Market Overview

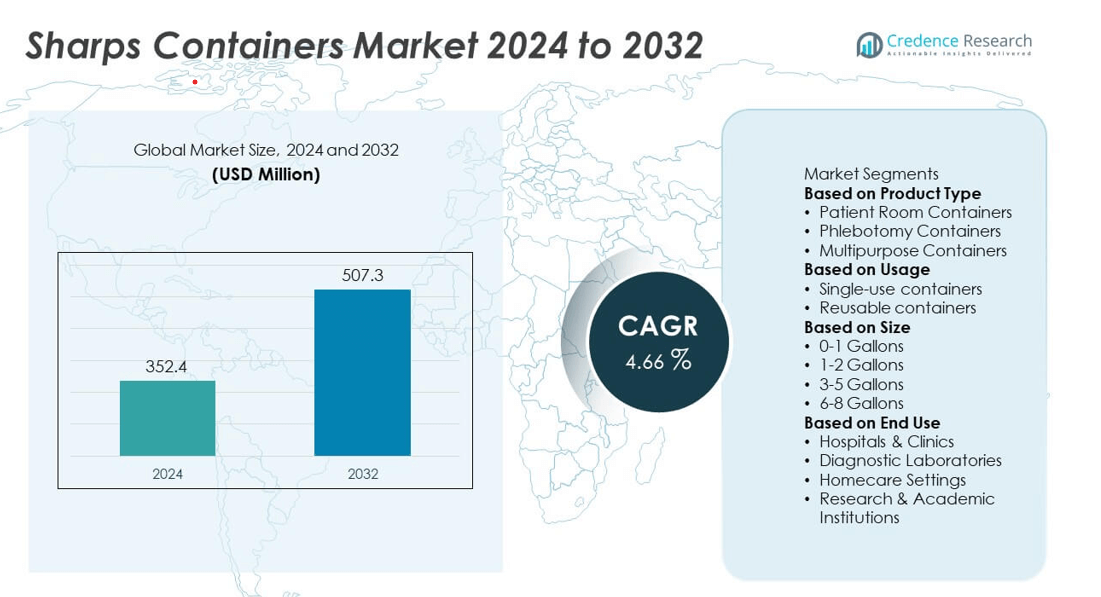

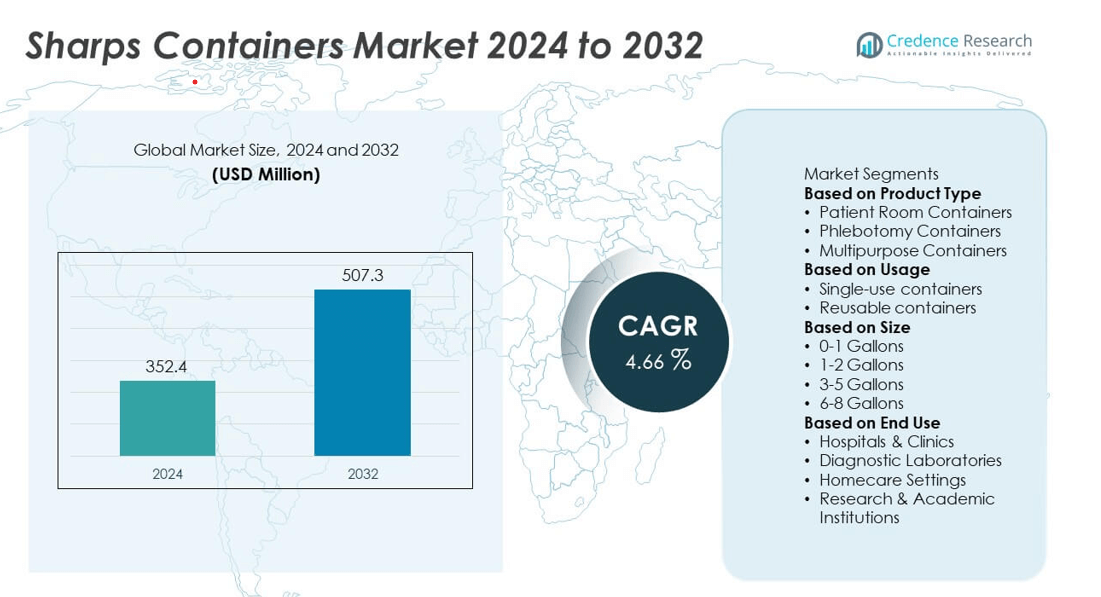

The Sharps Containers Market size was valued at USD 352.4 million in 2024 and is anticipated to reach USD 507.3 million by 2032, growing at a CAGR of 4.66% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sharps Containers Market Size 2024 |

USD 352.4 million |

| Sharps Containers Market, CAGR |

4.66% |

| Sharps Containers Market Size 2032 |

USD 507.3 million |

The Sharps Containers Market grows through rising healthcare waste generation, strict regulatory compliance, and increasing awareness of infection risks. Hospitals, clinics, and home healthcare settings adopt certified containers to prevent needle-stick injuries and control disease transmission.

The Sharps Containers Market demonstrates strong presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America dominates with advanced healthcare infrastructure and strict waste management regulations, while Europe emphasizes standardized compliance and sustainability in disposal practices. Asia-Pacific emerges as the fastest-growing region, supported by expanding healthcare facilities, increasing chronic disease cases, and improving regulatory frameworks. Latin America and the Middle East & Africa show gradual adoption, driven by healthcare modernization and awareness initiatives. Key players such as Cardinal Health, BD, and Stericycle focus on innovation, compliance, and scalable solutions to meet diverse healthcare demands. Companies like Daniels Sharpsmart Inc. and Medline Industries, LP. further strengthen the market by offering eco-friendly, customizable, and safety-oriented designs. Together, these regional developments and competitive strategies highlight the market’s adaptability to regulatory, environmental, and healthcare infrastructure trends worldwide.

Market Insights

- The Sharps Containers Market was valued at USD 352.4 million in 2024 and is projected to reach USD 507.3 million by 2032, growing at a CAGR of 4.66%.

- Rising healthcare waste generation and strict regulatory requirements drive the adoption of certified sharps disposal solutions across hospitals, clinics, and home healthcare settings.

- Market trends highlight increasing demand for eco-friendly, recyclable containers and smart features such as fill-level indicators and tamper-proof mechanisms that improve compliance and safety.

- Competitive analysis shows key players including Cardinal Health, BD, Stericycle, Daniels Sharpsmart Inc., and Medline Industries focusing on product innovation, sustainability, and expanded global distribution networks.

- Market restraints include high disposal costs, limited infrastructure in developing regions, and fragmented regulatory frameworks that create barriers for uniform adoption across countries.

- Regional analysis shows North America leading with advanced healthcare systems, Europe emphasizing standardized compliance, Asia-Pacific growing fastest due to rising healthcare investments, and Latin America, Middle East, and Africa showing gradual progress.

- Overall, the market reflects a balance of strong regulatory-driven demand, rising sustainability focus, and innovation opportunities, while cost and infrastructure limitations remain key challenges in emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Healthcare Waste Generation Driving the Demand for Safe Disposal Solutions

The Sharps Containers Market grows steadily due to the rising volume of healthcare waste. Hospitals, clinics, and diagnostic centers generate large amounts of needles, syringes, and other sharp instruments daily. Safe disposal solutions reduce the risks of accidental injuries and infections among healthcare workers. Strict protocols encourage institutions to adopt standardized sharps containers across departments. The growing number of surgical procedures and vaccination drives further increases the demand for reliable waste handling. This rising burden strengthens the market’s foundation and ensures consistent adoption across healthcare settings.

- For instance, Stericycle reported diverting 101 million pounds of plastic from landfills in 2022 through the use of its reusable sharps and pharmaceutical containers, diverting them from single-use containers.

Strict Regulatory Frameworks and Safety Guidelines Reinforcing Adoption Across Facilities

Government agencies and health organizations enforce strict regulations for medical waste disposal. The Sharps Containers Market benefits directly from compliance requirements that prioritize worker and patient safety. Facilities must follow standards to prevent the spread of infectious diseases through improper waste handling. Regulations require hospitals and laboratories to invest in puncture-proof, leak-resistant containers. Non-compliance can result in penalties, creating strong incentives to maintain proper disposal practices. This regulatory pressure ensures stable demand and supports continuous product innovation to meet safety guidelines.

- For instance, BD offers Multi‑use One‑Piece Sharps Collectors in five sizes, each with features like visible fill‑level indicators, counterbalanced lids, and handles to reduce needlestick risk.

Increasing Awareness of Occupational Hazards and Need for Risk Mitigation

Awareness campaigns highlight the dangers of accidental needle-stick injuries and bloodborne infections. The Sharps Containers Market addresses these hazards by providing reliable containment solutions. Healthcare professionals demand products designed to reduce handling risks during disposal. Rising concerns about diseases like HIV and hepatitis drive institutions to strengthen their safety protocols. Training programs emphasize safe disposal methods, encouraging facilities to invest in certified containers. This heightened focus on workplace safety strengthens adoption across both developed and emerging healthcare markets.

Expanding Healthcare Infrastructure and Growth of Home Healthcare Practices

The global expansion of healthcare facilities drives steady product demand across hospitals, clinics, and community centers. The Sharps Containers Market gains from infrastructure development projects in developing economies. Growing home healthcare practices also contribute, with patients managing chronic conditions requiring safe disposal tools. Diabetes patients, for instance, use millions of syringes annually, necessitating secure household disposal options. Manufacturers respond by offering compact, portable, and user-friendly container designs. The dual demand from institutional and home settings supports robust market growth across regions.

Market Trends

Growing Shift Toward Eco-Friendly and Sustainable Disposal Solutions

The Sharps Containers Market reflects a strong trend toward eco-friendly and recyclable materials. Manufacturers design containers using non-toxic plastics and biodegradable alternatives to reduce environmental impact. Healthcare institutions seek greener disposal practices aligned with sustainability goals. Governments encourage adoption of products that minimize landfill burden and promote recycling. Companies invest in research to balance safety with environmental responsibility. This trend strengthens product differentiation and aligns with the global focus on sustainable healthcare operations.

- For instance, Daniels Sharpsmart Inc. reported diverting over 31 million pounds of plastic from landfills by using its reusable sharps container program across hospitals in the U.S. and Europe.

Integration of Smart Features and Advanced Safety Mechanisms

The Sharps Containers Market adopts technological upgrades to improve safety and usability. Smart containers with fill-level indicators and electronic tracking improve monitoring of medical waste. Locking mechanisms and tamper-proof features reduce risks during transportation and storage. Facilities favor designs that simplify handling without compromising security. Technology-driven innovations support better compliance with waste management protocols. It reflects a growing preference for advanced solutions that address both safety and efficiency requirements.

- For instance, BD developed more than 40 different sharps collector models with built-in counterbalanced safety lids and visible fill-line indicators, covering sizes from 1 quart to 17 gallons to enhance safety in clinical settings.

Expansion of Single-Use and Portable Containers in Homecare Settings

The Sharps Containers Market shows rising demand for single-use and compact models. Growth in home healthcare creates a need for portable, easy-to-handle solutions. Patients managing diabetes or chronic illnesses seek safe disposal tools designed for daily use. Lightweight containers support convenience without reducing protective features. Portable formats appeal to both households and community health programs. This trend broadens the consumer base and complements institutional demand.

Increased Focus on Customization and Industry-Specific Designs

The Sharps Containers Market emphasizes customization to meet varied healthcare needs. Hospitals, laboratories, and diagnostic centers require containers tailored to their scale and workflow. Manufacturers respond with products in multiple sizes, shapes, and capacities. Industry-specific designs ensure compatibility with automated disposal systems and collection services. Customization supports operational efficiency while enhancing workplace safety. It demonstrates how product flexibility has become a defining trend within the sector.

Market Challenges Analysis

High Disposal Costs and Limited Infrastructure for Medical Waste Management

The Sharps Containers Market faces challenges linked to high disposal costs and insufficient infrastructure in many regions. Safe handling requires specialized incineration or treatment facilities, which are costly to operate. Developing countries often lack robust waste management systems, creating barriers to large-scale adoption. Hospitals and clinics must allocate significant budgets for compliance, reducing resources for other operational needs. The uneven distribution of disposal infrastructure delays proper collection and increases health risks. It restricts efficient adoption of sharps containers, especially in underserved markets.

Regulatory Complexity and Product Standardization Issues Across Regions

The Sharps Containers Market also struggles with regulatory complexity and inconsistent standards. Different countries enforce varied rules for container design, material use, and disposal procedures. This fragmentation creates challenges for manufacturers trying to enter multiple regions with uniform products. Small healthcare providers often find compliance with shifting regulations difficult, limiting widespread usage. Variations in certification and labeling requirements slow down product approvals and market entry. It forces companies to invest heavily in adapting products to meet regional standards, raising costs and delaying innovation.

Market Opportunities

Rising Demand in Emerging Economies with Expanding Healthcare Infrastructure

The Sharps Containers Market holds strong opportunities in emerging economies investing in healthcare infrastructure. Rapid urbanization and population growth increase the number of hospitals, clinics, and diagnostic centers. Governments allocate funds to strengthen waste management systems, creating room for large-scale adoption of safe disposal tools. Growing awareness of infection control drives institutions to replace informal practices with certified solutions. Expanding healthcare access in rural and semi-urban regions further boosts product demand. It positions sharps containers as a critical component of modern medical waste management strategies.

Innovation in Design and Integration with Digital Waste Tracking Systems

The Sharps Containers Market benefits from opportunities linked to design innovation and digital integration. Manufacturers explore smart features such as electronic tracking, automated alerts, and tamper-proof seals. These solutions support compliance while reducing risks for healthcare workers. Customized products designed for home healthcare expand reach beyond institutional users. Companies that combine safety, convenience, and digital monitoring gain a competitive edge. It creates potential for product portfolios that align with both regulatory and technological shifts in healthcare systems.

Market Segmentation Analysis:

By Product Type

The Sharps Containers Market divides into disposable and reusable product types, with disposable containers holding a strong position. Hospitals and clinics prefer single-use designs for their convenience and ability to ensure complete elimination of infection risks. Disposable variants are widely used in vaccination campaigns and outpatient facilities where waste volume is consistent. Reusable containers gain traction in large healthcare institutions seeking cost efficiency and sustainability. These products undergo sterilization cycles before reuse, reducing overall waste generation. It highlights how product type preferences depend on balancing safety, cost, and environmental priorities.

- For instance, Stericycle’s reusable sharps container program processed more than 50 million safety devices in 2023, diverting 101 million pounds of plastic and 18 million pounds of cardboard from landfills through multiple sterilization cycles.

By Usage

The Sharps Containers Market segments into hospitals, clinics, diagnostic centers, and home healthcare. Hospitals remain the leading adopters, driven by high patient volumes and strict compliance requirements. Clinics and diagnostic laboratories also maintain steady demand due to daily use of syringes, needles, and testing equipment. Home healthcare emerges as a fast-growing segment, fueled by rising cases of chronic illnesses such as diabetes. Patients rely on compact containers for safe disposal of needles used in self-administered treatments. It underscores how both institutional and household usage reinforce the steady need for sharps containers worldwide.

- For instance, BD has distributed billions of injection devices like insulin syringes and pen needles globally. However, these are not supplied with sharps containers for disposal. Safe household disposal requires a separate, puncture-resistant container, with users often purchasing or creating them according to local guidelines.

By Size

The Sharps Containers Market further divides by size into small, medium, and large containers. Small containers cater to home healthcare and mobile clinics, offering portability and easy handling. Medium-sized units dominate in outpatient departments and diagnostic labs that manage moderate waste volumes. Large containers serve high-capacity hospital settings, surgical theaters, and vaccination centers where disposal needs are substantial. The choice of container size depends on frequency of use, waste volume, and space availability. It ensures that manufacturers provide a diverse portfolio tailored to the operational requirements of different healthcare environments.

Segments:

Based on Product Type

- Patient Room Containers

- Phlebotomy Containers

- Multipurpose Containers

Based on Usage

- Single-use containers

- Reusable containers

Based on Size

- 0-1 Gallons

- 1-2 Gallons

- 3-5 Gallons

- 6-8 Gallons

Based on End Use

- Hospitals & Clinics

- Diagnostic Laboratories

- Homecare Settings

- Research & Academic Institutions

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America leads the Sharps Containers Market with a market share of about 45–47% in 2024. The region benefits from advanced healthcare infrastructure and strict biomedical waste management regulations. Hospitals, outpatient centers, and diagnostic facilities invest significantly in certified containers to maintain compliance and reduce infection risks. Demand is further supported by high volumes of surgical procedures and vaccination programs. Manufacturers introduce reusable and eco-friendly products to align with sustainability goals while meeting stringent safety requirements. It continues to dominate due to a strong regulatory framework and large concentration of healthcare facilities.

Europe

Europe accounts for approximately 28–30% of the Sharps Containers Market, supported by well-established healthcare systems and strict medical waste disposal regulations. Countries across the region enforce compliance measures that drive hospitals and laboratories to adopt puncture-proof and certified containers. Publicly funded healthcare systems sustain consistent product demand across leading economies such as Germany, France, and the United Kingdom. Manufacturers create designs that comply with EU standards, enabling cross-border uniformity in supply. Growing emphasis on sustainability encourages adoption of eco-friendly sharps containers with recyclable features. It maintains a strong market position through regulatory enforcement and modernized healthcare infrastructure.

Asia-Pacific

Asia-Pacific represents about 18–20% of the Sharps Containers Market and records the fastest growth rate globally. Rapid investment in healthcare facilities across China, India, and Southeast Asia strengthens demand for safe disposal solutions. Rising cases of chronic illnesses and high vaccination volumes increase the frequency of container usage. Governments enhance biomedical waste management regulations to improve compliance in both rural and urban regions. Global and local manufacturers expand their presence by establishing distribution networks and affordable product lines. It emerges as a high-potential region that offers strong growth opportunities for the long term.

Latin America

Latin America holds a market share of around 4–5% of the Sharps Containers Market, reflecting steady but limited adoption. Countries like Brazil, Mexico, and Argentina invest in expanding healthcare access, creating stronger demand for certified sharps disposal solutions. Rising awareness of infection control drives hospitals and clinics to replace informal methods with standardized containers. Public vaccination programs further support container usage across multiple care settings. Regulations are still evolving, yet gradual enforcement improves compliance rates. It shows consistent growth prospects as healthcare infrastructure improves and biomedical waste practices strengthen across the region.

Middle East and Africa

The Middle East and Africa together account for approximately 3–4% of the Sharps Containers Market due to infrastructure gaps and uneven regulation. Wealthier nations such as Saudi Arabia and the UAE invest in advanced healthcare facilities, increasing demand for certified sharps containers. In contrast, several African countries lack reliable waste management infrastructure, slowing adoption rates. International aid programs and NGO-led initiatives promote safe disposal practices in underserved regions. Vaccination campaigns and a growing burden of chronic diseases gradually expand container usage. It reflects modest adoption today but demonstrates long-term potential as governments improve healthcare systems and strengthen waste disposal regulations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Sharps Containers Market features leading players such as Cardinal Health, BD, Stericycle, Daniels Sharpsmart Inc., Medline Industries, LP., Thermo Fisher Scientific Inc., BondTech Corporation (Atlas Copco AB), EnviroTain, Sharps Medical Waste Services, and GPC Medical Ltd. These companies compete by focusing on innovation, regulatory compliance, and sustainable product development. Established players emphasize designing puncture-proof, leak-resistant, and eco-friendly containers to align with rising safety and environmental standards. Many invest in research and development to integrate smart features like fill-level indicators and tamper-proof systems that enhance user safety and operational efficiency. Strategic partnerships, acquisitions, and geographic expansion support their global reach, particularly in fast-growing regions such as Asia-Pacific. Market leaders also focus on providing both disposable and reusable options to serve diverse healthcare institutions, from hospitals and clinics to home healthcare settings. Competitive intensity remains high, with firms differentiating through cost efficiency, product customization, and adherence to international standards.

Recent Developments

- In June 2024, Thermo Fisher Scientific Inc. introduced innovative bio‑based films for bioprocessing containers, promoting sustainability by reducing carbon emissions and earning ISCC PLUS certification for circular products.

- In April 2024, Daniels Sharpsmart Inc. launched SANIBOX, a sustainable cardboard clinical waste container made to expand the eco‑friendly product range.

- In September 2024, BD introduced its PGII Sharps Container Portfolio, meeting U.S. Department of Transportation Packing Group II requirements. The line incorporates recycled content via the BD Recykleen™ initiative and offers multiple lid configurations for safety and convenience.

- In August 2023, Stericycle redesigned its one-gallon SafeDrop Sharps Mail and CsRx Controlled Substance containers, introducing a modern look, easier handling, and a more eco‑friendly design compared to its previous models.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Usage, Size, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Market will continue to grow due to rising syringe, catheter use, and increased medical procedures.

- Expanding healthcare infrastructure in emerging economies will support higher container demand.

- Stricter biomedical waste regulations will accelerate adoption of certified disposal solutions.

- Reusable and eco-friendly containers will gain traction to meet global sustainability goals.

- Smart containers with monitoring and safety features will see stronger adoption in hospitals.

- Multipurpose container designs will expand due to their operational flexibility and cost efficiency.

- Growth in home healthcare will increase demand for compact and user-friendly sharps containers.

- Online and digital sales channels will strengthen product availability and accessibility.

- Asia-Pacific region will continue to show the fastest growth with rising healthcare investments.

- Manufacturers will pursue partnerships, mergers, and product innovation to improve competitiveness.