Market Overview

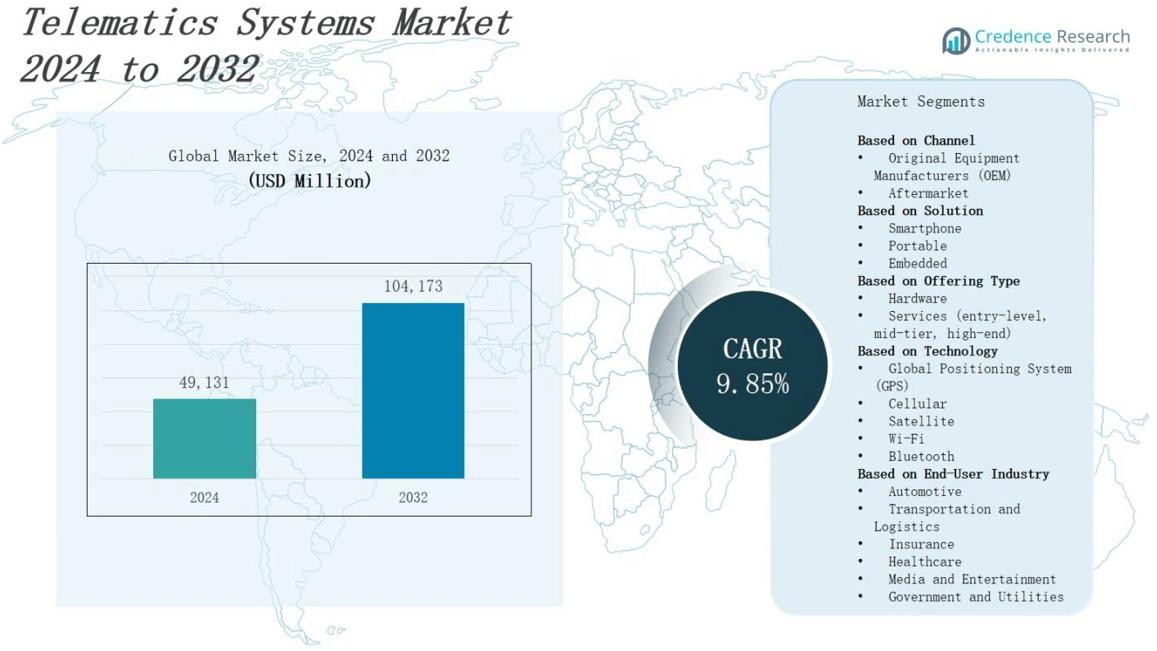

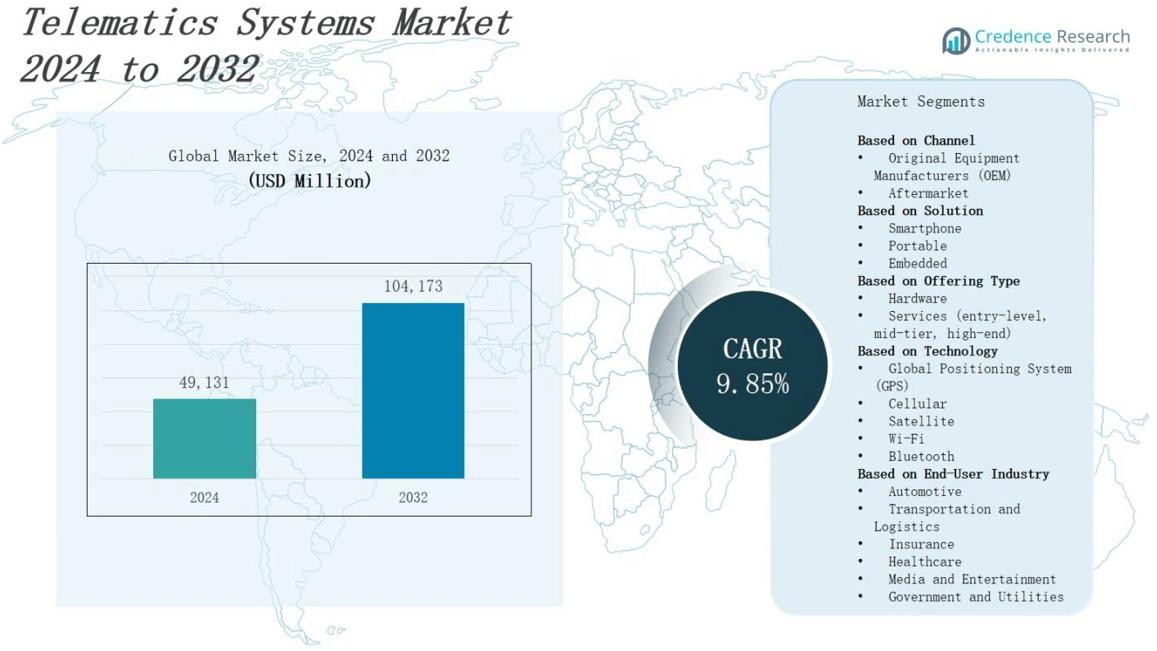

The telematics systems market is projected to grow from USD 49,131 million in 2024 to USD 104,173 million by 2032, registering a compound annual growth rate (CAGR) of 9.85%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Telematics systems market Size 2024 |

USD 49,131 million |

| Telematics systems market, CAGR |

9.85% |

| Telematics systems market Size 2032 |

USD 104,173 million |

The telematics systems market grows steadily driven by increasing demand for vehicle tracking, fleet management, and insurance telematics solutions. Rising adoption of connected vehicles and the integration of IoT technologies enhance real-time data collection and analytics, improving operational efficiency and safety. Growing regulatory requirements for vehicle monitoring and emissions control further stimulate market growth. Additionally, advancements in AI and big data enable predictive maintenance and driver behavior analysis, creating new opportunities. The shift toward electric and autonomous vehicles also drives telematics innovation, while expanding applications in logistics, transportation, and insurance sectors sustain market momentum globally.

The telematics systems market spans key regions including North America, Europe, Asia-Pacific, and the Rest of the World, each contributing uniquely to market growth. North America leads with 35% market share, followed by Europe at 28%, Asia-Pacific at 22%, and the Rest of the World holding 15%. Leading players such as Geotab Inc., Fleet Complete, Octo Telematics, TomTom Telematics, Mix Telematics, Intel Corporation, Continental AG., Sierra Wireless, Verizon Connect, and Trimble Inc. drive innovation and regional expansion, leveraging advanced technologies and strategic partnerships to capitalize on diverse market opportunities globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The telematics systems market is projected to grow from USD 49,131 million in 2024 to USD 104,173 million by 2032, with a CAGR of 9.85%.

- Increasing demand for vehicle tracking, fleet management, and insurance telematics drives steady market growth. Rising adoption of connected vehicles and IoT integration enhances real-time data collection, improving efficiency and safety.

- Regulatory requirements for vehicle monitoring and emissions control stimulate market expansion. AI and big data advancements enable predictive maintenance and driver behavior analysis, creating new opportunities.

- The rise of electric and autonomous vehicles drives telematics innovation, while logistics, transportation, and insurance sectors sustain global momentum.

- North America leads with 35% market share, followed by Europe at 28%, Asia-Pacific at 22%, and the Rest of the World at 15%. Key players include Geotab Inc., Fleet Complete, Octo Telematics, and Intel Corporation.

- Data privacy and cybersecurity concerns challenge market adoption, requiring strong encryption and secure protocols. High implementation costs and integration complexities limit growth, especially in developing regions.

- Market growth benefits from escalating demand for fleet management, IoT-enabled analytics, compliance with safety regulations, and expanding electric and autonomous vehicle segments driving specialized telematics solutions.

Market Drivers

Rising Demand for Fleet Management and Vehicle Tracking Solutions

The telematics systems market experiences strong growth due to escalating demand for efficient fleet management and vehicle tracking. Companies seek real-time monitoring to optimize routes, reduce fuel consumption, and improve asset utilization. It enables businesses to enhance driver safety and compliance with regulatory standards. The need for effective logistics management in transportation, delivery, and service industries further fuels adoption. Growing awareness of telematics benefits across small and large fleets drives widespread implementation globally.

- For instance, Verizon Connect enables real-time route optimization and fuel consumption monitoring, helping fleets reduce operational costs and improve efficiency.

Integration of IoT and Advanced Analytics

The integration of Internet of Things (IoT) technologies into telematics systems transforms data collection and analysis capabilities. It connects vehicles, infrastructure, and devices, providing comprehensive insights through real-time data streams. The telematics systems market benefits from this innovation by offering predictive maintenance, improved route planning, and driver behavior monitoring. AI-driven analytics convert vast datasets into actionable intelligence, enabling proactive decision-making. This technological evolution supports enhanced safety and operational efficiency. Industry players continuously invest in IoT-enabled telematics to differentiate their offerings and capture new opportunities.

Regulatory Compliance and Safety Enhancement Initiatives

Governments worldwide implement stringent regulations on vehicle emissions, driver hours, and safety standards, increasing the necessity for telematics adoption. The telematics systems market responds to these mandates by providing reliable tracking and reporting tools to ensure compliance. It supports accident reduction through monitoring driver behavior and encouraging safer driving practices. Organizations face penalties for non-compliance, making telematics a critical solution to mitigate risks. Insurance companies also leverage telematics data to incentivize safe driving and reduce claims. Compliance-driven demand creates a steady market expansion and fosters innovation in telematics features.

- For instance, the European Union mandates automakers to install telematics systems to track fuel efficiency and emission data, supporting adherence to CO2 reduction targets.

Growth of Electric and Autonomous Vehicles

The rise of electric and autonomous vehicles creates new avenues for telematics systems in vehicle monitoring and control. The telematics systems market adapts to support battery management, charging station integration, and autonomous navigation data needs. It plays a key role in vehicle-to-everything (V2X) communication, enhancing traffic management and road safety. Manufacturers and fleet operators rely on telematics to optimize electric vehicle performance and autonomous system efficiency. The expanding electric and self-driving vehicle segments drive the development of specialized telematics solutions tailored to emerging transportation technologies. This trend accelerates market diversification and growth prospects.

Market Trends

Expansion of Connected Vehicle Technologies Enhances Market Capabilities

The telematics systems market evolves with the rapid expansion of connected vehicle technologies that enable seamless communication between vehicles, infrastructure, and cloud platforms. It delivers real-time data exchange that improves traffic management, vehicle diagnostics, and safety features. Enhanced connectivity supports advanced driver assistance systems (ADAS) and paves the way for autonomous driving solutions. Automakers and technology providers invest heavily in vehicle-to-everything (V2X) communication protocols to improve system reliability and user experience. This trend broadens telematics applications beyond traditional fleet management to personal and commercial vehicles, fueling market growth.

- For instance, French startup Airnity provides a multi-cloud network platform that improves vehicle connectivity by optimizing cost and quality of service while meeting telecom and automotive compliance standards through a full-mobile virtual network operator model.

Adoption of Artificial Intelligence and Machine Learning for Advanced Insights

The market increasingly integrates artificial intelligence (AI) and machine learning (ML) to analyze telematics data more efficiently and accurately. It processes vast amounts of information to identify patterns, predict vehicle maintenance needs, and monitor driver behavior. These capabilities help reduce downtime and improve safety through early detection of potential issues. AI-driven analytics enable personalized services such as dynamic routing and insurance telematics. The telematics systems market benefits from continuous improvements in AI algorithms, driving smarter, more proactive fleet and vehicle management solutions.

- For instance, Motive uses AI-powered dashcams that detect driver distraction and fatigue in real time, enabling proactive safety interventions and reducing accidents.

Shift Toward Cloud-Based Telematics Platforms for Scalability

The telematics systems market adopts cloud-based platforms to enhance scalability, flexibility, and data accessibility for users. Cloud integration allows for centralized data storage, seamless software updates, and easier integration with third-party applications. It supports real-time monitoring and analytics from any location, improving decision-making for fleet managers and vehicle owners. The transition from on-premise solutions to cloud services reduces IT infrastructure costs and accelerates deployment. This trend encourages widespread adoption of telematics across diverse industries and supports rapid innovation in feature development.

Rising Demand for Usage-Based Insurance and Personalized Services

The increasing demand for usage-based insurance (UBI) models drives the telematics systems market to develop more accurate and customizable monitoring solutions. It enables insurers to assess risk based on real driving behavior, offering tailored premiums and incentives for safe driving. Consumers benefit from personalized feedback and coaching to improve driving habits. The telematics systems market capitalizes on this trend by collaborating with insurance companies and expanding offerings in telematics-based risk management. Growth in UBI adoption promotes wider use of telematics technology beyond fleet operations into individual vehicle owners.

Market Challenges Analysis

Data Privacy and Security Concerns Impede Market Adoption

The telematics systems market faces significant challenges related to data privacy and cybersecurity risks. It collects vast amounts of sensitive information, including location, driver behavior, and vehicle diagnostics, which raises concerns about unauthorized access and misuse. Companies must comply with stringent data protection regulations, increasing the complexity of system design and deployment. Cyberattacks targeting telematics platforms threaten operational integrity and customer trust. Addressing these vulnerabilities requires robust encryption, secure communication protocols, and continuous monitoring. Resistance from customers wary of surveillance further slows adoption. Overcoming privacy concerns remains critical for the market to expand sustainably.

High Implementation Costs and Integration Complexities Limit Growth

The telematics systems market encounters barriers due to the high costs associated with hardware installation, software licensing, and ongoing maintenance. It often demands significant upfront investment, which can deter small and medium-sized enterprises from adoption. Integration with existing fleet management or enterprise systems presents technical challenges, requiring customized solutions and skilled personnel. Compatibility issues across diverse vehicle types and brands add complexity to deployment. Furthermore, limited standardization in telematics protocols hampers seamless interoperability. These factors collectively restrict rapid market penetration, especially in developing regions where cost sensitivity remains high.

Market Opportunities

Growing Demand for Electric and Autonomous Vehicle Integration

The telematics systems market presents significant opportunities with the rapid adoption of electric and autonomous vehicles worldwide. It supports critical functions such as battery management, charging infrastructure coordination, and autonomous navigation data exchange. Manufacturers and fleet operators seek telematics solutions that optimize energy consumption and enhance vehicle safety. The expanding electric vehicle segment creates demand for specialized monitoring and diagnostic tools. Autonomous driving technologies rely heavily on telematics for real-time communication and control. Capitalizing on these trends enables market players to develop innovative products tailored to emerging transportation needs, driving revenue growth and technological advancement.

Expansion into Usage-Based Insurance and Personalized Mobility Services

The telematics systems market benefits from rising interest in usage-based insurance (UBI) and personalized mobility services, creating new revenue streams. It enables insurers to offer customized premium models based on accurate driver behavior data, reducing risk and encouraging safer driving. Telecommunication providers and mobility platforms integrate telematics to deliver tailored transportation solutions such as dynamic routing and car-sharing optimization. The growing urbanization and demand for smart city infrastructure further amplify opportunities for telematics in public transportation and logistics. Expanding collaborations across insurance, automotive, and technology sectors strengthen market penetration and promote innovative service offerings.

Market Segmentation Analysis:

By Channel

The telematics systems market divides into Original Equipment Manufacturers (OEM) and aftermarket channels, each contributing distinct growth dynamics. OEMs integrate telematics solutions directly into new vehicles, offering seamless connectivity and advanced features from the factory. It benefits from increasing automaker partnerships and rising demand for connected vehicles. The aftermarket segment caters to vehicle owners seeking retrofit solutions to upgrade older fleets or personal cars. Aftermarket growth gains momentum due to cost-effectiveness and flexibility. Both channels collectively expand telematics adoption across new and existing vehicle bases, enhancing overall market penetration.

- For instance, BMW integrates telematics directly into new vehicles, providing built-in connected services like remote diagnostics and advanced driver assistance, enhancing vehicle safety and user experience.

By Solution

The market segments telematics solutions into smartphone-based, portable, and embedded categories, providing varied deployment options. Smartphone telematics leverage mobile devices for affordable and accessible vehicle monitoring, appealing to individual users and small fleets. Portable devices offer plug-and-play functionality with ease of installation, serving fleets requiring quick setups. Embedded systems integrate directly into vehicle electronics, delivering advanced data accuracy and comprehensive features. It enables real-time diagnostics and continuous monitoring. These solution types address diverse user needs and use cases, driving widespread telematics system adoption.

- For instance, Verizon Connect’s smartphone telematics app enables fleet managers to monitor vehicle location and driver behavior affordably through mobile devices, appealing to small fleets and individual users.

By Offering Type

The telematics systems market categorizes offerings into hardware and services, including entry-level, mid-tier, and high-end service packages. Hardware includes devices such as GPS modules, sensors, and communication units critical for data collection and transmission. It supports service tiers that range from basic tracking to advanced analytics, predictive maintenance, and driver coaching. Service-based revenue grows with increasing demand for cloud platforms, software updates, and customer support. This segmentation allows providers to tailor solutions to varying customer budgets and technical requirements, fueling sustainable market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segments:

Based on Channel

- Original Equipment Manufacturers (OEM)

- Aftermarket

Based on Solution

- Smartphone

- Portable

- Embedded

Based on Offering Type

- Hardware

- Services (entry-level, mid-tier, high-end)

Based on Technology

- Global Positioning System (GPS)

- Cellular

- Satellite

- Wi-Fi

- Bluetooth

Based on End-User Industry

- Automotive

- Transportation and Logistics

- Insurance

- Healthcare

- Media and Entertainment

- Government and Utilities

Based on Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Two-wheelers

- Off-highway Vehicles

Based on Application

- Fleet Management

- Vehicle Tracking

- Satellite Navigation

- Vehicle Safety Communication

- Insurance Telematics (Usage-Based Insurance)

- Infotainment

- Remote Diagnostics

- Others

Based on Deployment Model

- On-Premise

- Cloud-based

- Hybrid

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America commands the largest share of the telematics systems market, holding 35% of the global revenue. It benefits from advanced automotive infrastructure, widespread adoption of connected vehicles, and strong regulatory support for safety and emissions monitoring. The presence of major telematics solution providers and insurance companies investing in usage-based insurance models drives market growth. It also sees rapid integration of IoT and AI technologies in telematics platforms. High consumer awareness and well-established fleet management services contribute to sustained demand. Continuous innovation and government incentives for electric and autonomous vehicles further strengthen the region’s leadership.

Europe

Europe holds 28% of the telematics systems market share, driven by stringent government regulations on vehicle emissions and safety standards. It promotes telematics adoption through policies mandating real-time monitoring and compliance reporting for commercial fleets. The region benefits from a mature automotive industry focusing on connected and autonomous vehicle technologies. It leverages telematics for improving urban mobility and logistics efficiency across diverse countries. Investments in smart city projects and expanding electric vehicle infrastructure also support market expansion. Strong collaboration between automakers and technology providers accelerates product development and deployment.

Asia-Pacific

Asia-Pacific captures 22% of the telematics systems market and exhibits rapid growth fueled by increasing vehicle production and rising demand for fleet management solutions. It experiences growing adoption in countries such as China, India, Japan, and South Korea, supported by expanding logistics, e-commerce, and transportation sectors. Urbanization and infrastructure development drive the need for efficient traffic management and vehicle tracking. It faces challenges related to infrastructure and standardization but benefits from government initiatives promoting connected vehicle technologies. Market players focus on cost-effective solutions to cater to emerging economies, widening telematics accessibility.

Rest of the World

The Rest of the World accounts for 15% of the telematics systems market, with growing interest in Latin America, the Middle East, and Africa. It sees increasing investments in fleet optimization and vehicle safety across commercial transportation sectors. The region’s telematics adoption benefits from rising awareness of operational efficiency and regulatory encouragement. Infrastructure development and digital transformation efforts support gradual market penetration. Limited technological maturity and cost barriers slow growth, but strategic partnerships and government support aim to enhance market presence. Emerging demand for personalized mobility and insurance telematics also contribute to expansion opportunities.

Key Player Analysis

- Trimble Inc.

- Octo Telematics

- Verizon Connect

- Geotab Inc.

- Sierra Wireless

- Continental AG.

- Fleet Complete

- TomTom Telematics

- Intel Corporation

- Mix Telematics

Competitive Analysis

The telematics systems market features intense competition among key players striving to innovate and expand their global footprint. Leading companies such as Geotab Inc., Fleet Complete, Octo Telematics, TomTom Telematics, and Mix Telematics invest heavily in research and development to enhance product capabilities and differentiate their offerings. It also includes major technology and automotive firms like Intel Corporation, Continental AG., Sierra Wireless, Verizon Connect, and Trimble Inc., which leverage their broad industry expertise and extensive distribution networks. These players focus on strategic partnerships, acquisitions, and collaborations to strengthen market position and address evolving customer demands. The telematics systems market rewards companies that deliver integrated solutions combining hardware, software, and data analytics to improve fleet management, driver safety, and operational efficiency. Competitive pricing, scalability, and the ability to adapt to regional regulatory requirements remain critical success factors. Continuous innovation in AI, IoT integration, and cloud-based services further intensifies competition, prompting companies to accelerate product launches and expand service portfolios.

Recent Developments

- In May 2024, Ambarella unveiled next-generation AI System on Chips (SoCs), the CV75AX and CV72AX, designed for in-vehicle fleet telematics systems.

- In May 2024, Geotab partnered with Rivian to deliver an integrated data solution for Rivian’s commercial vehicles in North America.

- In April 2024, Samsara partnered with United Natural Foods, Inc. (UNFI) to install its commercial vehicle telematics platform in UNFI trucks.

- On April 2, 2024, Powerfleet completed a merger with MiX Telematics, creating one of the largest mobile asset AIoT SaaS providers globally.

Market Concentration & Characteristics

The telematics systems market exhibits a moderately concentrated competitive landscape dominated by a mix of specialized telematics providers and major technology and automotive companies. Leading players such as Geotab Inc., Fleet Complete, Octo Telematics, TomTom Telematics, Intel Corporation, and Continental AG. hold significant market shares by offering comprehensive hardware, software, and analytics solutions. It favors companies that deliver integrated, scalable platforms combining real-time data monitoring, AI-driven insights, and cloud-based services. The market demands continuous innovation to address evolving regulatory requirements, data security challenges, and diverse customer needs across fleet management, insurance, and connected vehicle segments. Smaller players face challenges due to high entry barriers, including substantial R&D investment and complex system integration. The telematics systems market rewards agility, technological advancement, and strong strategic partnerships to expand regional presence and service offerings. Customer-centric approaches and compliance with data privacy standards remain critical to maintaining competitive advantage and driving sustainable growth.

Report Coverage

The research report offers an in-depth analysis based on Channel, Solution, Offering Type, Technology, End User Industry, Vehicle Type, Application, Deployment Model and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The telematics systems market will expand due to increasing adoption of connected and autonomous vehicles.

- Integration of AI and machine learning will enhance predictive maintenance and driver behavior analysis.

- Usage-based insurance models will drive demand for advanced telematics monitoring solutions.

- IoT-enabled telematics platforms will improve real-time data accuracy and operational efficiency.

- Growing regulatory requirements for emissions and safety will boost telematics implementation.

- Expansion of electric vehicle fleets will create new opportunities for specialized telematics services.

- Cloud-based telematics solutions will gain traction for their scalability and ease of integration.

- Data privacy and cybersecurity measures will become more critical to market growth.

- Increasing demand for fleet optimization in logistics and transportation sectors will sustain market momentum.

- Strategic collaborations and technology partnerships will accelerate innovation and regional market penetration.