Market Overview:

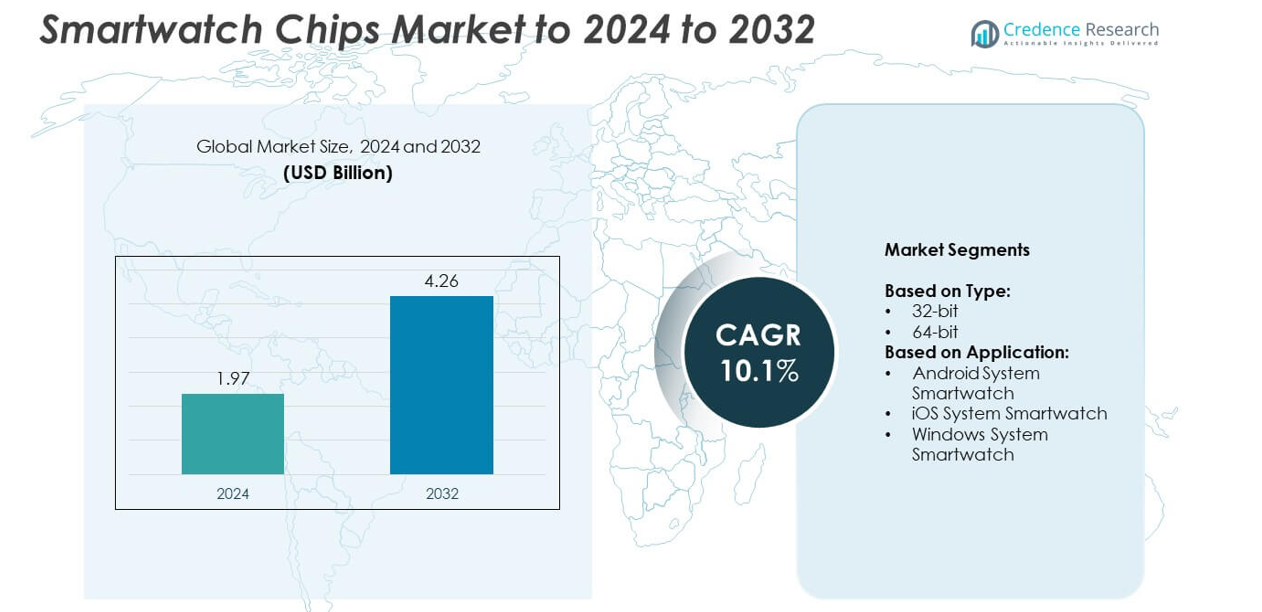

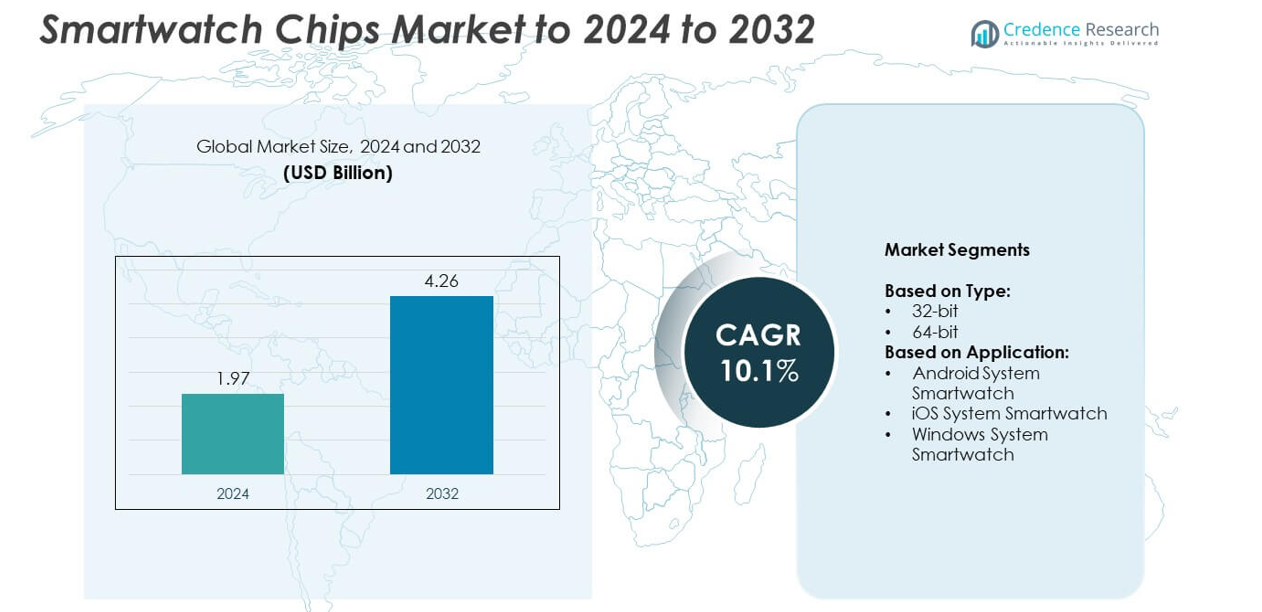

The Smartwatch Chips market size was valued at USD 1.97 Billion in 2024 and is anticipated to reach USD 4.26 Billion by 2032, at a CAGR of 10.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smartwatch Chips Market Size 2024 |

USD 1.97 Billion |

| Smartwatch Chips Market, CAGR |

10.1% |

| Smartwatch Chips Market Size 2032 |

USD 4.26 Billion |

The smartwatch chips market is driven by prominent players such as Samsung Electronics, Arm Ltd., Huawei Technologies Co., Ltd., Microchip Technology Inc., Apple, Intel Corp., Broadcom, Analog Devices, Inc., Qualcomm Technologies, Inc., Silicon Laboratories, Nordic Semiconductor, and Ingenic Semiconductor Co., Ltd. These companies focus on innovations in energy efficiency, AI integration, and 5G connectivity to strengthen their positions in the competitive landscape. Regionally, North America led the market in 2024 with 35% share, supported by strong adoption of premium smartwatches and advanced healthcare applications. Europe followed with 27% share, driven by demand for secure and sustainable devices, while Asia Pacific held 25% share, fueled by rapid urbanization and cost-effective smartwatch adoption.

Market Insights

- The smartwatch chips market was valued at USD 1.97 Billion in 2024 and is projected to reach USD 4.26 Billion by 2032, growing at a CAGR of 10.1%.

- Growth is driven by rising demand for health-monitoring features, AI-enabled applications, and energy-efficient processors that support seamless connectivity.

- A key trend is the integration of AI and 5G-ready chipsets, enabling real-time analytics, improved personalization, and standalone smartwatch performance beyond smartphone dependence.

- The market is competitive, with major companies focusing on R&D, collaborations, and affordable chip solutions to expand both premium and cost-sensitive segments.

- North America led the market with 35% share in 2024, followed by Europe at 27% and Asia Pacific at 25%, while the 64-bit chip segment dominated by holding over 60% share due to its high-performance capabilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The 64-bit smartwatch chips segment dominated the market in 2024 with over 60% share. This dominance comes from rising demand for advanced computing power and energy efficiency in premium smartwatches. 64-bit processors enable smoother multitasking, better graphics, and support for AI-driven health monitoring features. Their adoption is fueled by major smartwatch makers integrating advanced features such as ECG tracking, GPS, and fitness analytics. Meanwhile, 32-bit chips continue serving entry-level and cost-sensitive models, but growth is slower due to limited performance and reduced compatibility with high-end applications.

- For instance, Google’s Pixel Watch 2 uses the Qualcomm Snapdragon W5+ Gen 1 platform, which combines a 4 nm Snapdragon W5 Gen 1 chip with a Cortex M33 co-processor, and features 2 GB RAM and 32 GB storage. The 306 mAh battery charges to about 50% in approximately 30 minutes and is rated for up to 24 hours of battery life with the always-on display enabled.

By Application

Android system smartwatches accounted for the largest market share in 2024 with nearly 55%. Their leadership is driven by wide adoption across multiple brands, open-source flexibility, and affordability compared to iOS-based devices. Growth is further supported by integration of health-tracking sensors, LTE connectivity, and fitness features within Android wearables. iOS system smartwatches, while holding a smaller share, remain strong in premium categories due to brand loyalty and seamless ecosystem integration. Windows system smartwatches occupy a marginal niche, limited by restricted compatibility and fewer manufacturer partnerships, slowing their long-term growth potential.

- For instance, OnePlus Watch 2 (Wear OS) delivers up to 100 hours in Smart Mode using a Dual-Engine setup (Snapdragon W5 + BES2700), includes 2 GB RAM, 32 GB storage, and dual-frequency L1+L5 GNSS.

Market Overview

Rising Adoption of Wearable Health Technologies

The growing use of smartwatches for health monitoring is a major driver. Consumers demand advanced features like ECG, heart rate, blood oxygen tracking, and sleep monitoring. These functions require powerful smartwatch chips with higher processing efficiency and energy optimization. Increasing healthcare awareness and integration with telemedicine platforms also accelerate adoption. This shift is particularly strong in developed regions where preventive healthcare is gaining traction. As a result, smartwatch chips are evolving to support AI-driven diagnostics and long-term wellness tracking, solidifying health applications as the key growth driver.

- For instance, Apple’s Watch Series 8 uses two temperature sensors that sample skin temperature every 5 seconds during sleep to detect deviations from baseline.

Advancements in Connectivity and IoT Integration

Smartwatch chips benefit from the expansion of IoT and improved wireless technologies. Enhanced Bluetooth, Wi-Fi, and LTE/5G connectivity options drive demand for chips capable of seamless communication. Users increasingly expect smartwatches to serve as independent devices rather than smartphone companions. This requires higher processing speeds, stronger connectivity, and efficient battery usage. Companies are innovating chips that balance performance and power consumption to extend battery life. The push toward IoT ecosystems in smart homes and workplaces is accelerating adoption, making connectivity innovation a core driver of market growth.

- For instance, Qualcomm states that its Adreno GPU in Snapdragon 8 Gen 2 achieves up to 45% better power efficiency compared to prior generation GPUs.

Expansion of Affordable Smartwatches in Emerging Markets

Emerging economies are witnessing rising adoption of smartwatches due to growing disposable incomes and shifting lifestyles. Manufacturers are releasing cost-effective models powered by efficient chips to attract first-time buyers. This expansion is enabling mass-market penetration, especially in Asia-Pacific and Latin America. Affordable smartwatches now feature essential health and fitness tracking, aligning with consumer demand at lower price points. Governments and corporations promoting digital health also contribute to adoption. With the rise of local smartwatch brands, the demand for mid- and low-cost smartwatch chips is increasing significantly in these regions.

Key Trends & Opportunities

Integration of AI and Machine Learning Capabilities

AI-powered chips are becoming a key trend in the smartwatch market. These processors enable real-time predictive analytics for health, fitness, and user behavior. AI also enhances personalized insights, such as stress management and workout optimization. Leading players are focusing on embedding neural network accelerators to process data locally, reducing reliance on cloud connectivity. This improves privacy and responsiveness, making AI-enabled chips highly attractive. The opportunity lies in expanding AI-driven applications beyond health, including payments, productivity tools, and gesture recognition, positioning advanced chips at the core of future smartwatch innovation.

- For instance, Huawei’s Watch 4 Pro supports eSIM cellular connectivity for phone-free features like calls and SMS, along with illustrating IoT-enabled health data transmission through AI-powered health monitoring.

Growing Demand for Energy-Efficient Processors

Energy efficiency has emerged as a critical trend due to user demand for longer battery life. Smartwatch chips are now designed with low-power architectures, balancing performance and efficiency. This is crucial as consumers rely on smartwatches for 24/7 health monitoring and connectivity. Energy-efficient chips reduce charging frequency, improving user convenience and adoption. The opportunity for manufacturers is to develop processors optimized for both premium and budget smartwatches. With sustainability becoming a purchasing factor, chips enabling extended life cycles and reduced energy consumption are gaining strong momentum in global markets.

- For instance, Samsung reduced display power use by 13%–16% in its Galaxy S23 series to improve battery life.

Expansion of 5G-Enabled Smartwatches

5G connectivity integration represents a growing opportunity for smartwatch chipmakers. Enhanced network speed and reliability allow smartwatches to operate more independently, supporting high-bandwidth applications such as video calling and real-time health data sharing. This shift reduces dependence on paired smartphones and elevates smartwatch functionality. Although adoption is currently limited to high-end models, 5G penetration in consumer electronics will drive wider adoption over time. Chipmakers investing in 5G-ready designs can gain early-mover advantages, particularly as telecom providers expand global coverage, enabling smartwatches to serve as true standalone communication devices.

Key Challenges

High Power Consumption and Thermal Management Issues

One of the key challenges is managing the high power demand of advanced smartwatch chips. As chips integrate AI, 5G, and multitasking features, energy requirements rise. This leads to faster battery drain and overheating, impacting user experience. Manufacturers face difficulties in balancing performance with energy efficiency, especially in compact smartwatch designs. Addressing these issues requires innovative low-power architectures and advanced cooling solutions. Without solving these challenges, mass adoption of feature-rich smartwatches may be limited, slowing the growth of high-performance smartwatch chips in global markets.

Supply Chain Disruptions and Rising Production Costs

Global semiconductor shortages and rising material costs remain a major challenge for smartwatch chipmakers. Geopolitical tensions and dependency on a few manufacturing hubs further strain supply reliability. This results in production delays, cost escalation, and limited availability of advanced chips for manufacturers. Smaller smartwatch brands are particularly impacted as they lack the resources to secure stable supply contracts. Additionally, fluctuating raw material prices add to the challenge. Overcoming these supply chain risks will require diversification of production bases and investments in regional semiconductor manufacturing capacities.

Regional Analysis

North America

North America held the largest share of the smartwatch chips market in 2024 with 35%. Strong consumer adoption of premium smartwatches, combined with high spending on health and fitness devices, drives this dominance. The presence of major technology companies and semiconductor manufacturers in the U.S. supports innovation and faster integration of advanced chips. Rising demand for AI-driven health monitoring and 5G-enabled wearables further boosts the market. Continuous investments in R&D and favorable healthcare digitalization trends keep North America at the forefront, ensuring sustained demand for high-performance smartwatch processors throughout the forecast period.

Europe

Europe accounted for 27% of the smartwatch chips market in 2024, making it the second-largest region. Growing consumer focus on health, wellness, and sustainability supports smartwatch adoption across countries like Germany, the UK, and France. Strict data protection regulations encourage development of secure and energy-efficient chips. Leading European electronics brands are also collaborating with global chipmakers to strengthen supply chains and expand smartwatch features. The rising popularity of digital healthcare applications and government-led health initiatives further accelerate growth. Increasing demand for premium smartwatches with longer battery life supports continued momentum in the European market.

Asia Pacific

Asia Pacific captured 25% of the smartwatch chips market in 2024, driven by large-scale adoption in China, India, South Korea, and Japan. Rising disposable incomes, urbanization, and a tech-savvy youth population fuel demand. Regional manufacturers introduce affordable smartwatch models powered by efficient chips, expanding accessibility. The presence of leading semiconductor hubs in Taiwan and South Korea also strengthens supply capacity. Rapid integration of AI and IoT into wearable devices further enhances growth. With both premium and low-cost segments growing rapidly, Asia Pacific remains a highly competitive and fast-expanding market for smartwatch chip suppliers.

Latin America

Latin America represented 8% of the smartwatch chips market in 2024, supported by growing adoption of fitness and health-oriented devices. Brazil and Mexico lead regional demand, driven by expanding middle-class consumers and increasing smartphone penetration. Affordability remains a critical factor, pushing demand for cost-efficient smartwatch chips in mass-market models. Partnerships between global smartwatch brands and local distributors further aid market reach. Although premium segment adoption is slower, rising health awareness and connectivity needs are fueling steady growth. The market outlook remains positive, with demand likely to rise alongside economic improvements and digital lifestyle adoption.

Middle East and Africa

The Middle East and Africa accounted for 5% of the smartwatch chips market in 2024. Demand is growing steadily, supported by urban populations adopting fitness and lifestyle wearables. The Gulf countries, including the UAE and Saudi Arabia, drive premium smartwatch adoption due to higher purchasing power. Meanwhile, African markets show rising interest in affordable smartwatch models as digital health solutions expand. Limited local chip production capabilities result in reliance on imports, creating challenges in supply. However, increasing investments in digital infrastructure and rising health-conscious consumers are expected to strengthen long-term growth in this region.

Market Segmentations:

By Type:

By Application:

- Android System Smartwatch

- iOS System Smartwatch

- Windows System Smartwatch

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The smartwatch chips market is shaped by leading players such as Samsung Electronics, Arm Ltd., Huawei Technologies Co., Ltd., Microchip Technology Inc., Apple, Intel Corp., Broadcom, Analog Devices, Inc., Qualcomm Technologies, Inc., Silicon Laboratories, Nordic Semiconductor, and Ingenic Semiconductor Co., Ltd. Competition is driven by continuous innovation in chip architectures, with a focus on energy efficiency, AI integration, and support for advanced connectivity such as LTE and 5G. Companies are investing heavily in R&D to deliver processors that enhance real-time health tracking, improve battery performance, and enable seamless device integration. Strategic collaborations with smartwatch manufacturers are expanding market reach, while partnerships with telecom operators support the rollout of connected wearables. The market is also witnessing rising demand in emerging economies, pushing chipmakers to balance affordability with performance. Supply chain resilience and semiconductor manufacturing capacity remain critical factors influencing competitiveness in this rapidly evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Samsung Electronics

- Arm Ltd.

- Huawei Technologies Co., Ltd.

- Microchip Technology Inc.

- Apple

- Intel Corp.

- Broadcom

- Analog Devices, Inc.

- Qualcomm Technologies, Inc.

- Silicon Laboratories

- Nordic Semiconductor

- Ingenic Semiconductor Co., Ltd.

Recent Developments

- In 2025, Qualcomm Technologies, Inc. launched the Snapdragon W5+ Gen 2 and W5 Gen 2 wearable platforms. These chips support satellite connectivity for two-way emergency messaging in remote areas without cell service, a significant step in safety and communication for wearables.

- In 2025, Apple launched the Apple Watch Series 11, Apple Watch Ultra 3, and Apple Watch SE 3.

- In 2025, Samsung Electronics Launched the Samsung Galaxy Watch 8 and Galaxy Watch Ultra, with an emphasis on advanced health monitoring features, including blood pressure and ECG readings, and introducing new metrics like “Energy Score” and “Ages

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with strong demand for health-focused smartwatches.

- AI-enabled chips will drive personalized health monitoring and predictive analytics.

- Energy-efficient processors will remain critical for extending smartwatch battery life.

- 5G-ready smartwatch chips will gain traction as networks expand globally.

- Affordable chip solutions will fuel adoption in emerging markets.

- Premium smartwatches will integrate advanced graphics and seamless multitasking features.

- Partnerships between chipmakers and smartwatch brands will accelerate product innovation.

- Supply chain diversification will reduce risks from global semiconductor shortages.

- Wearables with standalone connectivity will increase demand for high-performance chips.

- Continuous R&D investments will shape next-generation smartwatch processors.