Market Overview

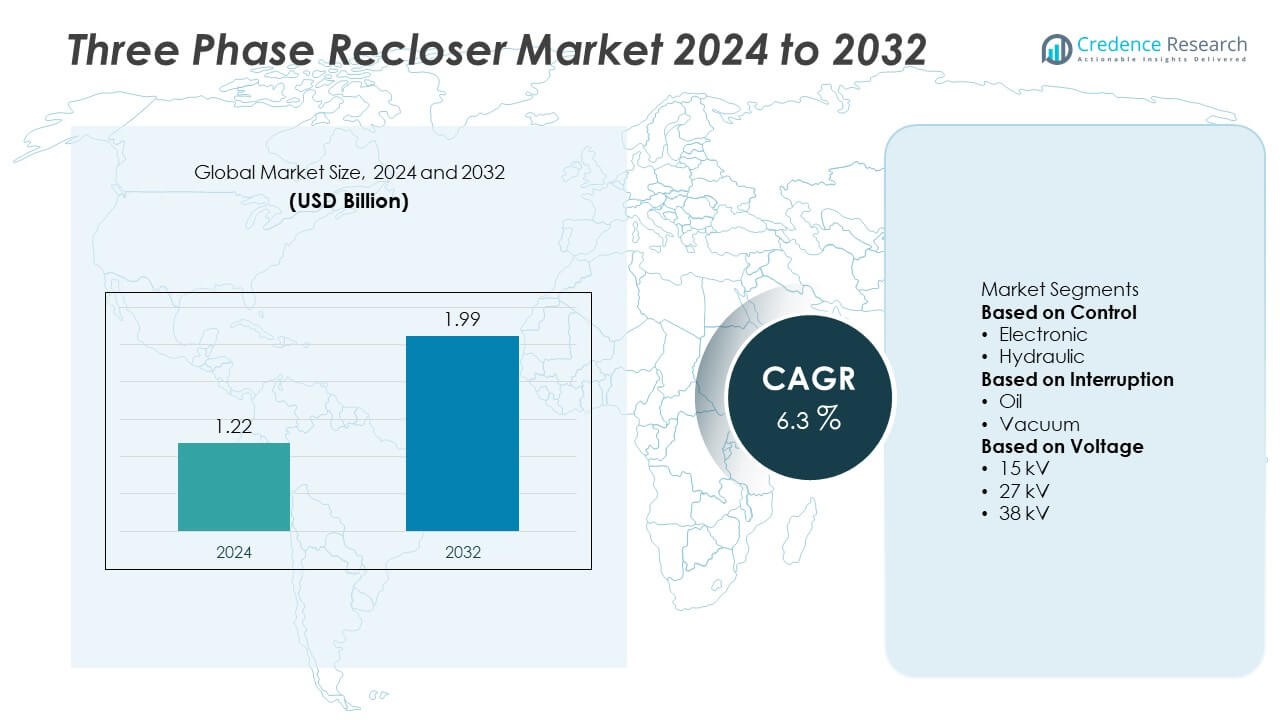

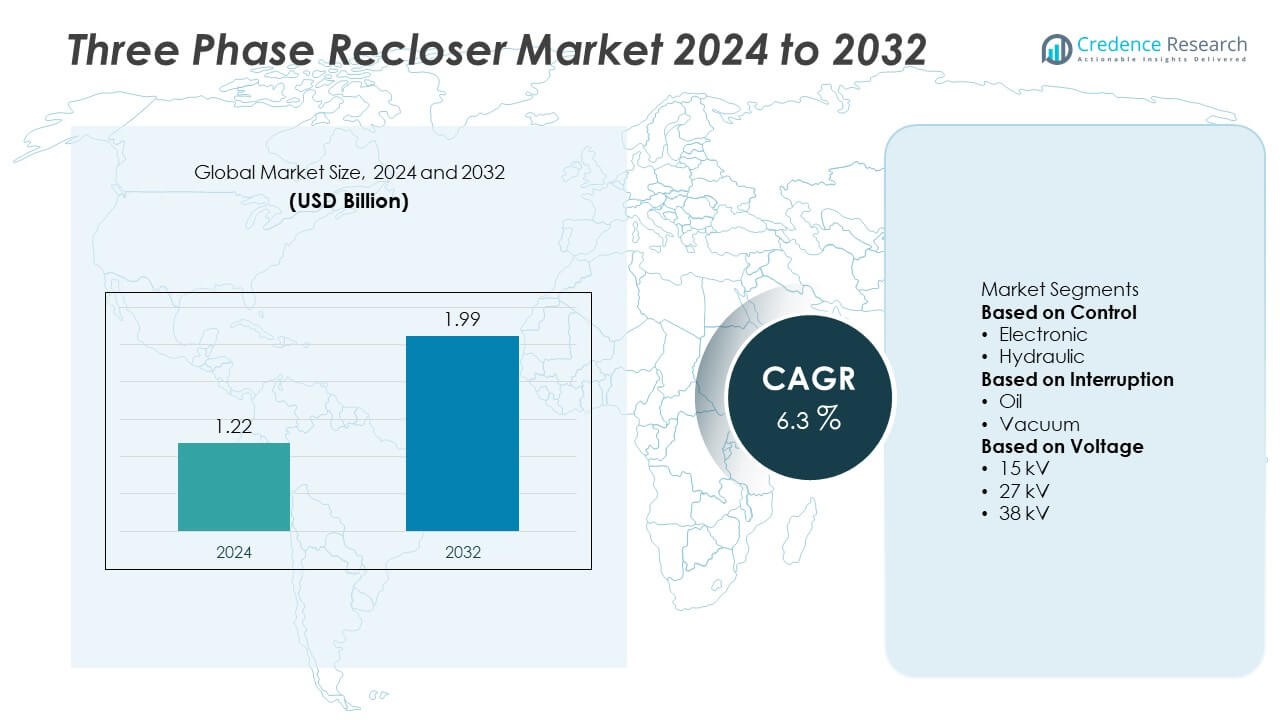

The Three Phase Recloser market was valued at USD 1.22 billion in 2024 and is projected to reach USD 1.99 billion by 2032, growing at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Three Phase Recloser Market Size 2024 |

USD 1.22 Billion |

| Three Phase Recloser Market, CAGR |

6.3% |

| Three Phase Recloser Market Size 2032 |

USD 1.99 Billion |

The Three Phase Recloser market is led by prominent players such as Rockwell, Noja Power, Eaton, Arteche, G&W Electric, Hughes Power System, ABB, Ensto, Hubbell, and Entec. These companies are focused on advancing grid automation and delivering high-performance, smart recloser solutions for power distribution networks. They emphasize digital control, IoT integration, and vacuum interruption technologies to enhance grid reliability and reduce downtime. North America led the global market with a 37.8% share in 2024, driven by large-scale smart grid projects and utility modernization programs, followed by Europe with a 27.4% share, supported by renewable energy integration and sustainability-driven infrastructure investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Three Phase Recloser market was valued at USD 1.22 billion in 2024 and is projected to reach USD 1.99 billion by 2032, expanding at a CAGR of 6.3% during the forecast period.

- Rising investment in smart grid development and renewable energy integration is driving demand for automated recloser systems to enhance power reliability and fault management.

- Technological advancements in electronic control and vacuum interruption systems are shaping market trends, improving efficiency and operational safety.

- Key players such as Rockwell, Eaton, ABB, Noja Power, and G&W Electric are focusing on product innovation, IoT-enabled systems, and regional partnerships to strengthen competitiveness.

- North America dominated with a 37.8% share, followed by Europe (27.4%) and Asia-Pacific (24.9%), while electronic control reclosers held a 63.4% share and vacuum interruption systems led with 58.9% in 2024.

Market Segmentation Analysis:

By Control

The electronic control segment dominated the Three Phase Recloser market in 2024 with a 63.4% share, driven by its superior fault detection accuracy, remote operation capability, and integration with modern SCADA systems. Utilities increasingly prefer electronic controls for smart grid applications due to their ability to support data analytics, automation, and real-time monitoring. Hydraulic reclosers remain relevant in smaller substations and rural networks for their cost efficiency and low maintenance needs. The shift toward digital substations and grid modernization continues to strengthen demand for advanced electronic-controlled reclosers.

- For instance, the Noja Power’s RC10 control system integrates with IEC 61850 protocols, including MMS and high-speed GOOSE messaging for peer-to-peer automation. The unit features extensive programmable logic functions through its Smart Grid Automation (SGA) based on IEC 61499 for flexible application development.

By Interruption

Vacuum interruption technology held a 58.9% share in 2024, emerging as the dominant segment due to its enhanced safety, longer operational life, and low environmental impact. Vacuum reclosers provide superior arc-quenching capability and require minimal maintenance compared to oil-based systems. Oil interruption reclosers are gradually declining in usage due to higher environmental and maintenance concerns. The increasing emphasis on eco-friendly and reliable power distribution networks is accelerating the transition toward vacuum reclosers across both urban and industrial power systems.

- For instance, G&W Electric’s Viper-ST three-phase vacuum recloser is rated for systems up to 38 kV maximum, 800 A continuous current, with 12.5 kA symmetrical interrupting capacity. The device achieves over 10,000 mechanical operations without maintenance and integrates solid-dielectric insulation eliminating SF₆ gas use.

By Voltage

The 27 kV segment led the market in 2024 with a 46.7% share, supported by its wide deployment in medium-voltage distribution networks and industrial facilities. It offers an optimal balance between cost, performance, and coverage area, making it the preferred choice for utilities upgrading legacy systems. The 15 kV segment follows, catering to low- to medium-load rural and sub-urban distribution grids, while the 38 kV segment is gaining traction in high-capacity industrial and transmission applications. Rising investments in grid expansion projects continue to drive adoption across all voltage classes.

Key Growth Drivers

Expansion of Smart Grid Infrastructure

The rapid development of smart grid infrastructure is a key driver for the Three Phase Recloser market. Utilities are deploying intelligent reclosers to enhance grid reliability, automate fault detection, and minimize power interruptions. Integration with SCADA and IoT-based monitoring systems enables real-time performance tracking and predictive maintenance. Governments and energy providers are investing heavily in smart distribution networks to improve efficiency and reduce operational losses, driving the adoption of digital and automated three-phase reclosers across advanced and developing markets.

- For instance, S&C Electric Company developed its IntelliRupter PulseCloser fault interrupter with technology capable of testing for permanent faults using a current pulse of just 5 milliseconds, which significantly limits the energy released into the fault.

Rising Demand for Reliable Power Supply

Growing industrialization and urbanization have increased the need for stable and uninterrupted electricity supply. Three-phase reclosers play a critical role in maintaining grid continuity by automatically restoring power after transient faults. Utilities are prioritizing equipment that enhances service reliability and reduces outage duration. With increasing electricity consumption and renewable energy integration, the focus on grid resilience and fault-tolerant power systems is propelling market growth worldwide.

- For instance, ABB’s OVR recloser, which is available in models rated up to 27 kV and designed for 10,000 full load operations (mechanical and electrical), utilizes vacuum interrupters to rapidly extinguish the arc.

Government Investments in Rural Electrification

Expanding electrification programs in emerging economies are boosting the deployment of three-phase reclosers in rural and semi-urban areas. Governments are modernizing transmission and distribution infrastructure to improve access to reliable electricity. The installation of reclosers supports automatic fault isolation and reduces system downtime in remote grids. Public–private collaborations and funding for energy access projects are further encouraging utilities to adopt automated protection equipment, strengthening the market outlook in developing regions.

Key Trends & Opportunities

Adoption of Advanced Communication and IoT Technologies

Integration of IoT and cloud-based platforms is transforming grid management, enabling utilities to monitor and control reclosers remotely. Advanced communication protocols such as DNP3 and IEC 61850 enhance interoperability across smart grids. These innovations provide predictive maintenance insights, improving grid uptime and reducing operational costs. The ongoing digital transformation of power distribution networks presents opportunities for manufacturers to develop intelligent reclosers with embedded sensors and data analytics capabilities.

- For instance, Viasat reports that its IoT Pro remote-monitoring terminals are deployed on “tens of thousands” of reclosers globally and deliver connectivity with up to 99.9 % availability for remote SCADA control.

Shift Toward Sustainable and Maintenance-Free Systems

The market is witnessing a shift from oil-based to vacuum-type reclosers due to environmental and maintenance concerns. Vacuum reclosers eliminate the need for insulating oil, offering eco-friendly operation and longer service life. Utilities are also exploring solid dielectric insulation technologies to improve performance and sustainability. This transition aligns with global efforts to reduce greenhouse gas emissions and minimize environmental risks, driving demand for green and low-maintenance power distribution equipment.

- For instance, Schneider Electric’s U-series solid-insulated auto recloser supports up to 27 kV pole-mount applications and uses cycloaliphatic epoxy insulation instead of oil, enabling service in –40 °C to +55 °C climates with minimal maintenance.

Key Challenges

High Initial Investment and Installation Costs

The high upfront cost of three-phase reclosers, combined with installation and integration expenses, poses a challenge for smaller utilities. Advanced models with electronic controls and smart monitoring systems require significant capital investment. Developing countries with limited budgets often delay modernization projects. To overcome this barrier, manufacturers and governments must introduce cost-effective financing solutions and incentive programs to support large-scale grid automation and recloser deployment.

Complex Integration with Existing Grid Systems

Integrating modern reclosers into aging grid infrastructure can be technically challenging. Many legacy distribution networks lack compatibility with advanced communication and control systems. This creates operational inefficiencies and increases maintenance complexity. Utilities must upgrade supporting components such as relays and communication modules to ensure seamless functionality. The lack of skilled personnel for managing digital power systems further complicates adoption, highlighting the need for specialized training and system standardization.

Regional Analysis

North America

North America dominated the Three Phase Recloser market in 2024 with a 37.8% share, driven by widespread smart grid adoption and modernization of aging electrical infrastructure. The United States leads the region with strong investments in automation, renewable integration, and grid reliability enhancement projects. Utilities are focusing on advanced reclosers integrated with SCADA and IoT systems for improved monitoring and fault detection. Supportive regulatory frameworks, coupled with government funding for grid resilience, continue to strengthen the market’s position, particularly across industrial and high-demand urban distribution networks.

Europe

Europe held a 27.4% share in 2024, supported by increasing deployment of renewable energy systems and grid automation initiatives. Countries such as Germany, the U.K., and France are investing in reliable power distribution equipment to integrate solar and wind energy sources efficiently. The European Union’s focus on sustainability and emission reduction encourages utilities to replace conventional oil reclosers with vacuum-based alternatives. Growing adoption of digital substations and automated protection devices also drives steady growth across industrial and residential power networks within the region.

Asia-Pacific

Asia-Pacific accounted for a 24.9% share in 2024 and emerged as the fastest-growing regional market. Rapid industrialization, rising electricity demand, and extensive rural electrification projects are driving adoption of three-phase reclosers. China and India dominate regional installations due to large-scale grid expansion and smart distribution programs. Government initiatives promoting renewable integration and power reliability support strong market penetration. Increasing local manufacturing capabilities and technology partnerships with global firms further enhance regional competitiveness and reduce dependency on imports.

Latin America

Latin America captured a 6.1% share in 2024, driven by ongoing investments in power distribution modernization and grid reliability improvements. Brazil and Mexico lead the regional market due to their expanding industrial base and government-led energy reform programs. Utilities are adopting vacuum-type reclosers to improve grid performance and minimize outage duration. Although economic fluctuations limit large-scale investments, regional partnerships and public funding initiatives are helping strengthen grid stability and promote automation in medium-voltage networks across Latin American countries.

Middle East & Africa

The Middle East & Africa region held a 3.8% share in 2024, supported by rising electricity demand and development of smart power infrastructure. The Gulf Cooperation Council (GCC) countries are leading with significant investments in grid automation and renewable energy integration. In Africa, expanding electrification projects and government focus on improving rural power access are driving steady growth. Despite limited adoption compared to developed regions, increasing funding for transmission upgrades and partnerships with global recloser manufacturers are gradually strengthening regional market presence.

Market Segmentations:

By Control

By Interruption

By Voltage

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Three Phase Recloser market features key players such as Rockwell, Noja Power, Eaton, Arteche, G&W Electric, Hughes Power System, ABB, Ensto, Hubbell, and Entec. These companies focus on innovation, product reliability, and automation to enhance grid stability and operational efficiency. Market leaders are investing in smart recloser technologies integrated with SCADA, IoT, and cloud-based monitoring systems to support real-time fault management. Strategic collaborations with utilities and renewable energy developers strengthen market positioning. Manufacturers are also expanding their regional footprints through partnerships, acquisitions, and localized production to meet rising demand. Continuous advancements in vacuum interruption and digital control systems further intensify competition, driving the shift toward sustainable and intelligent recloser solutions across global distribution networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Rockwell

- Noja Power

- Eaton

- Arteche

- G&W Electric

- Hughes Power System

- ABB

- Ensto

- Hubbell

- Entec

Recent Developments

- In March 2025, G&W Electric unveiled the next-generation Viper®-ST recloser with ratings up to 170 kV BIL and 1000 A continuous current, interrupting 12.5 kA or 16 kA, and supporting advanced automation integrations.

- In November 2024, G&W Electric expanded its manufacturing operations with a new facility in San Luis Potosí, Mexico. This expansion, driven by rising market demand across Latin America and other international markets, increases the size of the original location by four times, significantly boosting the manufacturing capacity for products such as reclosers, sensors, and system protection equipment.

- In February 2024, ABB introduced its new virtualized protection and control solution at DISTRIBUTECH 2024 in Orlando, Florida. The company presented a comprehensive range of medium voltage grid hardening reclosers designed to improve reliability and reduce outages in response to the growing pressures on power distribution networks.

Report Coverage

The research report offers an in-depth analysis based on Control, Interruption, Voltage and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as utilities expand smart grid and automation infrastructure globally.

- Vacuum-type reclosers will gain traction due to low maintenance and eco-friendly operation.

- Electronic control systems will dominate with growing use of IoT and real-time monitoring.

- Integration of AI and data analytics will enhance fault detection and predictive maintenance.

- Renewable energy integration will increase the need for advanced grid protection solutions.

- Manufacturers will focus on modular designs to support flexible grid modernization.

- Strategic partnerships with utilities will strengthen supply chains and market reach.

- Developing regions will experience strong growth through rural electrification projects.

- Government funding for grid resilience will support adoption of digital reclosers.

- Continuous innovation in communication protocols will improve automation and reliability.