Market Overview

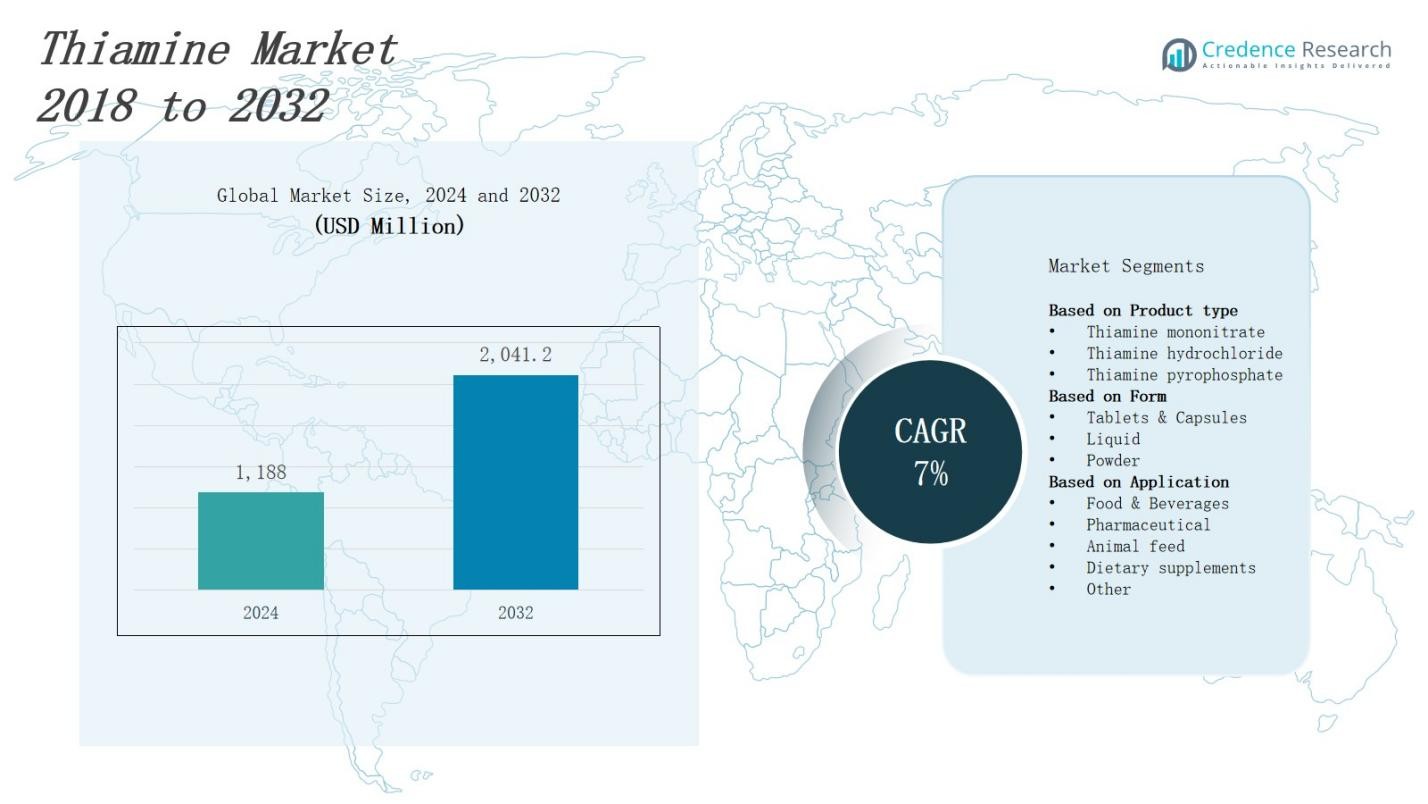

The Thiamine market is projected to grow from USD 1,188 million in 2024 to USD 2,041.2 million by 2032, expanding at a CAGR of 7%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Thiamine Market Size 2024 |

USD 1,188 Million |

| Thiamine Market, CAGR |

7% |

| Thiamine Market Size 2032 |

USD 2,041.2 Million |

The thiamine market grows driven by rising demand for fortified foods and dietary supplements due to increasing awareness of vitamin B1’s health benefits. Growing prevalence of nutritional deficiencies and chronic diseases encourages thiamine supplementation. Expanding applications in animal feed and pharmaceutical industries further support market growth. Innovations in delivery forms, such as sustained-release and bioavailable formulations, enhance consumer acceptance. Additionally, regulatory support for mandatory fortification in several regions boosts adoption. The trend toward natural and clean-label products also drives manufacturers to develop thiamine sourced from natural ingredients, strengthening market expansion opportunities.

The thiamine market spans North America, Europe, Asia-Pacific, and the Rest of the World, with North America leading at 35%, followed by Europe at 28%, Asia-Pacific at 25%, and the Rest of the World holding 12%. Key players such as BASF, DSM, Lonza Group AG, Jiangsu Jubang Pharmaceutical, and Huazhong Pharmaceutical actively compete across these regions. These companies focus on innovation, expanding production capacity, and strengthening distribution networks to capture diverse market demands and regional growth opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The thiamine market is projected to grow from USD 1,188 million in 2024 to USD 2,041.2 million by 2032, at a CAGR of 7%.

- Rising awareness of vitamin B1 benefits and nutritional deficiencies drives demand for fortified foods and dietary supplements.

- Expanding applications in animal feed and pharmaceutical industries support market growth and diversify usage.

- Innovations in delivery forms like sustained-release and bioavailable formulations enhance consumer acceptance and convenience.

- Regulatory mandates for mandatory fortification in various regions boost thiamine adoption and market expansion.

- North America leads with 35% market share, followed by Europe (28%), Asia-Pacific (25%), and the Rest of the World (12%).

- Key players such as BASF, DSM, and Lonza Group AG focus on innovation, production capacity expansion, and distribution to capture regional growth.

Market Drivers

Rising Awareness of Nutritional Deficiencies

Increasing global awareness of vitamin B1 deficiency drives demand for thiamine supplements and fortified products. Many populations suffer from malnutrition or chronic conditions that impair nutrient absorption, creating a critical need for thiamine intake. Health organizations recommend supplementation to prevent related disorders such as beriberi and Wernicke-Korsakoff syndrome. This awareness encourages consumers and healthcare providers to prioritize thiamine, expanding its market penetration across dietary supplements, functional foods, and beverages. The growing focus on preventive healthcare supports sustained demand for it.

- For instance, various legumes like black beans deliver around 33% of the daily value of thiamine per half-cup serving, and they are often used in diets to combat nutrient deficiencies.

Expanding Applications in Food and Pharmaceutical Industries

Thiamine finds wide applications in food fortification, animal nutrition, and pharmaceutical formulations. The food industry uses it to enrich cereals, dairy products, and beverages, improving nutritional profiles and meeting regulatory fortification standards. Animal feed manufacturers include thiamine to enhance livestock health and productivity, fueling growth in the agricultural sector. Pharmaceutical companies incorporate it in multivitamin complexes and therapeutic treatments targeting metabolic and neurological disorders. These diverse applications strengthen the thiamine market’s stability and growth potential across multiple sectors.

- For instance, Jiangxi Tianxin Pharmaceutical and Huazhong Pharmaceutical Company are key manufacturers supplying thiamine for pharmaceutical formulations, including multivitamin complexes and therapeutic uses targeting metabolic and neurological disorders

Innovations in Formulation and Delivery Technologies

Manufacturers invest in developing advanced thiamine formulations to improve bioavailability and consumer compliance. Technologies such as sustained-release capsules and liquid forms enhance absorption rates and provide convenient dosing options. The introduction of natural and clean-label thiamine products caters to consumer preferences for organic and minimally processed ingredients. These innovations support product differentiation and open new market segments. It also drives adoption among health-conscious consumers who seek efficient and safer supplementation options, bolstering market growth.

Regulatory Support and Mandatory Fortification Policies

Governments worldwide implement regulations mandating thiamine fortification in staple foods to combat nutrient deficiencies. These policies increase thiamine’s inclusion in widely consumed products, expanding market demand. Regulatory agencies also establish quality and safety standards, encouraging manufacturers to enhance product reliability and consumer trust. The enforcement of such mandates in developing and developed countries fuels consistent market growth. It ensures broader consumer access and reinforces thiamine’s critical role in public health initiatives globally.

Market Trends

Growing Demand for Natural and Plant-Based Thiamine Sources

The thiamine market experiences a significant shift toward natural and plant-based sources driven by consumer preference for clean-label and organic products. Manufacturers focus on extracting thiamine from grains, legumes, and yeast to meet this demand. Consumers increasingly avoid synthetic vitamins due to health and environmental concerns. This trend encourages product innovation and diversification, enabling companies to capture niche markets. It also aligns with sustainability goals, supporting long-term growth in natural ingredient adoption across supplements and fortified foods.

Rising Integration of Thiamine in Functional and Fortified Foods

Functional and fortified foods increasingly incorporate thiamine to enhance nutritional value and address specific health needs. The market benefits from consumer interest in wellness and preventive care, prompting food producers to develop enriched cereals, snacks, and beverages. It helps brands differentiate offerings while complying with government fortification regulations. Thiamine inclusion in these products improves public health outcomes by preventing deficiencies. This trend promotes broader acceptance of thiamine beyond traditional supplement forms.

- For instance, pork loin chops supply about 55% of the daily value of thiamine in just a 3.5-ounce cooked portion, making them a key fortified source of the vitamin in meat products.

Advancements in Sustainable Production and Supply Chain Practices

Sustainability drives innovation within the thiamine market, with manufacturers adopting eco-friendly production methods and optimizing supply chains. Producers seek to reduce waste, lower carbon footprints, and utilize renewable resources in thiamine synthesis. Transparent sourcing and responsible manufacturing gain importance for regulatory compliance and consumer trust. It encourages collaborations across the value chain to enhance efficiency and sustainability. These efforts attract environmentally conscious buyers and improve brand reputation in competitive markets.

- For instance, Kerry Group utilizes fermentation technology for natural vitamin production, including thiamine hydrochloride, integrating sustainable raw material sourcing and optimized bioprocesses to lower carbon footprint and waste in manufacturing

Increasing Adoption of Personalized Nutrition and Customized Supplementation

Personalized nutrition trends influence the thiamine market by promoting tailored supplementation based on individual health profiles and lifestyle factors. Advances in diagnostic tools and digital health platforms enable precise nutrient recommendations, driving demand for customized thiamine products. It offers targeted health benefits, such as improved cognitive function and energy metabolism. Manufacturers respond by developing flexible dosing formats and combination supplements to meet diverse consumer needs. This trend supports market expansion through innovation and consumer engagement.

Market Challenges Analysis

Regulatory Complexity and Compliance Costs

The thiamine market faces challenges from complex regulatory frameworks across different regions. Varying fortification mandates, labeling requirements, and safety standards create compliance difficulties for manufacturers operating globally. It increases the time and cost needed for product approvals and market entry. Companies must invest heavily in regulatory expertise and documentation to avoid penalties and ensure consumer safety. This complexity may slow product launches and limit flexibility in formulation changes. Navigating these regulations remains a significant barrier for new and existing players alike.

Raw Material Availability and Price Volatility

Fluctuations in raw material supply and costs pose challenges to the thiamine market’s stability and profitability. Dependence on agricultural sources and chemical precursors exposes manufacturers to seasonal variations, geopolitical tensions, and trade disruptions. It complicates supply chain management and increases production expenses, affecting pricing strategies. Limited availability of high-quality natural thiamine further intensifies competition among suppliers. Companies must develop robust sourcing strategies and explore alternative raw materials to mitigate these risks and maintain consistent production levels.

Market Opportunities

Expansion in Emerging Markets with Growing Health Awareness

The thiamine market holds significant growth potential in emerging economies where increasing health awareness and rising disposable incomes drive demand for nutritional supplements. Countries in Asia-Pacific, Latin America, and Africa exhibit high prevalence of vitamin deficiencies, creating urgent needs for fortification and supplementation programs. It offers manufacturers opportunities to introduce affordable, region-specific products tailored to local dietary habits. Collaborations with governments and NGOs to support public health initiatives can further boost market penetration. Expanding distribution networks and e-commerce platforms also enable wider consumer reach in these markets.

Innovation in Formulations and Delivery Systems for Enhanced Consumer Appeal

Innovation in thiamine formulations and delivery technologies presents substantial opportunities to capture diverse consumer segments. Development of novel dosage forms such as chewables, gummies, and liquid supplements improves convenience and compliance. It allows customization to meet specific age groups, lifestyles, and health conditions. The rise of personalized nutrition fuels demand for targeted thiamine products integrated with other vitamins and minerals. Investing in research and development to create bioavailable and natural-source thiamine formulations enhances product differentiation and competitive advantage in the growing supplement industry.

Market Segmentation Analysis:

By Product Type

The thiamine market segments by product type include thiamine mononitrate, thiamine hydrochloride, and thiamine pyrophosphate. Thiamine mononitrate dominates due to its stability and cost-effectiveness in fortification and supplement applications. Thiamine hydrochloride serves pharmaceutical uses requiring high purity and rapid absorption. Thiamine pyrophosphate, the biologically active form, finds niche applications in therapeutic treatments. It allows manufacturers to target specific industry needs and consumer preferences through diversified product offerings.

- For instance, Spectrum Chemical produces thiamine mononitrate FCC grade that meets Food Chemical Codex standards, making it suitable for all food, beverage, and nutritional supplement uses with consistent quality assurance

By Form

Thiamine products come in tablets and capsules, liquid, and powder forms. Tablets and capsules lead the market, favored for dosage accuracy and ease of use in supplements and pharmaceuticals. Liquid formulations support faster absorption and suit pediatric or geriatric consumers. Powder form offers flexibility for incorporation into food, beverages, and animal feed. It enables manufacturers to cater to varying consumer demands and application requirements, supporting broader market adoption.

By Application

The thiamine market serves food and beverages, pharmaceuticals, animal feed, dietary supplements, and other applications. Food and beverage fortification accounts for a large share, driven by regulatory mandates and health trends. Pharmaceutical use targets treatment of deficiency-related disorders. Animal feed inclusion improves livestock health and productivity. Dietary supplements meet growing consumer demand for preventive health. This wide application spectrum strengthens the market’s resilience and growth opportunities across industries.

- For instance, in pharmaceuticals, DSM incorporates thiamine mononitrate into multivitamin tablets and injectables aimed at treating deficiency-related disorders.

Segments:

Based on Product type

- Thiamine mononitrate

- Thiamine hydrochloride

- Thiamine pyrophosphate

Based on Form

- Tablets & Capsules

- Liquid

- Powder

Based on Application

- Food & Beverages

- Pharmaceutical

- Animal feed

- Dietary supplements

- Other

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a significant share of 35% in the thiamine market, driven by strong health awareness and well-established supplement industries. It benefits from high consumer spending on fortified foods and dietary supplements. Regulatory support for vitamin fortification and stringent quality standards promote widespread thiamine adoption. The presence of leading pharmaceutical and nutraceutical companies encourages continuous product innovation. It maintains a robust supply chain and advanced manufacturing infrastructure. Growing demand for natural and clean-label products further supports market growth in this region.

Europe

Europe commands 28% of the thiamine market, supported by strict regulations on food fortification and increasing public health initiatives. Governments mandate thiamine inclusion in staple foods to combat deficiency-related diseases. The region’s focus on preventive healthcare boosts supplement consumption. It hosts numerous established players investing in research to improve product bioavailability and formulation. Rising consumer interest in organic and plant-based thiamine sources stimulates market diversification. The mature healthcare infrastructure enhances access to pharmaceutical thiamine products.

Asia-Pacific

Asia-Pacific accounts for 25% of the thiamine market, showing rapid growth fueled by increasing awareness of nutritional deficiencies and expanding middle-class populations. Governments in countries like China and India promote fortification programs targeting widespread micronutrient deficiencies. It experiences rising demand in food and beverage fortification, pharmaceuticals, and animal feed sectors. Expanding urbanization and improved healthcare access boost consumption. Local manufacturers increase production capacity to meet growing domestic and export demand. This region presents substantial opportunities for market expansion.

Rest of the World

The Rest of the World, including Latin America, Middle East, and Africa, holds 12% of the thiamine market share. Growing government initiatives addressing malnutrition and vitamin deficiencies drive demand. It faces challenges from limited infrastructure and varying regulatory frameworks. However, increasing health awareness and rising disposable incomes stimulate market growth. Manufacturers focus on affordable and region-specific product offerings to capture emerging consumer bases. Investments in distribution networks and partnerships with public health organizations improve market penetration in these regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- McCartan’s Pharmacy

- Huazhong Pharmaceutical

- PharmoVit

- Chemizo Enterprise

- BASF

- Jiangsu Jubang Pharmaceutical

- Lonza Group AG

- Caisson Labs

- Nutricost

- DSM

- Molekula Group

- HPC Standards

Competitive Analysis

The thiamine market features intense competition among leading global and regional players focusing on product innovation, quality, and sustainable sourcing. Companies like BASF, DSM, and Lonza Group AG invest heavily in research and development to enhance thiamine bioavailability and develop natural formulations. It drives differentiation through advanced delivery systems and compliance with evolving regulatory standards. Emerging manufacturers such as Jiangsu Jubang Pharmaceutical and Huazhong Pharmaceutical expand production capacities to capture growing demand in Asia-Pacific. Strategic partnerships, mergers, and acquisitions enable key players to strengthen market presence and distribution networks. Competitive pricing and strong customer relationships remain critical for gaining market share. It emphasizes sustainability and clean-label trends to meet consumer preferences, positioning the thiamine market for continued growth amid evolving industry dynamics.

Recent Developments

- On June 19, 2023, Lupin Limited launched Thiamine Hydrochloride Injection USP, 200 mg/2 mL multiple-dose vials in the U.S.

- In March 2024, DSM introduced a new thiamine product line, enhancing its portfolio to meet the growing demand for fortified foods and dietary supplements.

Market Concentration & Characteristics

The thiamine market exhibits a moderately concentrated competitive landscape, dominated by a few global key players alongside several regional manufacturers. Leading companies such as BASF, DSM, and Lonza Group AG hold significant market shares through extensive production capacities, strong distribution networks, and continuous investment in research and development. It balances innovation in bioavailable and natural formulations with compliance to stringent regulatory standards worldwide. The presence of emerging manufacturers, particularly in Asia-Pacific, introduces competitive pricing and regional market penetration. It fosters a dynamic environment where companies focus on sustainability, product differentiation, and strategic partnerships to strengthen market position. The market’s characteristics include steady demand driven by health awareness, regulatory mandates, and diverse applications across food, pharmaceuticals, and animal nutrition. This structure promotes both collaboration and rivalry, encouraging innovation and efficiency to meet evolving consumer needs.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The thiamine market will expand due to increasing consumer focus on health and nutrition.

- Fortification of staple foods will drive steady demand globally.

- Innovation in natural and plant-based thiamine sources will gain momentum.

- Personalized nutrition will boost demand for customized thiamine supplements.

- Emerging economies will offer significant growth opportunities with rising awareness.

- Regulatory support will encourage broader adoption of thiamine in food and pharma.

- Advances in delivery technologies will improve bioavailability and user compliance.

- Sustainability initiatives will influence manufacturing and sourcing practices.

- Strategic collaborations and mergers will strengthen market positions of key players.

- Expanding applications in animal nutrition will contribute to market diversification.