Market Overview:

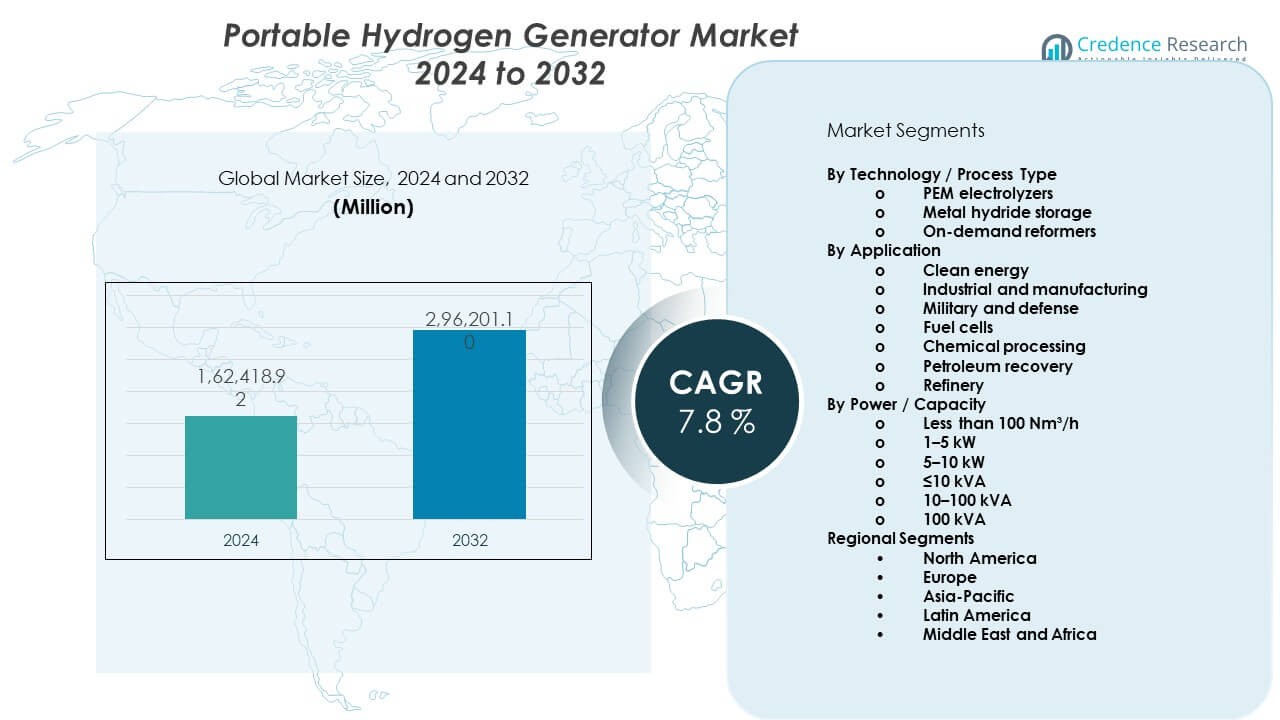

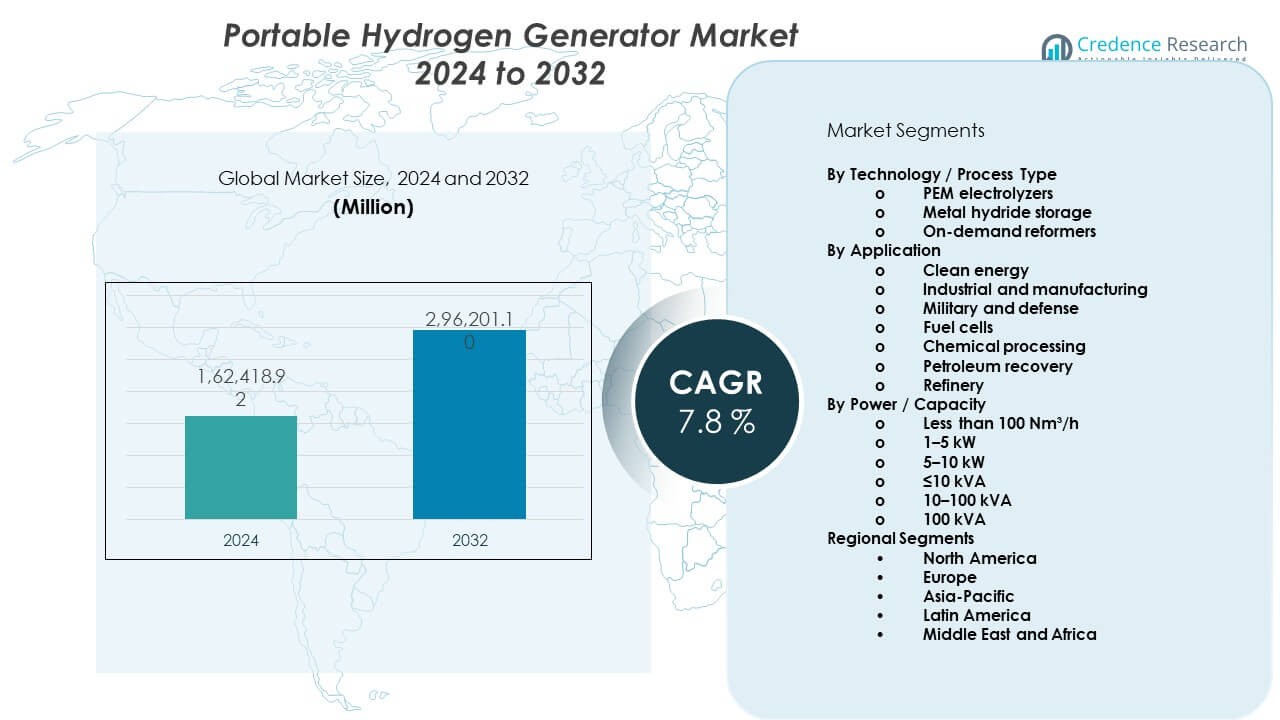

The Portable Hydrogen Generator Market is projected to grow from USD 162,418.92 million in 2024 to an estimated USD 296,201.1 million by 2032. The market is expected to record a compound annual growth rate (CAGR) of 7.8% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Portable Hydrogen Generator Market Size 2024 |

USD 162,418.92 Million |

| Portable Hydrogen Generator Market, CAGR |

7.8% |

| Portable Hydrogen Generator Market Size 2032 |

USD 296,201.1 Million |

Market growth is driven by the global push for decarbonization and energy security. Industries adopt portable hydrogen generators to reduce reliance on fossil fuels. Advancements in electrolysis improve efficiency, safety, and portability. Lower system sizes support field operations, emergency power, and mobility use cases. Governments promote hydrogen adoption through clean energy programs. Industrial users value on-site hydrogen generation for reliability. These factors position the market as a key enabler of distributed clean energy systems.

North America leads the market due to strong hydrogen pilot projects and clean energy funding. The United States shows high adoption across industrial and mobility segments. Europe follows, driven by strict emission rules and hydrogen roadmaps. Germany and France invest in portable systems for transport and backup power. Asia Pacific emerges rapidly, led by Japan, South Korea, and China. These countries support hydrogen through national strategies and fuel cell development. Emerging regions adopt systems to improve off-grid energy access.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The market reached USD 162,418.92 million in 2024 and targets USD 296,201.1 million by 2032, at 7.8% CAGR.

- North America leads with 38%, Europe follows at 30%, and Asia-Pacific holds 25%, driven by policy, industry, and technology.

- Asia-Pacific grows fastest with 25% share due to hydrogen programs, fuel cells, and off-grid demand.

- By technology, PEM electrolyzers hold about 55%, metal hydride storage 25%, and on-demand reformers 20%.

- By application, clean energy and fuel cells account for 45%, industrial and defense hold 35%, and others share 20%.

Market Drivers:

Global Push Toward Decarbonized and Low-Emission Energy Systems

Governments promote clean energy to reduce carbon emissions. Hydrogen gains priority as a zero-emission fuel option. Industries seek alternatives to diesel-based generators. Portable systems support flexible deployment across sites. Mobility and backup power segments show steady demand. The Portable Hydrogen Generator Market benefits from policy alignment. It fits national hydrogen roadmaps and targets. Public funding supports pilot and early deployments.

- For instance, Plug Power PEM electrolyzers reach electrical efficiency above 70%. National hydrogen strategies support such deployments. Public programs fund pilot hydrogen power projects.

Rising Demand for Reliable Off-Grid and Backup Power Solutions

Remote operations require dependable energy access. Grid instability increases the need for backup systems. Portable hydrogen units offer quiet and clean operation. These systems reduce fuel transport and storage risks. Construction and telecom sectors value mobility. Emergency services rely on compact power sources. The Portable Hydrogen Generator Market addresses reliability needs. It supports continuous operations in critical settings.

- For instance, Enapter’s AEM electrolyzer module delivers about 2.4 kW per unit. Emergency services rely on compact power sources. Reliability drives adoption in critical operations.

Advances in Electrolysis and System Miniaturization Technologies

Electrolyzer efficiency improves through material innovation. Smaller stacks reduce overall system weight. Compact designs enable easy field use. Enhanced safety features improve adoption confidence. Automation simplifies daily operation requirements. Lower maintenance improves lifecycle performance. The Portable Hydrogen Generator Market gains from these advances. It supports wider application diversity.

Energy Security and On-Site Hydrogen Production Benefits

Organizations seek greater energy supply control. On-site generation reduces fuel dependency risks. Hydrogen storage supports extended runtime needs. Portable units improve operational resilience. Defense and disaster response teams adopt such systems. Logistics simplify without fuel delivery chains. The Portable Hydrogen Generator Market supports autonomy goals. It aligns with resilience planning strategies.

Market Trends:

Integration With Fuel Cells for Mobile and Modular Power Systems

Manufacturers pair generators with fuel cells. Modular designs allow scalable power output. Mobile platforms enable rapid deployment. Users prefer plug-and-play configurations. Compact units fit vehicles and trailers. Integration improves system efficiency. The Portable Hydrogen Generator Market follows modular trends. It supports flexible power architectures.

- For instance, Ballard fuel cell systems achieve electrical efficiency near 60%. Integration improves overall system efficiency. Flexible architectures support mobile power needs.

Growing Adoption Across Research, Medical, and Laboratory Uses

Laboratories require consistent hydrogen supply. Portable generators replace gas cylinders safely. On-demand production improves workplace safety. Medical research values compact equipment footprints. Universities adopt mobile energy tools. Research teams favor flexible assets. The Portable Hydrogen Generator Market serves niche users. It supports controlled environments effectively.

- For instance, Proton OnSite generators supply high-purity hydrogen above 99.999%. Research teams favor flexible assets. Controlled environments drive steady adoption.

Shift Toward Digital Monitoring and Smart Control Features

Manufacturers add digital control interfaces. Remote monitoring improves system oversight. Data tracking supports predictive maintenance. Smart controls optimize hydrogen output. Users monitor performance in real time. Automation reduces operator skill needs. The Portable Hydrogen Generator Market adopts smart features. It enhances operational visibility.

Expansion of Rental and Service-Based Deployment Models

Users seek lower upfront investment options. Rental models improve technology access. Service contracts support uptime assurance. Project-based users prefer temporary deployment. Providers expand mobile equipment fleets. This model supports pilot programs. The Portable Hydrogen Generator Market adapts to service demand. It enables flexible procurement choices.

Market Challenges Analysis:

High Initial Costs and Limited Cost Parity With Conventional Systems

Capital costs remain high for many buyers. Electrolyzer materials increase system pricing. Balance-of-system components add expense. Small-scale users face budget constraints. Cost parity with diesel remains limited. Financing options stay uneven across regions. The Portable Hydrogen Generator Market faces adoption resistance. It must address affordability gaps.

Hydrogen Storage, Safety, and Infrastructure Constraints

Hydrogen handling requires strict safety measures. Storage adds weight and complexity. Regulations differ across regions. Certification processes delay deployments. Limited service infrastructure affects uptime. Training needs increase operational burden. The Portable Hydrogen Generator Market navigates these barriers. It requires standardization progress.

Market Opportunities:

Rising Use in Defense, Disaster Relief, and Emergency Response

Emergency operations demand reliable clean power. Portable hydrogen systems suit rapid response. Defense agencies value silent operation. Field hospitals require emission-free energy. Disaster zones lack fuel logistics. Mobile units improve response efficiency. The Portable Hydrogen Generator Market can scale in this space. It supports mission-critical operations.

Expansion in Developing Regions With Weak Grid Infrastructure

Many regions face unreliable electricity supply. Portable generators offer decentralized energy access. Hydrogen reduces fuel import dependence. Rural projects benefit from clean power. Infrastructure projects need mobile solutions. Public programs support clean energy trials. The Portable Hydrogen Generator Market can expand here. It supports inclusive energy development.

Market Segmentation Analysis:

Technology / Process Type

PEM electrolyzers lead adoption due to fast response and compact design. These systems suit mobile and on-demand hydrogen needs. Metal hydride storage supports safer handling and steady supply in portable formats. This option appeals to defense and laboratory users. On-demand reformers serve sites with access to hydrocarbons. These units support transitional use cases where hydrogen logistics remain limited. Technology choice depends on purity needs, mobility, and operational control.

- For instance, Air Products reformer units support continuous field hydrogen supply. Technology choice depends on purity and mobility. Operational control shapes system selection.

By Application

Clean energy applications drive demand across off-grid and backup power uses. Industrial and manufacturing sites use portable systems for process reliability. Military and defense units value silent operation and energy autonomy. Fuel cell integration supports mobility and modular power systems. Chemical processing adopts portable hydrogen for testing and small-scale reactions. Petroleum recovery and refinery uses focus on field flexibility. The Portable Hydrogen Generator Market serves diverse end users with varied operational needs.

- For instance, Cummins Hydrogenics systems support field fuel cell trials. Petroleum recovery values operational flexibility. Diverse needs shape end-user adoption.

By Power / Capacity

Systems below 100 Nm³/h support laboratories and research sites. The 1–5 kW and 5–10 kW ranges fit telecom, construction, and mobile assets. Units rated ≤10 kVA meet small backup and field power needs. The 10–100 kVA segment serves industrial and defense deployments. Systems above 100 kVA target large mobile platforms and temporary infrastructure. Capacity selection reflects runtime needs, mobility limits, and load profiles.

Segmentation:

By Technology / Process Type

- PEM electrolyzers

- Metal hydride storage

- On-demand reformers

By Application

- Clean energy

- Industrial and manufacturing

- Military and defense

- Fuel cells

- Chemical processing

- Petroleum recovery

- Refinery

By Power / Capacity

- Less than 100 Nm³/h

- 1–5 kW

- 5–10 kW

- ≤10 kVA

- 10–100 kVA

- 100 kVA

By Regional Segments

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the global market, accounting for around 38% of demand. The United States leads regional adoption due to strong hydrogen pilot programs. Federal clean energy funding supports portable hydrogen deployments. Defense, telecom, and construction sectors drive steady use. Fuel cell integration strengthens mobile power applications. The Portable Hydrogen Generator Market benefits from advanced manufacturing capacity here. It also gains from a mature supplier ecosystem.

Europe

Europe represents nearly 30% of the global market share. Western Europe leads through strict emission rules and hydrogen strategies. Germany, France, and the Netherlands invest in portable systems for mobility. Industrial decarbonization supports steady demand growth. Eastern Europe shows gradual adoption through energy security initiatives. The Portable Hydrogen Generator Market aligns with EU hydrogen roadmaps. It supports clean backup power and testing needs.

Asia-Pacific and Rest of the World

Asia-Pacific accounts for about 25% of global demand and shows the fastest growth pace. Japan and South Korea lead through fuel cell and hydrogen programs. China expands adoption across industrial and construction uses. South Asia and Southeast Asia adopt systems for off-grid power. Latin America, Middle East, and Africa hold nearly 7% share combined. The Portable Hydrogen Generator Market supports remote energy access here. It benefits from rising infrastructure and energy diversification efforts.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Portable Hydrogen Generator Market shows moderate concentration with a mix of global energy firms and specialized hydrogen players. Companies compete on system efficiency, portability, and safety performance. PEM-based solutions dominate product portfolios due to fast response and compact size. Firms invest in modular designs to address diverse end uses. Strategic partnerships support fuel cell integration and service reach. Product differentiation focuses on durability and digital control features. The market rewards suppliers with strong manufacturing scale. It also favors companies with defense and industrial contracts. Competitive pressure drives continuous product upgrades. Entry barriers remain moderate due to technology and certification needs.

Recent Developments:

- In December 2025, Air Products and Chemicals and Yara International announced advanced partnerships to produce and globally distribute large-scale low-emission ammonia, supporting decarbonization and clean energy demand. The partnership centers on the Louisiana Clean Energy Complex, which Air Products is currently developing as the world’s largest low-carbon energy project, designed to deliver more than 750 million standard cubic feet per day of low-carbon hydrogen with approximately 95% carbon dioxide capture. Air Products would own and operate the industrial gases production, where approximately 80% of the low-carbon hydrogen would be supplied to Yara under a long-term 25-year offtake agreement to produce approximately 2.8 million tonnes of low-carbon ammonia annually. Both companies aim to finalize investment decisions by mid-2026, with full project completion anticipated by 2030. The partnership also includes alignment on the NEOM Green Hydrogen Project in Saudi Arabia, which is over 90% complete and scheduled to begin commercial output in 2027.

- In July 2025, Ballard Power Systems announced a significant 6.4 MW fuel cell engine order from eCap Marine for deployment on two vessels operated by Samskip, representing one of the largest marine fuel cell engine orders in history. The delivery of the engines was planned for 2025 and 2026. In the same month, Ballard also signed a supply agreement with California-based rail operator Sierra Northern Railway for the supply of 1.5 MW of fuel cell engines, with expected delivery in 2025. In November 2024, Ballard announced a purchase order to supply 200 fuel cell engines to New Flyer, a subsidiary of NFI Group Inc., representing approximately 20 MW of power. This order doubled the first purchase order under a long-term supply agreement announced in January 2024, with deliveries planned for 2025 to power New Flyer’s next-generation Xcelsior CHARGE FC hydrogen fuel cell buses for deployment across multiple U.S. states including California, Washington, Arizona, Nevada, and New York.

- In March 2025, Enapter AG expanded its product range by offering supporting battery solutions from its joint venture partner Wolong under the Enapter brand in addition to its own multicore electrolyzers. Lithium-ion batteries from Chinese partner Zhejiang Wolong Energy Storage System Co., Ltd., with a capacity ranging from 150 KW up to several megawatts, were integrated to enhance hydrogen production efficiency. In July 2025, Enapter AG announced the expansion of its product portfolio with a new 2.5 MW multicore electrolyzer called Nexus 2500. Thanks to the use of new, more powerful stacks, the Nexus 2500 offers significantly more power than the current 1 MW multicore electrolyzers while maintaining the same size in a 40-foot container. The electrolyzer is now available for pre-order and opens up new markets for large-scale hydrogen production plants on an industrial scale, with applications in steel and ammonia production, refueling stations for heavy-duty vehicles, and energy storage from solar and wind farms.

Report Coverage:

The research report offers an in-depth analysis based on technology or process type, application, and power or capacity. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Adoption expands across off-grid and mobile power uses

- PEM electrolyzers remain the preferred technology choice

- Defense and emergency response demand strengthens

- Modular and scalable designs gain wider acceptance

- Digital monitoring becomes a standard system feature

- Rental and service models see higher penetration

- Asia-Pacific records faster deployment rates

- Safety and certification standards improve buyer trust

- Integration with fuel cells supports mobility growth

- Industrial users seek compact on-site hydrogen solutions