Market Overview

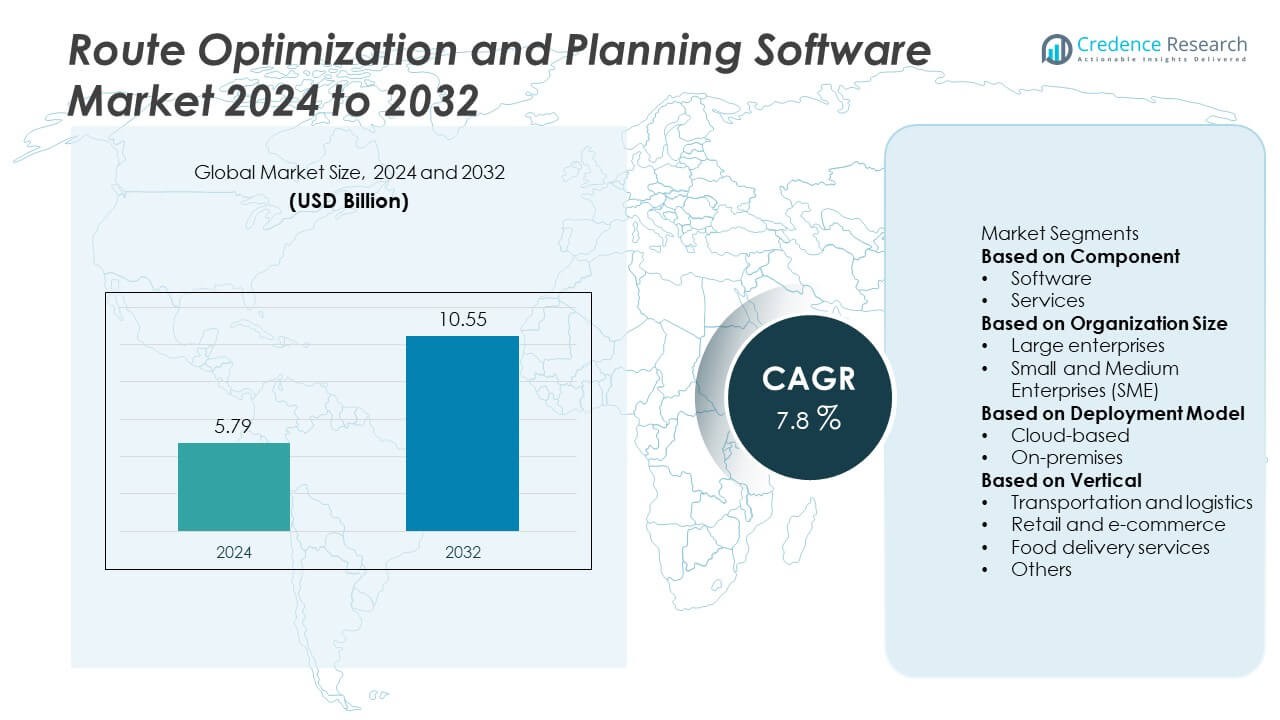

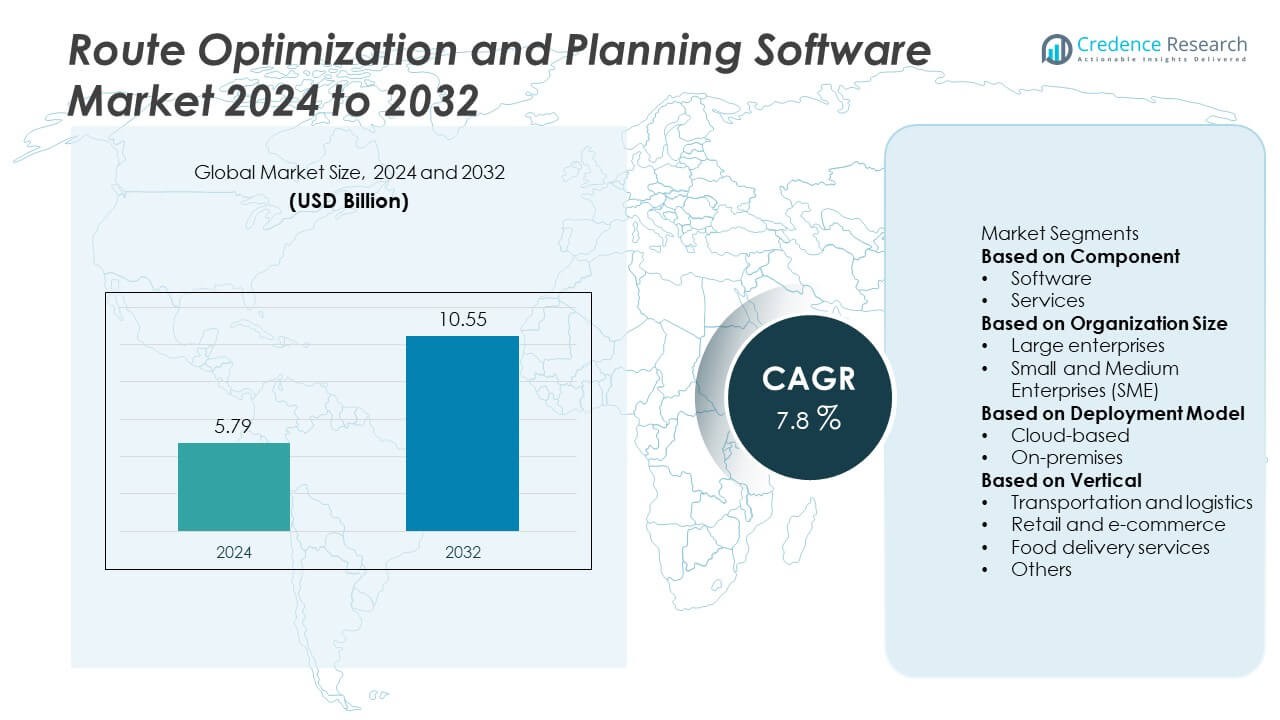

The global Route Optimization and Planning Software market was valued at USD 5.79 billion in 2024 and is projected to reach USD 10.55 billion by 2032, growing at a CAGR of 7.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Route Optimization and Planning Software Market Size 2024 |

USD 5.79 Billion |

| Route Optimization and Planning Software Market, CAGR |

7.8% |

| Route Optimization and Planning Software Market Size 2032 |

USD 10.55 Billion |

The Route Optimization and Planning Software market is led by key players such as Oracle Corporation, Trimble, Omnitracs, FarEye, Verizon Connect, Descartes Systems Group, Locus, OptimoRoute, Paragon Software Systems, and Route4Me Inc. These companies dominate through AI-driven solutions, cloud-based analytics, and real-time fleet management tools that enhance operational efficiency. North America held the largest share of 38% in 2024, driven by advanced logistics infrastructure and early technology adoption. Europe followed with 28%, supported by sustainability-focused logistics reforms, while Asia Pacific accounted for 24%, propelled by rapid e-commerce growth, rising digitalization, and increasing investments in smart transportation systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global route optimization and planning software market was valued at USD 5.79 billion in 2024 and is projected to reach USD 10.55 billion by 2032, growing at a CAGR of 7.8% during 2025–2032.

- Increasing demand for real-time fleet tracking and cost-efficient logistics operations drives software adoption across transportation, retail, and e-commerce sectors.

- Growing integration of AI, IoT, and predictive analytics in route optimization platforms represents a key market trend, improving delivery accuracy and sustainability.

- Leading players such as Oracle Corporation, Trimble, and Verizon Connect maintain competitiveness through advanced SaaS models and cloud-enabled logistics management solutions.

- North America led the market with 38%, followed by Europe at 28% and Asia Pacific at 24%, while the software segment held 68% share in 2024, supported by expanding e-commerce networks and digital transformation in fleet operations.

Market Segmentation Analysis:

By Component

The software segment dominated the market with a 68% share in 2024, driven by growing adoption of AI-based and real-time analytics platforms for fleet and delivery route management. Companies leverage advanced algorithms for predictive traffic analysis, fuel optimization, and improved dispatch scheduling. Integration with GPS, IoT sensors, and telematics systems enhances efficiency and reduces operational costs. The services segment, including consulting and support, is gaining traction as enterprises seek customized solutions and continuous optimization support to improve logistics performance and compliance.

- For instance, Trimble Inc. enhanced its Trimble Maps platform with the CoPilot routing engine, which integrates predictive ETA algorithms and vehicle telematics for commercial fleets. The system also enables real-time route recalculations and offers features like predictive parking, improving efficiency and safety for commercial vehicles.

By Organization Size

Large enterprises accounted for a 61% share in 2024, supported by extensive logistics networks and high investment capacity in advanced planning tools. These organizations use route optimization software to enhance supply chain visibility, meet on-time delivery goals, and reduce transportation expenses. Small and medium enterprises (SMEs) are increasingly adopting cloud-based route optimization platforms to improve last-mile delivery efficiency. Affordable subscription models and user-friendly interfaces continue to make these solutions accessible to SMEs seeking digital transformation.

- For instance, Locus offers a Dispatch Management Platform for large enterprise clients in logistics, retail, and e-commerce. Its AI-driven engine calculates optimal routes considering more than 180 constraints, which include vehicle load, driver hours, and delivery time windows, enabling measurable delivery time reduction and improved route adherence.

By Deployment Model

The cloud-based segment held a 72% share in 2024, emerging as the dominant deployment model. Businesses prefer cloud platforms for their scalability, flexibility, and ability to process real-time data across distributed networks. Cloud-based systems enable seamless updates, multi-device accessibility, and integration with ERP and CRM systems. On-premises deployment remains relevant among enterprises prioritizing data privacy and regulatory compliance. However, ongoing digital transformation and growing e-commerce operations continue to accelerate the shift toward cloud-based route optimization and planning solutions globally.

Key Growth Drivers

Rising Demand for Real-Time Fleet Management

The growing need for efficient fleet operations is driving adoption of route optimization software. Businesses in logistics, e-commerce, and field service industries use these platforms to minimize travel time, reduce idle fuel consumption, and enhance delivery accuracy. Real-time tracking, predictive route adjustments, and integration with telematics systems allow companies to improve productivity and lower operational costs. The increasing use of connected vehicles and GPS-enabled solutions further accelerates the adoption of intelligent route optimization tools globally.

- For instance, Verizon Connect enhanced its RouteCloud platform, processing near real-time GPS location updates and integrating AI algorithms to predict route congestion and optimize delivery sequencing. The system helps fleets reduce idling time and supports telematics integrations for real-time performance insights.

Expansion of E-Commerce and Last-Mile Delivery

The rapid growth of e-commerce and online retail is a major driver for the route optimization and planning software market. Companies rely on advanced algorithms to optimize delivery routes, handle multiple stops, and improve customer satisfaction through timely deliveries. Rising demand for same-day and next-day deliveries intensifies the need for automated route planning. Logistics providers and retailers are increasingly deploying cloud-based optimization tools to handle high delivery volumes while reducing fuel and labor expenses.

- For instance, FarEye’s Intelligent Delivery Management Platform empowers businesses to manage and optimize last-mile deliveries across 30 countries. Its AI-powered predictive route engine analyzes multiple data parameters—such as real-time traffic, delivery priorities, and vehicle capacity—to optimize routes and improve operational efficiency.

Adoption of AI and Machine Learning Technologies

Artificial intelligence and machine learning integration have significantly enhanced route optimization capabilities. These technologies analyze vast data sets on traffic patterns, weather conditions, and vehicle performance to generate the most efficient routes. Predictive analytics enable dynamic route adjustments, improving accuracy and speed. Businesses use AI-driven tools for scenario-based planning, resource allocation, and demand forecasting. This intelligent automation boosts cost efficiency and decision-making accuracy across logistics and distribution networks.

Key Trends & Opportunities

Shift Toward Cloud-Based and SaaS Models

The adoption of cloud-based route optimization solutions is rapidly expanding due to their scalability, flexibility, and lower upfront cost. Cloud and SaaS models allow businesses to deploy updates in real time and access route data across multiple devices. These platforms facilitate collaboration between drivers, dispatchers, and managers through centralized dashboards. The growing preference for subscription-based models among SMEs presents a key opportunity for software vendors to expand their market reach.

- For instance, OptimoRoute introduced its web-based SaaS delivery planning software that uses proprietary cloud algorithms to plan efficient routes in seconds. The platform provides real-time driver tracking and updates, with live ETAs sent to customers via email or text. Its services support a variety of fleet sizes, ranging from small businesses to larger enterprises with thousands of vehicles.

Integration of IoT and Autonomous Technologies

IoT-enabled sensors and autonomous vehicle technologies are transforming route optimization capabilities. Fleet operators gain real-time data on vehicle health, driver behavior, and traffic conditions to plan efficient routes dynamically. Integration of IoT with predictive analytics allows for automated scheduling and smart rerouting during disruptions. The increasing use of autonomous delivery vehicles and drones also creates new opportunities for advanced route optimization systems tailored to multi-modal logistics operations.

- For instance, Descartes Systems Group integrated IoT-enabled vehicle telematics with its Route Planner platform, processing over 1 billion GPS and sensor data points each day. The system applies AI-based predictive routing and vehicle diagnostics, enabling automated rerouting in response to mechanical faults or delays and improving on-road efficiency for large autonomous-ready fleet networks.

Key Challenges

High Implementation and Integration Costs

Despite their benefits, route optimization and planning solutions involve significant upfront costs related to software deployment, integration, and employee training. Many small and medium enterprises face financial constraints in adopting advanced AI or IoT-enabled systems. Customization and compatibility with existing ERP or CRM systems can further increase implementation expenses. These factors may slow adoption among cost-sensitive businesses in emerging economies.

Data Privacy and Security Concerns

The extensive use of GPS, telematics, and cloud platforms raises concerns about data privacy and cybersecurity. Real-time tracking and data sharing across fleets and third-party platforms create potential vulnerabilities. Unauthorized access or data breaches can expose sensitive logistics information and impact operational integrity. Ensuring strong encryption, compliance with data protection regulations, and secure cloud infrastructure remains a critical challenge for software providers in the route optimization and planning market.

Regional Analysis

North America

North America held the largest share of 38% in 2024, driven by early adoption of digital logistics platforms and strong presence of leading software vendors. High e-commerce activity, advanced IT infrastructure, and widespread use of AI-powered route optimization tools support market dominance. The U.S. leads regional demand due to extensive transportation networks and a growing focus on real-time fleet management. Increasing integration of GPS, telematics, and predictive analytics in logistics operations continues to strengthen the region’s leadership in route optimization and planning software adoption.

Europe

Europe accounted for 28% of the market share in 2024, supported by government initiatives promoting smart logistics and sustainable transport. Countries such as Germany, the U.K., and France are adopting advanced route planning tools to reduce carbon emissions and fuel consumption. The strong presence of logistics and manufacturing industries accelerates software demand across supply chains. Implementation of intelligent transportation systems and data-driven fleet management practices further boosts regional growth, supported by EU policies emphasizing operational efficiency and environmental sustainability.

Asia Pacific

Asia Pacific captured a 24% market share in 2024, emerging as the fastest-growing regional market. Rapid e-commerce expansion, urbanization, and increasing investments in digital logistics platforms drive adoption. Countries like China, Japan, and India are deploying AI and IoT-enabled route optimization software to enhance delivery accuracy and efficiency. Growing demand for last-mile delivery solutions and government-backed smart city initiatives continue to boost adoption. Expanding logistics networks and rising awareness of operational cost savings further position the region as a key growth hub.

Latin America

Latin America represented a 6% market share in 2024, supported by expanding retail and e-commerce sectors. Brazil and Mexico are leading adopters due to their growing transportation infrastructure and increasing logistics digitization. Companies in the region are deploying route planning software to improve delivery accuracy, reduce fuel consumption, and manage dispersed fleets. Rising cross-border trade and government initiatives promoting logistics modernization are creating favorable conditions for market growth across the region.

Middle East & Africa

The Middle East & Africa accounted for a 4% market share in 2024, driven by digital transformation in logistics and transportation management. GCC countries such as the UAE and Saudi Arabia are adopting route optimization tools to support their rapidly expanding e-commerce and retail delivery networks. Infrastructure development and smart city projects further contribute to growth. In Africa, increasing logistics digitalization and investments in fleet management systems are strengthening regional adoption, though limited technical infrastructure still poses challenges to large-scale deployment.

Market Segmentations:

By Component

By Organization Size

- Large enterprises

- Small and Medium Enterprises (SME)

By Deployment Model

By Vertical

- Transportation and logistics

- Retail and e-commerce

- Food delivery services

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Route Optimization and Planning Software market is shaped by major players such as Oracle Corporation, Trimble, Omnitracs, FarEye, Verizon Connect, Descartes Systems Group, Locus, OptimoRoute, Paragon Software Systems, and Route4Me Inc. These companies dominate through advanced software platforms that integrate AI, machine learning, and real-time analytics to improve logistics performance. Oracle and Trimble lead with strong enterprise solutions and cloud-based route optimization systems, while FarEye and Locus focus on last-mile delivery and predictive intelligence. Verizon Connect and Omnitracs emphasize fleet telematics and data-driven logistics efficiency. Strategic collaborations, mergers, and SaaS-based innovations help these players enhance global reach. Continuous product upgrades, mobile accessibility, and API integration capabilities maintain competitiveness in an evolving digital logistics ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Locus reported that its route planning system had optimized over 1.22 billion deliveries globally, achieving an on-time delivery rate of 99.5%.

- In January 2025, Oracle Corporation introduced an AI-powered order-route prediction feature within its Transportation Management solution, enabling real-time selection of optimal shipment routes across complex global networks.

- In 2024, Verizon Connect showcased its RouteCloud API capable of optimizing job sequences by vehicle capacity, driver certifications and equipment needs across multi-stop deliveries for distributed fleets.

Report Coverage

The research report offers an in-depth analysis based on Component, Organization Size, Deployment Model, Vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing e-commerce and logistics digitalization will drive continuous adoption of route optimization platforms.

- Cloud-based and SaaS deployment will remain the preferred choice for scalability and remote accessibility.

- AI and machine learning will enhance real-time route adjustments and predictive analytics accuracy.

- Integration with IoT and telematics systems will expand to support smart fleet management.

- Vendors will focus on low-cost, user-friendly software for SMEs entering digital logistics.

- Strategic collaborations between software providers and logistics firms will strengthen market presence.

- Sustainability goals will push demand for route optimization that reduces fuel consumption and emissions.

- Regional expansion in Asia Pacific and Latin America will accelerate with growing delivery networks.

- Data security and privacy improvements will become a key focus for global software providers.

- Advancements in autonomous vehicle routing and drone logistics will create new growth opportunities.