| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solid Carbide Cutting Tools Market Size 2024 |

USD 11,003.6 million |

| Solid Carbide Cutting Tools Market, CAGR |

4.9% |

| Solid Carbide Cutting Tools Market Size 2032 |

SD 16,152.5 million |

Market Overview:

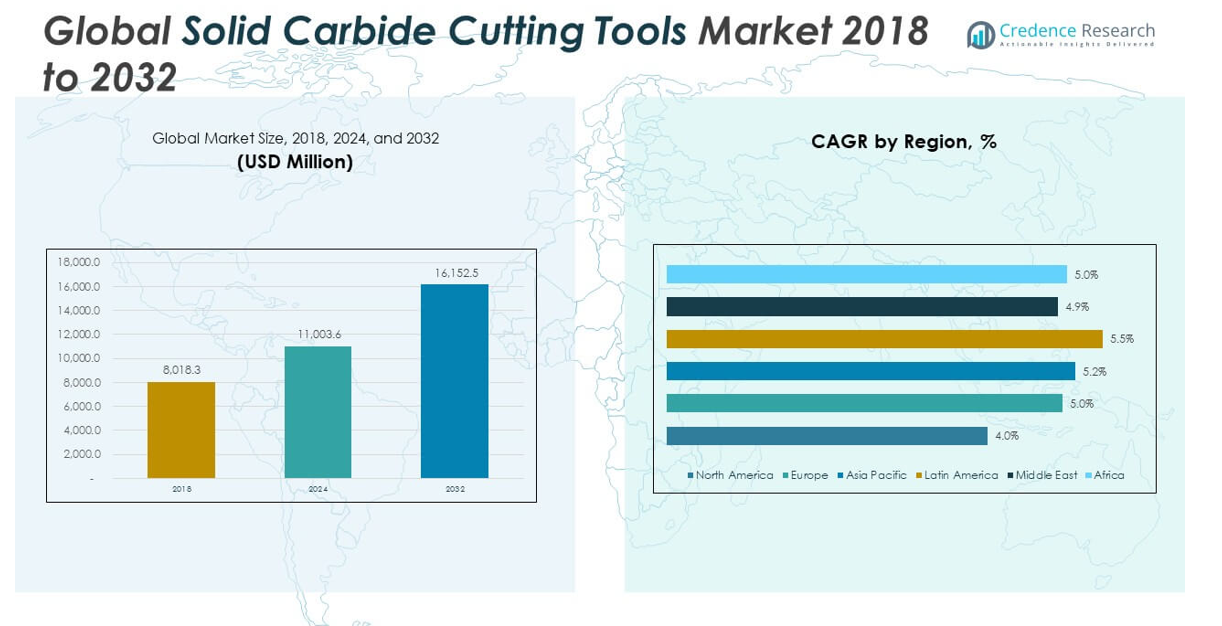

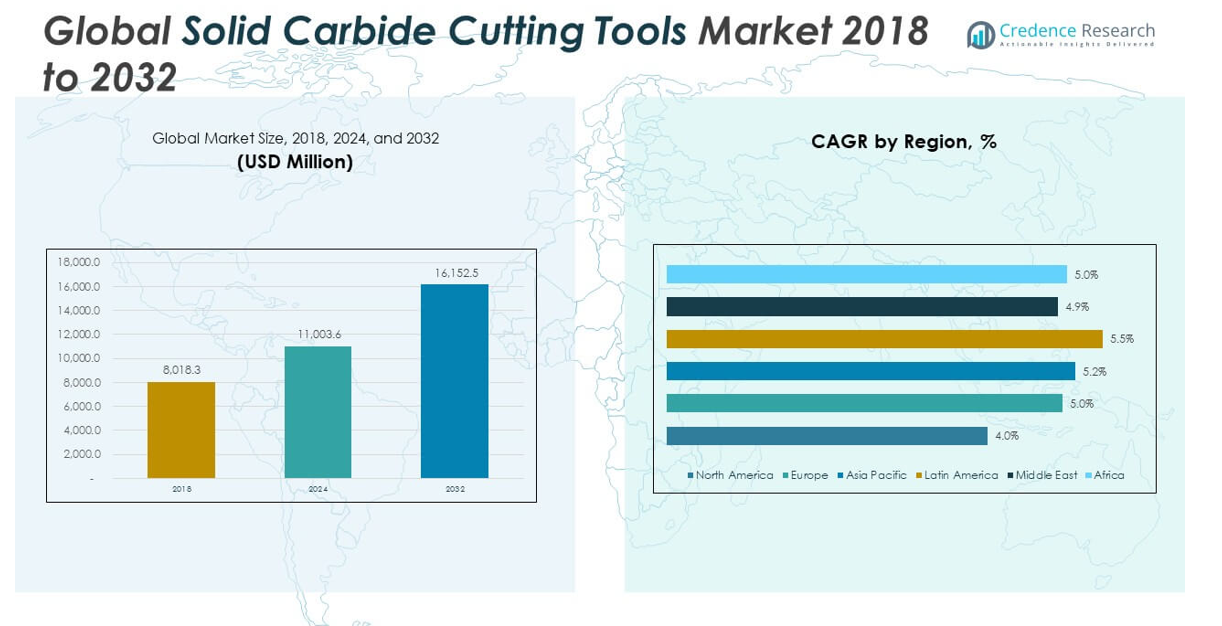

The Global Solid Carbide Cutting Tools Market size was valued at USD 8,018.3 million in 2018 to USD 11,003.6 million in 2024 and is anticipated to reach USD 16,152.5 million by 2032, at a CAGR of 4.9% during the forecast period.

The growth of the Global Solid Carbide Cutting Tools Market is driven by several critical factors. The demand for higher productivity, reduced tool change time, and lower operational costs has encouraged manufacturers to invest in durable, heat-resistant tools. Solid carbide tools offer significant advantages in machining hard materials, providing excellent surface finish and high wear resistance. The rise of electric vehicle (EV) production, medical equipment manufacturing, and micro-machining in electronics has expanded the application range of these tools. Technological advancements, such as multi-layer coatings including titanium nitride (TiN), aluminum titanium nitride (AlTiN), and diamond-like carbon (DLC), have extended tool life and improved heat dissipation. These developments, combined with the increased integration of robotics and computer-aided manufacturing systems, are reshaping operational efficiency and fueling adoption across industries. As more companies adopt lean manufacturing and precision engineering practices, the role of solid carbide tools as a key productivity enabler continues to grow.

Regionally, North America holds the largest share of the Global Solid Carbide Cutting Tools Market. The region’s well-established automotive and aerospace sectors, along with a strong presence of advanced machine shops, support sustained demand. Europe is the second-largest market, with Germany, the UK, and France leading demand due to their strong manufacturing bases and focus on high-precision engineering. Asia Pacific is emerging as the fastest-growing region, led by industrial growth in China, India, Japan, and South Korea. Rapid urbanization, infrastructure development, and government initiatives to boost domestic manufacturing are driving tool consumption in this region. Latin America, the Middle East, and Africa are expected to experience moderate but steady growth, supported by increased investments in infrastructure, energy, and industrial equipment manufacturing. These regional dynamics reflect a globally expanding market supported by both mature and emerging economies.

Market Insights:

- The Global Solid Carbide Cutting Tools Market was valued at USD 8,018.3 million in 2018, reached USD 11,003.6 million in 2024, and is expected to hit USD 16,152.5 million by 2032, growing at a CAGR of 4.9%.

- Rising demand for high-precision machining in automotive and aerospace industries is fueling market growth, as solid carbide tools offer superior hardness, wear resistance, and thermal stability for critical components.

- The market is closely tied to the global expansion of CNC machinery and smart manufacturing, where solid carbide tools support faster machining speeds, longer tool life, and efficient machine utilization.

- Growth in emerging economies across Asia Pacific, Latin America, and the Middle East is boosting demand for high-performance tools amid rapid industrialization, infrastructure projects, and government support for local manufacturing.

- Continuous advancements in tool coatings and geometries, including DLC, TiAlN, and AlCrN coatings, are enhancing tool durability, chip removal, and machining performance for hard-to-cut materials.

- High upfront costs and budget limitations in small and mid-sized enterprises are slowing adoption, especially in price-sensitive regions, prompting the need for flexible pricing and tool leasing models.

- North America leads the global market, driven by mature automotive and aerospace sectors, while Asia Pacific is the fastest-growing region, led by industrial expansion in China, India, Japan, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for High-Precision Machining in Automotive and Aerospace Industries:

The growing complexity and precision requirements in automotive and aerospace manufacturing are major drivers of the Global Solid Carbide Cutting Tools Market. These industries demand tools that can maintain tight tolerances, withstand high cutting speeds, and deliver consistent surface finishes on hard metals and composites. Solid carbide tools offer superior hardness, thermal resistance, and durability compared to traditional high-speed steel tools. Automakers increasingly rely on carbide tools to machine critical engine parts, transmission systems, and lightweight aluminum components. Aerospace manufacturers also use these tools for titanium and alloy components, where accuracy and tool life are critical. It benefits directly from the expanding production of electric vehicles, aircraft, and advanced mobility systems.

- For instance, Knight Carbide supplies aerospace and defense contractors with custom carbide inserts capable of holding tolerances to within ±0.0002 inches, enabling efficient machining of titanium and Inconel components for jet engines and structural parts.

Growing Adoption of CNC Machinery and Smart Manufacturing Practices:

The widespread integration of computer numerical control (CNC) machines across global manufacturing operations is boosting demand for advanced tooling solutions. CNC systems require high-performance, wear-resistant tools to sustain uninterrupted production and achieve optimal machine utilization. The Global Solid Carbide Cutting Tools Market is closely aligned with this trend, as solid carbide tools enable faster machining speeds, extended tool life, and reduced downtime. Manufacturers are upgrading their machine shops with 5-axis and multi-tasking CNC centers, driving demand for versatile cutting tools compatible with automated processes. It supports productivity improvements and lean manufacturing goals, making carbide tools an essential part of modern industrial systems. The synergy between tooling innovation and digital machining drives sustained market expansion.

- For instance, Kyocera SGS Precision Tools’ Z-Carb HPR five-flute roughing end mills are engineered for high-speed CNC milling, delivering 20–40% higher productivity compared to three- and four-flute end mills, and achieving a surface finish of 80 RMS or better on most materials.

Expansion of Manufacturing in Emerging Economies and Infrastructure Projects:

Emerging markets in Asia Pacific, Latin America, and the Middle East are expanding their manufacturing bases, particularly in automotive, construction equipment, and general engineering sectors. Countries like China, India, Vietnam, and Brazil are witnessing rapid growth in industrial output and infrastructure development. The Global Solid Carbide Cutting Tools Market benefits from this industrialization wave, as local manufacturers invest in high-quality tooling to meet international standards. Governments are also supporting domestic production through incentives and skill development programs, further accelerating tool consumption. It gains momentum in small and mid-sized enterprises (SMEs) that are upgrading their machining capabilities to stay competitive in global supply chains. The shift toward localized manufacturing and export-oriented production strengthens long-term market prospects.

Technological Advancements in Tool Coatings and Geometries:

Ongoing innovation in tool design and coating technologies is enhancing the performance and versatility of carbide cutting tools. Manufacturers are developing advanced coatings such as TiAlN, AlCrN, and DLC to improve heat resistance, chip evacuation, and surface finish quality. The Global Solid Carbide Cutting Tools Market benefits from these enhancements, as industries demand tools that extend tool life while reducing energy consumption and material waste. Optimized tool geometries and cutting-edge designs also contribute to better cutting performance in difficult-to-machine materials. Toolmakers continue to invest in R&D to address evolving application challenges across sectors. It ensures that carbide tools remain relevant in highly specialized and high-performance machining environments.

Market Trends:

Rising Focus on Sustainability and Energy-Efficient Machining Solutions:

Sustainability is becoming a key priority in the tooling industry, prompting a shift toward energy-efficient and environmentally responsible machining practices. Manufacturers are increasingly adopting cutting tools that minimize energy use and reduce material waste without compromising performance. The Global Solid Carbide Cutting Tools Market is responding with tools that extend operational life, enable dry machining, and support high-efficiency processes. Toolmakers are developing products that allow lower cutting forces and optimized coolant usage, contributing to reduced carbon footprints in production environments. This trend aligns with broader corporate sustainability goals and regulatory pressures across industrial sectors. It is encouraging innovation in tool substrate recycling and eco-friendly coating technologies.

- For instance, Tungaloy’s ISO-EcoTurn series features miniaturized inserts that weigh around 47% less than standard ISO inserts, significantly reducing material waste. In documented cases, manufacturers achieved a 40% reduction in tool waste and lowered CO₂ emissions by an estimated 25% over the course of a year by adopting these tools.

Growth of Customized and Application-Specific Tooling Solutions:

Manufacturers are demanding customized tooling solutions tailored to specific materials, machine types, and production goals. Standard tools often fall short in specialized applications, prompting toolmakers to deliver application-specific geometries and performance features. The Global Solid Carbide Cutting Tools Market is witnessing an increase in demand for bespoke cutting tools, particularly in aerospace, defense, and medical sectors where tolerances are critical. Digital modeling, simulation, and additive manufacturing technologies enable rapid prototyping and tool customization at scale. It is creating opportunities for tool providers to differentiate offerings and build closer relationships with end users. This trend is pushing the industry toward a service-oriented model built around engineering support and process optimization.

- For instance, Kyocera SGS Precision Tools provides custom solid carbide tools for composite machining in aerospace, with diamond-coated drills demonstrating 38% less edge wear and producing 50 high-quality holes in carbon fiber reinforced polymer (CFRP) without fraying, compared to uncoated drills..

Integration of Tool Condition Monitoring and Predictive Maintenance Systems:

With the advancement of Industry 4.0, manufacturers are integrating tool condition monitoring systems to improve machining efficiency and reduce unplanned downtime. These systems collect real-time data on tool wear, vibration, and cutting forces, enabling predictive maintenance and optimized tool usage. The Global Solid Carbide Cutting Tools Market is adapting to this trend by offering sensor-compatible tool holders and partnering with software providers to enhance data analytics capabilities. Smart manufacturing environments require tooling solutions that seamlessly interact with digital platforms and automation systems. It strengthens the value proposition of carbide tools in high-precision and high-throughput operations. Tool lifecycle management through predictive insights is becoming a competitive differentiator.

Expansion of E-Commerce Platforms and Digital Tooling Catalogs:

The rise of digital platforms is transforming how manufacturers source and select cutting tools. Tool suppliers are expanding their online presence through interactive catalogs, configurators, and e-commerce portals that simplify product discovery and ordering. The Global Solid Carbide Cutting Tools Market is experiencing growth through online channels, especially among small and mid-sized machine shops seeking quick procurement and technical information. Digital sales models offer enhanced accessibility, faster delivery, and support for global distribution. It allows toolmakers to reach new markets while lowering sales and logistics costs. This trend reflects a broader digital transformation in industrial supply chains.

Market Challenges Analysis:

High Initial Costs and Budget Constraints in Small to Mid-Sized Enterprises:

The high cost of solid carbide cutting tools presents a significant barrier for small and mid-sized enterprises (SMEs), particularly in cost-sensitive markets. These tools offer long-term value through extended life and precision, but their upfront pricing remains considerably higher than high-speed steel or coated alternatives. The Global Solid Carbide Cutting Tools Market faces adoption hurdles in workshops and machine shops operating with limited capital or lower production volumes. SMEs often delay tool upgrades due to cost concerns, even when better productivity and tool life are achievable. This price sensitivity can slow market penetration in regions with a large concentration of small-scale manufacturers. Toolmakers must address this challenge by offering flexible pricing, starter kits, or tool-as-a-service models to improve accessibility.

Supply Chain Disruptions and Raw Material Volatility:

Volatility in the supply and pricing of tungsten carbide, cobalt, and other critical raw materials continues to challenge tool production and cost planning. These materials are subject to geopolitical risks, mining constraints, and export restrictions, which can disrupt availability and inflate costs. The Global Solid Carbide Cutting Tools Market depends heavily on stable sourcing to maintain competitive pricing and delivery schedules. Delays in raw material supply or sudden price hikes can impact profitability and reduce customer confidence. The market also faces logistical challenges in delivering specialized tooling across global regions with inconsistent infrastructure. Tool manufacturers must diversify their supplier base and invest in localized production to reduce these vulnerabilities and ensure continuity.

Market Opportunities:

Growing Penetration in Emerging Economies and Expanding SME Manufacturing Base:

Rapid industrialization across Asia Pacific, Latin America, and parts of Africa presents strong opportunities for tool manufacturers to expand their footprint. Rising investment in infrastructure, automotive production, and consumer electronics has increased demand for high-performance cutting tools. The Global Solid Carbide Cutting Tools Market can leverage this momentum by offering entry-level carbide solutions tailored to regional production needs. Governments in countries like India, Vietnam, and Mexico are supporting small and mid-sized enterprises with subsidies and skill development programs. It creates a favorable environment for market expansion among first-time adopters upgrading from conventional tooling. Manufacturers that align product offerings with regional machining requirements can secure long-term growth in these markets.

Advancements in Tool Reconditioning and Circular Economy Practices:

The adoption of tool reconditioning services and recycling programs offers a compelling opportunity to enhance customer retention and reduce material waste. High-value carbide tools can be reground and recoated multiple times, extending usability and improving cost efficiency for end users. The Global Solid Carbide Cutting Tools Market benefits from this trend by supporting sustainable practices while generating recurring service revenue. Toolmakers that invest in reconditioning infrastructure and promote end-of-life recovery will strengthen their brand positioning. It aligns with growing environmental expectations and industry demand for lifecycle-based tooling strategies. These services also create differentiation in competitive regional markets.

Market Segmentation Analysis:

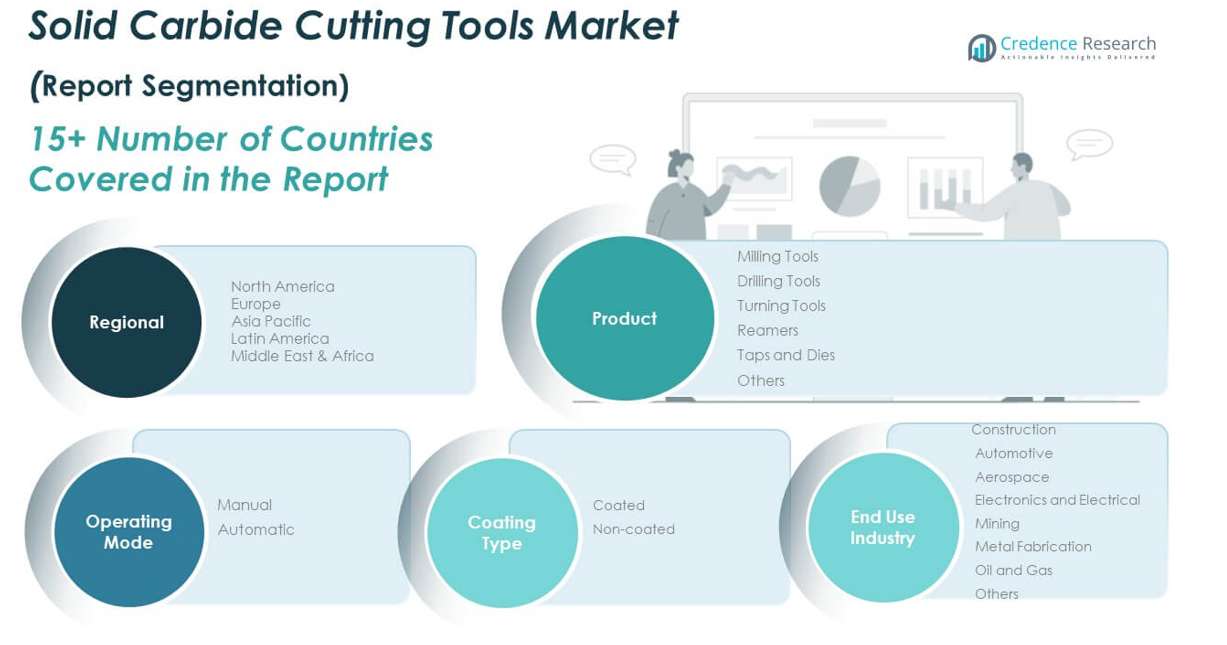

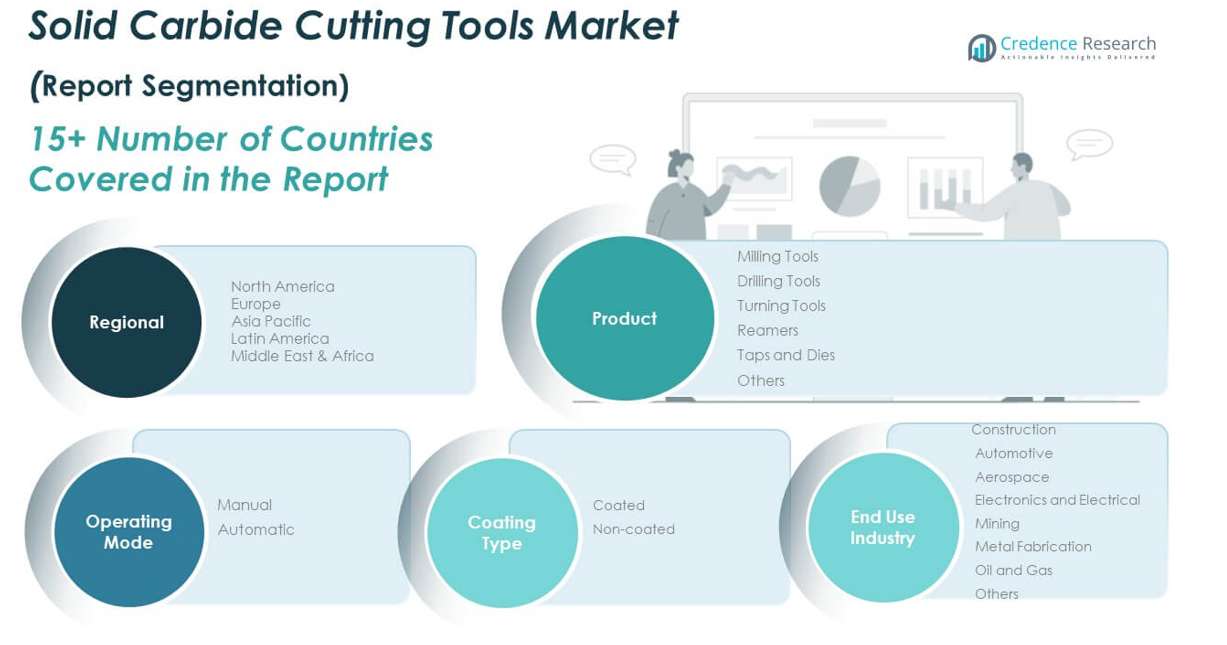

By Product

The market is led by milling tools, widely used for precision machining in industries such as automotive and aerospace. Drilling tools and turning tools account for significant market shares due to their essential roles in metal cutting and component shaping. Reamers, taps and dies, and other tools cater to specific threading and finishing operations, supporting specialized industrial tasks.

- For instance, SGS’s Series 43ML high-performance end mills offer a maximum depth of cut of 16 mm and are used extensively in automotive and aerospace milling operations, supporting high-precision and high-throughput requirements.

By Operating Mode

Automatic solid carbide cutting tools dominate the market as industries adopt automation to increase productivity and reduce operational errors. Manual tools continue to serve maintenance, repair, and low-volume operations where flexibility and cost control are essential.

- For instance, Kyocera SGS’s solid carbide tools are optimized for use in automated CNC environments, with advanced coatings and geometries that extend tool life and reduce the frequency of tool changes, supporting continuous, high-volume production runs in automotive and aerospace sectors.

By Coating Type

Coated tools command a larger share due to their superior heat resistance, wear protection, and extended life, especially in high-speed machining applications. Non-coated tools are preferred in low-intensity tasks or when machining softer materials, offering a cost-effective solution.

By End User Industry

The automotive and aerospace sectors are primary consumers, requiring high-precision tools for engine, structural, and interior components. Construction and metal fabrication industries use carbide tools for robust material processing. The electronics and electrical segment supports demand for micro-machining and precision finishing. In mining and oil & gas, tool durability is critical for drilling and extraction. Other industries, including general manufacturing and maintenance, contribute to consistent market demand.

Segmentation:

By Product

- Milling Tools

- Drilling Tools

- Turning Tools

- Reamers

- Taps and Dies

- Others

By Operating Mode

By Coating Type

By End User Industry

- Construction

- Automotive

- Aerospace

- Electronics and Electrical

- Mining

- Metal Fabrication

- Oil and Gas

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Solid Carbide Cutting Tools Market size was valued at USD 1,612.48 million in 2018 to USD 2,113.33 million in 2024 and is anticipated to reach USD 2,907.45 million by 2032, at a CAGR of 4.0% during the forecast period. The Global Solid Carbide Cutting Tools Market in North America benefits from a mature manufacturing base with strong demand from automotive, aerospace, and medical equipment sectors. The U.S. leads regional consumption due to its extensive network of precision machine shops and rapid adoption of CNC technologies. Companies in the region invest in high-performance cutting tools to meet tight tolerances and lean production targets. Focus on reshoring manufacturing and domestic production also supports tool consumption. The region maintains a sizable market share through consistent innovation and high-value manufacturing operations.

Europe

The Europe Solid Carbide Cutting Tools Market size was valued at USD 2,253.15 million in 2018 to USD 3,108.53 million in 2024 and is anticipated to reach USD 4,595.38 million by 2032, at a CAGR of 5.0% during the forecast period. It holds the second-largest share in the Global Solid Carbide Cutting Tools Market, driven by Germany, France, and the UK. Demand stems from high-precision applications in automotive, aerospace, and energy industries. European manufacturers prioritize sustainable machining and advanced tooling integration with smart factories. Toolmakers in the region focus on high-performance coatings and geometries to extend tool life. Strict EU environmental standards push the market toward more efficient, low-waste cutting technologies.

Asia Pacific

The Asia Pacific Solid Carbide Cutting Tools Market size was valued at USD 2,942.72 million in 2018 to USD 4,099.64 million in 2024 and is anticipated to reach USD 6,137.95 million by 2032, at a CAGR of 5.2% during the forecast period. It is the fastest-growing region in the Global Solid Carbide Cutting Tools Market, supported by rapid industrialization in China, India, Japan, and South Korea. Strong growth in automotive, electronics, and metal fabrication sectors fuels regional tool demand. Governments in Asia Pacific actively promote domestic manufacturing and technology upgrades, expanding opportunities for tool suppliers. Companies are investing in advanced machining centers and automated systems, increasing reliance on solid carbide tooling. The region benefits from cost-competitive production and export-driven manufacturing.

Latin America

The Latin America Solid Carbide Cutting Tools Market size was valued at USD 329.55 million in 2018 to USD 468.76 million in 2024 and is anticipated to reach USD 720.40 million by 2032, at a CAGR of 5.5% during the forecast period. It shows steady growth driven by construction, agriculture machinery, and automotive part manufacturing. Brazil and Mexico are the leading markets, supported by expanding industrial bases and improving technical capabilities. The Global Solid Carbide Cutting Tools Market in this region gains from increased investments in domestic production and infrastructure development. Small and mid-sized enterprises are gradually adopting advanced cutting tools to enhance competitiveness. Access to affordable CNC technologies is accelerating the shift toward precision machining.

Middle East

The Middle East Solid Carbide Cutting Tools Market size was valued at USD 604.58 million in 2018 to USD 831.56 million in 2024 and is anticipated to reach USD 1,224.36 million by 2032, at a CAGR of 4.9% during the forecast period. Regional demand is shaped by investment in oil and gas infrastructure, defense manufacturing, and industrial equipment. The market benefits from increased automation in machining operations and rising demand for high-tolerance components. GCC countries lead in tool consumption due to their industrial modernization agendas. Local demand is supported by public and private sector initiatives to localize manufacturing and reduce reliance on imports. The market continues to evolve with the growth of non-oil industrial sectors.

Africa

The Africa Solid Carbide Cutting Tools Market size was valued at USD 275.83 million in 2018 to USD 381.83 million in 2024 and is anticipated to reach USD 566.95 million by 2032, at a CAGR of 5.0% during the forecast period. It remains a developing region in the Global Solid Carbide Cutting Tools Market, with potential linked to growth in mining, construction, and energy sectors. South Africa is the primary market, with emerging opportunities in Egypt and East Africa. Tool adoption is improving as manufacturers seek to upgrade equipment and meet export standards. Limited access to advanced technologies and skilled labor still constrains growth. Market expansion depends on foreign investment, training programs, and regional industrialization efforts.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Sumitomo Electric Corporation

- Best Carbide Cutting Tools, Inc.

- Advent Tool & Manufacturing, Inc.

- Garr Tool Company

- Ingersoll Cutting Tool Company

- Mitsubishi Materials Corporation

- VHF Camfacture AG

- CERATIZIT S.A.

- Rock River Tool, Inc.

- Vora Industries

- SGS Tool Company

- Tunco Manufacturing Inc.

- PROMAX Tools

- Global Excel Tools Manufacturing Sdn

- OSG Corporation

- Sandvik AB

- Plansee Group

Competitive Analysis:

The Global Solid Carbide Cutting Tools Market is highly competitive, with a mix of multinational corporations and regional manufacturers vying for market share through product performance, innovation, and service capabilities. Leading players such as Sandvik AB, Mitsubishi Materials Corporation, Kennametal Inc., and ISCAR Ltd. maintain strong positions through broad portfolios, advanced coatings, and global distribution networks. Emerging companies focus on niche applications and cost-effective solutions tailored for local markets. It continues to evolve with strategic mergers, acquisitions, and partnerships aimed at expanding geographic reach and technological capability. Manufacturers increasingly compete on precision, tool life, and support services rather than price alone. Digital tooling platforms and smart inventory systems are becoming key differentiators. The market rewards firms that offer consistent quality, application expertise, and reliable supply chains across diverse industries and regions.

Recent Developments:

- In June 2025, Ingersoll Cutting Tool Company introduced the WinTwist modular turning tool line, designed for easier setup and adaptability to multispindle and Swiss-type machines. The modular design allows users to create diameters between 6.0 and 20.9 mm, supporting a wide range of toolholders and improving flexibility in automated machining environments.

- In May 2025, CERATIZIT S.A. acquired a majority stake in Best Carbide Cutting Tools LLC, a California-based manufacturer of round carbide tools. This acquisition is intended to strengthen CERATIZIT’s U.S. distribution network, particularly for high-quality micro tools, and marks Best Carbide’s first integration into a global cutting tool organization in its 37-year history.

- In April 2025, Garr Tool Company released several new products, including the HTD 12 Series drill for deep hole applications and the A3 Series end mill designed for high-velocity machining. The company also announced the upcoming launch of new products featuring advanced BALIQ® coating technology from Oerlikon Balzers, expected by Q2 2025, to enhance tool performance and longevity.

- On April 1, 2025, Mitsubishi Materials Corporation launched several new products, including the MC/MP7100 Series coated grade for stainless steel turning, new end mills in the SMART MIRACLE series, and the RX1S exchangeable head reamer. Additionally, the company rebranded its global cemented carbide tool products from “DIAEDGE” to “Mitsubishi Materials” to strengthen global competitiveness and expand sales regions.

Market Concentration & Characteristics:

The Global Solid Carbide Cutting Tools Market is moderately concentrated, with a handful of global players holding significant market share alongside a broad base of regional and specialized manufacturers. It is characterized by high technical precision, strong end-user demand for customization, and consistent innovation in tool design and coatings. Product differentiation focuses on cutting efficiency, tool life, and performance in specific materials and applications. The market maintains high entry barriers due to capital-intensive manufacturing processes, strict quality standards, and the need for application expertise. It supports both volume-driven production for mass-market applications and tailored solutions for niche industries such as aerospace and medical. Digitalization, sustainability, and customer service integration are becoming essential characteristics of competitive positioning.

Report Coverage:

The research report offers an in-depth analysis based on by product, operating mode, coating type, and end user industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing adoption of precision machining will continue to drive demand for high-performance carbide tools.

- Growth in electric vehicle and renewable energy sectors will expand tool applications in lightweight and composite materials.

- Rising use of automation and robotics will boost the need for durable, CNC-compatible cutting tools.

- Expansion of manufacturing in emerging economies will create new opportunities for tool suppliers.

- Advancements in nanocoatings and tool geometries will enhance cutting speed and tool life.

- Demand for reconditioning and circular economy services will strengthen aftermarket revenue streams.

- Digital catalogs and e-commerce platforms will streamline global tool distribution and customer access.

- Government initiatives supporting industrial modernization will stimulate investment in advanced tooling.

- Integration of tool condition monitoring with smart factory systems will optimize lifecycle management.

- Greater emphasis on sustainability will drive the development of eco-friendly tool production and recycling practices.