Market Overview

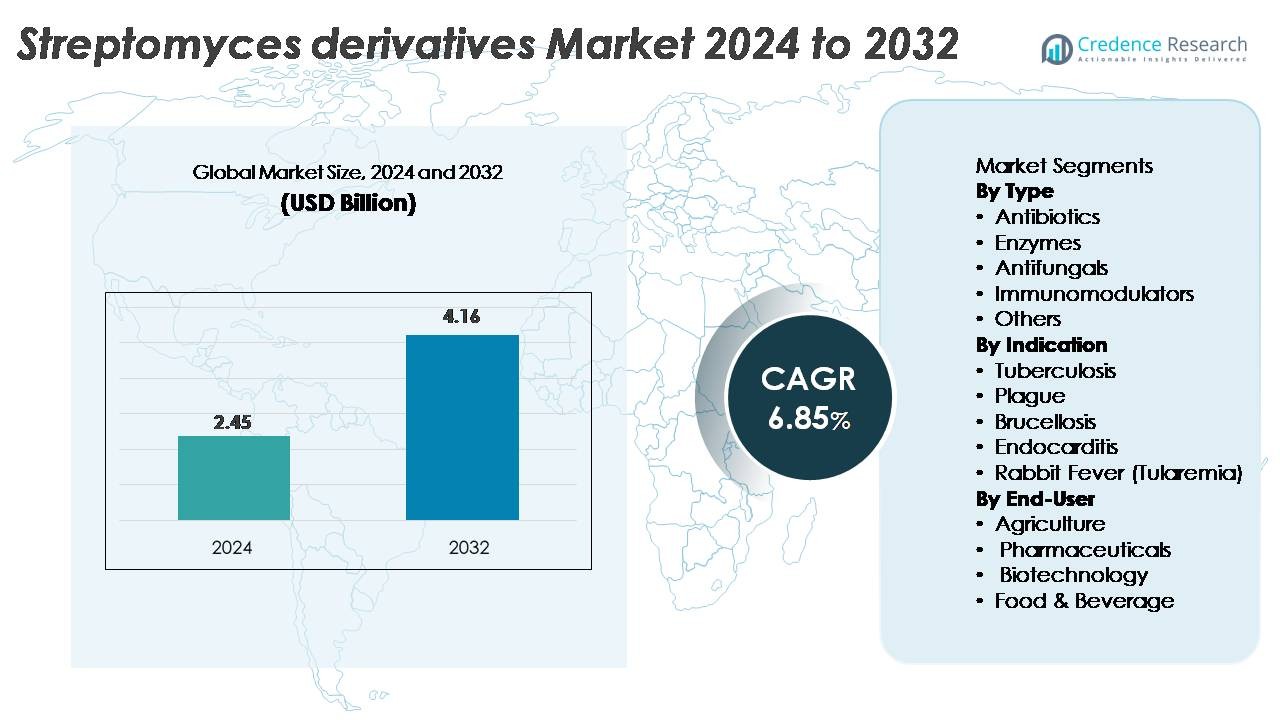

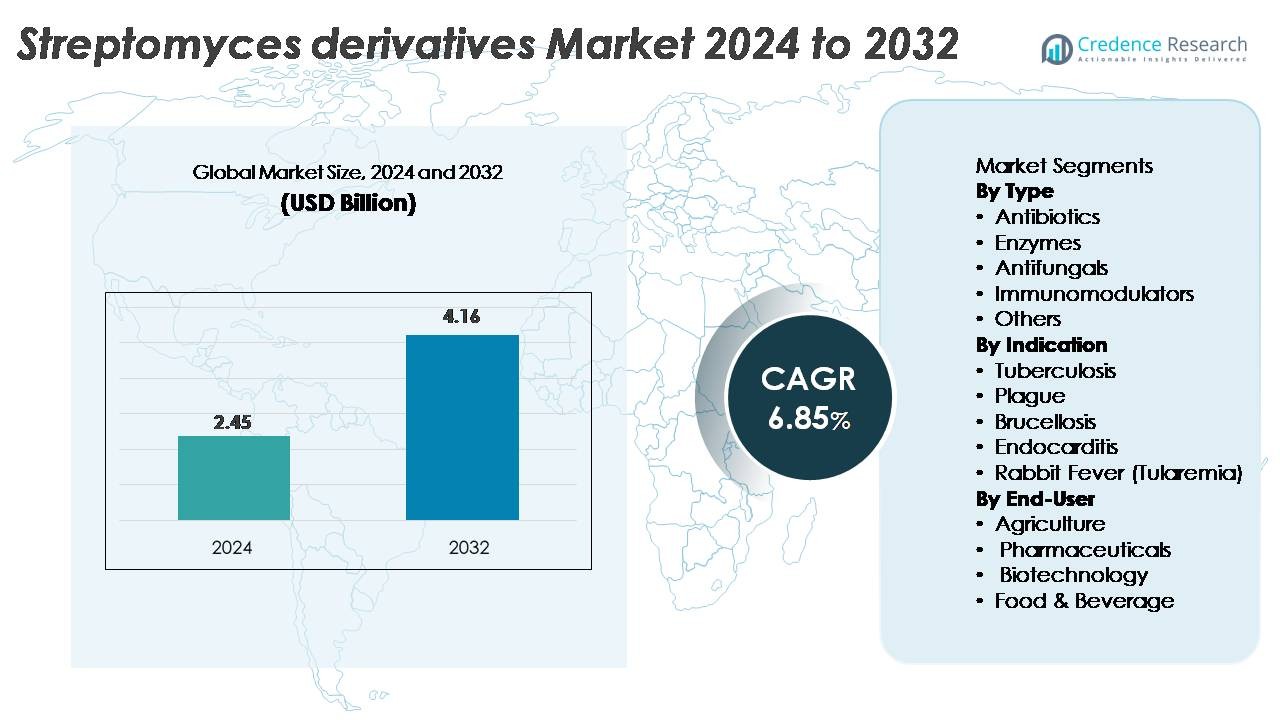

The global Streptomyces derivatives market, valued at USD 2.45 billion in 2024, is projected to reach USD 4.16 billion by 2032, reflecting a CAGR of 6.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Streptomyces Derivatives Market Size 2024 |

USD 2.45 Billion |

| Streptomyces Derivatives Market, CAGR |

6.85% |

| Streptomyces Derivatives Market Size 2032 |

USD 4.16 Billion |

The Streptomyces derivatives market is shaped by a mix of global pharmaceutical leaders and advanced biotechnology innovators, including Pfizer, Merck & Co., Novartis, Sanofi, Eli Lilly, Bayer AG, GlaxoSmithKline (GSK), Syngenta, Nextbiotics, and research-driven institutions such as MIT. These organizations actively develop antibiotics, immunomodulators, and bioactive metabolites derived from Streptomyces strains, supported by strong fermentation capabilities and synthetic biology platforms. North America leads the market with an estimated 37% share, driven by advanced biopharmaceutical R&D and extensive antibiotic use. Europe follows with about 29%, supported by strong AMR programs and industrial biotechnology adoption, while Asia-Pacific holds roughly 26%, fueled by high infection prevalence and expanding fermentation-based manufacturing capacity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Streptomyces derivatives market was valued at USD 2.45 billion in 2024 and is projected to reach USD 4.16 billion by 2032, expanding at a CAGR of 6.85%, supported by rising demand for antibiotics, enzymes, antifungals, and immunomodulators.

- Strong market drivers include increasing reliance on Streptomyces-derived antibiotics to manage resistant infections, expanding use of enzymes in biotechnology, and growing agricultural adoption of Streptomyces-based bio-control agents.

- Key trends center on synthetic biology, strain engineering, and activation of silent gene clusters to develop next-generation therapeutics, alongside rising opportunities in oncology, immunotherapy, and sustainable bioprocessing.

- Competitive activity intensifies as Pfizer, Merck, Novartis, Sanofi, GSK, Bayer, Syngenta, and emerging biotech firms advance fermentation platforms and diversify Streptomyces-derived product pipelines, though high production complexity and regulatory barriers restrain market expansion.

- Regionally, North America leads with ~37%, followed by Europe at ~29% and Asia-Pacific at ~26%, while antibiotics remain the dominant segment with the largest overall share.

Market Segmentation Analysis:

By Type

Antibiotics dominate the Streptomyces derivatives market with the largest share, driven by the continued reliance on Streptomyces-derived classes such as tetracyclines, macrolides, and aminoglycosides across global antimicrobial therapy. Their extensive clinical use in respiratory, zoonotic, and hospital-acquired infections ensures stable demand, while rising resistance trends reinforce ongoing antibiotic discovery from Streptomyces strains. Enzymes and antifungals follow, supported by expanding biotechnology workflows and crop-protection applications. Immunomodulators represent a niche but growing segment as research advances in anti-inflammatory compounds and immune-regulating metabolites, whereas the “Others” category gains traction from emerging bioactive molecules under preclinical evaluation.

- For instance, Merck & Co. historically scaled industrial production of streptomycin (from Streptomyces griseus) using fermentation systems exceeding 50,000 L capacity, with the drug exhibiting an MIC of 0.5–1 µg/mL against Mycobacterium tuberculosis.

By Indication

Tuberculosis represents the dominant indication, holding the highest market share due to the essential role of Streptomyces-derived antibiotics—particularly streptomycin—in first-line and adjunct TB treatment frameworks. High disease prevalence in Asia, Africa, and Eastern Europe continues to sustain product uptake. Indications such as endocarditis, brucellosis, and rabbit fever follow, supported by the effectiveness of aminoglycosides and related derivatives in severe bacterial infections. Plague treatments form a smaller segment but remain strategically important for biodefense stockpiles. The broad therapeutic relevance of Streptomyces compounds across rare, zoonotic, and life-threatening infections reinforces multi-indication demand.

- For instance, Eli Lilly, the original industrial producer of streptomycin, manufactured the drug at commercial scale beginning in 1946, with purified formulations demonstrating bactericidal activity at 1–2 µg/mL against Mycobacterium tuberculosis in standard susceptibility assays.

By End-User

Pharmaceuticals account for the dominant share of end-user demand, driven by their extensive use of Streptomyces-derived antibiotics, antifungals, and immunomodulators in commercial therapeutics and R&D pipelines. The biotechnology sector follows closely as Streptomyces enzymes and metabolites support fermentation processes, drug discovery, and bio-manufacturing applications. Agriculture contributes steady demand for antifungal and bio-control agents used in crop protection. Food and beverage applications represent a smaller but expanding segment, especially for Streptomyces-derived enzymes utilized in food processing and fermentation optimization. Rising innovation across multiple industries reinforces a balanced end-user ecosystem.

Key Growth Drivers

Expanding Use of Streptomyces-Derived Antibiotics in Global Anti-Infective Therapy

The growing medical need for effective antimicrobial therapies continues to drive demand for Streptomyces derivatives, especially for the treatment of multidrug-resistant infections. Streptomyces-derived antibiotics—including aminoglycosides, macrolides, tetracyclines, and glycopeptides—remain essential in managing hospital-acquired infections, zoonotic diseases, and tuberculosis. Their unique metabolic pathways enable the production of structurally diverse molecules with potent antibacterial, antifungal, and antiparasitic activity, reinforcing their relevance in modern therapeutics. Rising antimicrobial resistance is accelerating innovation in strain engineering, combinational therapies, and semi-synthetic derivatives, increasing both research funding and commercial investments. The continued reliance on Streptomyces metabolites in essential medicine lists ensures stable global uptake across emerging and mature markets.

- For instance, Pfizer’s azithromycin—derived from the erythromycin scaffold originally produced by Streptomyces erythreus—demonstrates MIC values as low as 0.12–0.5 µg/mL against Streptococcus pneumoniae in clinical susceptibility tests.

Increasing Adoption of Streptomyces Enzymes and Bioactive Metabolites in Biotechnology

Biotechnology and industrial bioprocessing sectors are expanding their use of Streptomyces-derived enzymes—including amylases, proteases, cellulases, and chitinases—for fermentation, enzyme engineering, and high-value biochemical synthesis. These enzymes offer high substrate specificity, thermal stability, and robust performance in industrial reactors, making them integral to pharmaceuticals, agriculture, and biopolymers. Advances in microbial genomics, CRISPR-based pathway optimization, and precision fermentation are enabling enhanced metabolite yields and improved enzyme stability. As industries shift toward bio-based production systems, Streptomyces strains gain prominence for their reliability and scalability. Their role in producing specialty metabolites, biocatalysts, and secondary compounds positions them as a strategic asset for sustainable biomanufacturing.

- For instance, Amano Enzyme commercializes Streptomyces griseus protease A, which shows optimal activity at pH 7.5 and maintains catalytic function up to 60°C, enabling efficient peptide modification in pharmaceutical processing.

Rising Agricultural Demand for Streptomyces-Derived Antifungals and Biocontrol Agents

Agriculture is increasingly adopting Streptomyces derivatives as effective alternatives to chemical fungicides and pesticides. Streptomyces-based bio-control agents—such as Streptomyces lydicus and Streptomyces griseoviridis—demonstrate strong antifungal activity against soil-borne and foliar pathogens, including Fusarium, Rhizoctonia, and Botrytis species. These biological solutions enhance soil health, reduce chemical input, and support integrated pest management systems. Growing regulatory pressure against synthetic agrochemicals is accelerating the shift toward microbial-based crop protection products. Farmers value Streptomyces agents for their root-colonizing ability, environmental safety, and compatibility with organic farming. Increasing investments in sustainable agriculture further strengthen global demand for Streptomyces-derived biofungicides and plant growth-promoting formulations.

Key Trends & Opportunities

Advancements in Metabolic Engineering and Synthetic Biology for Novel Molecule Discovery

Rapid progress in synthetic biology is unlocking new opportunities to engineer Streptomyces strains for novel antibiotics, antifungals, and immunomodulatory molecules. Genome-scale engineering, cluster refactoring, and heterologous expression platforms are enabling the activation of previously silent biosynthetic gene clusters, significantly expanding the discovery pipeline. Techniques such as CRISPR-Cas editing, multi-omics integration, and machine-learning-driven pathway prediction are increasing metabolite yields and enabling the design of tailored derivatives with improved efficacy and reduced toxicity. These innovations create a substantial opportunity for pharmaceutical companies seeking next-generation anti-infective compounds, especially as resistance rates rise worldwide. The expanding toolbox for microbial engineering ensures long-term growth in high-value molecule development.

- For instance, researchers at MIT demonstrated that multiplex CRISPR interference (CRISPRi) in Streptomyces venezuelae increased jadomycin B titers by 4-fold in a controlled 2-L bioreactor, while multi-gene repression improved precursor flux by 180%, directly validating scalable synthetic-biology tuning of Streptomyces pathways.

Expanding Applications in Immunotherapy, Oncology, and Rare Diseases

Streptomyces metabolites are gaining attention for their therapeutic potential beyond infectious diseases, particularly in immunomodulation, oncology, and rare disease treatments. Compounds such as rapamycin, tacrolimus, and mithramycin highlight the untapped potential of Streptomyces for developing targeted immunotherapies and anticancer agents. Increasing investment in specialty biologics and orphan disease therapeutics is driving research into novel Streptomyces derivatives that modulate immune pathways, inhibit tumor progression, or regulate cell signaling. As precision medicine expands, pharmaceutical developers are exploring Streptomyces metabolites for niche therapeutic areas where unmet clinical demand remains high. This trend opens new commercial avenues and diversifies the application base of Streptomyces-derived compounds.

- For instance, Rapamycin (sirolimus), a macrolide compound originally discovered by scientists at Ayerst Research Laboratories (later acquired by Wyeth and then Pfizer) and produced by the bacterium Streptomyces hygroscopicus, inhibits the mTOR (mechanistic target of rapamycin) pathway.

Growing Opportunity in Sustainable Bioprocessing and Green Manufacturing

Industries are increasingly adopting Streptomyces-based systems to support environmentally sustainable production methods. Their ability to produce high-value enzymes, organic acids, and bioactive metabolites with low energy input aligns with global ESG-driven manufacturing initiatives. Companies deploying green chemistry frameworks value Streptomyces for their compatibility with renewable feedstocks, reduced waste profiles, and high bioconversion efficiency. This creates opportunities for their integration into bioplastic synthesis, natural pigment production, and bio-based surfactants. As governments promote carbon-neutral industrial processes, Streptomyces fermentation platforms are emerging as key enablers of next-generation sustainable manufacturing, positioning the segment for strong long-term expansion.

Key Challenges

Rising Antimicrobial Resistance and Declining Efficacy of Legacy Streptomyces Molecules

The rapid emergence of antimicrobial resistance poses a significant challenge to the long-term efficacy of Streptomyces-derived antibiotics. Many first- and second-generation compounds face reduced clinical effectiveness as bacteria evolve resistance mechanisms, including drug-modifying enzymes, efflux pumps, and altered binding sites. This trend increases the cost of drug development and forces companies to invest in newer analogues, combination therapies, or novel chemical scaffolds. Regulatory agencies are tightening guidelines for antibiotic stewardship, reducing the indiscriminate use of these compounds and limiting commercial growth in certain markets. The escalating threat of resistance requires continuous R&D investment, raising operational complexity for manufacturers.

High Production Complexity and Regulatory Constraints in Pharmaceutical-Grade Fermentation

Producing pharmaceutical-grade Streptomyces derivatives requires sophisticated fermentation control, strict purification processes, and compliance with stringent quality regulations. Streptomyces strains can exhibit variable productivity, making large-scale manufacturing technically challenging and costly. Batch-to-batch consistency, impurity management, and downstream processing efficiency remain major hurdles, particularly for complex metabolites and enzymes. Regulatory requirements for safety, efficacy, and contamination control further increase manufacturing timelines and expenses. These challenges slow market entry and limit the participation of smaller biotechnology firms. The need for advanced production infrastructure and GMP-certified facilities continues to act as a barrier to scaling commercial Streptomyces derivative operations.

Regional Analysis

North America

North America holds the largest share of the Streptomyces derivatives market, accounting for an estimated 35–38%, driven by advanced pharmaceutical R&D, strong antibiotic usage patterns, and leadership in biotechnology innovation. The region benefits from high investment in antimicrobial resistance (AMR) research, synthetic biology platforms, and fermentation-based drug development. U.S. biopharmaceutical companies actively explore Streptomyces-derived immunosuppressants, anticancer agents, and enzymes, while academic research pipelines remain robust. Increasing use of bio-control agents in agriculture also contributes to growth. Regulatory support for innovative anti-infective solutions reinforces North America’s dominant regional position.

Europe

Europe contributes approximately 28–30% of the global market, supported by strong pharmaceutical manufacturing capacity, extensive AMR surveillance programs, and increasing adoption of microbial enzymes across industrial biotechnology. Countries such as Germany, France, Switzerland, and the U.K. maintain leading roles in antibiotic development and bioprocess engineering. The region’s stringent agricultural regulations are accelerating the transition from chemical pesticides to Streptomyces-based biofungicides. European research institutions remain active in discovering new secondary metabolites through genome mining and strain engineering. Growing investments in immunomodulators and rare disease therapeutics further strengthen the region’s market expansion.

Asia-Pacific

Asia-Pacific accounts for roughly 25–27% of global market value, propelled by high incidence rates of tuberculosis and other bacterial infections that rely on Streptomyces-derived antibiotics. China, India, Japan, and South Korea are expanding biopharmaceutical production capacity and strengthening fermentation-based manufacturing infrastructure. The region’s rapidly growing agriculture sector increasingly adopts Streptomyces bio-control agents to improve crop resilience and reduce chemical pesticide dependency. Government funding for biotechnology, coupled with the expansion of contract manufacturing organizations (CMOs), fuels additional demand. APAC’s improving healthcare access and strong generic antibiotic production base reinforce steady regional growth.

Latin America

Latin America holds an estimated 5–7% share, supported by growing agricultural adoption of Streptomyces-based antifungal agents and steady demand for antibiotics in public health systems. Countries such as Brazil, Mexico, and Argentina are increasing investments in microbial crop-protection technologies due to rising fungal disease pressures and regulatory incentives promoting sustainable farming. Pharmaceutical usage remains moderate but expanding as antimicrobial stewardship programs improve healthcare outcomes. Limited local fermentation capacity restricts large-scale production, but regional imports of Streptomyces derivatives continue to rise. Biotechnology start-ups in Brazil and Chile are gradually increasing research activity in microbial metabolites.

Middle East & Africa

The Middle East & Africa region represents approximately 3–4% of the global market, driven primarily by antibiotic use in infectious disease management and increasing agricultural demand for biological crop-protection solutions. Countries such as South Africa, Saudi Arabia, and the UAE are gradually strengthening biotechnology research capabilities and investing in pathogen surveillance programs. While pharmaceutical manufacturing capacity remains limited, partnerships with global producers support market penetration. Growth is influenced by rising TB incidence in parts of Africa and growing interest in microbial soil enhancers. Infrastructure gaps and regulatory variability continue to constrain broader market acceleration.

Market Segmentations:

By Type

- Antibiotics

- Enzymes

- Antifungals

- Immunomodulators

- Others

By Indication

- Tuberculosis

- Plague

- Brucellosis

- Endocarditis

- Rabbit Fever (Tularemia)

By End-User

- Agriculture

- Pharmaceuticals

- Biotechnology

- Food & Beverage

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Streptomyces derivatives market is shaped by a mix of multinational pharmaceutical companies, biotechnology firms, agricultural bio-solutions providers, and specialized fermentation-based manufacturers. Leading pharmaceutical players focus on producing high-value antibiotics, antifungals, and immunomodulatory molecules derived from Streptomyces strains, supported by advanced fermentation infrastructure and strong R&D pipelines. Biotechnology companies increasingly invest in synthetic biology and metabolic engineering to activate silent gene clusters, enhance metabolite yields, and discover next-generation therapeutic compounds. Agricultural technology firms strengthen their portfolios with Streptomyces-based biofungicides and plant growth-promoting products as demand for sustainable crop protection rises. Collaborations between universities, research institutes, and industry partners accelerate innovation in enzyme optimization, new secondary metabolites, and strain refinement. Meanwhile, emerging players in Asia-Pacific and Latin America expand their manufacturing capabilities through contract fermentation and cost-efficient production models, intensifying global competition. The market remains dynamic, driven by innovation, expanded applications, and rising demand across healthcare, agriculture, and industrial biotechnology.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nextbiotics

- Bayer AG

- Sanofi

- GlaxoSmithKline (GSK)

- Merck & Co.

- Pfizer

- Syngenta

- MIT (Massachusetts Institute of Technology)

- Novartis

- Eli Lilly

Recent Developments

- In November 2025, GlaxoSmithKline (GSK) announced a major research collaboration under the Fleming Initiative (with Imperial College / Imperial College Healthcare) to accelerate discovery of new antibiotics — including efforts to combat Gram-negative bacteria and fungal infections.

- In August 2025, researchers at MIT used generative AI to design novel antibiotics active against drug-resistant pathogens including MRSA and Neisseria gonorrhoeae.

- In June 2024, Eli Lilly announced a collaboration with OpenAI to leverage generative-AI for discovery of novel antimicrobial drugs targeting drug-resistant bacteria. This collaboration may enable identification of candidate molecules that could—potentially—include those derived or inspired by natural producers such as Streptomyces, although the public announcement does not explicitly state “Streptomyces-derived.

Report Coverage

The research report offers an in-depth analysis based on Type, Indication, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see expanding therapeutic applications as Streptomyces-derived molecules gain prominence in treating resistant infections and rare diseases.

- Advances in synthetic biology and gene cluster activation will accelerate discovery of novel antibiotics, antifungals, and immunomodulators.

- Pharmaceutical companies will increase investment in strain engineering to enhance metabolite yields and reduce production complexity.

- Biotechnology firms will adopt Streptomyces enzymes more widely for industrial bioprocessing and precision fermentation.

- Agricultural demand will grow as Streptomyces-based biofungicides and soil-enhancing microbes replace synthetic chemicals.

- Next-generation immunomodulatory compounds will open new opportunities in oncology and autoimmune disorder therapies.

- Contract manufacturing organizations will expand fermentation capacity to support global production needs.

- AI-driven metabolite prediction and pathway optimization will shorten development cycles for new derivatives.

- Regulatory support for sustainable, biologically derived solutions will boost adoption across multiple industries.

- Asia-Pacific will gain strategic importance as regional manufacturers scale up cost-efficient Streptomyces-based production.