| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Energy Storage Market Size 2024 |

USD 10,590.42 million |

| Smart Energy Storage Market, CAGR |

11..36% |

| Smart Energy Storage Market Size 2032 |

USD 26,575.40 million |

Market Overview

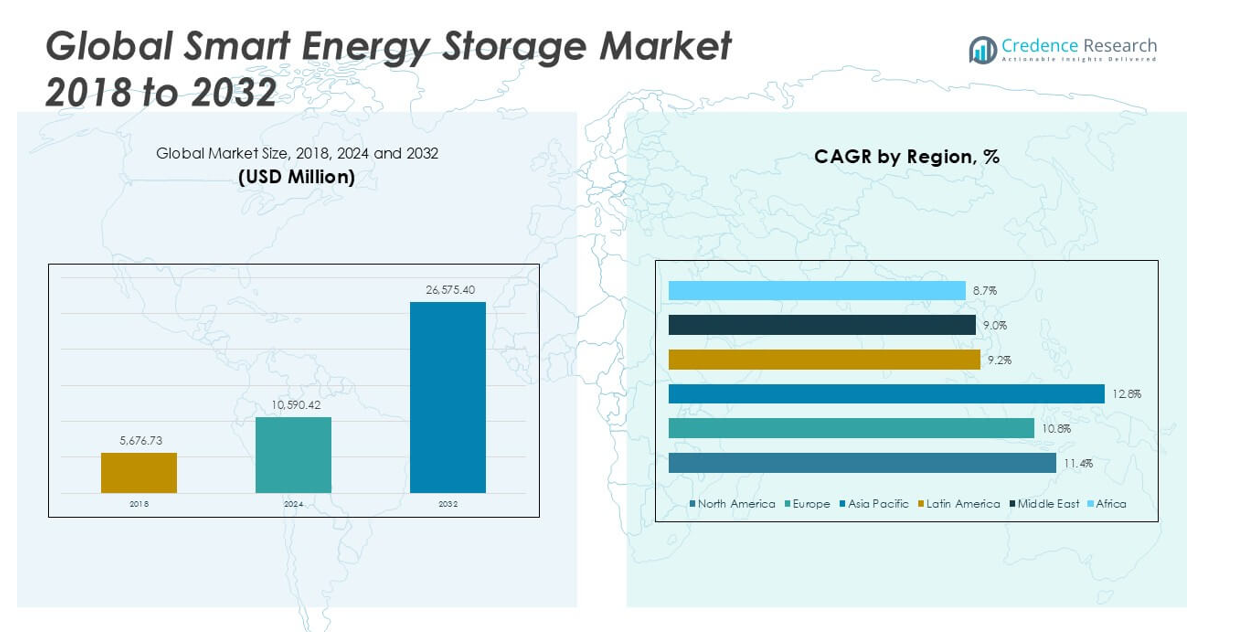

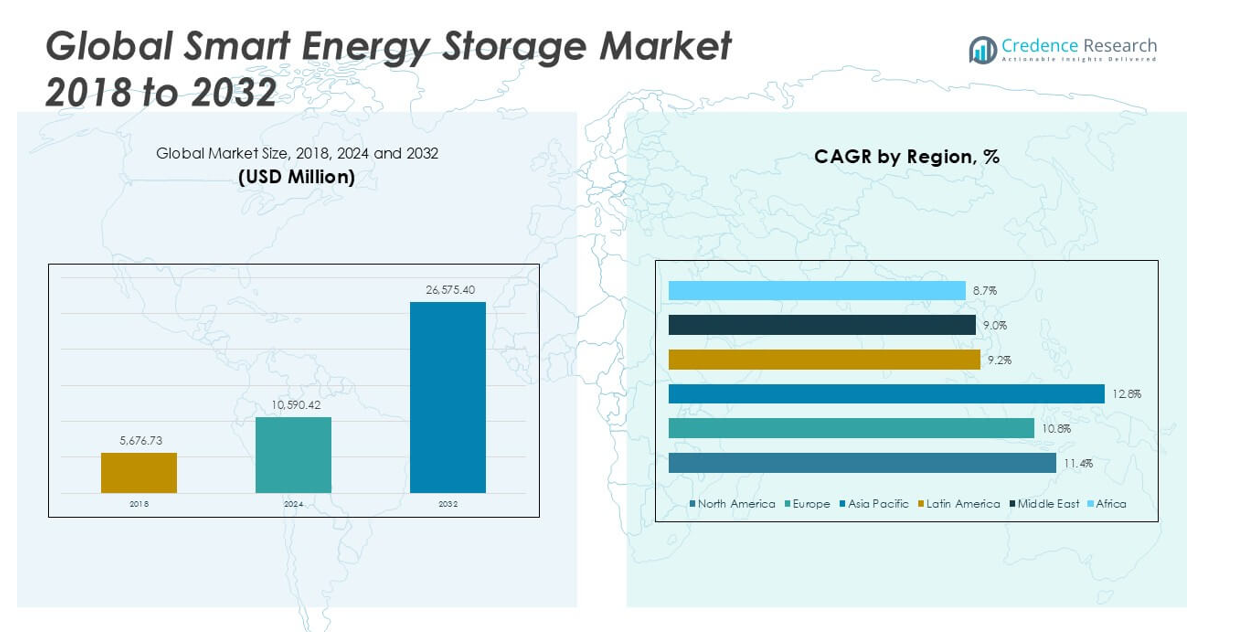

The Smart Energy Storage Market was valued at USD 5,676.73 million in 2018 and increased to USD 10,590.42 million in 2024. It is anticipated to reach USD 26,575.40 million by 2032, reflecting a compound annual growth rate (CAGR) of 11.36% during the forecast period.

The Smart Energy Storage Market is experiencing robust growth due to the rising integration of renewable energy sources, increasing demand for grid stability, and growing focus on energy efficiency. Advanced storage technologies, such as lithium-ion and flow batteries, enable utilities and businesses to balance supply and demand more effectively, support peak load management, and ensure uninterrupted power during outages. Regulatory support for clean energy initiatives and the proliferation of smart grids further accelerate market expansion. Technological advancements are driving down storage costs, improving system performance, and enabling wider adoption across residential, commercial, and industrial sectors. Real-time monitoring, automation, and predictive analytics are transforming energy management strategies, making storage systems more efficient and reliable. The ongoing shift toward decentralized energy infrastructure and the need to reduce carbon emissions continue to stimulate innovation, positioning smart energy storage as a critical component in modernizing power systems and achieving sustainability goals.

The Smart Energy Storage Market demonstrates dynamic growth across key regions, with North America, Europe, and Asia Pacific leading in terms of technology adoption and deployment scale. Countries such as the United States, Germany, China, and Japan drive advancements through supportive policies, substantial investments, and a strong focus on renewable integration. The market sees robust expansion in urban areas with high energy demand, while emerging economies increase adoption to support electrification and grid modernization. Key players shaping the competitive landscape include Tesla, Inc., LG Chem Ltd., and Samsung SDI Co., Ltd., all recognized for their technological innovation and large-scale storage projects. Companies like BYD Company Limited and Panasonic Corporation also play significant roles, bringing advanced battery technologies and integrated solutions to both utility and distributed energy segments. Their continued focus on research and global partnerships accelerates the evolution of smart energy storage solutions worldwide.

Market Insights

- The Smart Energy Storage Market was valued at USD 5,676.73 million in 2018, reached USD 10,590.42 million in 2024, and is projected to hit USD 26,575.40 million by 2032, reflecting a CAGR of 11.36%.

- Rising adoption of renewable energy sources and the need for grid stability are primary drivers, pushing investments in advanced storage solutions across residential, commercial, and utility segments.

- Market trends highlight the rapid evolution of lithium-ion and flow battery technologies, the integration of artificial intelligence for energy management, and the expansion of decentralized energy systems.

- Key players such as Tesla, LG Chem, Samsung SDI, and BYD Company Limited focus on technological innovation, large-scale projects, and global partnerships to strengthen their market position.

- High initial investment, complex integration processes, and supply chain constraints for raw materials pose notable challenges, impacting the speed of deployment and project viability.

- North America, Europe, and Asia Pacific lead regional growth, with strong policy support, aggressive renewable energy targets, and significant investments in grid modernization; China, the US, and Germany drive the majority of global installations.

- Competitive dynamics are shaped by strategic collaborations, advancements in battery performance, and efforts to create more sustainable, cost-effective storage solutions tailored for diverse energy needs

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Integration of Renewable Energy Sources Fuels Demand

The increasing integration of renewable energy sources, such as solar and wind, drives the need for advanced energy storage solutions. Variability in renewable generation creates a critical need for systems that can store excess energy and release it during periods of low production. The Smart Energy Storage Market benefits from utilities and governments promoting clean energy adoption to meet climate goals. Storage systems support grid reliability by compensating for fluctuations and enabling higher renewable penetration. Investments in grid modernization projects are encouraging the adoption of smart storage technologies. Regulatory incentives and mandates for renewable integration reinforce the market’s momentum. It enables utilities to address intermittency challenges and deliver consistent energy supply.

- For instance, Tesla’s Hornsdale Power Reserve in South Australia delivered grid services with a battery capacity of 150 megawatt-hours, stabilizing the regional power network and significantly reducing response times to power fluctuations.

Grid Stability and Peak Load Management as Key Drivers

Grid operators face rising pressure to maintain stability and reliability amid growing energy consumption and diverse generation sources. Smart energy storage systems provide a critical solution by absorbing surplus energy during off-peak times and discharging it when demand spikes. The Smart Energy Storage Market expands as utilities deploy these systems to manage peak loads, minimize transmission losses, and prevent outages. Energy storage plays an essential role in balancing supply and demand in real time, which supports operational efficiency and grid health. Investments in large-scale battery projects help utilities optimize infrastructure without major expansions. It delivers cost savings and enhances the resilience of modern power networks.

- For instance, LG Chem supplied battery storage for Southern California Edison’s Mira Loma facility, providing a system with a rated output of 20 megawatts to help manage grid peak demand and reduce strain during high usage periods.

Technological Advancements and Falling Storage Costs Accelerate Adoption

Continuous innovation in battery chemistries and energy management software underpins the rapid growth of the Smart Energy Storage Market. Advances in lithium-ion, flow, and solid-state batteries have improved energy density, cycle life, and safety. Falling costs make these technologies increasingly attractive for utilities, commercial entities, and residential users. Enhanced monitoring and automation capabilities empower users to optimize energy usage and respond to grid signals efficiently. The development of scalable solutions supports diverse applications, from microgrids to utility-scale projects. It encourages broader deployment and integration into smart infrastructure.

Decentralized Energy Models and Sustainability Goals Drive Growth

The transition toward decentralized energy models strengthens demand for flexible storage systems. Consumers and businesses seek greater energy independence through distributed storage and behind-the-meter solutions. The Smart Energy Storage Market responds to this trend by enabling real-time energy management, demand response, and participation in local energy markets. Sustainability targets and regulatory frameworks stimulate investments in low-carbon technologies. The ability to reduce reliance on fossil fuels and lower greenhouse gas emissions makes smart storage vital for future energy landscapes. It supports global efforts to modernize grids and achieve ambitious climate objectives.

Market Trends

Adoption of Advanced Battery Technologies Sets New Standards

The adoption of advanced battery technologies marks a significant trend in the Smart Energy Storage Market. Innovations in lithium-ion, flow, and solid-state batteries are improving performance, safety, and energy density. These advancements enable longer operational lifespans and support rapid scaling of both residential and utility-scale projects. Energy storage providers focus on reducing maintenance needs and enhancing the durability of their systems. The ability to deploy modular and flexible battery solutions allows adaptation to evolving energy demands. It strengthens the market’s capacity to support both grid-connected and off-grid applications.

- For instance, Samsung SDI’s lithium-ion battery modules support over 5,000 charge-discharge cycles, enabling their use in both residential and industrial settings with improved safety features and reduced maintenance intervals.

Integration of Artificial Intelligence and Data Analytics Enhances System Efficiency

Smart energy storage solutions increasingly incorporate artificial intelligence (AI) and advanced data analytics to optimize energy usage. AI-driven platforms deliver predictive maintenance, real-time monitoring, and automated demand response capabilities. The Smart Energy Storage Market benefits from the ability to analyze large datasets, forecast consumption patterns, and adapt charging and discharging schedules. This trend leads to more efficient energy management and lowers operational costs for users. The growing use of software platforms also supports interoperability with smart grid infrastructure. It drives the shift toward intelligent, self-optimizing storage networks.

- For instance, Siemens’ SIESTORAGE system integrates AI-based analytics to forecast load and adjust storage parameters, achieving a reduction in operating costs and improved grid balancing during peak usage.

Expansion of Decentralized and Behind-the-Meter Solutions

The market is witnessing a rise in decentralized and behind-the-meter storage deployments, allowing consumers and businesses to manage energy use locally. This trend supports energy independence and resilience, especially in regions with unreliable grids. Distributed storage systems enable participation in demand response programs and peer-to-peer energy trading. The Smart Energy Storage Market evolves to address these emerging needs by offering scalable solutions tailored for homes, commercial buildings, and microgrids. Utilities and service providers are building new business models around decentralized storage. It creates opportunities for greater flexibility and localized energy optimization.

Focus on Sustainability and Circular Economy Principles

A growing emphasis on sustainability shapes product development and deployment strategies in the Smart Energy Storage Market. Companies are adopting circular economy principles by prioritizing battery recycling, repurposing, and eco-friendly materials. This trend addresses environmental concerns and enhances the value proposition for end-users. Manufacturers invest in low-impact production processes and end-of-life management systems to reduce waste. Regulatory initiatives reinforce the importance of sustainable practices throughout the storage value chain. It aligns the industry with global climate commitments and consumer expectations for responsible technology.

Market Challenges Analysis

High Initial Investment and Complex Integration Requirements Impede Growth

The Smart Energy Storage Market faces significant challenges from high upfront costs and complex integration processes. Developing and deploying advanced storage systems often requires substantial capital, deterring small-scale players and budget-conscious utilities. Compatibility issues with existing grid infrastructure and legacy systems increase installation complexity and extend project timelines. Regulatory uncertainties and permitting delays create obstacles for new projects. Specialized technical expertise is necessary for optimal deployment and ongoing maintenance, which limits market accessibility in less developed regions. It must overcome these barriers to unlock widespread adoption and achieve its growth potential.

Concerns Over Raw Material Supply and Environmental Impact

Securing a stable supply of critical raw materials, such as lithium, cobalt, and nickel, presents a persistent challenge for the Smart Energy Storage Market. Fluctuations in material prices and risks of supply chain disruption threaten long-term sustainability and cost-effectiveness. Environmental concerns related to battery manufacturing, recycling, and disposal create public scrutiny and regulatory pressures. Insufficient recycling infrastructure and unclear standards for end-of-life management can result in environmental harm and reputational risks for stakeholders. It must address these challenges to maintain credibility and support future expansion across global markets.

Market Opportunities

Expansion of Decentralized Energy Systems Creates New Revenue Streams

The global shift toward decentralized energy production offers substantial opportunities for the Smart Energy Storage Market. The growing adoption of distributed generation technologies, such as rooftop solar and local microgrids, increases the demand for flexible and scalable storage solutions. Consumers and businesses seek greater energy independence and resilience, which drives investments in behind-the-meter storage and virtual power plants. The market can capitalize on this trend by developing innovative products tailored for residential, commercial, and community-scale applications. It enables new service models, including energy sharing and peer-to-peer trading, which foster engagement and support recurring revenue streams. Strategic collaborations with utilities and technology providers further enhance market reach and value.

Advancements in Digital Technologies Accelerate Market Adoption

The integration of digital technologies such as artificial intelligence, machine learning, and real-time analytics presents significant growth opportunities for the Smart Energy Storage Market. Intelligent storage platforms allow users to optimize energy consumption, improve grid responsiveness, and lower operating costs through predictive maintenance and automated control systems. The increasing use of data-driven insights supports smarter decision-making and enables seamless interaction with evolving smart grid infrastructure. The market stands to benefit from ongoing innovation in software and hardware, which enhances system performance and user experience. It can leverage these advancements to support the transition to sustainable energy systems and address global energy management challenges.

Market Segmentation Analysis:

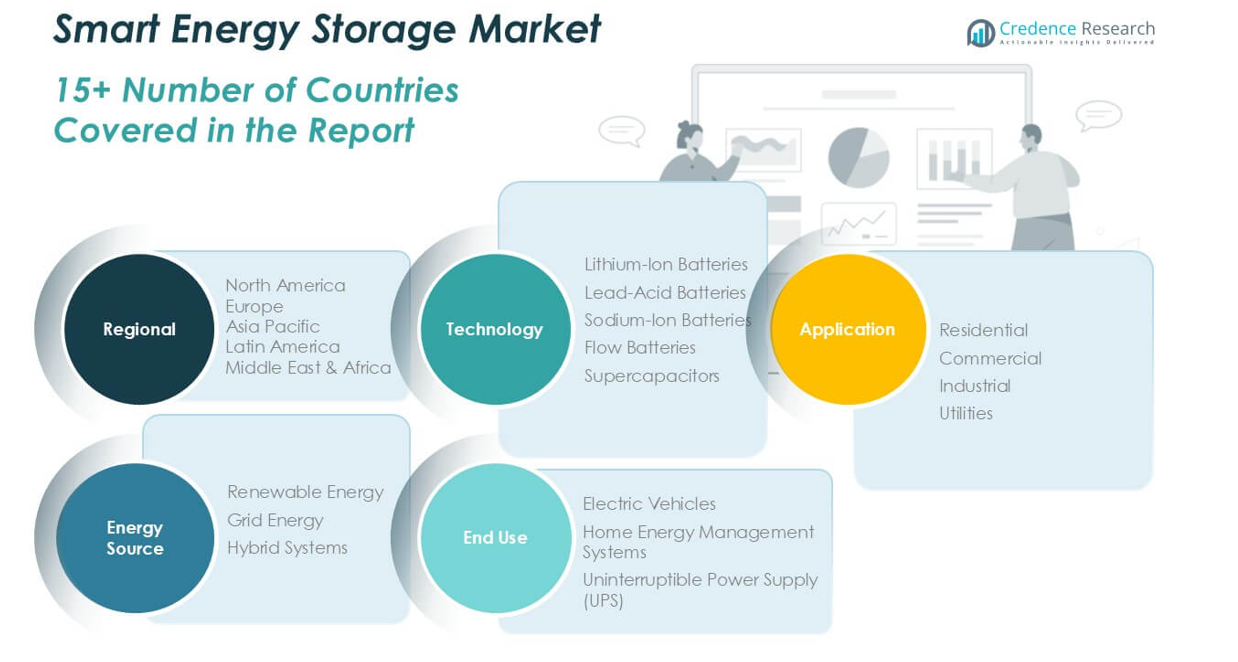

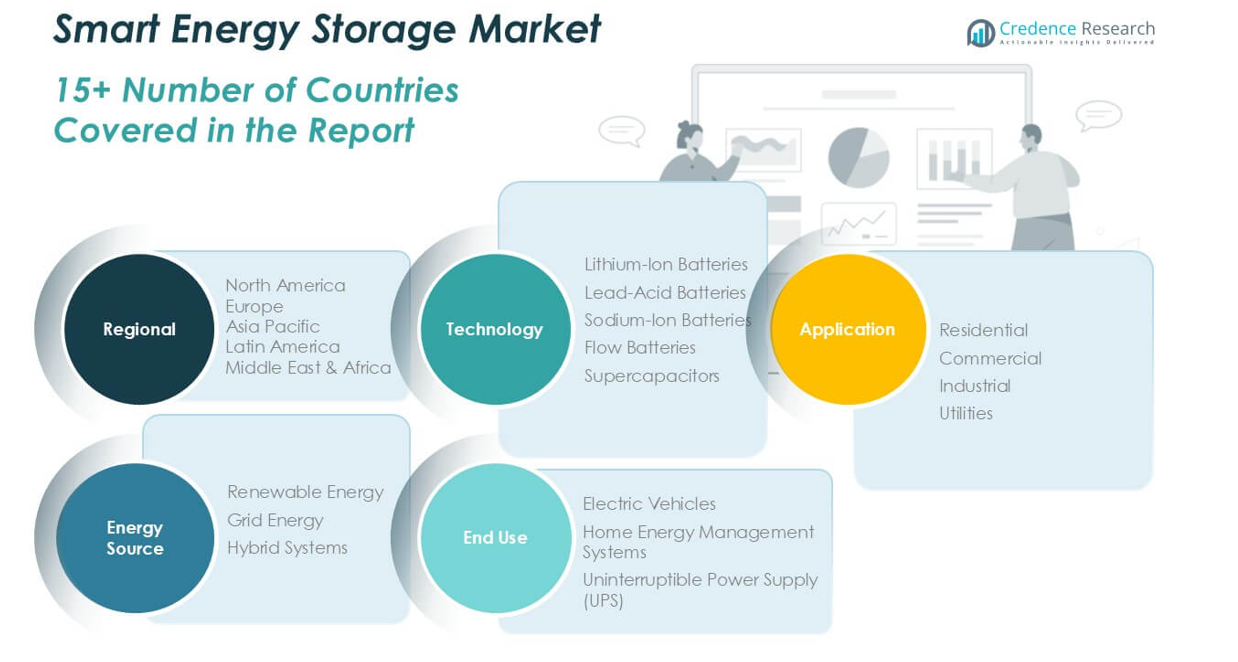

By Technology:

Lithium-ion batteries hold a leading position, supported by high energy density, reliability, and rapid innovation. These batteries dominate grid-scale projects and consumer electronics, benefitting from lower costs and longer lifespans. Lead-acid batteries maintain relevance in uninterruptible power supply systems and backup applications due to cost-effectiveness and established supply chains, though limited cycle life and performance constraints restrict wider adoption. Sodium-ion batteries gain traction as emerging alternatives, valued for sustainability and abundance of raw materials, which help reduce reliance on critical minerals. Flow batteries are increasingly chosen for large-scale and long-duration energy storage projects because of their scalability and flexibility. Supercapacitors serve niche applications where high power output and fast charge-discharge cycles are essential, such as grid stabilization and short-term backup.

- For instance, BYD’s lithium iron phosphate battery technology supports over 4,000 cycles, while Redflow’s zinc-bromine flow batteries operate continuously for multiple hours, providing scalable solutions for commercial energy storage.

By Application:

The Smart Energy Storage Market serves diverse end users including residential, commercial, industrial, and utilities. The residential segment sees rising adoption of storage systems paired with rooftop solar, enabling consumers to optimize self-consumption and ensure backup power. Commercial facilities adopt smart storage to manage peak demand charges, support business continuity, and enhance sustainability initiatives. Industrial users deploy storage solutions for process optimization, load balancing, and power quality improvement, especially in energy-intensive operations. Utilities integrate smart storage to manage grid reliability, support renewable integration, and delay infrastructure upgrades, driving investments in both centralized and distributed storage projects.

- For instance, Panasonic’s Ever Volt residential storage system delivers up to 17.1 kilowatt-hours of usable capacity, supporting homes during grid outages, while Fluence Energy’s utility-scale systems manage hundreds of megawatts for real-time grid stabilization.

By Energy Source:

The market aligns with renewable energy, grid energy, and hybrid systems. Renewable energy storage remains the fastest growing segment, as countries expand solar and wind capacity and require reliable solutions for intermittent supply. Grid energy storage supports frequency regulation, peak load shifting, and emergency backup across centralized networks. Hybrid systems that combine renewable and conventional energy sources with advanced storage deliver flexibility, optimize energy use, and support microgrid development. The Smart Energy Storage Market leverages this segmentation to address diverse operational needs and regulatory environments, reinforcing its role in modernizing global power infrastructure.

Segments:

Based on Technology:

- Lithium-Ion Batteries

- Lead-Acid Batteries

- Sodium-Ion Batteries

- Flow Batteries

- Supercapacitors

Based on Application:

- Residential

- Commercial

- Industrial

- Utilities

Based on Energy Source:

- Renewable Energy

- Grid Energy

- Hybrid Systems

Based on End-Use:

- Electric Vehicles

- Home Energy Management Systems

- Uninterruptible Power Supply (UPS)

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Smart Energy Storage Market

North America Smart Energy Storage Market grew from USD 1,694.84 million in 2018 to USD 3,113.85 million in 2024 and is projected to reach USD 7,845.72 million by 2032, reflecting a compound annual growth rate (CAGR) of 11.4%. North America is holding a 30% market share. The United States leads regional adoption, supported by robust investments in renewable energy, grid modernization, and energy storage incentives. Canada and Mexico follow, driven by cross-border energy trade and expansion of distributed energy resources. Key states in the U.S., such as California and Texas, are at the forefront, prioritizing grid resilience and battery deployment.

Europe Smart Energy Storage Market

Europe Smart Energy Storage Market grew from USD 2,199.45 million in 2018 to USD 3,994.94 million in 2024 and is expected to reach USD 9,599.64 million by 2032, with a CAGR of 10.8%. Europe is holding a 36% market share. Germany, the UK, and France are leading markets, supported by aggressive climate policies, renewable integration, and demand for grid balancing solutions. EU directives and national subsidies accelerate technology deployment across member states. Energy storage plays a central role in supporting renewable targets and maintaining grid reliability during the energy transition.

Asia Pacific Smart Energy Storage Market

g Asia Pacific Smart Energy Storage Market rew from USD 1,302.56 million in 2018 to USD 2,600.91 million in 2024 and is forecasted to reach USD 7,261.22 million by 2032, registering the highest CAGR of 12.8%. Asia Pacific accounts for 27% of the global market share. China, Japan, South Korea, and India drive market growth, backed by government investments, expanding solar and wind capacity, and urbanization trends. China’s national storage policies and technology manufacturing base propel large-scale deployments, while Japan and South Korea invest in resilience and grid modernization.

Latin America Smart Energy Storage Market

Latin America Smart Energy Storage Market grew from USD 212.59 million in 2018 to USD 390.39 million in 2024 and is set to reach USD 837.20 million by 2032, at a CAGR of 9.2%. Latin America holds a 3% market share. Brazil, Chile, and Mexico lead in adopting smart storage solutions, leveraging abundant renewable resources and increasing investments in grid upgrades. Policy incentives and cross-border energy cooperation enhance market growth and promote integration of distributed storage in regional energy systems.

Middle East Smart Energy Storage Market

Middle East Smart Energy Storage Market grew from USD 161.54 million in 2018 to USD 275.88 million in 2024 and is projected to reach USD 585.97 million by 2032, with a CAGR of 9.0%. The Middle East contributes a 2% market share. The United Arab Emirates and Saudi Arabia drive deployments through investments in renewable mega-projects and pilot storage initiatives. The focus on energy diversification and sustainability goals is shaping the regional market, though grid-scale projects remain in early stages compared to other regions.

Africa Smart Energy Storage Market

Africa Smart Energy Storage Market grew from USD 105.75 million in 2018 to USD 214.45 million in 2024 and is expected to reach USD 445.64 million by 2032, showing a CAGR of 8.7%. Africa holds a 2% market share. South Africa and Egypt lead regional activities, supported by solar and wind integration, electrification goals, and development finance. Off-grid storage solutions and microgrid projects address rural electrification needs, while urban centers are gradually embracing grid-connected storage to improve power reliability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tesla, Inc.

- LG Chem Ltd.

- Samsung SDI Co., Ltd.

- BYD Company Limited

- General Electric Company (GE)

- Siemens AG

- Panasonic Corporation

- ABB Ltd.

- Schneider Electric SE

- AES Corporation

- Fluence Energy, Inc.

- VARTA AG

Competitive Analysis

The competitive landscape of the Smart Energy Storage Market features global leaders such as Tesla, Inc., LG Chem Ltd., Samsung SDI Co., Ltd., BYD Company Limited, General Electric Company (GE), Siemens AG, Panasonic Corporation, ABB Ltd., Schneider Electric SE, AES Corporation, Fluence Energy, Inc., and VARTA AG. These companies drive innovation through significant investments in research and development, focusing on improving battery efficiency, safety, and life cycle. Firms deploy large-scale projects worldwide, leverage international partnerships, and invest in scalable manufacturing to strengthen their market presence. The landscape is shaped by efforts to integrate storage with intelligent grid solutions and energy management platforms, delivering value across evolving energy systems. Strategic moves include acquisitions, joint ventures, and the development of sustainable product portfolios to address stringent regulatory standards and growing customer demand for reliable, cost-effective solutions. The market also sees increased emphasis on after-sales services, system customization, and digital capabilities such as real-time monitoring and predictive analytics. Continuous product differentiation and a focus on innovation drive competition and set the pace for future growth within the industry.

Recent Developments

- In May 2025, NRG Energy has acquired the generation assets of LS Power for USD 12 billion, which includes 18 power facilities and a virtual power platform. This acquisition doubles NRG’s generation capacity to 25 GW, allowing it to meet the increasing energy demand in the U.S. driven by AI, electrification, and cryptocurrency mining activities.

- In April 2025, VARO Energy has reached an agreement to acquire Preem Holding AB, a Swedish company, by purchasing its parent company, Corral Petroleum Holdings. This acquisition enhances VARO’s capacity for sustainable fuel and refining throughout Europe. The transaction is anticipated to be finalized by late 2025, pending the necessary regulatory approvals.

- In March 2025, ONGC NTPC Green from India has acquired Ayana Renewable Power for USD 2.3 billion. Ayana possesses approximately 4.1 GW of renewable assets and has a 1 GW project pipeline. This strategic acquisition aligns with India’s increased commitment to clean energy while significantly expanding the joint venture’s renewable energy portfolio.

- In 2022, GE Renewable Energy has secured orders from Continuum Green Energy Limited for 81 units of its 2.7-132 onshore wind turbines. The turbines, totaling 218.70 MW, will be installed across wind power projects in Tamil Nadu and Madhya Pradesh, India.

- In March 2022, GE Digital announced the first solution resulting from its acquisition of Opus One Solutions to power the energy transition. Opus One DERMS is designed to be an end-to-end modular Distributed Energy Resource Management System (DERMS) that can help utilities on their Distributed Energy Resources (DERs) journey to keep the grid safe, secure, and resilient while enabling energy affordability and customer participation in power generation/contribution.

Market Concentration & Characteristics

The Smart Energy Storage Market exhibits moderate to high concentration, with a few large multinational firms capturing significant market share through technological leadership, robust supply chains, and expansive global operations. It is characterized by high entry barriers due to intensive capital requirements, strict regulatory compliance, and the need for continuous innovation in battery technologies and energy management systems. The market features strong emphasis on research and development, rapid adoption of advanced lithium-ion and flow battery solutions, and increasing integration of digital technologies for monitoring, analytics, and automation. It serves a wide spectrum of end users, including utilities, commercial enterprises, and residential customers, reflecting diverse application demands and deployment scales. The industry prioritizes product safety, sustainability, and adaptability to evolving grid requirements, supporting the transition toward renewable energy and decentralized power networks. The Smart Energy Storage Market demonstrates dynamic growth, driven by technological progress and shifting energy policies worldwide.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, Energy Source, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for grid-scale energy storage solutions will continue to rise with increasing renewable energy integration.

- Utilities will adopt advanced battery technologies to enhance grid reliability and stability.

- Smart energy storage systems will see accelerated deployment in commercial and industrial sectors.

- Regulatory support and favorable policies will drive investments in energy storage infrastructure.

- Distributed energy storage adoption will grow in residential areas for backup power and cost savings.

- Digital platforms will optimize energy storage operations through real-time data analytics.

- Declining costs of lithium-ion and alternative batteries will encourage wider market penetration.

- Energy storage systems will play a critical role in supporting electric vehicle charging networks.

- Strategic collaborations will foster technological innovation and new business models.

- Energy storage will become a key enabler for microgrid and off-grid applications in emerging markets.