| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UAE Green Data Center Market Size 2024 |

USD 392.01 Million |

| UAE Green Data Center Market, CAGR |

17.46% |

| UAE Green Data Center Market Size 2032 |

USD 1,420.77 Million |

Market Overview

The UAE Green Data Center Market is projected to grow from USD 392.01 million in 2024 to an estimated USD 1,420.77 million by 2032, with a compound annual growth rate (CAGR) of 17.46% from 2025 to 2032. This growth is driven by the increasing demand for sustainable and energy-efficient data storage solutions, as organizations seek to reduce their carbon footprints and operational costs.

Key drivers of the UAE Green Data Center Market include the rising emphasis on environmental sustainability, government regulations encouraging energy efficiency, and the growing adoption of renewable energy sources. Trends such as the integration of advanced cooling technologies, energy-efficient infrastructure, and the implementation of green building standards are shaping the market landscape. Additionally, the increasing awareness among businesses about the benefits of sustainable practices is contributing to the market’s growth.

Geographically, the UAE’s strategic location and robust infrastructure make it an attractive hub for green data centers. Key players in the market include global and regional companies such as Equinix, Etisalat, Gulf Data Hub, Khazna Data Centers, and Web Werks, which are investing in eco-friendly data center solutions to meet the growing demand for sustainable IT infrastructure. These companies are focusing on integrating renewable energy sources and energy-efficient technologies to enhance their service offerings and align with environmental goals.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UAE Green Data Center Market is projected to grow from USD 392.01 million in 2024 to USD 1,420.77 million by 2032, with a CAGR of 17.46%. This growth is driven by increasing demand for energy-efficient data storage solutions.

- The global Green Data Center Market is expected to grow from USD 59,645.02 million in 2024 to USD 239,470.06 million by 2032, at a CAGR of 18.98% from 2025 to 2032.

- Key drivers include government initiatives promoting sustainability, the rising adoption of renewable energy, and businesses’ growing focus on reducing their carbon footprints through eco-friendly technologies.

- High initial investment costs for green technologies and the complexity of implementing energy-efficient solutions in existing infrastructure are major constraints in the market.

- The UAE government’s regulatory frameworks, such as Vision 2021 and the Dubai Clean Energy Strategy 2050, offer significant incentives and support to businesses adopting green data center technologies.

- The UAE dominates the market, but other MENA countries such as Saudi Arabia and Qatar are also witnessing growth due to increased investments in green infrastructure and data center services.

- The integration of advanced cooling systems, AI-powered energy management, and renewable energy sources is transforming the data center landscape in the UAE, enhancing sustainability.

- Leading players like Equinix, Etisalat, Khazna Data Centers, and Web Werks are focusing on providing energy-efficient, scalable, and sustainable data center solutions to meet the growing demand in the region.

Report Scope

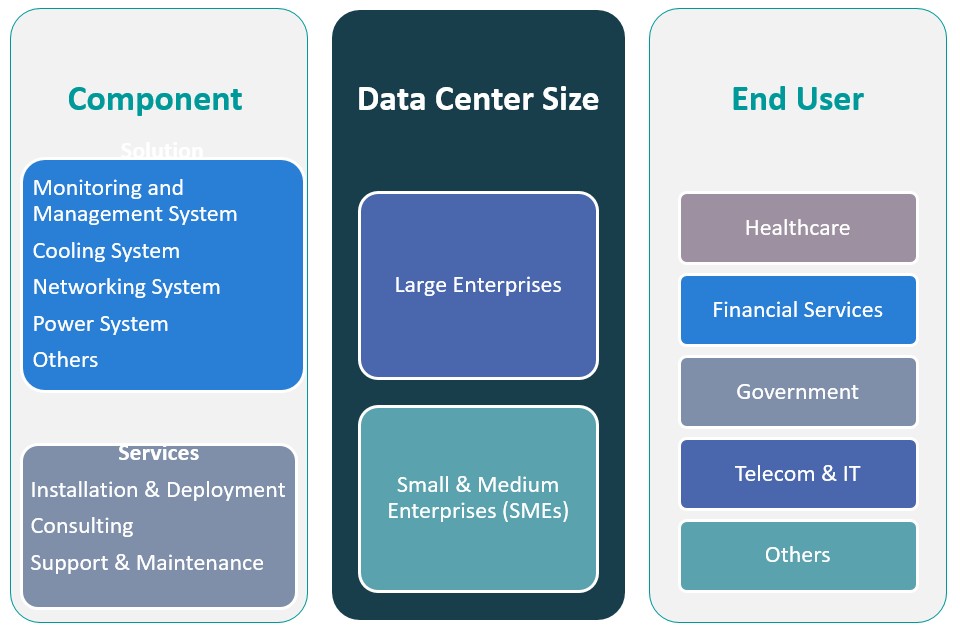

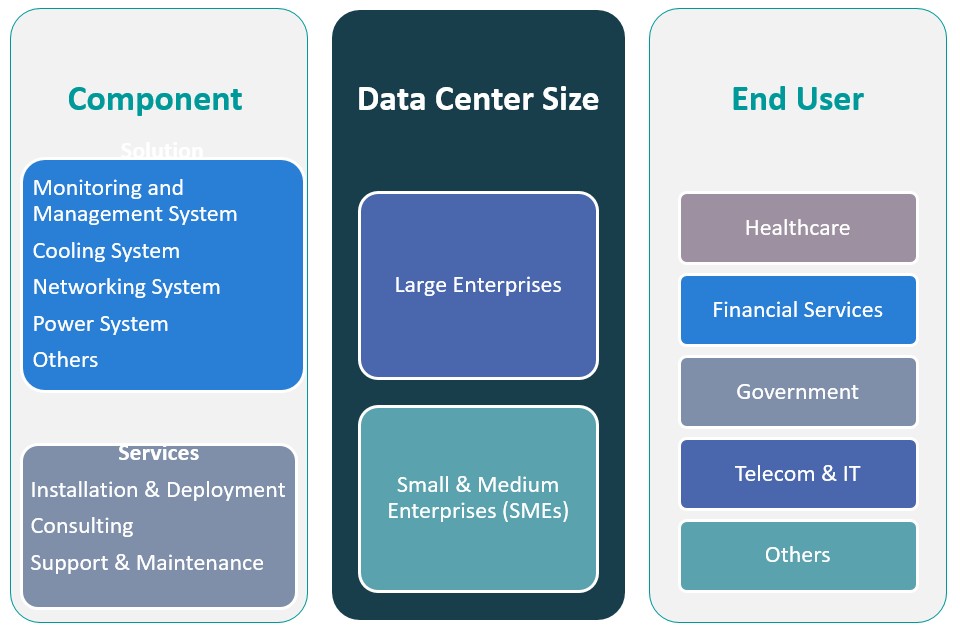

This report segments the UAE Green Data Center Market as follows:

Market Drivers

Advancements in Renewable Energy Integration

The UAE’s aggressive push towards renewable energy, particularly solar energy, plays a significant role in the growth of the green data center market. The country’s investments in solar power, such as the Mohammed bin Rashid Al Maktoum Solar Park in Dubai, are expected to provide a steady and sustainable energy source for data centers. The integration of renewable energy into data center operations not only helps reduce dependence on fossil fuels but also enables data centers to operate in a more sustainable manner. As energy costs are one of the largest operational expenditures for data centers, the use of solar power and other renewable energy sources can significantly lower operational costs while contributing to the overall reduction of greenhouse gas emissions. This trend of utilizing renewable energy in data centers aligns with global sustainability goals and is expected to accelerate the adoption of green data centers in the UAE.

Corporate Social Responsibility and Consumer

Demand Companies in the UAE are increasingly adopting green data center technologies as part of their broader corporate social responsibility (CSR) strategies. Investors, consumers, and stakeholders are becoming more aware of the environmental impacts of businesses, and many are prioritizing organizations that take active steps toward reducing their carbon footprints. In particular, consumers and businesses operating in the UAE are showing a preference for environmentally responsible companies that make sustainability a priority. This shift in consumer behavior is driving companies to invest in green technologies, including data centers that minimize energy consumption and reduce environmental harm. The demand for greener, more sustainable business practices is expected to continue rising, leading to more investments in eco-friendly data center solutions. The increasing alignment of business strategies with sustainability goals, coupled with pressure from consumers and investors, is acting as a strong driver for the UAE green data center market.

Government Initiatives and Regulatory Support

The UAE government plays a crucial role in driving the growth of the green data center market by implementing policies and regulations aimed at promoting sustainability and reducing the carbon footprint of industries. For instance, the UAE Vision 2021 and the UAE Green Growth Strategy emphasize advancing energy efficiency, particularly in the IT and data center sectors. The Dubai Clean Energy Strategy 2050 aims to generate 75% of Dubai’s energy from clean sources by 2050. Additionally, the Mohammed bin Rashid Al Maktoum Solar Park, one of the largest renewable energy projects in the region, supports green data center operations by providing a sustainable energy supply. Moro Hub, located within this solar park, operates a green data center with a capacity exceeding 100 megawatts, showcasing the UAE’s commitment to integrating renewable energy into data center infrastructure. These government-backed initiatives provide incentives such as tax rebates and grants, encouraging organizations to invest in green technologies and transition to energy-efficient practices.

Rising Demand for Sustainable and Energy-Efficient Solutions

As organizations in the UAE, especially those in the financial, telecommunications, and government sectors, become more environmentally conscious, the demand for sustainable and energy-efficient data storage solutions is growing. For instance, a green data center in Abu Dhabi implemented advanced cooling technologies, reducing its reliance on traditional air conditioning systems. Modular data center designs are also being adopted to optimize space and energy usage. The growing adoption of cloud services and big data analytics has led to increased data center demand, with green data centers providing a viable solution to ensure operations remain sustainable and cost-effective. High-efficiency power systems, such as those used in a Dubai-based data center, have further contributed to reducing energy consumption while maintaining high-performance computing capabilities.

Market Trends

Modular and Scalable Data Center Designs

The shift towards modular and scalable data center designs is another key trend in the UAE Green Data Center Market. Modular data centers are pre-fabricated, energy-efficient units that can be easily expanded or reconfigured based on demand. This approach allows businesses to only use the necessary infrastructure, thereby reducing energy waste. These data centers are designed to be energy-efficient from the start, utilizing advanced cooling systems, power-saving components, and renewable energy solutions. The ability to scale operations without significantly increasing energy consumption makes modular designs highly attractive in a market that prioritizes sustainability. Furthermore, these modular systems can be built in phases, which reduces upfront investment costs and enables more flexibility in operations. This trend is expected to continue growing as more companies seek flexible, energy-efficient solutions that align with their green initiatives and business growth.

Focus on Energy-Efficient Infrastructure and Operations

A strong focus on enhancing energy efficiency in data center operations is a prevalent trend in the UAE. Companies are continuously optimizing their infrastructure to reduce power consumption while maintaining operational performance. This includes implementing energy-efficient servers, power systems, and storage solutions. Data centers are also adopting better energy management systems that monitor and control energy usage in real time, helping to optimize performance while minimizing energy waste. In addition, innovations in power distribution and battery storage technologies are improving overall efficiency by ensuring that energy is used only when necessary and stored for later use. This focus on energy efficiency is aligned with the UAE’s broader sustainability goals and helps businesses meet international standards for green certifications, such as LEED and BREEAM. As the demand for sustainable operations grows, the emphasis on energy-efficient infrastructure will remain one of the defining trends in the UAE Green Data Center Market.

Increased Integration of Renewable Energy

One of the leading trends in the UAE Green Data Center Market is the increasing integration of renewable energy sources, particularly solar power. The UAE’s push for sustainability has spurred data center operators to adopt solar energy and other green technologies to power their operations. For instance, the Mohammed bin Rashid Al Maktoum Solar Park in Dubai, one of the largest solar parks in the world, has a capacity of 1,013 megawatts and supplies clean energy to various facilities, including data centers. These data centers are increasingly using renewable energy to lower their carbon footprints, align with government regulations, and lower operational costs. With energy consumption being a significant operational expense for data centers, the use of renewable energy is seen as both a sustainable and cost-effective solution. As the demand for green data centers grows, more operators are expected to invest in renewable energy infrastructure to power their operations, making this trend a dominant force in the market.

Adoption of Advanced Cooling Technologies

Another significant trend in the UAE Green Data Center Market is the growing adoption of advanced cooling technologies aimed at reducing energy consumption. Traditional cooling methods are energy-intensive and contribute significantly to a data center’s operational costs. To address this, operators are increasingly turning to energy-efficient cooling solutions such as liquid cooling, free cooling, and immersion cooling. For instance, Etisalat has implemented liquid cooling systems in its Abu Dhabi data centers, achieving a reduction of approximately 40% in cooling energy consumption compared to traditional methods. Additionally, the use of AI and machine learning to optimize cooling systems is becoming more widespread, allowing for dynamic adjustments based on real-time data center conditions. By minimizing cooling energy requirements, data centers can operate in a more sustainable manner while enhancing their energy efficiency. This trend is not only driven by cost savings but also by the growing emphasis on environmental sustainability and the need to comply with stringent energy efficiency regulations in the UAE.

Market Challenges

High Initial Capital Investment

One of the key challenges faced by the UAE Green Data Center Market is the high initial capital investment required to implement green technologies. While renewable energy, advanced cooling solutions, and energy-efficient infrastructure can significantly reduce operational costs in the long term, the upfront costs of these technologies can be prohibitively expensive for many businesses. For instance, Moro Hub has developed the world’s largest green data center in Dubai, located in the Mohammed bin Rashid Al Maktoum Solar Park, with a capacity exceeding 100 MW. The installation of solar energy systems, liquid cooling technologies, and energy-efficient servers often requires substantial capital investment, which can be a barrier for smaller players in the market. Additionally, data center operators need to ensure that their facilities are built to meet international sustainability standards, such as LEED or BREEAM certifications, which often require higher construction and operational costs. The challenge lies in balancing these initial investments with the long-term cost savings and sustainability goals. While the UAE government offers various incentives and regulations to promote green energy, businesses may still face difficulties in securing the necessary funds to fully transition to eco-friendly data centers. This high capital expenditure remains a significant barrier to widespread adoption of green technologies in the UAE’s data center sector.

Regulatory and Operational Compliance

Another challenge in the UAE Green Data Center Market is ensuring compliance with both local and international regulations regarding environmental sustainability and energy efficiency. The UAE government has stringent regulations in place to encourage the adoption of green technologies and reduce the carbon footprint of industries, including data centers. However, these regulations are constantly evolving, and staying compliant with changing environmental laws can be complex. Additionally, international standards for data center certifications, such as ISO 50001 for energy management and ISO 14001 for environmental management, require data center operators to adopt specific energy-saving practices and continuously monitor their environmental impact. Implementing and maintaining compliance with these regulations often requires dedicated resources and expertise, which can be a burden on businesses. Furthermore, the rapid pace of technological advancements in green technologies means that data centers must regularly upgrade their infrastructure to remain compliant with the latest energy efficiency standards. This dynamic regulatory environment, coupled with the need for continuous upgrades to stay compliant, poses a significant challenge for companies looking to operate green data centers in the UAE.

Market Opportunities

Expansion of Renewable Energy Infrastructure

One of the most significant opportunities in the UAE Green Data Center Market lies in the continued expansion of renewable energy infrastructure, particularly solar energy. The UAE’s ambitious goals for renewable energy adoption, exemplified by projects like the Mohammed bin Rashid Al Maktoum Solar Park, present a unique opportunity for data center operators to integrate solar power into their operations. By capitalizing on these renewable energy sources, data centers can significantly reduce their reliance on non-renewable energy, lower operational costs, and align with the country’s sustainability targets. As the government continues to prioritize clean energy initiatives, there will be an increasing availability of affordable and sustainable energy options for data centers, enabling more companies to invest in green technologies and drive down carbon emissions. This growing focus on renewable energy presents a promising opportunity for businesses to innovate and create data centers that operate entirely on sustainable power.

Government Support and Incentives for Sustainability

Another opportunity in the UAE Green Data Center Market is the increasing government support for sustainability initiatives. The UAE government has introduced various policies and regulations to encourage businesses to adopt energy-efficient technologies and reduce their carbon footprints. These include incentives for adopting renewable energy solutions, grants for energy efficiency improvements, and tax breaks for businesses that comply with green standards. As part of the UAE Vision 2021 and the Dubai Clean Energy Strategy 2050, data center operators can benefit from favorable regulations designed to accelerate the transition to sustainable practices. The combination of supportive government policies, financial incentives, and a regulatory environment that promotes sustainability provides a conducive environment for the growth of the green data center market, enabling businesses to reduce costs while contributing to the country’s environmental goals.

Market Segmentation Analysis

By Component

The UAE Green Data Center Market is segmented into several key components, each playing a crucial role in ensuring the efficient and sustainable operation of data centers. The Monitoring and Management System is a vital component, enabling real-time monitoring of energy usage, cooling efficiency, and overall system performance. These systems allow data center operators to optimize resource usage, reduce energy waste, and improve overall operational efficiency. The Cooling System segment is another critical component, with green technologies such as liquid cooling, free cooling, and advanced AI-driven cooling techniques gaining popularity. These cooling solutions are designed to minimize energy consumption while maintaining optimal temperatures for high-performance computing equipment. Networking Systems are also integral to the operation of green data centers, as they facilitate efficient data transfer while minimizing energy usage. The Power System segment includes renewable energy integration, such as solar and wind power, which significantly reduces reliance on conventional energy sources and supports sustainable operations. The Others category encompasses various additional components, including energy storage systems and backup power solutions, which are essential for maintaining operational continuity in a sustainable manner.

By Data Center Type

The market is divided based on data center type, with Large Enterprises representing a significant share of the market. These enterprises require high-capacity data centers to support their extensive IT operations, and the demand for green technologies is rising as these organizations seek to reduce their environmental footprint. On the other hand, Small & Medium Enterprises (SMEs) are also increasingly adopting green data center solutions due to their growing reliance on digital infrastructure and cloud services. SMEs benefit from modular and scalable green data center designs that allow them to optimize costs and energy efficiency, aligning with sustainability goals while accommodating their smaller-scale operations.

Segments

Based on Component

- Solution

- Monitoring and Management System

- Cooling System

- Networking System

- Power System

- Others

- Services

- Installation & Deployment

- Consulting

- Support & Maintenance

Based on Data Center Type

- Large Enterprises

- Small & Medium Enterprises (SMEs)

Based on End User

- Healthcare

- Financial Services

- Government

- Telecom & IT

- Others

Based on Region

Regional Analysis

UAE (40%)

The UAE, being at the forefront of green infrastructure development, represents the largest market share in the region, accounting for approximately 40% of the total market share. The country benefits from government-backed initiatives, such as the UAE Vision 2021 and the Dubai Clean Energy Strategy 2050, which foster a strong demand for green data centers that prioritize energy efficiency and sustainability. Furthermore, the UAE’s position as a regional business hub attracts multinational companies that seek to invest in eco-friendly data centers, contributing to the dominance of the UAE in this market.

Saudi Arabia (20%)

Beyond the UAE, the Saudi Arabian green data center market is gaining traction, holding an estimated market share of 20%. Saudi Arabia’s ongoing efforts to diversify its economy under Vision 2030, which includes significant investments in digital infrastructure, are propelling the demand for green data center solutions. As the country moves towards renewable energy integration, especially solar power, there is an increasing push for energy-efficient data centers that align with the nation’s sustainability goals. Additionally, the presence of major cloud service providers and telecom companies in Saudi Arabia is further driving the need for sustainable data storage solutions.

Key players

- eHosting DataFort

- Khazna Data Centers

- UAE Technology Investment Corporation (UAE-TIC)

- ADNOC Data Center

- DATAMENA

Competitive Analysis

The UAE Green Data Center Market is characterized by the presence of several key players that are driving innovation and sustainability in the region. eHosting DataFort is known for offering secure and energy-efficient data center services, with a focus on green technologies and robust infrastructure. Khazna Data Centers is another prominent player, specializing in energy-efficient solutions with a strong emphasis on renewable energy integration and sustainable design practices. UAE Technology Investment Corporation (UAE-TIC) focuses on enhancing the nation’s digital infrastructure by supporting green data centers and aligning with the UAE’s sustainability goals. ADNOC Data Center, backed by a major oil and gas player, ensures high-performance and eco-friendly operations, optimizing energy use across its facilities. Lastly, DATAMENA offers scalable data center services, with a growing focus on sustainable operations, renewable energy adoption, and reducing carbon emissions, positioning itself as a key competitor in the market.

Recent Developments

- In December 2023, Vertiv acquired CoolTera Ltd., a provider of liquid cooling infrastructure solutions. This acquisition strengthens Vertiv’s capabilities in high-density compute cooling, aligning with the industry’s shift towards energy-efficient data center technologies.

- In July 2024, Huawei unveiled three green data center facility solutions at the Global Smart Data Center Summit. These include the AeroTurbo fans, IceCube polymer heat exchangers, and iCooling AI energy efficiency cooling solutions, designed to optimize cooling efficiency and reduce energy consumption.

- In May 2024, Microsoft launched its first hyperscale cloud data center region in Mexico, located in Querétaro. This facility aims to provide scalable, highly available, and resilient cloud services, supporting digital transformation and sustainable innovation in the region.

- In June 2024, HPE partnered with Danfoss to introduce the HPE IT Sustainability Services – Data Center Heat Recovery. This turnkey heat recovery module helps organizations manage and repurpose excess heat, contributing to more sustainable IT infrastructures.

- In November 2024, Google announced a partnership with SB Energy Global to supply 942 MW of renewable energy to power its data center operations in Texas. This initiative supports Google’s commitment to operate on carbon-free energy and aligns with its sustainability goals.

- In January 2025, AWS announced plans to invest approximately $11 billion in Georgia to expand its infrastructure, supporting cloud computing and AI technologies. This investment is expected to create at least 550 new high-skilled jobs and enhance the state’s digital innovation capabilities.

- In May 2024, IBM announced a partnership with Schneider Electric to develop and deploy energy-efficient data center solutions, focusing on reducing carbon emissions and improving operational efficiency.

Market Concentration and Characteristics

The UAE Green Data Center Market exhibits moderate concentration, with a mix of established players and emerging companies contributing to its growth. Leading players such as eHosting DataFort, Khazna Data Centers, and ADNOC Data Center dominate the market by offering energy-efficient, sustainable solutions tailored to meet the region’s growing demand for green technologies. The market is characterized by a strong focus on integrating renewable energy sources, advanced cooling systems, and energy-efficient infrastructure to minimize operational costs and environmental impact. Companies are increasingly adopting modular, scalable designs and leveraging innovations in AI and machine learning to optimize energy usage. With the UAE’s government providing regulatory support and incentives for sustainability, the market is evolving rapidly, attracting both regional and international players to invest in eco-friendly data centers. As demand for digital services continues to rise, competition is intensifying, driving continuous improvements in sustainability practices and technological advancements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Data Center Type, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UAE government’s focus on sustainability will continue to drive growth in the green data center sector. Initiatives like the UAE Vision 2021 and Dubai Clean Energy Strategy 2050 will reinforce investment in energy-efficient infrastructure.

- As the demand for green data centers grows, renewable energy sources such as solar and wind will increasingly power these facilities. This trend will help data centers reduce their dependence on fossil fuels and lower operational costs.

- AI and machine learning technologies will play a pivotal role in optimizing data center operations. These technologies will enable real-time energy management, cooling optimization, and predictive maintenance to reduce energy consumption.

- Modular data centers will gain prominence as businesses seek scalable, energy-efficient solutions. These systems will allow for easy expansion while maintaining low energy consumption and supporting sustainable operations.

- Green data centers will increasingly adopt advanced cooling systems, such as liquid and free cooling technologies, to reduce energy use. These energy-efficient cooling methods will help minimize carbon footprints and improve operational sustainability.

- As digital transformation accelerates, the demand for cloud computing and data storage services will rise. This will drive the need for green data centers that can handle high-volume data processing while adhering to sustainability standards.

- The growing reliance on digital infrastructure will lead to heightened demand for robust cybersecurity solutions in green data centers. Securing data storage and ensuring privacy will remain a critical focus area.

- With stricter data protection laws being implemented globally, there will be a rising need for data centers that can locally store and process sensitive data. This will lead to more localized green data centers across the UAE.

- UAE data centers will increasingly align with international certifications, such as ISO 50001 and LEED, to meet global sustainability benchmarks. This will enhance their marketability and attractiveness to international clients.

- As the UAE Green Data Center Market matures, more players, including international firms, will enter the market. This increase in competition will drive innovation, enhance service offerings, and reduce operational costs across the sector.