Market Overview

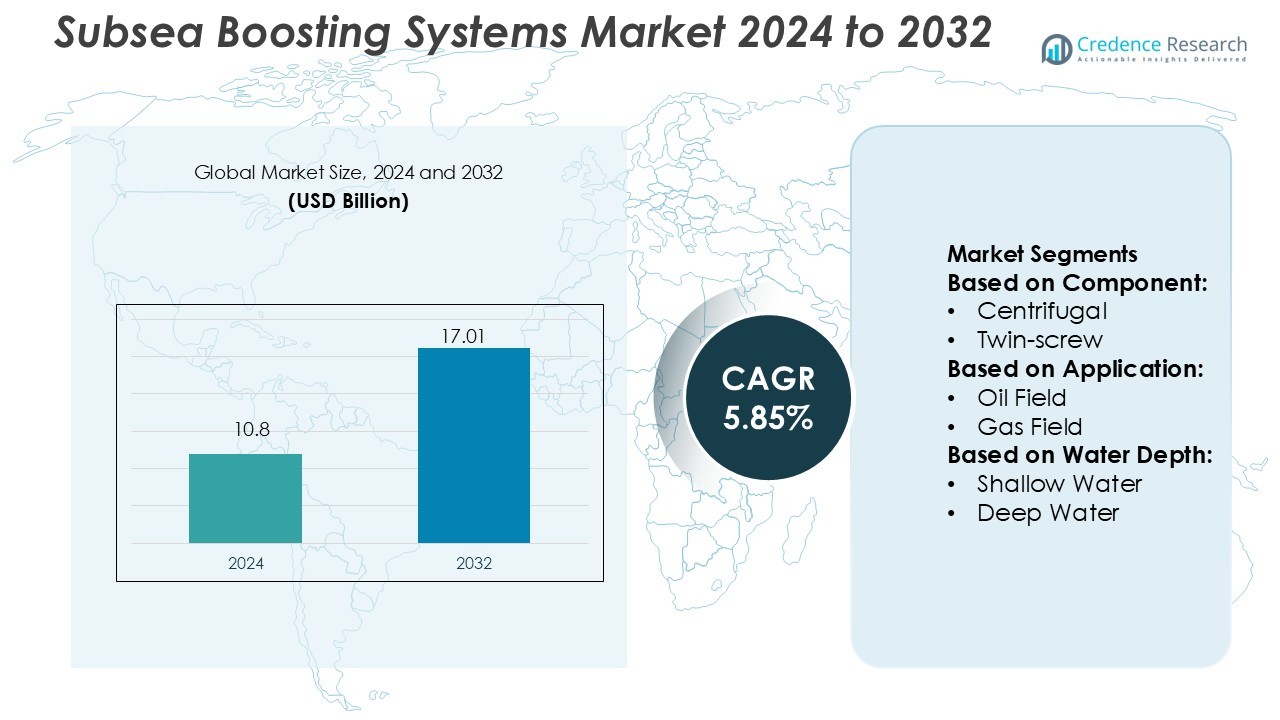

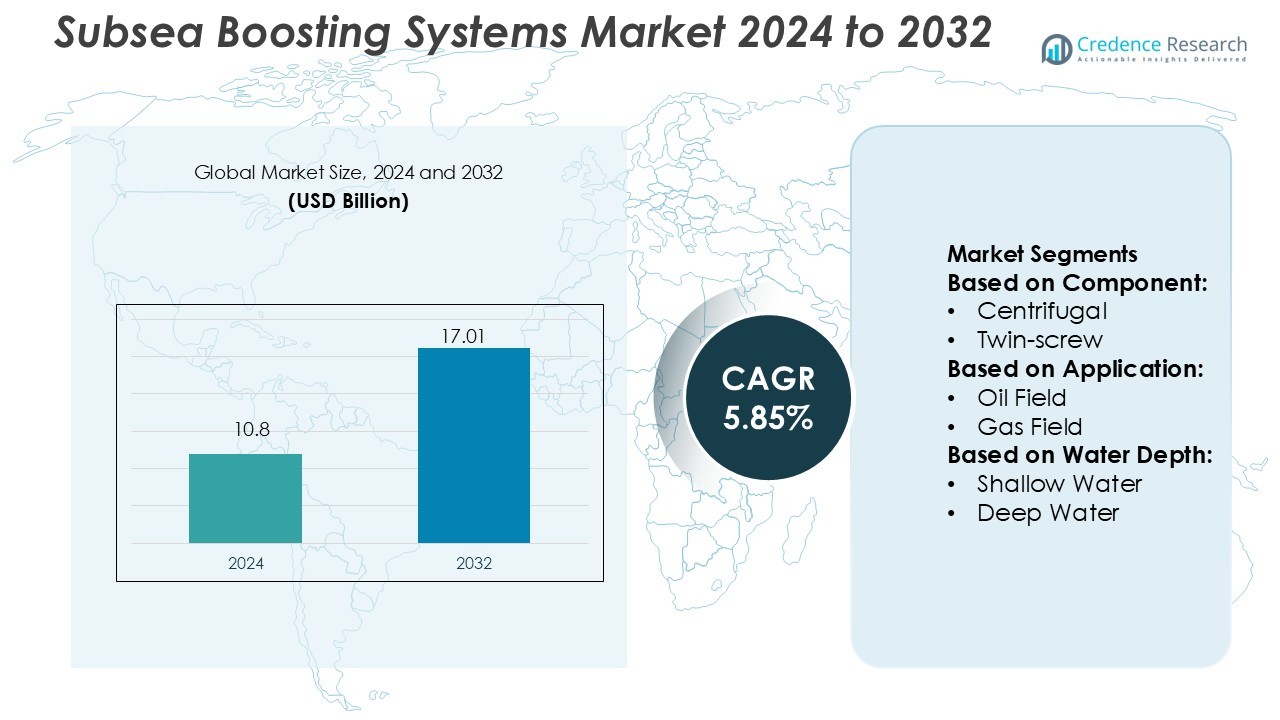

Subsea Boosting Systems Market size was valued USD 10.8 billion in 2024 and is anticipated to reach USD 17.01 billion by 2032, at a CAGR of 5.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Subsea Boosting Systems Market Size 2024 |

USD 10.8 Billion |

| Subsea Boosting Systems Market, CAGR |

5.85% |

| Subsea Boosting Systems Market Size 2032 |

USD 17.01 Billion |

The Subsea Boosting Systems Market include SLB Ltd. (via its OneSubsea brand), Technip FMC plc and Subsea 7 S.A., which lead with broad portfolios in deepwater boosting and compression solutions. These firms significantly influence market direction through engineering, procurement, construction and installation (EPCI) capabilities and integrated subsea systems. Regionally, Latin America holds the leading position with around 31% of the global market share in 2024, bolstered by large deepwater and ultra-deepwater developments in Brazil and supportive upstream policies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Subsea Boosting Systems Market was valued at USD 10.8 billion in 2024 and is projected to reach USD 17.01 billion by 2032, registering a CAGR of 5.85%.

- Growing demand for enhanced oil recovery and efficient deepwater production systems drives market expansion across major offshore basins.

- Increasing integration of digital monitoring, predictive maintenance, and subsea compression technologies marks a key industry trend.

- Intense competition among leading players such as SLB Ltd., Technip FMC plc, and Subsea 7 S.A. strengthens innovation and cost optimization.

- Latin America leads the market with 31% share, supported by large-scale developments in Brazil, while deepwater boosting systems dominate the segment due to higher reliability and production efficiency.

Market Segmentation Analysis:

By Component

The pump segment dominates the Subsea Boosting Systems Market with over 45% share. Within this segment, helico-axial pumps lead due to their efficiency in handling multiphase flows and maintaining stable pressure in long tieback systems. These pumps are widely used in deepwater projects where flow assurance and enhanced recovery are critical. Advancements in high-pressure pump materials and seal technology by key players have further boosted their adoption. Variable speed drives and control systems follow, as operators integrate digital monitoring for optimized subsea production performance.

- For instance, Baker Hughes Company’s CENsea seabed boosting system supports flow rates up to 150,000 barrels per day and offers boost pressures greater than 5,000 psi (≈ 345 bar) in high‐gas‐fraction conditions.

By Application

The oil field segment holds the major market share exceeding 60% of global revenue. This dominance stems from the rising deployment of subsea boosting solutions in mature offshore oil reservoirs to sustain declining production rates. Operators are increasingly retrofitting existing fields with advanced pumping units to maximize extraction and reduce downtime. Gas field applications are expanding gradually as new projects in deepwater basins require efficient compression systems for high-gas-volume environments, particularly in regions like the Gulf of Mexico and the North Sea.

- For instance, Rockwell Automation’s PowerFlex® 7000 medium-voltage drives were deployed at the Daqing Petrochemical Company refinery (China) with a 6 kV rating, enabling the installed motors to operate at full load of 10,000 kW while the integrated PlantPAx® Distributed Control System handled process and safety logic in one platform.

By Water Depth

Deepwater projects account for the largest share of the market, representing over 50% of total installations. These environments demand robust and reliable boosting systems capable of operating under extreme pressure and temperature conditions. The growing development of deepwater reserves in Brazil, West Africa, and the U.S. drives the demand for advanced subsea pumps and control units. Ultra-deepwater projects are expected to gain momentum due to upcoming exploration activities and improved subsea power distribution technologies that enhance system efficiency and reliability.

Key Growth Drivers

- Rising Deepwater Exploration Activities

The expansion of deepwater and ultra-deepwater exploration projects is a primary growth driver for the Subsea Boosting Systems Market. Oil companies are investing heavily in remote offshore fields to offset declining onshore production. Subsea boosting systems enable efficient hydrocarbon recovery under high-pressure environments and extended tiebacks. Increasing exploration in regions such as Brazil, the Gulf of Mexico, and West Africa strengthens market demand. These systems enhance flow assurance and production rates, offering higher returns on capital-intensive offshore developments.

- For instance, SAP GmbH’s “Digital Twin for Drilling” initiative enabled a major oil-and-gas operator to model 1,200 well operations across deep-water sites and integrate 430 million data points into its real-time upstream systems, reducing unplanned downtime by 22 %.

- Enhanced Oil Recovery (EOR) and Production Efficiency

Growing demand for enhanced oil recovery solutions drives adoption of subsea boosting technology. These systems maintain consistent flow rates, reduce slugging, and optimize well pressure, which increases total recovery from mature reservoirs. Operators employ helico-axial and centrifugal pumps to extend field life and minimize intervention costs. The shift toward production efficiency, combined with advancements in high-reliability pump design and corrosion-resistant materials, supports continuous system deployment across both greenfield and brownfield projects.

- For instance, Siemens Energy’s subsea offerings include a Subsea Variable-Speed Drive (VSD) designed for water depths up to 3,000 metres and supports power ratings of 11 MW for subsea pumps and compressors.

- Integration of Digital Monitoring and Control Systems

The growing use of digital control systems and real-time monitoring technologies is transforming subsea operations. Advanced sensors, data analytics, and predictive maintenance tools improve system performance and reliability. Variable speed drives and automated control modules allow remote optimization of flow conditions. The integration of digital twins further enhances operational decision-making and risk mitigation. This technological evolution is pushing companies to adopt smart subsea boosting systems that ensure lower downtime, better asset visibility, and cost-effective offshore management.

Key Trends & Opportunities

- Expansion into Ultra-Deepwater Fields

Operators are increasingly investing in ultra-deepwater exploration as technological advancements make these fields economically viable. Subsea boosting systems are crucial for maintaining flow in wells located at depths exceeding 2,000 meters. New materials, modular designs, and advanced cooling systems are enabling efficient high-pressure operations. Growing project activity in Africa and the Asia Pacific presents opportunities for OEMs to provide tailor-made boosting solutions designed for extreme subsea environments.

- For instance, Honeywell’s digital-twin and asset-performance monitoring connected more than 100 major assets and over 3,500 secondary assets, yielding cost savings of USD 2.5 million per year and a return of ~11 ×.

- Shift Toward Electrification and Low-Carbon Operations

The industry trend toward decarbonization has encouraged the development of all-electric subsea systems. Electrically driven pumps eliminate hydraulic leaks and reduce emissions, aligning with net-zero production goals. This transition also improves energy efficiency by enabling precise flow control through power optimization. As operators pursue sustainable offshore production, vendors offering electric boosting solutions with proven energy savings and minimal environmental footprint are well-positioned to capture emerging opportunities in this evolving landscape.

- For instance, ABB’s subsea power distribution and conversion system completed a 3,000-hour shallow-water test in 2019 and is rated to deliver up to 100 MW of power over distances up to 600 km and depths up to 3,000 m.

- Strategic Alliances and Localized Manufacturing

Companies are forming partnerships to co-develop next-generation subsea technologies and expand local production capabilities. Collaborations between equipment suppliers and offshore operators support cost reduction and faster deployment. Establishing manufacturing bases near offshore hubs in Norway, Brazil, and Malaysia enables customization for regional conditions. These alliances not only drive innovation but also strengthen supply chains, ensuring faster delivery and maintenance support in remote project locations.

Key Challenges

- High Capital and Installation Costs

The initial investment required for subsea boosting systems remains a major challenge. Complex installation processes, specialized vessels, and high-cost components drive up total project expenditure. Operators in price-sensitive markets often delay deployment due to uncertain oil prices and return-on-investment concerns. Although modular designs and improved pump reliability have reduced lifecycle costs, financial risk continues to hinder widespread adoption in smaller offshore projects.

- Technical Complexity and Harsh Operating Conditions

Subsea environments expose equipment to extreme pressure, corrosion, and temperature fluctuations, posing reliability challenges. Failures in pumps, control modules, or seals can cause extended downtime and high repair costs. Maintaining equipment in deepwater locations is difficult and time-consuming, requiring advanced remote diagnostics and intervention tools. As operations extend into deeper waters, the industry faces growing demand for durable, easily maintainable systems capable of long-term performance under harsh subsea conditions.

Regional Analysis

North America

North America holds the leading share of over 35% in the Subsea Boosting Systems Market. The United States and the Gulf of Mexico dominate regional growth, supported by deepwater oil projects and redevelopment of mature fields. Major offshore producers are investing in advanced boosting technologies to enhance recovery and extend field life. Technological upgrades in subsea pumps and control systems, along with favorable government policies for offshore drilling, further support market expansion. The presence of key service providers and established infrastructure strengthens North America’s dominance in global subsea operations.

Europe

Europe accounts for nearly 30% of the global market share, driven by significant offshore activities in the North Sea and Norwegian Continental Shelf. The region benefits from mature oil and gas infrastructure and early adoption of subsea technology. Countries such as Norway and the United Kingdom continue to deploy boosting systems to maintain output in declining reservoirs. Strong environmental regulations are encouraging the use of energy-efficient, electric subsea equipment. Investments in low-carbon offshore projects and increasing partnerships with technology suppliers are reinforcing Europe’s leadership in subsea innovation.

Asia Pacific

Asia Pacific captures over 20% market share, with major contributions from Australia, Malaysia, and China. The region’s offshore exploration activities in deepwater fields are expanding rapidly due to growing domestic energy demand. National oil companies are adopting subsea boosting systems to increase production efficiency and reduce operational downtime. Strategic collaborations between regional operators and international OEMs are accelerating technology transfer. Government-backed investments in offshore infrastructure and rising exploration in emerging basins such as Indonesia and India are propelling Asia Pacific’s position as a fast-growing market.

Latin America

Latin America holds around 10% of the market share, led by Brazil and Mexico. Brazil’s pre-salt reserves continue to drive high demand for subsea boosting equipment, as operators focus on enhancing deepwater production. Petrobras and other regional players are investing in integrated subsea systems to support large-scale offshore developments. Mexico’s energy reforms and the opening of offshore licensing rounds are attracting new entrants. The adoption of high-performance pump technologies and rising collaborations with European suppliers are further strengthening Latin America’s subsea capabilities.

Middle East & Africa

The Middle East & Africa region accounts for nearly 5% of the global share but is poised for steady growth. Offshore projects in Angola, Nigeria, and Ghana are driving new demand for subsea boosting systems. Regional operators are increasingly exploring deepwater and ultra-deepwater reserves to diversify production sources. In the Middle East, new offshore gas developments and energy diversification efforts are promoting subsea investments. Growing partnerships with international engineering firms and advances in subsea control technologies are helping overcome infrastructure and technical limitations across the region.

Market Segmentations:

By Component:

By Application:

By Water Depth:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Subsea Boosting Systems Market features strong competition among key players such as Oracle, Rockwell Automation, SAP GmbH, Dassault Systèmes, Siemens, Octavic, Honeywell International Inc., ABB, Schneider Electric, and General Electric. The Subsea Boosting Systems Market is characterized by strong technological competition and continuous innovation. Companies focus on enhancing deepwater production through advanced pump systems, control modules, and monitoring technologies. The market emphasizes improved oil recovery, energy efficiency, and operational reliability under extreme subsea conditions. Strategic partnerships between equipment manufacturers and offshore operators are common, enabling faster deployment of integrated solutions. Automation, digital twins, and condition-based monitoring systems are becoming standard, driving higher system uptime and lower maintenance costs. Growing investments in deepwater and ultra-deepwater projects further stimulate demand for efficient subsea processing equipment. Overall, the competitive landscape is defined by technological advancements, strong R&D initiatives, and the increasing adoption of digitalization to optimize subsea production performance.

Key Player Analysis

- Oracle

- Rockwell Automation

- SAP GmbH

- Dassault Systèmes

- Siemens

- Octavic

- Honeywell International Inc.

- ABB

- Schneider Electric

- General Electric

Recent Developments

- In April 2025, BW Energy made an FID for the Golfinho Boost project, which intends to contribute an additional 3,000 barrels per day of oil production starting in 2027. The initiative consists of several strategies designed to enhance production efficiency and raise recoverable reserves.

- In June 2025, Sequentify and Bio Molecular Systems (BMS) launched the InfiniSeq™ Protocol, an automated workflow for NGS (Next-Generation Sequencing) library preparation, available for download from the BMS Script Library.

- In January 2025, Tecan unveiled Veya™, the newest member of its liquid handling lineup, aimed at improving throughput, efficiency, and the general quality of laboratory experiments. Veya’s streamlined design and user-friendly functionality make it a perfect option for enhancing workflows, especially in labs incorporating automation for the initial time.

- In October 2024, Becton, Dickinson and Company, a prominent global medical technology firm, announced the commercial release of the first in a series of high-throughput, robotics-compatible reagent kits designed to facilitate automation, ensuring improved consistency and enhanced efficiency in large-scale, single-cell discovery research.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Application, Water Depth and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing investments in deepwater and ultra-deepwater oil projects will boost demand.

- Advancements in subsea compression and multiphase boosting technologies will enhance efficiency.

- Digitalization and predictive maintenance tools will improve operational uptime and reduce downtime.

- Increased collaboration between oilfield service providers and equipment manufacturers will strengthen innovation.

- Rising focus on energy-efficient subsea operations will drive adoption of electric-driven systems.

- Expansion of subsea tieback projects will create new growth opportunities across offshore regions.

- Development of autonomous and remotely operated subsea systems will reduce maintenance costs.

- Integration of digital twins and real-time monitoring platforms will enhance asset reliability.

- Government initiatives supporting offshore exploration will encourage long-term market growth.

- Continuous R&D efforts toward cost reduction and modular designs will improve market competitiveness.