| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Data Center Containment Market Size 2024 |

USD 29.14 Million |

| Australia Data Center Containment Market, CAGR |

12.10% |

| Australia Data Center Containment Market Size 2032 |

USD 72.70 Million |

Market Overview

The Australia Data Center Containment Market is projected to grow from USD 29.14 million in 2024 to an estimated USD 72.70 million by 2032, reflecting a compound annual growth rate (CAGR) of 12.10% from 2025 to 2032. This growth is driven by the increasing demand for efficient data management and storage solutions across various industries in Australia.

Key market drivers include the rapid expansion of digital services, the proliferation of data-intensive applications, and the need for enhanced cooling solutions to support high-performance computing. Additionally, trends such as edge computing and the adoption of cloud services are contributing to the demand for advanced data center containment solutions.

Geographically, the market is primarily concentrated in major Australian cities like Sydney and Melbourne, which serve as key data hub locations. Leading players in this sector include companies like Schneider Electric, Vertiv, and Eaton, which offer innovative containment solutions tailored to the evolving needs of Australian data centers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Australia Data Center Containment Market is expected to grow significantly, from USD 29.14 million in 2024 to USD 72.70 million by 2032, driven by increased demand for data storage and processing solutions.

- The Global Data Center Containment Market is projected to grow from USD 3,719.95 million in 2024 to USD 8,654.34 million by 2032, driven by a CAGR of 11.13% from 2025 to 2032.

- Growth is fueled by the rising need for efficient data management, rapid digital service expansion, data-intensive applications, and enhanced cooling solutions to support high-performance computing.

- Challenges include high energy consumption and the limited availability of suitable locations for large-scale data centers in certain regions, which can hinder market growth.

- Major cities like Sydney and Melbourne dominate the market due to their status as key data hub locations, with growing infrastructure developments in other regions like Queensland and Western Australia.

- Energy-efficient containment solutions are in high demand as businesses look to reduce operational costs and meet sustainability goals, aligning with government regulations on energy use.

- Innovations in containment solutions, such as liquid cooling and modular designs, are driving the demand for more flexible and scalable data center infrastructures.

- Leading companies such as Schneider Electric, Vertiv, and Eaton are central to the market, offering advanced containment solutions tailored to the evolving needs of Australian data centers.

Market Drivers

Expansion of Cloud Computing and Edge Data Centers

The rapid adoption of cloud computing and the proliferation of edge data centers are also major factors driving the demand for data center containment solutions in Australia. The shift towards cloud-based services and solutions is transforming how businesses manage their IT infrastructure. As more companies migrate their operations to the cloud, the need for scalable, efficient data centers grows. Cloud service providers require robust containment solutions that can handle large-scale data processing and storage while maintaining energy efficiency and reducing operational costs. In parallel, edge computing is becoming increasingly prevalent as companies seek to reduce latency and improve the performance of real-time applications. Edge data centers, which are distributed and located closer to end-users, require highly efficient containment systems to optimize space, power usage, and cooling at smaller, more distributed locations. The combination of cloud computing and edge data centers is driving the need for sophisticated containment solutions capable of supporting diverse and high-demand workloads across multiple facilities.

Technological Advancements in Data Center Infrastructure

Technological advancements in data center infrastructure are another critical driver of the Australia Data Center Containment Market. Innovations in containment solutions have made it easier to optimize space and energy use while enhancing operational efficiency. Modern containment systems incorporate features like hot aisle/cold aisle containment, precision cooling systems, and high-density rack systems that can handle the increased computational needs of advanced workloads. These solutions not only improve efficiency but also contribute to the overall reliability and security of data centers. As Australian businesses seek to modernize their data infrastructure and remain competitive in a fast-paced digital economy, the demand for state-of-the-art containment technologies continues to rise. Furthermore, the integration of smart monitoring and automation systems within containment solutions allows for real-time tracking of temperature, humidity, and power consumption, enabling data centers to operate more efficiently and reduce downtime. Technological innovation in containment solutions is thus key to meeting the evolving needs of the Australian data center industry.

Rising Demand for Data Storage and Processing Capacity

The increasing generation of data across various industries in Australia is one of the most influential drivers for the data center containment market. With the growing adoption of digital technologies, including IoT, AI, machine learning, and big data analytics, the volume of data being processed and stored continues to surge. Industries such as finance, healthcare, retail, and government are increasingly dependent on data-driven operations, necessitating more advanced infrastructure solutions. For instance, major cloud service providers like Amazon Web Services (AWS), Microsoft, and Google Cloud are expanding their presence in Australia, driving the demand for new data centers and, consequently, more storage devices to meet the growing computing needs. Data centers are the backbone of this digital ecosystem, providing critical storage, processing, and networking capabilities. As organizations across Australia expand their data infrastructure, the demand for effective containment solutions that can support high-performance computing and ensure data center efficiency becomes even more important. These solutions help optimize space usage, manage power consumption, and enhance cooling efficiency, which are essential in accommodating the growing demand for data storage and processing capabilities.

Growing Need for Energy Efficiency and Sustainability

Energy consumption is a significant concern in data center operations. Cooling systems, in particular, are major contributors to energy consumption in data centers, as they are essential for maintaining optimal operating conditions. Given the increasing focus on sustainability and reducing carbon footprints, businesses in Australia are seeking energy-efficient data center solutions that minimize energy use while maintaining high operational performance. For instance, companies like Equinix are investing in sustainable data center expansions, incorporating advanced cooling technologies to reduce energy consumption while maintaining operational efficiency. Data center containment systems play a crucial role in enhancing energy efficiency by isolating hot and cold airflows, reducing the need for extensive cooling. By optimizing airflow, these containment systems allow for more precise temperature control, reducing the overall energy required for cooling purposes. As governments and regulatory bodies increasingly push for sustainable business practices, the adoption of energy-efficient data center containment solutions is expected to rise, making energy optimization one of the central drivers of market growth.

Market Trends

Focus on Sustainable Data Center Practices

Sustainability is becoming an increasingly prominent trend in the Australia Data Center Containment Market as companies seek to reduce their environmental impact. Data centers consume large amounts of energy, particularly for cooling purposes, and as a result, they are under pressure to adopt greener practices. The demand for more sustainable data center solutions has led to a significant shift toward energy-efficient containment systems and renewable energy sources. Data center operators are increasingly implementing green data center practices, such as utilizing renewable energy sources like solar and wind power, alongside efficient containment solutions. Energy-efficient cooling technologies, such as liquid cooling and evaporative cooling, are also gaining traction as more sustainable alternatives to traditional air-conditioning systems. Additionally, businesses are integrating environmental, social, and governance (ESG) factors into their decision-making processes, further driving the adoption of sustainable containment technologies. In Australia, where energy prices are rising and environmental regulations are becoming stricter, adopting energy-efficient containment systems is seen as both a financial and environmental imperative. This trend not only helps reduce operational costs but also positions businesses as responsible corporate citizens, which is increasingly valued by customers and investors alike.

Emergence of Modular and Scalable Containment Solutions

As data centers in Australia are being required to handle an increasing amount of data processing and storage, modularity and scalability are becoming critical requirements for containment solutions. Traditional, fixed containment systems often fall short when it comes to supporting the rapid growth and changing demands of modern data centers. In response to this challenge, modular containment solutions have gained popularity. These systems are designed to be flexible, allowing data center operators to scale up or down based on their changing requirements. Modular containment solutions allow for easy expansion without significant disruptions to existing operations. As businesses in Australia face the challenges of supporting dynamic workloads and evolving IT infrastructure, these scalable containment systems provide the flexibility needed to accommodate growing data needs. Modular solutions are also easier to install and configure, reducing the time and cost associated with large-scale data center upgrades. Additionally, they offer significant operational benefits, such as improved energy efficiency and reduced downtime during expansions. As the demand for more flexible and adaptable data centers increases, modular containment systems are becoming a preferred choice for Australian data center operators seeking cost-effective and scalable solutions.

Increased Adoption of Hot Aisle/Cold Aisle Containment Systems

One of the most significant trends in the Australia Data Center Containment Market is the widespread adoption of hot aisle/cold aisle containment systems. These containment strategies focus on isolating hot and cold airflows within a data center to prevent the mixing of air, which leads to inefficient cooling and increased energy consumption. For instance, companies like Digital Realty have implemented cold aisle containment systems, which have significantly improved their Power Usage Effectiveness (PUE) and led to substantial energy savings. By implementing these systems, data centers can increase cooling efficiency and reduce the energy required to maintain optimal temperatures for servers and other critical equipment. The benefits of these containment systems extend beyond energy savings. They also improve the overall reliability of data center operations by maintaining a stable temperature environment for high-performance computing. This is crucial as data centers face increasingly complex workloads and higher server densities. The trend toward adopting hot aisle/cold aisle containment systems is further fueled by the growing emphasis on sustainability and regulatory pressures aimed at reducing energy consumption. In Australia, where energy efficiency is a major concern, businesses are increasingly opting for these containment solutions as part of their broader sustainability initiatives. For example, government initiatives like the Australian Federal Government’s push for energy-efficient data centers encourage the adoption of such systems.

Integration of Smart and Automated Monitoring Systems

As the demand for real-time operational insights and automated control rises, data centers in Australia are increasingly integrating smart monitoring and automation systems into their containment solutions. These systems enable operators to monitor critical parameters such as temperature, humidity, airflow, and power consumption in real-time. By leveraging sensors, IoT devices, and cloud-based analytics, these solutions provide actionable insights that allow data center managers to optimize performance, detect inefficiencies, and predict potential issues before they result in downtime or damage to equipment. The trend toward automation in data centers is primarily driven by the need to reduce human intervention, lower operational costs, and increase efficiency. For instance, companies like Equinix are investing in advanced monitoring systems to support their expanding data center operations, emphasizing sustainability and efficiency. Automated systems can adjust cooling settings based on real-time data, ensuring that the environment is always optimal for the servers. This not only reduces energy consumption but also prevents overheating and improves overall system reliability. The integration of smart technologies within containment systems allows Australian data centers to operate more efficiently, with a focus on both cost savings and sustainability. Moreover, the use of automation in managing containment systems enhances operational visibility and provides actionable data that can help optimize resource allocation, improve decision-making, and boost productivity.

Market Challenges

Energy Consumption and Sustainability Concerns

Data centers are among the most energy-intensive facilities, with their consumption contributing substantially to greenhouse gas emissions. This issue is exacerbated by the rising adoption of energy-hungry technologies such as artificial intelligence (AI) and high-performance computing (HPC). For instance, AI-driven applications are not only increasing computational demand but also driving the need for more advanced cooling systems to manage heat generated by dense server clusters. To mitigate environmental impacts, data center operators are under pressure to integrate renewable energy sources, such as locating facilities near renewable energy zones to reduce reliance on fossil fuels. Advanced cooling techniques, including liquid immersion cooling and air-side economization, are also being adopted to enhance energy efficiency. Additionally, implementing waste heat recovery systems presents opportunities to repurpose excess heat for other uses, aligning with sustainability goals.

Infrastructure Constraints and Geopolitical Vulnerabilities

The rapid expansion of data centers in Australia is encountering infrastructure limitations, particularly in power supply and connectivity. Major cities like Sydney face challenges in meeting the growing energy demands of new data centers, leading to a search for alternative locations with adequate power capacity. Moreover, Australia’s dependence on a limited number of undersea cables for international data connectivity poses significant risks. These cables are susceptible to physical threats, including accidental damage from fishing activities, geological events, and potential sabotage. Disruptions to these cables can have profound political, economic, and military implications, underscoring the need for enhanced security measures and infrastructure redundancy. Addressing these challenges necessitates a collaborative approach involving industry stakeholders, government bodies, and technology providers. Prioritizing sustainable practices, investing in resilient infrastructure, and developing comprehensive risk management strategies are essential steps toward ensuring the continued growth and stability of Australia’s data center sector.

Market Opportunities

Expansion of Edge Computing and Regional Data Centers

The growing adoption of edge computing presents a significant market opportunity for the Australia Data Center Containment Market. As businesses and industries increasingly demand real-time data processing with low latency, the need for distributed, smaller data centers near end-users is rising. Edge data centers, which are strategically located closer to users and devices, require highly efficient containment solutions to optimize cooling, space, and power usage while supporting high-density equipment. This trend is particularly strong in sectors such as telecommunications, manufacturing, and healthcare, which rely on quick processing and minimal downtime. Data center operators in Australia can capitalize on the rising demand for edge computing by offering scalable, modular containment solutions that support the unique needs of smaller, more localized data centers, thus addressing the challenges of limited space and high operational costs.

Government Initiatives and Renewable Energy Integration

Another compelling opportunity lies in the growing focus on sustainability and renewable energy within Australia’s data center sector. The Australian government has committed to reducing carbon emissions and enhancing energy efficiency, providing a favorable environment for data center operators to implement green initiatives. As a result, there is an increasing demand for energy-efficient containment solutions that integrate with renewable energy sources such as solar and wind power. By adopting advanced containment technologies, such as liquid cooling and precision air conditioning, data centers can reduce their energy consumption and operating costs, while aligning with national sustainability goals. Furthermore, with the government’s emphasis on green technology, operators that prioritize sustainability can benefit from incentives and enhanced public perception, offering a competitive edge in the market.

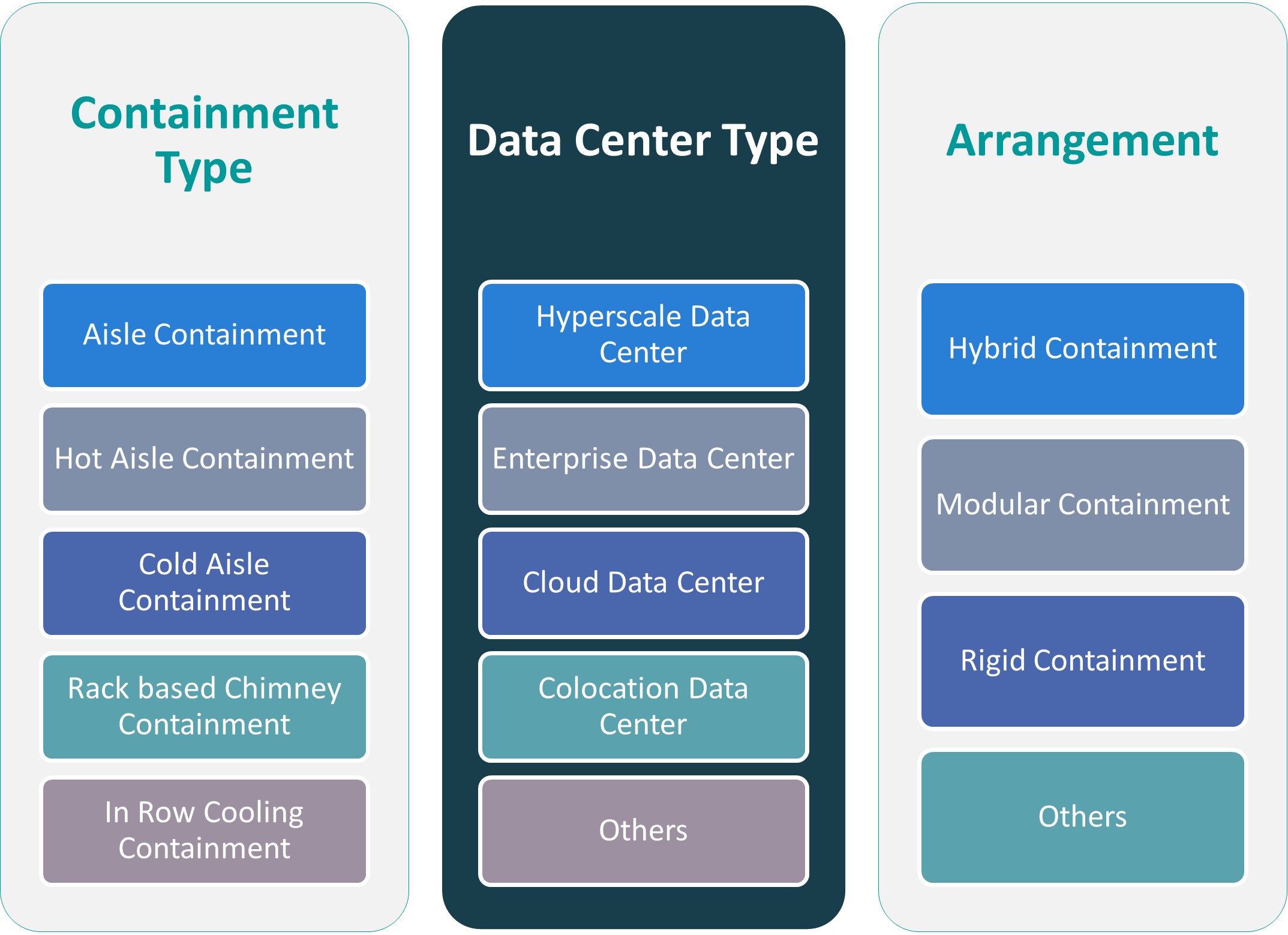

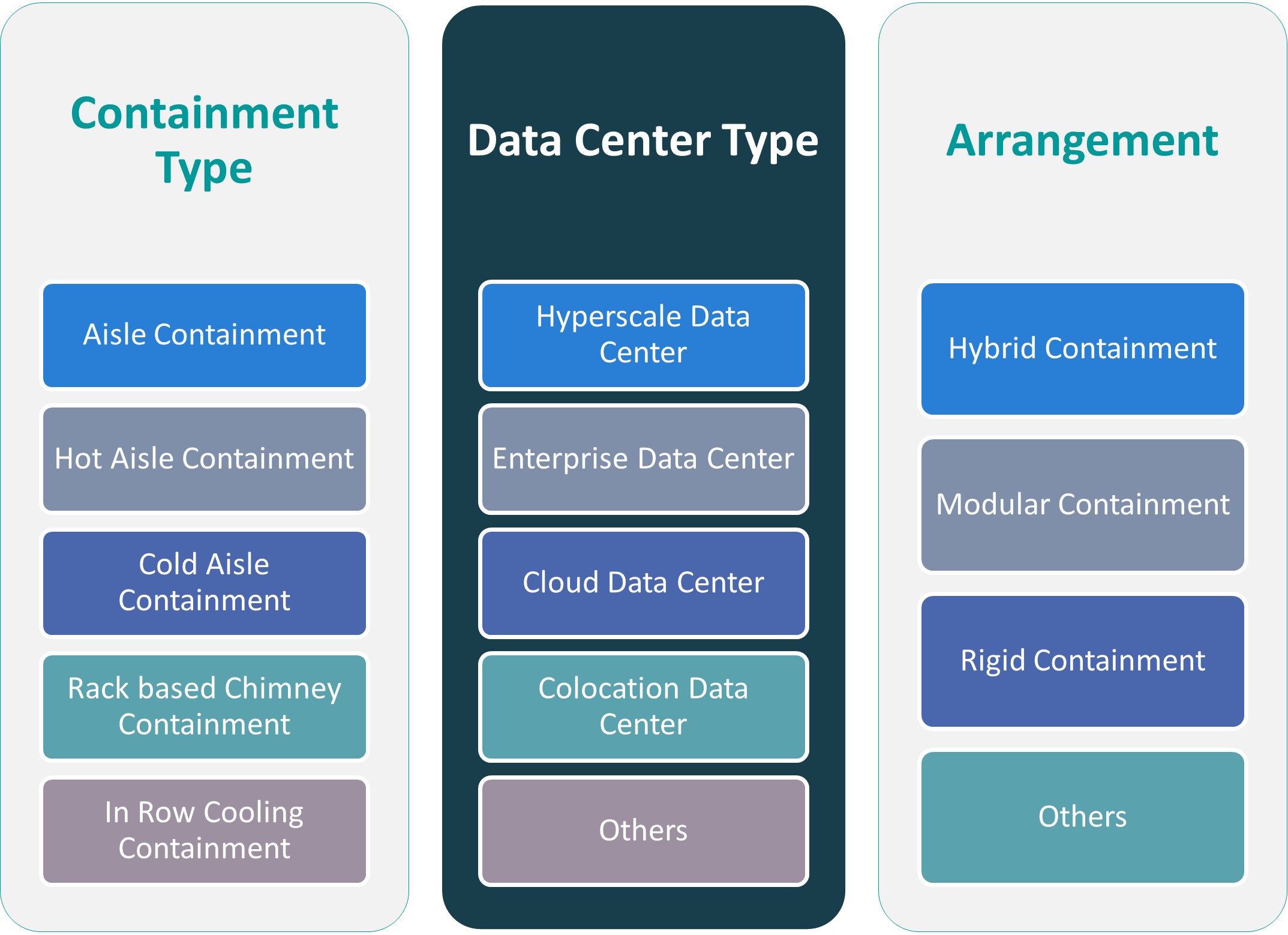

Market Segmentation Analysis

By Containment Type

The Australia Data Center Containment Market is segmented into several types of containment solutions, each designed to address specific operational needs. Hot Aisle Containment (HAC) isolates hot air produced by servers into a dedicated aisle, improving cooling efficiency and reducing energy consumption. It is widely used in high-density data centers where precise temperature control is essential. Cold Aisle Containment (CAC), in contrast, isolates cold air from the supply side to maintain an optimal environment for servers, preventing the mixing of hot and cold air and improving energy efficiency. Rack-based Chimney Containment involves enclosing individual racks with chimneys to direct hot air upwards, enabling precise airflow control and improving cooling for high-density systems. Lastly, In-Row Cooling Containment places cooling units between server racks to directly address heat sources, enhancing cooling efficiency in environments with high heat loads.

By Data Center Type

The Australia Data Center Containment Market is also classified by data center type, each with distinct containment needs. Hyperscale Data Centers, typically operated by large tech companies, require scalable and efficient containment solutions to handle vast amounts of data and equipment. They are the largest segment, driven by the demand for cloud infrastructure and processing capabilities. Enterprise Data Centers are owned and operated by individual companies, focusing on stability, security, and efficiency, with containment systems designed to optimize space and energy use. Cloud Data Centers are rapidly expanding in Australia due to the growing adoption of cloud services. These data centers require flexible containment solutions to accommodate increasing computing demands and ensure reliability. Colocation Data Centers, which provide space and services to multiple customers, rely on scalable and efficient containment systems that can support varying customer requirements, driving the demand for flexible and modular solutions.

Segments

Based on Containment Type

- Aisle Containment

- Hot Aisle Containment

- Cold Aisle Containment

- Rack based Chimney Containment

- In Row Cooling Containment

Based on Data Center Type

- Hyperscale Data Center

- Enterprise Data Center

- Cloud Data Center

- Colocation Data Center

- Others

Based on Arrangement

- Hybrid Containment

- Modular Containment

- Rigid Containment

- Others

Based on Region

- New South Wales (NSW)

- Victoria

- Queensland

- Western Australia

Regional Analysis

New South Wales (40%)

New South Wales, particularly Sydney, leads the Australia Data Center Containment Market with the largest share. The region’s dominance is attributed to Sydney being the primary data center hub in the country, with a high concentration of businesses and industries reliant on digital infrastructure. Sydney is home to numerous hyperscale data centers and colocation facilities, driving the demand for advanced containment solutions. The region’s focus on digital transformation and the expansion of cloud services further contributes to the growth of the data center containment market. Energy-efficient and scalable containment solutions are in high demand as businesses look to optimize operational costs and reduce environmental impacts.

Victoria (30%)

Victoria, with Melbourne as its central business hub, holds a significant share of the market. The state’s growing digital economy, fueled by the demand for cloud services, IT infrastructure, and data storage, has made it a key player in the data center containment space. As the second-largest contributor to the market, Victoria’s data centers are increasingly adopting sustainable containment solutions to meet energy efficiency regulations and reduce their carbon footprint. Melbourne’s strategic location and robust business ecosystem also contribute to its rising demand for modular and flexible containment systems in enterprise and cloud data centers.

Key players

- Siemens

- Trane

- Kordia

- Arsenics Australia

- Digital Realty

Competitive Analysis

The Australia Data Center Containment Market is characterized by a competitive landscape with major players focusing on innovation, energy efficiency, and scalable solutions. Siemens stands out with its comprehensive portfolio of containment solutions, offering cutting-edge technologies aimed at enhancing energy efficiency and reducing operational costs for large-scale data centers. Trane, known for its cooling solutions, is a strong contender, focusing on providing highly efficient and sustainable systems. Kordia, with its expertise in telecommunications and data center infrastructure, is emerging as a strong competitor in the containment segment, particularly in hybrid containment solutions. Arsenics Australia is gaining traction by offering customized containment systems that cater to specific operational requirements, while Digital Realty, a global leader in data center services, is a significant player with a strong presence in the Australian market. These companies are intensifying their efforts to capture market share through strategic partnerships, technological advancements, and a focus on sustainability.

Recent Developments

- In November 2023, Huawei introduced two new additions to its Smart Modular Data Center and SmartLi uninterruptible power supply (UPS) series – FusionModule2000 6.0, a modular small/medium-sized data center solution, and UPS2000-H, a small-footprint power supply solution running on SmartLi Mini.

- In February 2025, Trane Technologies expanded its data center solutions to include liquid cooling thermal management systems, introducing the Trane 1MW Coolant Distribution Unit for high-performance workloads.

- In 2025, Honeywell launched a data center management suite to improve efficiency and sustainability by integrating operational and IT infrastructure data.

- In March 2025, Vertiv introduced new solutions to support dense AI and high-performance computing workloads, including consolidated infrastructure management software and prefabricated modular overhead infrastructure.

- In March 2025, Siemens announced a $285 million investment in U.S. manufacturing, including establishing new facilities in California and Texas. This investment aims to enhance manufacturing capabilities and advance AI technologies, supporting sectors such as commercial, industrial, construction, and AI data centers.

Market Concentration and Characteristics

The Australia Data Center Containment Market exhibits a moderately concentrated structure, with key players such as Siemens, Trane, Kordia, Arsenics Australia, and Digital Realty holding substantial market share. These companies dominate the landscape by offering a range of advanced containment solutions, focusing on energy efficiency, scalability, and sustainability. However, the market is also characterized by the presence of several smaller, specialized players that cater to niche segments, such as modular containment and custom solutions. The market is dynamic, with constant innovation driven by the increasing demand for high-performance data centers, particularly in major urban centers like Sydney and Melbourne. While the leading companies hold a significant portion of the market, the rising demand for cost-effective, energy-efficient, and sustainable containment solutions creates opportunities for new entrants to capture market share through innovative approaches and partnerships.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Containment Type, Data Center Type, Arrangement and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The increasing focus on sustainability will drive the demand for energy-efficient containment solutions in Australia. Data centers will prioritize innovations that reduce power consumption and enhance operational efficiency.

- As edge computing continues to expand, demand for compact and efficient containment solutions will grow. This will lead to greater adoption of modular and scalable containment systems in smaller, decentralized data centers.

- Data centers will increasingly integrate renewable energy sources such as solar and wind power into their operations. This will drive the development of containment systems that support renewable energy infrastructure and energy-efficient cooling.

- Innovations in cooling technologies, such as liquid cooling and immersion cooling, will reshape the containment solutions market. These technologies will offer more efficient ways to handle rising server temperatures in high-density environments.

- The continued expansion of cloud services and hybrid cloud solutions will increase the demand for advanced containment systems. This growth will require flexible containment systems capable of adapting to various operational needs.

- Data centers will continue to pursue certifications such as LEED and Green Globes, driving the demand for containment systems that meet stringent environmental and sustainability standards.

- The Australian government’s regulations on energy efficiency will intensify, compelling data centers to adopt more advanced containment solutions. Compliance with these regulations will become a key competitive factor for data center operators.

- Ongoing investments in data center infrastructure, particularly in regional areas, will boost the need for containment solutions. New developments will prioritize scalable and cost-effective containment designs.

- Smart monitoring systems and IoT integration will become integral parts of containment solutions. These technologies will allow for real-time monitoring and optimization of energy usage and cooling efficiency.

- As Australia’s data center market expands beyond major cities, there will be increased demand for containment solutions in emerging regions. This diversification will lead to opportunities for specialized containment systems tailored to local needs.