Market Overview

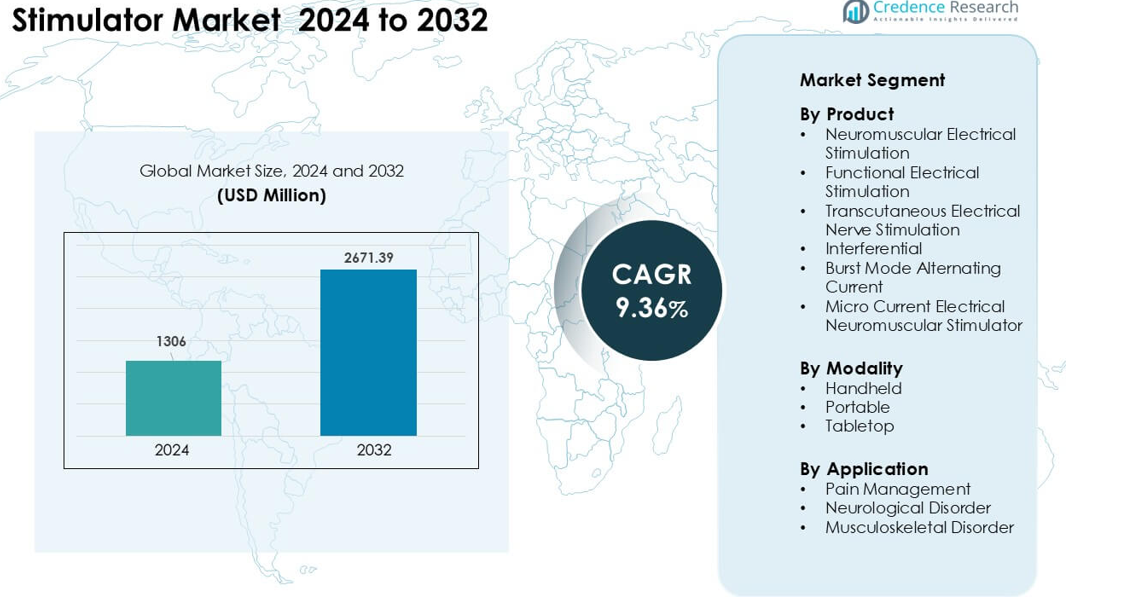

Stimulator Market was valued at USD 1306 million in 2024 and is anticipated to reach USD 2671.39 million by 2032, growing at a CAGR of 9.36 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

Stimulator Market Size 2024

|

USD 1306 million |

| Stimulator Market, CAGR |

9.6% |

| Stimulator Market Size 2032 |

USD 2671.39 million |

Major players in the Stimulator Market include OG Wellness Technologies, Zimmer MedizinSysteme, Zynex, RS Medical, Beurer, EMS Physio, OMRON, NeuroMetrix, DJO Global, and BioMedical Life Systems, each contributing to strong innovation across pain management, rehabilitation, and neuromuscular therapy devices. These companies focus on portable designs, multi-mode systems, and improved clinical performance to meet rising demand from hospitals, physiotherapy centers, and home-care users. North America emerged as the leading region in 2024 with about 37% share, supported by advanced healthcare infrastructure, high chronic pain incidence, and strong adoption of non-invasive stimulation technologies.

Market Insights

- The Stimulator Market reached USD 1306 million in 2024 and is projected to hit USD 2671.39 million by 2032, growing at a CAGR of 9.36%.

- Rising chronic pain cases and wider use of non-invasive therapy devices fuel strong demand, with pain management holding about 52% share in 2024.

- Smart and portable stimulation devices gained traction as consumers adopted app-based control and home-care therapy solutions.

- Key players such as OG Wellness, Zimmer MedizinSysteme, Zynex, RS Medical, Beurer, and OMRON strengthened competition through product upgrades and broader distribution networks.

- North America led the market with around 37% share in 2024, while Asia-Pacific showed the fastest expansion; portable stimulators accounted for nearly 48% share across modalities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

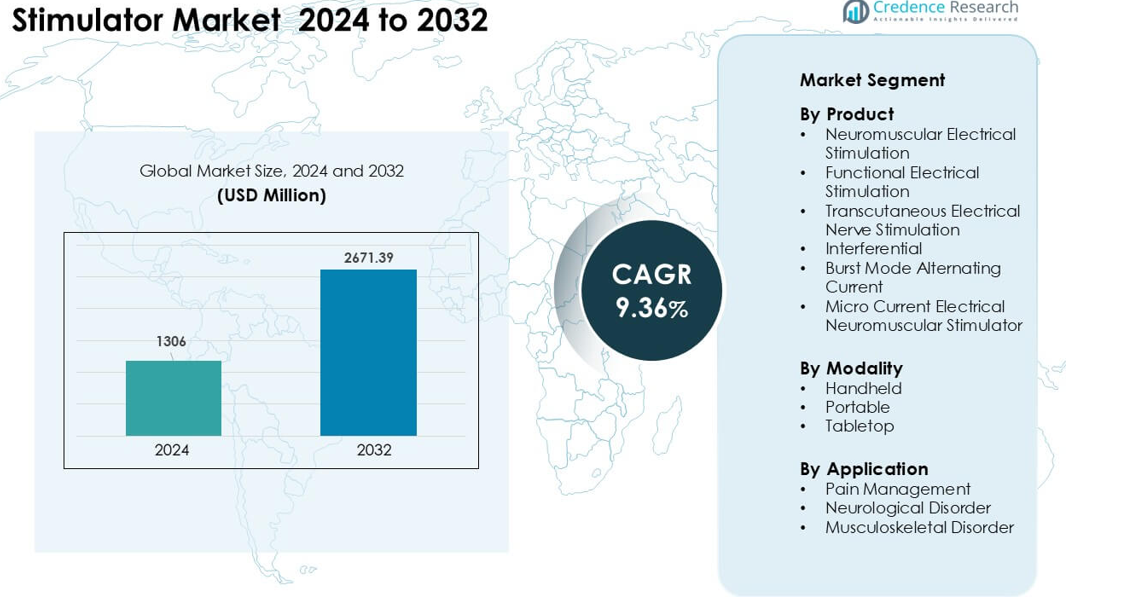

By Product

Transcutaneous Electrical Nerve Stimulation led the product segment in 2024 with about 34% share. Strong demand came from rising cases of chronic back pain, arthritis, and post-operative discomfort. Users preferred these systems because they offer non-invasive relief and allow home-based therapy. Neuromuscular and functional electrical stimulation devices grew due to wider use in stroke and spinal injury rehabilitation. Microcurrent units gained attention for soft-tissue recovery, but their share stayed lower due to limited clinical adoption. Interferential and burst-mode systems expanded across sports clinics but remained secondary in overall volume.

- For instance, according to a 2025 market‑size forecast report for the muscle stimulator sector, the share of TENS remained significantly larger than other modalities, confirming that interferential or burst‑mode units accounted for a smaller portion of unit sales relative to TENS in 2024.

By Modality

Portable stimulators dominated the modality segment in 2024 with nearly 48% share. Growth was driven by rising use among athletes, elderly patients, and individuals seeking therapy outside hospitals. Portable units offered easy handling, battery support, and multi-mode functions that improved user convenience. Handheld devices saw steady expansion in physiotherapy centers because therapists used them for quick pain-relief sessions. Tabletop systems maintained importance in advanced rehabilitation clinics, yet their share stayed modest as more patients shifted toward mobile, home-based recovery solutions supported by compact and digital platforms.

- For instance, within the 2023 data for the Transcutaneous Electrical Nerve Stimulation Market, portable (rather than stationary/tabletop) TENS devices dominated usage reinforcing that desktop/tabletop units formed a smaller share of overall devices in use.

By Application

Pain Management held the leading position in 2024 with about 52% share. Widespread cases of lower back pain, neuropathic pain, and sports injuries supported stronger adoption of TENS and neuromuscular systems. Patients favored these devices because they reduce discomfort without drugs and support continuous daily relief. Musculoskeletal disorder treatments grew as physiotherapists relied on stimulation to improve mobility and muscle strength. Neurological disorder applications expanded in stroke rehabilitation programs, but their share remained smaller due to longer therapy cycles and limited access in some care settings.

Key Growth Drivers

Rising Prevalence of Chronic Pain Conditions

Chronic pain cases continue to rise worldwide, and this trend drives broad adoption of electrical stimulators. Many patients now seek drug-free options due to concerns about long-term medication use and dependency risk. Clinics and home users prefer electrical stimulation because it offers steady relief and supports daily function with low risk. Healthcare systems also promote these devices to reduce reliance on opioids and cut treatment costs. Wider awareness through physiotherapy programs has increased early use among patients recovering from injuries or surgery. Growing aging populations amplify demand because older adults face higher rates of joint pain, neuropathies, and mobility problems that respond well to nerve and muscle stimulation.

- For instance, globally about 1.5 billion people are estimated to suffer from chronic pain.

Expanding Use in Rehabilitation and Neurological Recovery

Rehabilitation centers rely on stimulators to restore movement, rebuild muscle strength, and speed recovery from major injuries. These systems support structured therapy for stroke, spinal cord injuries, and post-surgical weakness by improving muscle activation and nerve response. Early integration of functional electrical stimulation in rehab programs has improved outcomes and encouraged broader adoption across hospitals and specialty clinics. Sports medicine teams also use stimulators to help athletes recover faster and prevent injury recurrence. Technology improvements have created programmable modes that fit diverse therapy needs. As neurological cases increase, demand grows for tools that help patients regain independence and reduce long hospital stays.

- For instance, a systematic review of functional electrical stimulation (FES) in upper‑limb stroke rehabilitation showed that FES‑based therapy improved functional scores in one analysis, patients using EMG‑controlled FES improved by a mean difference of 14.14 points on the Fugl‑Meyer Assessment compared to baseline.

Growth in Home-Based and Portable Therapy Solutions

Portable stimulators have reshaped patient care because many individuals now prefer treatment at home rather than repeated clinic visits. Lighter designs, wireless control, and multi-mode therapy settings have made these systems easy to use without supervision. Home users can manage long-term pain, muscle weakness, or nerve issues through regular sessions that fit daily schedules. Digital health tools also support remote tracking, enabling therapists to adjust plans without in-person meetings. Aging populations and rising healthcare costs fuel the shift toward home therapy solutions. This movement expands the market as more people seek personalized, flexible, and cost-effective care options delivered through compact devices.

Key Trends & Opportunities:

Adoption of Smart and Connected Stimulation Devices

The market is seeing a move toward digital and connected platforms that improve therapy personalization. Many new devices now include app-based controls, cloud tracking, and AI-supported session adjustments. These upgrades help users monitor progress and allow clinicians to oversee sessions remotely. Smart devices also offer automated intensity regulation and customizable treatment programs. This feature set appeals to younger patients and tech-driven home users. As digital health ecosystems grow, connected stimulators gain relevance in pain care, sports rehab, and neurological recovery, creating strong expansion opportunities for manufacturers focused on advanced interfaces.

- For instance, a 2025 publication described a wearable, closed‑loop sEMG‑driven TENS platform that integrates real‑time electromyography (sEMG) to adapt stimulation based on the user’s muscle activity. The system achieved closed‑loop latency under 10 ms, delivered stable biphasic stimulation (±22 mA), and provided multi‑channel output — demonstrating that smart stimulators can deliver clinically relevant, responsive therapy outside hospitals.

Expansion of Applications Beyond Traditional Therapy

Electrical stimulators are now entering broader wellness, sports optimization, and preventive care settings. Athletes use stimulators to improve circulation, warm muscles before training, and reduce soreness after workouts. Wellness centers adopt microcurrent and neuromuscular stimulation to support skin tightening and tissue repair. Early research also explores new fields such as cognitive stimulation and metabolic modulation. These expanding uses drive fresh revenue streams as brands target fitness enthusiasts and lifestyle consumers. Growing acceptance of bio-stimulation tools in non-clinical environments strengthens long-term growth prospects and widens the customer base beyond medical facilities.

- For instance, many sports and fitness centers especially gyms looking to offer recovery services now incorporate EMS (Electrical Muscle Stimulation) as part of regular training or post-workout recovery routines, aiming to reduce muscle fatigue, accelerate recovery, and support conditioning.

Key Challenges:

Limited Clinical Evidence for Certain Modalities

Some stimulation types still lack strong, long-term clinical validation, which slows adoption in hospitals and insurance-funded programs. Microcurrent and advanced interferential systems face skepticism because trial results remain mixed across conditions. Clinicians often rely on proven approaches when treating chronic pain or neurological cases, making it harder for newer technologies to gain trust. Regulatory bodies also require solid evidence for therapeutic claims, creating longer approval timelines. This gap affects reimbursement and restricts growth in formal care settings. Manufacturers must invest more in robust clinical studies to improve acceptance among healthcare professionals.

High Cost Barriers in Advanced Rehabilitation Settings

Advanced stimulation platforms designed for neurological rehab often involve high prices, which can limit use in smaller clinics and low-resource hospitals. Many systems need trained staff, multiple accessories, and integration with other rehab tools, adding to the total cost of ownership. Insurance coverage varies widely, and some plans do not support newer modalities or home-based devices. These economic barriers slow widespread rollout, especially in developing regions. Clinics may opt for basic stimulators instead of advanced programmable systems. Addressing pricing and reimbursement gaps is essential for broader access and faster market expansion.

Regional Analysis

North America

North America held the leading position in the Stimulator Market in 2024 with about 37% share. Strong adoption came from high chronic pain incidence, advanced physiotherapy networks, and wide insurance coverage for nerve and muscle stimulation therapies. Hospitals and rehab centers used functional electrical stimulation for post-stroke recovery and sports injuries, while home users preferred portable units for daily pain relief. The U.S. dominated regional demand due to strong device availability and frequent product upgrades. Canada supported growth through expanding digital health programs and greater acceptance of non-invasive stimulation methods.

Europe

Europe accounted for nearly 29% share of the Stimulator Market in 2024. Growth was supported by structured rehabilitation pathways, strong geriatric populations, and wider acceptance of drug-free pain therapies. Germany, France, and the U.K. drove adoption through advanced clinical infrastructure and strong physiotherapy participation. The region also promoted electrical stimulation for musculoskeletal disorders and neurological rehabilitation across public hospitals. Portable and handheld devices gained traction as home-care programs expanded. Rising investment in sports recovery and wellness technologies further strengthened market development across key EU countries.

Asia-Pacific

Asia-Pacific captured about 24% share in 2024 and remained the fastest-growing regional market. Demand rose due to expanding patient populations with chronic pain, rapid healthcare modernization, and increasing physiotherapy access in China, India, and Japan. Consumers favored portable and affordable devices for home therapy, boosting adoption across urban and semi-urban areas. Hospitals used neuromuscular and functional electrical stimulation for stroke and injury rehabilitation as neurological cases increased. Government focus on aging-related health issues further pushed demand. Growing sports sectors and wellness uptake also contributed to broader market penetration.

Latin America

Latin America held roughly 6% share of the Stimulator Market in 2024. Growth came from expanding physiotherapy clinics, rising musculoskeletal cases, and higher awareness of non-invasive pain control. Brazil led the region due to stronger urban healthcare access and wider device availability. Mexico and Argentina adopted stimulators for orthopedic recovery and chronic pain linked with lifestyle disorders. Home-care therapy gained attention as portable devices became accessible. Limited reimbursement coverage slowed deeper penetration, yet rising investment in private rehabilitation centers supported steady demand growth.

Middle East & Africa

The Middle East & Africa region accounted for about 4% share in 2024. Uptake increased in Gulf countries as hospitals integrated advanced electrical stimulation for neurological and orthopedic recovery. Saudi Arabia and the UAE led demand due to expanding rehabilitation networks and higher healthcare spending. Africa showed gradual adoption driven by growing chronic pain cases and improving physiotherapy services in urban centers. Cost sensitivity and limited device availability restricted wider use, but rising private clinic investments and training programs supported modest but consistent market expansion.

Market Segmentations:

By Product

- Neuromuscular Electrical Stimulation

- Functional Electrical Stimulation

- Transcutaneous Electrical Nerve Stimulation

- Interferential

- Burst Mode Alternating Current

- Micro Current Electrical Neuromuscular Stimulator

By Modality

- Handheld

- Portable

- Tabletop

By Application

- Pain Management

- Neurological Disorder

- Musculoskeletal Disorder

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Stimulator Market features strong competition driven by product innovation, wider clinical use, and expanding home-care demand. Leading companies such as OG Wellness Technologies, Zimmer MedizinSysteme, Zynex, RS Medical, Beurer, EMS Physio, OMRON, NeuroMetrix, DJO Global, and BioMedical Life Systems focus on advancing TENS, neuromuscular, and functional stimulation technologies. These companies invest in compact designs, multi-mode therapy systems, and connected platforms that support remote monitoring. Manufacturers also expand distribution through physiotherapy centers, sports clinics, and digital retail channels to reach broader user groups. Strategic partnerships with rehabilitation networks, continuous R&D in pain and neurological therapy, and regulatory approvals strengthen market presence. Growing demand for portable and home-based solutions pushes companies to prioritize ease of use, safety performance, and smart features that enhance treatment outcomes.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, RS Medical, Inc. RS Medical has actively promoted its prescription-grade RS-4i® Plus sequential stimulator through clinical communications and site content in early 2025 (blog posts and clinical summaries in Jan–Mar 2025). In parallel, payer/medical policy documents referencing RS-4i therapy appeared in 2025 (e.g., health-plan/medical policy references).

- In December 2024, Zimmer MedizinSysteme GmbH (Zimmer Aesthetics / Z Stim) Zimmer rolled out the Z-Stim muscle-stimulation platform in its aesthetic/physical-therapy portfolio (covered in press/industry media in Dec 2024) and published product brochures and site content describing multi-channel muscle-stimulation protocols for body-contouring and rehab. (product brochure and launch coverage).

- In September 2024, Zynex, Inc. Zynex obtained FDA clearance and announced a new prescription-only TENS product (TensWave) as part of its pain-management device lineup (press release — Sept 3, 2024); Zynex continued company updates through 2025 via regular financial/press releases.)

Report Coverage

The research report offers an in-depth analysis based on Product, Modality, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for non-invasive stimulation therapies will rise as chronic pain cases increase.

- Portable and home-use stimulators will gain stronger adoption across all age groups.

- Smart connected devices with app control will shape the next wave of product innovation.

- Rehabilitation centers will expand use of neuromuscular and functional electrical stimulation.

- Sports medicine will adopt advanced systems to enhance recovery and prevent injuries.

- AI-based personalization will improve treatment accuracy and therapy outcomes.

- Manufacturers will focus on lightweight designs and multi-mode therapy platforms.

- Emerging markets will see faster growth due to rising physiotherapy access.

- Regulatory approvals will accelerate as clinical evidence improves for newer modalities.

- Competition will intensify as more companies enter wellness, fitness, and home-care therapy segments.