Market Overview

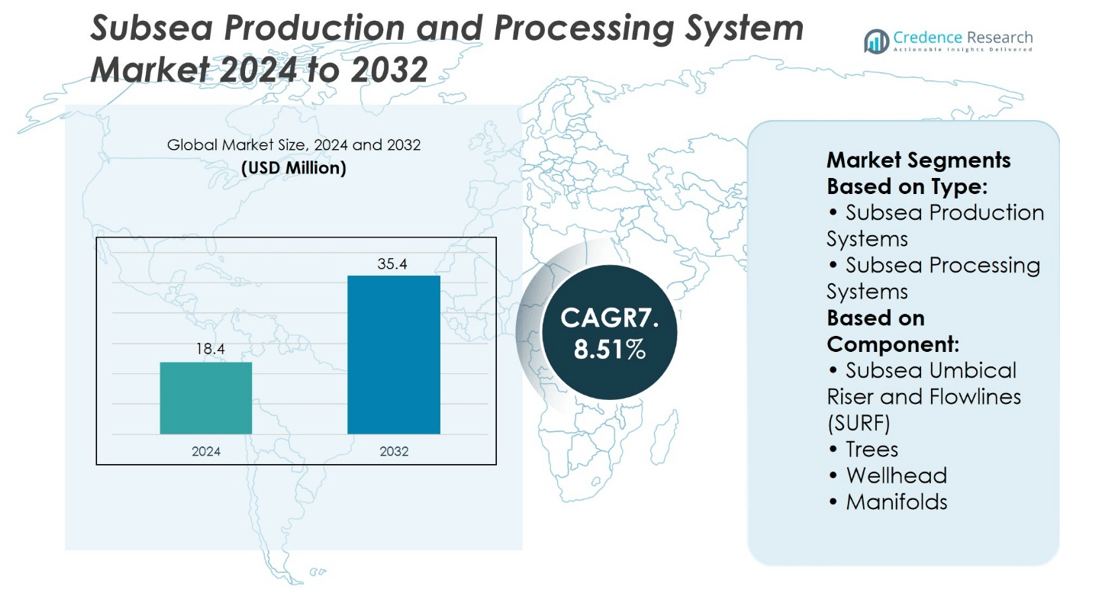

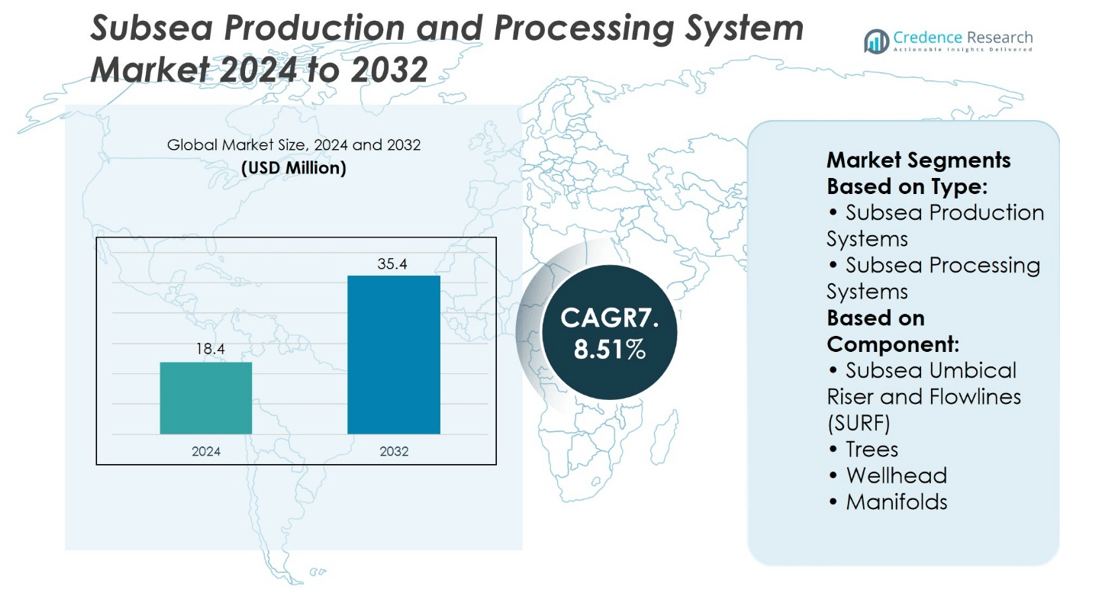

Subsea Production and Processing System Market size was valued at USD 18.4 million in 2024 and is anticipated to reach USD 35.4 million by 2032, at a CAGR of 8.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Subsea Production and Processing System Market Size 2024 |

USD 18.4 million |

| Subsea Production and Processing System Market, CAGR |

8.51% |

| Subsea Production and Processing System Market Size 2032 |

USD 35.4 million |

The Subsea Production and Processing System Market is driven by the rising development of deepwater reserves, increasing demand for cost-efficient offshore solutions, and the growing need to maximize recovery from mature fields. Operators focus on reducing project complexity through standardized designs and modular systems that shorten delivery cycles. Trends highlight the adoption of subsea electrification, digital monitoring, and all-electric fields that enhance efficiency and support sustainability targets. Integration of digital twins and remote operations strengthens asset reliability, while regional growth in Brazil, West Africa, and Asia-Pacific reinforces its position as a critical enabler of long-term offshore energy production.

The Subsea Production and Processing System Market shows strong geographical presence, with Brazil, the Gulf of Mexico, and West Africa leading in deepwater project demand, while Asia-Pacific emerges as a growing hub for offshore investments. Europe maintains technological leadership through advanced subsea engineering and sustainability-driven projects. Key players such as Schlumberger, Aker Solutions, Subsea 7, Saipem, McDermott International, Siemens, NOV, Oceaneering International, COSL, and Japan Drilling shape the market through integrated solutions, digital innovation, and strategic alliances across global offshore basins.

Market Insights

- The Subsea Production and Processing System Market size was valued at USD 18.4 million in 2024 and is anticipated to reach USD 35.4 million by 2032, at a CAGR of 8.51%.

- Rising development of deepwater reserves and demand for cost-efficient offshore solutions drive market expansion.

- Growing need to maximize recovery from mature fields pushes adoption of advanced subsea technologies.

- Subsea electrification, digital monitoring, and all-electric fields set key trends in efficiency and sustainability.

- Competition intensifies as Schlumberger, Aker Solutions, Subsea 7, Saipem, McDermott International, Siemens, NOV, Oceaneering International, COSL, and Japan Drilling focus on integrated solutions and alliances.

- High capital intensity, supply chain constraints, and project execution risks act as market restraints.

- Brazil, the Gulf of Mexico, and West Africa lead demand, Asia-Pacific grows rapidly, and Europe sustains leadership through technological innovation and sustainability-driven subsea projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Offshore Exploration and Deepwater Investments

The Subsea Production and Processing System Market benefits from the rapid increase in offshore oil and gas exploration activities. Companies focus on deepwater and ultra-deepwater fields to secure long-term production capacity. It supports higher output by enabling efficient extraction in challenging marine environments. Governments and energy majors invest heavily in offshore drilling programs to meet global energy demand. These developments create consistent demand for advanced subsea systems with reliable performance. The market grows steadily as offshore reserves continue to be prioritized for strategic energy security.

- For instance, Petrobras set a benchmark in 2023 by producing 2.36 million barrels of oil equivalent per day from its pre-salt fields in Brazil, supported by subsea production systems deployed across more than 2,000 meters water depth in the Santos Basin.

Growing Demand for Enhanced Oil Recovery Solutions

The industry experiences strong momentum with rising interest in enhanced oil recovery technologies. The Subsea Production and Processing System Market benefits from advanced subsea boosting, compression, and separation systems that extend the life of mature offshore fields. It maximizes production efficiency by reducing flow assurance challenges such as hydrate formation and wax deposition. Operators adopt innovative subsea solutions to lower costs associated with topside infrastructure. Global energy companies integrate digital monitoring tools to optimize system performance. This integration strengthens operational resilience and production stability.

- For instance, Aker Solutions deployed its subsea multiphase compressor at the Åsgard field in Norway, which has successfully added an estimated 306 million barrels of oil equivalent in recoverable reserves since its startup in 2015, operating at water depths of 300 meters with compression capacity of 22 megawatts.

Cost Optimization and Operational Efficiency Goals

The sector advances with continuous pressure on operators to minimize capital and operational expenditures. The Subsea Production and Processing System Market addresses this need through modular designs, standardized equipment, and improved installation techniques. It reduces the need for large surface platforms and lowers overall infrastructure costs. Companies prefer subsea systems for their ability to streamline operations while ensuring safety. Automation and remote monitoring technologies enhance maintenance planning and system reliability. These drivers reinforce subsea adoption as operators seek long-term cost competitiveness.

Regulatory Support and Technological Advancements

The industry benefits from supportive regulatory frameworks that encourage offshore energy development. The Subsea Production and Processing System Market gains traction with advancements in subsea robotics, sensors, and real-time monitoring solutions. It improves safety and environmental compliance by reducing risks associated with offshore operations. Collaborative R&D projects between technology providers and oilfield operators lead to breakthroughs in subsea processing. Governments also promote innovation to balance energy security with sustainable practices. This alignment of regulatory support and technology development accelerates subsea system deployment globally.

Market Trends

Expansion of Deepwater and Ultra-Deepwater Projects

The Subsea Production and Processing System Market witnesses strong momentum with the expansion of deepwater and ultra-deepwater developments. Energy companies direct investment toward fields that require advanced subsea solutions for efficient extraction. It supports higher production in regions where conventional reserves are either depleted or declining. Offshore basins in Brazil, the Gulf of Mexico, and West Africa drive steady demand for robust subsea technologies. The increasing complexity of these environments accelerates the adoption of specialized subsea equipment. Global operators prioritize long-term output by relying on proven subsea systems.

Integration of Digitalization and Remote Monitoring

The market advances with rapid adoption of digital technologies across subsea operations. The Subsea Production and Processing System Market benefits from integration of sensors, data analytics, and predictive maintenance platforms. It improves operational visibility by enabling real-time monitoring of subsea infrastructure. Digitalization reduces downtime and enhances reliability through proactive system adjustments. Companies adopt cloud-based tools to optimize asset performance and lifecycle management. These advancements transform subsea operations into more efficient and data-driven environments.

- For instance, Equinor has deployed digital twin technology on the Johan Sverdrup field, enabling remote monitoring of more than 0.4 million data points per day, which supports predictive maintenance and improves operational efficiency across subsea infrastructure.

Shift Toward Modular and Standardized Designs

The industry experiences a shift toward modular and standardized equipment to address cost efficiency. The Subsea Production and Processing System Market adapts to this trend by offering flexible solutions that can be deployed across multiple field developments. It reduces project lead times and simplifies system integration for operators. Modular systems lower maintenance costs and enhance scalability for future expansions. Standardization supports faster installation and improves supply chain coordination. The trend strengthens industry efforts to achieve operational agility and economic sustainability.

- For instance, TechnipFMC has advanced its Subsea 2.0® platform, delivering more than 0.25 million subsea components globally through standardized modular systems, which reduce installation time and optimize deployment across large-scale offshore projects.

Emphasis on Sustainability and Environmental Compliance

The subsea sector responds to rising global focus on sustainability and environmental safety. The Subsea Production and Processing System Market integrates eco-friendly designs that minimize carbon footprint and improve energy efficiency. It supports compliance with stricter regulations governing offshore production. Companies develop subsea technologies that reduce flaring, emissions, and leak risks. Collaboration between technology providers and regulators drives innovations in environmentally responsible subsea processing. This emphasis on sustainability reinforces subsea adoption while aligning with long-term climate objectives.

Market Challenges Analysis

High Capital Intensity and Complex Deployment Requirements

The Subsea Production and Processing System Market faces significant barriers due to the high cost of equipment, installation, and maintenance. It demands specialized vessels, advanced engineering expertise, and long project timelines, which increase financial risks for operators. Harsh offshore conditions require durable materials and advanced designs that raise manufacturing expenses. Companies often delay or scale back subsea projects when oil prices fluctuate, limiting steady investment. The complexity of installation and commissioning also exposes operators to logistical challenges. These capital-intensive requirements restrict smaller players from entering the market and concentrate opportunities among established firms.

Operational Risks and Harsh Environmental Conditions

The industry confronts persistent risks tied to deepwater operations, which complicate the reliability of subsea systems. The Subsea Production and Processing System Market must contend with issues such as hydrate formation, corrosion, and equipment failures in high-pressure environments. It faces heightened risks of production downtime due to difficult repair and maintenance processes at extreme depths. Limited accessibility prolongs response times when technical failures occur. Regulatory pressures related to safety and environmental impact further add to operational constraints. These challenges underscore the need for continuous innovation and robust maintenance strategies to ensure consistent subsea performance.

Market Opportunities

Expansion into Untapped Offshore Fields

The Subsea Production and Processing System Market presents strong opportunities with the development of new offshore reserves in frontier regions. It supports operators in accessing hydrocarbon resources located in deepwater basins across Africa, South America, and Southeast Asia. Governments encourage investment in offshore projects to diversify energy supply and enhance production capacity. Energy companies seek advanced subsea solutions to maximize returns from newly identified reserves. It enables production in areas where traditional surface infrastructure is economically or technically unfeasible. These untapped regions create long-term growth prospects for system manufacturers and service providers.

Advancement in Subsea Processing Technologies

The industry benefits from increasing adoption of subsea separation, boosting, and compression technologies that extend field life. The Subsea Production and Processing System Market leverages these advancements to enhance recovery rates and reduce surface facility requirements. It improves project economics by minimizing topside infrastructure and lowering operational risks. Integration of digital tools and automation further strengthens reliability and efficiency in complex offshore environments. Energy operators prioritize these solutions to optimize asset utilization and meet sustainability standards. These developments create significant opportunities for technology providers to deliver innovative subsea systems.

Market Segmentation Analysis:

By Type

The Subsea Production and Processing System Market divides into subsea production systems and subsea processing systems, each playing a critical role in offshore operations. Subsea production systems dominate due to their widespread use in deepwater field development, where reliable extraction and control of hydrocarbons are essential. It ensures efficient flow from wells to surface facilities while reducing dependence on large offshore platforms. Subsea processing systems gain traction as operators focus on improving recovery rates and extending field life. They offer advanced solutions such as boosting, separation, and compression that support production in mature or complex reservoirs. This segment is expected to expand steadily as companies adopt technologies that reduce surface infrastructure costs and improve operational efficiency.

- For instance, Subsea 7 has installed over 1.2 million meters of subsea umbilicals, risers, and flowlines (SURF) globally, supporting large subsea production systems.

By Component

The market also segments into subsea umbilical riser and flowlines (SURF), trees, wellhead, and manifold, each contributing to overall system performance. SURF holds a significant share due to its essential function in connecting subsea wells with surface facilities, ensuring safe transport of hydrocarbons. It provides reliability in extreme conditions and supports complex field layouts. Subsea trees remain vital as they control well flow and provide safety mechanisms for production, with advanced designs improving reliability and durability. Wellheads demonstrate consistent demand for their critical role in securing the structural integrity of subsea wells. Manifolds support production optimization by allowing multiple wells to be connected and managed efficiently, improving flow assurance. Each component plays a strategic role in ensuring operational safety, reducing downtime, and enhancing production efficiency across offshore projects.

- For instance, Saipem has installed over 2.4 million meters of subsea flowlines and umbilicals across deepwater projects worldwide.

Segments:

Based on Type:

- Subsea Production Systems

- Subsea Processing Systems

Based on Component:

- Subsea Umbical Riser and Flowlines (SURF)

- Trees

- Wellhead

- Manifolds

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a substantial share of the Subsea Production and Processing System Market, accounting for 28% of the global share in 2024. The region benefits from strong activity in the Gulf of Mexico, where both shallow-water and deepwater projects continue to attract investment. It reflects the presence of leading energy operators and service companies that deploy advanced subsea technologies to maximize production efficiency. The United States leads regional demand, driven by stable offshore leasing programs and the need to sustain output from mature fields. Canada also contributes through offshore developments in the Atlantic, particularly in Newfoundland and Labrador. The presence of advanced infrastructure, combined with favorable regulatory support, reinforces North America’s role as a critical market for subsea systems.

Europe

Europe accounts for 31% of the market share in 2024, making it the largest regional market. Norway and the United Kingdom dominate with extensive operations in the North Sea and the Norwegian Continental Shelf. The region demonstrates high adoption of subsea technologies due to its challenging offshore conditions and mature reserves that require innovative production solutions. It maintains strong focus on subsea processing, separation, and boosting to extend the life of offshore fields. Energy operators such as Equinor, BP, and Shell continue to invest in subsea projects that align with both production targets and environmental standards. Europe’s established expertise in subsea engineering and presence of global service providers further strengthen its leading position in the market.

Asia-Pacific

Asia-Pacific captures 22% of the global share in 2024, reflecting rapid expansion of offshore energy projects across emerging economies. The region sees increasing demand from countries such as China, Australia, India, and Malaysia, where investments in offshore exploration and field development continue to rise. It leverages subsea systems to access reserves in complex environments, including deepwater basins in the South China Sea and offshore Australia. Local operators, supported by international oilfield service companies, focus on cost optimization through modular subsea solutions. Growing energy demand and supportive government policies encourage sustained investment in offshore infrastructure. Asia-Pacific emerges as the fastest-growing region in terms of adoption, backed by rapid urbanization and rising energy consumption.

Latin America

Latin America secures 12% of the global market share in 2024, supported by extensive offshore reserves in Brazil and Mexico. Brazil leads with large-scale deepwater and ultra-deepwater projects in the pre-salt basin, which demand advanced subsea production and processing systems. It continues to be one of the most attractive markets globally for subsea technology deployment. Mexico follows with offshore developments in the Gulf of Mexico, where foreign and domestic operators expand production capacity. The region benefits from ongoing regulatory reforms that encourage foreign investment in offshore exploration. Subsea adoption remains strong as companies seek reliable systems for long-term production in technically demanding environments.

Middle East and Africa

The Middle East and Africa represent 7% of the global share in 2024, with activity concentrated in offshore West Africa. Countries such as Nigeria, Angola, and Ghana lead demand for subsea technologies due to their reliance on deepwater fields for production. It highlights the importance of subsea systems in enhancing recovery rates and sustaining long-term output. The Middle East contributes modestly, with offshore projects in Saudi Arabia and Qatar focusing on diversification of energy infrastructure. Limited regional infrastructure and geopolitical challenges restrict faster adoption in some areas, but international partnerships help maintain steady progress. The region remains strategically important due to its large untapped reserves and growing interest from global operators in offshore exploration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- COSL

- Subsea 7

- NOV

- McDermott International

- Aker Solutions

- Schlumberger

- Saipem

- Japan Drilling

- Siemens

- Oceaneering International

Competitive Analysis

The Subsea Production and Processing System (SPS) market features by COSL, Subsea 7, NOV, McDermott International, Aker Solutions, Schlumberger, Saipem, Japan Drilling, Siemens, Oceaneering International. The Subsea Production and Processing System (SPS) market features intense competition driven by the need for reliable offshore development, cost efficiency, and technological innovation. Companies compete on their ability to deliver integrated solutions that combine subsea trees, boosting systems, control platforms, and advanced SURF packages to optimize recovery and extend field life. Electrification and digitalization are emerging as decisive factors, with subsea power distribution and real-time asset monitoring setting new benchmarks for performance. Standardized equipment and modular designs reduce project complexity and shorten lead times, strengthening competitiveness in a cost-sensitive environment. Market growth is concentrated in deepwater regions such as Brazil, the Gulf of Mexico, and West Africa, where large-scale projects continue to drive demand for advanced systems. However, the competitive landscape is challenged by supply chain constraints, fluctuating oil prices, and the pressure to deliver lower carbon solutions. Players differentiate themselves by leveraging strategic alliances, expanding regional presence, and aligning with operators’ sustainability targets. The shift toward subsea processing retrofits and tiebacks underlines a preference for solutions that maximize existing infrastructure while lowering capital intensity. Overall, the market’s competitive intensity hinges on innovation, execution reliability, and responsiveness to shifting energy transition priorities.

Recent Developments

- In October 2024, Subsea 7 announced involvement in several offshore deepwater subsea projects integrating advanced subsea processing and pumping systems designed to optimize hydrocarbon recovery while minimizing environmental impact.

- In March 2023, One Subsea announced it had won to provide the equipment for the in the Santos Basin pre-salt. The contract offers the delivery of 16 wet Christmas trees (ANMs) in phase 10 of the field’s exploration.

- In February 2023, Aker Solutions announced securing a contract from Eni Angola SpA. – Sucursal de Angola, an AzuleEnergy Holdings Limited subsidiary.

- In February 2023, TechnipFMC received a contract for subsea production systems by Equinor for Irpaoil and gas development on the Norwegian Continental Shelf.

Market Concentration & Characteristics

The Subsea Production and Processing System Market demonstrates moderate to high concentration, with a small group of multinational contractors and equipment manufacturers dominating project execution and technology leadership. It is characterized by high entry barriers due to the capital intensity of offshore operations, stringent safety standards, and the need for advanced engineering capabilities. Market leaders maintain strong influence through integrated portfolios that cover subsea trees, boosting systems, compression, and SURF infrastructure, often supported by proprietary digital and electrification technologies. It shows strong reliance on long-term contracts, strategic alliances, and vessel availability, which secure backlog visibility and sustain competitive positioning. Regional characteristics vary, with deepwater hubs in Brazil, the Gulf of Mexico, and West Africa acting as primary growth centers, while emerging activity in Asia-Pacific strengthens diversification. The market emphasizes efficiency and reliability, with standardization, modularization, and remote operations becoming central features to reduce costs and risks. It also reflects growing pressure to align with decarbonization goals, where subsea electrification and emissions-reducing designs differentiate competitive offerings. The combination of technological complexity, capital intensity, and geographic concentration defines its structure, making consolidation and partnerships key characteristics of its competitive environment.

Report Coverage

The research report offers an in-depth analysis based on Type, Component and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for subsea production and processing systems will rise with the expansion of deepwater and ultra-deepwater projects.

- Operators will adopt standardized and modular subsea equipment to reduce project timelines and lower costs.

- Subsea electrification will gain momentum as all-electric fields support longer tiebacks and lower carbon emissions.

- Digital twins and advanced monitoring systems will strengthen predictive maintenance and improve field reliability.

- Collaboration between oilfield service providers and technology developers will intensify to enhance integrated solutions.

- Emerging offshore activity in Asia-Pacific and Africa will create new opportunities for system deployment.

- Brownfield upgrades and subsea tiebacks will drive demand for retrofitting and life-extension solutions.

- Sustainability commitments will push companies to develop low-carbon subsea technologies and energy-efficient designs.

- Vessel availability and supply chain resilience will remain decisive factors in competitive positioning.

- Consolidation and strategic alliances among global players will continue shaping the market structure.