Market Overview

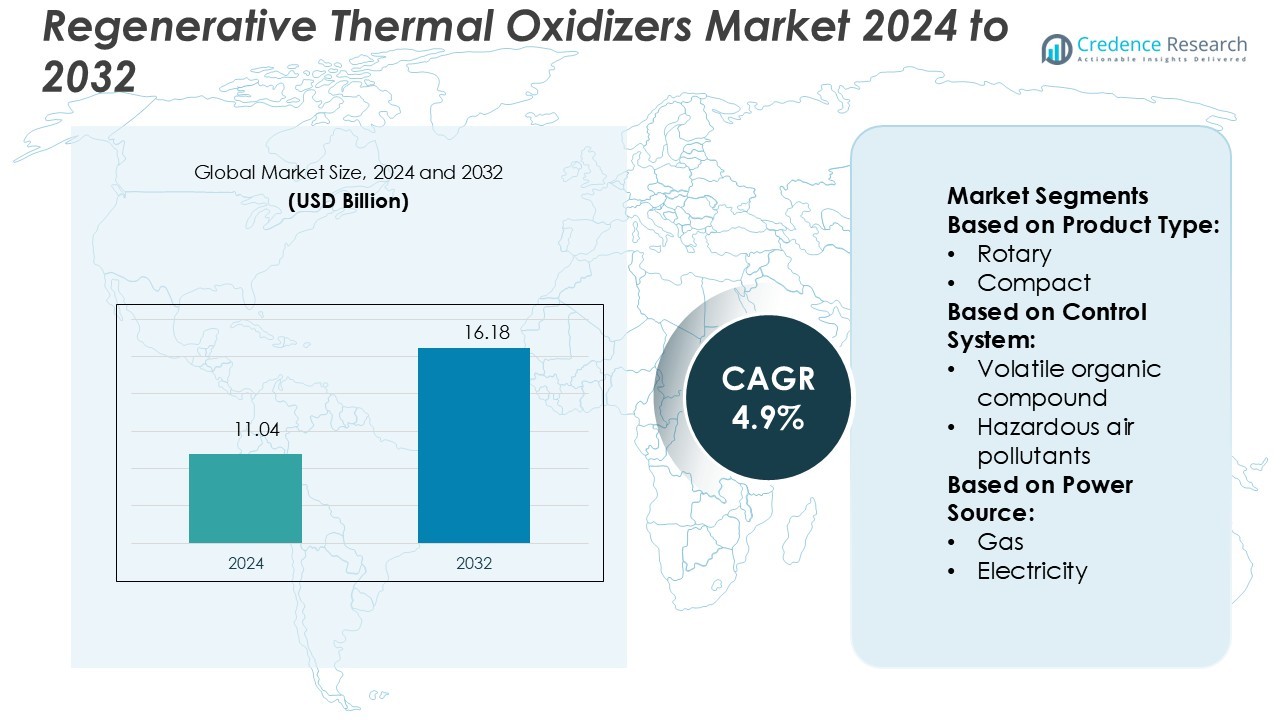

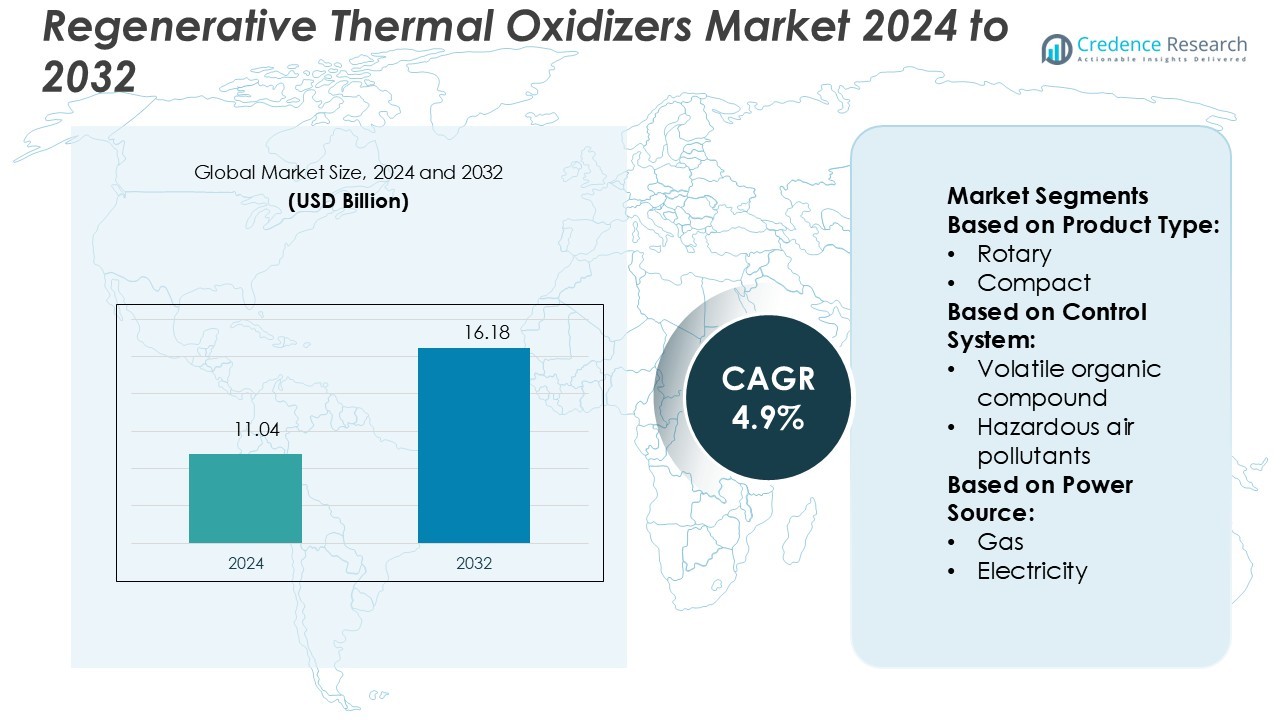

Regenerative Thermal Oxidizers Market size was valued USD 11.04 billion in 2024 and is anticipated to reach USD 16.18 billion by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Regenerative Thermal Oxidizers Market Size 2024 |

USD 11.04 Billion |

| Regenerative Thermal Oxidizers Market, CAGR |

4.9% |

| Regenerative Thermal Oxidizers Market Size 2032 |

USD 16.18 Billion |

The regenerative thermal oxidizers market features strong competition with top players such as Fives Group, EPA Technologies, Nitro Environmental, HIDROJET, Biothermica Technologies, Kono Kogyo, Condorchem Envitech, Anguil Environmental Systems, Gulf Coast Environmental Systems, and Catalytic Products International. These companies focus on advanced designs, energy efficiency, and compliance with stringent emission standards to maintain market leadership. Their strategies include global expansion, technology partnerships, and customized solutions tailored for diverse industries. Asia-Pacific emerges as the leading region, holding 34% of the market share, driven by rapid industrialization, stricter environmental regulations, and rising adoption across chemicals, automotive, and electronics sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Regenerative Thermal Oxidizers Market size was valued at USD 11.04 billion in 2024 and is projected to reach USD 16.18 billion by 2032, growing at a CAGR of 4.9%.

- Market growth is driven by stringent emission regulations, rising demand for energy-efficient systems, and industrial expansion across key sectors including chemicals, automotive, and food processing.

- Trends such as IoT integration, predictive maintenance, and modular system designs are reshaping product offerings, creating opportunities for improved efficiency and lower operating costs.

- The market is highly competitive with players like Fives Group, EPA Technologies, and Anguil Environmental Systems focusing on global expansion, technological innovation, and compliance-driven solutions, while smaller firms target niche applications.

- Asia-Pacific leads with 34% share, supported by rapid industrialization and strict regulations, followed by North America at 32% and Europe at 28%; among product types, rotary systems dominate due to high efficiency in large-scale industrial applications.

Market Segmentation Analysis:

By Product Type

Rotary regenerative thermal oxidizers hold the largest market share due to their high efficiency and scalability. These systems are preferred in industries such as chemicals, petrochemicals, and automotive, where large volumes of air emissions require treatment. Their ability to recover up to 95% of heat energy reduces operating costs and makes them a cost-effective solution. Compact systems are gaining traction in small-scale facilities, but their limited throughput restricts dominance. Demand for rotary systems remains strong, driven by stricter regulations and rising adoption in large industrial plants.

- For instance, Fives Group’s rotary regenerative thermal oxidizers (RTOs) are renowned for their high efficiency and scalability. Their ITAS Rigetherm™ model, for example, can handle airflow rates ranging from 5,000 to 250,000 Nm³/h, making them suitable for large-scale industrial applications such as chemical and petrochemical plants.

By Control System

Volatile organic compound (VOC) control systems dominate the market with the highest share, driven by stringent emission standards across manufacturing industries. VOC oxidizers are widely deployed in packaging, paints, and coatings industries due to their proven ability to destroy harmful compounds at high efficiency. Hazardous air pollutant and odor control systems are expanding in niche applications, but VOC control remains the primary revenue contributor. Increasing awareness of workplace air quality and global regulations on VOC emissions continue to boost adoption of these systems across key end-user industries.

- For instance, Nitro Environmental provides turnkey services for Direct-Fired Thermal Oxidizers, which are designed to achieve a destruction removal efficiency (DRE) of over 99% for VOCs.

By Power Source

Gas-powered regenerative thermal oxidizers lead the market, capturing the dominant share due to their energy reliability and efficiency. Natural gas provides a stable fuel source, making it the preferred option for continuous, large-scale industrial operations. Electricity-powered units are emerging, supported by renewable energy integration and sustainability goals, but their adoption is limited by higher operating costs in high-capacity applications. Gas-powered systems continue to drive growth, supported by strong demand in regions with established gas infrastructure and industries requiring large-scale emission abatement solutions.

Key Growth Drivers

Stringent Environmental Regulations

Stringent environmental regulations on industrial emissions drive the adoption of regenerative thermal oxidizers. Governments in North America, Europe, and Asia enforce strict standards on volatile organic compounds (VOCs) and hazardous air pollutants. Industries such as chemicals, automotive, and food processing invest heavily in these systems to comply with legal frameworks and avoid penalties. Regulatory focus on sustainability strengthens demand, making RTOs an essential investment for emission-intensive facilities. Rising inspections and compliance checks further accelerate installations across diverse industrial sectors.

- For instance, VOC concentration is as low as 2 g/Nm³, reducing the need for auxiliary fuel consumption. This high thermal efficiency ensures compliance with stringent emission standards while minimizing operational costs.

Energy Efficiency and Cost Savings

Energy efficiency and operational cost savings remain core growth drivers for regenerative thermal oxidizers. RTOs recover up to 95% of heat energy, reducing fuel consumption and lowering operating expenses. This capability appeals to industries managing high-volume exhaust streams where energy recovery translates into significant financial savings. As companies prioritize cost control and long-term sustainability, demand for energy-efficient RTOs increases. Industries view them not only as compliance solutions but also as strategic tools for improving profit margins and operational efficiency.

- For instance, Biothermica’s Biotox® regenerative thermal oxidizer (RTO) units are designed for applications like treating emissions from printing processes. The system is capable of achieving high thermal efficiency (up to 95%) and a VOC destruction efficiency exceeding 98%.

Industrial Expansion and Globalization

Rising industrial expansion and globalization significantly boost demand for regenerative thermal oxidizers. Rapid growth in manufacturing sectors, including pharmaceuticals, paints, and electronics, increases the volume of emissions requiring treatment. Emerging economies in Asia-Pacific and Latin America are witnessing new industrial plants equipped with advanced air pollution control technologies. Global companies expanding operations in these regions adopt RTOs to align with international environmental standards. This expansion enhances adoption across diverse industries, ensuring continued market growth and technological advancement.

Key Trends & Opportunities

Integration of IoT and Automation

The integration of IoT and automation in regenerative thermal oxidizers is reshaping market opportunities. Smart monitoring systems enable predictive maintenance, real-time emissions tracking, and operational optimization. Automated controls reduce downtime and enhance system efficiency, providing industries with reliable performance and compliance assurance. IoT-enabled RTOs support remote management, making them attractive for multinational operations. This trend creates new opportunities for manufacturers to differentiate offerings with digital-enabled solutions that align with Industry 4.0 practices.

- For instance, Kono Kogs, Inc. systems are designed to operate at temperatures between 1,500°F and 1,600°F, with a residence time of 0.5 to 1.0 seconds, ensuring efficient destruction of volatile organic compounds (VOCs) and hazardous air pollutants (HAPs).

Sustainability and Renewable Energy Adoption

Sustainability goals and renewable energy adoption are shaping new opportunities in the RTO market. Industries are increasingly focused on aligning operations with carbon neutrality targets and eco-friendly practices. Electricity-powered and hybrid oxidizers, though less common, are gaining traction as companies explore alternatives to natural gas dependency. Manufacturers offering energy-efficient and eco-friendly designs gain a competitive edge. Growing investments in sustainable infrastructure further position RTOs as essential components of green industrial strategies.

- For instance, Condorchem Envitech RTOs can handle air volumes between 10,000 and 100,000 m³/h, treating solvent concentrations up to 11,000 mg/Nm³, with an operating temperature of 750°C and a thermal efficiency exceeding 95%.

Expansion in Emerging Economies

Emerging economies present untapped opportunities for the regenerative thermal oxidizers market. Rapid industrialization in India, China, and Brazil fuels demand for reliable air pollution control systems. Governments are tightening environmental laws, driving adoption across sectors such as textiles, pharmaceuticals, and automotive. Local industries prioritize RTOs to balance regulatory compliance with efficiency. Expansion in these markets provides manufacturers with long-term growth prospects supported by rising industrial investments and increasing awareness of emission control technologies.

Key Challenges

High Initial Investment Costs

High initial investment costs challenge the widespread adoption of regenerative thermal oxidizers, particularly among small and medium enterprises. The installation of RTO systems requires substantial capital expenditure, including design, customization, and integration. For industries with limited budgets, the upfront expense often outweighs long-term energy savings. This cost barrier slows adoption in price-sensitive markets. Manufacturers face the challenge of developing cost-effective solutions to cater to smaller facilities while maintaining efficiency and compliance standards.

Operational Complexity and Maintenance Needs

Operational complexity and maintenance requirements pose challenges for RTO deployment. These systems rely on precise temperature control, refractory materials, and valve mechanisms, which demand regular upkeep. Any malfunction can lead to costly downtime, reducing production efficiency. Skilled technicians are necessary to maintain system reliability, but workforce shortages often increase maintenance challenges. Companies face pressure to balance operational efficiency with maintenance costs, making it essential for manufacturers to offer user-friendly designs with lower service requirements.

Regional Analysis

North America

North America holds a 32% share of the regenerative thermal oxidizers market, supported by strict environmental regulations and advanced industrial infrastructure. The United States leads adoption, driven by the Environmental Protection Agency’s (EPA) stringent standards on VOC and hazardous air pollutant emissions. Industries such as automotive, petrochemicals, and food processing contribute significantly to demand. High awareness of energy efficiency and the presence of established manufacturers strengthen the region’s market position. Canada also shows steady growth, with its industrial modernization efforts and emphasis on sustainable technologies reinforcing market expansion across diverse sectors.

Europe

Europe accounts for 28% of the regenerative thermal oxidizers market, with leadership from Germany, the UK, and France. The region’s strict emission control directives, including the Industrial Emissions Directive (IED), drive robust adoption. Automotive and chemical sectors play a major role, as compliance with carbon reduction policies fuels investment in RTO systems. Germany dominates due to its large-scale manufacturing base, while France and Italy show rising demand from pharmaceuticals and paints industries. Strong government focus on decarbonization, coupled with technological innovations, ensures continued growth across Europe, making it a mature and competitive regional market.

Asia-Pacific

Asia-Pacific commands the largest share at 34%, driven by rapid industrialization in China, India, and Southeast Asia. China leads the region, with strict environmental policies encouraging widespread adoption in chemicals, textiles, and electronics. India follows, supported by strong government initiatives to regulate industrial emissions and modernize facilities. Expanding automotive production across South Korea and Japan also boosts adoption. Low-cost manufacturing and rising foreign investments accelerate demand for cost-effective and efficient RTO systems. Asia-Pacific’s dominance is reinforced by its large industrial base and growing awareness of emission control technologies across multiple industries.

Latin America

Latin America represents 4% of the regenerative thermal oxidizers market, with Brazil and Mexico driving regional demand. Industrial growth in food processing, petrochemicals, and automotive sectors contributes to adoption. Regulatory frameworks are less stringent compared to North America and Europe, but enforcement is strengthening in major economies. Brazil shows the fastest uptake due to investments in industrial modernization and export-focused manufacturing. Mexico follows with steady demand from automotive suppliers and electronics industries. While the overall share is small, increasing environmental regulations and rising industrial activity are expected to create expansion opportunities in this region.

Middle East & Africa

The Middle East & Africa account for 2% of the regenerative thermal oxidizers market, with adoption mainly concentrated in Gulf Cooperation Council (GCC) countries and South Africa. Oil and gas industries in Saudi Arabia and the UAE drive demand, as emission control systems become integral to meet global compliance standards. South Africa shows growth in mining and chemicals, adopting RTOs to improve sustainability practices. Limited industrial diversification restricts overall adoption, but rising awareness of environmental compliance and ongoing industrial investments are expected to gradually increase demand in this developing regional market.

Market Segmentations:

By Product Type:

By Control System:

- Volatile organic compound

- Hazardous air pollutants

By Power Source:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The regenerative thermal oxidizers market is highly competitive, with key players including Fives Group, EPA Technologies, Nitro Environmental, HIDROJET, Biothermica Technologies, Kono Kogyo, Condorchem Envitech, Anguil Environmental Systems, Gulf Coast Environmental Systems, and Catalytic Products International. The regenerative thermal oxidizers market is characterized by strong competition, with companies focusing on innovation, efficiency, and compliance to maintain their positions. Market participants emphasize developing systems with higher thermal efficiency and reduced operational costs to address industries’ growing demand for sustainable solutions. Advanced designs that enhance heat recovery and minimize fuel consumption are gaining traction, particularly in high-capacity sectors such as petrochemicals, automotive, and food processing. Companies are also investing in compact and modular systems to serve small and medium enterprises. Strategic initiatives, including global expansion, technology partnerships, and sustainability-driven product launches, continue to shape the competitive environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fives Group

- EPA Technologies

- Nitro Environmental

- HIDROJET

- Biothermica Technologies

- Kono Kogyo

- Condorchem Envitech

- Anguil Environmental Systems

- Gulf Coast Environmental Systems

- Catalytic Products International

Recent Developments

- In December 2024, Brenmiller Energy Ltd, a leading global energy provider of thermal energy storage solutions to industrial and utility customers, announced that its bGen™ ZERO thermal energy storage has been selected to anchor a clean energy project being developed by Recursos de la Biomasa (“REBI”) in Spain, a leading Energy Service Company (ESCO) specializing in the decarbonization of residential and industrial heat.

- In November 2024, A 100MW thermal solar and molten salt energy storage system in Xinjiang, China, is set to be completed and integrated into the grid by the end of the year as part of a broader 1GW solar thermal energy storage and photovoltaic integration project in Turfan.

- In December 2023, Catalytic Products International (CPI) newly launched a 35,000 SCFM Regenerative thermal oxidizer (RTO) for the paint booth industry located in the northeastern part of the USA. The RTO was used with TRITON-35.95 and was placed in regions of the facility where VOC emissions of toluene, ethyl acetate, and isopropyl alcohol were targeted.

- In June 2023, SatVu launched its revolutionary thermal imaging satellite, HOTSAT-1. Once deployed in orbit, this advanced climate technology offers unparalleled insights into economic activities and energy efficiency across various industries.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Control System, Power Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising enforcement of emission control regulations worldwide.

- Demand will grow as industries prioritize energy-efficient solutions to reduce operating costs.

- Asia-Pacific will remain the leading region due to rapid industrialization and stricter policies.

- Adoption of IoT-enabled and automated RTO systems will increase for real-time monitoring.

- Compact and modular systems will gain traction among small and medium industries.

- Sustainability targets will drive interest in electricity-powered and hybrid oxidizer solutions.

- Emerging economies will create new opportunities with expanding manufacturing sectors.

- Investments in R&D will focus on enhancing system durability and reducing maintenance needs.

- Strategic collaborations will strengthen global supply chains and technology integration.

- Long-term growth will be shaped by industries aligning operations with carbon neutrality goals.