Market Overview:

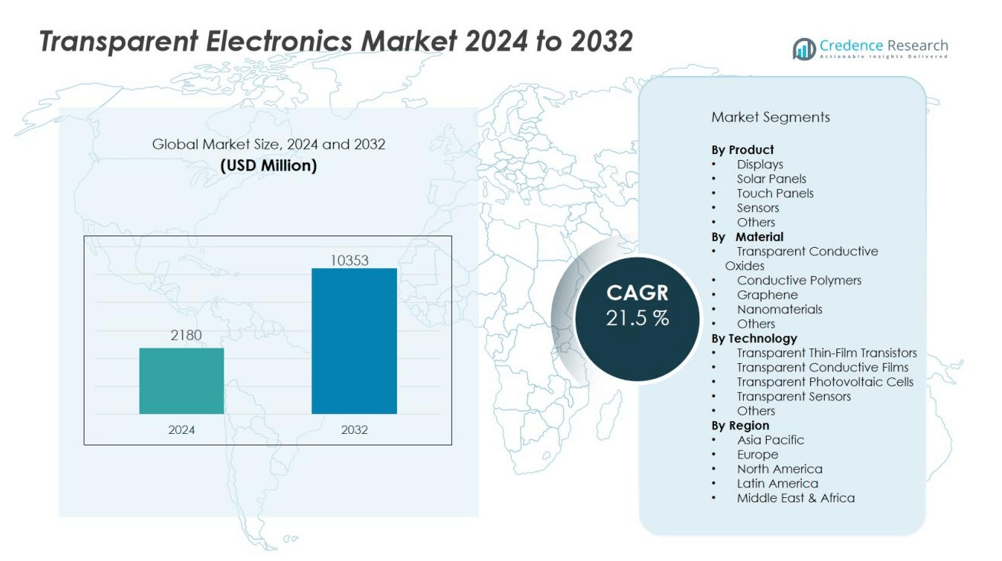

The Transparent electronics market size was valued at US 2180 million in 2024 and is anticipated to reach USD 10353 million by 2032, at a CAGR of 21.5 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Transparent Electronics Market Size 2024 |

US 2180 million |

| Transparent Electronics Market, CAGR |

21.5% |

| Transparent Electronics Market Size 2032 |

USD 10353 million |

Growth drivers of the transparent electronics market include rising demand for smart consumer devices, sustainability trends, and the push for lightweight, flexible, and energy-efficient electronics. Transparent conductive oxides, polymers, and graphene are playing a key role in developing next-generation displays and solar panels. The adoption of transparent displays in augmented reality, vehicle windshields, and smart wearables further strengthens market expansion. Increasing R&D investments from major technology firms and government support for renewable energy integration also drive growth opportunities.

Regionally, North America leads the transparent electronics market with strong adoption in automotive, aerospace, and consumer electronics, accounting for nearly 35 percent of global share. Europe follows closely, supported by advanced research programs and demand for sustainable energy technologies. Asia Pacific is expected to register the fastest growth, driven by consumer electronics manufacturing in China, Japan, and South Korea, along with expanding adoption of transparent solar applications. Latin America and the Middle East & Africa show gradual growth with increasing investment in renewable projects.

Market Insights:

- The Transparent electronics market was valued at USD 2180 million in 2024 and is projected to reach USD 10353 million by 2032, recording a CAGR of 21.5 % during the forecast period.

- Growth is fueled by rising demand for smart consumer devices, transparent displays in AR, vehicle windshields, and wearable technologies, supported by innovation in conductive oxides, polymers, and graphene.

- Key challenges include high production costs, complex fabrication methods, and performance limitations such as trade-offs between conductivity, transparency, and long-term durability under environmental stress.

- North America leads with 35 % share, backed by strong adoption in consumer electronics, aerospace, and automotive sectors, while Asia Pacific holds 32 % share and shows the fastest expansion driven by manufacturing dominance in China, Japan, and South Korea.

- Europe maintains 22 % share, supported by sustainability initiatives, green energy policies, and advanced R&D, while Latin America and the Middle East & Africa show gradual growth through renewable energy integration and smart infrastructure projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Advanced Consumer Electronics:

The Transparent electronics market is driven by the increasing adoption of next-generation consumer devices. Transparent displays and touch panels are gaining traction in smartphones, tablets, and smart wearables. Manufacturers seek lightweight, flexible, and energy-efficient solutions to meet evolving consumer expectations. It supports innovation in device design while improving product performance and aesthetics.

- For instance, Samsung Electronics showcased its 55-inch transparent OLED display achieving 40% transparency while maintaining full HD resolution, demonstrating a significant leap in balancing clarity with display quality.

Expanding Applications in Automotive and Aerospace:

Automotive and aerospace industries are fueling market growth with the integration of transparent displays and conductive materials. Heads-up displays, smart windows, and augmented windshields are becoming standard in premium vehicles. Aerospace applications use transparent electronics for lightweight control panels and advanced navigation systems. It enhances safety, efficiency, and user experience while reducing material weight.

- For instance, Panasonic Automotive developed a transparent OLED heads-up display that delivers 1000 nits of brightness, significantly improving visibility even in direct sunlight.

Technological Advancements in Materials and Nanotechnology:

Advances in nanomaterials, conductive polymers, and graphene play a key role in market expansion. These materials improve conductivity, durability, and flexibility of transparent components. Their adoption in solar panels and medical devices increases the scope of applications. It positions transparent electronics as a critical enabler of innovation across diverse industries.

Support from Renewable Energy and Sustainability Goals:

Global sustainability efforts create strong demand for transparent solar cells and energy-efficient devices. Governments and corporations are investing in renewable energy technologies that integrate transparent electronics. This includes applications in building-integrated photovoltaics and smart glass systems. It supports environmental goals while creating profitable opportunities for industry players worldwide.

Market Trends:

Integration of Transparent Electronics into Smart Devices and Displays:

The Transparent electronics market is witnessing a strong trend of integration into smart devices and interactive displays. Transparent OLEDs, LCDs, and micro-LED technologies are advancing design possibilities for smartphones, televisions, and wearable devices. Manufacturers are focusing on thinner, flexible, and energy-efficient components that deliver enhanced user experiences. Retail and advertising sectors are adopting transparent display panels for interactive signage and immersive customer engagement. Automotive companies are also embedding transparent electronics into windshields and dashboard systems to improve driver safety and visibility. It demonstrates the expanding role of transparent components in reshaping both consumer electronics and industrial applications.

- For instance, LG Display’s 55EW5P-M 55-inch Transparent OLED signage combines self-emitting pixels with no backlight, achieving 43% transparency while delivering up to 600 nits peak brightness.

Growth in Renewable Energy and Smart Infrastructure Applications:

The Transparent electronics market is also shaped by its rising role in renewable energy solutions and smart infrastructure. Transparent solar cells and building-integrated photovoltaics are being used in windows, facades, and smart glass to improve energy efficiency. Governments and corporations are investing in these technologies to align with sustainability goals and carbon reduction targets. Healthcare and medical device industries are deploying transparent sensors for diagnostics and monitoring, reflecting broader adoption across sectors. Smart cities are incorporating transparent electronics into urban infrastructure to create intelligent, connected environments. It highlights the role of transparent technologies in enabling energy savings, advanced monitoring, and sustainable development across industries.

- For instance, View Inc.’s electrochromic dynamic windows reduced total building energy consumption by 28% compared to single-pane baseline in a Department of Defense demonstration project, delivering 2.4× greater savings than upgrading to low-e glazing.

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Processes:

The Transparent electronics market faces a significant challenge due to high production costs and complex fabrication methods. Advanced materials such as graphene, conductive polymers, and transparent oxides require expensive processes to achieve scalability. Limited yield rates in mass production restrict widespread adoption across industries. Manufacturers struggle to balance performance, durability, and cost efficiency in commercial applications. It creates barriers for small and medium enterprises to enter the market and compete with established players.

Material Limitations and Performance Concerns in End-Use Applications:

Another key challenge lies in material limitations and performance concerns for transparent electronic components. Transparent conductors often face trade-offs between conductivity, transparency, and long-term stability. Their vulnerability to environmental conditions, such as moisture and UV exposure, reduces device lifespan. Integration into automotive, aerospace, and energy systems demands higher durability standards that current materials may not always meet. It slows adoption in critical applications where safety and reliability remain top priorities.

Market Opportunities:

Expanding Role in Renewable Energy and Smart Infrastructure:

The Transparent electronics market presents strong opportunities in renewable energy and sustainable infrastructure development. Transparent solar cells and building-integrated photovoltaics offer dual benefits of energy generation and design flexibility. Governments and private investors are funding projects that integrate smart glass and transparent panels into modern architecture. Healthcare facilities and transportation hubs are adopting transparent electronics to enhance energy efficiency and monitoring capabilities. It strengthens market adoption by aligning with global sustainability and carbon reduction targets.

Adoption in Advanced Consumer Electronics and Automotive Applications:

The Transparent electronics market also benefits from growing demand in consumer electronics and automotive sectors. Transparent displays, touch panels, and sensors are increasingly integrated into smartphones, wearables, and home appliances. Automakers are exploring transparent windshields and heads-up displays to enhance safety and user experience. Smart retail and advertising applications are embracing transparent displays for interactive engagement. It creates profitable opportunities for manufacturers developing flexible, lightweight, and durable transparent components to meet diverse industry needs.

Market Segmentation Analysis:

By Product:

The Transparent electronics market by product includes displays, solar panels, touch panels, and sensors. Displays lead the segment, driven by adoption in smartphones, wearables, and advertising panels. Solar panels are expanding in demand due to the integration of transparent photovoltaics in buildings and infrastructure. Touch panels are widely used in automotive dashboards, smart devices, and consumer electronics. It shows strong potential across industries where transparency and functionality combine to enhance user experience.

- For instance, the EU-funded CitySolar project’s transparent tandem solar cell combines perovskite and organic layers to achieve a record 12.3 percent power conversion efficiency at 30 percent transparency, paving the way for fully functional solar windows.

By Material:

Materials shaping this market include transparent conductive oxides, conductive polymers, and graphene. Transparent conductive oxides remain dominant due to their balance of conductivity and optical clarity. Graphene is gaining momentum for its superior flexibility and durability in next-generation electronics. Conductive polymers are also advancing applications in displays and solar cells. It highlights the role of advanced materials in driving cost efficiency and performance improvements across applications.

By Technology:

Key technologies include transparent thin-film transistors, transparent conductive films, and transparent photovoltaic cells. Transparent thin-film transistors dominate display applications, enabling high-resolution and flexible designs. Transparent conductive films are widely applied in touchscreens, smart windows, and solar cells. Transparent photovoltaic cells are gaining traction in renewable energy integration for buildings and vehicles. It reinforces how technology adoption shapes the versatility and growth of transparent electronics across multiple sectors.

- For instance, LG Display integrated oxide-based transparent thin-film transistors in their 55-inch transparent OLED signage display, achieving a pixel density of 403 pixels per inch (PPI), enhancing image clarity for commercial applications.

Segmentations:

By Product:

- Displays

- Solar Panels

- Touch Panels

- Sensors

- Others

By Material:

- Transparent Conductive Oxides

- Conductive Polymers

- Graphene

- Nanomaterials

- Others

By Technology:

- Transparent Thin-Film Transistors

- Transparent Conductive Films

- Transparent Photovoltaic Cells

- Transparent Sensors

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America:

North America holds 35 % share of the Transparent electronics market, supported by strong adoption in advanced industries. The region benefits from early deployment of transparent displays, solar cells, and automotive applications. High investments in R&D from technology giants strengthen innovation in flexible displays and energy-efficient solutions. Aerospace and defense sectors also contribute by adopting transparent control panels and navigation systems. Government initiatives promoting renewable energy integration enhance market growth. It positions North America as a leading hub for transparent electronics development and commercialization.

Asia Pacific:

Asia Pacific accounts for 32 % share of the Transparent electronics market, driven by its strong electronics manufacturing base. Countries like China, Japan, and South Korea dominate in consumer electronics and semiconductor production. Expanding adoption of transparent OLEDs, solar panels, and heads-up displays fuels regional demand. Local companies and research institutes are advancing nanomaterials and transparent conductive polymers. Rising consumer demand for smart devices further accelerates growth in this region. It establishes Asia Pacific as the fastest-growing market with significant opportunities across end-use industries.

Europe:

Europe captures 22 % share of the Transparent electronics market, supported by advanced research and sustainability initiatives. Regional players are developing transparent photovoltaics and integrating them into smart infrastructure projects. Automotive manufacturers adopt transparent windshields and display systems to improve safety and driver experience. EU policies focused on green energy and innovation funding create favorable conditions for growth. Research institutions and industry collaborations strengthen advancements in transparent conductive materials. It enhances Europe’s position as a competitive and innovative region within the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- 3M Company

- Apple Inc.

- LG Electronics Inc.

- Samsung Electronics Co., Ltd.

- Panasonic Corporation

- Sony Corporation

- Pioneer Corporation

- AU Optronics Corp.

- PolyIC GmbH & Co. KG

- ClearLED Ltd.

- Grafoid Inc.

Competitive Analysis:

The Transparent electronics market is characterized by strong competition among global technology leaders and innovators. Major players include 3M Company, Apple Inc., LG Electronics Inc., Samsung Electronics Co., Ltd., Panasonic Corporation, Sony Corporation, and Pioneer Corporation. These companies focus on advancing transparent displays, solar panels, and conductive films to strengthen their market positions. Strategic investments in research and development help them deliver innovative materials and applications for consumer electronics, automotive, and renewable energy. Partnerships and collaborations with research institutes further accelerate product innovation and commercialization. It reflects a dynamic market where continuous technological progress, brand strength, and product diversification determine competitiveness. Global leaders maintain dominance through large-scale production capabilities, while emerging players compete by offering specialized solutions in flexible and energy-efficient transparent technologies.

Recent Developments:

- In August 2025, LG Electronics Inc. announced new content partnerships at IAA MOBILITY 2025, introducing enhanced in-cabin entertainment and connectivity experiences through its Automotive Content Platform (ACP) powered by webOS, further elevating the digital capabilities of vehicles.

- In August 2025, Samsung Electronics expanded its mobile cloud gaming platform to Europe through new strategic partnerships, resulting in rapid user growth and increased platform adoption.

- In August 2024, Panasonic Connect’s subsidiary Blue Yonder acquired One Network Enterprises, strengthening its position in supply chain management software and analytical solutions.

Market Concentration & Characteristics:

The Transparent electronics market demonstrates moderate concentration, with a mix of established players and emerging innovators shaping competition. Leading companies focus on developing advanced materials such as transparent conductive oxides, polymers, and graphene to support high-performance applications. Startups and research-driven firms play an important role in expanding product portfolios through novel nanomaterials and energy-efficient solutions. It reflects a market characterized by rapid technological advancements, strong R&D investment, and continuous product innovation. Strategic partnerships between manufacturers, research institutes, and government agencies further enhance commercialization. The market also shows high potential in consumer electronics, automotive, aerospace, and renewable energy, making it a dynamic and innovation-driven sector.

Report Coverage:

The research report offers an in-depth analysis based on Product, Material, Technology and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Transparent electronics market will expand with higher adoption in smart consumer devices.

- Transparent OLED and micro-LED technologies will strengthen demand in display applications.

- Automotive integration of transparent windshields and heads-up displays will accelerate industry growth.

- Building-integrated photovoltaics will emerge as a key solution in sustainable construction projects.

- Healthcare applications will grow with transparent sensors and diagnostic devices supporting patient monitoring.

- Continuous material innovation in graphene and polymers will enhance durability and conductivity.

- Strategic collaborations between manufacturers and research institutions will drive faster commercialization of new products.

- Smart retail and advertising will increasingly use transparent displays for interactive consumer engagement.

- Aerospace and defense sectors will adopt transparent systems for advanced navigation and control panels.

- Global sustainability initiatives will create strong opportunities for transparent electronics in renewable energy systems.