Market Overview:

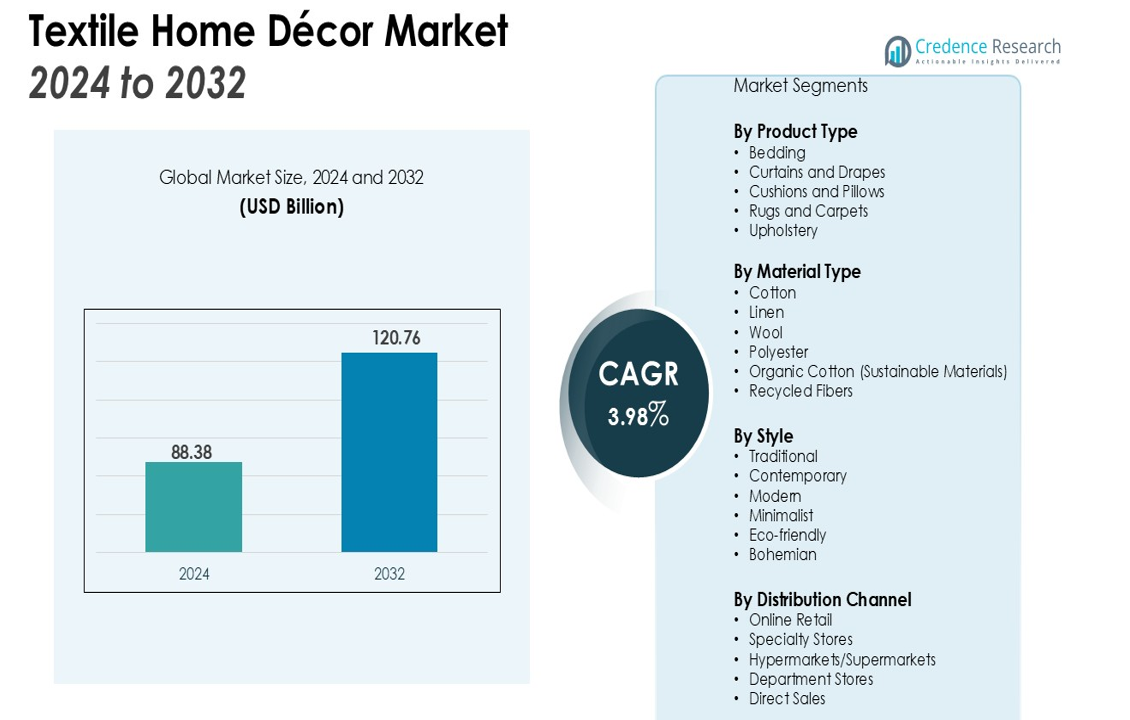

The Textile Home Décor Market size was valued at USD 88.38 billion in 2024 and is anticipated to reach USD 120.76 billion by 2032, at a CAGR of 3.98% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Textile Home Décor Market Size 2024 |

USD 88.38 billion |

| Textile Home Décor Market, CAGR |

3.98% |

| Textile Home Décor Market Size 2032 |

USD 120.76 billion |

Key drivers of market growth include the growing trend toward home personalization, rising disposable income, and the expanding real estate sector. Consumers are increasingly opting for sustainable, eco-friendly textile home decor products, contributing to the shift toward environmentally conscious manufacturing. Additionally, the increasing popularity of online retail platforms has made textile home decor more accessible to a global audience, further fueling market expansion.

Regionally, North America holds the largest market share, supported by a high standard of living and strong demand for luxury home decor products. Europe follows closely, with countries like Germany and the UK witnessing strong demand for premium textile products. The Asia Pacific region is expected to experience the highest growth rate during the forecast period, driven by urbanization, changing lifestyles, and growing consumer spending in emerging economies like China and India.

Market Insights:

- The textile home decor market was valued at USD 88.38 billion in 2024 and is projected to reach USD 120.76 billion by 2032, growing at a CAGR of 3.98%.

- Rising demand for personalized home decor solutions is driving the market, with consumers seeking customized textile products like unique patterns and colors.

- The growing preference for eco-friendly, sustainable materials, such as organic cotton and recycled fabrics, is a key driver of market growth.

- Increased disposable income, especially in emerging markets, is boosting consumer spending on premium and high-quality textile home decor products.

- The expanding real estate sector continues to influence the demand for home decor textiles, with new homebuyers investing in aesthetic products for their spaces.

- The Asia Pacific region holds a 22% market share and is expected to experience the highest growth due to urbanization and changing consumer preferences.

- Intense competition and price sensitivity challenge brands to innovate while maintaining affordability and quality in textile home decor products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Personalized Home Decor

Consumers are increasingly seeking personalized home decor solutions, driving demand for textile products that reflect individual tastes and preferences. Textile home decor allows for customization in various aspects, such as fabric choices, patterns, and colors, offering consumers the opportunity to create unique living spaces. This trend is further fueled by the growing influence of social media platforms, where interior design inspirations lead to heightened interest in personalizing home environments. Homeowners now view textile home decor as a means of expressing personal style, contributing to its growing popularity.

- For instance, Contrado, a company specializing in custom fabric printing, empowers consumer creativity by offering a choice of 138 different fabrics for their designs. The company’s digital printing technology provides a rapid turnaround, with custom products ready in as little as 1 to 2 days.

Increase in Disposable Income and Changing Lifestyles

The rising disposable income, especially in emerging economies, is a significant driver for the textile home decor market. With higher income levels, consumers are more willing to invest in premium home textiles for enhancing their living spaces. Changing lifestyles and a growing focus on home comfort and aesthetics have led to a shift in consumer preferences toward high-quality, durable, and stylish textile products. This shift is particularly prominent in urban areas, where space optimization and home decor play a significant role in consumers’ purchasing decisions.

- For instance, in response to demand for premium products, Welspun is establishing a new pillow manufacturing facility in Ohio, USA. This greenfield project represents a significant investment in producing high-quality goods closer to the market, with the plant having an initial capacity to produce 6.7 million pillows annually.

Growth of the Real Estate Sector

The expansion of the global real estate sector directly influences the textile home decor market. Increased construction of residential properties, along with a booming real estate market in developing regions, creates a substantial demand for home decor products, including textiles. New homebuyers and renters prioritize enhancing their living spaces with modern and attractive textile decor items, boosting the sales of products such as curtains, rugs, cushions, and bed linens. The growth of this sector is expected to maintain a positive outlook for the textile home decor industry.

Shift Toward Eco-Friendly and Sustainable Products

The growing consumer demand for sustainability is becoming a critical driver in the textile home decor market. Eco-conscious buyers prefer products made from sustainable materials, such as organic cotton, recycled fabrics, and biodegradable textiles. Manufacturers are responding by offering eco-friendly options that align with consumer values. This shift toward sustainable home decor is likely to continue as consumers seek to reduce their environmental impact while enhancing their homes with high-quality, responsible products.

Market Trends:

Growing Popularity of Smart Textiles in Home Decor

The integration of smart textiles into home decor is a prominent trend in the market. These textiles are embedded with technology to offer enhanced functionality, such as temperature regulation, lighting control, and even health-monitoring capabilities. Smart textiles in bedding, curtains, and upholstery are gaining traction due to the increasing demand for convenience and innovation in home interiors. Consumers are looking for solutions that not only improve aesthetics but also provide practical benefits. This trend is expected to expand as technological advancements make smart textiles more affordable and accessible to a wider audience. Manufacturers are investing in research and development to create textile home decor items that seamlessly combine design with innovative technology.

- For instance, Carnegie Fabrics has developed high-performance textiles for commercial interiors that demonstrate significant durability. Their Endeavor Collection fabrics are engineered to withstand 100,000 double rubs, ensuring longevity in high-traffic environments.

Rising Preference for Sustainable and Eco-Friendly Products

Sustainability has become a dominant trend in the textile home decor market, with a growing number of consumers prioritizing eco-friendly and ethical products. The demand for materials such as organic cotton, hemp, and recycled fibers has increased significantly as environmental concerns rise. Consumers are more conscious of the environmental impact of their purchases, leading to a shift toward home decor products that promote sustainability. Textile home decor brands are responding by adopting eco-friendly production methods and offering products that align with these values. This trend is driving innovation within the industry, with manufacturers focusing on reducing waste, conserving water, and minimizing energy use during production processes. Sustainability is expected to remain a key factor influencing consumer purchasing decisions in the coming years.

- For instance, as part of its broad sustainability initiatives, IKEA reported a significant achievement in its fiscal year 2023. The company’s total climate footprint for the year was estimated to be 24.1 million tonnes of CO2 equivalent.

Market Challenges Analysis:

Supply Chain Disruptions and Raw Material Shortages

The textile home decor market faces challenges related to supply chain disruptions and raw material shortages. Global supply chain issues, exacerbated by events like the COVID-19 pandemic, have led to delays in production and increased costs for manufacturers. A shortage of key raw materials, such as cotton and synthetic fibers, has made it difficult for brands to meet consumer demand. These disruptions also affect the timely delivery of finished products, further impacting market growth. Manufacturers are forced to adapt to these challenges by finding alternative sourcing solutions and improving inventory management practices. However, the ongoing volatility in the supply chain remains a significant hurdle for the industry.

Intense Competition and Price Sensitivity

The textile home decor market is highly competitive, with numerous local and international players vying for market share. This intense competition puts pressure on brands to continuously innovate while managing costs. Consumers are increasingly price-sensitive, seeking high-quality products at affordable prices, which forces manufacturers to balance quality, design, and pricing. Brands that cannot differentiate themselves or offer unique value propositions may struggle to maintain a competitive edge. The increasing presence of online platforms also intensifies price competition, as consumers have easy access to a wide variety of products at different price points. This price sensitivity and competition challenge manufacturers to develop cost-effective solutions without compromising on quality.

Market Opportunities:

Expansion of Online Retail and E-Commerce Platforms

The growing shift toward online retail presents a significant opportunity for the textile home decor market. Consumers increasingly prefer the convenience of shopping from home, leading to higher demand for digital platforms that offer a wide variety of textile products. E-commerce giants and specialized online retailers are capitalizing on this trend by providing easy access to diverse home decor textiles, allowing consumers to explore a broader range of designs, materials, and price points. This digital transformation opens doors for companies to reach global audiences and expand their market presence. Furthermore, online platforms enable targeted marketing, helping brands better connect with specific consumer segments and tailor their offerings.

Increasing Demand for Sustainable and Eco-Friendly Textiles

The rising consumer focus on sustainability presents a significant opportunity for growth within the textile home decor market. Consumers are increasingly seeking eco-friendly products made from organic, biodegradable, or recycled materials. Manufacturers can tap into this growing demand by incorporating sustainable practices in their production processes and offering environmentally friendly home decor options. As awareness of climate change and resource conservation grows, brands that prioritize sustainability are likely to attract a loyal customer base. This trend aligns with a broader industry movement toward adopting circular economy principles, providing long-term opportunities for growth and differentiation in the market.

Market Segmentation Analysis:

By Product Type:

The textile home decor market is primarily segmented into bedding, curtains and drapes, cushions and pillows, rugs and carpets, and upholstery. Bedding holds the largest market share due to its essential role in home decor, driven by the increasing demand for comfort and design. Rugs and carpets also make up a significant portion of the market, as they add both functionality and style to living spaces. Upholstery is gaining traction, especially in the premium market segment, as consumers focus on the aesthetic appeal of their furniture.

- For instance, Sleep Number’s 360® smart bed showcases a significant technological achievement in personalized comfort.

By Material Type:

The market is dominated by natural fabrics such as cotton, linen, and wool, which remain the preferred choice due to their comfort and versatility. Cotton, in particular, leads the market due to its affordability and wide range of uses in home textiles. Synthetic materials like polyester are also popular, known for their durability and easy maintenance. A growing trend towards sustainability is driving demand for eco-friendly materials such as organic cotton and recycled fibers, with consumers increasingly prioritizing environmentally conscious choices.

- For instance, Textile Exchange’s 2025 Recycled Polyester Challenge has spurred significant industry action, with 116 companies signing on to increase their use of recycled polyester.

By Style:

Consumer preferences for traditional, contemporary, and modern styles drive the textile home decor market. Traditional home decor continues to dominate, particularly in North America and Europe, where classic designs are favored. Modern and minimalist styles are increasingly popular, especially in urban areas, as consumers opt for clean, simple lines and neutral tones. Additionally, eco-friendly and bohemian styles are gaining momentum, reflecting the growing interest in sustainability and personalized, unique home environments.

Segmentations:

By Product Type:

- Bedding

- Curtains and Drapes

- Cushions and Pillows

- Rugs and Carpets

- Upholstery

By Material Type:

- Cotton

- Linen

- Wool

- Polyester

- Organic Cotton (Sustainable Materials)

- Recycled Fibers

By Style:

- Traditional

- Contemporary

- Modern

- Minimalist

- Eco-friendly

- Bohemian

By Distribution Channel:

- Online Retail

- Specialty Stores

- Hypermarkets/Supermarkets

- Department Stores

- Direct Sales

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America: Leading the Premium Segment

North America holds a 35% share of the global textile home decor market, driven by strong demand for premium products. Consumers in the U.S. and Canada prioritize high-quality, stylish home decor items, with significant spending on textiles for home interiors. The region also benefits from a well-established retail infrastructure and a growing preference for eco-friendly and sustainable products. Online retail platforms have further boosted market growth by offering convenient shopping experiences and a wide range of textile home decor options. The ongoing trend of home improvement, along with rising disposable incomes, continues to support market expansion in this region.

Europe: High Demand for Traditional and Sustainable Products

Europe accounts for 28% of the textile home decor market, with countries like Germany, France, and the UK driving demand. The region exhibits a strong preference for traditional home decor styles, with a significant market for both modern and vintage textile products. Growing awareness of environmental issues has increased the demand for sustainable and eco-friendly textiles. Manufacturers in Europe are responding to this by focusing on producing textile home decor with natural, recyclable materials. The rise in online shopping, combined with the region’s penchant for home styling, creates opportunities for further market growth in the coming years.

Asia Pacific: Rapid Growth in Emerging Economies

The Asia Pacific region holds a 22% share of the textile home decor market and is expected to see the highest growth rate during the forecast period. Urbanization, rising disposable incomes, and changing consumer preferences in emerging economies like China and India contribute to this growth. The growing middle class in these countries is increasing spending on home decor products, including textiles for bedding, curtains, and upholstery. E-commerce platforms are expanding rapidly, making textile home decor products more accessible to consumers. As lifestyles evolve and urban living spaces become more common, demand for affordable, stylish home textiles is expected to continue rising.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Walmart

- Joann Fabrics and Crafts

- Home Depot

- Pier 1 Imports

- Wayfair

- Crate and Barrel

- WilliamsSonoma

- IKEA

- West Elm

- Anthropologie

- Pottery Barn

- Target

Competitive Analysis:

The textile home decor market is highly competitive, with several key players dominating the landscape. Companies like IKEA, Bed Bath & Beyond, and Target are leading due to their extensive product range, competitive pricing, and strong brand presence. These players capitalize on their large-scale distribution networks, ensuring wide accessibility across global markets. Smaller brands focus on niche segments, offering personalized and sustainable products to appeal to eco-conscious consumers. The market is also witnessing increased participation from online retailers such as Amazon and Wayfair, which are reshaping the competitive dynamics by providing a convenient shopping experience and a broad selection of textile home decor products. Manufacturers are focusing on product innovation, incorporating eco-friendly materials and smart textiles to differentiate themselves. Competitive strategies revolve around product diversification, sustainability, and expanding digital platforms to cater to changing consumer preferences. The market remains dynamic, with growing opportunities for both established and emerging brands.

Recent Developments:

- In March 2025, The Home Depot launched Magic Apron, a suite of generative AI tools on its website and mobile app to assist customers with their projects.

- In January 2025, The Home Depot partnered with DoorDash to offer on-demand delivery of home improvement products in as little as an hour.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Material Type, Style, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for sustainable and eco-friendly textile home decor will continue to rise as consumers prioritize environmentally responsible choices.

- Personalized and customizable home decor products will see increased popularity, with consumers seeking unique designs that reflect individual styles.

- E-commerce platforms will play a significant role in the market’s growth, offering convenience and a broader range of textile home decor products.

- The focus on smart textiles and home automation will drive innovation, with products offering features like temperature control and integrated technology.

- Urbanization and rising disposable income, particularly in emerging economies, will lead to a higher demand for home textiles, especially in cities.

- The trend toward minimalism and modern designs will shape consumer preferences, driving demand for sleek, functional textile products.

- Companies will increasingly adopt circular economy principles, using recycled and sustainable materials in their production processes.

- Luxury home decor will continue to grow, particularly in North America and Europe, with a focus on high-end, premium textiles.

- There will be a growing interest in multifunctional textile products, such as convertible furniture and space-saving designs.

- Partnerships and collaborations between textile manufacturers and interior designers will become more common to create exclusive and trendy collections for consumers.