest growth, supported by strong domestic production capabilities.

Latin America

Latin America accounts for nearly 7% share in 2024, supported by growing demand for home care and personal hygiene products across Brazil, Mexico, and Argentina. Increasing urban population and rising adoption of multipurpose cleaners boost surfactant consumption. Local detergent producers rely on cost-effective LABSA and SLS grades to meet demand for mass-market cleaning products. Economic recovery in key countries improves household spending and encourages FMCG expansion. Although growth is moderate, the region benefits from rising industrial cleaning needs in food processing, hospitality, and manufacturing sectors, strengthening long-term market prospects.

Middle East and Africa

Middle East and Africa hold about 5% share in 2024, driven by expanding detergent production in Gulf countries and rising hygiene awareness across African nations. Growing urbanization and improving household income support higher use of laundry detergents, dishwashing liquids, and personal care items. Investments in local surfactant and detergent manufacturing capacity reduce reliance on imports, especially in the Middle East. The region also shows increasing industrial cleaning demand due to construction, hospitality, and commercial sector growth. While overall consumption remains lower than major markets, steady adoption and infrastructure development support gradual market expansion.

Market Segmentations:

By Type

- Sodium Lauryl Sulfate (SLS)

- Linear Alkyl Benzene Sulfonic Acid (LABSA

By Function

- Cleansing

- Emulsifying

- Wetting

- Additive

- Coupling

- Mercerizing

- Other

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The SLS and LABSA market is shaped by key players such as Fogla Group, Cepsa, BASF SE, Stepan Company, Sasol Chemicals LLC, Galaxy Surfactants Ltd, Solvay Vishnu Barium Pvt Ltd, Sinopec Jinling Petrochemical Co. Ltd, Arabian Sulfonates Company, and Kao Corporation. Companies compete through capacity expansion, wide product lines, and long-term contracts with detergent and personal care manufacturers. Producers focus on high-purity grades for home care, textile, and institutional cleaning. Many firms invest in sustainable feedstocks and cleaner production to meet rising environmental expectations. Regional manufacturing hubs support faster delivery and lower logistic costs. Suppliers also strengthen R&D to develop stable blends for liquid detergents, concentrated powders, and specialized cleaning products. Competitive advantage depends on cost efficiency, consistent quality, and supply reliability across global and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fogla Group

- Cepsa

- BASF SE

- Stepan Company

- Sasol Chemicals LLC.

- Galaxy Surfactants Ltd.

- Solvay Vishnu Barium Pvt Ltd.

- Sinopec Jinling Petrochemical Co. Ltd.

- Arabian Sulfonates Company

- Kao Corporation

Recent Developments

- In 2025, Stepan has been noted for focusing on specialty applications of LABSA as part of their portfolio to broaden industrial use, driven by the increasing demand for biodegradable surfactants and sustainability improvements in production methods.

- In 2025, Sasol reported improved financial delivery and business performance, with its chemicals division exhibiting increased adjusted EBITDA and expanded margins, attributed to efficiency improvements and a favorable market.

- In 2024, BASF inaugurated a new Catalyst Development and Solids Processing Center in Ludwigshafen, Germany.

Report Coverage

- The research report offers an in-depth analysis based on Type, Function and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

- Future Outlook

- Demand for SLS and LABSA will grow as hygiene and cleaning usage increases worldwide.

- Asia Pacific will continue leading consumption due to strong FMCG expansion.

- Producers will invest more in energy-efficient and low-emission manufacturing technologies.

- Sustainable and biodegradable surfactant variants will gain wider adoption.

- Personal care brands will expand mild and sulfate-reduced formulations, influencing product demand.

- Industrial cleaning applications will rise with manufacturing and infrastructure growth.

- Raw material optimization will become a priority to manage price fluctuations.

- Companies will strengthen supply chains to reduce dependency on imported feedstocks.

- Innovation in detergent and home-care formulations will support higher surfactant integration.

- Regulatory pressure will push manufacturers to upgrade processes and adopt greener chemistry.