Market Overview

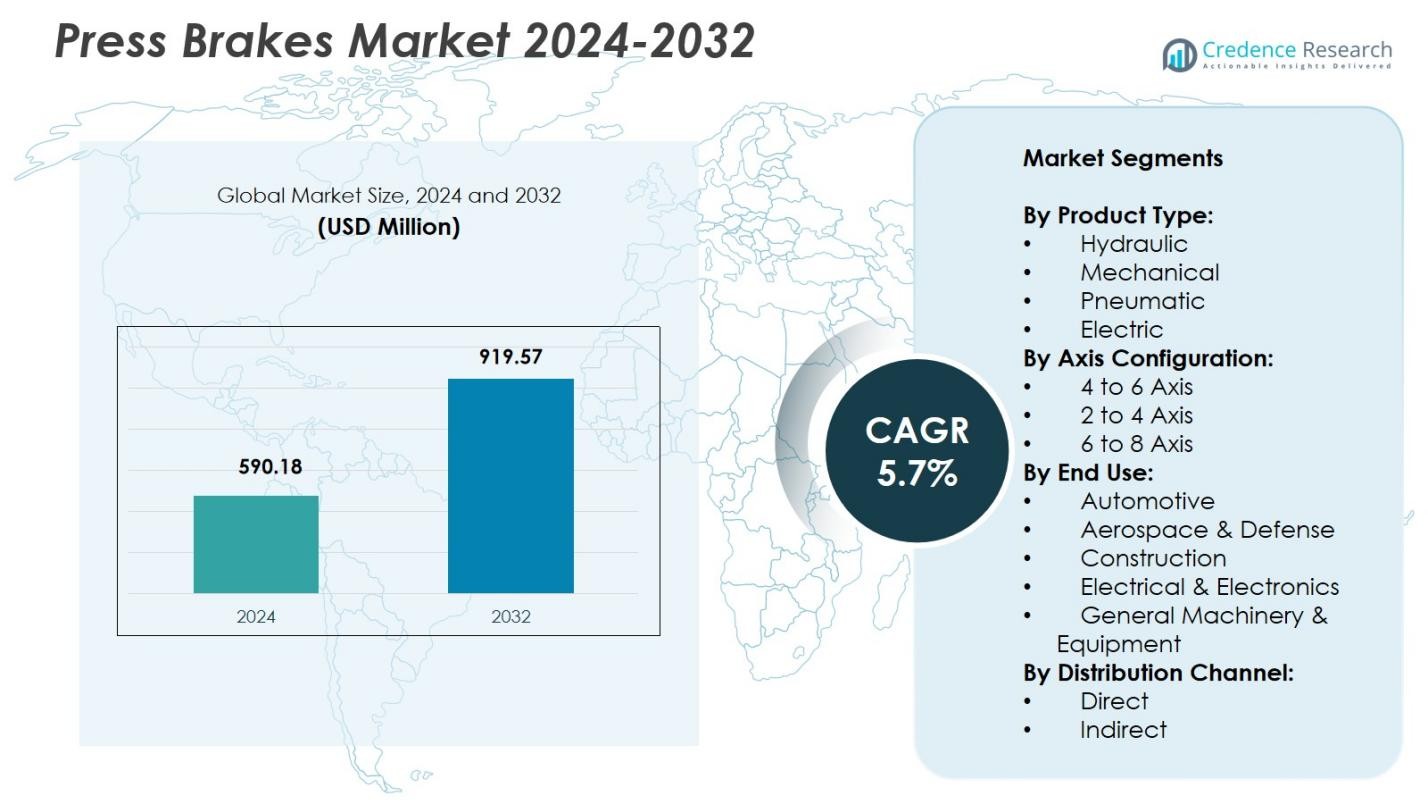

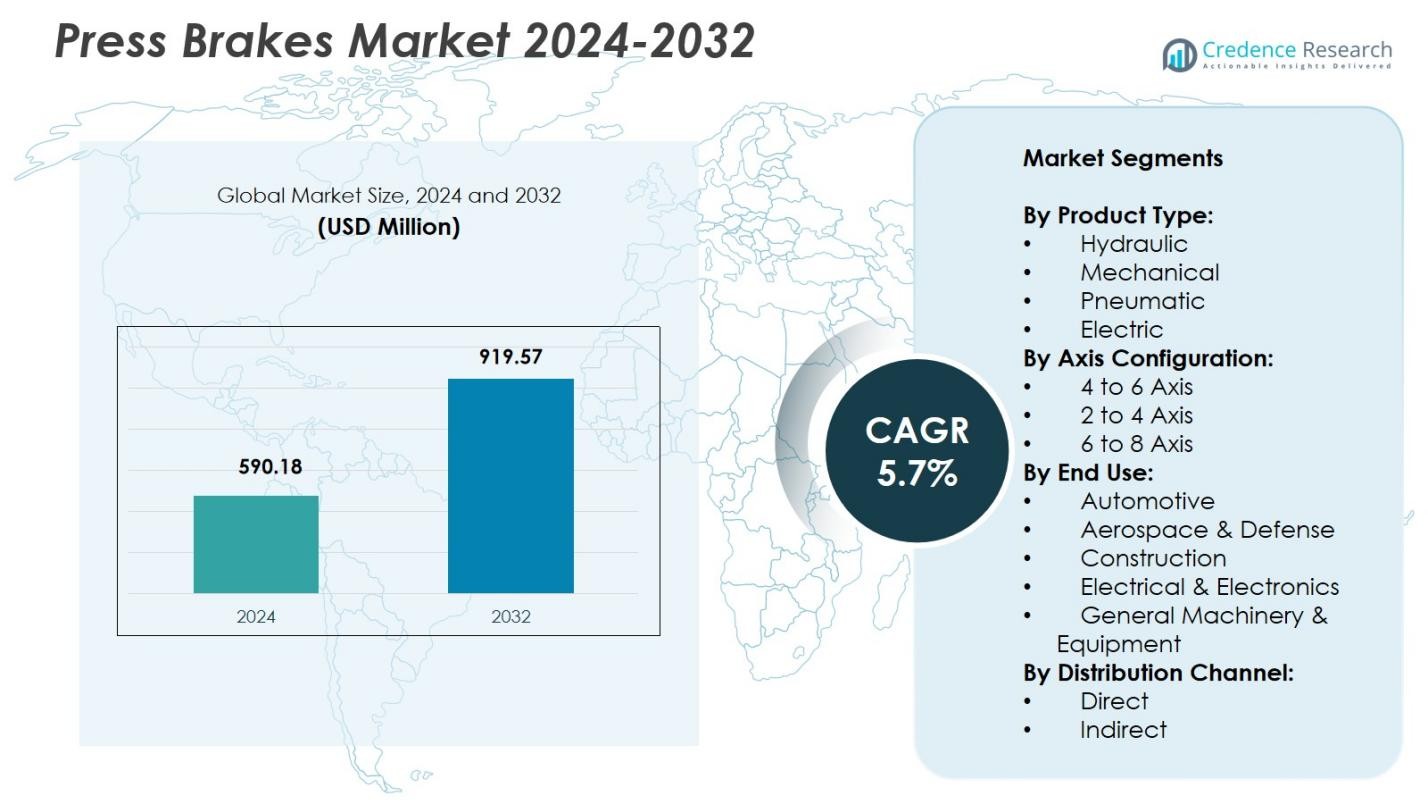

Press Brakes Market size was valued at USD 590.18 Million in 2024 and is anticipated to reach USD 919.57 Million by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Press Brakes Market Size 2024 |

USD 590.18 Million |

| Press Brakes Market, CAGR |

5.7% |

| Press Brakes Market Size 2032 |

USD 919.57 Million |

Press Brakes Market is shaped by leading manufacturers such as TRUMPF, Amada, Bystronic, Accurpress, Durma, ERMAKSAN, LVD, Cincinnati, Haco, and Baykal, all of whom focus on enhancing CNC precision, automation, and energy-efficient bending technologies. These companies strengthen their presence through advanced multi-axis systems, electric and hybrid models, and smart control software that support high-accuracy metal fabrication. Continuous product innovation and expanded service networks enable these players to serve diverse end-use industries, including automotive, aerospace, and construction. Asia-Pacific emerged as the leading region in 2024 with 34.6% share, driven by rapid industrialization and strong manufacturing activity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Press Brakes Market reached USD 590.18 Million in 2024 and will grow at a CAGR of 5.7% to 2032.

- Market growth is driven by rising demand for precision metal fabrication across automotive, aerospace, and construction, supported by increasing automation in manufacturing processes.

- Key trends include the adoption of electric and hybrid press brakes, rising integration of CNC and multi-axis technologies, and growing implementation of IoT-enabled monitoring systems.

- Major players such as TRUMPF, Amada, Bystronic, Accurpress, Durma, and ERMAKSAN expand their portfolios with advanced bending technologies, while hydraulic press brakes lead the product segment with 46.8% share.

- Asia-Pacific leads the global market with 34.6% share, followed by North America at 29.4% and Europe at 27.1%, reflecting strong industrialization, automation, and large-scale manufacturing activity.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

Hydraulic press brakes dominated the product type segment with 46.8% share in 2024, driven by their high force output, adaptability for thick metal sheets, and reliability in continuous industrial operations. Their precise bending capabilities, enhanced safety features, and compatibility with CNC controls support large-scale manufacturing across automotive, construction, and heavy machinery sectors. Mechanical press brakes held a notable share due to their high-speed operation for repetitive bending tasks, whereas pneumatic and electric models gained traction in light-to-medium fabrication because of energy efficiency and reduced maintenance requirements. Increasing automation and demand for precision continue to reinforce hydraulic dominance.

- For instance, Hindustan Hydraulics’ Falcon and Griffon series CNC hydraulic press brakes feature synchronized bed reference technology and direct angle programming for precise parallelism and accurate bends in demanding conditions.

By Axis Configuration

The 4 to 6 axis configuration led the market with 41.3% share in 2024, supported by its balance of flexibility, precision, and cost-effectiveness for complex bending applications. These systems enable synchronized multi-axis movement, improving repeatability and setup efficiency in medium-to-high production environments. The 2 to 4 axis segment followed due to its suitability for basic and moderate bending tasks in small fabrication units, while the 6 to 8 axis systems served advanced aerospace and automotive requirements. Rising adoption of CNC systems and tighter tolerance demands strengthen the growth of multi-axis configurations.

- For instance, Hines Bending Systems’ 200 CNC-B model provides 3-axis servo-driven control for distance between bends, plane of bend, and degree of bend on tubes up to 2.5″ OD x 0.200″ wall, with 0.1°/0.1 mm repeatability for exhaust and automotive parts.

By End Use

The automotive sector dominated the end-use segment with 32.5% share in 2024, fueled by the growing production of vehicle body components, chassis structures, and customized metal parts requiring precise and repeatable bending. Increasing EV manufacturing expansion further supports equipment upgrades across fabrication facilities. The aerospace and defense segment showed strong adoption for forming lightweight alloys with high accuracy, while construction demand stemmed from structural metal fabrication. Electrical and electronics and general machinery contributed steadily through enclosure, panel, and equipment part manufacturing. Industrial modernization and automation continue to accelerate adoption across all end-use segments.

Key Growth Drivers

Expansion of Precision Metal Fabrication

Growing demand for high-accuracy metal components across automotive, aerospace, construction, and machinery sectors drives strong adoption of advanced press brakes. Manufacturers increasingly rely on precision bending systems to meet tighter tolerances, faster turnaround times, and higher production volumes. CNC-enabled hydraulic and electric models support multi-axis control, automated adjustments, and reduced human error, improving productivity and consistency. As industries shift toward lightweight materials and customized fabrication, press brakes capable of complex, precise forming operations continue to experience accelerating demand.

- For instance, TRUMPF TruBend Series 8000 press brakes feature automatic angle measuring systems like ACB Wireless or ACB Laser for real-time springback correction and up to 6 CNC-controlled backgauge axes, supporting precise bending of thick sheets in demanding applications.

Rising Industrial Automation and Digitalization

Automation is transforming fabrication workflows, pushing manufacturers to adopt intelligent press brakes integrated with sensors, robotics, and digital monitoring systems. CNC and servo-driven technologies enhance operational efficiency, reduce setup time, and enable rapid switching between part geometries. These capabilities support lean manufacturing initiatives and Industry 4.0 programs across global production facilities. Automated material handling, tool changing, and real-time performance analytics further increase throughput while lowering operational costs, making modern press brakes essential investments in highly automated fabrication environments.

- For instance, Salvagnini’s B3 press brake features ATA and AU-TO systems that automatically adjust tool lengths and complete tool setups, supporting kit and batch-one production with backgauges offering up to 9 axes for flexibility.

Growth in Infrastructure and Manufacturing Expansion

Increasing infrastructure development and industrial expansion across emerging and developed markets contribute significantly to press brake demand. Construction projects require structural steel, beams, brackets, and architectural metal components formed with high precision. Simultaneously, growth in machinery, equipment production, and renewable energy installations boosts the need for robust sheet-metal fabrication capabilities. Government-led manufacturing incentives and capacity expansions in automotive and heavy engineering sectors further strengthen equipment upgrades, supporting sustained market growth for high-performance press brakes.

Key Trends & Opportunities

Adoption of Electric and Energy-Efficient Press Brakes

Manufacturers increasingly pursue energy-efficient production solutions, driving interest in electric press brakes that deliver lower power consumption, quieter operation, and reduced maintenance. Their superior precision and instant response capabilities make them attractive for electronics, aerospace, and high-precision fabrication. Sustainability regulations and cost-saving initiatives encourage facilities to replace older hydraulic systems. This shift opens opportunities for suppliers offering hybrid and fully electric systems optimized for speed, accuracy, and environmental compliance, reinforcing long-term market transformation toward greener fabrication technologies.

- For instance, Salvagnini’s B3 adaptive press brake employs Direct Drive servo motors for real-time energy optimization, achieving approach speeds up to 250 mm/s with no hydraulic oil for cleaner, high-precision kit production.

Integration of Smart Technologies and Connected Systems

The growing integration of IoT, digital twins, and cloud-connected monitoring tools enables predictive maintenance, improved process optimization, and enhanced quality control in press brake operations. These technologies help manufacturers reduce downtime, extend equipment life, and achieve consistent performance across multi-machine environments. Real-time data visualization and AI-driven bending simulations support faster programming and reduced scrap rates. As fabrication facilities modernize and adopt Industry 4.0 frameworks, demand for smart, connected press brakes with advanced automation features continues to expand.

- For instance, HARSLE’s smart press brake systems integrate digital twin platforms with robotic automation, allowing users to remotely upload bending programs, monitor machine performance including bending force and oil temperature, and manage predictive maintenance via a secure cloud-based dashboard for 24/7 unattended operations.

Key Challenges

High Initial Investment and Upgrading Costs

Advanced CNC, multi-axis, and electric press brakes require substantial capital investment, creating barriers for small and medium fabrication shops. Costs increase further with automation modules, tool changers, and digital connectivity features, making large-scale upgrades financially challenging. Despite long-term operational efficiencies, many manufacturers delay modernization due to budget constraints. This challenge is more pronounced in developing markets where access to financing and technical expertise remains limited, slowing adoption of next-generation bending technologies.

Skilled Labor Shortages and Programming Complexity

Operating modern press brakes demands a skilled workforce capable of programming CNC systems, understanding multi-axis bending algorithms, and managing automated workflows. Persistent labor shortages across manufacturing industries create operational bottlenecks and limit productivity gains from advanced equipment. The complexity of part setup, tool selection, and bend sequence programming increases training requirements. Although automation reduces manual workloads, the need for highly trained technicians remains critical, posing a challenge for fabricators transitioning to technologically advanced metal-forming environments.

Regional Analysis

North America

North America held 29.4% share in 2024, driven by strong demand from automotive, aerospace, construction, and industrial machinery sectors. The region benefits from advanced manufacturing capabilities, rapid adoption of CNC and automated press brakes, and strong investments in metal fabrication modernization. The presence of major OEMs and a mature fabrication ecosystem supports steady equipment replacement cycles. Growth is further reinforced by reshoring initiatives and increased production of EV components, structural metal products, and precision-machined parts. Expanding infrastructure upgrades and industrial automation continue to strengthen market expansion across the United States and Canada.

Europe

Europe accounted for 27.1% share in 2024, supported by the region’s advanced engineering expertise and high adoption of energy-efficient electric and hybrid press brakes. Strong demand from automotive manufacturing hubs, aerospace clusters, and machinery producers drives consistent equipment upgrades. The region emphasizes sustainable production and precision engineering, encouraging greater use of multi-axis CNC systems. Germany, Italy, and France lead regional consumption due to their extensive metal fabrication industries. Continued investments in automation, robotics integration, and smart manufacturing technologies further reinforce Europe’s strong position in the global press brakes market.

Asia-Pacific

Asia-Pacific dominated the global market with 34.6% share in 2024, driven by rapid industrialization, large-scale manufacturing expansion, and significant investments in automotive, electronics, and construction sectors. China, Japan, South Korea, and India lead demand due to extensive fabrication activities and the presence of large OEM clusters. Growing infrastructure projects, machine tool adoption, and government-led manufacturing incentives accelerate equipment purchases. The region’s shift toward automated CNC press brakes and higher precision bending systems supports stronger growth. Expanding export-driven industries and rising metal component production further strengthen Asia-Pacific’s leadership in the global market.

Latin America

Latin America held 5.4% share in 2024, driven by gradual industrial development and increasing demand for metal fabrication in automotive assembly, construction, and general engineering. Brazil and Mexico remain key markets due to their expanding manufacturing bases and adoption of CNC-enabled hydraulic press brakes. Infrastructure modernization projects and growth in consumer goods production support additional equipment demand. Despite economic fluctuations, foreign investments in industrial facilities and automotive supply chains contribute to a positive growth outlook. Rising interest in automation and energy-efficient systems continues to shape technology adoption across the region.

Middle East & Africa

The Middle East & Africa region captured 3.5% share in 2024, influenced by growing construction activity, infrastructure expansion, and rising investments in metalworking industries. The Gulf countries drive demand through large-scale industrial projects, fabrication yards, and machinery production. South Africa and the UAE show increasing adoption of CNC-controlled hydraulic and hybrid press brakes as manufacturing capacity expands. Although the region faces skill and technology gaps, industrial diversification plans and government-backed industrial development initiatives create opportunities for advanced metal-forming equipment. The shift toward modern fabrication facilities continues to support long-term market growth.

Market Segmentations:

By Product Type:

- Hydraulic

- Mechanical

- Pneumatic

- Electric

By Axis Configuration:

- 4 to 6 Axis

- 2 to 4 Axis

- 6 to 8 Axis

By End Use:

- Automotive

- Aerospace & Defense

- Construction

- Electrical & Electronics

- General Machinery & Equipment

By Distribution Channel:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Press Brakes Market includes leading manufacturers such as TRUMPF, Amada, Bystronic, Accurpress, Durma, ERMAKSAN, LVD, Cincinnati, Haco, and Baykal. These companies focus on advancing CNC precision, automation, and energy-efficient bending technologies to strengthen their market position. Many invest in hybrid and electric press brake innovations that support high-speed production, reduced energy consumption, and superior accuracy. Strategic initiatives such as product upgrades, regional expansion, and partnerships with automation and software providers help enhance their technological edge. Manufacturers increasingly integrate IoT connectivity, AI-assisted programming, and multi-axis control systems to meet rising demand for smart fabrication solutions. Continuous investment in R&D and customer-specific customization further differentiates key players as metal fabrication industries expand globally.

Key Player Analysis

- Durma

- TRUMPF

- Bystronic

- ERMAKSAN

- Cincinnati

- Haco

- Baykal

- Accurpress

- LVD

- Amada

Recent Developments

- In March 2025, TRUMPF introduced the TruBend 1000 series press brake equipped with the Right Angle (RA) control system for simplified programming in the U.S. and Canadian markets.

- In August 2025, HACO launched the OptiForm press brake, a new-generation bending machine designed for enhanced usability and cost-efficient fabrication.

- In July 2025, HACO launched the OptiForm 30150 CNC press brake in the UK & Ireland market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Axis Configuration, End Use, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced CNC and multi-axis press brakes will continue to rise as industries prioritize precision and automation.

- Adoption of electric and hybrid press brakes will accelerate due to growing emphasis on energy efficiency and sustainability.

- Integration of IoT, AI, and smart monitoring capabilities will shape next-generation bending systems.

- Automotive and EV manufacturing expansion will drive higher consumption of high-accuracy metal bending equipment.

- Aerospace and defense sectors will increase investment in precision forming technologies for lightweight materials.

- Construction and infrastructure development will support sustained growth in heavy-duty press brake applications.

- Fabricators will shift toward fully automated bending cells with robotic handling and digital programming.

- Demand for customized and flexible bending solutions will grow as production shifts toward smaller batch sizes.

- Emerging markets will witness rapid adoption of CNC-enabled systems as industrialization accelerates.

- Equipment manufacturers will focus more on training, service support, and digital solutions to address skill shortages.

Market Segmentation Analysis:

Market Segmentation Analysis: