Market Overview

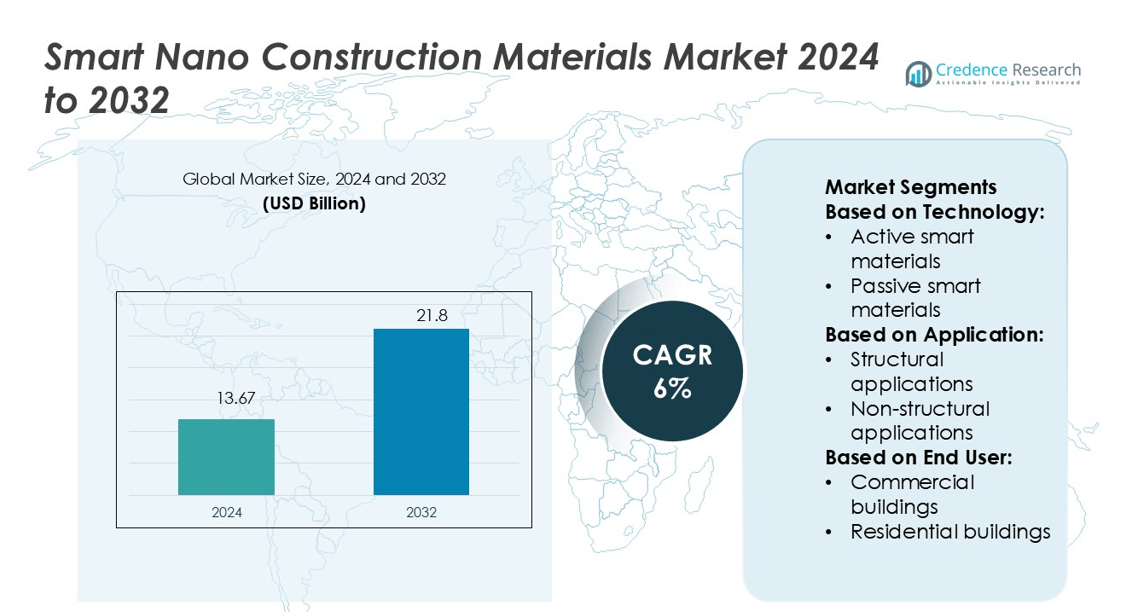

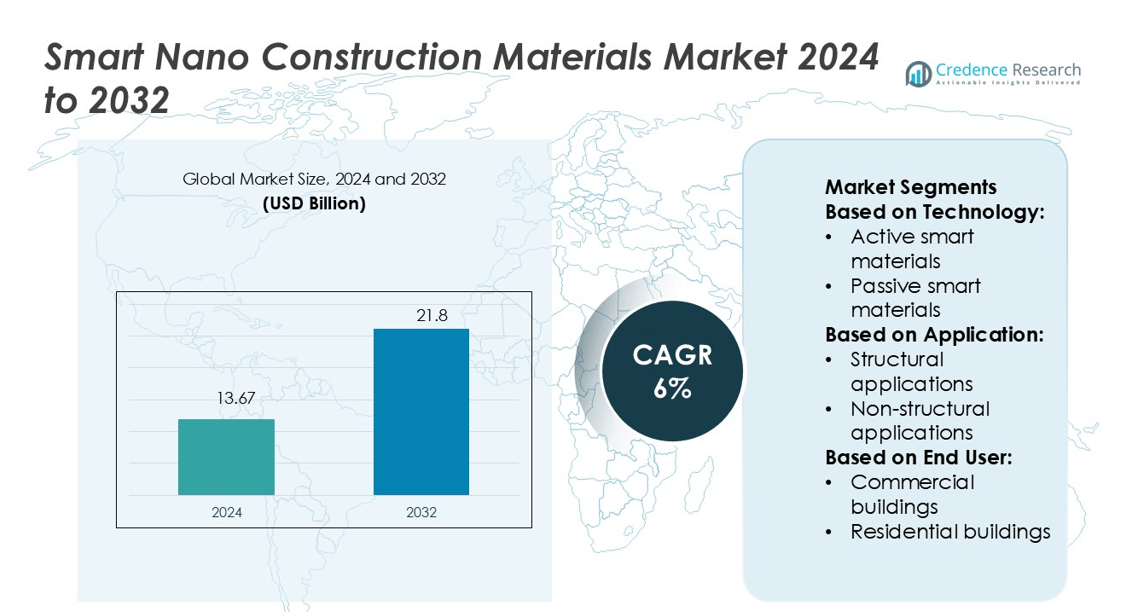

Smart Nano Construction Materials Market size was valued USD 13.67 billion in 2024 and is anticipated to reach USD 21.8 billion by 2032, at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Nano Construction Materials Market Size 2024 |

USD 13.67 billion |

| Smart Nano Construction Materials Market, CAGR |

6% |

| Smart Nano Construction Materials Market Size 2032 |

USD 21.8 billion |

The Smart Nano Construction Materials Market features prominent players such as Haliburton Company, Cabot Corporation, Arkema, Aerogel Technologies, LLC, AkzoNobel N.V., BASF SE, Dupont, Evonik Industries AG, Advenira Enterprises, Inc., and 3M Company. These companies drive innovation through advanced nanocomposites, high-performance coatings, and thermal-insulating materials that enhance durability and energy efficiency in construction. Strategic investments in research, product diversification, and partnerships strengthen their global presence. Regionally, Asia-Pacific leads the market with a 31% share, fueled by rapid urbanization, large-scale infrastructure projects, and government-backed smart city initiatives, positioning it as the primary growth hub in this sector.

Market Insights

- The Smart Nano Construction Materials Market was valued at USD 13.67 billion in 2024 and is projected to reach USD 21.8 billion by 2032, registering a CAGR of 6% during the forecast period.

- Market growth is driven by rising demand for sustainable construction solutions, increasing adoption of self-healing concrete, and government regulations promoting energy-efficient building practices.

- Key trends include integration of nanosensors for real-time structural monitoring, expanding use of lightweight composites, and growing demand for antibacterial and self-cleaning coatings in residential and commercial projects.

- The competitive landscape is shaped by leading players focusing on R&D investments, product diversification, and strategic partnerships, while restraints include high production costs and safety concerns regarding nanomaterial handling.

- Asia-Pacific leads with 31% share due to rapid urbanization and infrastructure projects, followed by North America at 34% and Europe at 29%, while structural applications hold 46% share and commercial buildings dominate with 39%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

Active smart materials dominate the technology segment with a 58% share, driven by their ability to adapt properties in response to external stimuli such as stress, temperature, or magnetic fields. These materials enhance structural resilience and enable real-time response, which is vital in advanced construction projects. Their integration in self-healing concrete and shape-memory alloys supports reduced maintenance costs and longer building lifecycles. The growing demand for sustainable and efficient building solutions accelerates the adoption of active smart materials, giving them a competitive edge over passive counterparts.

- For instance, Halliburton developed its SmartWell® intelligent completion system, enabling zonal flow control in wells at depths exceeding 4,500 meters. This system features sensors and components designed to operate in extreme environments, with high-performance variants capable of withstanding temperatures up to 200°C and pressures up to 15,000 psi.

By Application

Structural applications hold the leading share of 46% in the application segment, supported by the widespread use of smart materials in load-bearing components and reinforcement systems. These applications improve durability, energy efficiency, and seismic resistance in large-scale projects. Demand is particularly strong in urban areas where high-rise buildings and bridges require enhanced performance and longevity. The growing emphasis on smart infrastructure upgrades further boosts this segment, as advanced construction materials help reduce repair costs while ensuring compliance with evolving building codes and safety standards.

- For instance, Aerogel Technologies’ Airloy® composite panels offer both structural and insulating performance in one component. Airloy X103 material with a density of 0.20 g/cm³ can support compressive loads up to 2 MPa and maintains a low thermal conductivity of 26-29 mW/m·K.

By End User

Commercial buildings account for 39% of the market share within the end-user segment, making them the dominant category. Rising investments in green building certifications, smart office complexes, and sustainable urban infrastructure drive this growth. Commercial developers prioritize smart nano construction materials to achieve energy efficiency, extend service life, and enhance environmental performance. This trend is reinforced by government incentives promoting low-carbon construction and corporate commitments to ESG targets. The scale of commercial projects, combined with their higher adoption rates for advanced materials, secures this segment’s leading position.

Market Overvie

RisingDemand for Sustainable Construction

The shift toward eco-friendly building solutions drives the adoption of smart nano construction materials. These materials enhance energy efficiency, reduce carbon emissions, and support green certifications such as LEED and BREEAM. Governments worldwide implement stricter environmental policies, creating strong incentives for sustainable construction practices. Developers prefer self-cleaning coatings, thermal-insulating nanomaterials, and lightweight composites to meet both regulatory standards and consumer demand. This alignment of ecological goals with advanced material capabilities positions smart nano construction materials as a central pillar in the transition toward sustainable infrastructure.

- For instance, DuPont’s FilmTec™ Fortilife™ XC160 reverse osmosis membrane is designed to operate under ultra-high-pressure conditions, with a maximum operating pressure of up to 120 bar (1,740 psi).

Advancements in Nanotechnology Applications

Rapid innovations in nanotechnology expand the performance and functionality of construction materials. Nano-additives in concrete, coatings, and composites improve strength, durability, and thermal resistance, ensuring longer service life for infrastructure. These advancements reduce maintenance costs and enhance resilience against extreme conditions such as earthquakes or high humidity. The increasing commercialization of nanostructured coatings, photocatalytic materials, and self-healing concrete accelerates adoption in large-scale projects. Continuous R&D investments by material science companies create new opportunities, reinforcing nanotechnology as a powerful driver for smart construction markets.

- For instance, Evonik’s SITREN® shrinkage reduction and compressive strength performance depend on the mix design and the type of SITREN® product used. SITREN® PSR 100 has been shown to reduce the drying shrinkage ratio by more than 30% when dosed at 0.5%.

Infrastructure Development and Urbanization

Expanding urban populations and large-scale infrastructure projects significantly boost demand for innovative construction materials. Governments invest heavily in smart cities, transportation hubs, and high-rise complexes that require durable and energy-efficient materials. Smart nano materials provide lightweight yet strong alternatives, enabling sustainable urban development. Rapid urbanization in emerging economies such as China, India, and Brazil amplifies growth, supported by rising disposable incomes and modern housing needs. The integration of advanced nanomaterials ensures compliance with stringent safety standards while supporting long-term infrastructure goals globally.

Key Trends & Opportunities

Integration of Smart Monitoring Systems

One major trend is the integration of smart nano materials with digital monitoring systems. Materials embedded with nanosensors provide real-time data on structural health, stress, and environmental exposure. This capability enhances predictive maintenance and improves safety, reducing risks in large infrastructure projects. Opportunities emerge in industrial facilities, bridges, and tunnels, where early detection of weaknesses prevents costly failures. The convergence of IoT with nanotechnology strengthens this trend, positioning monitoring-enabled materials as a transformative force in modern construction practices.

- For instance, Kyocera achieved a record underwater optical communication speed of 750 Mbps in offshore trials, using short-range underwater wireless optical communication (UWOC) technology.

Growth of Smart Residential Applications

The residential sector shows rising interest in smart nano materials for enhanced living comfort and sustainability. Nanocoatings with self-cleaning, antibacterial, and thermal insulation properties gain traction among homeowners seeking healthier and energy-efficient environments. Governments offering incentives for green housing projects create further opportunities for adoption. Expanding demand for smart residential complexes in Asia-Pacific and Europe highlights this trend, with developers leveraging nanomaterials to differentiate properties. This growing preference for advanced housing solutions makes the residential segment a promising growth opportunity.

- For instance, CeramTec produces 3D-printed silicon carbide (SiSiC) components for thermal management and other demanding applications. Using additive manufacturing, CeramTec’s ROCAR® 3D SiSiC material achieves a thermal conductivity of approximately 160 W/m·K and a density of around 3.1 g/cm³.

Key Challenges

High Production and Implementation Costs

The primary challenge lies in the high costs of manufacturing and deploying smart nano construction materials. Specialized production processes, advanced R&D, and complex integration techniques elevate pricing, limiting adoption in price-sensitive markets. Small-scale builders and contractors often struggle to justify the investment compared to traditional alternatives. While costs are gradually declining with scaling, affordability remains a barrier, particularly in developing regions. Overcoming this challenge requires technological breakthroughs, cost-effective production, and government subsidies to encourage broader market penetration.

Health and Safety Concerns of Nanomaterials

Potential risks associated with nanomaterial exposure present another critical challenge. Concerns include possible toxicity during production, handling, and end-of-life disposal, raising regulatory scrutiny. Construction workers face occupational hazards if proper safety measures are not enforced. Additionally, public perception of nanotechnology risks can slow acceptance despite proven benefits. Regulatory bodies continue to research and set guidelines for safe usage, but uncertainty persists. Addressing these challenges through transparent communication, stringent safety protocols, and eco-friendly material innovation will be essential for sustainable market growth.

Regional Analysis

North America

North America holds a 34% share of the Smart Nano Construction Materials Market, supported by strong adoption in sustainable infrastructure projects and advanced commercial buildings. The region benefits from established R&D ecosystems and government incentives promoting energy-efficient construction. Developers increasingly use nanocoatings, self-healing concrete, and smart composites to meet LEED-certified standards. Demand is high in the U.S., driven by smart city initiatives and the renovation of aging infrastructure. Canada follows with growth in eco-friendly residential projects. Continuous technological innovations and collaborations between universities and material science companies further solidify North America’s leadership in the market.

Europe

Europe accounts for 29% of the market, driven by stringent environmental regulations and a strong focus on green building certifications. Countries such as Germany, France, and the UK prioritize sustainable urban development, boosting demand for advanced nanomaterials. The region’s leadership in smart coatings, structural composites, and thermal insulation supports adoption in both commercial and residential sectors. EU directives on reducing carbon emissions accelerate investments in energy-efficient construction materials. Collaborative research projects between universities and industry players enhance technological breakthroughs. Europe’s mature construction sector and proactive climate policies position the region as a key hub for market expansion.

Asia-Pacific

Asia-Pacific dominates with a 31% market share, fueled by rapid urbanization and infrastructure development in China, India, and Southeast Asia. Government-led smart city programs and rising investments in residential and commercial complexes boost adoption of nano-enabled materials. Demand is particularly strong for self-cleaning coatings, lightweight composites, and energy-efficient insulation. Rising disposable incomes and consumer awareness of sustainable housing further support growth. Japan and South Korea lead in technological innovations, while China drives large-scale consumption. Expanding construction activity, combined with supportive policies, makes Asia-Pacific the fastest-growing regional market for smart nano construction materials.

Latin America

Latin America contributes a 4% market share, with steady adoption driven by infrastructure modernization projects and green building initiatives. Brazil and Mexico lead the region, focusing on sustainable housing and energy-efficient public infrastructure. Developers increasingly adopt smart coatings and advanced composites to reduce maintenance costs in humid and high-temperature climates. Limited awareness and higher costs compared to conventional materials slow broader adoption, but government-backed urban renewal projects create opportunities. Growing partnerships between regional firms and global players are expected to accelerate market penetration. Latin America remains an emerging but promising region for long-term market expansion.

Middle East & Africa (MEA)

The Middle East & Africa region holds a 2% market share, with demand largely concentrated in the Gulf Cooperation Council (GCC) countries. Mega-projects such as NEOM in Saudi Arabia and Expo City Dubai showcase the region’s focus on futuristic and sustainable infrastructure. Nano-enabled insulation, coatings, and structural composites gain traction in commercial and industrial projects. Harsh climatic conditions drive demand for materials that improve durability and reduce energy consumption. However, limited local production and high import reliance restrict growth. Ongoing investments in smart cities and infrastructure modernization present future opportunities for smart nano material adoption in MEA.

Market Segmentations:

By Technology:

- Active smart materials

- Passive smart materials

By Application:

- Structural applications

- Non-structural applications

By End User:

- Commercial buildings

- Residential buildings

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The Smart Nano Construction Materials Market is shaped by leading players including Haliburton Company, Cabot Corporation, Arkema, Aerogel Technologies, LLC, AkzoNobel N.V., BASF SE, Dupont, Evonik Industries AG, Advenira Enterprises, Inc., and 3M Company. The Smart Nano Construction Materials Market is highly competitive, driven by continuous innovation and strong demand for sustainable construction solutions. Companies focus on developing advanced products such as self-healing concrete, nano-coatings, and aerogels that enhance durability, energy efficiency, and cost-effectiveness in large-scale projects. Strategic investments in research and development accelerate product advancements, while collaborations with construction firms and research institutes expand application potential. Growing emphasis on green building certifications and smart city initiatives further intensifies competition, encouraging manufacturers to align portfolios with sustainability goals. The market landscape remains dynamic, shaped by technological breakthroughs and evolving regulatory frameworks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2024, Kyocera launched a Peltier (thermoelectric) module with enhanced heat absorption capabilities. This new Peltier module’s heat absorption rate is 21% higher than the organization’s products, resulting in significantly improved cooling performance.

- In June 2024, CeramTec GmbH unveiled the ceramic substrate Sinalit. This development enables greater diversity in solutions and enhances sustainability. The attributes of silicon nitride enhance performance across numerous applications and support a successful transition toward electromobility and new energy sources.

- In June 2024, India’s IIT Bhilai researchers created a ‘smart material’ for controlled delivery of anti-cancer drugs, enhancing treatment efficacy and reducing side effects.

- In May 2024, Qatar Free Zones Authority and Germany’s Evonik signed a MoU to explore sustainable investment opportunities in Qatar’s Umm Alhoul free zone, focusing on eco-friendly solutions for energy transition.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness rising adoption of self-healing concrete in large infrastructure projects.

- Energy-efficient nanomaterials will gain traction as governments enforce stricter building regulations.

- Smart coatings with antibacterial and self-cleaning properties will see strong demand in residential sectors.

- Integration of nanosensors in materials will expand predictive maintenance and monitoring applications.

- Lightweight nanocomposites will play a key role in high-rise and commercial construction.

- Emerging economies will drive growth through urbanization and smart city development programs.

- Collaborative R&D will accelerate commercialization of advanced nanomaterials across multiple applications.

- Sustainability-focused investments will fuel innovation in eco-friendly and recyclable nano-enabled materials.

- Digital integration with IoT platforms will enhance the value of smart monitoring systems.

- Market competition will intensify as players expand global presence through strategic partnerships.