| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Railway Traction Motor Market Size 2024 |

USD 11,844.04 Million |

| Railway Traction Motor Market, CAGR |

5.24% |

| Railway Traction Motor Market Size 2032 |

USD 18,352.56 Million |

Market Overview

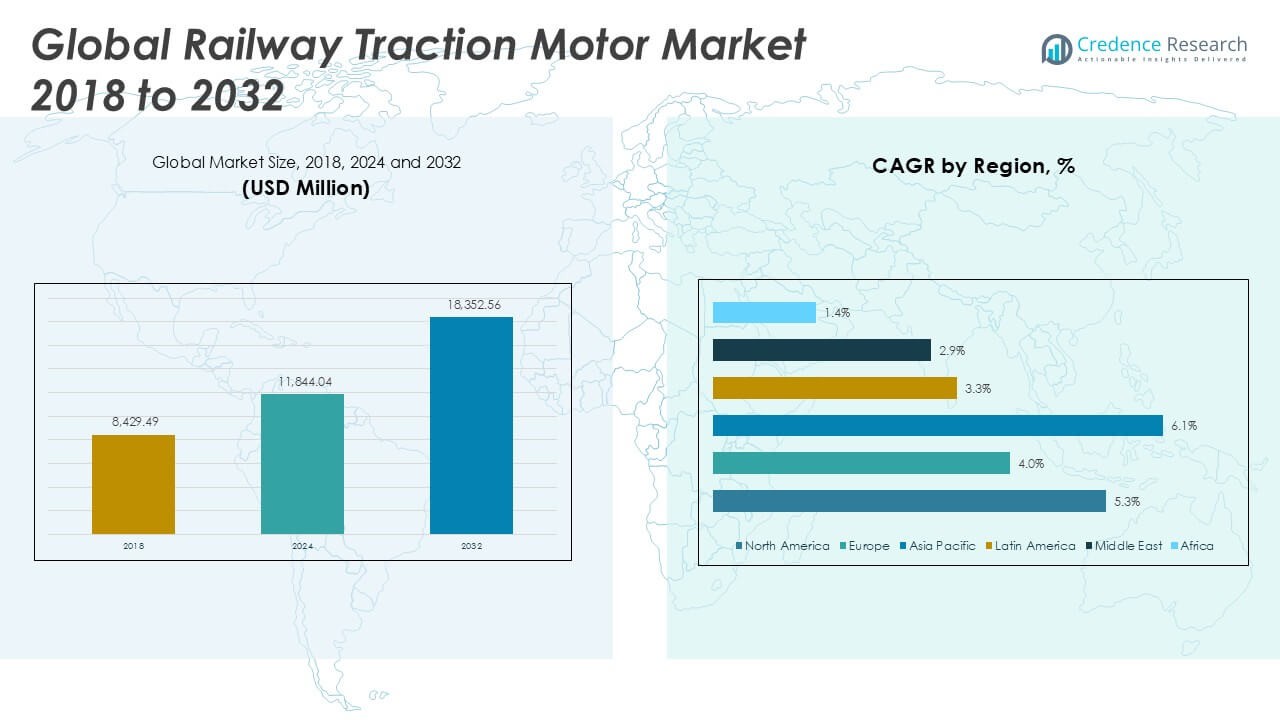

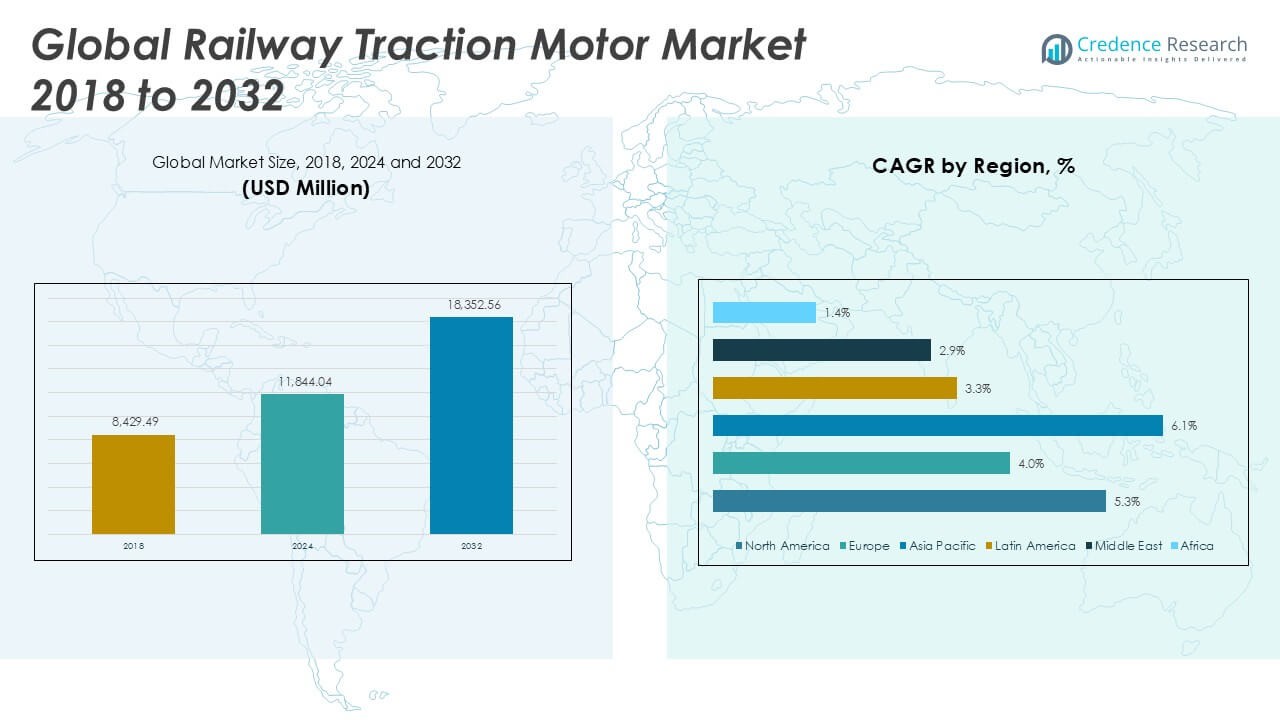

The Railway Traction Motor Market was valued at USD 8,429.49 million in 2018, grew to USD 11,844.04 million in 2024, and is anticipated to reach USD 18,352.56 million by 2032, at a CAGR of 5.24% during the forecast period.

The Railway Traction Motor Market is experiencing steady growth driven by rising investments in railway infrastructure, increasing demand for energy-efficient and high-performance locomotives, and expanding urban transit networks. Governments and private operators are prioritizing electrification projects to reduce carbon emissions and enhance operational efficiency, which directly boosts traction motor adoption. Technological advancements, including the integration of lightweight materials, smart monitoring, and regenerative braking systems, support improved reliability and cost-effectiveness. The market also benefits from the growing preference for electric and hybrid trains, especially in densely populated regions. Key trends include the adoption of permanent magnet synchronous motors (PMSM) and asynchronous motors, both of which offer enhanced performance and lower maintenance requirements. The push for sustainable transportation and ongoing modernization of existing rail fleets further accelerates the demand for advanced traction motor solutions worldwide.

The Railway Traction Motor Market spans globally, with significant activity concentrated in regions investing heavily in rail infrastructure modernization and electrification. Key players driving innovation and market growth include ABB Ltd., known for its advanced motor technologies and strong global presence. Siemens AG offers a wide range of traction motor solutions, focusing on energy efficiency and smart system integration. Alstom SA stands out with its comprehensive portfolio supporting high-speed and urban rail projects worldwide. Mitsubishi Electric Corporation contributes through robust product development and emphasis on sustainable transportation solutions. These companies leverage technological advancements and strategic partnerships to meet rising demand across emerging and developed markets. Their continuous focus on product innovation, quality, and service reliability positions them as leaders shaping the future of railway traction systems worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Railway Traction Motor Market was valued at USD 8,429.49 million in 2018, reached USD 11,844.04 million in 2024, and is projected to hit USD 18,352.56 million by 2032, growing at a CAGR of 5.24%.

- Rising investments in rail infrastructure and electrification projects worldwide drive market growth, supported by government initiatives focused on sustainable and efficient transportation.

- The market benefits from technological advancements such as permanent magnet synchronous motors and smart monitoring systems that enhance energy efficiency and reduce maintenance costs.

- Increased urbanization and expansion of metro and high-speed rail networks create strong demand for advanced traction motors across Asia Pacific, North America, and Europe.

- Leading companies like ABB Ltd., Siemens AG, Alstom SA, and Mitsubishi Electric Corporation compete by focusing on product innovation, strategic partnerships, and geographic expansion.

- Challenges include high initial capital requirements for infrastructure development and stringent regulatory compliance that increase operational costs and slow market penetration in certain regions.

- Regional markets show varied growth rates, with Asia Pacific leading due to rapid urbanization and infrastructure spending, while North America and Europe grow steadily with ongoing fleet modernization and environmental policies.

Market Drivers

Rising Investments in Rail Infrastructure Fuel Market Expansion

Governments worldwide continue to prioritize rail infrastructure modernization and expansion, driving the demand for advanced traction motors. The Railway Traction Motor Market benefits from large-scale electrification projects, high-speed rail corridor development, and increased urban metro construction. Investments in upgrading aging rolling stock and introducing high-capacity trains also contribute to greater adoption of reliable and energy-efficient motors. This infrastructure focus supports efforts to improve connectivity, reduce travel time, and address rising urbanization. The industry sees consistent support through public-private partnerships and long-term transport policies, making rail modernization a central growth factor.

- For instance, Siemens delivered over 1,200 AC traction motors for Indian Railways’ electrification projects, helping upgrade more than 10,000 km of rail tracks.

Emphasis on Energy Efficiency and Environmental Sustainability

Global transportation policies are evolving to prioritize environmental sustainability and carbon emission reduction. The Railway Traction Motor Market is propelled by the shift toward electric locomotives, hybrid trains, and alternative energy propulsion systems. It enables rail operators to meet regulatory requirements for lower emissions while optimizing power consumption and reducing operational costs. Demand for high-efficiency traction motors rises as stakeholders pursue cleaner and greener mobility solutions. The growing adoption of regenerative braking and smart energy management systems further accelerates the shift toward sustainable rail transport.

- For instance, ABB’s regenerative braking systems have been installed on over 500 metro trains worldwide, recovering more than 15 megawatts of energy annually.

Technological Advancements Enhance Performance and Reliability

Continuous innovation in traction motor technology plays a pivotal role in market growth. Manufacturers integrate lightweight materials, advanced cooling techniques, and digital monitoring systems to boost reliability and extend product life. The Railway Traction Motor Market benefits from the adoption of permanent magnet synchronous motors (PMSM) and asynchronous motors, which offer improved power density and reduced maintenance needs. It supports rail operators by delivering robust performance under varying load conditions and harsh environments. The focus on digitalization and predictive maintenance enables proactive asset management and reduces unexpected downtime.

Urbanization and Modern Transit Networks Create New Opportunities

Rapid urbanization and growing populations increase the demand for efficient mass transit solutions in metropolitan areas. The Railway Traction Motor Market finds new opportunities with the global expansion of metro systems, commuter trains, and light rail projects. It supports urban planners aiming to reduce congestion, improve air quality, and deliver reliable public transportation. Increased investment in smart city initiatives and multi-modal mobility encourages the integration of advanced rail technologies. The market’s growth aligns with global trends toward seamless and sustainable urban mobility.

Market Trends

Adoption of Permanent Magnet Synchronous Motors Gains Momentum

The Railway Traction Motor Market is witnessing increased adoption of permanent magnet synchronous motors (PMSM), which deliver high efficiency and lower maintenance compared to traditional motors. PMSMs provide enhanced torque density and compact designs, making them ideal for new-generation electric and hybrid locomotives. Manufacturers are investing in research and development to optimize these motors for heavy-duty rail applications. It is leading to improved energy utilization and extended operational life for rolling stock. Market players report growing demand for PMSM solutions from operators aiming to modernize their fleets with high-performance equipment.

- For instance, Mitsubishi Electric’s PMSM units generate torque levels up to 3,400 Newton-meters and operate reliably at speeds exceeding 5,000 revolutions per minute.

Integration of Smart Technologies for Predictive Maintenance

Smart technology integration is a prominent trend in the Railway Traction Motor Market, with digital sensors and IoT-enabled systems being incorporated to enable predictive maintenance. Real-time data analytics allow rail operators to monitor motor performance, identify potential failures, and schedule maintenance activities efficiently. It reduces unplanned downtime and minimizes costs associated with manual inspections. The deployment of condition monitoring solutions extends asset longevity and enhances operational safety. The trend toward digitalization positions rail operators to achieve greater reliability and optimize fleet management.

- For instance, Alstom’s HealthHub platform connects over 1,000 traction motors across global fleets, analyzing data from thousands of sensors per motor to reduce maintenance costs by up to 25%.

Focus on Lightweight and Compact Motor Designs

Design innovation is pushing the Railway Traction Motor Market toward lightweight, compact, and modular motors that offer improved performance and easier integration into diverse train models. Manufacturers are exploring advanced materials such as aluminum alloys and composites to reduce motor weight without sacrificing durability or output. It supports energy efficiency targets and allows for increased passenger or cargo capacity. The shift toward modularity also enables quicker assembly, easier maintenance, and customization for various rail applications. This trend supports rail operators seeking greater flexibility and operational efficiency.

Expansion of Urban Rail and High-Speed Transit Projects

The Railway Traction Motor Market is closely aligned with the expansion of urban rail and high-speed transit projects worldwide. Growing investments in metro, light rail, and bullet train systems create robust demand for advanced traction motors that support higher speeds and frequent service intervals. It reflects the global emphasis on sustainable, rapid, and reliable urban mobility solutions. As cities continue to upgrade and expand their public transportation infrastructure, the trend toward electrification and modernization fuels steady traction motor market growth.

Market Challenges Analysis

High Initial Investment and Infrastructure Limitations Impede Growth

The Railway Traction Motor Market faces significant challenges due to high initial costs associated with motor procurement, installation, and supporting electrification infrastructure. Developing regions often struggle to allocate sufficient capital for large-scale rail projects, which slows the pace of modernization and expansion. It creates barriers for new entrants and restricts smaller operators from adopting advanced traction motor technologies. The complexity of retrofitting existing fleets with new motors further compounds budgetary and logistical concerns. Limited access to skilled labor and technical expertise can also hinder project implementation. Delays in government approvals and funding cycles frequently impact project timelines and market momentum.

Stringent Regulatory Standards and Supply Chain Disruptions Impact Operations

Stringent safety and environmental regulations present another set of challenges for the Railway Traction Motor Market. Compliance with evolving global standards demands continual product innovation, rigorous testing, and regular upgrades, driving up operational costs for manufacturers and rail operators. It creates pressure on supply chains, especially when sourcing specialized materials and components under fluctuating market conditions. The industry is vulnerable to supply chain disruptions caused by geopolitical instability, transportation bottlenecks, and global economic uncertainties. These disruptions can lead to delays in production, increased costs, and difficulty in meeting project delivery timelines. Persistent regulatory and logistical hurdles limit the speed at which market players can respond to rising demand.

Market Opportunities

Expanding Electrification Projects in Emerging Economies Offer Significant Growth Potential

The Railway Traction Motor Market stands to gain from accelerating electrification efforts in emerging economies across Asia, Africa, and Latin America. Governments in these regions prioritize sustainable transportation to reduce reliance on fossil fuels and improve urban mobility. It creates substantial demand for efficient and reliable traction motors suited to new and upgraded rail networks. Infrastructure development programs backed by international funding and public-private partnerships provide strong support. The growing middle-class population and rising urbanization intensify the need for modern rail solutions. This creates fertile ground for market players to introduce cost-effective, technologically advanced motor systems tailored to regional needs.

Adoption of Green Technologies and Smart Systems Drives Innovation Opportunities

Increasing focus on green transportation solutions presents lucrative opportunities in the Railway Traction Motor Market. The shift toward electric and hybrid propulsion systems encourages manufacturers to develop energy-efficient motors with lower environmental impact. It enables integration with smart systems such as IoT-based monitoring, predictive maintenance, and regenerative braking technologies. These innovations improve operational efficiency, reduce maintenance costs, and extend motor lifespan. Rail operators and manufacturers investing in sustainability and digitalization can capitalize on evolving market preferences. Collaborations and strategic partnerships aimed at developing next-generation traction motor technologies further expand growth avenues.

Market Segmentation Analysis:

By Product:

The product segment includes DC traction motors, AC traction motors, and synchronous AC traction motors. DC traction motors have traditionally dominated due to their robust torque characteristics and simplicity. They remain widely used in older locomotive models and regions with legacy rail infrastructure. However, the market is shifting toward AC traction motors, which offer higher efficiency, better speed control, and reduced maintenance requirements. AC motors support advanced control systems, making them more suitable for modern rail applications. Synchronous AC traction motors represent a growing segment due to their high power density, improved efficiency, and precise speed regulation. They are increasingly adopted in new electric and hybrid trains, driven by technological advancements and energy efficiency demands. This diversification in motor types enables operators to select optimal solutions based on performance requirements and operational conditions.

- For instance, Siemens’ AC traction motors for high-speed trains deliver continuous power output exceeding 5,500 kilowatts at operating speeds of 6,200 revolutions per minute.

By Application:

The Railway Traction Motor Market divides into diesel locomotives, electric locomotives, and diesel-electric locomotives. Diesel locomotives predominantly use DC motors in conventional setups, favored in regions with limited electrification infrastructure. The demand for diesel locomotives continues in developing markets due to cost-effectiveness and operational flexibility. Electric locomotives form a crucial segment, driven by expanding rail electrification projects globally. They typically use AC and synchronous AC traction motors to deliver high power output and energy efficiency. The growth of electric locomotives aligns with environmental policies targeting emission reductions and sustainable transport. Diesel-electric locomotives combine diesel engines with electric traction motors, offering a hybrid approach to locomotive propulsion. This segment provides advantages in fuel efficiency and reduced emissions while allowing operation on non-electrified tracks. It caters to markets undergoing gradual electrification, bridging gaps in infrastructure.

- For instance, Hitachi’s diesel-electric locomotives use traction motors capable of generating up to 3,200 kilowatts of power, effectively supporting mixed urban and freight operations.

Segments:

Based on Product:

- DC Traction Motor

- AC Traction Motor

- Synchronous AC Traction Motor

Based on Application:

- Diesel Locomotive

- Electric Locomotive

- Diesel-Electric Locomotive

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Railway Traction Motor Market

North America Railway Traction Motor Market grew from USD 2,684.37 million in 2018 to USD 3,718.02 million in 2024 and is projected to reach USD 5,783.17 million by 2032, reflecting a compound annual growth rate (CAGR) of 5.3%. North America holds approximately 23% market share globally, driven by extensive investments in rail infrastructure modernization and electrification projects. The United States and Canada lead demand due to expanding urban transit systems and government initiatives focused on sustainable transportation. Rail operators increasingly adopt energy-efficient traction motors to improve performance and meet strict emission standards. Technological upgrades in freight and passenger rail networks further boost market growth in this region.

Europe Railway Traction Motor Market

Europe Railway Traction Motor Market grew from USD 1,580.11 million in 2018 to USD 2,099.03 million in 2024, with projections to reach USD 2,958.85 million by 2032, recording a CAGR of 4.0%. Europe accounts for around 17% of the global market, supported by stringent environmental regulations and a well-established rail network. Countries such as Germany, France, and the UK lead the market with substantial investments in high-speed rail and metro expansions. The shift toward electrified locomotives and adoption of synchronous AC traction motors contribute to steady growth. The region’s focus on smart rail technologies and renewable energy integration also drives demand for advanced traction motor solutions.

Asia Pacific Railway Traction Motor Market

Asia Pacific Railway Traction Motor Market grew robust growth from USD 3,500.18 million in 2018 to USD 5,109.10 million in 2024 and is expected to reach USD 8,423.92 million by 2032, achieving a CAGR of 6.1%. This region commands the largest market share, approximately 33%, due to rapid urbanization, infrastructure development, and government support for rail electrification. China, India, and Japan are key contributors, investing heavily in high-speed rail networks and metro projects. The demand for energy-efficient and durable traction motors rises with the expansion of public transit systems. Emerging economies within the region also drive growth by upgrading existing diesel locomotives to electric variants.

Latin America Railway Traction Motor Market

Latin America Railway Traction Motor Market grew from USD 332.59 million in 2018 to USD 460.36 million in 2024 and is forecasted to reach USD 614.97 million by 2032, at a CAGR of 3.3%. Latin America holds approximately 4% of the global market share. Brazil, Mexico, and Argentina are the primary markets, with investments focusing on rail network modernization and expansion. Government initiatives aim to improve freight transportation efficiency and reduce carbon emissions, encouraging the adoption of electric locomotives and hybrid traction systems. Infrastructure challenges and fluctuating economic conditions remain concerns, but steady growth continues through targeted projects.

Middle East Railway Traction Motor Market

Middle East Railway Traction Motor Market grew from USD 230.46 million in 2018 to USD 295.31 million in 2024, with an expected rise to USD 384.18 million by 2032, at a CAGR of 2.9%. The Middle East accounts for roughly 2% of the global market share. Countries like the UAE, Saudi Arabia, and Qatar invest in urban transit systems and freight corridors to diversify transport modes. The demand for traction motors in this region is linked to smart city initiatives and expanding metro networks. However, market growth faces challenges due to geopolitical factors and infrastructure development pace.

Africa Railway Traction Motor Market

Africa Railway Traction Motor Market grew from USD 101.78 million in 2018 to USD 162.20 million in 2024 and is projected to reach USD 187.47 million by 2032, at a CAGR of 1.4%. Africa holds about 1% market share globally. South Africa, Egypt, and Kenya lead the regional demand, driven by ongoing rail modernization and electrification efforts. The market remains nascent due to limited infrastructure and economic constraints but presents opportunities with international funding and development programs. Increasing focus on sustainable transport solutions could stimulate future traction motor adoption.

Key Player Analysis

- ABB Ltd.

- Alstom SA

- Mitsubishi Electric Corporation

- Siemens AG

- Hitachi Ltd.

- Sulzer Ltd.

- Hyundai Rotem Company

- CG Power and Industrial Solutions Limited (Murugappa Group)

- VEM Group

- Saini Group

Competitive Analysis

The Railway Traction Motor Market is highly competitive, led by key players such as ABB Ltd., Siemens AG, Alstom SA, Mitsubishi Electric Corporation, Hitachi Ltd., Sulzer Ltd., Hyundai Rotem Company, CG Power and Industrial Solutions Limited, VEM Group, and Saini Group. These companies focus on continuous innovation, leveraging advanced technologies to improve motor efficiency, durability, and integration with smart rail systems. Heavy investments in synchronous AC traction motor development and predictive maintenance enable improved operational performance and reduced downtime. Growth is propelled by expanding urban transit networks and the shift toward sustainable, high-speed rail applications. Market participants leverage strategic collaborations, mergers, and acquisitions to strengthen regional presence and access emerging markets. Research and development efforts prioritize meeting evolving regulatory standards and environmental requirements. Customization of products and superior after-sales service remain critical factors for gaining a competitive edge. Rising demand for electric and hybrid propulsion systems intensifies competition, encouraging the introduction of motors with higher power density and lower emissions. This dynamic landscape fosters rapid technological progress, enabling railway operators to enhance efficiency and sustainability in rail transport worldwide.

Recent Developments

- In October 2024, Siemens revealed a major deal with a European rail company to provide state-of-the-art traction motors and systems.

- In April 2024, Alstom introduced a new line of traction systems designed for high-speed trains, improving energy efficiency.

- In February 2024, GE introduced a new environmentally-friendly traction motor made to decrease emissions in freight uses.

- In January 2024, Bombardier confirmed positive results from testing its newest electric traction motors, with a focus on enhancing performance in urban transit systems.

- In November 2023, in line with India’s “Make in India” and “Atmanirbhar Bharat” initiatives, ABB partnered with Titagarh Rail Systems to supply propulsion systems for Indian metro projects. This partnership allows Titagarh to purchase ABB propulsion systems, including traction motors, auxiliary converters, traction converters, and TCMS software, and acquire manufacturing rights and production licenses for ABB traction motors and technology for GoA4 TCMS software.

- In September 2023, CRRC Zhuzhou Electric, a unit of state-owned CRRC, developed China’s first domestically made permanent magnet traction motor for 400 km/h trains. This TQ-800 motor unveiled in 2019 aims to increase efficiency and reduce reliance on foreign technology, breaking the monopoly previously held by overseas manufacturers. Previously, Chinese bullet trains that used different traction systems had a maximum speed of 350 km/h.

- In July 2023, Škoda Group announced plans to supply up to 1,120 traction motors for a new fleet of trams being manufactured for Melbourne, Australia.

Market Concentration & Characteristics

The Railway Traction Motor Market demonstrates a moderately concentrated competitive landscape characterized by the presence of several well-established global players and numerous regional manufacturers. It is dominated by companies with strong technological capabilities, extensive product portfolios, and established distribution networks, enabling them to meet diverse customer requirements across different geographies. The market’s characteristics include high entry barriers due to substantial capital investment, complex manufacturing processes, and stringent regulatory standards. Innovation and continuous product development remain critical for maintaining market position and responding to evolving demands for energy efficiency, reliability, and sustainability. The emphasis on advanced motor types such as synchronous AC and permanent magnet motors highlights the market’s focus on performance optimization. Strategic partnerships, mergers, and acquisitions support expansion and enhance technological expertise. The market exhibits steady growth driven by increasing rail electrification, urban transit expansion, and environmental regulations, encouraging operators to upgrade fleets with more efficient traction motors. While global players capture the majority of market share, regional companies capitalize on localized opportunities by offering cost-competitive and customized solutions. This combination of global expertise and regional specialization shapes the Railway Traction Motor Market’s dynamics, fostering both innovation and competitive pricing.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by increasing global demand for efficient rail transportation.

- Investments in rail infrastructure and electrification projects will continue to boost market expansion.

- Advancements in energy-efficient and high-performance traction motor technologies will enhance operational capabilities.

- Integration of smart technologies and digital monitoring systems will improve maintenance and reliability.

- Rapid urbanization and expansion of metro and high-speed rail networks will increase demand for advanced traction motors.

- Growing focus on sustainable transport and stricter environmental regulations will promote electric and hybrid locomotive adoption.

- Market players will prioritize product innovation, strategic partnerships, and expansion into emerging regions.

- Emerging economies in Asia Pacific and Latin America will offer significant opportunities due to modernization efforts.

- Development of modular, lightweight, and compact motor designs will address diverse rail application needs.

- Continuous research and development will lead to next-generation traction motor solutions, supporting future market growth.