Market Overview

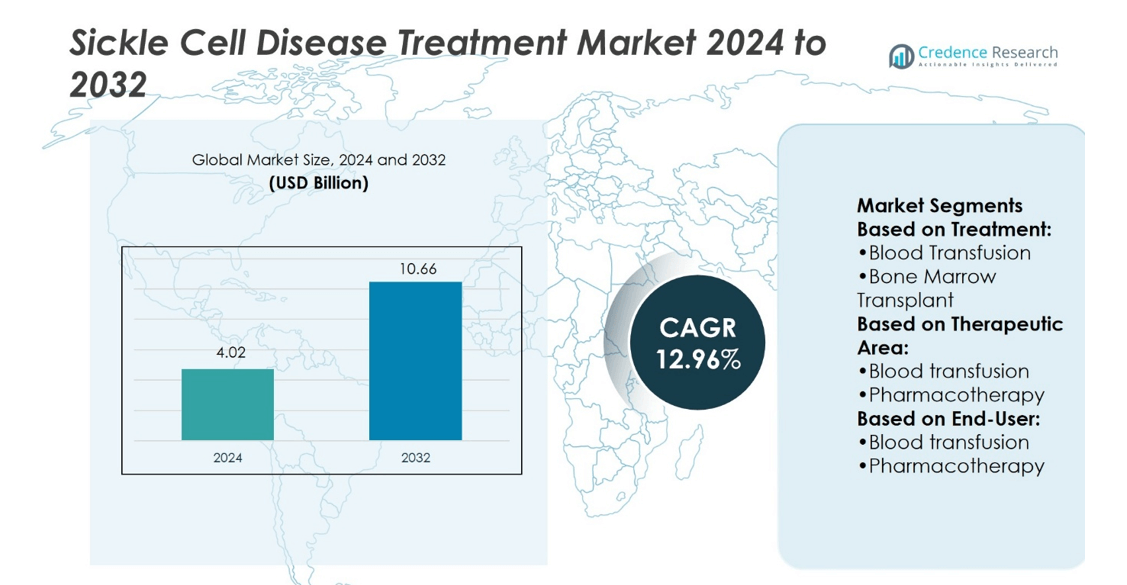

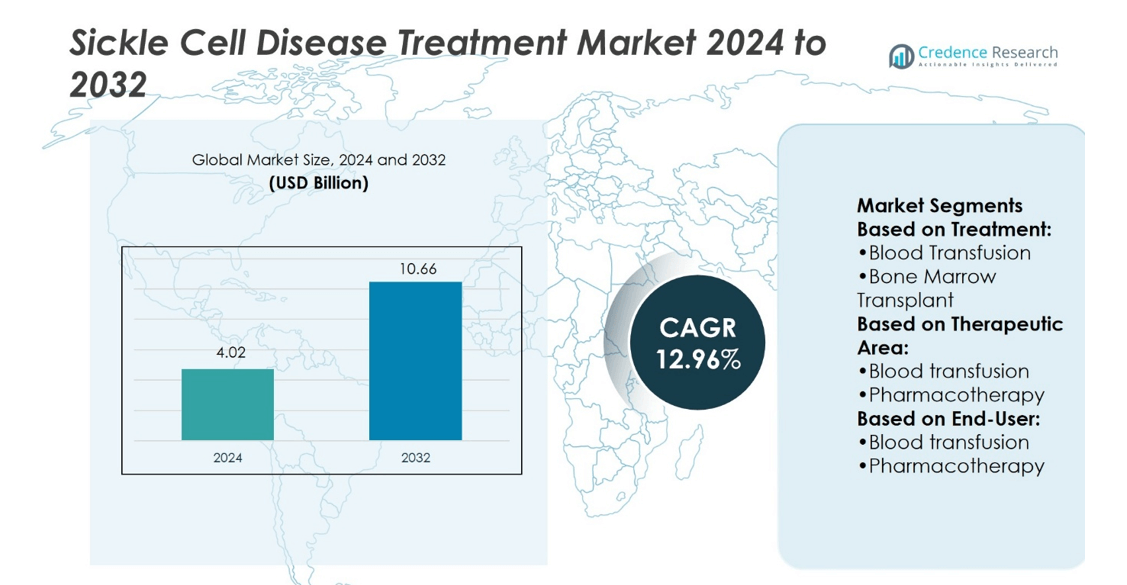

Sickle Cell Disease Treatment Market size was valued at USD 4.02 billion in 2024 and is anticipated to reach USD 10.66 billion by 2032, at a CAGR of 12.96% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sickle Cell Disease Treatment Market Size 2024 |

USD 4.02 billion |

| Sickle Cell Disease Treatment Market, CAGR |

12.96% |

| Sickle Cell Disease Treatment Market Size 2032 |

USD 10.66 billion |

The Sickle Cell Disease Treatment Market grows through rising prevalence, improved diagnosis, and expanding access to advanced therapies. Strong demand for hydroxyurea, targeted biologics, and gene-based treatments drives innovation across the industry. Governments support early screening programs and patient care initiatives, which increase treatment adoption. Research collaborations and funding accelerate clinical trials, leading to faster approvals of novel drugs. Digital health tools and telemedicine enhance disease monitoring and patient compliance. Growing investment in curative options, including stem cell and gene-editing therapies, shapes long-term opportunities. These factors strengthen market growth while positioning advanced treatments as the future standard of care.

North America holds the largest share of the Sickle Cell Disease Treatment Market, supported by advanced healthcare systems and high adoption of innovative therapies. Europe follows with strong government policies and clinical trial activity, while Asia-Pacific shows the fastest growth due to expanding healthcare infrastructure and screening programs. Latin America demonstrates steady progress through public health initiatives, and the Middle East & Africa hold smaller shares but are improving through awareness campaigns. Key players include Novartis, Pfizer, Bristol-Myers Squibb, and bluebird bio.

Market Insights

- The Sickle Cell Disease Treatment Market was valued at USD 4.02 billion in 2024 and will reach USD 10.66 billion by 2032, at a CAGR of 12.96%.

- Rising prevalence, better diagnosis, and wider access to advanced therapies drive market growth.

- Strong demand for hydroxyurea, targeted biologics, and gene-based treatments shapes industry innovation.

- Intense competition among leading players focuses on research pipelines, partnerships, and faster approvals.

- Limited donor availability and high treatment costs act as major restraints for adoption.

- North America leads with the largest share, followed by Europe, while Asia-Pacific records the fastest growth.

- Latin America and Middle East & Africa expand gradually with public health programs and awareness campaigns.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Availability of Targeted Therapies and Novel Drug Approvals

The Sickle Cell Disease Treatment Market benefits from the approval of targeted therapies that address underlying causes. Novel drugs such as voxelotor and crizanlizumab improve patient outcomes by reducing complications. These therapies strengthen physician adoption by offering disease-modifying benefits. Regulators support rapid approvals to meet the urgent need for effective options. Pharmaceutical companies expand clinical trials to evaluate combination approaches. Strong pipelines ensure steady introduction of innovative treatments in global markets.

- For instance, During early interim analysis of Phase III trials for exa-cel (now known as Casgevy™), data presented showed that 24 of 27 evaluable patients with transfusion-dependent beta-thalassemia (TDT) achieved transfusion independence.

Increasing Focus on Advanced Gene and Cell Therapies

Investment in gene and cell therapy research drives transformative opportunities in the Sickle Cell Disease Treatment Market. Techniques like gene editing with CRISPR and stem cell transplantation show promising results in clinical trials. Companies focus on improving safety and reducing treatment-related risks. It strengthens long-term disease management by targeting root genetic mutations. High research spending from biotech firms and academic institutions accelerates therapy development. Strategic partnerships support broader access to these advanced solutions.

- For instance, Addmedica reported that among 141 pediatric patients who had not previously been treated with hydroxyurea in the ESCORT-HU trial, those treated with Siklos saw marked reductions in clinical complications after one year.

Rising Prevalence and Unmet Medical Needs Across Regions

The Sickle Cell Disease Treatment Market grows due to rising prevalence, especially in Africa, the Middle East, and parts of India. Unmet needs remain significant, with many patients lacking timely access to therapies. Healthcare systems struggle to manage complications such as organ damage and stroke. Governments expand screening programs to identify patients early. It ensures more people gain access to preventive and curative treatments. The expanding patient pool strengthens demand for innovative therapies.

Expanding Government and Nonprofit Support for Patient Care

Government funding and nonprofit initiatives improve access in the Sickle Cell Disease Treatment Market. Programs provide subsidized therapies and improve infrastructure for comprehensive care. Advocacy groups create awareness campaigns that highlight treatment gaps. It supports demand for therapies by educating communities about available options. Global organizations invest in collaborative projects to address disparities in care. These coordinated efforts enhance affordability and expand adoption across developing and developed regions.

Market Trends

Growing Emphasis on Curative Approaches Through Gene Therapy and Gene Editing

The Sickle Cell Disease Treatment Market shows a clear trend toward curative solutions. Gene therapy and CRISPR-based gene editing attract investment from leading biopharmaceutical firms. Clinical trials highlight strong efficacy in reducing painful crises and improving hemoglobin levels. It represents a shift from symptom management to disease modification. Healthcare providers recognize the potential for one-time treatments with lasting benefits. These developments reshape the competitive landscape and redefine treatment expectations.

- For instance, Pfizer’s Phase III THRIVE‑131 trial enrolled 241 patients aged 16 and older over a 48‑week period, yet inclacumab did not reduce vaso‑occlusive crises compared to placebo every 12 weeks; the treatment was generally well tolerated but did not meet its primary endpoint.

Expanding Role of Combination Therapies to Improve Patient Outcomes

Companies develop combination strategies that integrate disease-modifying drugs with supportive care in the Sickle Cell Disease Treatment Market. Research highlights the benefits of pairing hydroxyurea with novel agents to reduce complications. It enhances treatment durability while minimizing the risk of relapse. Physicians increasingly adopt this approach in high-burden regions. Strong clinical data encourages regulators to support broader approvals. The trend drives collaboration between biotech innovators and established pharmaceutical players.

- For instance, GBT awarded 450,000 across multiple US community-based organizations under its ACCEL Grant Program to boost access to care for sickle cell patients, including funding eight nonprofits and institutions to improve care transitions, education, and equity initiatives.

Increasing Use of Digital Health Tools and Remote Monitoring Solutions

The Sickle Cell Disease Treatment Market benefits from digital platforms that track patient health and treatment response. Remote monitoring tools improve medication adherence and identify early signs of complications. Mobile applications provide patients with education and self-management resources. It supports healthcare providers by enabling data-driven decisions. Digital adoption grows across both developed and resource-limited settings. These tools strengthen long-term care outcomes and align with value-based healthcare models.

Rising Focus on Access and Equity Through Global Partnerships

Efforts to expand equitable access define a major trend in the Sickle Cell Disease Treatment Market. Partnerships among governments, NGOs, and pharmaceutical companies aim to reduce treatment disparities. It supports affordable access to new therapies in low-income regions. Global health agencies prioritize funding for large-scale screening and treatment programs. Advocacy organizations create awareness campaigns targeting early detection and intervention. The trend ensures broader patient inclusion in innovative care pathways.

Market Challenges Analysis

High Treatment Costs and Limited Affordability in Low-Income Regions

The Sickle Cell Disease Treatment Market faces challenges related to high costs of advanced therapies. Gene therapy and biologic drugs often exceed the budgets of public health systems in Africa and South Asia. It restricts access for patients who need long-term treatment solutions. Insurance coverage remains limited in many developing economies. Governments struggle to balance affordability with the urgency of life-saving care. These financial barriers create unequal access and slow adoption of innovative therapies.

Infrastructure Gaps and Shortage of Specialized Healthcare Providers

Weak healthcare infrastructure limits the effective delivery of therapies in the Sickle Cell Disease Treatment Market. Specialized centers for bone marrow transplantation and gene therapy remain concentrated in high-income regions. It prevents widespread access to curative treatments in emerging economies. A shortage of trained hematologists and support staff further restricts patient care. Diagnostic delays remain common due to lack of screening facilities. These structural limitations hinder timely treatment and increase long-term patient complications.

Market Opportunities

Expanding Scope of Research and Development Creating New Avenues

The Sickle Cell Disease Treatment Market benefits from a strong pipeline of advanced therapies. Gene editing and stem cell transplantation research expand potential treatment options beyond conventional drugs. Pharmaceutical companies invest in targeted biologics that reduce complications and hospitalizations. Partnerships between research institutes and biotech firms accelerate innovation and clinical trial success rates. It creates opportunities for faster regulatory approvals and broader adoption of breakthrough solutions. Increased funding from public and private sectors strengthens the growth prospects of novel therapies.

Growing Global Awareness and Access Programs Supporting Wider Adoption

Rising awareness campaigns and supportive government initiatives open significant opportunities for the Sickle Cell Disease Treatment Market. Patient advocacy groups promote education and drive participation in clinical studies. Expansion of newborn screening programs allows earlier detection, improving treatment outcomes. It creates demand for preventive care and long-term disease management services. International organizations collaborate to improve access in underserved regions, enhancing treatment reach. Pharmaceutical companies leverage differential pricing and access programs to tap into emerging economies. Digital health platforms and telemedicine further expand access, enabling remote disease monitoring and timely interventions.

Market Segmentation Analysis:

By Treatment

The Sickle Cell Disease Treatment Market shows strong reliance on blood transfusion, which remains the most widely used approach. It provides immediate relief from anemia and reduces stroke risk in patients. The demand for regular transfusion therapy continues to grow due to its established effectiveness. Pharmacotherapy contributes significantly, with hydroxyurea and new drug approvals improving patient outcomes. It supports long-term disease management and lowers the frequency of painful crises. Bone marrow transplant, though less common, offers the only potential cure for the disease. Its adoption remains limited due to donor availability, costs, and associated risks, but research advancements increase its future potential.

- For instance,Graphite Bio’s Phase I/2 CEDAR trial (GPH101/nula-cel), which aimed to enroll approximately 15 patients, was voluntarily paused and ultimately discontinued after a serious adverse event occurred in the first patient dosed.

By Therapeutic Area

Blood transfusion dominates therapeutic practices for both acute and chronic management. It stabilizes hemoglobin levels and prevents life-threatening complications. Pharmacotherapy gains momentum as innovative drugs reduce hospitalization rates and improve quality of life. It also attracts investments in targeted therapies that address genetic causes of the disease. Bone marrow transplant remains restricted to severe cases but continues to receive attention from healthcare providers. High success rates in pediatric patients drive further adoption where suitable donors are available. It is expected to expand with advancements in stem cell technologies and reduced-risk procedures.

- For instance, in the Phase I/II trial of Novartis’ CRISPR–Cas9 gene‑edited therapy OTQ923, three patients achieved stable engraftment and fetal hemoglobin levels ranging from 19% to 26.8%, with wide red-cell distribution (from 69.7% to 87.8%).

By End-user

Hospitals hold the largest share of treatment delivery due to their advanced infrastructure and skilled healthcare teams. They manage both emergency interventions and long-term treatment plans, ensuring comprehensive care. It reflects the concentration of resources, blood banks, and transplant facilities in hospital settings. Specialty clinics also play an important role by focusing on personalized care and outpatient services. They deliver continuity in pharmacotherapy and regular transfusion management, enhancing patient compliance. It creates a balanced ecosystem where hospitals address complex needs, while clinics support ongoing disease management. Together, both end-user segments ensure widespread availability of treatments across regions.

Segments:

Based on Treatment:

- Blood Transfusion

- Bone Marrow Transplant

Based on Therapeutic Area:

- Blood transfusion

- Pharmacotherapy

Based on End-User:

- Blood transfusion

- Pharmacotherapy

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America dominates the Sickle Cell Disease Treatment Market with 38% share. The United States leads due to advanced healthcare systems, strong diagnosis rates, and wide use of blood transfusions, bone marrow transplants, and pharmacotherapy. High adoption of new drugs and early access to gene therapies strengthen growth. Reimbursement policies improve patient access to expensive treatments. Research collaborations between biotech firms and universities encourage continuous innovation. Hospitals and specialty centers across the region ensure effective treatment delivery. With strong infrastructure and funding, North America continues to hold the top position.

Europe

Europe holds 30% share, making it the second-largest regional market. Countries such as Germany, the UK, France, and Italy contribute the most to growth. Supportive government programs and healthcare policies improve treatment adoption. Early approvals of innovative drugs and patient assistance initiatives support accessibility. Pharmaceutical companies expand research and clinical trials in the region. Hospitals maintain strong focus on long-term disease management. Europe remains steady in its market performance due to its established systems and innovation-driven environment.

Asia-Pacific

Asia-Pacific accounts for 22% share and shows the fastest growth. Rising prevalence in India and China, along with healthcare reforms, creates strong demand. Government-led screening programs improve early detection, boosting adoption of transfusions and drugs. Healthcare spending in the region is increasing, improving affordability. International firms adopt differential pricing strategies to improve patient access. Hospitals and specialty clinics expand across urban centers, driving better availability of treatments. The region is expected to increase its share further in the coming years due to rapid healthcare development.

Latin America

Latin America captures 9% of the market, reflecting an emerging but growing segment. Brazil and Mexico remain the major contributors due to their larger patient base. Expanding public health programs improve diagnosis and treatment access. Growing collaborations between international drug makers and local healthcare providers strengthen availability. Rising awareness campaigns improve patient participation in care programs. Infrastructure limitations exist but ongoing improvements are helping. Latin America continues to move toward wider adoption of advanced therapies at a steady pace.

Middle East & Africa

The Middle East & Africa region holds only 1% of the global market. Limited healthcare resources and affordability issues slow adoption. Saudi Arabia shows progress with government-supported awareness programs and improved facilities. Sub-Saharan Africa faces higher disease burden but limited access to advanced treatments. International partnerships and NGO-led programs aim to improve hydroxyurea distribution and blood transfusion services. Infrastructure expansion in select countries slowly creates new opportunities. While growth is limited, focused initiatives are expected to bring gradual improvement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CRISPR Therapeutics

- bluebird bio Inc.

- Addmedica

- Pfizer Inc.

- Bristol-Myers Squibb Company

- Global Blood Therapeutics, Inc. (Pfizer Inc.)

- Graphite Bio, Inc.

- Novartis AG

- Emmaus Medical, Inc.

- Agios Pharmaceuticals, Inc.

Competitive Analysis

The Sickle Cell Disease Treatment Market include Bristol-Myers Squibb Company, Novartis AG, Pfizer Inc., Global Blood Therapeutics, Inc., Addmedica, Emmaus Medical, Inc., bluebird bio Inc., Agios Pharmaceuticals, Inc., Graphite Bio, Inc., and CRISPR Therapeutics. The Sickle Cell Disease Treatment Market shows strong competition driven by innovation in therapies and rapid advancements in research. Companies focus heavily on expanding pipelines, conducting clinical trials, and gaining faster regulatory approvals to strengthen their market presence. Gene therapies, disease-modifying drugs, and stem cell approaches are shaping the future of treatment. Strategic partnerships, licensing agreements, and acquisitions play a key role in building broader portfolios and ensuring global reach. Firms also prioritize patient support programs, pricing strategies, and regional expansion to improve accessibility. Growing investment in research and healthcare infrastructure continues to fuel competitive intensity, creating opportunities for differentiation through advanced, targeted solutions.

Recent Developments

- In 2025, Gene therapy and CRISPR-Cas9 genome editing emerge as the most promising treatment innovations for sickle cell disease, led by companies like CRISPR Therapeutics and bluebird bio Inc. Ongoing clinical trials and regulatory momentum are rapidly advancing curative therapies that address the genetic root of SCD instead of only managing symptoms.

- In April 2023, Bluebird Bio submitted a Biologics License Application (BLA) to the U.S. FDA for its gene therapy drug, lovotibeglogene autotemcel (lovo-cel), for the treatment of Sickle Cell Disease (SCD) in patients.

- In April 2023, Editas Medicine, Inc. announced that the U.S. Food and Drug Administration (FDA) granted Orphan Drug Designation to their gene-editing medicine, EDIT-301, for the treatment of sickle cell disease (SCD).

- In March 2023, AddMedica partnered with Abacus Medicine Pharma Services for the distribution of Siklos (hydroxyurea) in Belgium, the Netherlands, and Luxembourg. The therapy is indicated for patients aged 2 years and above.

Report Coverage

The research report offers an in-depth analysis based on Treatment, Therapeutic Area, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising adoption of gene therapies.

- Research in stem cell treatments will create long-term curative options.

- Drug innovation will continue to reduce hospitalization and crisis frequency.

- Governments will support wider screening and early detection programs.

- Patient awareness campaigns will increase treatment adoption across regions.

- Partnerships between biotech firms and research institutes will accelerate breakthroughs.

- Digital health tools will enhance disease monitoring and patient management.

- Access programs will improve availability of advanced drugs in emerging markets.

- Regulatory bodies will fast-track approvals for novel therapies.

- Growing healthcare investments will strengthen infrastructure for specialized treatments.