CHAPTER NO. 1 : INTRODUCTION 18

1.1.1. Report Description 18

Purpose of the Report 18

USP & Key Offerings 18

1.1.2. Key Benefits for Stakeholders 18

1.1.3. Target Audience 19

1.1.4. Report Scope 19

CHAPTER NO. 2 : EXECUTIVE SUMMARY 20

2.1. South Korea Data Centre Market Snapshot 20

2.1.1. South Korea Data Centre Market, 2018 – 2032 (USD Million) 22

CHAPTER NO. 3 : SOUTH KOREA DATA CENTRE MARKET – INDUSTRY ANALYSIS 23

3.1. Introduction 23

3.2. Market Drivers 24

3.2.1. Rising Demand for Cloud Computing Services 24

3.2.2. Increasing Use of Advanced Technology 25

3.3. Market Restraints 26

3.3.1. Lack of Trained Labor 26

3.3.2. High Initial Investments 27

3.4. Market Opportunities 28

3.4.1. Market Opportunity Analysis 28

3.5. Porter’s Five Forces Analysis 29

CHAPTER NO. 4 : ANALYSIS COMPETITIVE LANDSCAPE 30

4.1. Company Market Share Analysis – 2023 30

4.1.1. South Korea Data Centre Market: Company Market Share, by Revenue, 2023 30

4.1.2. South Korea Data Centre Market: Top 3 Company Market Share, by Revenue, 2023 31

4.2. South Korea Data Centre Market Company Revenue Market Share, 2023 32

4.3. Company Assessment Metrics, 2023 33

4.1. Strategic Developments 33

4.2. Key Players Product Matrix 34

CHAPTER NO. 5 : PESTEL 35

5.1. PESTEL 35

5.1.1. Political Factors 35

5.1.2. Economic Factors 35

5.1.3. Social Factors 35

5.1.4. Technological Factors 35

5.1.5. Environmental Factors 35

5.1.6. Legal Factors 35

5.2. Adjacent Market Analysis 35

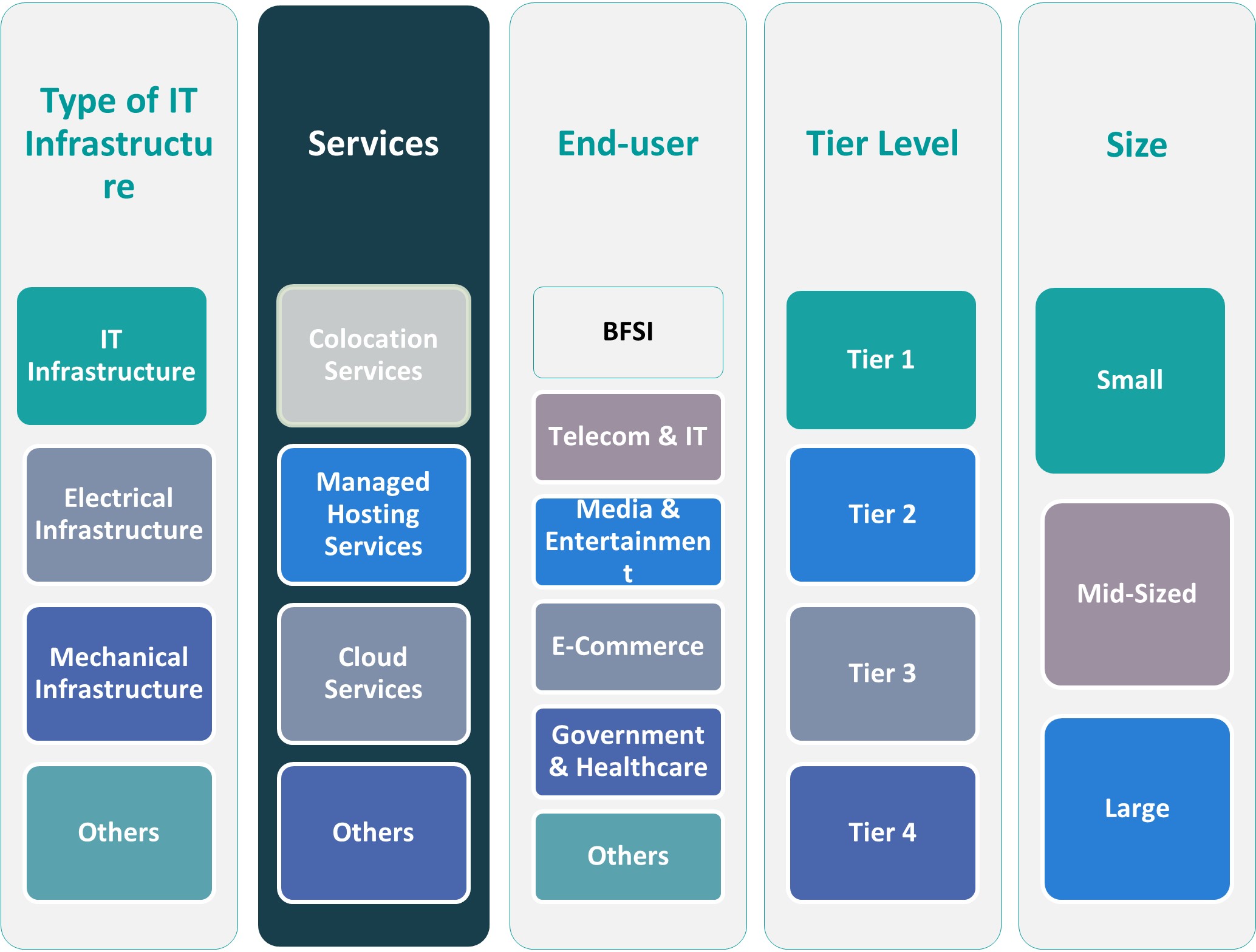

CHAPTER NO. 6 : SOUTH KOREA DATA CENTRE MARKET – BY TYPE OF INFRASTRUCTURE SEGMENT ANALYSIS 36

6.1. South Korea Data Centre Market Overview, by Type of Infrastructure Segment 36

6.1.1. South Korea Data Centre Market Revenue Share, By Type of Infrastructure, 2023 & 2032 37

6.1.2. South Korea Data Centre Market Attractiveness Analysis, By Type of Infrastructure 38

6.1.3. Incremental Revenue Growth Opportunity, by Type of Infrastructure, 2024 – 2032 38

6.1.4. South Korea Data Centre Market Revenue, By Type of Infrastructure, 2018, 2023, 2027 & 2032 39

6.2. IT Infrastructure 40

6.3. Electrical Infrastructure 41

6.4. Mechanical Infrastructure 42

6.5. Others 43

CHAPTER NO. 7 : SOUTH KOREA DATA CENTRE MARKET – BY SERVICE TYPE SEGMENT ANALYSIS 44

7.1. South Korea Data Centre Market Overview, by Service Type Segment 44

7.1.1. South Korea Data Centre Market Revenue Share, By Service Type, 2023 & 2032 45

7.1.2. South Korea Data Centre Market Attractiveness Analysis, By Service Type 46

7.1.3. Incremental Revenue Growth Opportunity, by Service Type, 2024 – 2032 46

7.1.4. South Korea Data Centre Market Revenue, By Service Type, 2018, 2023, 2027 & 2032 47

7.2. Colocation Services 48

7.3. Managed Hosting Services 49

7.4. Cloud Services 50

7.5. Others 51

CHAPTER NO. 8 : SOUTH KOREA DATA CENTRE MARKET – BY END-USER SEGMENT ANALYSIS 52

8.1. South Korea Data Centre Market Overview, by End-user Segment 52

8.1.1. South Korea Data Centre Market Revenue Share, By End-user, 2023 & 2032 53

8.1.2. South Korea Data Centre Market Attractiveness Analysis, By End-user 54

8.1.3. Incremental Revenue Growth Opportunity, by End-user, 2024 – 2032 54

8.1.4. South Korea Data Centre Market Revenue, By End-user, 2018, 2023, 2027 & 2032 55

8.2. BFSI 56

8.3. IT & Telecom 57

8.4. Media & Entertainment 58

8.5. E-Commerce 59

8.6. Government & Healthcare 60

8.7. Others 61

CHAPTER NO. 9 : SOUTH KOREA DATA CENTRE MARKET – BY TIER LEVEL OF INFRASTRUCTURE SEGMENT ANALYSIS 62

9.1. South Korea Data Centre Market Overview, by Tier Level of Infrastructure Segment 62

9.1.1. South Korea Data Centre Market Revenue Share, By Tier Level of Infrastructure, 2023 & 2032 63

9.1.2. South Korea Data Centre Market Attractiveness Analysis, By Tier Level of Infrastructure 64

9.1.3. Incremental Revenue Growth Opportunity, by Tier Level of Infrastructure, 2024 – 2032 64

9.1.4. South Korea Data Centre Market Revenue, By Tier Level of Infrastructure, 2018, 2023, 2027 & 2032 65

9.2. Tier 1 66

9.3. Tier 2 67

9.4. Tier 3 68

9.5. Tier 4 69

CHAPTER NO. 10 : SOUTH KOREA DATA CENTRE MARKET – BY SIZE SEGMENT ANALYSIS 70

10.1. South Korea Data Centre Market Overview, by Size Segment 70

10.1.1. South Korea Data Centre Market Revenue Share, By Size, 2023 & 2032 71

10.1.2. South Korea Data Centre Market Attractiveness Analysis, By Size 72

10.1.3. Incremental Revenue Growth Opportunity, by Size, 2024 – 2032 72

10.1.4. South Korea Data Centre Market Revenue, By Size, 2018, 2023, 2027 & 2032 73

10.2. Small 74

10.3. Mid-Sized 75

10.4. Large 76

CHAPTER NO. 11 : SOUTH KOREA DATA CENTER MARKET –ANALYSIS 77

11.1. Type of Infrastructure 77

11.1.1. South Korea Data Center Market Revenue, By Type of Infrastructure, 2018 – 2024 (USD Million) 77

11.1.2. South Korea Data Center Market Revenue, By Type of Infrastructure, 2025 – 2032 (USD Million) 77

11.2. Service Type 78

11.2.1. South Korea Data Center Market Revenue, By Service Type, 2018 – 2024 (USD Million) 78

11.2.2. South Korea Data Center Market Revenue, By Service Type, 2025 – 2032 (USD Million) 78

11.3. End-user 79

11.3.1. South Korea Data Center Market Revenue, By End-user, 2018 – 2024 (USD Million) 79

11.3.2. South Korea Data Center Market Revenue, By End-user, 2025 – 2032 (USD Million) 79

11.4. Tier 80

11.4.1. South Korea Data Center Market Revenue, By Tier, 2018 – 2024 (USD Million) 80

11.4.2. South Korea Data Center Market Revenue, By Tier, 2025 – 2032 (USD Million) 80

11.5. Size 81

11.5.1. South Korea Data Center Market Revenue, By Size, 2018 – 2024 (USD Million) 81

11.5.2. South Korea Data Center Market Revenue, By Size, 2025 – 2032 (USD Million) 81

CHAPTER NO. 12 : COMPANY PROFILES 82

12.1. Kakao Corp 82

12.1.1. Company Overview 82

12.1.2. Service Portfolio 83

12.1.3. Financial Overview 83

12.2. Korea Telecom KT 84

12.3. Equinix 84

12.4. Cisco Systems 84

12.5. IBM 84

12.6. Company 6 84

12.7. Company 7 84

12.8. Company 8 84

12.9. Company 9 84

12.10. Company 10 84

List of Figures

FIG NO. 1. South Korea Data Centre Market Revenue, 2018 – 2032 (USD Million) 22

FIG NO. 2. Porter’s Five Forces Analysis for South Korea Data Centre Market 29

FIG NO. 3. Company Share Analysis, 2023 30

FIG NO. 4. Company Share Analysis, 2023 31

FIG NO. 5. South Korea Data Centre Market – Company Revenue Market Share, 2023 32

FIG NO. 6. South Korea Data Centre Market Revenue Share, By Type of Infrastructure, 2023 & 2032 37

FIG NO. 7. Market Attractiveness Analysis, By Type of Infrastructure 38

FIG NO. 8. Incremental Revenue Growth Opportunity by Type of Infrastructure, 2024 – 2032 38

FIG NO. 9. South Korea Data Centre Market Revenue, By Type of Infrastructure, 2018, 2023, 2027 & 2032 39

FIG NO. 10. South Korea Data Centre Market for IT Infrastructure, Revenue (USD Million) 2018 – 2032 40

FIG NO. 11. South Korea Data Centre Market for Electrical Infrastructure, Revenue (USD Million) 2018 – 2032 41

FIG NO. 12. South Korea Data Centre Market for Mechanical Infrastructure, Revenue (USD Million) 2018 – 2032 42

FIG NO. 13. South Korea Data Centre Market for Others, Revenue (USD Million) 2018 – 2032 43

FIG NO. 14. South Korea Data Centre Market Revenue Share, By Service Type, 2023 & 2032 45

FIG NO. 15. Market Attractiveness Analysis, By Service Type 46

FIG NO. 16. Incremental Revenue Growth Opportunity by Service Type, 2024 – 2032 46

FIG NO. 17. South Korea Data Centre Market Revenue, By Service Type, 2018, 2023, 2027 & 2032 47

FIG NO. 18. South Korea Data Centre Market for Colocation Services, Revenue (USD Million) 2018 – 2032 48

FIG NO. 19. South Korea Data Centre Market for Managed Hosting Services, Revenue (USD Million) 2018 – 2032 49

FIG NO. 20. South Korea Data Centre Market for Cloud Services, Revenue (USD Million) 2018 – 2032 50

FIG NO. 21. South Korea Data Centre Market for Others, Revenue (USD Million) 2018 – 2032 51

FIG NO. 22. South Korea Data Centre Market Revenue Share, By End-user, 2023 & 2032 53

FIG NO. 23. Market Attractiveness Analysis, By End-user 54

FIG NO. 24. Incremental Revenue Growth Opportunity by End-user, 2024 – 2032 54

FIG NO. 25. South Korea Data Centre Market Revenue, By End-user, 2018, 2023, 2027 & 2032 55

FIG NO. 26. South Korea Data Centre Market for BFSI, Revenue (USD Million) 2018 – 2032 56

FIG NO. 27. South Korea Data Centre Market for IT & Telecom, Revenue (USD Million) 2018 – 2032 57

FIG NO. 28. South Korea Data Centre Market for Media & Entertainment, Revenue (USD Million) 2018 – 2032 58

FIG NO. 29. South Korea Data Centre Market for E-Commerce , Revenue (USD Million) 2018 – 2032 59

FIG NO. 30. South Korea Data Centre Market for Government & Healthcare, Revenue (USD Million) 2018 – 2032 60

FIG NO. 31. South Korea Data Centre Market for Others, Revenue (USD Million) 2018 – 2032 61

FIG NO. 32. South Korea Data Centre Market Revenue Share, By Tier Level of Infrastructure, 2023 & 2032 63

FIG NO. 33. Market Attractiveness Analysis, By Tier Level of Infrastructure 64

FIG NO. 34. Incremental Revenue Growth Opportunity by Tier Level of Infrastructure, 2024 – 2032 64

FIG NO. 35. South Korea Data Centre Market Revenue, By Tier Level of Infrastructure, 2018, 2023, 2027 & 2032 65

FIG NO. 36. South Korea Data Centre Market for Tier 1, Revenue (USD Million) 2018 – 2032 66

FIG NO. 37. South Korea Data Centre Market for Tier 2, Revenue (USD Million) 2018 – 2032 67

FIG NO. 38. South Korea Data Centre Market for Tier 3, Revenue (USD Million) 2018 – 2032 68

FIG NO. 39. South Korea Data Centre Market for Tier 4, Revenue (USD Million) 2018 – 2032 69

FIG NO. 40. South Korea Data Centre Market Revenue Share, By Size, 2023 & 2032 71

FIG NO. 41. Market Attractiveness Analysis, By Size 72

FIG NO. 42. Incremental Revenue Growth Opportunity by Size, 2024 – 2032 72

FIG NO. 43. South Korea Data Centre Market Revenue, By Size, 2018, 2023, 2027 & 2032 73

FIG NO. 44. South Korea Data Centre Market for Small, Revenue (USD Million) 2018 – 2032 74

FIG NO. 45. South Korea Data Centre Market for Mid-Sized, Revenue (USD Million) 2018 – 2032 75

FIG NO. 46. South Korea Data Centre Market for Large, Revenue (USD Million) 2018 – 2032 76

List of Tables

TABLE NO. 1. : South Korea Data Centre Market: Snapshot 20

TABLE NO. 2. : Drivers for the South Korea Data Centre Market: Impact Analysis 24

TABLE NO. 3. : Restraints for the South Korea Data Centre Market: Impact Analysis 26

TABLE NO. 4. : South Korea Data Center Market Revenue, By Type of Infrastructure, 2018 – 2024 (USD Million) 77

TABLE NO. 5. : South Korea Data Center Market Revenue, By Type of Infrastructure, 2025 – 2032 (USD Million) 77

TABLE NO. 6. : South Korea Data Center Market Revenue, By Service Type, 2018 – 2024 (USD Million) 78

TABLE NO. 7. : South Korea Data Center Market Revenue, By Service Type, 2025 – 2032 (USD Million) 78

TABLE NO. 8. : South Korea Data Center Market Revenue, By End-user, 2018 – 2024 (USD Million) 79

TABLE NO. 9. : South Korea Data Center Market Revenue, By End-user, 2025 – 2032 (USD Million) 79

TABLE NO. 10. : South Korea Data Center Market Revenue, By Tier, 2018 – 2024 (USD Million) 80

TABLE NO. 11. : South Korea Data Center Market Revenue, By Tier, 2025 – 2032 (USD Million) 80

TABLE NO. 12. : South Korea Data Center Market Revenue, By Size, 2018 – 2024 (USD Million) 81

TABLE NO. 13. : South Korea Data Center Market Revenue, By Size, 2025 – 2032 (USD Million) 81