Market Overview

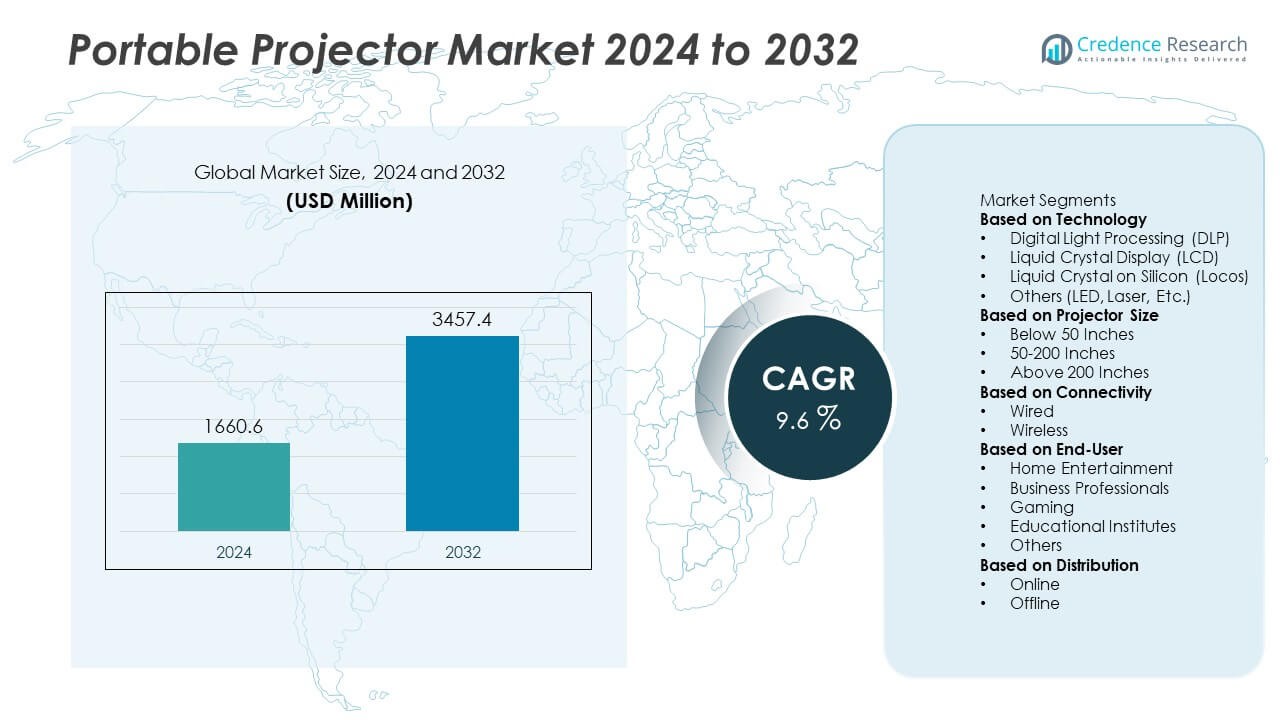

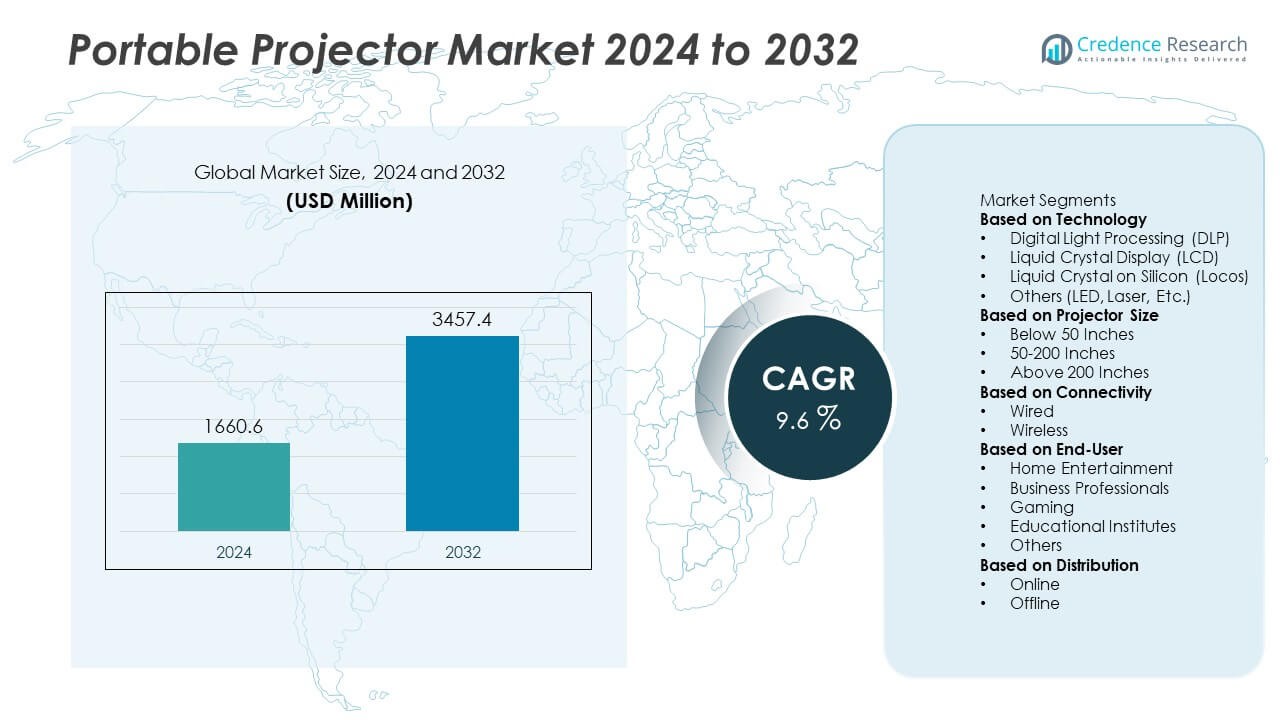

The Portable Projector Market was valued at USD 1,660.6 million in 2024 and is anticipated to reach USD 3,457.4 million by 2032, expanding at a CAGR of 9.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Portable Projector Market Size 2024 |

USD 1,660.6 Million |

| Portable Projector Market, CAGR |

9.6% |

| Portable Projector Market Size 2032 |

USD 3,457.4 Million |

The Portable Projector Market grows with rising demand for compact, lightweight devices that serve education, corporate, and home entertainment needs. Industries adopt portable projectors for flexibility, easy connectivity, and cost-effective deployment in classrooms and small offices. Trends highlight the shift toward LED and laser light sources that deliver longer lifespans and reduced maintenance.

The Portable Projector Market demonstrates strong geographical diversity, with North America emphasizing professional and educational adoption supported by advanced digital infrastructure. Europe focuses on eco-friendly LED and laser models, catering to both business and residential needs. Asia-Pacific emerges as the fastest-growing region, where China, India, Japan, and South Korea lead demand for smart and compact projectors across classrooms, small businesses, and consumer entertainment. Latin America and the Middle East & Africa witness steady uptake driven by education initiatives, corporate expansion, and increasing affordability of compact models. Leading companies shaping the competitive landscape include Xiaomi Corporation, which drives demand with affordable, app-integrated mini projectors; BenQ, known for high-resolution and gaming-oriented portable projectors; LG Electronics, which emphasizes smart connectivity and ultra-portable designs; and Panasonic Corporation, focusing on durable, high-brightness solutions for professional and education markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Insights

- The Portable Projector Market was valued at USD 1,660.6 million in 2024 and is expected to reach USD 3,457.4 million by 2032, expanding at a CAGR of 9.6% during the forecast period.

- Growth is fueled by rising demand for compact, lightweight devices that deliver reliable projection for home entertainment, digital classrooms, and corporate presentations.

- Market trends emphasize adoption of LED and laser light sources with lifespans exceeding 20,000 hours, integration of wireless connectivity, and increasing popularity of pocket-sized models.

- Competitive dynamics feature leading players such as Xiaomi Corporation, BenQ, LG Electronics, and Panasonic Corporation, who focus on innovations in smart compatibility, high-resolution projection, and durability to strengthen global presence.

- Restraints include limited brightness in ultra-portable devices, inadequate built-in audio performance, and high price sensitivity in emerging economies that restrict broader penetration.

- Regional dynamics show North America advancing through education and corporate usage, Europe prioritizing sustainable LED and laser solutions, Asia-Pacific expanding rapidly with demand from digital learning and mobile lifestyles, while Latin America and the Middle East & Africa grow steadily through affordable models and education-driven adoption.

- The market outlook reflects a decisive shift toward sustainability and innovation, with manufacturers developing biofuel-compatible energy solutions, hybrid-ready features, and enhanced multimedia connectivity to align portable projectors with evolving consumer and institutional needs.

Market Drivers

Growing Demand for Compact and Lightweight Consumer Electronics

The Portable Projector Market expands with rising consumer preference for compact, lightweight devices that offer mobility without compromising functionality. Users adopt portable projectors for home entertainment, education, and business applications where portability provides clear advantages. The growing culture of remote work and mobile lifestyles increases demand for flexible display solutions. Compact size combined with easy connectivity makes these devices suitable for personal and professional use. It reinforces the market’s position in consumer electronics by catering to convenience-driven users who seek multifunctional gadgets.

- For instance, Xiaomi launched the Mi Smart Compact Projector with dimensions of 150 × 115 × 150 mm and weight of 1.3 kg, integrating Android TV with 5,000+ apps and supporting projection sizes up to 200 inches, making it one of the smallest full-HD smart projectors in its class.

Expansion of Digital Learning and Education Applications

The Portable Projector Market benefits from integration into digital classrooms and e-learning environments. Schools and universities deploy portable projectors to create interactive, large-format visuals in limited spaces. Their affordability and ease of use support adoption in developing economies with growing digital education initiatives. Teachers and trainers leverage wireless connectivity and battery-powered models to enhance learning experiences beyond traditional classrooms. It ensures steady growth as education systems worldwide prioritize digital transformation and accessible teaching tools.

- For instance, Global Growth Insights reports that over 49 percent of educational institutions now deploy smart projectors to enable interactive and enhanced learning environments.

Rising Adoption Across Corporate and Professional Environments

The Portable Projector Market gains momentum from increasing use in corporate offices, start-ups, and professional settings. Executives and sales teams prefer portable projectors for presentations in client meetings and business events. Wireless features, compatibility with multiple devices, and quick setup contribute to time efficiency. Demand accelerates in co-working spaces and small businesses where compact solutions replace bulky traditional projectors. It continues to establish relevance in professional environments where mobility and efficiency remain critical.

Technological Advancements in Projection Quality and Connectivity

The Portable Projector Market advances with innovations in projection technology, image quality, and connectivity options. Manufacturers focus on integrating LED and laser light sources that deliver longer life spans and lower maintenance requirements. High-resolution models now provide sharper visuals for both entertainment and professional use. Built-in Wi-Fi, Bluetooth, and app-based controls enhance accessibility for users across multiple platforms. It drives stronger adoption among consumers seeking high-performance features in compact formats.

Market Trends

Integration of Smart Features and Wireless Connectivity

The Portable Projector Market advances through the integration of smart technologies and wireless features that improve user convenience. Built-in Wi-Fi and Bluetooth connectivity enable seamless streaming from smartphones, tablets, and laptops. Manufacturers embed voice assistants and app-based controls that increase accessibility and ease of operation. Smart compatibility allows projectors to connect with popular platforms such as Android TV and streaming services. It strengthens appeal among tech-savvy consumers who prefer compact devices with integrated digital ecosystems.

- For instance, Xiaomi’s Mi Smart Projector 2 includes dual‑band Wi‑Fi (2.4 GHz and 5 GHz) and Bluetooth 5.0, supports Android TV, and offers voice control through Google Assistant within a device weighing just 1.3 kg and projecting up to 120 inches in size.

Shift Toward LED and Laser Light Source Adoption

The Portable Projector Market witnesses a strong shift from traditional lamp-based models toward LED and laser technologies. These light sources deliver longer operational lifespans, often exceeding 20,000 hours, while reducing maintenance requirements. They enhance energy efficiency and deliver consistent brightness levels over time. Compact LED-based designs make portable projectors more durable and travel-friendly. It drives demand among both personal and professional users who value reliability and low-cost ownership.

- For instance, BenQ’s LH750 LED projector offers up to 30,000 hours of maintenance-free operation in Eco mode and projects at 5,000 ANSI lumens brightness, supporting connectivity through Wi‑Fi dongles for wireless casting and ensuring long-term usage without lamp replacement.

Rising Popularity of Ultra-Portable and Pocket-Sized Models

The Portable Projector Market experiences growth from rising demand for ultra-portable and pocket-sized models. Consumers seek lightweight projectors that fit in bags or even pockets without sacrificing projection quality. These compact devices target travelers, students, and mobile professionals who need on-the-go display solutions. Manufacturers emphasize slim form factors and battery-powered functionality to attract wider audiences. It expands adoption across casual entertainment, small meeting spaces, and mobile educational setups.

Increasing Focus on High-Resolution and Multimedia Compatibility

The Portable Projector Market strengthens with rising consumer preference for high-resolution displays and versatile multimedia support. Devices now feature Full HD and 4K projection capabilities that enhance user experience in home cinema and gaming. Multimedia compatibility, including HDMI, USB-C, and screen mirroring, expands integration with multiple devices. Growing interest in immersive entertainment solutions drives innovation in sound integration and display sharpness. It positions portable projectors as strong alternatives to traditional television screens in compact living spaces.

Market Challenges Analysis

High Price Sensitivity and Limited Consumer Awareness in Emerging Regions

The Portable Projector Market faces hurdles in emerging regions where price sensitivity influences purchasing decisions. Many consumers continue to rely on televisions or smartphones for entertainment, reducing awareness of portable projectors as a viable option. High upfront costs of advanced models with LED or laser light sources restrict wider adoption in budget-conscious markets. Limited availability of distribution channels and after-sales support further slows growth in rural and semi-urban areas. It highlights the need for manufacturers to balance affordability with technological innovation to reach mass audiences.

Technical Limitations in Brightness and Audio Output

The Portable Projector Market encounters performance challenges related to brightness levels and integrated sound quality. Many compact models struggle to deliver sufficient lumens for well-lit environments, limiting their effectiveness in professional and outdoor use. Built-in speakers often provide inadequate audio output, requiring users to invest in external systems. Battery life also presents constraints for extended usage, especially in mobile or travel applications. It underscores the importance of continuous improvement in projection power, audio integration, and energy efficiency to meet rising consumer expectations.

Market Opportunities

Rising Adoption in Home Entertainment and Gaming Applications

The Portable Projector Market holds opportunities in home entertainment where consumers seek immersive yet compact alternatives to traditional screens. Growing interest in gaming and streaming platforms fuels demand for portable projectors that deliver high-definition visuals on flexible surfaces. Manufacturers introduce 4K-enabled models with built-in speakers to enhance cinematic experiences in compact living spaces. Battery-powered devices further expand usability for outdoor movie nights and casual gatherings. It leverages the shift toward lifestyle-driven consumer electronics that emphasize convenience and flexibility in entertainment.

Expanding Use in Education, Training, and Business Environments

The Portable Projector Market creates opportunities through integration into classrooms, training centers, and small enterprises. Schools in developing economies adopt portable projectors as cost-effective tools for digital learning where permanent installations are limited. Trainers and professionals use lightweight models with wireless connectivity for interactive sessions across multiple locations. Growing emphasis on hybrid work and mobile collaboration accelerates adoption in corporate environments. It positions portable projectors as essential tools that support productivity, education, and communication in diverse contexts.

Market Segmentation Analysis:

By Technology

The Portable Projector Market segments by technology into Digital Light Processing (DLP), Liquid Crystal Display (LCD), and Liquid Crystal on Silicon (LCoS). DLP projectors dominate due to their compact design, sharp image output, and cost-effectiveness, making them suitable for consumer entertainment and business use. LCD models deliver brighter images and stronger color accuracy, appealing to classrooms and professional environments. LCoS projectors serve premium applications with higher resolution and superior image quality, though they remain less common due to higher costs. Manufacturers integrate LED and laser light sources across these technologies to extend product lifespan and reduce maintenance. It supports a balance between performance and affordability across different user segments.

- For instance, BenQ’s LU9245 laser projector uses LCoS‑like WUXGA resolution at 1920×1200, projects at 7,000 ANSI lumens, and offers laser light‑source options rated for up to 75,000 operational hours in dimming mode.

By Projector Size

The Portable Projector Market divides by size into pocket-sized, mini, and standard portable projectors. Pocket-sized models gain traction among travelers, students, and casual users who prioritize mobility over advanced features. Mini projectors, slightly larger, deliver higher brightness and longer battery life, making them suitable for small offices and home entertainment. Standard portable projectors cater to professional presentations and larger gatherings, offering stronger performance with advanced connectivity and higher resolution. Each size segment appeals to distinct customer groups, allowing manufacturers to target specific lifestyle and business needs. It expands the overall adoption of portable projectors across consumer and professional environments.

By Connectivity

The Portable Projector Market categorizes by connectivity into wired and wireless models. Wired projectors remain relevant for users who prioritize stability, especially in professional and educational environments where HDMI and USB connections ensure uninterrupted output. Wireless models drive market growth by offering convenience through Wi-Fi, Bluetooth, and screen mirroring compatibility with smartphones, laptops, and tablets. Integration of smart features such as Android-based platforms and app-driven controls further enhances wireless adoption. Hybrid models combine wired reliability with wireless flexibility to appeal to a broader user base. It strengthens the market by aligning product innovation with consumer demand for convenience and versatility in multimedia access.

- For instance, a survey highlighted that over three-quarters of digital classrooms now rely on wireless projection tools to support interactive learning. A shift driven by the desire for more dynamic and engaging educational experiences that capture students’ attention more effectively than traditional methods.

Segments:

Based on Technology

- Digital Light Processing (DLP)

- Liquid Crystal Display (LCD)

- Liquid Crystal on Silicon (Locos)

- Others (LED, Laser, Etc.)

Based on Projector Size

- Below 50 Inches

- 50-200 Inches

- Above 200 Inches

Based on Connectivity

Based on End-User

- Home Entertainment

- Business Professionals

- Gaming

- Educational Institutes

- Others

Based on Distribution

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 27% share of the Portable Projector Market, supported by strong adoption across consumer electronics, education, and corporate sectors. The United States leads regional demand with widespread use of portable projectors in classrooms, home theaters, and business presentations. Universities and schools integrate compact projectors into digital learning environments, aided by government-driven education technology initiatives. Corporates and start-ups rely on portable projectors for mobile presentations and collaboration in co-working spaces. Canada contributes growth through expanding demand for portable projectors in residential and small-office applications, while Mexico shows rising adoption across education and small businesses. The presence of key brands and advanced distribution networks accelerates adoption. It reinforces North America’s role as a stable and mature market with consistent innovation.

Europe

Europe accounts for 23% share of the Portable Projector Market, characterized by demand for energy-efficient, compact, and eco-friendly designs. Countries such as Germany, the UK, and France emphasize portable projectors in professional settings, supported by advanced business infrastructure. Scandinavian nations drive demand for sustainable LED- and laser-based portable projectors that reduce energy consumption. Schools across the region integrate portable projectors into e-learning systems to expand digital education. Southern Europe, including Spain and Italy, supports growth in home entertainment applications where compact designs complement smaller living spaces. Manufacturers in Europe also focus on high-resolution and multifunctional projectors for corporate and consumer use. It strengthens Europe’s presence as a leader in sustainable and high-quality portable projection solutions.

Asia-Pacific

Asia-Pacific leads with 34% share of the Portable Projector Market, driven by large-scale adoption across China, India, Japan, and Southeast Asia. China dominates with strong manufacturing capacity and high domestic demand for consumer electronics. Japan and South Korea emphasize compact, high-tech projectors integrated with smart features that appeal to tech-savvy consumers. India demonstrates rising adoption across classrooms and digital training programs, fueled by government education technology initiatives. Southeast Asian markets, including Indonesia, Thailand, and Vietnam, expand usage across small businesses, educational setups, and mobile entertainment. Rapid urbanization, high mobile device penetration, and growing middle-class demand support market leadership in this region. It establishes Asia-Pacific as the fastest-growing and most dynamic contributor to portable projector adoption.

Latin America

Latin America represents 8% share of the Portable Projector Market, with Brazil, Mexico, and Argentina as primary contributors. Education drives much of the demand as schools and universities adopt projectors for cost-effective digital learning tools. Business adoption rises in urban centers where compact projectors meet the needs of small and medium enterprises. Entertainment applications, such as outdoor and home cinema, also gain popularity across Brazil and Chile. Economic fluctuations and high import dependency limit growth in some countries, but increasing availability of affordable models supports adoption. It highlights steady opportunities for portable projectors in education, business, and residential environments across the region.

Middle East & Africa

The Middle East & Africa hold 8% share of the Portable Projector Market, supported by rising education and business investments. Gulf countries such as Saudi Arabia, the UAE, and Qatar adopt portable projectors in corporate offices and smart classrooms. Africa demonstrates growing use of portable projectors for e-learning, particularly in Nigeria, South Africa, and Kenya, where digital education initiatives expand. Limited infrastructure in rural regions creates opportunities for battery-powered, ultra-portable projectors that operate without stable electricity. Demand also emerges in hospitality and tourism sectors, where compact devices support events and guest experiences. It reflects gradual but consistent adoption as the region modernizes education, corporate, and entertainment infrastructures.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BenQ

- Canon Inc.

- Panasonic Corporation

- AXA Technology

- LG Electronics

- Acer Inc.

- Koninklijke Philips N.V.

- Dell Inc.

- Xiaomi Corporation

- Phillips International B.V.

Competitive Analysis

The Portable Projector Market is defined by intense competition among global brands that focus on innovation, connectivity, and compact design to strengthen their positions. Leading players such as Xiaomi Corporation, BenQ, LG Electronics, Panasonic Corporation, Acer Inc., Canon Inc., Dell Inc., Koninklijke Philips N.V., Phillips International B.V., and AXA Technology drive growth through differentiated product strategies. Xiaomi emphasizes affordability and integration with smart platforms, making portable projectors more accessible to younger consumers and emerging markets. BenQ leads in high-resolution and gaming-oriented devices, while LG Electronics advances ultra-portable designs with wireless compatibility and AI-enhanced features. Panasonic targets education and professional sectors with durable, high-brightness models that withstand continuous use. Acer and Dell integrate portable projectors with business ecosystems, ensuring reliability for professional presentations. Canon develops advanced optics for compact models, while Philips focuses on LED-based projectors with extended lifespans for home and office use. AXA Technology explores niche innovations in battery efficiency and portability. These players invest heavily in research, design improvements, and service networks to remain competitive, ensuring the market evolves around smart connectivity, durability, and user-focused innovation.

Recent Developments

- In July 2025, Xiaomi also announced a multi-angle stand accessory for its projectors, offering 360° rotation and compatibility with models featuring a standard 1/4‑inch mount.

- In July 2025, BenQ launched its new W4100i 4K HDR home cinema projector in the U.S. for preorder, completing its premium lineup alongside the W2720i and W5800 models.

- In May 2025, Acer further unveiled the PD1810 portable projector, offering wireless-enabled projection, at Computex with an expected release in the second half of 2025.

Market Concentration & Characteristics

The Portable Projector Market reflects a moderately fragmented structure where global consumer electronics leaders compete with specialized projector manufacturers to capture diverse end-user segments. Leading companies differentiate through innovation in LED and laser light sources, wireless connectivity, and compact design, creating strong product variety across premium and budget categories. It demonstrates characteristics of rapid technology-driven growth, with smart features such as voice control, app integration, and screen mirroring becoming standard. Price sensitivity in emerging regions keeps affordability critical, while premium markets emphasize high-resolution and ultra-short-throw models. It shows adaptability to consumer, educational, and professional demands, with applications extending from classrooms and offices to home entertainment and outdoor use. Continuous improvements in battery efficiency, brightness, and integrated audio systems reinforce product relevance. Strong brand presence, retail networks, and after-sales services remain essential for market leadership. It highlights a balance between innovation, cost control, and user-focused design that defines long-term competitiveness.

Report Coverage

The research report offers an in-depth analysis based on Technology, Projector Size, Connectivity, End-User, Distribution and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Portable Projector Market will gain momentum through strong adoption in hybrid work environments that demand flexible presentation tools.

- Growth will accelerate in the home entertainment space where consumers seek portable alternatives to traditional television screens.

- Demand for ultra-portable, battery-powered models will rise among travelers and mobile professionals.

- Smart voice assistants and app-driven controls will become standard features across device ranges.

- Integration of UST (Ultra Short Throw) and 4K laser technology will push performance boundaries in compact formats.

- Education systems will increasingly rely on portable projectors for interactive and flexible classroom setups.

- Demand for rugged, weather-resistant models will grow in outdoor and event-based applications.

- Eco-conscious consumers will drive adoption of energy-efficient LED and laser-based systems with longer lifespan.

- Manufacturers will invest in modular and upgradeable components to extend product lifecycle.

- Augmented reality (AR) and smart-home integration will open new opportunities for immersive projection use cases.