Market Overview

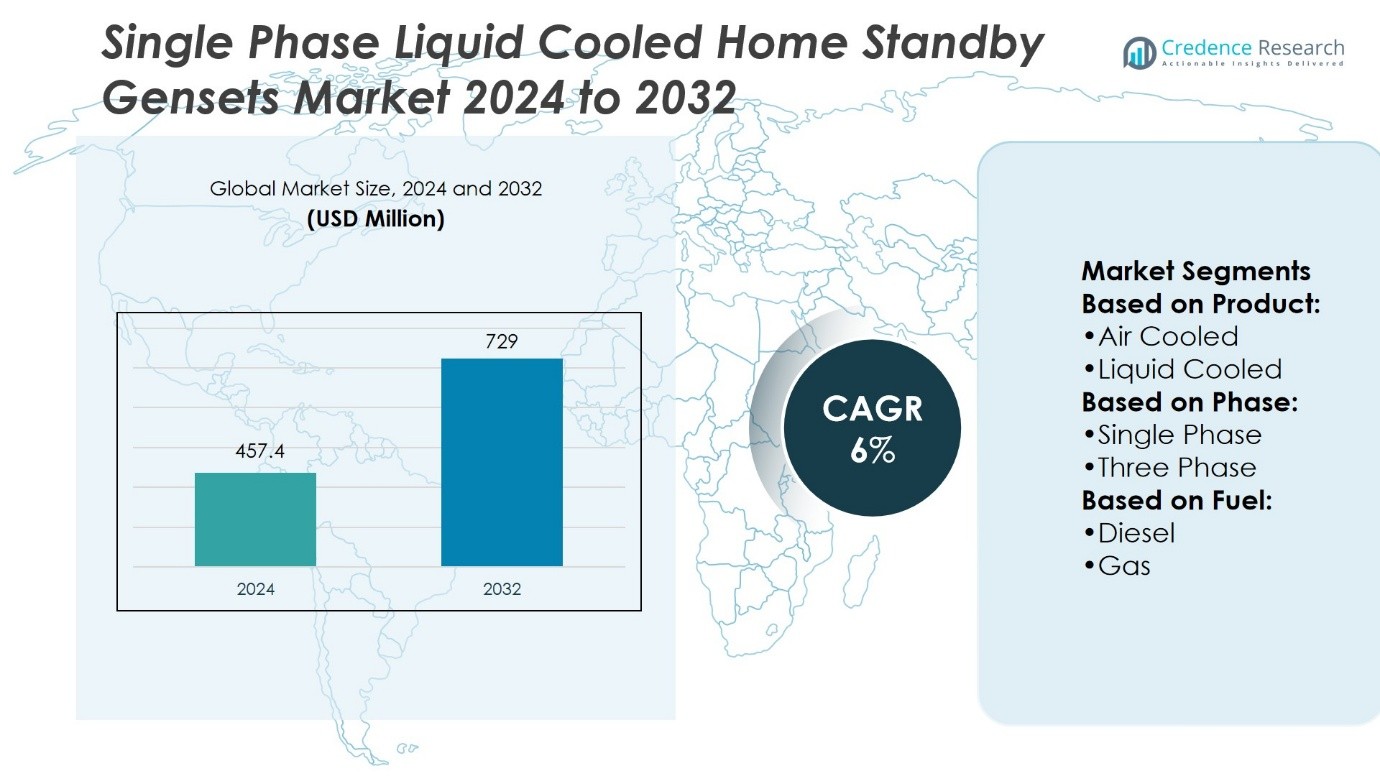

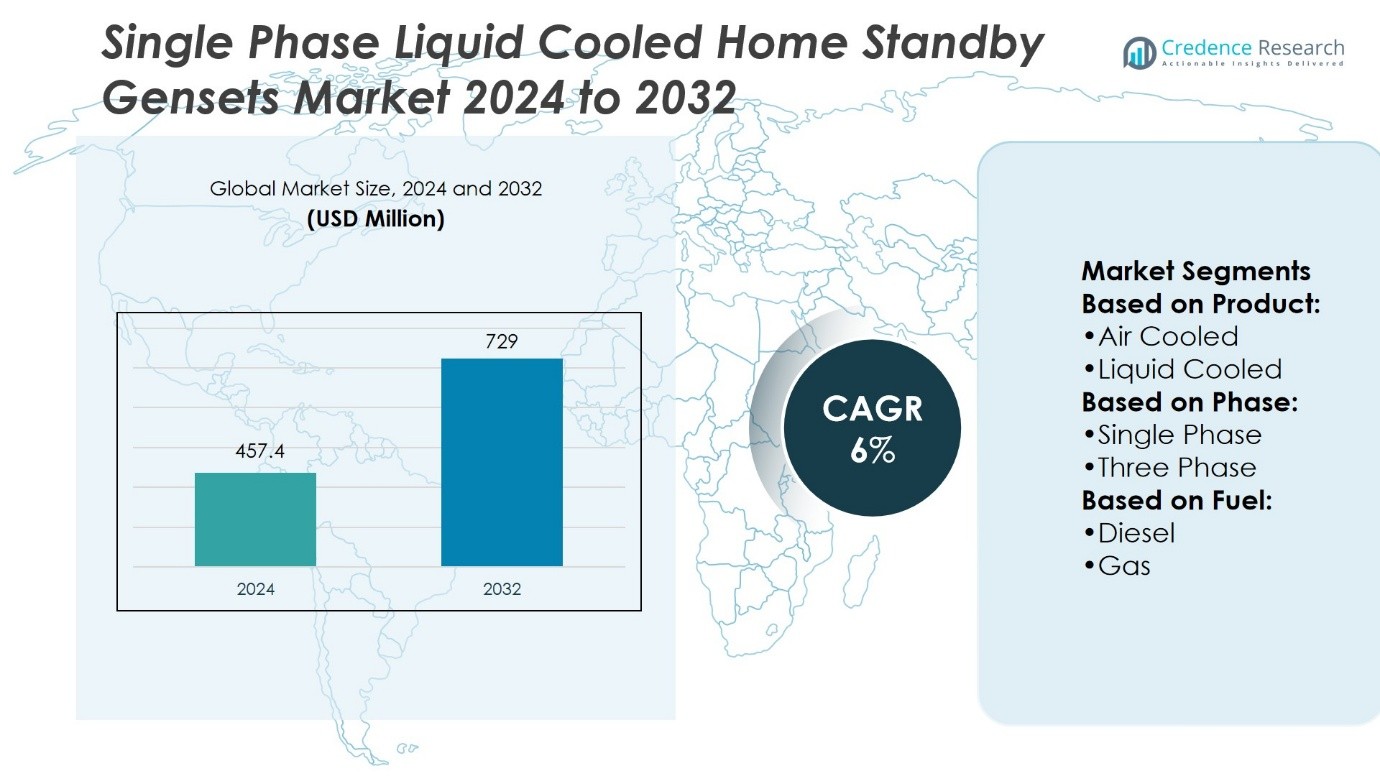

Single-Phase Liquid Cooled Home Standby Gensets Market was valued at USD 457.4 million in 2024 and is anticipated to reach USD 729 million by 2032, at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Single-Phase Liquid Cooled Home Standby Gensets Market Size 2024 |

USD 457.4 Million |

| Single-Phase Liquid Cooled Home Standby Gensets Market, CAGR |

6% |

| Single-Phase Liquid Cooled Home Standby Gensets Market Size 2032 |

USD 729 Million |

The Single-Phase Liquid Cooled Home Standby Gensets Market grows through strong drivers such as rising demand for reliable residential backup power, increasing grid instability, and heightened vulnerability to extreme weather events. It gains support from technological advancements in liquid-cooled designs that deliver quieter, longer, and more efficient performance. The market also reflects key trends including integration with smart monitoring systems, adoption of cleaner fuels like natural gas and propane, and focus on compact designs suited for modern homes. Together, these factors shape a competitive landscape defined by innovation, sustainability, and the pursuit of resilient household energy solutions.

The Single-Phase Liquid Cooled Home Standby Gensets Market shows strong geographical presence across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with North America leading due to frequent outages and advanced infrastructure. Europe emphasizes eco-friendly compliance, while Asia Pacific grows rapidly with urbanization and energy demand. Latin America and MEA provide emerging opportunities through grid limitations. Key players include Generac Power Systems, Cummins, Caterpillar, Briggs and Stratton, Eaton, HIMOINSA, Champion Power Equipment, Gillette Generators, Ashok Leyland, and Echo Group.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Single-Phase Liquid Cooled Home Standby Gensets Market was valued at USD 457.4 million in 2024 and is projected to reach USD 729 million by 2032, at a CAGR of 6%.

- Rising demand for reliable residential backup power, grid instability, and extreme weather events drive market growth.

- Integration with smart monitoring systems, adoption of natural gas and propane fuels, and compact designs define emerging trends.

- Competition is shaped by product innovation, fuel efficiency, quieter operation, and strong after-sales service networks.

- High installation costs, technical complexity, and regulatory compliance on emissions and noise act as restraints.

- North America leads the market share, Europe emphasizes eco-friendly compliance, and Asia Pacific grows rapidly with urbanization.

- Latin America and the Middle East & Africa provide emerging opportunities, while global players strengthen presence through innovation and expanded distribution networks.

Market Drivers

Rising Demand for Reliable Backup Power Solutions in Residential Areas

The Single-Phase Liquid Cooled Home Standby Gensets Market advances due to growing dependence on uninterrupted power in residential communities. Frequent power disruptions caused by aging grids and severe weather events heighten the need for reliable systems. Homeowners value gensets that automatically restore power without delay. The liquid cooling mechanism ensures longer operating cycles and lower maintenance needs compared to air-cooled alternatives. It secures energy resilience for homes that rely on sensitive electronic devices and essential medical equipment. This factor positions gensets as a practical investment for households in power-sensitive regions.

- For instance, HIMOINSA announced in 2022 that it had surpassed the milestone of manufacturing over 1.1 million generator sets globally, including a significant share of liquid-cooled models designed for residential and commercial standby applications.

Growing Integration with Smart Energy Management Systems

Integration of gensets with home automation and smart monitoring platforms strengthens market adoption. Consumers seek systems that can be remotely tracked and controlled through connected devices. It allows households to optimize power use and monitor fuel efficiency in real time. Manufacturers invest in intelligent controllers that align with modern energy management standards. These features enhance user convenience and long-term cost efficiency. The trend reflects rising expectations for connected, automated, and energy-conscious residential solutions.

- For instance, Cummins reported in 2021 that more than 1.5 million of its connected devices and gensets worldwide were actively linked through its PowerCommand Cloud™ and RemoteConnect platforms, enabling real-time monitoring, diagnostics, and fuel efficiency optimization for residential and commercial users.

Expanding Infrastructure for Cleaner and Fuel-Efficient Power Generation

The market benefits from advancements in fuel efficiency and cleaner combustion technologies. Manufacturers develop gensets that meet stringent emission norms while delivering reliable performance. It creates opportunities for adoption in regions where environmental regulations influence consumer choice. Liquid cooling enables engines to operate at stable temperatures, reducing wear and extending equipment life. Companies invest in natural gas and propane models that address sustainability demands. This progress builds confidence in gensets as dependable, compliant, and efficient systems.

Increasing Vulnerability to Extreme Weather and Climate Events

Heightened vulnerability to hurricanes, storms, and heat waves accelerates demand for standby power. Homeowners invest in gensets to secure uninterrupted energy during prolonged outages. It supports essential household operations, from heating and cooling to water supply systems. Liquid-cooled models are preferred for their ability to operate continuously under heavy load conditions. Energy resilience becomes a critical factor for households in climate-sensitive regions. This driver ensures consistent momentum for the market in both developed and emerging geographies.

Market Trends

Rising Focus on Smart Connectivity and Remote Monitoring Features

The Single-Phase Liquid Cooled Home Standby Gensets Market highlights a steady shift toward intelligent monitoring capabilities. Consumers demand systems that integrate seamlessly with smartphones and home networks. It supports real-time alerts on performance, fuel levels, and maintenance requirements. Manufacturers invest in cloud-based platforms that enable remote control and diagnostics. Smart connectivity ensures operational reliability while enhancing convenience for households. This trend reflects the broader movement toward digital and automated residential power systems.

- For instance, Generac reported in 2022 that over 2 million of its home standby generators were equipped with Wi-Fi and Mobile Link™ remote monitoring, enabling homeowners to track generator status, maintenance needs, and performance directly from connected devices.

Increasing Preference for Cleaner Fuels and Eco-Friendly Models

Environmental considerations influence product development across the market. Consumers show strong interest in gensets powered by natural gas and propane due to lower emissions. It encourages manufacturers to diversify portfolios with eco-friendly models that meet strict environmental norms. Liquid cooling supports cleaner combustion by stabilizing engine temperatures under continuous use. The focus on sustainable energy practices drives innovation in design and fuel choice. This direction positions gensets as reliable solutions aligned with environmental responsibility.

- For instance, Caterpillar announced in 2021 that it had delivered more than 4 million natural gas and propane-powered generator sets globally, reinforcing its commitment to expanding low-emission solutions in residential and commercial standby power markets.

Advancements in Noise Reduction and Compact System Design

Quiet operation emerges as a key differentiator for residential adoption. Homeowners prefer gensets that operate with minimal disturbance in densely populated neighborhoods. It pushes manufacturers to invest in advanced mufflers, acoustic enclosures, and vibration control. Compact liquid-cooled units also appeal to consumers with limited installation space. The combination of low noise levels and efficient cooling enhances household comfort. This trend strengthens the appeal of gensets in both suburban and urban housing markets.

Expansion of Distribution Networks and After-Sales Service Infrastructure

Wider distribution networks enhance product accessibility across diverse regions. Companies expand partnerships with local dealers and service providers to improve customer reach. It ensures timely availability of spare parts and reliable maintenance support. Manufacturers recognize that after-sales service influences long-term consumer confidence. The focus on strong service networks builds loyalty and repeat purchases. This trend reinforces the strategic importance of customer-centric models in sustaining market growth.

Market Challenges Analysis

High Installation Costs and Technical Complexity Limit Broader Adoption

The Single-Phase Liquid Cooled Home Standby Gensets Market faces challenges linked to the high cost of acquisition and installation. Liquid-cooled models require specialized setup that involves professional technicians, reinforced foundations, and integration with existing electrical systems. It creates a financial burden for households, particularly in cost-sensitive regions. Maintenance expenses further add to long-term ownership challenges. The technical complexity also reduces adoption among homeowners unfamiliar with advanced energy systems. This barrier limits rapid expansion despite strong demand for reliable power solutions.

Regulatory Compliance and Supply Chain Volatility Affect Market Stability

Strict regulatory frameworks on emissions and noise control create operational difficulties for manufacturers. It requires continuous investment in research and redesign to align products with evolving standards. Global supply chain disruptions contribute to inconsistent availability of engines, cooling systems, and electronic controllers. Rising raw material costs for metals and components place pressure on profit margins. Companies must balance innovation with compliance and cost management. This combination of regulatory hurdles and supply uncertainties challenges sustained growth and competitiveness in the market.

Market Opportunities

Growing Potential in Residential Energy Resilience and Grid Modernization

The Single-Phase Liquid Cooled Home Standby Gensets Market presents strong opportunities in regions facing frequent grid instability and aging infrastructure. Homeowners seek solutions that secure uninterrupted energy for critical appliances and digital systems. It creates room for manufacturers to design gensets tailored for urban and semi-urban households where outages disrupt daily activities. Integration with home energy storage and solar panels expands the appeal of these systems. Demand rises in areas investing in smart grid projects, where gensets support distributed power resilience. This convergence of residential resilience and infrastructure modernization strengthens long-term growth potential.

Expanding Reach in Emerging Economies and Service-Based Business Models

Emerging economies offer new opportunities driven by rapid urbanization and rising disposable incomes. Households in developing markets prioritize reliable power backup to safeguard modern living standards. It positions gensets as a preferred choice where grid access is limited or unreliable. Service-based models, including rental and maintenance packages, create an avenue for companies to expand their customer base. Partnerships with local distributors and installers enhance accessibility across new regions. This expansion builds opportunities for sustained adoption and broader market penetration.

Market Segmentation Analysis:

By Product

The market divides into air-cooled and liquid-cooled gensets, with each type catering to distinct residential needs. Air-cooled gensets attract households seeking cost-effective and compact backup power solutions. Liquid-cooled gensets dominate in high-demand households where extended operation and reduced noise levels are critical. It demonstrates superior durability under heavy load conditions and appeals to users requiring long-duration performance. The adoption of liquid-cooled units increases where premium home energy resilience becomes a priority.

- For instance, Generac’s Guardian Series 22 kW natural gas standby generator records a fuel consumption of 6.9 m³/hr at half load and 12.9 m³/hr at full load while meeting U.S. EPA emission standards.

By Phase

The market segments into Single-Phase and three phase gensets. The Single-Phase Liquid Cooled Home Standby Gensets Market secures growth among residential buyers who depend on reliable backup for essential appliances. It supports steady operation of lighting, cooling, and digital systems within standard home electrical layouts. Three phase gensets find demand in larger properties and small commercial facilities requiring higher load management. Their broader capacity supports advanced residential complexes and multi-unit buildings. This division ensures coverage of diverse end-user requirements across both household and light commercial settings.

- For instance, Kirloskar iGreen 15 kVA single-phase air-cooled genset for homes delivers a rated output of 12 kW with fuel consumption of 3.8 liters per hour at 75% load, equipped with a remote monitoring system for urban households.

By Fuel

The market divides into diesel and gas gensets, each offering specific operational benefits. Diesel gensets continue to attract users where fuel availability and reliability outweigh emission considerations. It delivers strong performance in remote locations and areas with inconsistent grid infrastructure. Gas gensets grow in adoption due to cleaner combustion and compliance with environmental standards. They appeal to homeowners integrating gensets with natural gas pipelines or propane storage. The shift toward gas-powered models reflects a broader preference for sustainable, low-emission solutions in residential power generation.

Segments:

Based on Product:

Based on Phase:

Based on Fuel:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the largest share of the Single-Phase Liquid Cooled Home Standby Gensets Market, accounting for around 36% of the total market share. The region benefits from frequent power outages caused by severe weather conditions, aging grid infrastructure, and rising electricity demand. The United States dominates the regional landscape, with strong adoption among suburban households seeking uninterrupted power for heating, cooling, and digital devices. Canada contributes through rising investments in residential backup systems in rural areas. Manufacturers expand their dealer networks and after-sales service capabilities to support long-term growth. The focus on reliability and comfort positions North America as a critical hub for residential standby power solutions.

Europe

Europe captures nearly 24% of the market share, driven by advanced residential infrastructure and stringent regulatory frameworks. Homeowners adopt liquid-cooled gensets to comply with noise and emission standards, while also ensuring uninterrupted power supply. Germany, the United Kingdom, and France lead the regional demand, supported by modernization of housing systems and growing energy-conscious consumer bases. It secures growth through alignment with eco-friendly practices and integration with smart energy systems. Eastern European countries also increase adoption in response to grid instability and rising household energy needs. The region remains attractive for manufacturers developing compact, efficient, and compliant gensets for high-density residential areas.

Asia Pacific

Asia Pacific holds a significant 28% of the global market share, with rapid urbanization and infrastructure expansion driving demand. Countries such as China, India, and Japan lead in residential genset installations as households face unstable power supply and frequent grid failures. It gains traction in suburban and rural markets where electricity infrastructure is underdeveloped. Rising disposable incomes and adoption of smart home solutions expand opportunities for premium gensets. Liquid-cooled models capture preference due to their durability and suitability for continuous operation under high loads. This region’s growth trajectory reflects increasing household investments in energy resilience.

Latin America

Latin America accounts for nearly 7% of the total market share, reflecting gradual adoption across residential communities. Brazil and Mexico dominate regional demand, supported by power outages during peak consumption seasons and natural events. It finds applications in middle- and high-income households prioritizing uninterrupted power for essential systems. Expansion of distribution networks enhances availability and affordability of standby gensets in emerging urban markets. Service-based models, including rental offerings, also support wider adoption. Latin America remains a developing but important region for future expansion of residential gensets.

Middle East and Africa

The Middle East and Africa represent around 5% of the market share, with growth driven by increasing household reliance on backup systems in areas with inconsistent grid infrastructure. Countries in the Gulf Cooperation Council, including Saudi Arabia and the United Arab Emirates, adopt gensets to ensure energy resilience during peak demand seasons. South Africa leads within the African sub-region, where power shortages encourage widespread household adoption. It benefits from ongoing investments in residential infrastructure and premium housing projects. Rising urbanization and expanding energy needs ensure steady opportunities for market players in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Echo Group

- Ashok Leyland

- Generac Power Systems

- HIMOINSA

- Eaton

- Briggs and Stratton

- Champion Power Equipment

- Caterpillar

- Cummins

- Gillette Generators

Competitive Analysis

The Single-Phase Liquid Cooled Home Standby Gensets Market players such as Echo Group, Ashok Leyland, Generac Power Systems, HIMOINSA, Eaton, Briggs and Stratton, Champion Power Equipment, Caterpillar, Cummins, and Gillette Generators. The Single-Phase Liquid Cooled Home Standby Gensets Market demonstrates intense competition driven by technological innovation, product reliability, and service differentiation. Manufacturers focus on developing gensets that offer superior fuel efficiency, reduced noise levels, and seamless integration with smart energy management systems. Companies strengthen their presence through extensive dealer networks, responsive after-sales service, and localized production strategies. Competition extends to the adoption of eco-friendly fuels such as natural gas and propane, aligning with global emission standards. Firms also emphasize compact designs and remote monitoring features to cater to residential consumers who prioritize convenience and resilience. Strategic investments in digital platforms, research facilities, and regional expansion further define the competitive landscape, ensuring continuous advancement and customer loyalty.

Recent Developments

- In January 2025, Generac Power Systems expanded its home standby generator lineup introducing a 28kW model, the most powerful air-cooled home standby generator on the market, with features for seamless integration with smart thermostats and battery systems, enhancing smart home energy management.

- In September 2024, Kohler’s assembly plant in Hattiesburg is among industry leaders in producing reliable standby generators which help keep homes and small businesses powered during storms. The plant also specializes in air cooled and water-cooled units which are designed to operate on propane or natural gas. These generators make reliable backup power solutions.

- In May 2024, Briggs & Stratton has launched the 26 kW Power Protect Home Standby Generator which integrates sophisticated motor starting capabilities and comes with an industry leading warranty. Additionally, the generator boasts dual fuel capability of natural gas and liquid propane.

- In March 2024, Cummins and Sudhir Power have successfully participated in a major roadshow in Rajasthan where the CPCB IV compliant technology of their gensets was on display. The campaign sought to foster a new brand for the products’ generators which included enhanced operational efficiency, reliability, and compliance with emission regulations.

Market Concentration & Characteristics

The Single-Phase Liquid Cooled Home Standby Gensets Market reflects moderate concentration with a mix of global leaders and regional manufacturers competing across residential segments. It is defined by the dominance of established companies that leverage strong distribution networks, brand recognition, and advanced product portfolios. The market favors players with proven expertise in liquid-cooled technology, reliable after-sales support, and integration with smart energy systems. It emphasizes durability, fuel efficiency, and compliance with stringent emission and noise regulations, which shape both design and adoption. Product differentiation is often achieved through digital monitoring features, compact installation formats, and enhanced service models. Competition remains steady as smaller manufacturers address localized demand with cost-effective offerings, while larger firms invest in innovation and capacity expansion. It maintains a balance between global scale and regional specialization, ensuring continuous evolution in product performance and consumer expectations.

Report Coverage

The research report offers an in-depth analysis based on Product, Phase, Fuel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as households seek reliable backup solutions for frequent grid failures.

- Manufacturers will invest in advanced liquid-cooled designs that extend operating life.

- Integration with smart energy management systems will enhance monitoring and efficiency.

- Adoption of natural gas and propane models will expand due to cleaner fuel preferences.

- Compact and quiet genset models will gain traction in urban and suburban housing.

- Regulatory standards on emissions and noise will push continuous innovation in design.

- Emerging economies will create strong opportunities through rising urbanization and infrastructure gaps.

- Service-based models including rental and maintenance packages will attract wider consumer bases.

- Digital platforms will support remote control, predictive maintenance, and fuel optimization.

- Competitive intensity will increase as global and regional players expand product portfolios.