| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Green Data Center Market Size 2024 |

USD 2,210.78 Million |

| UK Green Data Center Market, CAGR |

18.59% |

| UK Green Data Center Market Size 2032 |

USD 8,647.93 Million |

Market Overview

The UK Green Data Center Market is projected to grow from USD 2,210.78 million in 2024 to an estimated USD 8,647.93 million by 2032, with a compound annual growth rate (CAGR) of 18.59% from 2025 to 2032. This growth is driven by increasing demand for energy-efficient and sustainable data center solutions in the country, as businesses and governments focus on reducing their carbon footprints.

Key drivers of the UK Green Data Center Market include the growing need for environmental sustainability, the rise in data consumption, and the need for energy efficiency in data center operations. As the UK aligns with net-zero carbon emissions goals, data center operators are under pressure to integrate green technologies to reduce their environmental impact. Additionally, advancements in server virtualization, liquid cooling, and the increasing adoption of renewable energy sources like wind and solar are propelling the market. The rising emphasis on sustainable business practices further promotes the development of eco-friendly data centers.

Geographically, the UK stands as a key player in the European Green Data Center Market. Major cities like London, Manchester, and Birmingham are central hubs for data center growth, benefiting from favorable government policies and high demand from industries such as finance, technology, and telecommunications. Leading companies such as Digital Realty, Equinix, and Next Generation Data are spearheading the market, focusing on enhancing energy efficiency and offering scalable green solutions to meet the growing demand for data services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK Green Data Center Market is projected to grow from USD 2,210.78 million in 2024 to an estimated USD 8,647.93 million by 2032, with a compound annual growth rate (CAGR) of 18.59% from 2025 to 2032.

- The global Green Data Center Market is expected to grow from USD 59,645.02 million in 2024 to USD 239,470.06 million by 2032, at a CAGR of 18.98% from 2025 to 2032.

- Rising environmental concerns and the UK’s commitment to net-zero carbon emissions are major drivers, pushing businesses to adopt green data center technologies.

- Advancements in renewable energy integration, such as solar and wind, and innovative cooling technologies are enhancing the sustainability of data center operations.

- High initial investment costs for adopting green technologies, including renewable energy infrastructure and energy-efficient cooling systems, pose a challenge for some operators.

- Navigating complex and evolving regulatory compliance requirements related to energy efficiency and environmental standards can burden data center operators.

- Regions like London, Manchester, and Birmingham dominate the market, with increasing investments in green data center infrastructure, particularly in technology, finance, and telecom sectors.

- Smaller regions, such as Leeds and Bristol, are gradually gaining traction due to the growing demand for sustainable and scalable data center solutions across the UK.

Report Scope

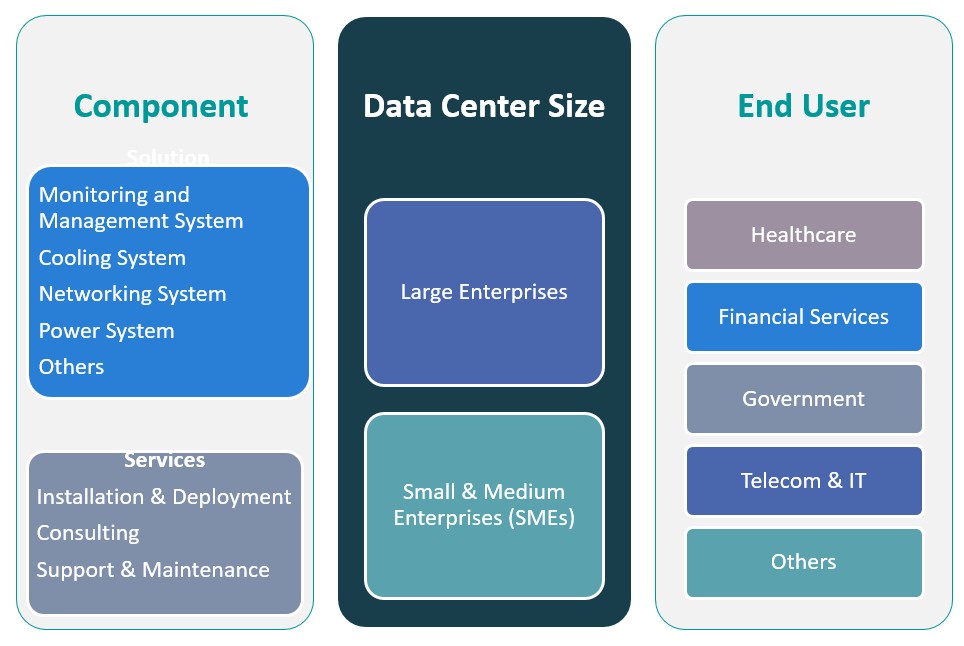

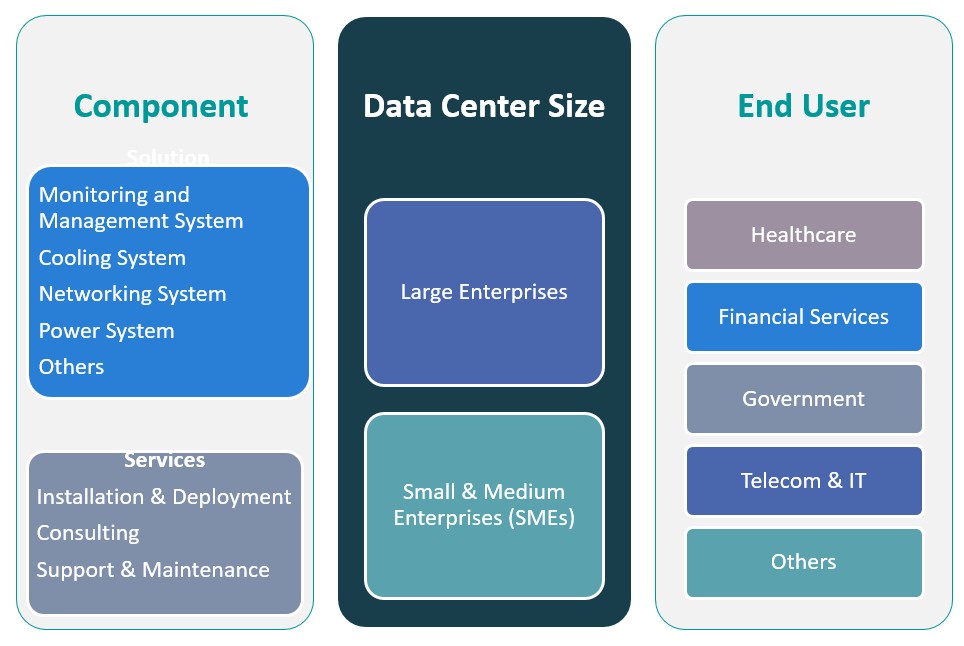

This report segments the UK Green Data Center Market as follows:

Market Drivers

Technological Advancements in Data Center Infrastructure

Technological advancements are rapidly transforming the design and operation of green data centers, significantly contributing to the growth of the UK Green Data Center Market. Innovations in cooling technologies, power-efficient server architectures, and energy management systems are enabling data centers to lower energy consumption without compromising performance. For instance, the development of advanced liquid cooling systems and immersion cooling solutions allows data centers to maintain optimal temperatures while minimizing energy usage, thus reducing overall environmental impact. Additionally, advancements in server virtualization technology and artificial intelligence (AI) allow for more efficient resource utilization, reducing the need for physical hardware and minimizing energy consumption. These innovations help data centers optimize their operations, decrease the carbon footprint, and enhance sustainability, driving further adoption of green technologies. The rapid evolution of cloud computing, big data analytics, and artificial intelligence is pushing the demand for more computing power, prompting data centers to seek energy-efficient technologies to support high-density workloads. This technological shift is one of the main drivers of the green data center market, as companies strive to meet the growing demand for faster and more efficient computing power while remaining environmentally responsible.

Increasing Corporate and Consumer Focus on Sustainability

As consumer and business expectations shift toward sustainability, companies are increasingly incorporating environmental considerations into their decision-making processes. Consumers are becoming more conscious of the environmental impact of the products and services they consume, and this trend is influencing corporate strategies. Companies that prioritize sustainability are more likely to attract eco-conscious customers, which is particularly important in the competitive landscape of the tech industry. Additionally, large corporations and global enterprises are setting ambitious sustainability goals and often require their data center partners to meet these standards. In the UK, businesses across industries are aligning their corporate social responsibility (CSR) goals with environmental sustainability, with data centers being a significant part of this strategy. Financial institutions, for example, are demanding their partners comply with sustainable practices, influencing the shift towards green data centers. As a result, data center operators in the UK are under increasing pressure to adopt renewable energy sources, reduce waste, and integrate environmentally friendly practices into their operations. This rising focus on sustainability is a key driver of the UK Green Data Center Market, as companies recognize the need to align their operations with broader environmental goals.

Rising Demand for Energy Efficiency and Sustainability

The growing global emphasis on sustainability and environmental responsibility is driving the UK Green Data Center Market. Data centers are notorious for their high energy consumption, with some facilities consuming as much electricity annually as 80,000 households. In response, operators are adopting sustainable practices such as renewable energy sources, including solar and wind power, and implementing energy-efficient cooling systems. For instance, a green data center in London recently integrated advanced cooling technology that significantly reduced its energy consumption. Additionally, optimizing server utilization has enabled data centers to handle increased workloads without requiring additional energy resources. These efforts not only contribute to the UK’s carbon reduction targets but also attract environmentally conscious clients and partners, further promoting the adoption of green data center technologies.

Government Initiatives and Regulations Supporting Green Infrastructure

The UK government plays a pivotal role in accelerating the growth of green data centers through regulations and initiatives that promote sustainable infrastructure development. Policies such as the Net Zero Strategy, launched in 2020, aim to achieve carbon neutrality by 2050 and encourage the adoption of cleaner technologies. For instance, the government has introduced tax rebates and grants for businesses investing in energy-efficient infrastructure. A recent initiative provided funding for a data center in Manchester to integrate renewable energy sources, reducing its reliance on traditional power grids. Additionally, building standards now require energy-efficient construction practices for data centers, ensuring compliance with environmental laws. These regulations create market stability and confidence, driving the integration of green technologies such as natural cooling solutions and waste heat recovery in new data center constructions.

Market Trends

Shift Towards Modular and Scalable Data Center Designs

Modular and scalable data center designs are gaining traction in the UK market as part of the push for green infrastructure. This trend involves building data centers with flexible, scalable, and easily upgradeable components that can grow as demand increases. Modular designs allow operators to add capacity incrementally, reducing the need for large-scale, energy-intensive facilities. These smaller, purpose-built units can be more energy-efficient, as they require fewer resources and less cooling compared to traditional data center designs. Additionally, modular designs are more cost-effective, as operators can invest in smaller units initially and expand as required. The scalability factor also contributes to sustainability by optimizing the use of space and energy. These designs are often paired with energy-efficient systems, including advanced cooling technologies, and are frequently built with sustainability certifications, such as LEED (Leadership in Energy and Environmental Design). The growing adoption of modular data centers reflects the industry’s increasing focus on optimizing energy use while maintaining flexibility and minimizing environmental impact.

Integration of Artificial Intelligence (AI) for Operational Efficiency

Artificial Intelligence (AI) is increasingly being integrated into the operations of green data centers in the UK. AI is being used to optimize energy consumption, improve cooling efficiency, and enhance overall data center management. Machine learning algorithms analyze real-time data from various systems within the data center to predict and adjust cooling needs, workload distribution, and power usage. AI-based systems can dynamically manage energy flows, reducing waste and improving the overall efficiency of operations. These intelligent systems are capable of identifying patterns and anomalies in data center operations that human operators may overlook, leading to more efficient use of resources. AI also helps data centers optimize server utilization, ensuring that hardware runs at optimal levels and minimizing idle times that can lead to unnecessary energy consumption. As the technology continues to evolve, AI will play a crucial role in helping data centers meet sustainability targets while maintaining high-performance standards. This trend towards AI-powered operations is essential to the ongoing development of the UK Green Data Center Market.

Adoption of Renewable Energy Sources

A significant trend in the UK Green Data Center Market is the increasing adoption of renewable energy sources. Data center operators are shifting away from conventional fossil fuels and integrating solar, wind, and hydroelectric power into their energy mix. For instance, the UK’s largest solar farm, Shotwick Solar Park, generates approximately 72 megawatts of clean energy annually, supporting various facilities, including data centers. Companies are entering power purchase agreements (PPAs) with renewable energy suppliers to ensure a steady and sustainable power supply. Additionally, data centers are exploring on-site renewable energy generation solutions, such as solar panels and wind turbines, to reduce their dependency on grid electricity. This shift not only supports the nation’s green energy transition but also helps data center operators cut operational costs over the long term by reducing reliance on expensive and fluctuating energy prices. The rise in renewable energy adoption reflects the broader global movement toward sustainable energy solutions, marking a clear direction for the UK Green Data Center Market.

Implementation of Advanced Cooling Technologies

Advanced cooling technologies are becoming a core trend in the UK Green Data Center Market. Traditional air cooling methods are being replaced by innovative solutions, such as liquid cooling and immersion cooling systems. For instance, Iceotope’s liquid cooling systems, deployed in Sheffield, UK, have demonstrated a 50% reduction in cooling energy consumption compared to traditional air cooling methods. Liquid cooling circulates coolant directly to the server components, removing heat more effectively than air cooling, while immersion cooling involves submerging hardware in thermally conductive liquids to maintain lower temperatures. These cooling methods reduce the energy required to keep servers at optimal temperatures, minimizing environmental impact. Moreover, some data centers are taking advantage of ambient cooling methods, using external weather conditions to cool their systems, reducing their dependence on mechanical cooling systems. These advancements in cooling technologies align with the industry’s push toward energy efficiency and environmental sustainability, positioning data centers to lower their carbon footprints while enhancing operational efficiency.

Market Challenges

High Initial Investment Costs for Green Technologies

One of the significant challenges facing the U.S. Green Data Center Market is the high initial capital investment required for the development of energy-efficient infrastructure. Although the long-term benefits of operating green data centers—such as reduced energy consumption and operational costs—are substantial, the upfront costs associated with building and upgrading to a green data center can be prohibitively high. For instance, Northern Virginia, a major hub for U.S. data centers, has over 2,000 megawatts of inventory as of the second half of 2022, reflecting the scale of infrastructure required. These costs include the installation of advanced cooling technologies, the integration of renewable energy sources, and the purchase of energy-efficient hardware. Additionally, retrofitting existing data centers to meet green standards often requires significant expenditure on new equipment and infrastructure. For many companies, especially small to mid-sized enterprises, these high capital costs can be a barrier to entry. Furthermore, while energy savings over time can offset the initial investment, the return on investment (ROI) may take several years to materialize, posing a financial challenge for organizations looking for quicker returns. The need to secure financing or access to capital can also be a deterrent for smaller companies or startups that are not in a financial position to make such substantial investments. Consequently, although the demand for green data centers is rising, the high initial investment remains a key hurdle, especially for organizations that are hesitant to commit significant resources to long-term sustainability projects.

Regulatory and Compliance Complexity

Another significant challenge in the UK Green Data Center Market is navigating the complex landscape of environmental regulations and compliance requirements. Data centers are subject to numerous local, national, and international standards aimed at reducing energy consumption and environmental impact. The UK has implemented stringent regulations, such as the Carbon Budget and various energy efficiency directives, which require data centers to meet specific environmental benchmarks. While these regulations are crucial for driving sustainability, they can create a complex and burdensome compliance environment for data center operators. Constantly evolving regulations may require frequent updates to infrastructure and operational practices, further adding to operational costs. Additionally, the UK is part of a larger European regulatory framework, with policies like the European Green Deal and the EU’s Energy Efficiency Directive influencing market conditions. This cross-border regulatory landscape can create confusion and compliance challenges, particularly for global data center operators who need to adhere to multiple sets of standards. Ensuring compliance with these regulations while maintaining operational efficiency and meeting sustainability targets requires dedicated resources, expertise, and ongoing investment, posing a challenge for many operators in the UK Green Data Center Market.

Market Opportunities

Growth of Renewable Energy Integration

One of the key opportunities in the UK Green Data Center Market lies in the continued integration of renewable energy sources into data center operations. As the UK seeks to meet its ambitious net-zero carbon emissions targets, the demand for renewable energy-powered data centers is rapidly increasing. Data center operators have the opportunity to capitalize on this shift by securing power purchase agreements (PPAs) with renewable energy providers or investing in on-site renewable energy generation, such as solar and wind. This trend not only helps reduce operational costs in the long term but also strengthens sustainability credentials, which can enhance a company’s competitive advantage. As the UK government continues to promote renewable energy adoption through various incentives and policies, data centers can leverage this opportunity to align with national sustainability goals, attract environmentally conscious clients, and improve brand value. The ongoing growth of green energy infrastructure offers a significant opportunity for data centers to innovate and lead in the market while contributing to the country’s energy transition.

Demand for Sustainable and Scalable Data Center Solutions

The increasing demand for scalable and sustainable data center solutions presents another significant opportunity for the UK Green Data Center Market. As businesses and industries continue to grow and generate large volumes of data, there is a rising need for data centers that are both energy-efficient and flexible in terms of capacity. Modular data center designs, which allow for incremental scaling as demand increases, offer a compelling opportunity for operators to meet growing needs while minimizing resource wastage. The trend toward hybrid and cloud-based infrastructure further drives the demand for energy-efficient, scalable solutions. Operators who invest in modular, high-performance, and green technologies can position themselves as leaders in the sustainable data center space, appealing to organizations focused on reducing their own carbon footprints. This demand for both sustainability and scalability will continue to drive growth in the UK Green Data Center Market, providing operators with the chance to capitalize on the rising need for future-proof, eco-friendly data center solutions.

Market Segmentation Analysis

By Component

The UK Green Data Center Market is segmented by various components that are essential to its operation. These components include the monitoring and management system, cooling system, networking system, power system, and others. The monitoring and management system plays a critical role in ensuring the efficient operation of data centers, enabling real-time tracking of energy consumption, performance, and environmental impact. The cooling system, another key component, is pivotal in maintaining optimal operating temperatures, with energy-efficient cooling solutions such as liquid and immersion cooling gaining popularity in the green data center space. The networking system supports the seamless communication between servers and storage devices, facilitating data transfer and ensuring minimal energy consumption. The power system, which includes energy-efficient power supply and backup systems, is integral to reducing carbon footprints, with many data centers opting for renewable energy sources to power their operations. Other components may include security systems, fire suppression systems, and data storage devices. The efficient integration of these components is crucial for reducing energy use, ensuring operational efficiency, and minimizing environmental impact.

By Data Center Type

Data centers in the UK are also categorized by their size and type, which include large enterprises and small and medium enterprises (SMEs). Large enterprises typically require data centers that can handle vast amounts of data and computational tasks, driving the demand for larger, more advanced, and highly energy-efficient facilities. These data centers are often characterized by high-performance servers, advanced cooling technologies, and extensive networking infrastructure. In contrast, SMEs typically operate on a smaller scale and may prioritize cost-efficiency over capacity, although the demand for energy-efficient and scalable solutions is still significant. Both categories are increasingly moving toward green solutions, with SMEs looking to adopt modular and energy-efficient technologies that scale with their growth. The increasing focus on sustainability across all sectors means both large enterprises and SMEs are investing in energy-efficient technologies to meet their corporate social responsibility (CSR) goals and comply with regulatory requirements.

Segments

Based on Component

- Solution

- Monitoring and Management System

- Cooling System

- Networking System

- Power System

- Others

- Services

- Installation & Deployment

- Consulting

- Support & Maintenance

Based on Data Center Type

- Large Enterprises

- Small & Medium Enterprises (SMEs)

Based on End User

- Healthcare

- Financial Services

- Government

- Telecom & IT

- Others

Based on Region

- London

- Birmingham

- Manchester

Regional Analysis

London (40%)

As the capital and a major global financial hub, London dominates the UK Green Data Center Market. It is home to a large concentration of multinational corporations, financial institutions, and technology firms that require highly secure and efficient data storage and processing solutions. The region’s demand for data centers is bolstered by its thriving tech ecosystem, strong digital infrastructure, and high energy consumption, prompting businesses to adopt more sustainable practices. London’s data centers are increasingly adopting renewable energy sources and advanced cooling technologies to align with the UK’s carbon reduction goals. The market share of London in the UK Green Data Center Market is estimated at around 40%, given its concentration of large enterprises and major industry players.

Manchester (25%)

Manchester is another critical region driving the adoption of green data centers in the UK. Known for its growing tech industry and smart city initiatives, Manchester has seen increased investment in green infrastructure, including sustainable data centers. The city is home to several data center operators who are committed to implementing renewable energy solutions and reducing their carbon footprints. As more businesses in the North of England seek energy-efficient and scalable data center solutions, Manchester’s market share is steadily rising. The city holds an approximate market share of 25%, making it one of the most prominent regions for green data center development in the UK.

Key players

- Virtus Data Centres

- Digital Realty

- GCP (Google Cloud Platform)

- Telehouse

- Colt Technology Services

Competitive Analysis

The UK Green Data Center Market is highly competitive, with several key players driving the adoption of sustainable infrastructure and energy-efficient technologies. Virtus Data Centres leads with its commitment to renewable energy and efficient data center designs, positioning itself as a prominent player in the green data center space. Digital Realty, a global leader in data center solutions, has expanded its footprint in the UK, focusing on sustainability and offering renewable energy-powered services to meet the growing demand for eco-friendly solutions. Google Cloud Platform (GCP) is another major player leveraging its cloud infrastructure to create energy-efficient data centers that align with global sustainability goals. Telehouse, known for its extensive network and connectivity, is increasing its green data center offerings, enhancing its competitive position in the UK market. Colt Technology Services continues to grow its portfolio of sustainable data center solutions, focusing on modular, scalable, and environmentally responsible technologies. These companies collectively contribute to a rapidly evolving market, focusing on innovation and operational efficiency.

Recent Developments

- In December 2023, Vertiv acquired CoolTera Ltd., a provider of liquid cooling infrastructure solutions. This acquisition strengthens Vertiv’s capabilities in high-density compute cooling, aligning with the industry’s shift towards energy-efficient data center technologies.

- In July 2024, Huawei unveiled three green data center facility solutions at the Global Smart Data Center Summit. These include the AeroTurbo fans, IceCube polymer heat exchangers, and iCooling AI energy efficiency cooling solutions, designed to optimize cooling efficiency and reduce energy consumption.

- In May 2024, Microsoft launched its first hyperscale cloud data center region in Mexico, located in Querétaro. This facility aims to provide scalable, highly available, and resilient cloud services, supporting digital transformation and sustainable innovation in the region.

- In June 2024, HPE partnered with Danfoss to introduce the HPE IT Sustainability Services – Data Center Heat Recovery. This turnkey heat recovery module helps organizations manage and repurpose excess heat, contributing to more sustainable IT infrastructures.

- In November 2024, Google announced a partnership with SB Energy Global to supply 942 MW of renewable energy to power its data center operations in Texas. This initiative supports Google’s commitment to operate on carbon-free energy and aligns with its sustainability goals.

- In January 2025, AWS announced plans to invest approximately $11 billion in Georgia to expand its infrastructure, supporting cloud computing and AI technologies. This investment is expected to create at least 550 new high-skilled jobs and enhance the state’s digital innovation capabilities.

- In May 2024, IBM announced a partnership with Schneider Electric to develop and deploy energy-efficient data center solutions, focusing on reducing carbon emissions and improving operational efficiency.

Market Concentration and Characteristics

The UK Green Data Center Market exhibits a moderate level of market concentration, with several dominant players such as Virtus Data Centres, Digital Realty, Google Cloud Platform (GCP), Telehouse, and Colt Technology Services leading the space. These players hold a significant share of the market due to their large-scale operations, advanced technological investments, and commitment to sustainability. The market is characterized by a strong emphasis on energy efficiency, with operators increasingly integrating renewable energy sources and advanced cooling solutions to reduce their environmental impact. There is also a growing focus on modular and scalable data center designs, allowing for flexible and cost-effective expansion while maintaining sustainability. Despite the presence of major players, smaller regional operators are also emerging, offering niche solutions and contributing to market diversification. As the demand for eco-friendly solutions rises, the UK Green Data Center Market is likely to witness continued innovation, with both large and small operators striving to meet sustainability goals and regulatory requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Data Center Type, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UK Green Data Center Market will see a significant shift towards renewable energy integration, with more data centers relying on solar, wind, and hydroelectric power to meet sustainability goals.

- Advancements in cooling technologies, such as liquid and immersion cooling, will drive energy efficiency, reducing operational costs and environmental impacts in data center operations.

- Stricter environmental regulations and government initiatives focused on carbon neutrality will encourage data center operators to adopt greener technologies and practices to ensure compliance.

- The rise of edge computing will drive demand for smaller, more localized green data centers, enabling faster processing and reducing the carbon footprint associated with data transmission over long distances.

- Modular data centers will gain popularity due to their scalability and flexibility, enabling companies to meet growing demands while minimizing resource wastage and promoting energy efficiency.

- The application of artificial intelligence (AI) and automation in energy management will enhance operational efficiency, optimize energy consumption, and reduce the overall environmental impact of data center operations.

- As cloud computing continues to expand, green data centers will play a crucial role in supporting cloud infrastructure, with a focus on reducing the carbon footprint and maintaining high-performance standards.

- Data centers will increasingly implement waste heat recovery systems, allowing excess heat to be repurposed for heating nearby buildings or facilities, further contributing to energy efficiency.

- Partnerships between data center operators, technology providers, and energy companies will foster innovation and promote the development of sustainable solutions, accelerating the green transformation of the sector.

- Regional hubs outside London, such as Manchester and Birmingham, will see increased investment in green data centers as demand for sustainable solutions rises across the UK and Europe.