Market Overview

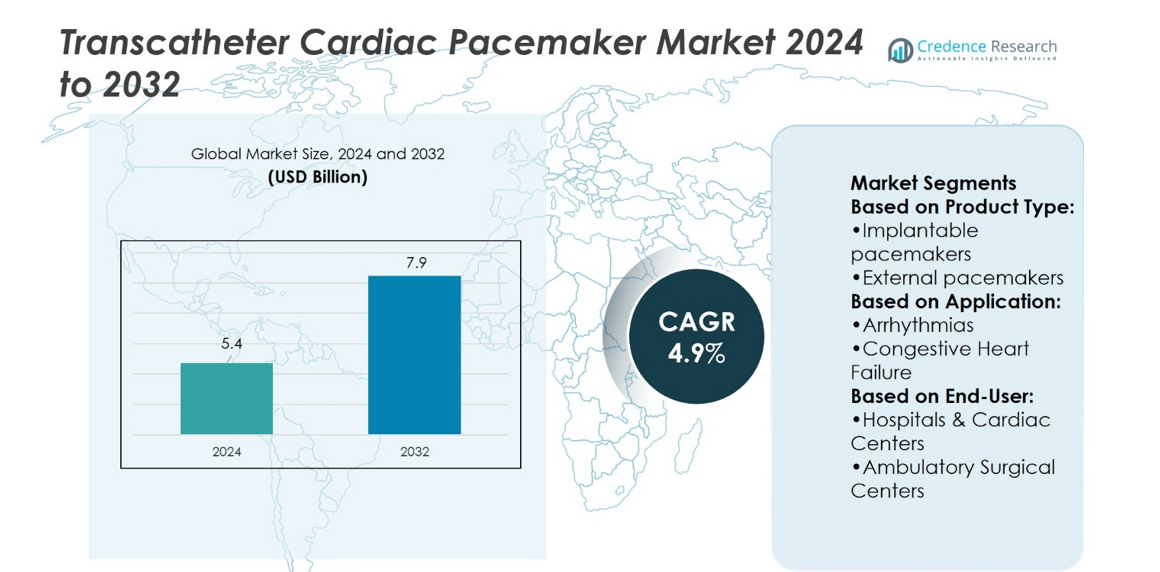

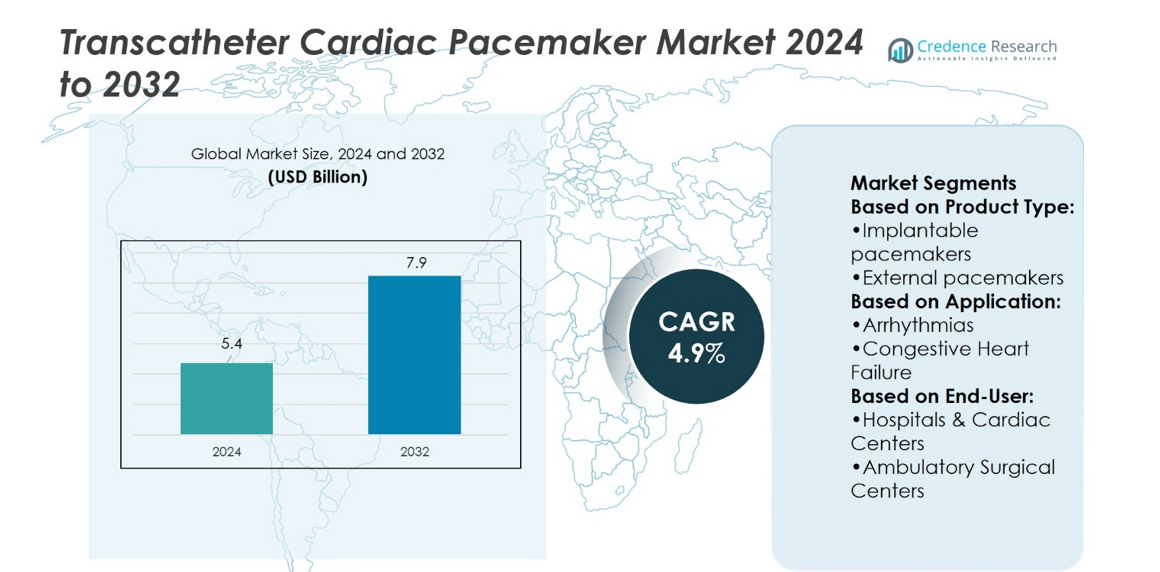

Transcatheter Cardiac Pacemaker Market size was valued at USD 5.4 billion in 2024 and is anticipated to reach USD 7.9 billion by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Transcatheter Cardiac Pacemaker Market Size 2024 |

USD 5.4 billion |

| Transcatheter Cardiac Pacemaker Market , CAGR |

4.9% |

| Transcatheter Cardiac Pacemaker Market Size 2032 |

USD 7.9 billion |

The Transcatheter Cardiac Pacemaker Market grows with rising prevalence of arrhythmias, heart failure, and aging populations requiring advanced pacing solutions. Demand strengthens as patients and providers favor minimally invasive procedures that reduce recovery times and complication risks. Continuous innovations in leadless technology, miniaturization, and extended battery life enhance adoption. Integration of remote monitoring and wireless connectivity improves therapy management and long-term outcomes. Increasing investments in healthcare infrastructure across emerging economies expand access to modern pacing solutions. Supportive regulatory policies and favorable reimbursement frameworks further accelerate adoption, creating strong momentum for sustained market growth and technological advancement worldwide.

North America holds the largest share of the Transcatheter Cardiac Pacemaker Market, supported by advanced healthcare systems and strong adoption of minimally invasive procedures. Europe follows with growing emphasis on regulatory-backed innovation and digital integration in cardiac care. Asia-Pacific emerges as the fastest-growing region, driven by rising cardiac disease prevalence and expanding healthcare investments. Latin America and Middle East & Africa show steady growth supported by urban healthcare infrastructure. Key players include Medtronic, Abbott, Boston Scientific, BIOTRONIK, and MicroPort Scientific Corporation.

Market Insights

- Transcatheter Cardiac Pacemaker Market size was valued at USD 5.4 billion in 2024 and is expected to reach USD 7.9 billion by 2032, at a CAGR of 4.9%.

- Rising prevalence of arrhythmias, heart failure, and aging populations drives consistent demand for advanced pacing solutions.

- Growing preference for minimally invasive, leadless, and miniaturized devices strengthens adoption across hospitals and cardiac centers.

- Competitive landscape highlights strong innovation, with key players focusing on extended battery life and digital integration.

- High device costs and limited reimbursement frameworks in developing regions act as restraints for broader adoption.

- North America dominates the market, Europe follows with innovation-driven growth, and Asia-Pacific emerges as the fastest expanding region.

- Latin America and Middle East & Africa record steady growth, supported by urban healthcare networks and increasing access to modern therapies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Prevalence of Cardiovascular Disorders Driving Device Demand

The Transcatheter Cardiac Pacemaker Market grows with the increasing burden of cardiovascular conditions such as arrhythmias and heart failure. A larger patient pool requires reliable pacing solutions that reduce complications. Rising geriatric populations in developed and emerging regions strengthen demand further. Growing preference for minimally invasive interventions also drives adoption. Hospitals and specialty centers integrate advanced pacemaker technologies to meet these clinical needs. Expanded awareness campaigns and preventive screening programs ensure a steady rise in eligible patients.

- For instance, Shree Pacetronix’s Charak DDD Model 747 uses a lithium-iodine battery rated at 1.58 Ah with an initial voltage of 2.8 V and maintains pacing 100 % at 60 beats per minute for its full expected service life.

Advancements in Miniaturization and Device Design Supporting Wider Adoption

The Transcatheter Cardiac Pacemaker Market benefits from major improvements in device size and design. Miniaturized pacemakers allow implantation through less invasive approaches, reducing recovery time. Smaller footprints and improved battery performance enhance patient comfort and long-term functionality. Companies emphasize ergonomic delivery systems that streamline physician use. These developments improve overall procedural success rates. It strengthens the appeal of these devices for both patients and providers.

- For instance, Oscor’s temporary PACE 203H external pacemaker supports rapid atrial stimulation up to 1,000 pulses per minute via intuitive dials and soft keys, and delivers at least 8 days of continuous operation using a standard 9-V alkaline battery under DDD mode with standard settings.

Integration of Digital Technologies Enhancing Clinical Outcomes

The Transcatheter Cardiac Pacemaker Market advances with digital features such as remote monitoring and wireless communication. Physicians track patient conditions in real time, allowing timely adjustments. Data integration with hospital systems improves decision-making and supports better long-term care. These connected solutions reduce the frequency of in-person visits. It contributes to improved efficiency across healthcare systems. Growing adoption of AI-enabled diagnostic tools further supports optimized therapy management.

Strong Regulatory Support and Reimbursement Frameworks Encouraging Growth

The Transcatheter Cardiac Pacemaker Market gains from supportive policies across major healthcare regions. Favorable reimbursement structures reduce patient cost burdens, driving procedural adoption. Regulatory bodies expedite approvals for innovative pacing devices with demonstrated safety and efficacy. Hospitals invest more confidently in new technologies under clear policy guidance. Training programs for clinicians expand access to advanced solutions. It ensures faster integration of new-generation pacemakers into mainstream treatment practices.

Market Trends

Increasing Shift Toward Leadless Pacemaker Systems Enhancing Clinical Practice

The Transcatheter Cardiac Pacemaker Market shows a strong shift toward leadless pacemaker technology. These systems eliminate the need for leads and surgical pockets, lowering infection risks. Their smaller size supports easier implantation and greater patient comfort. It reduces procedural complexity and enhances long-term reliability. Clinical trials highlight favorable outcomes that support wider adoption. Hospitals and physicians embrace leadless devices as a safer alternative to conventional pacing systems.

- For instance, Boston Scientific’s Empower leadless pacemaker prototype has a volume of approximately 0.78 cm³, positioning it among the smallest such devices reported.

Growing Emphasis on Remote Monitoring and Telehealth Integration

The Transcatheter Cardiac Pacemaker Market reflects a growing trend of remote monitoring integration. Patients benefit from real-time data transmission to healthcare providers. It allows physicians to intervene early when detecting irregularities. Remote connectivity decreases hospital visits, reducing strain on healthcare systems. Integration with telehealth platforms ensures seamless continuity of care. This trend strengthens patient engagement and long-term adherence to therapy plans.

- For instance, OSYPKA’s PACE® Model 101 external temporary pacemaker demonstrates long-duration reliability by sustaining continuous pacing for up to 38 days on a single 9-V alkaline battery when programmed at 72 ppm with an 8 V amplitude.

Expansion of AI and Predictive Analytics Improving Therapy Management

The Transcatheter Cardiac Pacemaker Market advances through the adoption of AI and predictive tools. These systems analyze continuous pacing data to improve therapy decisions. It enhances precision in detecting early complications and managing arrhythmias. Predictive algorithms help forecast patient needs with greater accuracy. Integration of analytics reduces variability in clinical outcomes. Growing partnerships between device makers and digital health firms accelerate this trend.

Rising Focus on Miniaturization and Longer Battery Life Driving Innovation

The Transcatheter Cardiac Pacemaker Market benefits from innovation in device size and power efficiency. Manufacturers create compact pacemakers that minimize procedural invasiveness. It supports better patient comfort and long-term device tolerance. Extended battery performance reduces replacement procedures and improves cost-effectiveness. Research focuses on energy-efficient circuitry and rechargeable options. These advancements reflect a long-term commitment to sustainability and patient-centric design.

Market Challenges Analysis

High Procedural Costs and Limited Accessibility Restricting Broader Adoption

The Transcatheter Cardiac Pacemaker Market faces obstacles due to high procedural expenses and device costs. Many healthcare systems in developing economies lack reimbursement frameworks, limiting access for patients. Hospitals must allocate significant budgets to adopt advanced pacemaker technologies. It restricts availability in cost-sensitive regions, reducing the overall adoption rate. Complex procurement processes and limited distribution networks further add to challenges. These financial barriers create disparities in treatment access across different geographies.

Technical Complications and Safety Concerns Slowing Wider Acceptance

The Transcatheter Cardiac Pacemaker Market also struggles with risks linked to procedural and technical complications. Leadless systems, while advanced, can present retrieval difficulties or device dislodgment. It creates caution among clinicians when selecting these solutions. Long-term safety data remains limited for newer pacemaker models, raising concerns during adoption. Training gaps among physicians further hinder consistent procedural outcomes. Regulatory delays tied to safety evaluations slow market entry for innovative devices. These hurdles collectively limit the pace of global expansion.

Market Opportunities

Expanding Applications in Emerging Healthcare Systems Offering Strong Growth Prospects

The Transcatheter Cardiac Pacemaker Market presents opportunities through expanding healthcare infrastructure in emerging economies. Rising investments in advanced cardiac care centers improve access to modern pacing technologies. It creates scope for companies to enter new regions with tailored solutions. Growing government focus on cardiovascular health further supports adoption of innovative devices. Training initiatives for cardiologists in minimally invasive therapies strengthen the clinical ecosystem. Expanding patient pools in Asia-Pacific, Latin America, and Middle East regions highlight significant untapped potential.

Technological Advancements and Strategic Collaborations Creating Pathways for Innovation

The Transcatheter Cardiac Pacemaker Market benefits from opportunities linked to miniaturization, battery longevity, and digital integration. Device makers invest in wireless communication, AI-enabled monitoring, and rechargeable systems. It enhances patient safety, reduces complications, and improves long-term management of cardiac conditions. Collaborations between medtech firms and research institutes accelerate product development pipelines. Joint ventures with hospitals expand clinical trial capacity and market reach. Continuous innovation opens pathways to strengthen competitiveness while addressing evolving patient needs.

Market Segmentation Analysis:

By Product Type

The Transcatheter Cardiac Pacemaker Market divides into implantable pacemakers and external pacemakers. Implantable pacemakers dominate due to their long-term reliability, minimal invasiveness, and ability to deliver consistent pacing in complex cases. Continuous design improvements such as miniaturized sizes and longer battery life expand clinical adoption. External pacemakers hold relevance in temporary or emergency use, particularly for patients awaiting permanent implantation. It ensures quick stabilization during acute cardiac episodes. Both product types demonstrate strong demand, though implantable devices maintain the primary focus for sustained growth.

- For instance, Abbott’s AVEIR DR dual-chamber leadless system introduces groundbreaking implant-to-implant (i2i) wireless communication. In a pivotal study across 55 centers, 300 patients achieved a 98.3% implant success rate, with over 97% demonstrating successful atrioventricular synchrony, and average AV synchrony exceeding 95% across seven different postures and walking speeds.

By Application

The Transcatheter Cardiac Pacemaker Market segments into arrhythmias, congestive heart failure, and others. Arrhythmias lead the application category, supported by the rising prevalence of atrial fibrillation and bradycardia. Pacemakers provide precision pacing to maintain stable heart rhythms in these conditions. Congestive heart failure represents another critical segment, where pacemakers improve cardiac output and patient quality of life. It drives adoption among aging populations who face higher risks of advanced heart disease. The “others” category includes usage in syncope, conduction disorders, and post-surgical cardiac complications, contributing to broader clinical adoption.

- For instance, MEDICO’s IRIS DR dual-chamber pacemaker integrates ECG diagnostics that automatically store atrial and ventricular electrogram of up to 12 seconds per episode, enabling precise differentiation between supraventricular and ventricular tachyarrhythmias.

By End-User

The Transcatheter Cardiac Pacemaker Market categorizes end-users into hospitals and cardiac centers, ambulatory surgical centers, and others. Hospitals and cardiac centers account for the largest share, supported by advanced infrastructure, high patient volumes, and availability of skilled specialists. They remain the central hubs for implantation and follow-up care. Ambulatory surgical centers gain traction with rising preference for outpatient procedures that reduce costs and hospital stays. It highlights the growing role of specialized facilities in offering minimally invasive solutions. The “others” category covers smaller clinics and diagnostic centers, where accessibility and patient-specific needs create demand for pacemaker monitoring and support.

Segments:

Based on Product Type:

- Implantable pacemakers

- External pacemakers

Based on Application:

- Arrhythmias

- Congestive Heart Failure

Based on End-User:

- Hospitals & Cardiac Centers

- Ambulatory Surgical Centers

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Transcatheter Cardiac Pacemaker Market, accounting for 38% of the global revenue. The region benefits from strong adoption of minimally invasive cardiac procedures and advanced healthcare infrastructure. Hospitals across the United States and Canada actively integrate leadless pacemakers and digital monitoring solutions into clinical practice. High prevalence of arrhythmias and congestive heart failure strengthens demand for long-term pacing therapies. It gains additional support from favorable reimbursement frameworks that reduce patient cost burdens. Major companies in the region invest in product launches, training programs, and collaborative clinical studies to maintain their leadership. The presence of skilled cardiologists and dedicated cardiac centers further accelerates market penetration.

Europe

Europe represents the second-largest market with a share of 28%. Countries such as Germany, France, and the United Kingdom drive demand due to advanced cardiovascular care systems. The region emphasizes patient safety and regulatory compliance, supporting the introduction of new-generation pacemakers with longer battery life and improved biocompatibility. It reflects a growing trend of adopting wireless and leadless devices, particularly in Western Europe. Eastern European countries show steady growth, driven by investments in hospital infrastructure and government healthcare programs. Strategic partnerships between medical device firms and academic institutions advance innovation pipelines. Europe also benefits from strong awareness campaigns that promote preventive cardiology and early diagnosis.

Asia-Pacific

Asia-Pacific emerges as the fastest-growing region, holding 22% of the Transcatheter Cardiac Pacemaker Market. Rising incidence of cardiac disorders in China, India, and Japan expands the patient base significantly. Increasing healthcare spending and government investments in modernizing cardiac care facilities support rapid adoption. It also benefits from large-scale training initiatives aimed at improving the skill base of interventional cardiologists. Japan remains a hub of innovation, while China demonstrates rapid capacity expansion with local manufacturing. India experiences growing demand fueled by a high burden of heart disease and greater affordability of advanced therapies. Expanding private healthcare networks across Southeast Asia contribute to rising implantation volumes.

Latin America

Latin America contributes 7% of the global market. Brazil and Mexico represent the largest contributors, with growing investments in healthcare infrastructure and specialist training. The region demonstrates rising demand for transcatheter pacemakers due to increasing patient preference for less invasive treatments. It faces challenges linked to limited reimbursement coverage, which restricts access in certain areas. However, expanding private hospital networks provide opportunities for market penetration. It shows particular growth in urban regions where advanced cardiology units are more accessible. Device makers focus on distributor partnerships and localized pricing strategies to expand adoption across diverse patient populations.

Middle East & Africa

The Middle East & Africa region accounts for 5% of the Transcatheter Cardiac Pacemaker Market. Wealthier Gulf states such as Saudi Arabia and the United Arab Emirates invest heavily in advanced cardiac care facilities. South Africa and Egypt represent emerging hubs, though resource limitations slow broader adoption. It gains momentum through international collaborations that bring expertise and training to local hospitals. Regional governments increase focus on cardiovascular disease management through national health programs. Urban centers demonstrate higher procedural volumes, while rural areas still lack adequate access. Companies entering this market leverage partnerships with government agencies and teaching hospitals to improve availability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- MicroPort Scientific Corporation

- Shree Pacetronix Ltd.

- OSCOR Inc

- Boston Scientific Corporation

- BIOTRONIK SE & Co. KG

- OSYPKA MEDICAL

- Abbott

- MEDICO S.R.L.

- Zoll Medical Corporation, an Asahi Kasei Group Company

- Medtronic

Competitive Analysis

The Transcatheter Cardiac Pacemaker Market players such as MicroPort Scientific Corporation, Shree Pacetronix Ltd., OSCOR Inc, Boston Scientific Corporation, BIOTRONIK SE & Co. KG, OSYPKA MEDICAL, Abbott, MEDICO S.R.L., Zoll Medical Corporation (an Asahi Kasei Group Company), and Medtronic. The Transcatheter Cardiac Pacemaker Market demonstrates strong competition driven by innovation, clinical outcomes, and global reach. Companies focus on miniaturization of devices, extended battery performance, and integration of digital technologies such as wireless monitoring and remote connectivity. Research pipelines emphasize precision pacing systems tailored for diverse cardiac conditions, while strategic collaborations with hospitals and research institutes accelerate product development. Manufacturers expand training programs for physicians to ensure consistent procedural success and broader adoption. Competitive strategies also include localized manufacturing, cost optimization, and product customization to meet the needs of developed and emerging healthcare systems. The market’s competitive landscape reflects a balance of technological leadership, patient safety priorities, and regional accessibility that collectively drive sustained growth.

Recent Developments

- In March 2025, MicroPort CRM launched the localized TEN pacemaker family in China. The TEN pacemaker range includes six models across three categories: T, E, and N, offering both single-chamber and dual-chamber frequency-responsive pacemakers. These devices feature AutoML™ technology and the advanced SAM™ function for monitoring nighttime sleep breathing patterns and associated arrhythmias.

- In September 2024, Boston Scientific Corporation received FDA approval to extend the use of INGEVITY+ Pacing Leads for conduction system pacing (CSP) and for sensing the left bundle branch area (LBBA). This technique provides an alternative to traditional right ventricular pacing for individuals experiencing symptomatic bradycardia.

- In June 2024, Abbott announced CE Mark approval for its AVEIR dual chamber (DR) leadless pacemaker, the first of its kind for dual chamber treatment of abnormal heart rhythms. This system features two small devices-AVEIR VR for the right ventricle and AVEIR AR for the right atrium-that wirelessly communicate to deliver coordinated therapy.

- In January 2024, Medtronic received CE Mark approval for its next-generation Micra™ AV2 and Micra™ VR2 leadless pacemakers. These devices offer approximately 40% more battery life compared to previous generations, with projected longevity of nearly 16 and 17 years, respectively. They also feature remote monitoring capabilities, allowing clinicians to check on a patient’s heart device without the need for in-person visits.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising adoption of minimally invasive pacemaker procedures.

- Leadless pacemakers will gain wider clinical preference due to safety and comfort advantages.

- Battery innovations will extend device life and reduce replacement interventions.

- Remote monitoring will become standard, improving long-term patient management.

- AI-driven analytics will support predictive insights and personalized pacing therapies.

- Emerging economies will increase investments in cardiac care infrastructure.

- Strategic collaborations will accelerate product development and clinical trial capacity.

- Training programs for physicians will enhance procedural expertise worldwide.

- Regulatory support will encourage faster approvals of innovative pacing devices.

- The market will grow steadily through combined technological, clinical, and regional expansion.