Market Overview:

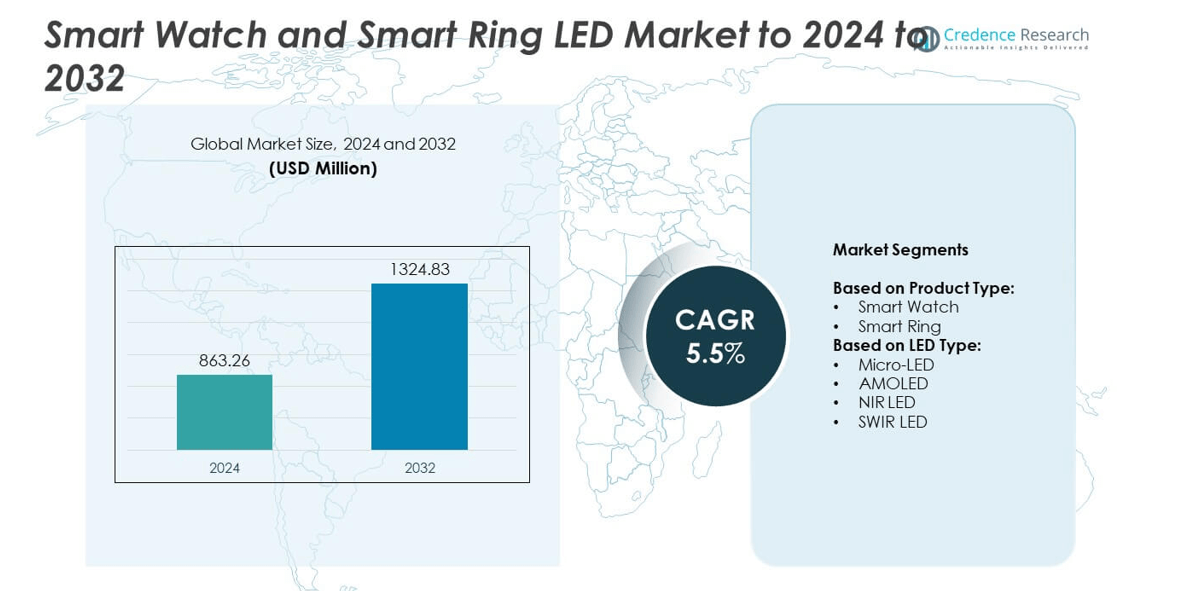

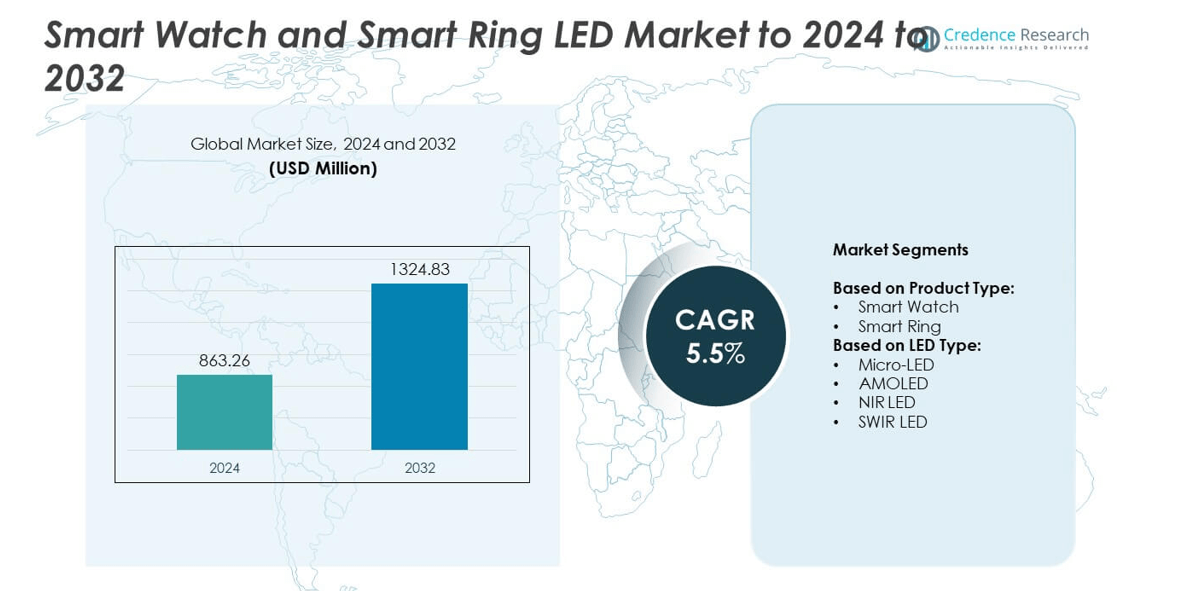

Smart Watch and Smart Ring LED Market size was valued USD 863.26 Million in 2024 and is anticipated to reach USD 1324.83 Million by 2032, at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Watch and Smart Ring LED Market Size 2024 |

USD 863.26 Million |

| Smart Watch and Smart Ring LED Market, CAGR |

5.5% |

| Smart Watch and Smart Ring LED Market Size 2032 |

USD 1324.83 Million |

The Smart Watch and Smart Ring LED Market is driven by key players such as Epistar Corporation, Apple Inc., Everlight Electronics Co. Ltd., LG Display, Garmin Ltd., OSRAM International GmbH, Nichia Corporation, AUO Corporation, Samsung Display, BOE Technology Group Co. Ltd., Samsung Electronics, Japan Display Inc. (JDI), and DOWA Electronics Materials Co. These companies focus on advancing micro-LED, AMOLED, and biometric integration to strengthen their market positions. Regionally, North America led the market in 2024 with a 35% share, supported by high adoption of premium wearables and strong consumer health awareness. Europe followed with 28% share, driven by lifestyle and regulatory support for digital healthcare solutions. Asia-Pacific accounted for 27%, reflecting rising demand for affordable devices and growing disposable incomes.

Market Insights

- The Smart Watch and Smart Ring LED Market was valued at USD 863.26 million in 2024 and is projected to reach USD 1324.83 million by 2032, expanding at a CAGR of 5.5%.

- Rising health and fitness awareness, coupled with demand for multifunctional wearables, drives growth, with smart watches holding over 70% share in 2024.

- Market trends include rapid adoption of micro-LED for premium devices and AMOLED for cost-sensitive segments, while smart rings gain traction for discreet health and payment features.

- Competition is defined by global leaders investing in advanced displays, biometric integration, and partnerships, with focus on innovation, affordability, and broader application areas.

- Regionally, North America led with 35% share in 2024, followed by Europe at 28% and Asia-Pacific at 27%, while Latin America and the Middle East & Africa together accounted for 10%, reflecting emerging opportunities and steady growth in developing regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Smart watches led the Smart Watch and Smart Ring LED Market in 2024 with more than 70% share. Their dominance is supported by multifunctional features like fitness tracking, health monitoring, and seamless connectivity. The integration of advanced displays such as micro-LED and AMOLED enhances visibility, energy efficiency, and user experience. Smart rings, holding about 30% share, are gaining traction due to their compact design, discreet usage, and functions like sleep monitoring, payments, and wellness tracking. Rising adoption among younger consumers positions smart rings as the fastest-growing product sub-segment.

- For instance, based on teardowns by iFixit in October 2021, the battery capacity for the Apple Watch Series 7 varies by size. The 41mm model features a 1.094 Wh battery (approximately 284 mAh), while the 45mm model includes a 1.189 Wh battery (approximately 309 mAh), the actual battery performance can differ between GPS-only and GPS + Cellular models, as the cellular versions consume more power for network connectivity.

By LED Type

Micro-LED dominated with over 45% share in 2024, driven by superior brightness, energy efficiency, and long lifespan, making it the preferred choice for premium wearables. AMOLED followed with around 35% share, valued for its vibrant color output, flexible form factor, and affordability, especially in mid-range devices. NIR LEDs, with a 12% share, supported growth in biometric and health monitoring applications, while SWIR LEDs, holding under 8%, remained a niche segment focused on advanced diagnostics and medical-grade wearables.

- For instance, according to Omdia, AMOLED display shipments for iPhones reached 240 million units in 2024. Samsung Display, LG Display, and BOE supplied these panels, with Samsung Display shipping 124 million units and accounting for 50% of the total in 2024. This illustrates the large scale of AMOLED adoption and the competitive supplier landscape for iPhones.

Key Growth Drivers

Rising Health and Fitness Awareness

The increasing focus on preventive healthcare and personal fitness is a primary driver of the Smart Watch and Smart Ring LED Market. Consumers demand wearables that track vital health metrics such as heart rate, oxygen levels, and sleep quality. Smart watches lead in this segment, while smart rings are gaining popularity due to their compact form. The integration of NIR LEDs for medical-grade monitoring further accelerates adoption. Growing health-conscious lifestyles, combined with rising global wellness trends, make this the key growth driver shaping market expansion.

- For instance, according to market data, the number of Fitbit active users was 38.5 million in 2023, a decrease from 40 million in 2022.

Advancements in Display Technologies

Rapid developments in micro-LED and AMOLED displays are fueling the adoption of wearable devices. Micro-LED dominates due to its superior brightness, lower energy consumption, and enhanced outdoor visibility, extending device battery life. AMOLED continues to remain popular in mid-range devices due to cost-effectiveness and strong color reproduction. These advancements not only improve the user experience but also drive consumer preference for premium devices. As display quality and durability remain critical purchasing factors, innovations in LED technology play a crucial role in sustaining long-term market growth.

- For instance, at its 2024 Innovation Partner Conference, BOE developed and showcased a 0.9-inch 4K (6020 PPI) OLED microdisplay. This display utilizes a tandem OLED architecture and achieves a maximum brightness of 5,000 nits.

Expansion of Wearable Applications

The market is expanding beyond fitness into lifestyle, payment, and healthcare applications. Smart rings are increasingly used for contactless payments, while both watches and rings integrate IoT connectivity features. The inclusion of medical monitoring capabilities, such as ECG and glucose tracking, further strengthens their role in healthcare. These innovations align with consumer demands for multipurpose, connected devices. Expanding application areas ensure wider adoption across diverse demographics, making multi-functionality and versatility an essential driver in market development.

Key Trends & Opportunities

Integration of AI and IoT

The integration of AI algorithms and IoT platforms in wearables is a major trend shaping the market. AI enables predictive health insights, while IoT enhances real-time data connectivity with smartphones and cloud platforms. This synergy improves user experience by offering personalized fitness recommendations and continuous monitoring. Opportunities lie in expanding AI-driven health analytics, which can transform wearables into advanced digital health assistants. The trend opens pathways for partnerships with healthcare providers and insurers, positioning wearables as essential tools in digital healthcare ecosystems.

- For instance, Huawei launched the improved TruSeen™ 5.5+ health monitoring technology in its WATCH GT 4 series in late 2023, enhancing heart rate monitoring accuracy. The Huawei Health app, which pairs with these devices, surpassed 400 million global users in late 2022 and had over 97 million monthly active users at that time. While the technology is used for extensive health tracking.

Rising Demand for Discreet and Stylish Wearables

Consumers increasingly seek wearable devices that combine functionality with style, driving demand for compact and discreet products like smart rings. These devices appeal to younger demographics, particularly in fashion-tech segments, where aesthetics play a crucial role in adoption. Opportunities are emerging for manufacturers to integrate advanced sensors and LED technologies into lightweight, fashionable designs. This trend strengthens brand differentiation and attracts new consumer segments. As fashion and technology converge, stylish wearable designs present a strong opportunity to broaden market reach and consumer acceptance.

- For instance, Movano relaunched its Evie Ring in September 2024 with key hardware and software upgrades, after having begun shipping the initial version in January 2024. The ring weighs between 3.2 and 3.7 grams, depending on its size. It is marketed with a fashion-focused design, featuring a gap in its surface to accommodate finger size fluctuations.

Growing Adoption in Emerging Markets

The rising penetration of affordable smart watches and smart rings in Asia-Pacific and Latin America presents significant opportunities. Local players are introducing cost-effective models with AMOLED displays, expanding accessibility for middle-income consumers. Government initiatives promoting digital health also support adoption. As disposable incomes grow in these regions, the demand for multifunctional wearables rises sharply. Emerging markets provide untapped potential for both global and regional brands to expand presence, making this a critical trend for future revenue growth and market diversification.

Key Challenges

High Costs of Advanced LED Technologies

The adoption of micro-LED and SWIR LED technologies comes with high manufacturing costs, which limit affordability for mass-market consumers. This challenge restricts widespread adoption, particularly in cost-sensitive regions like Asia-Pacific. While AMOLED offers a cheaper alternative, premium features still drive up prices in flagship models. The high cost barrier creates opportunities only in niche or premium consumer bases, slowing down the penetration of high-performance wearable devices. Reducing production expenses while maintaining performance remains a key challenge for market players.

Data Privacy and Security Concerns

The integration of AI, IoT, and health monitoring features increases the risk of data breaches and privacy violations. Wearables collect sensitive biometric and personal information, making them targets for cybersecurity threats. Growing concerns about data misuse and regulatory compliance pose challenges for manufacturers and service providers. Building consumer trust requires strict adherence to data protection laws and transparent usage policies. Without robust security frameworks, adoption in healthcare and payment-related applications may slow, representing a critical hurdle in the long-term growth of the market.

Regional Analysis

North America

North America led the Smart Watch and Smart Ring LED Market in 2024 with a 35% share. Growth in this region is driven by strong consumer demand for advanced wearables with integrated health monitoring and connectivity features. High adoption of premium devices with micro-LED and AMOLED displays further strengthens market presence. The United States dominates regional demand due to high disposable incomes, robust healthcare awareness, and widespread use of digital fitness solutions. Strategic investments by leading global players and favorable innovation ecosystems continue to reinforce North America’s position as the leading regional market.

Europe

Europe accounted for 28% of the Smart Watch and Smart Ring LED Market in 2024. Demand is supported by rising health-conscious lifestyles, rapid digitalization, and growing adoption of IoT-enabled wearables across fitness and healthcare applications. Countries such as Germany, the UK, and France are major contributors, driven by high consumer purchasing power. The region also benefits from strong regulatory support for digital health adoption. Increased focus on sustainability and eco-friendly product designs further influences consumer preferences, especially among younger demographics. Europe remains a key market with steady growth driven by premium and mid-range wearable devices.

Asia-Pacific

Asia-Pacific held a 27% share of the Smart Watch and Smart Ring LED Market in 2024. Growth is fueled by rising disposable incomes, rapid urbanization, and strong adoption of affordable wearable devices. China, Japan, South Korea, and India are leading markets, supported by both global and regional manufacturers. The availability of cost-effective smart watches with AMOLED displays drives penetration in middle-income groups. Increasing health awareness and expanding e-commerce channels further support growth. Asia-Pacific is expected to witness the fastest growth rate during the forecast period, driven by large population size and rising demand for digital health solutions.

Latin America

Latin America represented 6% of the Smart Watch and Smart Ring LED Market in 2024. The region shows growing adoption of wearable devices, particularly in Brazil and Mexico, where demand is driven by rising smartphone penetration and fitness awareness. Cost-sensitive consumers favor mid-range smart watches with AMOLED technology, though premium devices are slowly gaining traction among high-income groups. Expanding digital payment ecosystems also contribute to the adoption of smart rings. Despite current challenges in affordability, rising disposable incomes and growing urban populations are expected to strengthen Latin America’s position as an emerging growth market for wearables.

Middle East and Africa

The Middle East and Africa accounted for 4% of the Smart Watch and Smart Ring LED Market in 2024. Growth is primarily concentrated in Gulf countries such as the UAE and Saudi Arabia, where high-income consumers favor premium smart watches. Increasing interest in fitness tracking, coupled with government-led health awareness initiatives, drives adoption. Africa’s market remains at an early stage, limited by affordability and infrastructure challenges. However, growing smartphone usage and e-commerce access are expected to boost demand over time. The region presents long-term opportunities, though overall market share remains comparatively smaller than other regions.

Market Segmentations:

By Product Type:

By LED Type:

- Micro-LED

- AMOLED

- NIR LED

- SWIR LED

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the Smart Watch and Smart Ring LED Market is shaped by leading companies such as Epistar Corporation, Apple Inc., Everlight Electronics Co. Ltd., LG Display, Garmin Ltd., OSRAM International GmbH, Nichia Corporation, AUO Corporation, Samsung Display, BOE Technology Group Co. Ltd., Samsung Electronics, Japan Display Inc. (JDI), and DOWA Electronics Materials Co. These players drive innovation through advanced LED technologies, health-monitoring integration, and improved display efficiency. The market is characterized by continuous investment in micro-LED and AMOLED solutions, enhancing visual performance and battery life in wearables. Intense competition fuels product differentiation, with companies focusing on expanding applications into healthcare, lifestyle, and digital payments. Strategic partnerships, R&D collaborations, and expansion into emerging markets further define the landscape. Pricing strategies and the balance between premium and cost-effective devices also play a vital role. Collectively, the market reflects a dynamic ecosystem where innovation, affordability, and user experience remain the core competitive factors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Epistar Corporation

- Apple Inc.

- Everlight Electronics Co. Ltd.

- LG Display

- Garmin Ltd.

- OSRAM International GmbH

- Nichia Corporation

- AUO Corporation

- Samsung Display

- BOE Technology Group Co. Ltd

- Samsung Electronics

- Japan Display Inc. (JDI)

- DOWA Electronics Materials Co.

Recent Developments

- In 2025, Apple Inc. launched the Apple Watch Series 11, Apple Watch Ultra 3, and Apple Watch SE 3. The new models featured the S10 chipset and offered improvements in battery life and display efficiency. Speculation and patent activity suggested Apple is likely preparing for a smart ring launch, potentially with advanced LED sensors for health tracking.

- In 2025, Garmin Ltd. became one of the first major smartwatch manufacturers to adopt MicroLED technology.

- In 2023, Samsung Electronics launched the Samsung Galaxy Watch 6, featuring a larger and brighter Super AMOLED display

Report Coverage

The research report offers an in-depth analysis based on Product Type, LED Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily, driven by rising demand for health monitoring wearables.

- Smart watches will continue to dominate, but smart rings will grow at a faster pace.

- Micro-LED will gain higher adoption due to superior brightness and energy efficiency.

- AMOLED will remain popular in cost-sensitive regions with strong mid-range demand.

- Integration of AI and IoT will enhance predictive health and lifestyle features.

- Fashion-driven smart rings will attract younger demographics seeking discreet wearables.

- Emerging markets will offer significant growth opportunities through affordable devices.

- Premium devices will integrate advanced biometric and diagnostic features.

- Data privacy and cybersecurity will remain critical for consumer trust.

- The market will evolve toward multipurpose wearables combining healthcare, payment, and connectivity.