Market Overview:

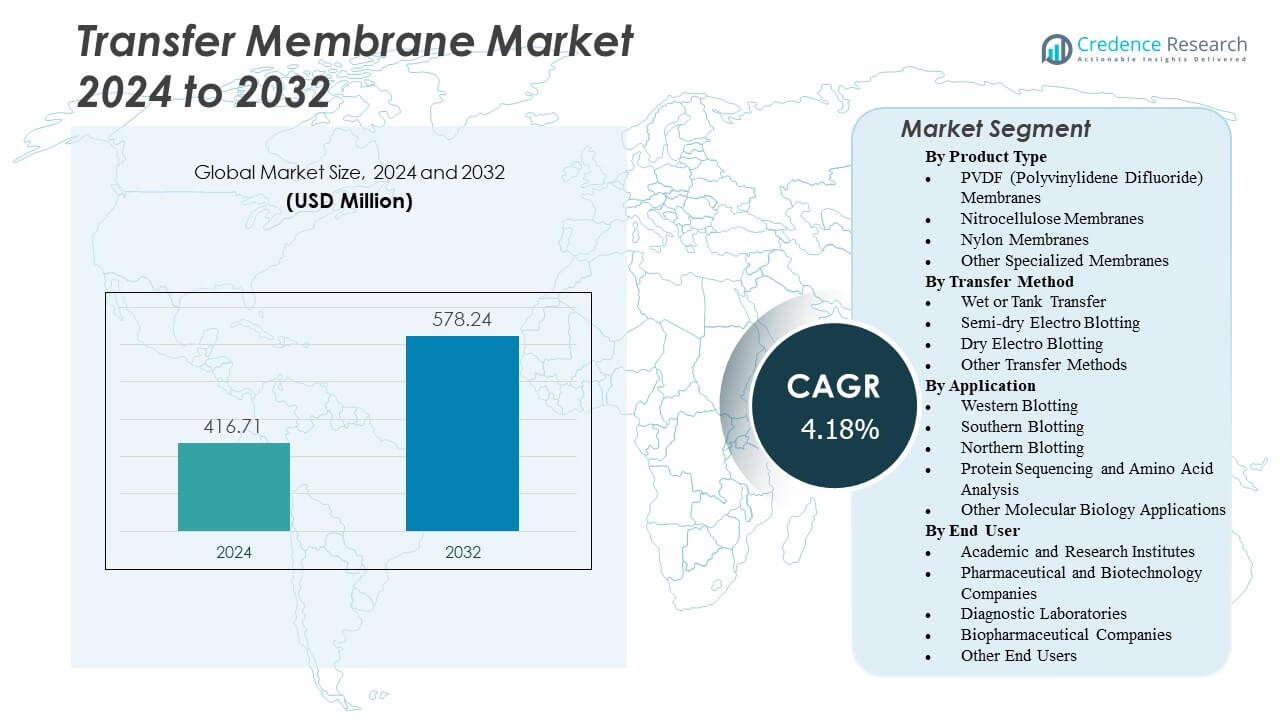

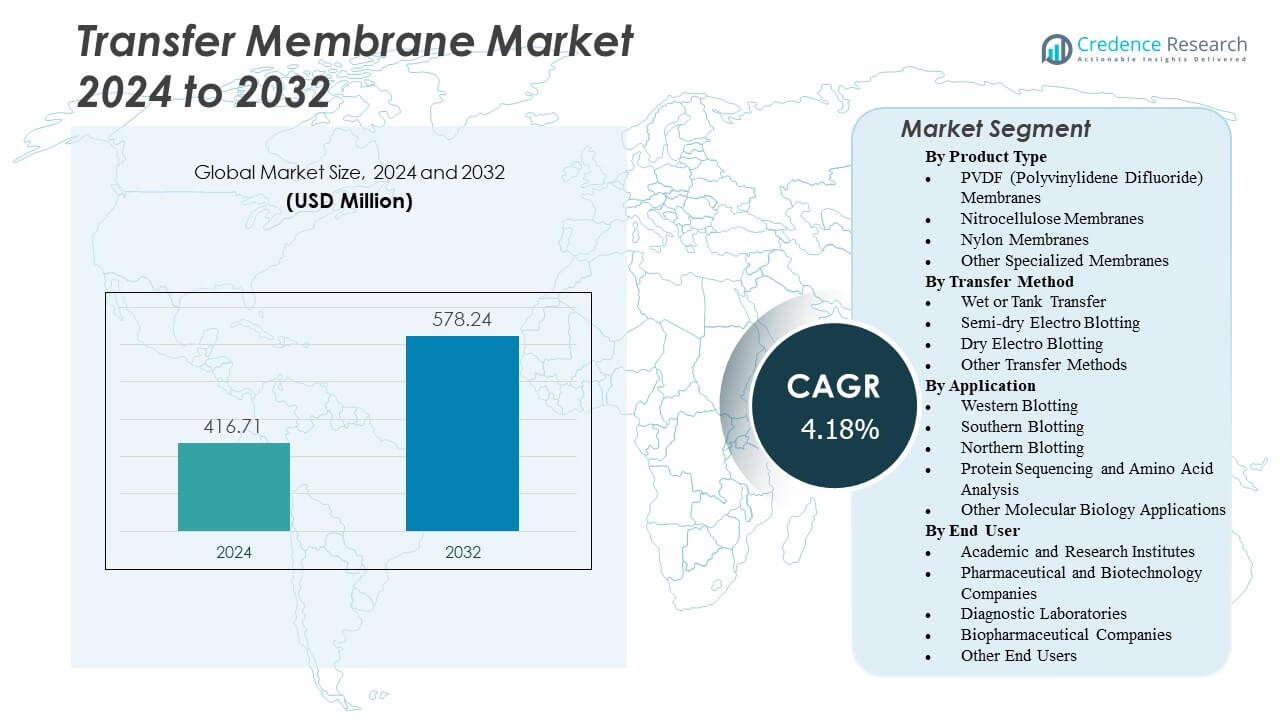

The Transfer Membrane Market is projected to grow from USD 416.71 million in 2024 to an estimated USD 578.24 million by 2032, with a compound annual growth rate (CAGR) of 4.18% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Transfer Membrane Market Size 2024 |

USD 416.71 Million |

| Transfer Membrane Market, CAGR |

4.18% |

| Transfer Membrane Market Size 2032 |

USD 578.24 Million |

The key driver for market growth is the growing focus on disease diagnostics, personalized medicine, and protein analysis. It benefits from the widespread use of PVDF and nitrocellulose membranes in molecular assays for detecting proteins and nucleic acids. The expansion of research in proteomics and genomic sequencing encourages continuous innovation in transfer membrane technology. Manufacturers are developing high-performance materials with improved binding capacity, sensitivity, and chemical resistance to meet evolving laboratory standards. Increasing R&D funding across pharmaceutical and academic sectors also supports market expansion.

North America dominates the global market due to strong research infrastructure, significant R&D investments, and high adoption rates in biotechnology and diagnostics. Europe follows closely with advanced biopharmaceutical production and academic research collaborations. Asia-Pacific is emerging as a key growth hub, supported by expanding biotechnology sectors in China, Japan, and India. Growing healthcare investment and research funding fuel regional demand. Latin America and the Middle East & Africa are developing markets, gradually adopting advanced molecular biology techniques.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Transfer Membrane Market is projected to grow from USD 416.71 million in 2024 to USD 578.24 million by 2032, at a CAGR of 4.18%.

- Increasing demand for protein and nucleic acid analysis in molecular biology boosts market adoption.

- Growing research in proteomics, genomics, and personalized medicine strengthens product utilization.

- Manufacturers focus on developing PVDF and nitrocellulose membranes with higher binding efficiency.

- High production costs and limited standardization across laboratories pose challenges to market expansion.

- North America leads due to advanced biotechnology infrastructure and consistent R&D investments.

- Asia-Pacific emerges as a fast-growing region driven by expanding biopharmaceutical and academic research sectors.

Market Drivers

Rising Focus on Molecular Biology Research and Diagnostic Advancements

The growing investment in molecular biology and diagnostic applications is a primary driver of the Transfer Membrane Market. It is gaining demand from researchers focused on studying protein and nucleic acid interactions with precision. The membranes are essential in blotting techniques, supporting effective visualization and quantification. Increased public and private funding for genomics and proteomics strengthens the market position. Pharmaceutical and biotech firms are adopting transfer membranes to ensure accurate protein identification. The trend toward personalized medicine supports a steady demand for reliable analysis tools. Growing adoption in infectious disease research adds further growth potential. The ongoing development of innovative laboratory protocols reinforces this expansion.

- For instance, Amersham Protran Premium 0.45 NC nitrocellulose membranes by Cytiva are made from 100% pure nitrocellulose and feature a protein binding capacity of 162–180 µg IgG/cm². They are designed for high-sensitivity protein transfer and are widely used in Western blot applications.

Development of High-Performance Membranes with Enhanced Sensitivity and Durability

Manufacturers are investing in advanced materials that improve sensitivity and durability, driving market innovation. PVDF and nitrocellulose membranes are being refined to enhance protein binding and detection accuracy. It benefits from these advancements through improved reproducibility and longer shelf life. High mechanical strength and chemical resistance are becoming key product differentiators. Companies are developing low-background membranes that ensure superior signal clarity. These developments improve outcomes in protein blotting and sequencing applications. Enhanced automation compatibility further supports large-scale research workflows. The trend contributes to wider acceptance in academic and industrial laboratories.

Increased Use of Transfer Membranes in Proteomics and Biopharmaceutical Research

Expanding proteomics and biopharmaceutical research continues to boost market demand. It supports complex analyses that require consistent and precise protein transfer. Researchers in therapeutic development rely on these membranes for efficient molecular validation. Growing biopharmaceutical pipelines create recurring needs for membrane-based assays. Government-backed initiatives promoting protein mapping expand laboratory-scale applications. Membrane-based Western blotting remains a preferred choice for protein confirmation studies. Enhanced data reproducibility increases user confidence in research environments. The segment’s growth aligns with broader trends in bioinformatics and molecular diagnostics.

- For example, the Immobilon®‑FL PVDF Membrane by Merck KGaA features a nominal pore size of 0.45 µm and offers a protein adsorption capacity of up to 300 µg/cm² (goat IgG).

Technological Integration and Automation in Laboratory Workflows

Automation and digital integration are transforming laboratory processes and strengthening adoption. The Transfer Membrane Market benefits from automation in electrophoresis and blotting systems. It improves operational efficiency and reduces human error in analytical workflows. Integration with robotic platforms accelerates high-throughput testing in diagnostics. Digital tracking of transfer accuracy ensures consistent data quality. Automation also supports laboratories in adhering to regulatory standards. Smart membrane systems are emerging to optimize precision in repetitive protocols. The alignment of transfer technologies with automated diagnostics enhances research output globally.

Market Trends

Shift Toward Sustainable and Eco-Friendly Membrane Manufacturing

Environmental sustainability is shaping trends within the Transfer Membrane Market. Manufacturers are focusing on eco-friendly production processes and recyclable materials. It aligns with global sustainability goals in biotechnology and healthcare manufacturing. Bio-based polymer alternatives are being explored to replace conventional plastics. Energy-efficient production lines are reducing waste and resource consumption. Regulatory emphasis on reducing environmental impact supports this transition. Companies investing in greener technologies strengthen their brand value. The trend reflects growing awareness of environmental responsibility in scientific supply chains.

- For instance, Pall Corporation reported a 40% reduction in market-based greenhouse gas emissions across its manufacturing sites since 2021, with 76% of its global sites ISO14001 certified for environmental management as of April 2025. This verified achievement is detailed in Pall’s corporate sustainability disclosures and annual environmental reports.

Adoption of Hybrid Membranes for Improved Analytical Versatility

Hybrid membranes combining features of multiple materials are gaining research traction. These membranes enhance compatibility with diverse analytical techniques. It promotes greater flexibility in life science experiments and diagnostics. Hybrid systems improve both hydrophobic and hydrophilic performance in assays. They support faster transfer times without compromising sensitivity or resolution. Researchers prefer these membranes for challenging protein analysis conditions. Ongoing product innovations target cross-compatibility with emerging blotting systems. The approach improves laboratory efficiency while maintaining data reliability across platforms.

Expansion of Digital Blot Imaging and Data Standardization Practices

Digital imaging tools are influencing how researchers document blotting results. It helps ensure consistency and traceability in data recording and analysis. Integration of imaging software supports quantification and automated reporting. Cloud-based data management allows multi-site collaboration on shared experiments. Digitalization reduces manual interpretation errors common in traditional workflows. Manufacturers now bundle transfer membranes with compatible imaging systems. This convergence of hardware and software strengthens standardization efforts. The trend ensures reproducibility in clinical and academic research settings.

Growing Role of Membrane Solutions in Point-of-Care Diagnostics

Transfer membranes are increasingly being integrated into point-of-care devices. The Transfer Membrane Market benefits from rapid diagnostic applications in hospitals and clinics. It supports lateral flow and immunoassay systems for infectious disease testing. Rapid detection methods are relying on improved membrane permeability and uniformity. Manufacturers are focusing on fine pore control for high assay precision. Membrane design now emphasizes consistent capillary flow for faster results. These advances shorten diagnostic turnaround times in critical care situations. The trend underscores the transition toward decentralized and fast-testing healthcare models.

- For instance, Sartorius’ UniSart CN nitrocellulose membranes are designed for lateral flow immunoassays, offering reliable capillary flow and consistent membrane structure essential for rapid detection tests. These membranes are widely used in diagnostic platforms, including rapid antigen assays, due to their uniform performance and high manufacturing quality.

Market Challenges Analysis

High Production Costs and Limited Standardization Across Applications

The production of high-quality membranes requires complex processing and quality control. The Transfer Membrane Market faces challenges from rising raw material costs. It increases the burden on smaller manufacturers competing with global suppliers. Variability in performance across different batches creates reliability issues for end users. Limited standardization of protocols between laboratories leads to inconsistent outcomes. Regulatory compliance adds further financial strain for certification and testing. High investment requirements slow entry for emerging regional players. This challenge emphasizes the need for scalable and cost-efficient production techniques.

Technical Limitations in Reproducibility and Protein Binding Efficiency

Reproducibility and binding consistency remain persistent technical concerns. It affects experiment accuracy, especially in high-sensitivity proteomic analyses. Variations in membrane porosity impact protein retention and signal strength. Some membranes fail to perform uniformly under extreme pH or temperature conditions. Repeated washing steps often lead to sample loss and inconsistent blotting. Laboratories face challenges maintaining uniform transfer results across multiple runs. These performance limitations restrict application in highly regulated research environments. Continuous improvements in surface chemistry are required to resolve these technical gaps.

Market Opportunities

Rising Biopharmaceutical Research Investments and Contract Manufacturing Expansion

The growing biopharmaceutical pipeline opens opportunities for transfer membrane suppliers. The Transfer Membrane Market gains from increased contract manufacturing activities. It enables greater demand for membranes used in protein and biomarker validation. Outsourcing of R&D to specialized labs expands product adoption globally. Research collaborations between public and private entities strengthen market penetration. Companies offering tailored membrane solutions for specific protein targets gain a competitive edge. Expansion of biologics and vaccine development further supports growth prospects. The opportunity lies in offering scalable and application-specific membrane technologies.

Emergence of Advanced Nanostructured and Functionalized Membrane Materials

Nanostructured membranes represent a significant future opportunity for performance enhancement. It enables precise control over molecular transfer and adsorption dynamics. Functionalized membranes with reactive coatings improve selectivity and binding strength. These innovations expand usage in complex protein sequencing and biosensing applications. Companies exploring nanotechnology integration position themselves for technological leadership. Collaborative research between academia and industry accelerates innovation. The convergence of nanomaterials with membrane engineering ensures higher assay reliability. This advancement creates a competitive landscape driven by innovation and specialized expertise.

Market Segmentation Analysis:

By Product Type

The Transfer Membrane Market is segmented by product type into PVDF, nitrocellulose, nylon, and other specialized membranes. PVDF membranes dominate due to their high mechanical strength, chemical resistance, and superior protein retention. Nitrocellulose membranes remain preferred for high signal clarity and affordability in standard blotting. Nylon membranes offer high tensile strength and are often used for nucleic acid transfer. Specialized membranes, including Immobilon variants, serve advanced applications requiring low background and enhanced sensitivity. It continues to see strong product innovation focused on material performance and reproducibility.

- For instance, Merck’s Immobilon-P PVDF membranes feature a 0.45 µm pore size and a hydrophobic surface with verified protein-binding capacities of 215 µg/cm² for albumin and 294 µg/cm² for goat IgG, as specified in Merck’s technical datasheets.

By Transfer Method

By transfer method, the market includes wet or tank transfer, semi-dry electro blotting, dry electro blotting, and other techniques. Wet transfer systems are widely adopted for their high transfer efficiency and compatibility with large proteins. Semi-dry blotting provides faster processing and reduced buffer consumption. Dry electro blotting has gained traction for its speed and ease of use in automated systems. It enables laboratories to streamline workflows while maintaining high accuracy. Other methods support specific experimental setups, ensuring flexibility across diverse laboratory needs.

- For instance, Bio-Rad’s Trans-Blot Turbo System completes semi-dry protein transfers in as little as 3–10 minutes per gel, a significant reduction compared to traditional wet or semi-dry transfers requiring 30–60 minutes, per the official Bio-Rad system manual.

By Application

Based on application, the market covers Western blotting, Southern blotting, Northern blotting, protein sequencing, and other molecular biology applications. Western blotting holds a major share due to its central role in protein detection and validation. Southern and Northern blotting techniques remain essential in genetic and RNA research. Protein sequencing applications demand membranes with high binding efficiency and stability. It is benefiting from expanded use in personalized medicine, oncology research, and proteomic studies. The segment continues evolving with the integration of digital analysis tools.

By End User

By end user, the market is divided into academic and research institutes, pharmaceutical and biotechnology companies, diagnostic laboratories, biopharmaceutical companies, and other end users. Academic and research institutes dominate due to strong research activity and government-funded projects. Pharmaceutical and biotechnology companies utilize membranes for drug discovery and biomarker analysis. Diagnostic laboratories apply them for disease detection and validation studies. Biopharmaceutical companies rely on them for protein characterization during product development. It maintains growing adoption in CROs and independent testing centers focused on molecular biology.

Segmentation:

By Product Type

- PVDF (Polyvinylidene Difluoride) Membranes

- Nitrocellulose Membranes

- Nylon Membranes

- Other Specialized Membranes

By Transfer Method

- Wet or Tank Transfer

- Semi-dry Electro Blotting

- Dry Electro Blotting

- Other Transfer Methods

By Application

- Western Blotting

- Southern Blotting

- Northern Blotting

- Protein Sequencing and Amino Acid Analysis

- Other Molecular Biology Applications

By End User

- Academic and Research Institutes

- Pharmaceutical and Biotechnology Companies

- Diagnostic Laboratories

- Biopharmaceutical Companies

- Other End Users

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds the dominant share of 37% in the Transfer Membrane Market, supported by advanced biotechnology infrastructure and extensive R&D funding. The United States leads due to a strong network of research institutions, pharmaceutical companies, and diagnostic laboratories. It benefits from government-backed biomedical research programs and high adoption of proteomics tools. Canada complements the regional growth through investments in healthcare innovation and academic collaborations. The focus on protein sequencing, disease biomarker studies, and high-quality research standards sustains market leadership. The presence of major manufacturers and distributors ensures efficient product availability and faster adoption across laboratories.

Europe accounts for 29% of the market share, driven by strong pharmaceutical manufacturing and academic research networks. Germany, the United Kingdom, and France contribute significantly through biopharmaceutical advancements and clinical diagnostic developments. It experiences growth from increased government support for life sciences research and proteomic studies. The region’s emphasis on laboratory automation and sustainability also drives new membrane innovations. Companies in Europe focus on producing eco-friendly materials and expanding application coverage across molecular biology. The integration of digital blotting and imaging solutions supports better analytical performance. Regional demand continues to rise with increasing collaborations between universities and biotech firms.

Asia-Pacific captures 25% of the market and is the fastest-growing region due to expanding biotechnology sectors in China, Japan, and India. Rapid urbanization and rising healthcare expenditure promote adoption in diagnostic and research laboratories. It benefits from strong government investment in genomics and academic R&D. Japan remains a hub for technological advancements in electrophoresis systems, while China and India lead in research expansion. The region’s growing focus on biopharmaceutical production and academic collaboration fuels demand for advanced membranes. Latin America and the Middle East & Africa together hold the remaining 9% share, showing potential for future growth through capacity expansion and healthcare modernization.

Key Player Analysis:

- Thermo Fisher Scientific

- Merck KGaA

- Bio-Rad Laboratories

- GE Healthcare

- Danaher Corporation

- PerkinElmer

- Abcam Plc

- Santa Cruz Biotechnology

- ATTO Corporation

- Azure Biosystems

- Advansta Inc.

- GVS S.p.A.

- Pall Corporation

- Macherey-Nagel

Competitive Analysis:

The Transfer Membrane Market features a mix of global leaders and specialized regional players focusing on innovation, product reliability, and application-specific solutions. Major companies such as Merck KGaA, Thermo Fisher Scientific, Bio-Rad Laboratories, Cytiva, and Pall Corporation dominate through extensive product portfolios and established distribution networks. It is characterized by continuous material advancements and integration of automation technologies to enhance analytical accuracy. Strategic collaborations with research institutions and diagnostic firms expand product reach and improve performance standards. Companies are investing in eco-friendly materials and advanced coating technologies to meet evolving regulatory and research demands. Competition remains strong as firms focus on improving membrane sensitivity, durability, and digital compatibility to strengthen their market positions.

Recent Developments:

- In October 2025, Merck KGaA signed a definitive agreement to acquire the chromatography business of JSR Life Sciences.

- In September 2025, Thermo Fisher Scientific completed the acquisition of Solventum’s Purification & Filtration business for $4.1 billion. This acquisition is explicitly intended to enhance Thermo Fisher’s capabilities in bioprocessing filtration for pharmaceutical and biotechnology clients, marking a prominent step to strengthen its footprint in the transfer membrane market.

- In May 2025, Danaher Corporation entered a strategic partnership with AstraZeneca through its Leica Biosystems subsidiary to co-develop and commercialize precision diagnostic tools, harnessing advanced transfer membrane technologies and AI-assisted algorithms.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Transfer Method, Application and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for high-performance membranes will expand as proteomics and genomics research advances globally.

- Automation in laboratory workflows will strengthen efficiency and improve transfer precision in diagnostic labs.

- Manufacturers will focus on sustainable and recyclable materials to meet environmental standards.

- Digital integration and smart imaging systems will enhance reproducibility and data accuracy in experiments.

- Collaboration between biotech firms and academic institutions will promote continuous innovation in membrane technology.

- Emerging economies will see rising adoption due to expanding biopharmaceutical and research infrastructure.

- Hybrid and nanostructured membranes will gain traction for advanced molecular analysis applications.

- Continuous R&D funding in life sciences will drive material and process improvements in membrane production.

- Integration with AI-based data analysis tools will support better interpretation of protein expression studies.

- Strategic partnerships among suppliers and end users will reinforce the global competitiveness of the market.