Market Overview

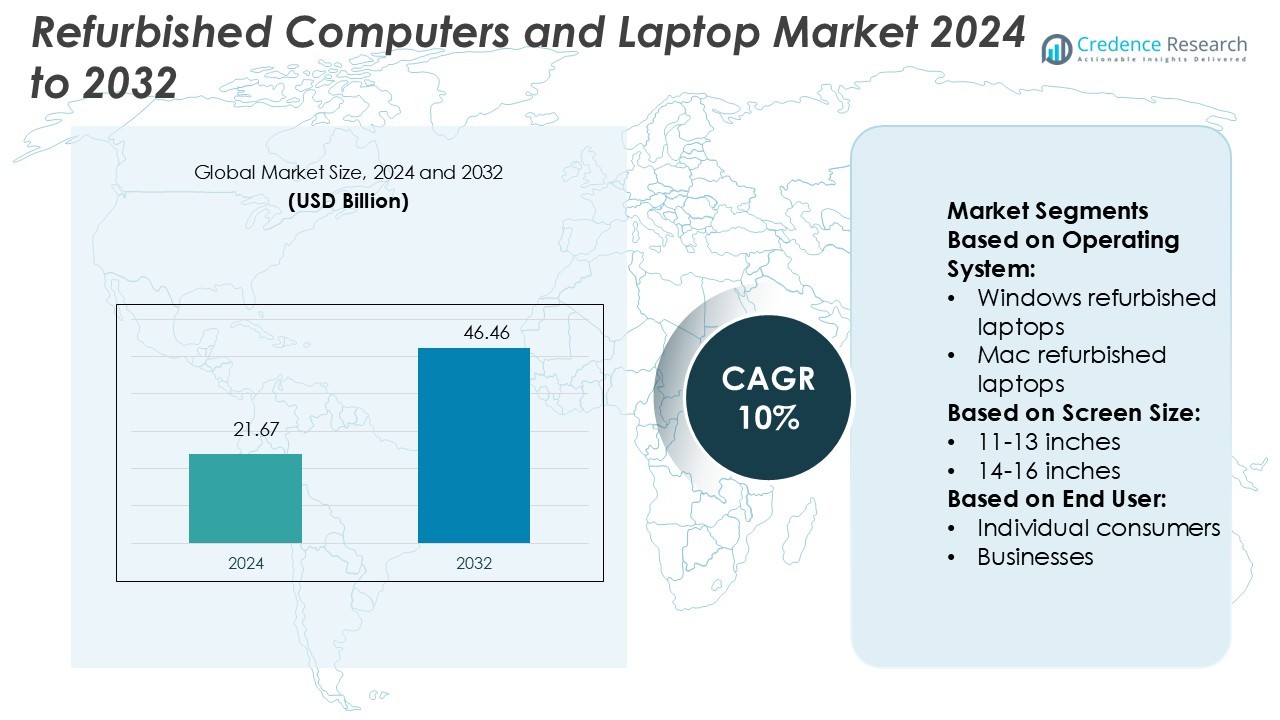

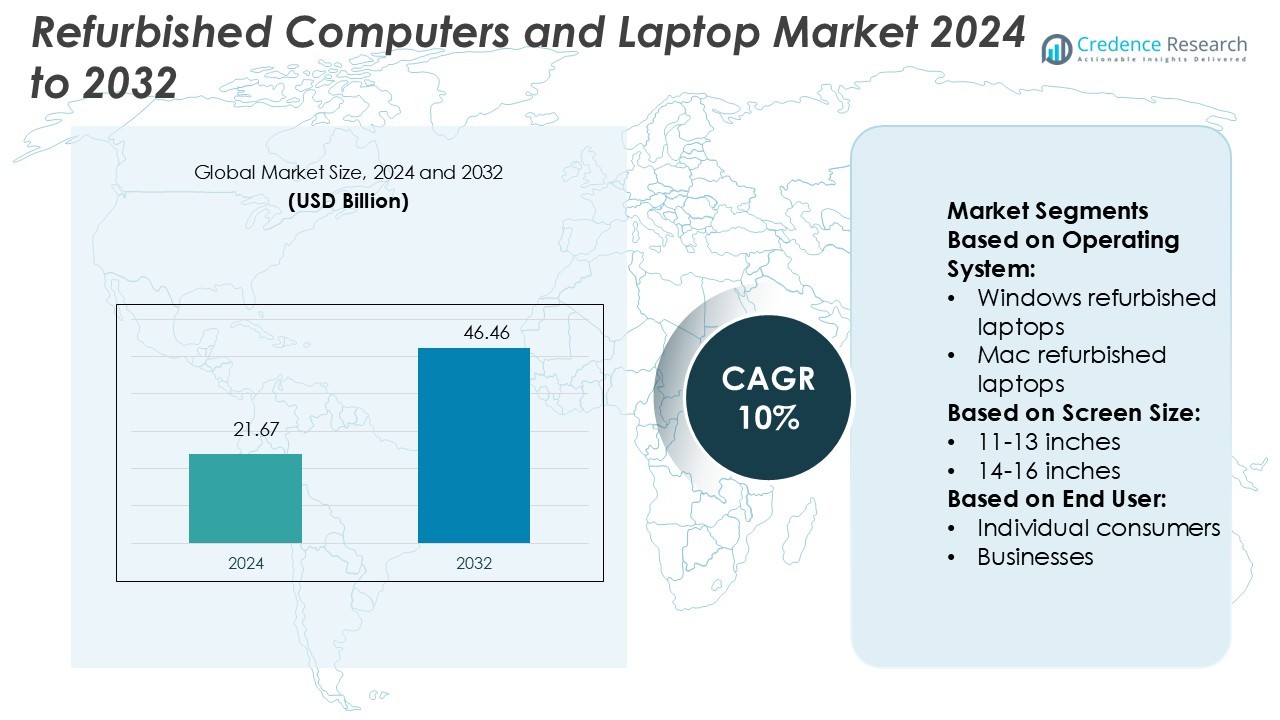

Refurbished Computers and Laptop Market size was valued USD 21.67 billion in 2024 and is anticipated to reach USD 46.46 billion by 2032, at a CAGR of 10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Refurbished Computers and Laptop Market Size 2024 |

USD 21.67 Billion |

| Refurbished Computers and Laptop Market, CAGR |

10% |

| Refurbished Computers and Laptop Market Size 2032 |

USD 46.46 Billion |

The refurbished computers and laptop market is driven by leading players including Apple, Dell, Acer, ASUS, Amazon Renewed, Back Market, Best Buy, Gazelle, Arrow Direct, and Blair Tech. These companies strengthen the market by offering certified devices, warranty-backed services, and wide product availability across both consumer and enterprise segments. Global OEMs such as Apple, Dell, Acer, and ASUS focus on manufacturer-certified programs, while platforms like Amazon Renewed and Back Market expand reach through strong e-commerce networks. Specialized refurbishers and retailers enhance competition with value-driven offerings and bulk procurement solutions. Regionally, North America leads the market with a 35% share, supported by strong demand from enterprises, educational institutions, and environmentally conscious consumers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The refurbished computers and laptop market was valued at USD 21.67 billion in 2024 and is projected to reach USD 46.46 billion by 2032, registering a CAGR of 10%.

- Growing consumer demand for affordable, certified devices and increasing adoption by enterprises and educational institutions are key drivers boosting market expansion.

- Market trends highlight rising trust in warranty-backed products, expansion of online platforms like Amazon Renewed and Back Market, and the growing role of circular economy initiatives.

- Competition remains strong, with Apple, Dell, Acer, ASUS, Best Buy, Gazelle, Arrow Direct, and Blair Tech competing on quality assurance, price, and after-sales services.

- Regionally, North America leads with a 35% share, followed by Europe at 28% and Asia Pacific at 22%, while the individual consumer segment remains dominant due to increasing affordability and wide product availability.

Market Segmentation Analysis:

By Operating System

Windows refurbished laptops hold the largest share in the refurbished computers and laptop market, accounting for over 60%. Their dominance is supported by strong compatibility with enterprise applications, affordability, and wide consumer familiarity. Businesses prefer Windows systems due to their seamless integration with office software and enterprise solutions, while individuals benefit from broader availability and competitive pricing. Mac refurbished laptops serve a niche segment, favored by creative professionals seeking performance at lower costs. The “Others” category, including Linux-based devices, captures minimal share but is gaining interest among developers and education institutions.

- For instance, Lenovo’s AI-powered refurbishment workflow augmented its diagnostic throughput by 116%, enabling more single-model units to be processed per hour, and achieved 100% on-time fulfillment of refurbished orders.

By Screen Size

The 14–16 inches category leads the market, holding close to 50% share. This dominance comes from its balance of portability and usability, appealing to both professionals and students. Refurbished devices in this size range are widely used by businesses for workforce deployment, supported by durability and performance standards. The 11–13 inches segment caters to highly mobile consumers, such as students and frequent travelers, while 17 inches and above laptops serve specialized use cases like gaming and design, where large displays are critical.

- For instance, Acer Predator Orion 7000 series units include the PredatorSense application, which offers built-in diagnostics that test storage, RAM, and system health.

By End User

Individual consumers form the largest segment, accounting for nearly 55% of the market. High price sensitivity drives demand in this group, as refurbished laptops provide affordable access to premium brands and specifications. Growth in online sales channels further strengthens consumer adoption, making refurbished devices accessible across wider demographics. Businesses follow closely, leveraging refurbished computers to optimize IT budgets and meet sustainability goals. The “Others” segment, including educational institutions and NGOs, also shows rising adoption as part of cost-effective digital transformation strategies.

Key Growth Drivers

Increasing Demand from Cost-Conscious Consumers

The refurbished computers and laptops market is driven by growing adoption among price-sensitive buyers. High-quality refurbished devices provide cost savings of 30–50% compared to new systems, making them attractive for students, small businesses, and households. Economic uncertainties and inflationary pressures further encourage consumers to opt for affordable alternatives. Rising trust in certified refurbishers and warranty-backed products boosts confidence. As more users prioritize functionality over brand-new purchases, the demand for refurbished devices continues to expand, positioning them as a viable option for diverse customer groups.

- For instance, Amazon Renewed requires every refurbished device to pass a full diagnostic test, ensure battery capacity of at least 80% relative to new units, and achieve zero visible defects from a distance of 30 cm.

Sustainability and E-Waste Reduction Initiatives

Growing awareness of environmental concerns significantly drives the refurbished computers and laptops market. Governments and organizations encourage circular economy practices, promoting device reuse to minimize e-waste. By extending product life cycles, refurbished laptops help reduce the carbon footprint of electronic production. Many companies are integrating sustainability goals, sourcing refurbished devices for employees to align with green commitments. Certification standards and recycling regulations further strengthen adoption. Consumers increasingly associate refurbished purchases with responsible consumption, reinforcing market growth while addressing critical global issues like resource conservation and environmental sustainability.

- For instance, Apple has deployed its disassembly robot Daisy, which can disassemble up to 200 iPhone units per hour into precise modules for material recovery. Apple also sources 24 % of the materials in its devices from recycled or renewable sources.

Expansion of Online Sales Channels and Distribution Networks

The rapid growth of e-commerce and dedicated refurbished marketplaces fuels sales expansion. Platforms such as Amazon Renewed, Back Market, and OEM-certified portals provide wide product availability, competitive pricing, and warranty assurance. Online channels offer transparent quality checks and reviews, enhancing customer trust in refurbished systems. Retailers and refurbishers also expand physical distribution networks, including direct partnerships with IT service providers and enterprises. This multichannel approach improves accessibility and supports strong market penetration across both consumer and enterprise segments. The convenience of online browsing combined with secure payment systems accelerates the adoption curve.

Key Trends & Opportunities

Rising Enterprise Adoption for Cost Optimization

Enterprises increasingly integrate refurbished laptops into IT procurement strategies to optimize budgets. Companies save significantly by adopting certified refurbished devices for large teams, especially during hybrid and remote work transitions. Vendors offering bulk supply with extended service packages strengthen corporate adoption. This trend creates strong opportunities for refurbishers to position themselves as strategic IT partners.

- For instance, Samsung operates a Certified Re-Newed program where each device undergoes a 132-point quality inspection, is fitted with a certified new battery, assigned a new IMEI, and must pass functionality tests using 100% genuine Samsung parts.

Integration of Advanced Quality Certification and Warranty Models

Improved grading systems, certifications, and extended warranties enhance the credibility of refurbished devices. Buyers increasingly value assurance of tested components, verified battery life, and manufacturer-backed guarantees. These enhancements open opportunities to capture premium segments, where customers are willing to pay more for certified reliability and long-term performance security.

- For instance, LG increased its recycled plastic usage in products by 36 % year over year, with usage rising from ~54,400 tons in 2023 to ~74,000 tons.

Growing Demand in Emerging Markets

Emerging economies present significant growth opportunities due to affordability needs and rising digital penetration. Government-led digital literacy programs and expanding educational access drive adoption among students. The availability of refurbished laptops at lower costs enables wider access to technology in price-sensitive regions, further accelerating market expansion.

Key Challenges

Consumer Perception and Trust Issues

Despite improvements, refurbished products still face skepticism around quality and durability. Some buyers associate refurbished devices with used or faulty systems. Limited awareness of certification processes and warranty programs further impacts adoption. Overcoming this perception challenge requires consistent education, transparent communication, and robust after-sales support to build long-term trust in refurbished markets.

Supply Chain and Component Availability Constraints

The availability of quality used systems and components often restricts consistent supply. Market fluctuations in IT upgrades or trade-in programs impact refurbishers’ ability to scale operations. Inconsistent component sourcing also affects device standardization, pricing, and turnaround times. Addressing these challenges requires stronger OEM partnerships, structured buy-back schemes, and investment in efficient refurbishment infrastructure to maintain a steady supply chain.

Regional Analysis

North America

North America leads the refurbished computers and laptop market with a 35% share in 2024. Strong demand arises from cost-conscious enterprises and educational institutions that adopt certified refurbished devices to reduce IT expenses. The region benefits from the presence of leading platforms such as Amazon Renewed and Back Market, which offer warranty-backed products. Government initiatives promoting e-waste reduction and sustainability further strengthen adoption. High digital penetration, coupled with increased remote and hybrid work culture, drives steady growth. The United States dominates regional sales, supported by corporate IT upgrades and a rising preference for eco-friendly device consumption.

Europe

Europe accounts for 28% of the refurbished computers and laptop market, supported by strong environmental regulations and sustainability goals. Countries such as Germany, France, and the UK show high adoption, driven by growing trust in certified refurbished devices. The European Union’s circular economy initiatives encourage the reuse of electronics, reducing e-waste and extending device lifecycles. Enterprise buyers and public sector institutions play a major role in demand generation. Well-established refurbishment networks, combined with online marketplaces offering quality assurance, further strengthen market growth. Rising digital transformation across SMEs also contributes to Europe’s robust position in the market.

Asia Pacific

Asia Pacific holds a 22% share in the refurbished computers and laptop market and is the fastest-growing region. Rapid digital adoption, expanding e-learning, and government-led digital literacy initiatives in countries like India, China, and Indonesia fuel demand. The affordability of refurbished laptops makes them attractive to students, households, and small businesses. Growing internet penetration and the rise of e-commerce platforms enhance accessibility. Local refurbishers and global players expand distribution to capture this cost-sensitive market. As the region experiences strong economic growth and increasing technology dependence, the demand for affordable, certified refurbished devices continues to accelerate significantly.

Latin America

Latin America contributes 9% of the refurbished computers and laptop market, with Brazil and Mexico leading adoption. Economic constraints and demand for budget-friendly IT solutions encourage buyers to opt for refurbished devices. Educational programs and small enterprises represent the core customer base. Online marketplaces and retail partnerships expand reach, while warranty-backed products build consumer confidence. Limited awareness and uneven refurbishment infrastructure remain challenges. However, increasing internet penetration and digital inclusion initiatives create growth opportunities. With a growing student population and rising digital economy, Latin America shows potential for further expansion in the refurbished laptop segment.

Middle East & Africa

The Middle East & Africa region holds a 6% share in the refurbished computers and laptop market. Affordability and demand from small businesses and educational institutions drive sales. Countries such as South Africa, the UAE, and Saudi Arabia show rising adoption as digital transformation accelerates. However, limited awareness and weaker refurbishment ecosystems slow wider penetration. E-commerce platforms and regional resellers are expanding their presence, offering certified refurbished devices with warranties to build trust. Government-led digital learning programs and increasing smartphone-to-laptop migration also support growth. The region’s market potential remains strong but requires better infrastructure and consumer education.

Market Segmentations:

By Operating System:

- Windows refurbished laptops

- Mac refurbished laptops

By Screen Size:

- 11-13 inches

- 14-16 inches

By End User:

- Individual consumers

- Businesses

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The refurbished computers and laptop market is shaped by key players such as Best Buy, Gazelle, Apple, Arrow Direct, Acer, Blair Tech, Back Market, ASUS, Amazon Renewed, and Dell. The refurbished computers and laptop market is highly competitive, with players focusing on pricing, quality assurance, and warranty-backed offerings to strengthen customer confidence. Companies differentiate themselves through certified refurbishment processes, advanced testing methods, and after-sales support that ensure performance reliability. The rise of online marketplaces has intensified competition, as wide product availability and transparent customer reviews influence purchasing decisions. Bulk procurement partnerships with enterprises, schools, and government institutions further expand market reach. Sustainability commitments, including reduced e-waste and circular economy practices, also act as key competitive levers. Overall, competition is shaped by affordability, trust-building, and service reliability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2024, Honeywell introduced three new handheld computers—CT37, CK67, and CK62—to optimize workflows in warehouses and retail environments. These devices are designed to support Artificial Intelligence (AI) applications, enhancing process efficiency and employee productivity.

- In September 2024, CipherLab Co., Ltd. announced a partnership with Springdel to enhance Mobile Device Management (MDM) solutions for its Android mobile computers. This collaboration aims to improve device monitoring, content delivery, and remote support across various industries, including retail, logistics, and manufacturing.

- In July 2024, Samsung launched its AI-powered laptop, the Galaxy Book4 Ultra, in India. The device is powered by Intel’s latest Core Ultra processors, delivering advanced AI capabilities for optimal performance and seamless multitasking. It features a sleek and compact design with a 16-inch Dynamic AMOLED 2X touchscreen display.

- In May 2024, Asus, Microsoft, and Qualcomm collaborated to launch a new generation of AI-powered PCs that promise to revolutionize personal computing. On May 20, ASUS launched a new-era ASUS AI PC at the Next Level AI Incredible virtual launch event. The new PCs offer comprehensive support for the latest AI functionality from Microsoft and ASUS, delivering personalized experiences tailored to individual needs.

Report Coverage

The research report offers an in-depth analysis based on Operating System, Screen Size, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as affordability continues to attract individual and enterprise buyers.

- Certified refurbishment programs will gain more trust, driving higher adoption rates worldwide.

- Online marketplaces will play a larger role in distribution and customer engagement.

- Enterprises will increasingly adopt refurbished laptops to optimize IT budgets.

- Growing focus on sustainability will position refurbished devices as eco-friendly alternatives.

- Warranty extensions and service packages will become standard across providers.

- Emerging markets will see rapid adoption due to rising digital penetration.

- Educational institutions will drive bulk demand for cost-effective refurbished devices.

- Supply chain partnerships with OEMs will enhance product quality and availability.

- Consumer awareness campaigns will reduce stigma and strengthen confidence in refurbished products.