Market Overview

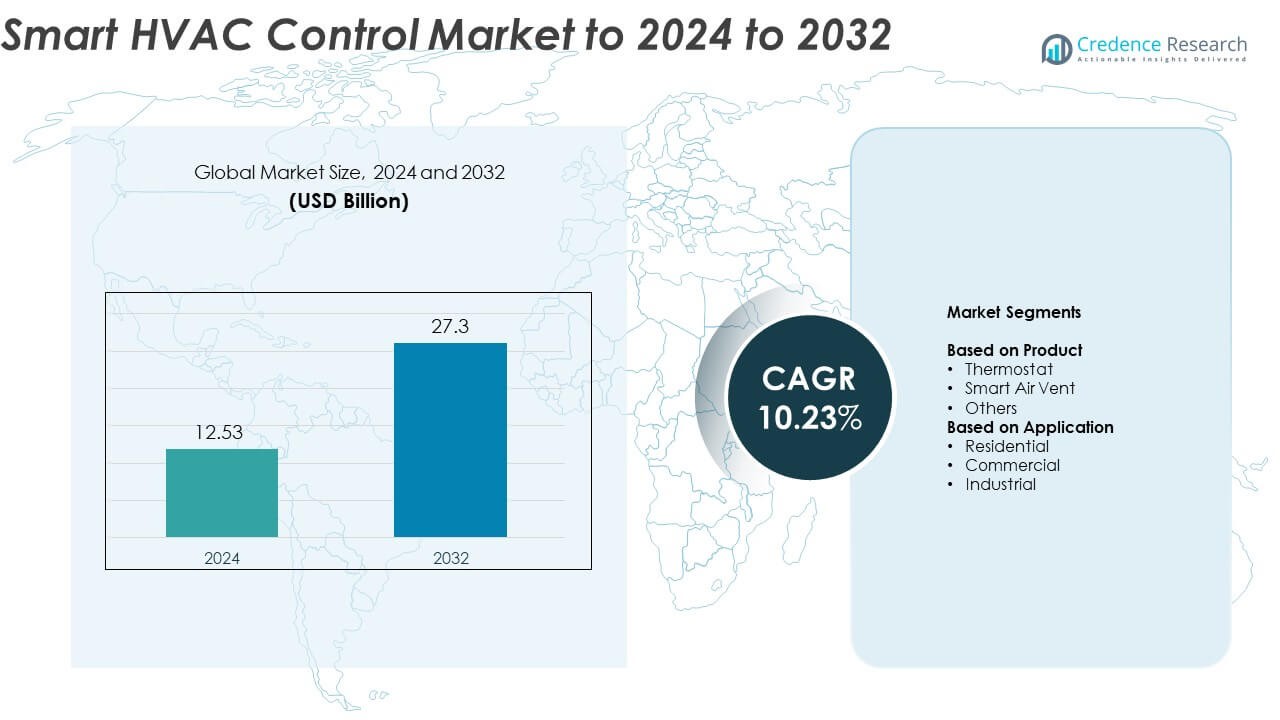

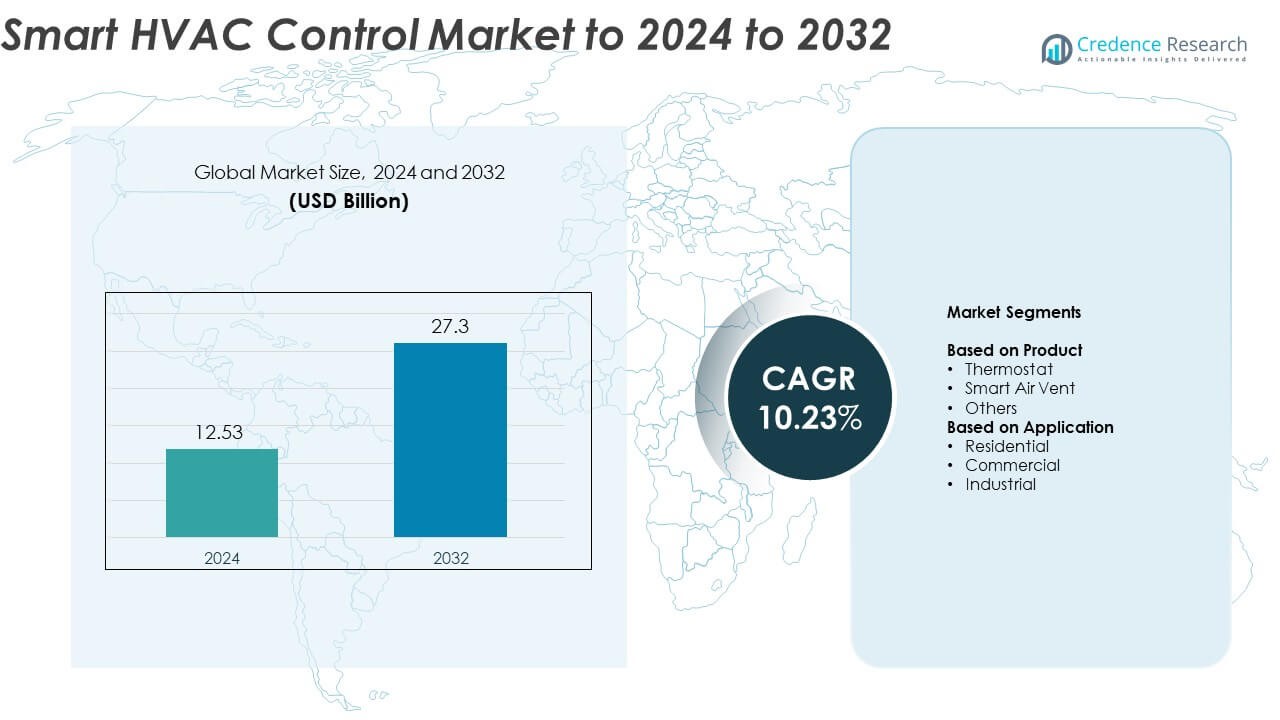

Smart HVAC Control Market size was valued at USD 12.53 Billion in 2024 and is anticipated to reach USD 27.3 Billion by 2032, at a CAGR of 10.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart HVAC Control Market Size 2024 |

USD 12.53 Billion |

| Smart HVAC Control Market, CAGR |

10.23% |

| Smart HVAC Control Market Size 2032 |

USD 27.3 Billion |

The smart HVAC control market is led by major players including Honeywell International Inc., LG Electronics Inc., Daikin Industries Ltd., Emerson Electric Co., and Johnson Controls International plc. These companies dominate through advanced product portfolios, strong R&D capabilities, and extensive global distribution networks. North America leads the market with a 37.6% share in 2024, supported by high smart home adoption and energy efficiency awareness. Europe follows with 28.4% share, driven by sustainability initiatives and smart building integration. Asia Pacific, holding 24.7% share, is emerging as the fastest-growing region due to rapid urbanization and expanding smart city projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The smart HVAC control market was valued at USD 12.53 billion in 2024 and is projected to reach USD 27.3 billion by 2032, growing at a CAGR of 10.23% during the forecast period.

- Rising demand for energy-efficient and connected climate control systems is driving market growth, supported by rapid smart home adoption and government energy regulations.

- Integration of IoT, AI, and wireless technologies is transforming HVAC management, enabling real-time monitoring and predictive maintenance across residential and commercial sectors.

- The market is highly competitive, with major players focusing on R&D, strategic partnerships, and sustainable product innovation to strengthen their presence globally.

- North America leads with 37.6% share, followed by Europe at 28.4% and Asia Pacific at 24.7%, while the thermostat segment dominates with 57.4% share, reflecting growing demand for intelligent temperature control solutions.

Market Segmentation Analysis:

By Product

The thermostat segment dominates the smart HVAC control market, accounting for nearly 57.4% share in 2024. This leadership stems from the widespread adoption of smart thermostats that enable precise temperature regulation, energy savings, and remote access through mobile applications. Growing integration with voice assistants and IoT-enabled home ecosystems further drives demand. Manufacturers are focusing on AI-based adaptive learning features that adjust heating and cooling patterns based on user behavior, enhancing comfort and efficiency. Rising demand for sustainable building solutions continues to strengthen the segment’s position globally.

- For instance, ecobee’s eco+ pilot covered about 240,000 thermostats in 2019. The study used a randomized encouragement design across North America.

By Application

The residential segment leads the smart HVAC control market with approximately 52.8% share in 2024. Increasing consumer preference for connected home technologies and energy-efficient systems drives this dominance. The adoption of smart thermostats and vents in households helps optimize energy consumption and reduce utility costs. Growing urbanization, rising disposable incomes, and government incentives promoting energy-saving devices further boost residential installations. Expanding smart home ecosystems and compatibility with popular digital assistants continue to accelerate the segment’s growth across developed and emerging markets.

- For instance, Resideo reports more than 12.8 million connected customers as of 2025. Resideo also notes a presence in over 150 million homes globally, showcasing the significant scale of their installed product base.

Key Growth Drivers

Rising Demand for Energy Efficiency

Growing emphasis on energy conservation is a major driver of the smart HVAC control market. Smart thermostats and automated air management systems reduce energy wastage by adjusting usage patterns based on occupancy and ambient conditions. Governments worldwide are introducing stricter energy efficiency regulations and offering incentives for smart home adoption. These factors are prompting both residential and commercial users to invest in advanced HVAC control technologies that improve comfort while lowering utility costs.

- For instance, ABB drives cut 4,000 MWh a year at Manchester Airport. That figure is cited in ABB’s HVAC case archive.

Integration of IoT and AI Technologies

The adoption of IoT and AI-enabled solutions is transforming HVAC management. Smart controls now use sensors, predictive analytics, and cloud connectivity to enhance performance and maintenance efficiency. AI-driven algorithms enable automated temperature calibration, fault detection, and predictive maintenance, minimizing downtime and energy loss. This technological integration enhances user experience and supports the shift toward intelligent building ecosystems, fostering faster adoption across industrial and commercial environments.

- For instance, According to a Forrester Total Economic Impact™ (TEI) study commissioned by Johnson Controls, a composite organization modeled to represent typical OpenBlue customers included 1,800 employees and managed 50 million square feet of assets.

Expansion of Smart Infrastructure Projects

Rising investment in smart cities and connected buildings is driving the demand for smart HVAC systems. These projects require intelligent energy management solutions that ensure comfort and sustainability. Governments and developers are increasingly incorporating automated climate control systems to meet green building standards. The construction of new commercial complexes and residential high-rises worldwide further supports market expansion, as building owners adopt centralized HVAC control to optimize performance and reduce operational costs.

Key Trends & Opportunities

Adoption of Wireless and Cloud-Based Controls

The market is witnessing strong adoption of wireless and cloud-based HVAC control solutions that simplify system integration and real-time monitoring. These technologies allow users to manage temperature, humidity, and ventilation remotely via smartphones or voice assistants. Growing use of 5G connectivity enhances system responsiveness and reliability. The convenience and scalability of wireless systems make them ideal for both retrofitting existing buildings and integrating with modern smart home networks.

- For instance, The Carrier Abound platform processed around 9.6 million records daily from more than 100,000 data points for a national specialty retailer. Carrier’s analytics were integrated across an initial engagement covering over 1,100 stores for the same retailer.

Focus on Sustainability and Green Buildings

The rising focus on sustainability is creating new opportunities for smart HVAC solutions. Manufacturers are developing eco-friendly systems that support renewable energy integration and reduce carbon emissions. Smart controls optimize power consumption by analyzing external temperature and occupancy data, aligning with LEED and other environmental standards. The growing preference for energy-efficient and low-emission buildings continues to strengthen the demand for sustainable HVAC automation.

- For instance, Schneider Electric’s Le Hive was the first ISO 50001-certified building. The Paris HQ uses roughly 3,500 sensors for real-time optimization.

Key Challenges

High Installation and Integration Costs

The upfront cost of smart HVAC systems remains a significant challenge for market penetration. Integrating advanced sensors, controllers, and software platforms often requires specialized installation and maintenance, increasing expenses for end users. Small and medium-sized businesses, in particular, face difficulties adopting these technologies due to budget constraints. Despite long-term energy savings, the high initial investment continues to restrain adoption, especially in price-sensitive regions.

Cybersecurity and Data Privacy Concerns

As smart HVAC systems become increasingly connected through IoT and cloud networks, data security risks are rising. Unauthorized access or breaches can expose sensitive information and disrupt system functionality. Ensuring robust encryption, authentication, and regular firmware updates is essential for maintaining user trust. The lack of standardized security frameworks across manufacturers poses additional challenges, potentially hindering widespread adoption of connected HVAC technologies.

Regional Analysis

North America

North America dominates the smart HVAC control market, accounting for nearly 37.6% share in 2024. The region’s leadership is driven by high adoption of smart home technologies and growing demand for energy-efficient systems across residential and commercial sectors. The United States leads due to rapid integration of IoT-based HVAC systems and favorable government policies promoting green building standards. Strong presence of major players and advanced infrastructure further boost market expansion, while increasing consumer awareness regarding energy savings continues to enhance the region’s dominance during the forecast period.

Europe

Europe holds around 28.4% share of the smart HVAC control market in 2024, supported by stringent energy efficiency directives and sustainability goals set by the European Union. Countries such as Germany, the UK, and France are at the forefront of implementing smart building technologies. Increasing retrofitting of old infrastructure with automated climate systems enhances energy performance and reduces carbon emissions. Rising demand for advanced comfort control, coupled with technological innovation and renewable integration, is expected to sustain Europe’s strong market position over the coming years.

Asia Pacific

Asia Pacific captures approximately 24.7% share of the smart HVAC control market in 2024, emerging as one of the fastest-growing regions. Rapid urbanization, expansion of smart city initiatives, and growing disposable incomes are key drivers fueling adoption. China, Japan, and South Korea are leading the transition toward connected living environments. Increasing investments in commercial infrastructure and residential construction also support market growth. The growing penetration of IoT-enabled devices and demand for efficient air management solutions continue to strengthen the regional outlook.

Latin America

Latin America accounts for about 5.6% share of the smart HVAC control market in 2024. The region’s growth is driven by the rising adoption of smart technologies in commercial buildings and hospitality sectors. Countries like Brazil and Mexico are witnessing increased investments in energy-efficient solutions to reduce operating costs. Government initiatives promoting sustainable construction practices are further encouraging market penetration. Despite challenges related to cost sensitivity and limited infrastructure, technological awareness and urban development are expected to boost the regional demand gradually.

Middle East & Africa

The Middle East & Africa region holds nearly 3.7% share in 2024, with demand primarily concentrated in Gulf countries. Rapid construction of smart cities and luxury real estate developments is fueling adoption of intelligent HVAC control systems. The need to optimize energy use in high-temperature environments drives investments in smart cooling technologies. Growing emphasis on sustainability, particularly in the UAE and Saudi Arabia, supports future market potential. Ongoing infrastructure modernization and expansion of commercial projects are expected to accelerate the region’s growth trajectory.

Market Segmentations:

By Product

- Thermostat

- Smart Air Vent

- Others

By Application

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the smart HVAC control market features prominent players such as Honeywell International Inc., LG Electronics Inc., Daikin Industries Ltd., Emerson Electric Co., Johnson Controls International plc., Google (Nest), Ingersoll Rand Inc., Ecobee Inc., Delta Controls Inc., Lennox International Inc., Distech Controls Inc., Haier Group, KMC Controls Inc., Regin AB, and OJ Electronics A/S. The market is characterized by strong technological innovation and increasing competition in energy-efficient climate control solutions. Companies are focusing on integrating IoT, AI, and cloud-based platforms to enhance system automation and predictive maintenance. Strategic collaborations with real estate developers and smart building projects are expanding brand presence globally. Continuous product upgrades, wireless control features, and sustainable manufacturing practices are gaining traction. Firms are also investing heavily in R&D to improve interoperability and system connectivity across residential, commercial, and industrial applications, aiming to strengthen their position in the evolving smart HVAC ecosystem.

Key Player Analysis

- Honeywell International Inc.

- LG Electronics Inc.

- Daikin Industries, Ltd.

- Emerson Electric Co.

- Johnson Controls International plc.

- Google (Nest)

- Ingersoll Rand Inc.

- Ecobee Inc.

- Delta Controls Inc.

- Lennox International Inc.

- Distech Controls Inc.

- Haier Group

- KMC Controls, Inc.

- Regin AB

- OJ Electronics A/S

Recent Developments

- In 2025, Delta introduced Delta Intelligent Building Technologies (DIBT) at the AHR Expo, a unified platform integrating smart, energy-saving solutions including their Delta Controls and LOYTEC building automation systems, real-time indoor air quality monitoring, AI-based security, and advanced building management software for sustainable and efficient buildings.

- In 2025, Haier India launched the Gravity Series, the only AI Climate Control air conditioners with fabric finish in India.

- In 2025, Lennox International launched the “Lennox Powered by Samsung” mini-split and VRF product lines as part of a strategic partnership with Samsung.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong growth driven by rising adoption of smart home ecosystems.

- Integration of AI and machine learning will enhance system efficiency and predictive maintenance.

- Growing preference for voice and app-controlled devices will boost product innovation.

- Expansion of smart city projects will increase demand for connected HVAC infrastructure.

- Energy efficiency regulations will encourage replacement of conventional systems with smart controls.

- Wireless and cloud-based HVAC management solutions will gain wider acceptance.

- Partnerships between tech companies and HVAC manufacturers will accelerate product advancements.

- Sustainability initiatives will drive development of low-emission and eco-friendly systems.

- Enhanced cybersecurity measures will become essential to protect IoT-based HVAC systems.

- Emerging economies in Asia Pacific and Latin America will provide new growth opportunities.