Market Overview

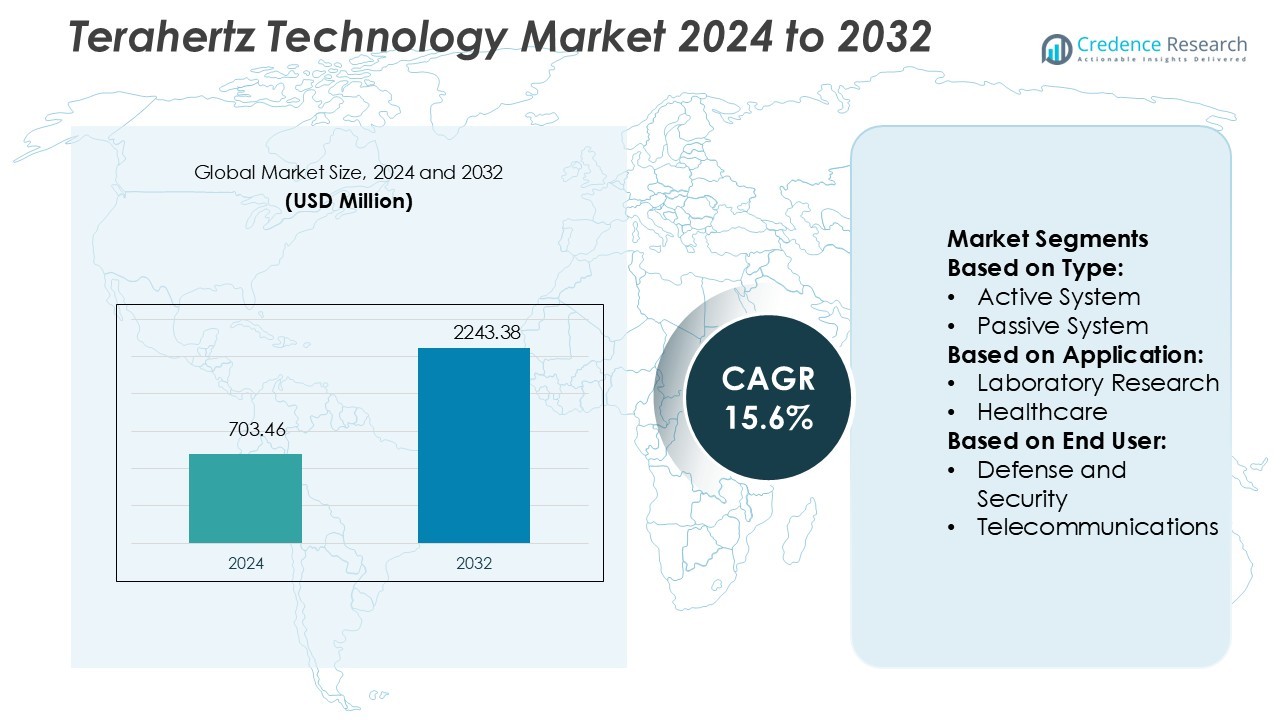

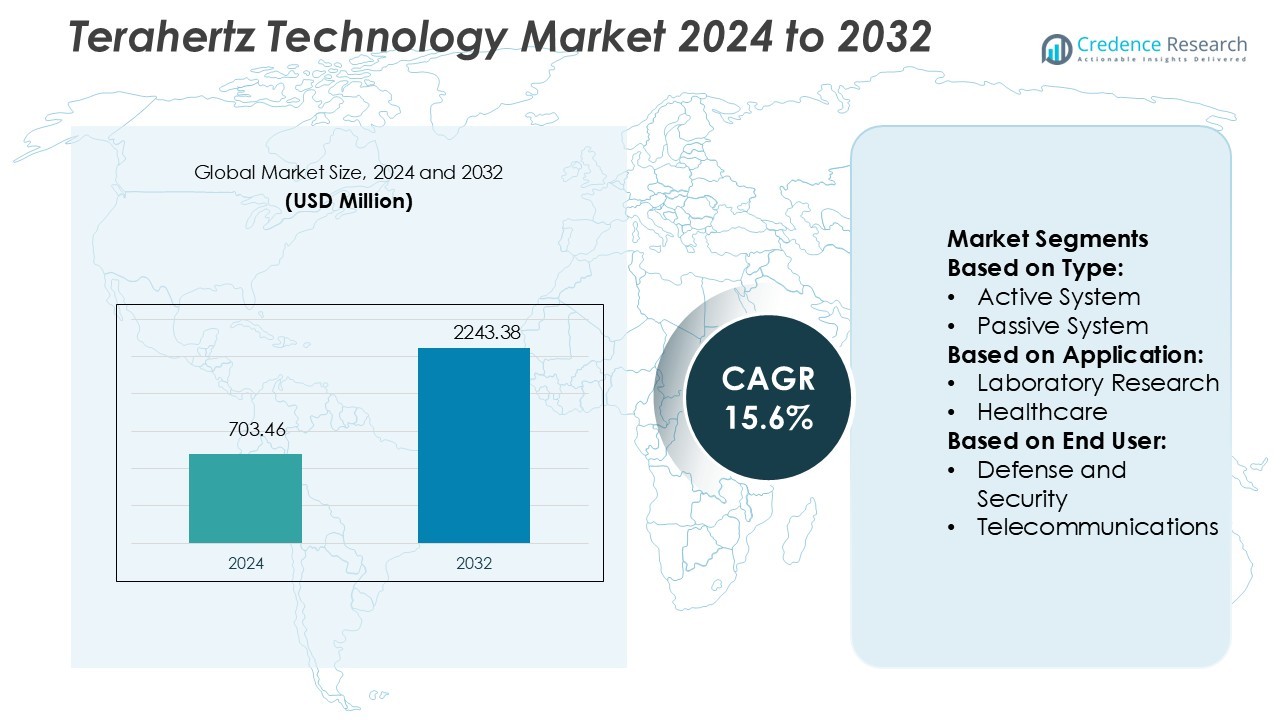

Terahertz Technology Market size was valued USD 703.46 million in 2024 and is anticipated to reach USD 2243.38 million by 2032, at a CAGR of 15.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Terahertz Technology Market Size 2024 |

USD 703.46 Million |

| Terahertz Technology Market, CAGR |

15.6% |

| Terahertz Technology Market Size 2032 |

USD 2243.38 Million |

The terahertz technology market is shaped by leading players including Advantest Corporation, Luna Innovations, HUBNER GmbH & Co. KG, TeraView Limited, Toptica Photonics AG, Gentec Electro-optics Inc., Bakman Technologies LLC, Menlo Systems, QMC Instruments Ltd., and TeraSense Group. These companies focus on advancing terahertz imaging, spectroscopy, and communication systems to serve healthcare, defense, industrial, and telecommunication applications. Strategic initiatives such as R&D investments, product miniaturization, and partnerships with research institutes strengthen their competitive positions. Regionally, North America leads the market with a 36% share, driven by strong adoption in healthcare diagnostics, defense screening, and 6G-related research programs, supported by government funding and advanced infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Terahertz Technology Market was valued at USD 703.46 million in 2024 and will reach USD 2243.38 million by 2032, growing at a CAGR of 15.6%.

- Strong drivers include rising adoption in healthcare diagnostics, non-destructive industrial testing, and advanced defense screening systems.

- Key trends highlight growing demand for terahertz communication in 6G networks and increasing miniaturization of devices for commercial and industrial use.

- The market is highly competitive with players such as Advantest Corporation, Luna Innovations, HUBNER GmbH & Co. KG, TeraView Limited, Toptica Photonics AG, Gentec Electro-optics Inc., Bakman Technologies LLC, Menlo Systems, QMC Instruments Ltd., and TeraSense Group focusing on R&D and global collaborations.

- Regional analysis shows North America leading with a 36% share, followed by Europe at 28% and Asia-Pacific at 25%, while healthcare applications dominate with 34% share, reinforcing strong growth prospects across industries.

Market Segmentation Analysis:

By Type

The Terahertz Technology Market by type is dominated by Terahertz Imaging Systems, which hold the largest share at 46%. Within this, active systems lead due to their precision in real-time scanning and adaptability for industrial and healthcare uses. Passive systems remain relevant in defense and security for concealed object detection but are less adopted due to lower resolution. Terahertz Spectroscopy, divided into time-domain and frequency-domain methods, is gaining traction in research applications. Communication systems are emerging but currently hold a smaller share due to ongoing R&D and infrastructure limitations.

- For instance, QMC Instruments offers superconducting bolometer arrays with a spectral range from 100 GHz to 30 THz. These arrays operate around 4 K and offer a large linear dynamic range.

By Application

Healthcare applications dominate the market with a 34% share, driven by terahertz imaging’s ability to detect early-stage cancers and skin diseases without harmful radiation. Laboratory research remains strong, particularly in spectroscopy-based molecular analysis, accounting for a significant share. Industrial non-destructive testing (NDT) is growing, supported by rising adoption in aerospace and semiconductor inspection. Military and defense leverage terahertz systems for security screening, while satellite communication and wireless communication are expanding with growing demand for high-bandwidth data transfer. Other applications, including food inspection, are gaining momentum due to stringent safety regulations.

- For instance, Luna’s T-Ray 5600 THz system is an industrial-grade tool that measures multi-layer thickness and density in opaque materials. It is capable of detecting layers as thin as 50 µm and is used for non-invasive quality assurance in applications such as electric vehicle battery manufacturing.

By End User

Defense and security lead with a 38% share, supported by increasing global investments in advanced screening and surveillance systems. Telecommunications is expanding as terahertz communication systems promise ultra-high-speed data transfer for 6G networks. Industrial adoption is rising in electronics and aerospace sectors for defect detection and material inspection. Food and agriculture is growing steadily, using terahertz for contamination detection and quality assessment. Laboratories continue as essential end users for spectroscopy and imaging studies. Other users, including healthcare facilities and academic institutions, provide consistent demand, ensuring steady adoption across diverse industries.

Key Growth Drivers

Rising Demand in Healthcare Applications

Healthcare drives terahertz technology growth due to its non-invasive imaging capabilities. Terahertz systems detect cancers, skin diseases, and dental conditions without ionizing radiation, making them safer than traditional imaging. With healthcare expenditure rising globally and early diagnosis becoming a priority, adoption in hospitals and diagnostic centers is accelerating. Advancements in terahertz-based endoscopes and compact imaging devices strengthen this demand. The growing preference for precision diagnostics ensures healthcare will remain a primary growth engine for the terahertz technology market over the coming years.

- For instance, Menlo Systems offers the TERA Image automated imaging tool, which can be integrated into its THz time-domain spectroscopy systems. The tool scans sample areas of 150 mm × 150 mm and 300 mm × 300 mm, with spatial resolution better than 250 µm.

Expanding Role in Defense and Security

Defense and security agencies adopt terahertz technology for advanced screening and surveillance. Its ability to detect concealed weapons, explosives, and hazardous materials without harmful exposure makes it ideal for airports, border security, and military checkpoints. Governments worldwide are investing in modern security infrastructure, driving large-scale procurement of terahertz scanners. Rising global threats and cross-border tensions further push adoption. Continuous development of portable, high-resolution terahertz imaging devices ensures the segment remains a robust driver, fueling both domestic and international market expansion.

- For instance, TeraView’s TeraPulse 4000 benchtop unit offers a spectral range from 0.06 THz to 5 THz, with a dynamic range greater than 90 dB at peak, enabling detection of fine features in materials relevant to threat detection.

Growth in Industrial and Research Applications

Industrial sectors increasingly integrate terahertz systems for non-destructive testing (NDT), quality control, and semiconductor inspection. The technology’s ability to detect structural defects and material inconsistencies without damage makes it valuable in aerospace, automotive, and electronics. Simultaneously, laboratories and research institutes rely on terahertz spectroscopy for molecular analysis, drug discovery, and chemical characterization. Expanding investments in R&D across Asia-Pacific and Europe reinforce this adoption. With industries focusing on high precision and research centers demanding advanced tools, these applications significantly accelerate terahertz technology market growth.

Key Trends & Opportunities

Emergence of Terahertz Communication in 6G Networks

Terahertz frequencies are central to next-generation wireless communication. With 6G development underway, terahertz communication systems promise ultra-fast data rates, low latency, and enhanced bandwidth. Telecommunications providers and technology companies are actively investing in terahertz transceivers and antenna systems. This trend creates opportunities for equipment manufacturers and semiconductor companies to commercialize 6G-ready solutions. Growing demand for real-time data transmission in autonomous vehicles, IoT ecosystems, and satellite communication further highlights terahertz communication as a transformative market opportunity over the next decade.

- For instance, Gentec-EO’s T-RAD lock-in radiometers can be paired with various pyroelectric THz detector heads, including those with 5-mm or 9-mm apertures, which operate at room temperature.

Miniaturization and Commercialization of Terahertz Devices

Manufacturers are focusing on miniaturizing terahertz components to create portable, cost-effective devices. Advances in photonics and semiconductor fabrication enable smaller, more efficient terahertz imaging and spectroscopy systems. This trend accelerates adoption in medical diagnostics, food inspection, and industrial testing, where compact and user-friendly solutions are preferred. Commercial availability of handheld scanners and integration with AI-based analysis platforms open new opportunities for mass-market penetration. The shift from bulky laboratory equipment to commercially viable devices positions miniaturization as a key growth opportunity in the market.

- For instance, Bakman Technologies’ portable, turn-key frequency-domain THz spectrometers offer continuous frequency sweep capability from roughly 100 GHz up to 1.8 THz, with frequency resolution down to 100 MHz depending on the model.

Key Challenges

High Cost of Terahertz Systems

The cost of terahertz equipment remains a major barrier to widespread adoption. Advanced imaging and spectroscopy systems require expensive photonic and electronic components, making them unaffordable for small healthcare facilities, research labs, or industrial units. High installation and maintenance expenses further limit deployment. While large defense and government organizations can absorb these costs, commercial industries struggle with return-on-investment challenges. Unless production costs decline and affordable models emerge, market penetration in developing regions and small-scale applications will remain limited.

Technical Complexity and Limited Standardization

Terahertz technology requires complex system integration, precise calibration, and specialized expertise for operation. This technical complexity slows adoption outside of advanced research labs and defense agencies. Additionally, the market lacks standardized protocols for device performance, safety, and data interpretation. Inconsistent regulatory frameworks across regions further restrict commercialization. Without standardized benchmarks, interoperability and scalability of terahertz devices remain limited. Addressing these gaps through global standards and workforce training is crucial to unlock the full commercial potential of terahertz technology.

Regional Analysis

North America

North America dominates the terahertz technology market with a 36% share, supported by strong adoption across healthcare, defense, and industrial sectors. The U.S. leads with investments in non-invasive medical imaging, airport security screening, and R&D programs, while Canada strengthens growth through academic research and telecommunications development. Government funding and presence of leading companies accelerate commercialization. Expanding demand for high-speed communication technologies also drives 6G-related research. With well-established healthcare infrastructure and stringent security regulations, North America remains the largest revenue contributor and sets benchmarks in technological innovation and product deployment within the global terahertz technology landscape.

Europe

Europe holds a 28% share of the terahertz technology market, with robust applications in healthcare, security, and industrial non-destructive testing. Germany and the U.K. drive adoption through significant research investments in spectroscopy and imaging systems. The European Union’s strict food safety and product quality regulations foster demand for terahertz inspection solutions in agriculture and manufacturing. Defense modernization across France and Italy adds to market expansion. Collaborative research projects among universities, industries, and government bodies further strengthen regional leadership. Europe’s strong focus on sustainability, regulatory compliance, and advanced manufacturing ensures consistent adoption across diverse industries in the region.

Asia-Pacific

Asia-Pacific accounts for 25% of the terahertz technology market and emerges as the fastest-growing region with a 5.0% CAGR. China, Japan, and South Korea drive growth through large-scale R&D, semiconductor manufacturing, and healthcare adoption. Expanding investments in 6G communication trials significantly boost demand for terahertz communication systems. India’s rising healthcare spending and industrial growth create new opportunities for imaging and testing applications. Government support for defense modernization and food safety monitoring enhances adoption. The presence of leading electronics and telecommunication players, coupled with increasing commercialization efforts, positions Asia-Pacific as the key growth hub for the next decade.

Latin America

Latin America represents a 5.2% share of the terahertz technology market, driven mainly by healthcare diagnostics, food quality inspection, and emerging industrial applications. Brazil leads the region with investments in medical imaging technologies and industrial testing solutions, while Mexico follows with adoption in defense and communication research. The region faces challenges due to limited R&D infrastructure and high equipment costs, slowing large-scale adoption. However, strengthening food safety regulations and government initiatives to modernize healthcare infrastructure create opportunities. As industries and laboratories adopt compact and cost-effective systems, Latin America is expected to show steady growth in terahertz adoption.

Middle East & Africa

The Middle East & Africa region holds a 5.8% share in the terahertz technology market, with steady growth driven by investments in defense and security infrastructure. Countries like the UAE and Saudi Arabia are adopting terahertz-based scanning systems for border control and airport security. Industrial adoption is limited but growing in oil and gas inspection and petrochemical applications. Africa shows gradual uptake through academic research and healthcare projects. While high equipment costs restrict widespread deployment, increasing government funding for advanced technologies and strategic security initiatives will support gradual market expansion across the region in the coming years.

Market Segmentations:

By Type:

- Active System

- Passive System

By Application:

- Laboratory Research

- Healthcare

By End User:

- Defense and Security

- Telecommunications

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the terahertz technology market features prominent players such as QMC Instruments Ltd., Luna Innovations, Menlo Systems, TeraView Limited, Gentec Electro-optics Inc., Bakman Technologies LLC, HUBNER GmbH & Co. KG, TeraSense Group, Advantest Corporation, and Toptica Photonics AG. The competitive landscape of the terahertz technology market is defined by rapid innovation, strong research collaborations, and expanding commercialization efforts across industries. Companies are focusing on developing advanced imaging, spectroscopy, and communication systems that address healthcare diagnostics, defense security, industrial non-destructive testing, and emerging 6G communication demands. Strategic partnerships with research institutions and government agencies are accelerating product development and standardization. The market also witnesses rising emphasis on miniaturization, affordability, and integration with AI-driven analytics, enabling broader adoption across laboratories, hospitals, and industrial facilities. As demand increases globally, competition centers on technological differentiation, application-specific solutions, and regional expansion strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- QMC Instruments Ltd.

- Luna Innovations

- Menlo Systems

- TeraView Limited

- Gentec Electro-optics Inc.

- Bakman Technologies LLC

- HUBNER GmbH & Co. KG

- TeraSense Group

- Advantest Corporation

- Toptica Photonics AG

Recent Developments

- In July 2024, US-based wellness solution provider Viiva launched its Viiva Discovery Station (VDS) in India, introducing terahertz technology to the market. Terahertz technology is widely used for detecting defects in tablet coatings, product inspection in various industries, material characterization in physics, identifying concealed weapons at airports, and detecting cancer and dental caries.

- In July 2024, TicWave Solutions GmbH announced the launch of their latest silicon-based terahertz product line, now available on their website. The new product categories include Terahertz Cameras, Terahertz Sources, and Terahertz Imaging Systems.

- In January 2024, Gentec Electro-Optics, a provider of laser beam and terahertz technology, launched a new PRONTO-250-FLEX laser power meter. It has flexible calibration options, allowing customers to pay only for the services they avail.

- In December 2023, TeraView Limited hosted a delegation from Malaysia at its headquarters in the UK. The visit is expected to pave the way for future partnerships & opportunities in applying terahertz technology. It aimed to explore potential collaborations between TeraView and critical stakeholders in Malaysia’s technology and research sectors.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with increasing adoption of terahertz imaging in healthcare diagnostics.

- Rising demand for advanced security screening will strengthen defense and homeland security applications.

- Industrial non-destructive testing will see higher uptake in aerospace, automotive, and semiconductor sectors.

- Terahertz communication will play a key role in the evolution of 6G networks.

- Miniaturization of terahertz devices will drive broader adoption across commercial and industrial sectors.

- Integration with AI and machine learning will enhance precision in spectroscopy and imaging.

- Food and agriculture industries will adopt terahertz systems for quality control and safety monitoring.

- Collaborative research between governments, academia, and private companies will accelerate innovation.

- Cost optimization and improved production efficiency will increase market penetration in developing regions.

- Standardization efforts and regulatory frameworks will support global commercialization and interoperability.