Market Overview

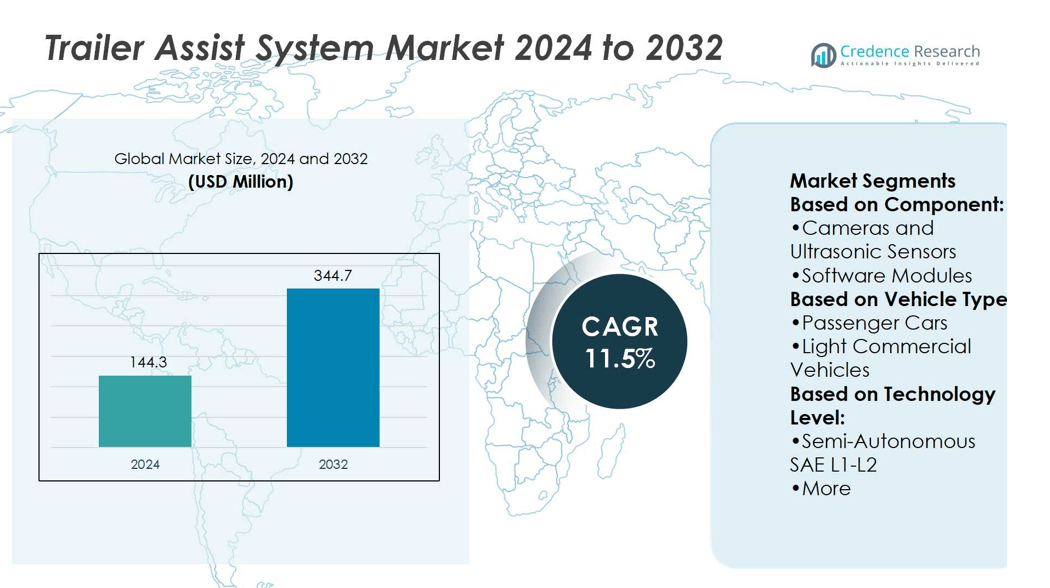

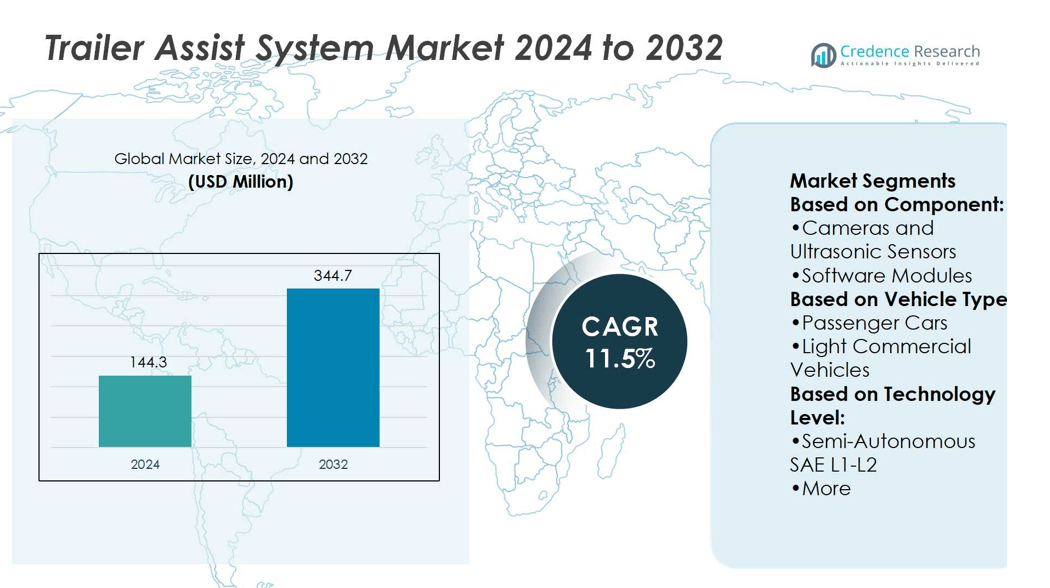

Trailer Assist System Market size was valued at USD 144.3 million in 2024 and is anticipated to reach USD 344.7 million by 2032, at a CAGR of 11.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Trailer Assist System Market Size 2024 |

USD 144.3 million |

| Trailer Assist System Market, CAGR |

11.5% |

| Trailer Assist System Market Size 2032 |

USD 344.7 million |

The Trailer Assist System Market grows through rising demand for safer and more convenient towing solutions. Increasing adoption of advanced driver assistance systems enhances vehicle safety standards and drives integration of trailer assist features. Automakers focus on embedding these systems into SUVs, pickup trucks, and commercial vehicles to meet consumer expectations. Advancements in cameras, ultrasonic sensors, and control algorithms improve maneuvering accuracy and user experience. Regulatory pressure for road safety and heightened awareness of towing risks further accelerate adoption. Growing use of smart and connected vehicles strengthens the market’s expansion, making trailer assist systems a mainstream automotive feature.

North America leads the Trailer Assist System Market with strong adoption in the U.S., while Europe follows with high integration driven by strict safety regulations and advanced OEM participation. Asia-Pacific records the fastest growth, fueled by rising vehicle ownership and infrastructure development. Latin America and the Middle East & Africa show gradual uptake supported by fleet modernization and logistics demand. Key players such as Bosch, Continental AG, Volkswagen, Magna, Garmin, and Hella drive innovation and expand system adoption across regions.

Market Insights

- Trailer Assist System Market size was valued at USD 144.3 million in 2024 and is projected to reach USD 344.7 million by 2032, growing at a CAGR of 11.5%.

- Rising demand for safer and more convenient towing solutions drives steady market expansion.

- Growing adoption of advanced driver assistance systems enhances safety standards and integration levels.

- Competition intensifies as automakers and technology suppliers focus on innovation and cost efficiency.

- High system costs and limited awareness in emerging regions act as restraints to wider adoption.

- North America leads the market, Europe follows with strong OEM participation, while Asia-Pacific shows the fastest growth.

- Latin America and the Middle East & Africa expand gradually, supported by fleet modernization and logistics development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Vehicle Safety and Driver Assistance Features

The Trailer Assist System Market benefits from growing demand for advanced driver assistance features. Rising accident rates involving towing vehicles increase interest in technologies that reduce risks. Governments emphasize safety regulations that require enhanced stability and maneuverability systems. It strengthens the role of trailer assist in minimizing human errors during reversing or lane changing. Drivers recognize the advantage of improved precision and convenience while handling trailers. Growing adoption of ADAS packages supports the integration of trailer assist systems across vehicle segments.

- For instance, Garmin’s BC 50 wireless backup camera is designed for longer vehicles like trucks and RVs and features a 50-foot transmission range. An optional extension cable can increase the range to 100 feet for even larger vehicle-trailer combinations.

Integration of Advanced Sensor and Camera Technologies

The market grows through innovations in sensors, cameras, and machine learning algorithms. It combines real-time monitoring with automated steering support to optimize trailer handling. Enhanced imaging systems improve accuracy in confined spaces, supporting safer operations for drivers. Automotive OEMs integrate trailer assist functions within broader infotainment and digital platforms. It ensures seamless connectivity with driver interfaces and vehicle telematics. Continuous improvements in hardware and software advance reliability and usability, driving higher adoption rates.

- For instance, Bosch’s Trailer Tow Assist employs a near-range camera that enables reversing with up to 1° steering accuracy, and supports 90° maneuvering in tight spaces—automating trailer alignment with minimal driver input.

Expansion of Towing Activities Across Commercial and Recreational Sectors

The Trailer Assist System Market sees growth from rising demand in logistics, construction, and leisure travel. Expanding e-commerce and freight activities increase the need for safe and efficient trailer operations. It enhances operational efficiency for fleets by reducing damages during loading and unloading processes. Recreational users adopt trailer assist systems to improve driving comfort when towing boats, campers, or caravans. Rising consumer preference for hassle-free towing supports adoption in pickup trucks and SUVs. The combination of efficiency and convenience reinforces the market’s appeal across diverse end-users.

Regulatory Push and Industry Collaborations Driving Standardization

Strong regulatory support influences adoption, as authorities encourage safety systems in heavy and light vehicles. The market gains momentum from industry collaborations between OEMs, suppliers, and technology providers. It leads to standardization of features across platforms, making trailer assist more accessible. Partnerships accelerate innovation in autonomous towing and integration with electric vehicles. Manufacturers position trailer assist as part of next-generation mobility ecosystems. Rising awareness of its value in reducing accidents supports regulatory acceptance and customer trust.

Market Trends

Growing Adoption of Advanced Driver Assistance Integration

The Trailer Assist System Market gains momentum through integration with broader driver assistance platforms. Automakers embed trailer assist functions with adaptive cruise control, lane-keeping, and parking sensors. This trend creates seamless vehicle management for users handling complex towing operations. It also improves maneuverability in tight spaces, boosting demand among recreational and commercial users. Automakers develop user-friendly dashboards that align with connected vehicle strategies. It signals an industry-wide shift toward integrated mobility ecosystems that support safer and smarter towing experiences.

- For instance, Hella’s SL | HD digital headlamp system—developed jointly with Porsche—features over 32,000 individually controllable LEDs per headlamp. This system enables real-time projection of lane guidance and precise light distribution based on steering data.

Rising Demand for Automation and Safety in Towing Operations

Automation stands as a major trend in the Trailer Assist System Market, reflecting a growing focus on safety. Drivers seek systems that reduce stress in reversing and parking scenarios with trailers. Commercial fleet operators value efficiency gains from automated maneuvering features. The technology reduces collision risks, making it attractive in logistics and utility applications. Regulatory focus on road safety also accelerates adoption in developed regions. It highlights how automation continues to transform towing into a safer and more reliable process.

- For instance, Westfalia’s Removable Tow Hook system delivers precise towing capacity of 2,200 kg and supports a vertical load of 100 kg. The design allows for an invisible bumper cutout when detached, and includes a detachable ball bar that weighs just 19.5 kg and measures 95 × 20 × 15 cm.

Expansion of Connectivity and Sensor-Based Technologies

The market advances through connectivity, sensors, and camera-based innovations that refine trailer assistance. Radar and ultrasonic sensors increase precision while camera systems improve visibility. Cloud-enabled solutions link towing performance data to driver applications and fleet platforms. It strengthens predictive maintenance, reduces errors, and improves vehicle-trailer coordination. Manufacturers promote real-time monitoring, which aligns with IoT and smart mobility initiatives. These advancements underscore the role of connected technologies in shaping the future of towing assistance.

Growing Penetration Across Recreational and Commercial Segments

The Trailer Assist System Market diversifies across recreational vehicles, caravans, and heavy-duty fleets. Recreational users adopt it for enhanced convenience in outdoor and lifestyle applications. Logistics firms embrace the systems to reduce training time for new drivers. Rental operators also integrate trailer assist to improve customer safety and experience. Growing trailer usage in agriculture and construction sectors further broadens adoption. The trend highlights its steady expansion from niche recreational use to mainstream commercial deployment.

Market Challenges Analysis

High Cost of Integration and Limited Consumer Awareness

The Trailer Assist System Market faces challenges linked to high integration costs across vehicle models. Premium systems demand advanced sensors, software, and calibration, raising overall vehicle prices. Mass adoption slows when customers perceive limited value compared to traditional driving skills. Consumer awareness also remains low in regions where towing is less frequent. It restricts demand among cost-sensitive buyers and smaller fleet operators. Manufacturers must balance affordability with advanced technology to achieve wider acceptance.

Technical Complexity and Regulatory Variations Across Regions

Technical challenges emerge from the complexity of integrating trailer assist with diverse vehicle platforms. Systems require compatibility with multiple trailer sizes, weight categories, and coupling types. Any mismatch impacts performance, raising concerns about reliability in real-world use. Regulatory variations across regions further complicate standardization and product rollout. It forces manufacturers to redesign features to meet local safety rules and certification demands. These obstacles hinder rapid expansion despite growing interest in automated towing solutions.

Market Opportunities

Expansion in Commercial and Fleet Applications

The Trailer Assist System Market presents opportunities in commercial transportation and fleet management. Logistics companies seek solutions that reduce driver fatigue and improve maneuvering efficiency with trailers. It enables safer operations in urban and congested environments, increasing operational productivity. Fleet operators benefit from shorter training periods and fewer accident-related costs. Manufacturers can offer tailored solutions for heavy-duty trucks, delivery vehicles, and utility fleets. Growing demand in construction, agriculture, and rental sectors further supports market expansion.

Advancements in Connected and Autonomous Vehicle Technologies

Technological progress in connectivity and semi-autonomous driving opens new opportunities for the Trailer Assist System Market. It can integrate with IoT platforms, telematics, and AI-driven navigation to enhance trailer control. Connected systems allow real-time monitoring of trailer behavior and predictive maintenance for fleet operators. Automakers can differentiate products by offering smarter, safer towing features. Expansion of smart city infrastructure and intelligent transport systems supports adoption in urban and commercial applications. Continuous innovation strengthens the market potential across recreational, commercial, and industrial segments.

Market Segmentation Analysis:

By Component

The Trailer Assist System Market is segmented into Cameras and Ultrasonic Sensors, Software Modules and Algorithms, and Electronic Control Units (ECUs). Cameras and ultrasonic sensors dominate adoption due to their critical role in providing accurate spatial awareness during reversing and maneuvering. It enhances driver confidence and reduces collision risks in complex towing scenarios. Software modules and algorithms manage the processing of sensor data and execute automated steering commands. These components improve system reliability and responsiveness under varied road conditions. ECUs coordinate communication between sensors and vehicle subsystems, ensuring seamless integration with braking and steering mechanisms. Advanced ECUs support updates and diagnostics, enhancing long-term system performance and fleet maintenance.

- For instance, Continental’s Ultrasonic Back-Up Sensor Kit includes four sensors, a central control unit, and a speaker. It activates an audible alarm when the vehicle comes within 10 feet of an object—beeping faster as the distance decreases—and can also trigger a voice announcement and overlay distance indicators on the display.

By Vehicle Type

Passenger cars, light commercial vehicles, and other vehicle categories form the market segmentation by vehicle type. Passenger cars lead in adoption due to growing recreational towing and lifestyle vehicle use. It provides convenience in reversing trailers and caravans, improving user safety and satisfaction. Light commercial vehicles gain traction in logistics, agriculture, and construction applications where trailer handling efficiency is crucial. Other vehicle types, including heavy-duty trucks and specialty vehicles, adopt systems to support fleet safety and operational efficiency. The growing trailer usage in commercial and industrial sectors drives demand across diverse vehicle platforms.

- For instance, Hitachi Astemo’s advanced AD-ECU features dual CPUs—one for recognition and one for vehicle control—enabling parallel processing and reducing response latency to under 50 milliseconds when integrating stereo-camera data with braking and steering actuation.

By Technology Level

The market further segments by technology level into Semi-Autonomous SAE L1-L2 and other advanced automation levels. Semi-autonomous systems dominate due to their capability to assist drivers without requiring full automation. It reduces manual intervention in trailer maneuvering while maintaining control and safety. Advanced automation levels integrate AI and predictive analytics for enhanced trailer guidance and obstacle avoidance. These systems appeal to fleet operators and premium vehicle buyers seeking smarter, safer towing solutions. Continuous development in sensor fusion, connectivity, and algorithm optimization strengthens market adoption across both consumer and commercial segments.

Segments:

Based on Component:

- Cameras and Ultrasonic Sensors

- Software Modules

Based on Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

Based on Technology Level:

- Semi-Autonomous SAE L1-L2

- More

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Trailer Assist System Market, accounting for 34.37% in 2024. The U.S. remains the leading contributor, supported by a strong base of pickup trucks, RVs, and commercial trailers. Advanced driver assistance adoption and strict safety regulations drive early integration by leading automakers. Consumer demand for towing convenience continues to push product penetration across passenger and light commercial vehicles. The region’s leadership is reinforced by innovation and strong investments from both OEMs and technology suppliers. Canada and Mexico also show steady adoption, though the U.S. dominates with 81.34% of regional revenue.

Europe

Europe represents close to 30% of global share, supported by strict automotive safety norms and high consumer interest in premium vehicles. Countries such as Germany, France, and the U.K. see strong integration due to OEM leadership from Volkswagen, BMW, and Daimler. Caravanning culture and logistics expansion increase trailer usage, making assist systems more relevant. Regulations on advanced driver assistance encourage manufacturers to offer these systems as standard or optional packages. Growth is also supported by consumer preference for vehicles equipped with ADAS for both safety and convenience. Eastern Europe adds potential with rising adoption in logistics and fleet vehicles.

Asia-Pacific

Asia-Pacific contributes about 25% market share and is expected to record the fastest growth. China and India lead adoption through rising vehicle ownership and infrastructure expansion. Japan drives uptake with advanced technologies and demand from elderly drivers for safety-focused assistance. Strong CAGR of over 25% through 2032 highlights the region’s importance in shaping the future market. Consumer preference for safer and technology-driven cars is steadily increasing. Expanding logistics, rapid urbanization, and government backing for ADAS adoption strengthen the regional outlook. The shift toward electrified and connected vehicles further supports wider use of trailer assist solutions.

Latin America

Latin America holds a smaller market share of around 6%, with slower but steady growth expected. Brazil and Mexico dominate regional demand due to larger automotive production bases. Adoption is still at an early stage, limited by cost sensitivity and lower penetration of ADAS. However, rising awareness of towing safety and gradual modernization of fleets provide growth opportunities. Manufacturers see the region as a developing market with long-term potential. Strategic partnerships and imports are likely to expand access to trailer assist technologies in the coming years.

Middle East & Africa

The Middle East & Africa accounts for about 5% market share, with adoption mainly in the commercial sector. GCC countries like Saudi Arabia and the UAE lead regional growth, supported by expanding logistics and infrastructure projects. Passenger car adoption is slower due to limited consumer awareness and high cost of advanced systems. However, luxury vehicle imports often come equipped with trailer assist, creating a niche market. Africa shows modest demand, mostly linked to fleet modernization in South Africa. The region is expected to remain a small but gradually expanding market for trailer assist systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Garmin

- Volkswagen

- Echomaster

- Bosch

- Hella

- Westfalia

- Continental AG

- Carit Automotive

- Siemens

- Magna

Competitive Analysis

The competitive landscape of the Trailer Assist System Market features players such as Garmin, Volkswagen, Echomaster, Bosch, Hella, Westfalia, Continental AG, Carit Automotive, Siemens, and Magna. The Trailer Assist System Market is highly competitive, shaped by continuous advancements in automotive safety and driver assistance technologies. Companies compete on innovation, focusing on improving camera accuracy, ultrasonic sensors, and algorithm efficiency to deliver seamless trailer maneuvering. Integration of these systems into both passenger vehicles and commercial fleets has become a key differentiator, with emphasis on ease of use and reliability. The market also sees strong momentum from aftermarket solutions, which allow retrofitting of older vehicles with advanced assist functions. Competition extends to pricing strategies, regional expansion, and compliance with regulatory standards that encourage adoption of advanced driver assistance systems. Overall, the market thrives on balancing cost, performance, and technological sophistication to capture growing demand.

Recent Developments

- In September 2024, Kodiak Robotics selected Wabash National’s Trailers as a Service (TaaS) to optimize autonomous fleet operations. The partnership provides fully maintained trailers and managed care services, supporting Kodiak’s high maintenance standards while advancing autonomous long-haul trucking capabilities and operational reliability.

- In October 2024, Nissan announced plans to launch affordable V2G technology in select electric vehicles by 2026. This system will allow EV owners to use stored electricity in car batteries to power homes or sell energy back to the grid, aiming to reduce annual EV charging costs by up to 50% and decrease net CO2 emissions from charging by 30% per year for the average UK household.

- In September 2023, Volta Trucks, a commercial vehicle manufacturer and services provider, signed a partnership with Spryker. In this regard, Volta Trucks aims to simplify truck ownership and accelerate the transition to an all-electric fleet through its innovative TaaS offering.

- In August 2023, Webfleet, Bridgestone fleet management solution, announced a strategic partnership with VEV, an e-fleet solutions provider, to boost the commercial Electric Vehicle (EV) transition. VEV provides a comprehensive fleet solution, helping commercial fleets build a robust fleet management system.

Report Coverage

The research report offers an in-depth analysis based on Component, Vehicle Type, Technology Level and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising adoption of driver assistance systems.

- Automakers will integrate trailer assist features in more mid-range and premium vehicles.

- Sensor and camera innovations will improve accuracy and reduce system errors.

- Software upgrades will enable faster trailer recognition and smoother maneuvering.

- Demand from commercial fleets will expand as logistics prioritize safety and efficiency.

- Aftermarket solutions will gain traction in regions with older vehicle bases.

- Regulatory support for advanced safety technologies will accelerate system adoption.

- Rising consumer awareness of towing safety will strengthen market penetration.

- Integration with electric and connected vehicles will create new opportunities.

- Emerging markets in Asia-Pacific and Latin America will drive long-term growth.