| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| South Africa Diabetes Drugs Market Size 2024 |

USD 330.45 Million |

| South Africa Diabetes Drugs Market, CAGR |

0.31% |

| South Africa Diabetes Drugs Market Size 2032 |

USD 353.64 Million |

Market Overview

South Africa Diabetes Drugs Market size was valued at USD 330.45 million in 2023 and is anticipated to reach USD 353.64 million by 2032, at a CAGR of 0.31% during the forecast period (2023-2032).

The South Africa diabetes drugs market is driven by the rising prevalence of diabetes, an aging population, and increasing urbanization, which contribute to lifestyle-related risk factors such as obesity and sedentary behavior. Government initiatives to improve healthcare access and the expansion of national health insurance programs support market growth. Advancements in diabetes treatment, including the adoption of innovative drugs like GLP-1 receptor agonists and SGLT2 inhibitors, enhance patient outcomes and drive demand. However, economic constraints and affordability issues limit access to advanced therapies. The increasing penetration of generic drugs, coupled with collaborations between pharmaceutical companies and healthcare providers, improves affordability and availability. Digital health solutions, including remote patient monitoring and telemedicine, are also gaining traction, enhancing diabetes management. Additionally, growing awareness campaigns and educational programs promote early diagnosis and treatment adherence. These factors collectively shape the competitive landscape and moderate yet steady market growth in South Africa’s diabetes drugs sector.

The South African diabetes drugs market is geographically diverse, with major urban provinces such as Gauteng, Western Cape, and KwaZulu-Natal driving demand due to their advanced healthcare infrastructure and high diabetes prevalence. Rural regions, including parts of Eastern Cape, are experiencing gradual market expansion as government initiatives improve access to essential diabetes medications. Key players in the market include Novo Nordisk, Sanofi, Merck & Co., Eli Lilly, AstraZeneca, and Boehringer Ingelheim, among others. These pharmaceutical giants dominate the industry by offering a wide range of insulin products, oral antidiabetic drugs, and innovative therapies such as GLP-1 receptor agonists and SGLT2 inhibitors. Companies are investing in research and development (R&D) to enhance treatment options and expand their market presence. Additionally, strategic collaborations with healthcare providers and government programs are improving drug availability and affordability, ensuring broader patient access to diabetes treatments across South Africa.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The South Africa diabetes drugs market was valued at USD 330.45 million in 2023 and is projected to reach USD 353.64 million by 2032, growing at a CAGR of 0.31%.

- Rising diabetes prevalence, driven by urbanization, aging populations, and lifestyle changes, is a key market driver.

- Advanced drug classes, including GLP-1 receptor agonists and SGLT2 inhibitors, are gaining traction due to their superior efficacy and additional health benefits.

- Leading pharmaceutical companies such as Novo Nordisk, Sanofi, Merck & Co., Eli Lilly, and AstraZeneca dominate the market through innovative product offerings and strategic partnerships.

- High treatment costs and unequal access to healthcare remain significant challenges, particularly in rural and lower-income communities.

- Gauteng and Western Cape lead the market due to advanced healthcare facilities, while rural regions are experiencing gradual growth due to improved accessibility.

- Government initiatives, digital health solutions, and increasing adoption of combination therapies are shaping the future of diabetes management in South Africa.

Report Scope

This report segments the South Africa Diabetes Drugs Market as follows:

Market Drivers

Rising Diabetes Prevalence and Aging Population

The increasing prevalence of diabetes in South Africa is a major driver of market growth. A combination of genetic predisposition, urbanization, and lifestyle changes has led to a significant rise in type 2 diabetes cases. For instance, the International Diabetes Federation (IDF) reported that 11.3% of adults in South Africa were living with diabetes as of 2021, with over 4.2 million cases documented. The aging population further contributes to the demand for diabetes drugs, as elderly individuals are more susceptible to the disease and its complications. This demographic shift underscores the need for effective and accessible diabetes treatments, boosting pharmaceutical sales and market expansion.

Government Initiatives and Healthcare Access Expansion

The South African government plays a crucial role in expanding access to diabetes medication through public healthcare policies and national health insurance programs. For instance, the National Department of Health’s Strategic Plan for the Prevention and Control of Non-Communicable Diseases includes initiatives to integrate diabetes management into primary healthcare services, improving early diagnosis and treatment accessibility. Subsidized medication programs and partnerships with pharmaceutical companies further ensure that essential diabetes drugs are available at reduced costs. Additionally, regulatory support for the development and approval of generic alternatives enhances affordability, allowing a larger patient base to benefit from effective diabetes treatments.

Advancements in Diabetes Treatment and Innovation

Technological advancements and pharmaceutical innovations have transformed diabetes management in South Africa. The introduction of newer drug classes, such as sodium-glucose cotransporter-2 (SGLT2) inhibitors and glucagon-like peptide-1 (GLP-1) receptor agonists, offers improved efficacy and fewer side effects compared to traditional treatments. The increasing adoption of combination therapies, which enhance glycemic control while reducing the burden of multiple medications, further drives demand. Moreover, digital health solutions, including mobile apps for glucose monitoring and telemedicine consultations, are becoming more prevalent, providing patients with better disease management tools and driving the market forward.

Growing Awareness and Preventive Healthcare Initiatives

Rising awareness about diabetes and its complications has led to increased demand for early diagnosis and effective treatment options. Public and private sector initiatives focus on educating individuals about the importance of lifestyle modifications, regular screenings, and medication adherence. Non-governmental organizations (NGOs) and healthcare providers actively engage in outreach programs, emphasizing preventive measures and early intervention strategies. As a result, more South Africans are seeking medical attention and adhering to prescribed treatment regimens, ultimately contributing to market growth. Additionally, corporate wellness programs encourage employees to monitor their health, further driving the demand for diabetes drugs.

Market Trends

Increased Adoption of Innovative Drug Therapies

The South African diabetes drugs market is witnessing a shift toward advanced treatment options, driven by the growing adoption of innovative drug classes such as GLP-1 receptor agonists and SGLT2 inhibitors. These therapies offer superior glycemic control, weight management benefits, and reduced cardiovascular risks compared to traditional medications like sulfonylureas and metformin. For instance, the South African Diabetes Advocacy has reported a significant increase in the prescription of GLP-1 receptor agonists, particularly for patients with type 2 diabetes and cardiovascular risks. As healthcare providers recognize the advantages of these newer drugs, their prescription rates continue to rise. However, affordability remains a challenge, leading to increased demand for generic versions and government-subsidized treatment programs.

Rising Demand for Combination Therapies

Combination drug therapies are gaining popularity in South Africa due to their ability to improve treatment adherence and patient outcomes. Fixed-dose combinations that integrate multiple active ingredients into a single pill simplify medication regimens, reducing pill burden and enhancing patient compliance. This trend aligns with healthcare providers’ efforts to optimize diabetes management by addressing multiple disease pathways simultaneously. Pharmaceutical companies are investing in research and development (R&D) to introduce more effective combination therapies tailored to diverse patient needs, further driving market growth.

Expansion of Digital Health and Telemedicine Solutions

The integration of digital health technologies is revolutionizing diabetes management in South Africa. Mobile applications, wearable glucose monitors, and telemedicine platforms are enabling patients to monitor their blood sugar levels and consult healthcare providers remotely. For instance, the “Sisonke Health” telemedicine platform has facilitated remote consultations for diabetes patients in rural areas, improving access to specialized care. These innovations improve disease monitoring, facilitate timely interventions, and reduce the burden on healthcare facilities. The COVID-19 pandemic accelerated the adoption of telemedicine, making remote diabetes care a more permanent fixture in the healthcare landscape. This trend is expected to continue, promoting better patient engagement and medication adherence.

Growing Focus on Preventive Healthcare and Lifestyle Management

Preventive healthcare is becoming a key focus in diabetes management, with increased emphasis on lifestyle interventions such as diet, exercise, and weight management. Public health campaigns, corporate wellness programs, and community-driven initiatives are educating individuals about the importance of early intervention and lifestyle modifications. This trend is influencing pharmaceutical strategies, with companies developing drugs that complement lifestyle-based treatments. Additionally, an increasing number of patients are seeking holistic approaches that combine medication with non-pharmacological interventions, shaping the future of diabetes care in South Africa.

Market Challenges Analysis

Limited Access and Affordability Constraints

One of the biggest challenges in the South African diabetes drugs market is limited access to affordable medication. A significant portion of the population relies on public healthcare facilities, where medication shortages and funding constraints often hinder consistent treatment availability. For instance, the South African Medical Research Council (SAMRC) reported that rural clinics frequently face shortages of essential diabetes medications, leaving patients without consistent access to treatment. While innovative diabetes drugs offer superior efficacy, their high costs make them inaccessible to many patients, particularly those without private health insurance. The dominance of generic drugs helps improve affordability, but concerns about quality and efficacy sometimes limit their widespread acceptance. Additionally, disparities in healthcare infrastructure between urban and rural areas exacerbate access issues, leaving many patients in remote regions with inadequate diabetes management options.

Healthcare System Strain and Treatment Adherence Issues

South Africa’s healthcare system faces increasing pressure due to the rising burden of diabetes and other chronic diseases. Public hospitals and clinics often experience overcrowding, long wait times, and resource limitations, making it difficult for patients to receive timely treatment and follow-up care. This strain contributes to poor treatment adherence, as patients struggle to maintain regular check-ups and medication routines. Furthermore, a lack of diabetes education and awareness leads to delayed diagnoses and improper medication use, reducing treatment effectiveness. Socioeconomic factors, including unemployment and food insecurity, also impact patients’ ability to maintain healthy lifestyles, further complicating diabetes management. Addressing these challenges requires coordinated efforts from the government, healthcare providers, and pharmaceutical companies to improve accessibility, affordability, and patient education.

Market Opportunities

The South African diabetes drugs market presents significant opportunities for growth, driven by increasing investments in healthcare infrastructure and the expansion of universal health coverage initiatives. As the government strengthens its commitment to improving public healthcare, there is potential for enhanced distribution of essential diabetes medications, particularly in underserved rural areas. The rising prevalence of diabetes also creates demand for cost-effective treatment options, providing opportunities for pharmaceutical companies to introduce affordable generic alternatives. Additionally, public-private partnerships can play a crucial role in improving access to innovative therapies, ensuring that a larger patient population benefits from advanced diabetes management solutions.

Technological advancements and the growing adoption of digital health solutions offer further opportunities for market expansion. The integration of telemedicine, wearable glucose monitoring devices, and mobile health applications is transforming diabetes care by enhancing patient engagement and improving treatment adherence. Companies investing in digital health solutions can capitalize on the increasing demand for remote monitoring and personalized diabetes management tools. Furthermore, growing health awareness and preventive care initiatives present opportunities for pharmaceutical firms to collaborate with healthcare providers and wellness programs to promote early intervention and lifestyle-based disease management. These factors position the South African diabetes drugs market for steady growth and innovation in the coming years.

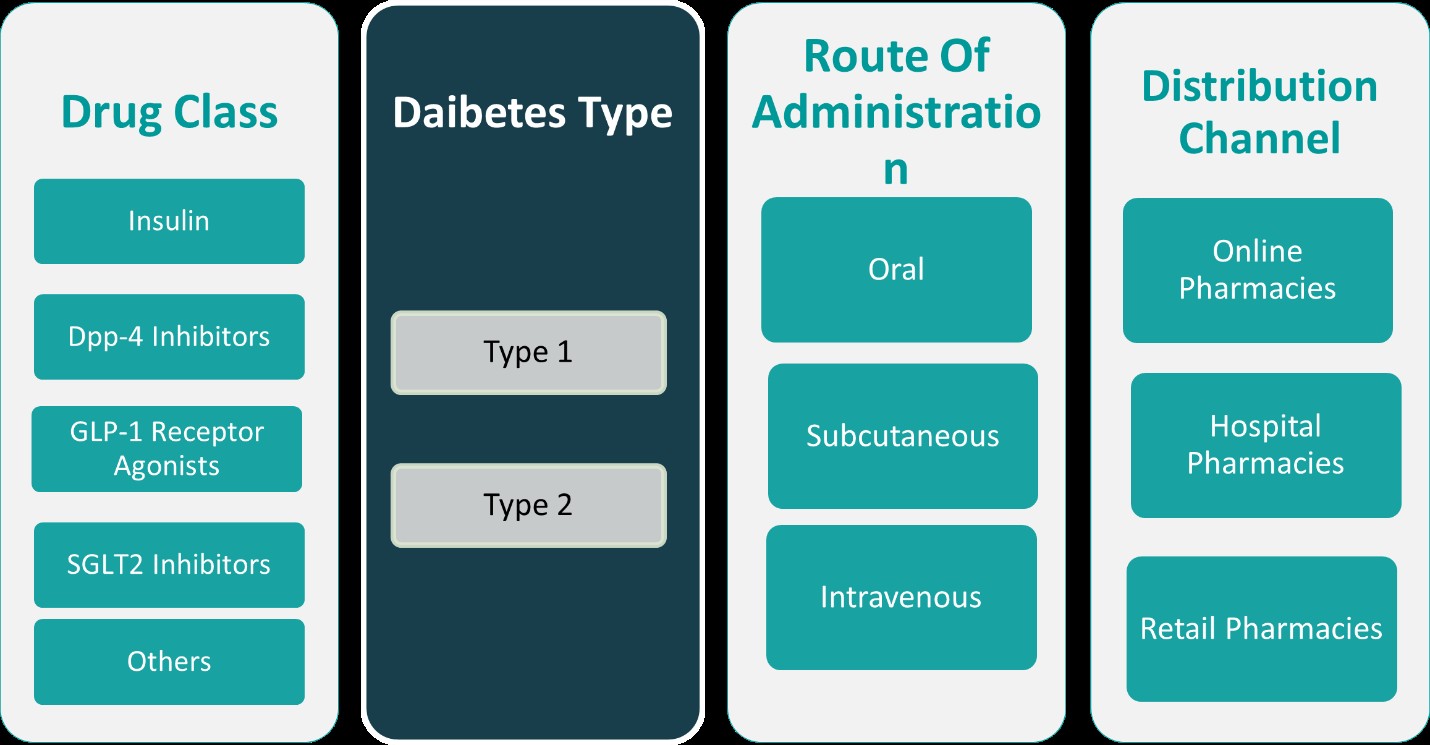

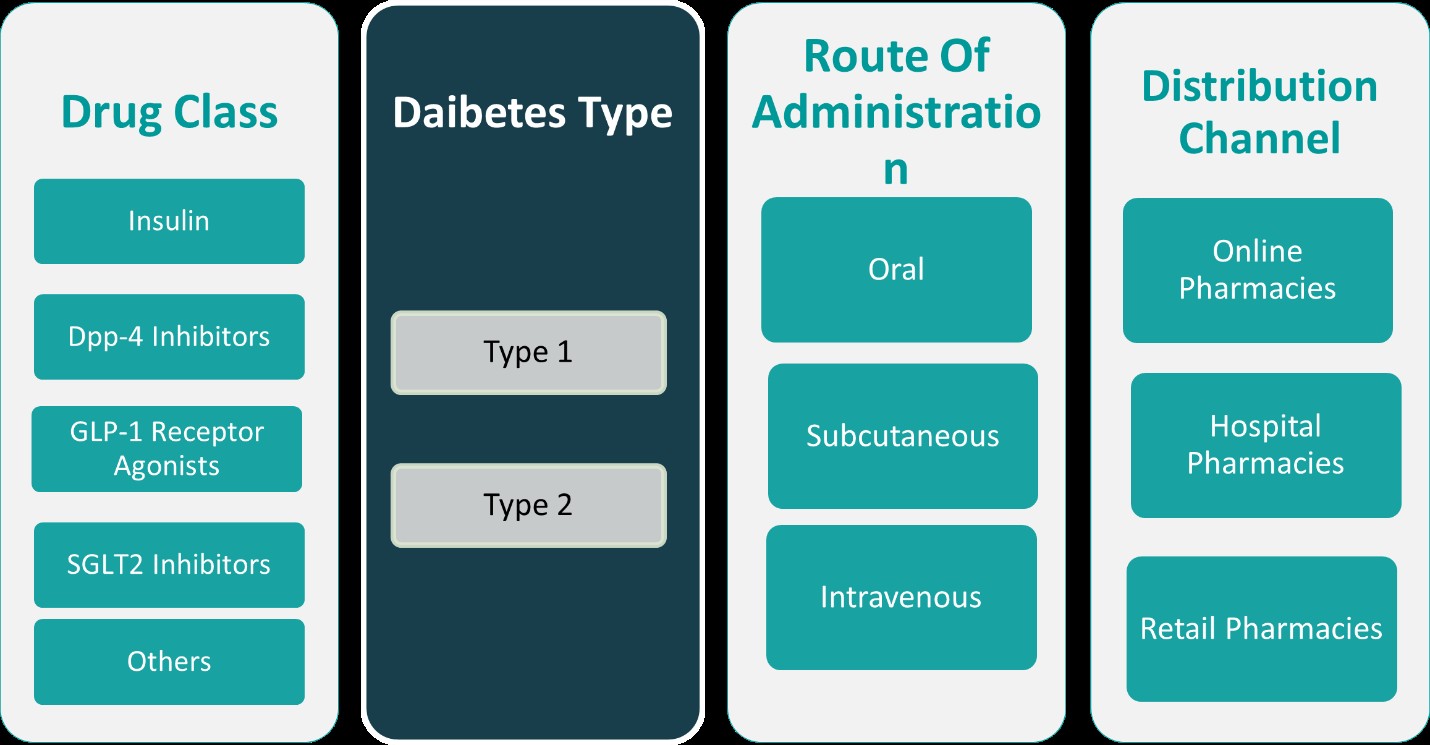

Market Segmentation Analysis:

By Drug Class:

The South African diabetes drugs market is categorized into various drug classes, including insulin, DPP-4 inhibitors, GLP-1 receptor agonists, SGLT2 inhibitors, and others. Insulin remains a dominant segment due to its essential role in managing type 1 diabetes and advanced cases of type 2 diabetes. The demand for rapid-acting and long-acting insulin formulations is increasing, driven by the need for better glycemic control and reduced hypoglycemia risks. DPP-4 inhibitors, known for their ability to enhance insulin secretion and lower blood glucose levels without causing significant weight gain, continue to be widely prescribed. The market is also witnessing a rising adoption of GLP-1 receptor agonists and SGLT2 inhibitors, which offer additional cardiovascular and renal benefits. These newer drug classes are gaining popularity among healthcare providers due to their improved patient outcomes and reduced side effects. The “Others” category includes traditional oral antidiabetics and emerging therapies, which continue to play a role in diabetes management, particularly in cost-sensitive patient groups.

By Diabetes Types:

The market is also segmented based on diabetes types, including type 1, type 2, type 3, type 4, and type 5 diabetes. Type 2 diabetes constitutes the largest market share, driven by the increasing prevalence of obesity, sedentary lifestyles, and poor dietary habits. The demand for oral antidiabetic drugs, including DPP-4 inhibitors and SGLT2 inhibitors, is rising as patients seek effective yet convenient treatment options. Type 1 diabetes, though less prevalent, maintains a steady demand for insulin therapies, as insulin remains the primary treatment. Less common forms of diabetes, such as types 3, 4, and 5, represent niche market segments with specialized treatment needs. These categories include conditions related to neurodegenerative diseases, pancreatic disorders, and genetic factors, creating opportunities for targeted research and pharmaceutical innovation. As awareness and diagnosis rates improve, the demand for tailored treatment solutions in these subcategories is expected to grow, further expanding the overall diabetes drugs market in South Africa.

Segments:

Based on Drug Class:

- Insulin

- DPP-4 Inhibitors

- GLP-1 Receptor Agonists

- SGLT2 Inhibitors

- Others

Based on Diabetes Types:

- Type 1

- Type 2

- Diabetes Type 3

- Diabetes Type 4

- Diabetes Type 5

Based on Route of Administration:

- Oral

- Subcutaneous

- Intravenous

- Route of Administration 4

- Route of Administration 5

Based on Technology:

- Technology 1

- Technology 2

- Technology 3

Based on Distribution Channel:

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

- Distribution Channel 4

- Distribution Channel 5

Based on the Geography:

- Gauteng

- Western Cape

- KwaZulu-Natal

- Eastern Cape

Regional Analysis

Gauteng

Gauteng holds the largest market share in the South African diabetes drugs market, accounting for approximately 35% of total sales. As the country’s economic hub, Gauteng has the highest concentration of healthcare facilities, private hospitals, and specialized diabetes care centers, which contribute to higher drug consumption. The province’s urban lifestyle and dietary habits have led to an increasing prevalence of type 2 diabetes, driving demand for both insulin and oral antidiabetic medications such as DPP-4 inhibitors and SGLT2 inhibitors. Furthermore, the availability of advanced healthcare infrastructure and a well-established pharmaceutical supply chain ensures consistent access to diabetes medications. Rising awareness initiatives and government-supported healthcare programs in Gauteng further boost market growth, making it the most significant contributor to South Africa’s diabetes drug industry.

Western Cape

Western Cape represents around 25% of the South African diabetes drugs market, supported by its advanced healthcare system and strong presence of research institutions. The province has a high prevalence of diabetes, particularly among aging populations and communities with genetic predispositions to the disease. The demand for innovative treatments, such as GLP-1 receptor agonists and combination therapies, is steadily increasing due to the growing focus on improved patient outcomes. The Western Cape’s well-developed private healthcare sector and efficient distribution networks enhance access to premium diabetes medications, contributing to its significant market share. Additionally, provincial health initiatives that promote early diagnosis and lifestyle management strategies help drive the adoption of diabetes drugs in the region.

KwaZulu-Natal

KwaZulu-Natal holds approximately 20% of the market share, driven by the province’s large and diverse population, including a significant portion of patients relying on public healthcare services. The region has a high burden of diabetes, particularly among low-income groups, which fuels the demand for cost-effective treatments such as generic insulin and oral antidiabetic medications. Government healthcare programs and nonprofit organizations play a crucial role in improving access to essential diabetes drugs, especially in rural and semi-urban areas. While public healthcare facilities experience challenges such as drug shortages and high patient volumes, ongoing efforts to strengthen diabetes care services and expand pharmaceutical distribution channels are expected to support steady market growth in KwaZulu-Natal.

Eastern Cape

Eastern Cape accounts for 15% of the South African diabetes drugs market, with growth driven by increasing awareness and improved healthcare accessibility. The province has historically faced challenges related to healthcare infrastructure and medication availability, particularly in rural communities. However, recent investments in healthcare services and expanded distribution of diabetes drugs through government programs are improving patient access to essential medications. The demand for insulin and oral antidiabetics is steadily rising as more individuals seek medical intervention for diabetes management. Additionally, community-based health initiatives and collaborations between public and private sectors are helping to bridge healthcare gaps, creating further opportunities for market expansion in Eastern Cape.

Key Player Analysis

- Novo Nordisk A/S

- Sanofi

- Merck & Co., Inc.

- Eli Lilly and Company

- AstraZeneca

- Takeda Pharmaceutical Company Limited

- Boehringer Ingelheim International GmbH

- Novartis AG

- Johnson & Johnson Services, Inc.

- Bayer AG

Competitive Analysis

The South African diabetes drugs market is highly competitive, with leading pharmaceutical companies driving innovation and market expansion. Novo Nordisk, Sanofi, Merck & Co., Eli Lilly, AstraZeneca, Boehringer Ingelheim, Takeda Pharmaceutical, Novartis, Johnson & Johnson, and Bayer are among the dominant players shaping the industry. These companies focus on research and development (R&D) to introduce advanced diabetes treatments, including GLP-1 receptor agonists, SGLT2 inhibitors, and combination therapies that improve glycemic control and reduce complications. Leading players invest heavily in research and development (R&D) to introduce advanced diabetes treatments, including novel insulin formulations, GLP-1 receptor agonists, and SGLT2 inhibitors, which offer superior glycemic control and additional health benefits. The adoption of combination therapies is also rising, as they improve treatment adherence and simplify diabetes management. Market competition is further fueled by strategic collaborations with healthcare providers, government programs, and digital health initiatives aimed at enhancing patient outcomes. Companies are expanding their product portfolios to cater to both premium and cost-sensitive segments, ensuring a balance between innovative and generic drug offerings. Price pressures and healthcare accessibility challenges remain key restraints, but efforts to improve distribution networks and expand telemedicine services are helping drive market growth and ensure broader patient coverage.

Recent Developments

- In March 2025, Novo Nordisk signed a deal worth up to $2 billion for the rights to UBT251, a new obesity and diabetes drug developed by United BioTechnology. The drug combines GLP-1, GIP, and glucagon to manage blood sugar and reduce hunger.

- In February 2025, Sanofi received FDA approval for MERILOG, the first rapid-acting insulin aspart biosimilar, to improve glycemic control in adults and pediatric patients with diabetes.

- In December 2024, JD Health began offering Merck’s GLUCOPHAGE XR (Reduce Mass) online in China, enhancing access to metformin hydrochloride extended-release tablets for type 2 diabetes patients.

- In December 2024, Torrent Pharma acquired three diabetes brands from Boehringer Ingelheim, including those with Empagliflozin, to strengthen its anti-diabetes portfolio

- In November 2024, AstraZeneca presented promising early data for its obesity pipeline, including AZD5004, an oral GLP-1 receptor blocker, at ObesityWeek 2024.

Market Concentration & Characteristics

The South African diabetes drugs market is moderately concentrated, with a few dominant multinational pharmaceutical companies controlling a significant portion of sales. These companies leverage extensive research and development (R&D) capabilities, strong distribution networks, and well-established brand reputations to maintain their competitive edge. The market is characterized by a mix of innovative patented drugs and cost-effective generic alternatives, catering to diverse patient needs. Insulin and oral antidiabetic drugs dominate the treatment landscape, with growing adoption of advanced drug classes such as GLP-1 receptor agonists and SGLT2 inhibitors. Market characteristics include increasing government involvement in diabetes management, a rising focus on preventive care, and expanding digital health solutions to improve patient adherence. While affordability and accessibility challenges persist, ongoing investments in healthcare infrastructure and pharmaceutical innovation continue to shape market dynamics, driving both competition and growth in the sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Drug Class, Diabetes Types, Route of Administration, Technology, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The South African diabetes drugs market is expected to grow steadily, driven by rising diabetes prevalence and increased healthcare awareness.

- Advanced drug classes, including GLP-1 receptor agonists and SGLT2 inhibitors, will see higher adoption due to their improved efficacy and additional health benefits.

- Insulin demand will continue to rise, particularly for long-acting and combination formulations to enhance glycemic control.

- Government initiatives and healthcare policies will focus on expanding access to affordable diabetes treatments in underserved regions.

- Digital health solutions, including telemedicine and wearable glucose monitoring devices, will improve patient engagement and treatment adherence.

- Pharmaceutical companies will invest more in research and development to introduce innovative therapies tailored to local market needs.

- The expansion of generic alternatives will help improve affordability and increase market penetration in low-income populations.

- Public-private partnerships will strengthen healthcare infrastructure and enhance distribution channels for diabetes medications.

- Preventive healthcare strategies and lifestyle interventions will gain more emphasis to reduce the long-term burden of diabetes.

- Market competition will intensify as multinational and local pharmaceutical companies expand their presence and introduce cost-effective treatment solutions.