| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| South Korea Retail Pharmacy Market Size 2024 |

USD 20,057.34 Million |

| South Korea Retail Pharmacy Market, CAGR |

3.76% |

| South Korea Retail Pharmacy Market Size 2032 |

USD 26,949.12 Million |

Market Overview

The South Korea Retail Pharmacy Market is projected to grow from USD 20,057.34 million in 2024 to an estimated USD 26,949.12 million by 2032, with a compound annual growth rate (CAGR) of 3.76% from 2025 to 2032. This growth trajectory reflects the increasing demand for accessible pharmaceutical services and the expanding role of retail pharmacies in the healthcare system.

Key drivers of this market include the growing geriatric population, which necessitates more frequent medication management, and the increasing prevalence of chronic conditions like diabetes and hypertension. Additionally, the government’s support for affordable healthcare solutions, including the promotion of generic drugs, is enhancing the accessibility of medications. Technological advancements in pharmacy automation and digital health services are also transforming the retail pharmacy landscape, improving efficiency and customer experience.

Geographically, the market is predominantly concentrated in urban areas, where the demand for healthcare services is higher. Seoul, as the capital, leads in the number of retail pharmacies and healthcare facilities. Key players in the South Korea Retail Pharmacy Market include major pharmacy chains and independent pharmacies that are expanding their services to meet the evolving needs of the population. These entities are focusing on enhancing service offerings, integrating digital solutions, and collaborating with healthcare providers to strengthen their market position.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The South Korea Retail Pharmacy Market is projected to grow from USD 20,057.34 million in 2024 to USD 26,949.12 million by 2032, at a CAGR of 3.76% from 2025 to 2032.

- The Global Retail Pharmacy Market is expected to grow from USD 14,45,920.00 million in 2024 to USD 19,65,958.05 million by 2032, at a CAGR of 3.92% from 2025 to 2032.

- An aging population, increasing prevalence of chronic diseases, and government support for affordable healthcare solutions are driving the growth of retail pharmacies.

- The integration of digital health services, pharmacy automation, and e-prescriptions is transforming the retail pharmacy landscape, improving service delivery and efficiency.

- Regulatory challenges around online pharmacies and restrictions on prescription drug sales limit the full potential of e-pharmacy services in South Korea.

- The market is concentrated in urban areas, especially Seoul, which leads in the number of retail pharmacies and healthcare facilities.

- Pharmacies are diversifying their services beyond medication dispensing to include health screenings, chronic disease management, and preventive healthcare offerings.

- Key players, including major pharmacy chains and independent pharmacies, are increasingly integrating digital solutions and expanding service offerings to enhance their market position.

Report Scope

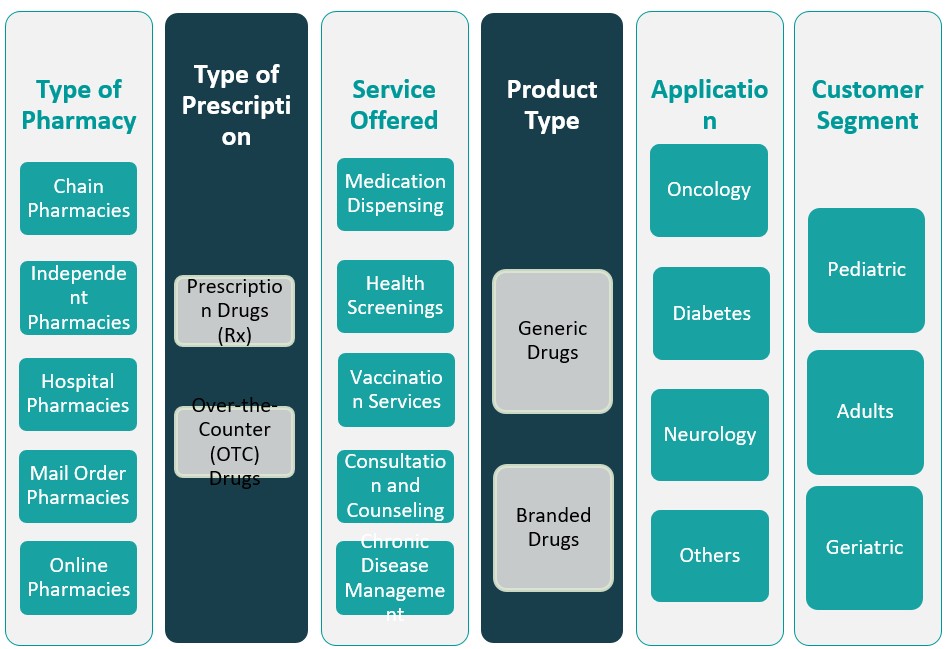

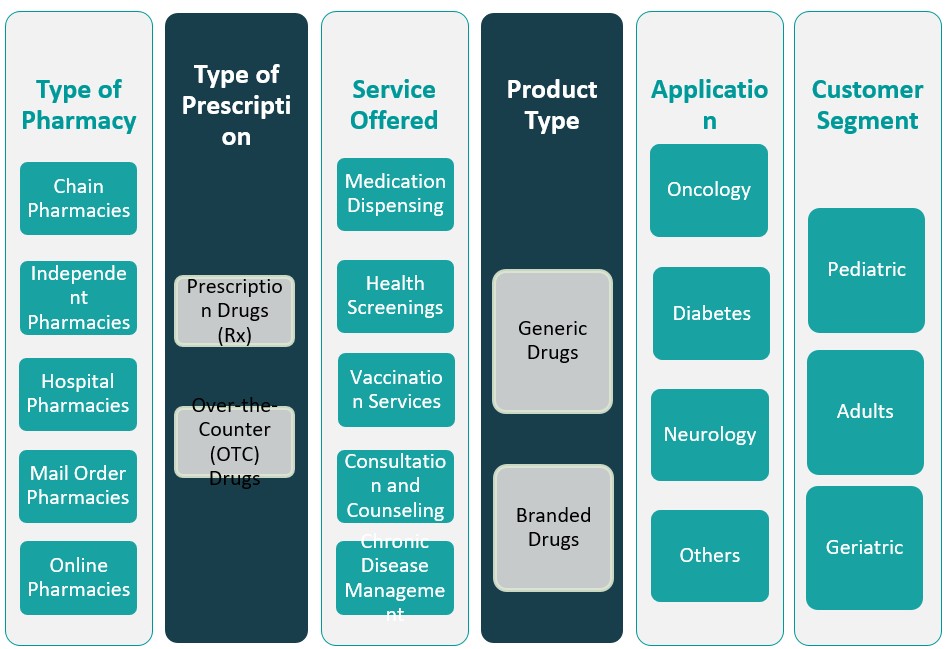

This report segments the South Korea Retail Pharmacy Market as follows:

Market Drivers

Aging Population and Rising Chronic Disease Burden

South Korea is experiencing a significant demographic shift with an increasingly aging population. As of 2024, more than 18% of the population is aged 65 or older. This aging trend is directly influencing healthcare demand, as older individuals are more susceptible to chronic conditions such as cardiovascular diseases, diabetes, osteoporosis, arthritis, and neurodegenerative disorders. For instance, the Ministry of Health and Welfare reported that over 70% of elderly individuals in South Korea suffer from at least one chronic condition, necessitating regular medication and follow-up care. The accessibility and affordability of retail pharmacies make them an ideal choice for elderly patients seeking quick access to essential medications and health advice. Additionally, pharmacists are playing a growing role in managing medication adherence, offering health consultations, and providing preventive care services like vaccinations and blood pressure monitoring. South Korea’s government-supported home healthcare programs include pharmaceutical services tailored for elderly patients, ensuring medication adherence and reducing hospital visits. As South Korea continues to age, the retail pharmacy sector is well-positioned to address the growing needs of this demographic, thereby fueling consistent market expansion.

Expansion of Universal Healthcare and Government Support for Pharmacy Services

South Korea’s universal healthcare system, managed by the National Health Insurance Service (NHIS), plays a vital role in enhancing access to medical and pharmaceutical services. Government policy has increasingly focused on cost-effective healthcare delivery, and retail pharmacies serve as an essential point of care for both prescription and over-the-counter (OTC) drugs. The NHIS covers approximately 97% of South Korea’s population, ensuring widespread access to essential medications. The government has implemented policies encouraging the use of generic drugs, enabling pharmacies to offer affordable alternatives and expand their margins. Moreover, healthcare reforms are promoting decentralization and shifting certain responsibilities from hospitals to primary and retail-based care settings to ease the burden on large medical institutions. For instance, South Korea’s healthcare reforms have introduced point-of-care diagnostic services at retail pharmacies, allowing patients to receive basic health screenings without visiting hospitals. Incentives for pharmacies to adopt digital health tools, participate in public health campaigns, and engage in chronic disease management programs further reinforce the strategic importance of retail pharmacies. These policy-level enablers not only enhance the operational viability of pharmacies but also increase their relevance in South Korea’s evolving healthcare ecosystem.

Technological Integration and Digital Health Transformation

South Korea is a global leader in digital technology adoption, and its healthcare sector is increasingly embracing digital transformation. Retail pharmacies are leveraging digital tools to streamline operations, enhance patient engagement, and improve service delivery. Technologies such as electronic prescription systems (e-prescriptions), pharmacy automation, inventory management systems, and mobile apps for ordering medication are reshaping the retail pharmacy landscape. These innovations reduce dispensing errors, optimize inventory flow, and enhance customer convenience. Online and mobile pharmacy services are gaining traction, especially among younger consumers and busy urban professionals. E-pharmacy platforms, enabled by recent regulatory relaxations, allow patients to consult pharmacists remotely, refill prescriptions digitally, and receive home delivery of medications. Pharmacies that invest in such platforms can reach broader demographics and reduce overhead costs. In addition, the integration of AI and data analytics is helping pharmacies personalize health recommendations, improve adherence tracking, and participate in early disease detection initiatives. As digital health infrastructure continues to evolve, pharmacies that adapt and innovate will maintain a competitive edge and drive market growth.

Changing Consumer Behavior and Emphasis on Preventive Healthcare

Modern South Korean consumers are becoming increasingly health-conscious and informed, prompting a shift in behavior towards preventive healthcare and wellness. This trend is driving demand for OTC medications, dietary supplements, and health monitoring devices, many of which are easily available at retail pharmacies. Consumers now view pharmacies not merely as drug dispensaries but as trusted health advisors. Retail pharmacies have responded by expanding their product range to include personal care, nutrition, skin care, and fitness-related products. The rise in self-medication practices, fueled by easy access to online health information and minor ailment management awareness, has further amplified OTC sales. Moreover, busy lifestyles and long working hours have made consumers value quick, walk-in access to health services—benefiting retail pharmacies located in residential neighborhoods and commercial hubs. Pharmacies are also introducing value-added services such as vaccination clinics, basic diagnostic tests, and health education workshops. These evolving consumer expectations are transforming the traditional pharmacy model into a health and wellness hub, reinforcing its relevance in both urban and rural contexts.

Market Trends

Growth of E-Pharmacy and Digital Health Platforms

The rapid digitization of healthcare in South Korea is accelerating the adoption of e-pharmacy platforms. For instance, during the pandemic, South Korea saw a 45% increase in the use of electronic prescriptions, highlighting the growing reliance on digital healthcare solutions. The integration of mobile applications, electronic prescriptions, and teleconsultation services has made online pharmacy solutions more accessible and widely accepted. Consumers increasingly prefer the convenience of ordering medications online, especially in urban areas where time constraints and digital literacy are high. Pharmacies are now investing in user-friendly apps, AI-powered recommendation engines, and logistics infrastructure to enhance customer experience. Additionally, collaborations between tech startups and traditional pharmacy chains are creating hybrid service models that blend online efficiency with offline reliability. As digital health becomes a mainstream mode of healthcare delivery, retail pharmacies in South Korea are capitalizing on this transition to expand their reach, streamline operations, and improve patient engagement.

Expansion of Preventive Healthcare Services in Pharmacies

South Korean retail pharmacies are shifting beyond traditional roles by incorporating preventive healthcare services into their core offerings. For example, over 70% of pharmacies in South Korea now offer flu vaccination services, reflecting their growing role in preventive care. With the rise in lifestyle-related conditions and growing consumer awareness, pharmacies are increasingly becoming health and wellness hubs. Many pharmacies now provide in-store services such as blood pressure monitoring, diabetes risk assessments, and health counseling. Pharmacists are undergoing specialized training, with data showing that 85% of pharmacists in South Korea are certified to provide chronic disease management consultations. Furthermore, the integration of preventive care with electronic medical records and mobile tracking apps enhances continuity of care and patient adherence. This transformation is not only improving population health outcomes but also opening new revenue streams for pharmacy operators in a competitive market landscape.

Rise in Demand for OTC and Wellness Products

The South Korean consumer’s growing preference for self-medication and proactive wellness management is driving increased demand for over-the-counter (OTC) medications and health-related consumer products. Pharmacies are expanding their product portfolios to include dietary supplements, herbal remedies, skincare solutions, immunity boosters, and fitness aids. This trend is particularly strong among younger and middle-aged consumers who value convenience, instant access to health solutions, and preventive care. The cultural emphasis on beauty and wellness in South Korea further fuels the popularity of pharmacy-sold skincare and nutritional brands. Pharmacies are capitalizing on this trend by enhancing their retail layouts, offering personalized wellness advice, and launching private-label products. In addition, the rise of influencer marketing and social media is impacting buying behavior, with pharmacies adjusting their offerings based on real-time demand signals. This diversification beyond prescription drugs is transforming pharmacies into lifestyle-focused retail destinations and strengthening their consumer base across different age segments.

Pharmacy Automation and Smart Infrastructure Adoption

The adoption of advanced automation technologies is reshaping pharmacy operations across South Korea. Retail chains and independent pharmacies alike are implementing smart dispensing systems, robotic inventory management, and digital queuing solutions to improve service efficiency and accuracy. These innovations reduce wait times, minimize human errors, and allow pharmacists to focus more on clinical and consultative roles. As customer expectations evolve, pharmacies are also leveraging data analytics to monitor inventory trends, predict demand, and optimize restocking schedules. The integration of pharmacy automation with electronic health records (EHRs) and insurance databases is enabling seamless prescription verification and claims processing. In urban areas, some next-generation pharmacies feature unmanned kiosks and AI-powered consultation booths to serve tech-savvy customers. The government’s support for digital healthcare infrastructure and the broader Industry 4.0 movement are catalyzing this trend. Automation not only enhances operational productivity but also ensures compliance with regulatory standards, positioning pharmacies for scalable and sustainable growth.

Market Challenges

Regulatory Restrictions on E-Pharmacy Expansion

Despite South Korea’s advanced digital infrastructure, regulatory challenges continue to limit the full potential of the e-pharmacy sector. Strict regulations surrounding the online sale of prescription medications are one of the major hurdles facing retail pharmacies seeking digital transformation. The government, concerned about issues like drug misuse, patient safety, and quality assurance, enforces rigid restrictions that require physical pharmacist interaction for prescription fulfillment. For instance, South Korea permits teleconsultations and e-prescriptions only under temporary measures, such as during the COVID-19 pandemic, but has yet to establish a permanent legal framework for these services. This creates operational complexities for retail pharmacies that want to integrate omnichannel strategies to serve digitally savvy customers. Startups and traditional pharmacies attempting to develop online platforms must navigate complex compliance frameworks, increasing costs and administrative burdens. Furthermore, the fragmented regulatory approach at regional and national levels generates uncertainty, delaying investment in digital health initiatives. Unless these regulatory bottlenecks are addressed in a structured and controlled manner, the market will face limitations in tapping into the growing consumer demand for online pharmacy services, thereby slowing the overall modernization of the sector.

Intense Competition and Pressure on Profit Margins

The South Korea retail pharmacy market is highly fragmented, with a mix of large pharmacy chains, independent operators, and hospital-linked pharmacies vying for market share. This intense competition exerts continuous pressure on profit margins, especially as pricing battles for both branded and generic drugs escalate. Government policies promoting the use of cost-effective generics, while beneficial to public healthcare affordability, further compress retail margins. Additionally, consumer behavior increasingly favors price-sensitive purchasing, pushing pharmacies to offer discounts and promotional schemes that erode profitability. Large chains, leveraging economies of scale, often outcompete smaller, independent pharmacies on pricing and service offerings, threatening their survival. The rise of digital health platforms and e-commerce players entering the pharmaceutical retail space adds another layer of competition. For pharmacies operating in urban centers, saturation and high operational costs, including rent and labor, further challenge financial sustainability. To remain viable, players must differentiate through value-added services, technological adoption, and customer loyalty initiatives.

Market Opportunities

Expansion into Preventive Healthcare and Wellness Services

Retail pharmacies in South Korea have a significant opportunity to broaden their role beyond medication dispensing by becoming community-based health and wellness centers. The growing emphasis on preventive healthcare, coupled with rising consumer interest in proactive health management, creates a favorable environment for pharmacies to offer services such as vaccination programs, health screenings, chronic disease monitoring, and lifestyle counseling. By integrating these services, pharmacies can attract a wider customer base seeking convenient, walk-in healthcare solutions without the need to visit crowded hospitals. Moreover, partnerships with insurance providers and healthcare institutions could further support the adoption of pharmacy-based preventive care models. Pharmacies that diversify into health and wellness segments can capture additional revenue streams, enhance brand loyalty, and strengthen their position in the evolving healthcare landscape.

Leveraging Digital Transformation to Expand Market Reach

The increasing acceptance of digital health solutions presents a major growth opportunity for retail pharmacies across South Korea. By investing in e-pharmacy platforms, mobile applications, remote consultations, and AI-driven customer engagement tools, pharmacies can enhance accessibility, convenience, and personalization for consumers. Digital transformation enables pharmacies to reach underserved or rural populations and cater to the tech-savvy younger demographic demanding seamless healthcare experiences. The integration of online and offline services through omnichannel strategies will allow pharmacies to optimize operations and offer value-added services such as personalized medication reminders and remote health monitoring. Capitalizing on this digital evolution will position pharmacies to remain competitive, expand their customer base, and drive long-term growth in an increasingly dynamic market environment.

Market Segmentation Analysis

By Type of Pharmacy

The South Korea retail pharmacy market is categorized into different pharmacy types, each serving distinct consumer needs. Chain pharmacies dominate the landscape, offering convenience, brand recognition, and widespread accessibility, particularly in urban centers. These pharmacies benefit from economies of scale, making them competitive in terms of pricing and service offerings. Independent pharmacies, though smaller in number, maintain strong relationships with local communities and often provide personalized services, which help foster customer loyalty. Hospital pharmacies, integrated within healthcare facilities, offer pharmaceutical care to inpatients and outpatients. While they focus on patient-specific needs, they also provide outpatient services. Mail order pharmacies are emerging as a niche segment, catering to customers who prefer the convenience of receiving their prescriptions via mail. This model is especially relevant for chronic disease patients who require regular medication refills. Online pharmacies, facilitated by digital health advancements, are rapidly growing in popularity, driven by consumer demand for easy access to medications and consultations. They offer convenience, time savings, and often, competitive pricing.

By Type of Prescription

The South Korean retail pharmacy market is primarily driven by two types of prescriptions: prescription drugs (Rx) and over-the-counter (OTC) drugs. Prescription drugs, which require a doctor’s prescription for dispensing, dominate the market due to their essential role in the treatment of chronic diseases, infections, and other health conditions. With an aging population and increasing chronic health issues such as diabetes and hypertension, the demand for Rx drugs is rising. On the other hand, OTC drugs, which consumers can purchase without a prescription, are also experiencing growth. The rising preference for self-medication and the convenience of easily accessible health solutions contribute to the increased demand for OTC products like pain relievers, cold medicines, and vitamins.

Segments

Based on Type of Pharmacy

- Chain Pharmacies

- Independent Pharmacies

- Hospital Pharmacies

- Mail Order Pharmacies

- Online Pharmacies

Based on Type of prescription

- Prescription Drugs (Rx)

- Over-the-Counter (OTC) Drugs

Based on Service offered

- Medication Dispensing

- Health Screenings

- Vaccination Services

- Consultation and Counseling

- Chronic Disease Management

Based on Product Type

- Generic Drugs

- Branded Drugs

Based on Application

- Oncology

- Diabetes

- Neurology

- Others

Based on Customer

- Paediatric

- Adults

- Geriatric

Based on Region

Regional Analysis

Seoul (38.5%)

Seoul dominates the national market, accounting for 38.5% of the total retail pharmacy revenue. The capital city’s high population concentration, advanced healthcare ecosystem, and widespread presence of both chain and independent pharmacies contribute to its leadership position. Pharmacies in Seoul have rapidly adopted digital health services, including e-prescriptions and teleconsultations, providing a model for the rest of the country. The urban consumer base in Seoul shows a higher inclination toward preventive healthcare and wellness services, further boosting pharmacy revenue streams beyond traditional medication dispensing.

Gyeonggi Province (24.7%)

The Gyeonggi Province follows, holding 24.7% of the South Korea retail pharmacy market share. As the most populous province, Gyeonggi benefits from a rapidly expanding suburban population seeking accessible healthcare options. Pharmacies in this region are increasingly investing in health screenings, chronic disease management programs, and e-commerce platforms to meet evolving patient expectations. The relatively younger demographic profile in Gyeonggi supports the demand for OTC drugs, wellness products, and digital pharmacy services. Competitive dynamics are strong, with both large chains and independent players vying to establish a dominant footprint across the province’s rapidly developing urban centers.

Key players

- CVS Health

- Boots Walgreens

- Cigna

- Walmart

- Kroger

- Rite Aid Corp.

Competitive Analysis

The South Korea retail pharmacy market, though dominated by local players, is influenced by the operational strategies and best practices of major international pharmacy chains such as CVS Health, Boots Walgreens, Cigna, Walmart, Kroger, and Rite Aid Corp. These companies demonstrate strong capabilities in supply chain management, customer service innovation, digital transformation, and diversified healthcare services. CVS Health and Boots Walgreens, for instance, have successfully integrated digital health platforms with traditional pharmacy services, setting benchmarks for operational excellence. Walmart and Kroger leverage their vast retail networks to offer competitive pricing and wide product accessibility. Cigna’s focus on healthcare integration showcases the potential of combining insurance services with pharmaceutical retail. Rite Aid Corp., despite its smaller footprint, emphasizes community-based health services. South Korean pharmacies are increasingly adopting similar strategies by investing in technology, expanding preventive care services, and improving customer engagement to stay competitive in a rapidly evolving healthcare landscape.

Recent Developments

- As of March 31, 2024, Apollo Pharmacy operated 6,030 stores across approximately 1,200 cities and towns in 22 states and 5 union territories. The company continues to expand its digital healthcare platform, offering services like online medicine delivery and virtual doctor consultations.

- In October 2024, Caring Pharmacy Retail Management Sdn Bhd, a 75%-owned unit of 7-Eleven Malaysia Holdings Bhd, announced acquisitions of equity interest and business assets in several pharmaceutical outlets for a combined cash consideration of RM48.86 million.

- In June 2024, the Australian Competition and Consumer Commission (ACCC) expressed concerns that the proposed acquisition of Chemist Warehouse by Sigma Healthcare could substantially lessen competition in pharmacy retailing, potentially leading to higher prices and reduced service quality.

- In January 2025, Watsons Philippines ended 2024 with 1,166 stores, expanding its community pharmacy format. The company opened more than 50 stores outside of Metro Manila.

Market Concentration and Characteristics

The South Korea retail pharmacy market exhibits moderate to high market concentration, with a mix of dominant chain pharmacies, a large number of independent pharmacies, and a growing presence of online pharmacy platforms. Chain pharmacies hold a competitive advantage through economies of scale, brand recognition, and broader service offerings, while independent pharmacies maintain strong customer loyalty through personalized care. The market is characterized by rapid digital transformation, an increasing emphasis on preventive healthcare services, and strong government regulation, particularly concerning prescription drug dispensing. Urban areas such as Seoul and Gyeonggi Province witness higher pharmacy density and more advanced service models, whereas regional markets are gradually adopting similar innovations. Consumer preferences are shifting towards convenience, digital engagement, and integrated health solutions, prompting pharmacies to expand beyond traditional medication dispensing into health screenings, chronic disease management, and wellness services. Competitive dynamics are intensifying, driving players to differentiate through technology, service quality, and diversified healthcare offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type of Pharmacy, Type of prescription, Service offered, Product Type, Application, Customer and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The South Korea retail pharmacy market will continue expanding steadily, driven by the aging population and rising demand for chronic disease management services across urban and suburban regions.

- Chain pharmacies are expected to strengthen their market dominance by investing heavily in digital platforms, omnichannel retail models, and customer-centric healthcare service offerings.

- Online pharmacies will witness significant growth as regulatory frameworks gradually evolve to support e-prescriptions, remote consultations, and home delivery of prescription medications.

- Preventive healthcare services such as vaccinations, health screenings, and wellness counseling will become core components of pharmacy operations, enhancing their role in public health initiatives.

- Pharmacies will increasingly adopt automation technologies, including smart dispensing systems and AI-driven inventory management, to optimize efficiency and minimize operational errors.

- Expansion into personalized healthcare solutions, including customized medication plans and targeted health programs, will differentiate pharmacies in an increasingly competitive landscape.

- The demand for over-the-counter (OTC) drugs and wellness products such as supplements and skincare will continue to surge, fueled by the growing health-conscious consumer base.

- Strategic partnerships between pharmacies, insurance companies, and healthcare providers will emerge, creating integrated healthcare networks that improve patient outcomes and service accessibility.

- Rural and suburban areas will offer new growth opportunities as pharmacies extend digital health services and mobile health solutions to underpenetrated regions.

- Sustainability initiatives, including eco-friendly pharmacy operations and green product offerings, will gain prominence as consumers prioritize environmentally responsible healthcare choices.