Market Overview

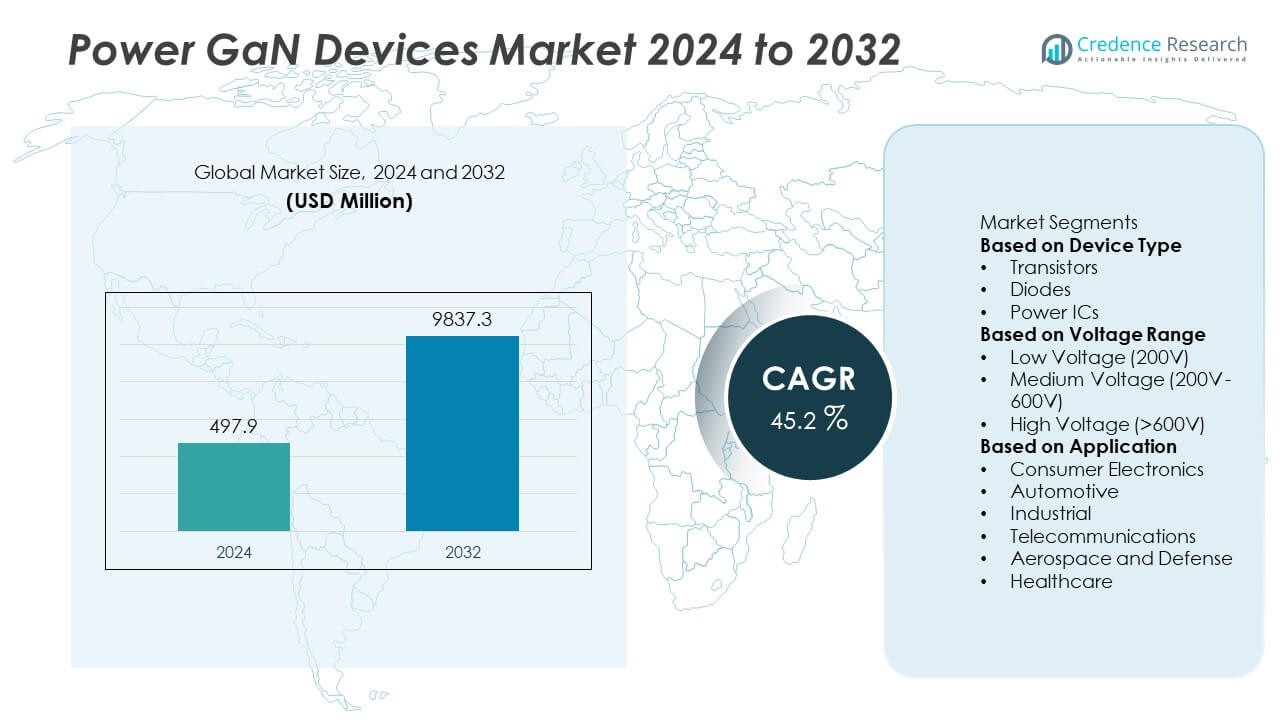

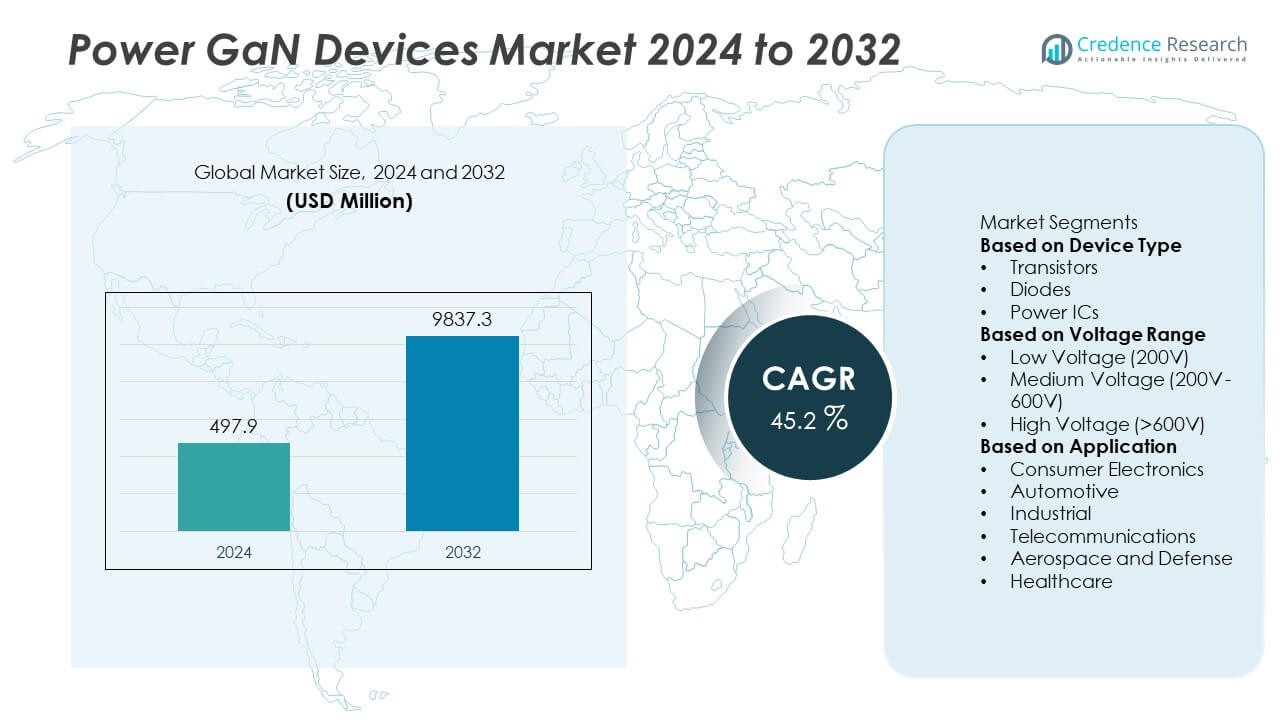

The Power GaN Devices Market size was valued at USD 497.9 million in 2024 and is anticipated to reach USD 9,837.3 million by 2032, expanding at a remarkable CAGR of 45.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Power GaN Devices Market Size 2024 |

USD 497.9 Million |

| Power GaN Devices Market, CAGR |

45.2% |

| Power GaN Devices Market Size 2032 |

USD 9,837.3 Million |

The Power GaN Devices Market grows through strong drivers such as rising adoption in electric vehicles, renewable energy systems, and high-efficiency consumer electronics. Demand intensifies as industries seek compact, energy-saving alternatives to silicon components.

The Power GaN Devices Market demonstrates strong geographical expansion across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with each region shaped by distinct industry drivers. North America leads through advanced adoption in electric vehicles, data centers, and renewable energy systems, supported by strong R&D capabilities. Europe emphasizes sustainability and clean mobility, with demand rising from automotive electrification and renewable integration. Asia Pacific emerges as the fastest-growing hub, driven by consumer electronics innovation, large-scale EV manufacturing, and expanding telecom networks. Latin America and the Middle East & Africa show steady uptake through renewable projects and telecom infrastructure modernization. Key players shaping the market include Infineon Technologies AG, known for its wide bandgap semiconductor leadership; GaN Systems Inc., a specialist in GaN power transistors for automotive and industrial sectors; Texas Instruments Inc., advancing GaN in high-performance power solutions; and Efficient Power Conversion Corporation, pioneering compact and energy-efficient GaN technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Power GaN Devices Market was valued at USD 497.9 million in 2024 and is projected to reach USD 9,837.3 million by 2032, expanding at a CAGR of 45.2%.

- Rising adoption in electric vehicles, renewable energy systems, and consumer electronics drives demand for GaN devices due to their higher efficiency and compact design advantages.

- Market trends highlight miniaturization, integration in fast chargers, and increased use in telecom and data centers to improve energy efficiency and manage high-frequency operations.

- Competitive analysis shows leading companies such as Infineon Technologies, GaN Systems, Texas Instruments, and Efficient Power Conversion focusing on innovation, product expansion, and partnerships to strengthen their positions.

- Market restraints include high production costs, limited GaN wafer availability, and reliability concerns in high-stress industrial environments, which slow down mass adoption.

- Regional analysis shows North America and Europe leading adoption through EV and renewable initiatives, while Asia Pacific emerges as the fastest-growing hub supported by electronics innovation and large-scale manufacturing.

- Latin America and the Middle East & Africa record gradual growth, driven by renewable energy projects, telecom infrastructure development, and early adoption in automotive supply chains.

Market Drivers

Rising Adoption in Electric Vehicles and Charging Infrastructure Boosts Growth

The transition toward electric mobility creates strong demand for high-efficiency power electronics. Power GaN devices improve inverter and onboard charger performance by reducing switching losses and supporting compact system design. Automakers integrate GaN solutions to increase driving range and reduce overall vehicle weight. It strengthens the role of GaN technology in addressing next-generation EV requirements. The Power GaN Devices Market benefits from expanding global investments in charging infrastructure where fast-charging stations require efficient and high-voltage handling components. This alignment with the EV ecosystem reinforces the long-term relevance of GaN devices.

- For instance, GaN Systems announced in 2024 that its GS-065-150 GaN transistors, rated at 650 V and 150 A, were adopted in a 350 kW EV fast charger, enabling 96.5% power conversion efficiency while reducing system size by 40%.

Expansion of Renewable Energy Systems Enhances Device Adoption

Global commitments to renewable energy accelerate the demand for efficient power conversion. Power GaN devices deliver higher power density and faster switching, making them suitable for solar inverters and wind power systems. Their ability to manage high-frequency operations improves energy yield and reduces system costs. It positions GaN as a preferred choice in distributed energy resources where space efficiency and durability are critical. The Power GaN Devices Market gains momentum as renewable capacity additions continue across developed and emerging economies. These dynamics establish GaN technology as a strategic enabler of clean energy transitions.

- For instance, Infineon Technologies confirmed delivery of GaN devices supporting solar inverters with outputs above 150 kW, enabling system efficiency levels above 98% and cutting cooling system requirements by 20%.

Growing Integration in Consumer Electronics Strengthens Market Expansion

Consumer electronics manufacturers adopt GaN-based power adapters and chargers to deliver faster charging and compact designs. GaN devices reduce heat generation and improve conversion efficiency, creating value for portable devices, laptops, and smartphones. It enhances user convenience while supporting sustainability goals through lower energy consumption. The Power GaN Devices Market benefits from rapid commercialization of GaN USB-C adapters capable of delivering higher wattage in smaller form factors. Integration in gaming consoles, tablets, and high-performance laptops further extends growth opportunities. This trend highlights GaN’s transformative role in consumer technology.

Advancements in Telecom and Data Center Infrastructure Drive Market Demand

The expansion of 5G networks and cloud computing increases the need for efficient power management. Power GaN devices support high-frequency and high-voltage operations required in telecom base stations and server power supplies. Their superior thermal performance ensures reliability under heavy workloads. It strengthens energy efficiency initiatives in hyperscale data centers, where reducing power losses is critical. The Power GaN Devices Market benefits from rising investments in telecom infrastructure across Asia-Pacific and North America. Growing deployment of GaN technology in RF amplifiers and power modules consolidates its position in next-generation communication systems.

Market Trends

Growing Shift Toward Wide Bandgap Semiconductors Accelerates Market Transformation

The semiconductor industry is witnessing a decisive shift from silicon to wide bandgap materials. Power GaN devices emerge as a leading choice due to their ability to handle higher voltages, operate at faster switching speeds, and deliver greater energy efficiency. It supports industries aiming to reduce energy losses and achieve compact system designs. The Power GaN Devices Market evolves in parallel with the wider adoption of GaN across automotive, telecom, and renewable applications. This transition reflects both performance advantages and the urgent need for sustainable energy technologies.

- For instance, Texas Instruments expanded its GaN portfolio with the LMG3522R030 650 V GaN FET, capable of switching at frequencies above 2.2 MHz, enabling designers to shrink power supplies by over 50% compared to traditional silicon MOSFETs.

Miniaturization and High-Power Density Define Product Development

Manufacturers prioritize compact and lightweight designs to meet the growing demand for space-saving power systems. Power GaN devices deliver high-power density that reduces the size of adapters, chargers, and inverters without compromising efficiency. It drives innovation in consumer electronics and electric mobility where form factor is critical. The Power GaN Devices Market advances with breakthroughs in packaging and integration techniques that enhance thermal management. This trend ensures that GaN technology maintains a competitive edge over conventional silicon solutions.

- For instance, Navitas Semiconductor reported in 2025 that its GaNFast power ICs enabled 240 W USB-C adapters weighing just 300 grams, with power densities exceeding 1.1 W/cc, making them 30% smaller and lighter than equivalent silicon-based chargers.

Integration into Fast-Charging and Portable Electronics Expands Applications

The global surge in portable electronics and the need for rapid charging accelerate the integration of GaN devices. Power GaN technology enables high-efficiency adapters that deliver faster charging in smaller units. It enhances user convenience while reducing energy losses in everyday consumer applications. The Power GaN Devices Market secures growth as leading brands introduce GaN-based USB-C and multi-port chargers capable of supporting higher power outputs. This trend reinforces the role of GaN in shaping modern digital lifestyles and consumer expectations.

Adoption in Telecom and Data Centers Strengthens Market Relevance

Telecom operators and data center providers adopt GaN devices to improve energy efficiency and manage rising data traffic. High-frequency capability and superior thermal performance position GaN as an ideal choice for RF amplifiers, base stations, and power supplies. It supports the operational stability of hyperscale data centers handling large-scale workloads. The Power GaN Devices Market benefits from global 5G rollouts and cloud infrastructure expansion. This trend highlights the ability of GaN to address both high-performance and sustainability objectives in communication networks.

Market Challenges Analysis

High Production Costs and Supply Chain Limitations Restrain Broader Adoption

The Power GaN Devices Market faces challenges linked to high manufacturing costs and limited material availability. Complex fabrication processes and expensive substrates increase the overall device cost compared to silicon alternatives. It restricts widespread adoption in cost-sensitive applications such as consumer goods and industrial power supplies. Supply chain vulnerabilities, particularly in sourcing high-quality GaN wafers, add further constraints. The industry continues to face pressure in scaling production while maintaining quality and consistency. These factors slow down mass deployment and limit penetration into price-sensitive regions.

Reliability Concerns and Integration Barriers Affect Market Penetration

Despite strong performance advantages, long-term reliability of GaN devices remains a concern for industries requiring stable operation under extreme conditions. Power module designers face integration challenges when adapting GaN devices to existing silicon-based systems. It complicates adoption in sectors with conservative qualification standards, such as aerospace and defense. Limited design expertise and shortage of skilled engineers also slow integration efforts across multiple applications. The Power GaN Devices Market must overcome these technical barriers to achieve full-scale adoption across diverse industries. Addressing reliability validation and improving ecosystem support are critical to ensure broader acceptance of GaN solutions.

Market Opportunities

Expansion of Electric Mobility and Renewable Energy Unlocks Growth Potential

The global push toward electrification and clean energy creates significant opportunities for GaN adoption. Power GaN devices enable compact, efficient, and high-performance power modules for electric vehicles, charging infrastructure, solar inverters, and wind turbines. Their ability to handle high voltages with minimal energy loss supports sustainability goals while reducing system footprint. It positions GaN technology as a preferred alternative for industries transitioning to low-carbon operations. The Power GaN Devices Market stands to benefit from increasing government incentives for EV adoption and renewable energy integration. These developments open pathways for long-term growth and broader commercialization.

Advancement in Consumer Electronics and Data Infrastructure Expands Applications

Portable electronics and fast-charging ecosystems present strong opportunities for GaN-based power solutions. Power GaN devices support ultra-compact chargers capable of delivering higher wattage without heat generation, enhancing consumer convenience. Telecom and data center industries also represent growth areas, as GaN improves efficiency in base stations, RF systems, and high-density server power supplies. It addresses the urgent demand for reduced power losses in digital infrastructure while supporting 5G rollouts and cloud expansion. The Power GaN Devices Market gains additional momentum from the trend of multi-device chargers and miniaturized adapters, reinforcing GaN’s role in shaping the future of energy-efficient electronics.

Market Segmentation Analysis:

By Device Type

The Power GaN Devices Market divides into transistors, diodes, and power ICs. Transistors dominate due to their critical role in high-frequency and high-efficiency switching applications. They support a wide range of uses, from consumer electronics to automotive inverters, where energy savings and compact designs are prioritized. Diodes hold relevance in circuits requiring fast recovery and low conduction losses, particularly in renewable energy systems and power supplies. Power ICs represent a fast-growing category, integrating GaN technology into compact modules designed for advanced consumer devices and telecom equipment. It demonstrates strong adoption across sectors where size reduction and efficiency gains are equally important.

- For instance, GaN Systems introduced the GS-065-030-2-L transistor rated at 650 V and 30 A, with an RDS(on) of 50 mΩ, which has been integrated into EV traction inverters delivering up to 250 kW output power.

By Voltage Range

The market is segmented into <200V, 200–600V, and >600V categories. Devices below 200V find demand in fast chargers, adapters, and portable electronic devices where compact design is vital. The 200–600V segment holds significant traction in automotive onboard chargers, industrial power supplies, and solar inverters. Devices above 600V, while still emerging, show promise in large-scale energy infrastructure, including wind turbines, grid systems, and high-capacity data centers. It highlights the versatility of GaN technology across both low-power consumer electronics and high-power industrial environments. This segmentation reflects the scalability of GaN devices to address a wide spectrum of voltage requirements.

- For instance, Infineon’s CoolGaN 600 V e-mode HEMTs (IGOT60R070D1) with an RDS(on) of 70 mΩ have been deployed in solar inverters exceeding 150 kW, achieving peak efficiencies of 98.5% in field installations.

By Application

Applications extend across consumer electronics, automotive, industrial, telecom, and renewable energy. Consumer electronics drive early adoption, with GaN devices enabling compact, high-speed chargers and adapters for smartphones, laptops, and gaming consoles. Automotive emerges as a critical growth area, as GaN improves the efficiency of onboard chargers, traction inverters, and fast-charging stations. Industrial applications involve efficient power supplies and motor drives, where GaN supports compact design and reduced heat management requirements. Telecom and data centers rely on GaN for high-frequency operations in RF amplifiers and server power supplies, reducing energy losses in large-scale systems. Renewable energy applications emphasize solar inverters and storage systems, where efficiency gains directly translate into higher energy yields. The Power GaN Devices Market secures relevance by addressing multiple high-growth industries with solutions that combine efficiency, compactness, and long-term reliability.

Segments:

Based on Device Type

- Transistors

- Diodes

- Power ICs

Based on Voltage Range

- Low Voltage (200V)

- Medium Voltage (200V – 600V)

- High Voltage (>600V)

Based on Application

- Consumer Electronics

- Automotive

- Industrial

- Telecommunications

- Aerospace and Defense

- Healthcare

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 34% of the Power GaN Devices Market, supported by strong adoption in electric vehicles, data centers, and renewable energy systems. The U.S. leads regional demand with significant investments in wide bandgap semiconductors driven by government initiatives promoting clean energy and electrification. Leading companies in the region integrate GaN devices into automotive inverters, charging infrastructure, and hyperscale data centers to enhance energy efficiency and reduce operating costs. It benefits from a mature ecosystem of semiconductor manufacturers, research institutions, and supportive regulatory policies. Canada contributes through renewable energy projects that deploy GaN-enabled inverters, while Mexico expands adoption through automotive supply chains. The region’s leadership position reflects both technological maturity and continuous investments in advanced power electronics.

Europe

Europe holds 26% of the Power GaN Devices Market, fueled by its focus on green energy, sustainable mobility, and strong industrial base. Germany, France, and the UK lead adoption through automotive electrification, where GaN devices enhance onboard chargers and improve EV range. It aligns with the European Union’s decarbonization goals, accelerating demand for GaN-based renewable energy systems. The presence of semiconductor firms and strong R&D capabilities strengthen the market landscape. In addition, GaN integration in telecom and industrial automation secures further growth opportunities. Countries such as the Netherlands and Italy adopt GaN devices in solar energy systems, reinforcing Europe’s sustainability-driven market direction.

Asia Pacific

Asia Pacific accounts for 32% of the Power GaN Devices Market, driven by rapid industrialization, consumer electronics growth, and government investments in EV and renewable energy infrastructure. China dominates regional demand, leveraging its strong semiconductor supply chain and massive electric vehicle production base. Japan and South Korea advance adoption in consumer electronics, where GaN devices power high-performance chargers, gaming consoles, and laptops. India emerges as a fast-growing market, supported by solar power expansion and increasing EV adoption. It also benefits from being a cost-effective manufacturing hub for GaN-based devices, supplying both regional and global markets. The region’s dominance reflects its position as both a producer and consumer of GaN technologies.

Latin America

Latin America represents 5% of the Power GaN Devices Market, with Brazil and Mexico leading adoption. The growing emphasis on renewable energy deployment, particularly solar and wind, drives GaN adoption in inverters and power conversion systems. Mexico’s automotive sector integrates GaN devices into EV supply chains, while Brazil supports adoption through smart grid and clean energy initiatives. It remains an emerging market, characterized by gradual uptake due to high costs and limited infrastructure. However, the region’s growing middle-class consumer base fuels demand for GaN-powered fast chargers and electronic devices. Local partnerships and distribution networks will play a vital role in expanding market penetration.

Middle East & Africa

The Middle East & Africa account for 3% of the Power GaN Devices Market, supported by demand in renewable energy, telecom, and electric mobility. The UAE and Saudi Arabia invest heavily in solar projects and smart grid modernization, where GaN devices enhance power efficiency. It reflects the region’s efforts to diversify away from oil and expand into sustainable technologies. Africa records slower adoption, but countries such as South Africa and Nigeria see early traction in telecom base stations and distributed solar systems. The market remains small compared to other regions but offers long-term opportunities as infrastructure modernization and renewable energy adoption accelerate.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ON Semiconductor Corporation

- Fujitsu Limited

- Texas Instruments Inc.

- Efficient Power Conversion Corporation Inc.

- Panasonic Corporation

- Infineon Technologies AG

- Toshiba Corporation

- GaN Systems Inc.

- VISIC Technologies Ltd

- Taiwan Semiconductor Manufacturing Company, Ltd.

Competitive Analysis

The competitive landscape of the Power GaN Devices Market is shaped by global semiconductor leaders and specialized GaN technology providers advancing efficiency, miniaturization, and high-power performance. Key players include Infineon Technologies AG, GaN Systems Inc., Texas Instruments Inc., Efficient Power Conversion Corporation, Fujitsu Limited, Panasonic Corporation, Toshiba Corporation, VISIC Technologies Ltd., ON Semiconductor Corporation, and Taiwan Semiconductor Manufacturing Company, Ltd. Infineon focuses on expanding GaN-on-Si solutions for automotive and industrial systems, while GaN Systems leads with power transistors designed for EV chargers and data centers. Texas Instruments integrates GaN into high-frequency applications, offering robust support for telecom and renewable energy. Efficient Power Conversion Corporation pioneers compact GaN solutions for consumer devices, achieving high efficiency in fast chargers and power supplies. Fujitsu and Panasonic contribute through R&D in wide bandgap semiconductors, targeting next-generation mobility and energy infrastructure. Toshiba and ON Semiconductor emphasize GaN integration in power management modules, reinforcing industrial and EV adoption. VISIC Technologies develops GaN-based automotive inverters to support electrification, while TSMC plays a critical role as a foundry partner enabling high-volume GaN device manufacturing. Collectively, these players compete through technology leadership, ecosystem partnerships, and innovation, driving widespread GaN penetration across automotive, telecom, renewable, and consumer electronics markets.

Recent Developments

- In July 2025, Infineon Technologies AG confirmed it will begin shipping customer samples of GaN power wafers on 300 mm platforms in Q4 2025, marking a significant step toward high-volume scalability and cost efficiency in GaN device production.

- In June 2025, Efficient Power Conversion Corporation (EPC) released the EPC91109, a high-performance evaluation board designed for a compact, thermally efficient two-phase synchronous buck converter using eGaN FETs.

- In March 2025, Efficient Power Conversion Corporation (EPC) introduced the EPC2367, a next-generation 100 V GaN FET. It features an ultra-low on-resistance of 1.2 mΩ in a compact 3.3 mm × 3.3 mm QFN package and sets new benchmarks for switching performance in power conversion systems.

Market Concentration & Characteristics

The Power GaN Devices Market reflects moderate concentration, with a mix of established semiconductor leaders and specialized GaN-focused firms competing on innovation, scalability, and cost efficiency. Large players such as Infineon Technologies, Texas Instruments, and ON Semiconductor invest heavily in high-volume manufacturing and integration of GaN into automotive, industrial, and telecom applications, while companies like GaN Systems and Efficient Power Conversion focus on advancing discrete devices and compact power solutions for consumer electronics and renewable systems. It demonstrates characteristics of rapid technology adoption where miniaturization, high switching efficiency, and thermal performance drive differentiation. The market is shaped by continuous R&D investments, partnerships with foundries like TSMC, and strong demand from electric vehicles, renewable energy, and data infrastructure. It remains highly competitive due to the need for proven reliability, scalable production, and ecosystem support, positioning GaN technology as a transformative enabler of next-generation power electronics.

Report Coverage

The research report offers an in-depth analysis based on Device Type, Voltage Range, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will accelerate in electric vehicles and charging infrastructure with focus on efficiency and compact design.

- Renewable energy systems will expand GaN adoption in solar inverters, wind turbines, and energy storage.

- Consumer electronics will integrate GaN devices in fast chargers, adapters, and compact power supplies.

- Telecom and 5G infrastructure will rely on GaN for high-frequency and high-power RF applications.

- Data centers will adopt GaN to reduce power losses and improve thermal performance in high-density servers.

- GaN-based power ICs will grow as integration increases across portable and industrial applications.

- Manufacturing scalability will improve with the transition to 300 mm GaN wafers for cost efficiency.

- Partnerships between device makers and foundries will strengthen global supply chain resilience.

- Reliability validation and standardization will expand adoption across aerospace and defense sectors.

- Sustainability and energy efficiency requirements will keep GaN at the forefront of wide bandgap semiconductors.