Market Overview

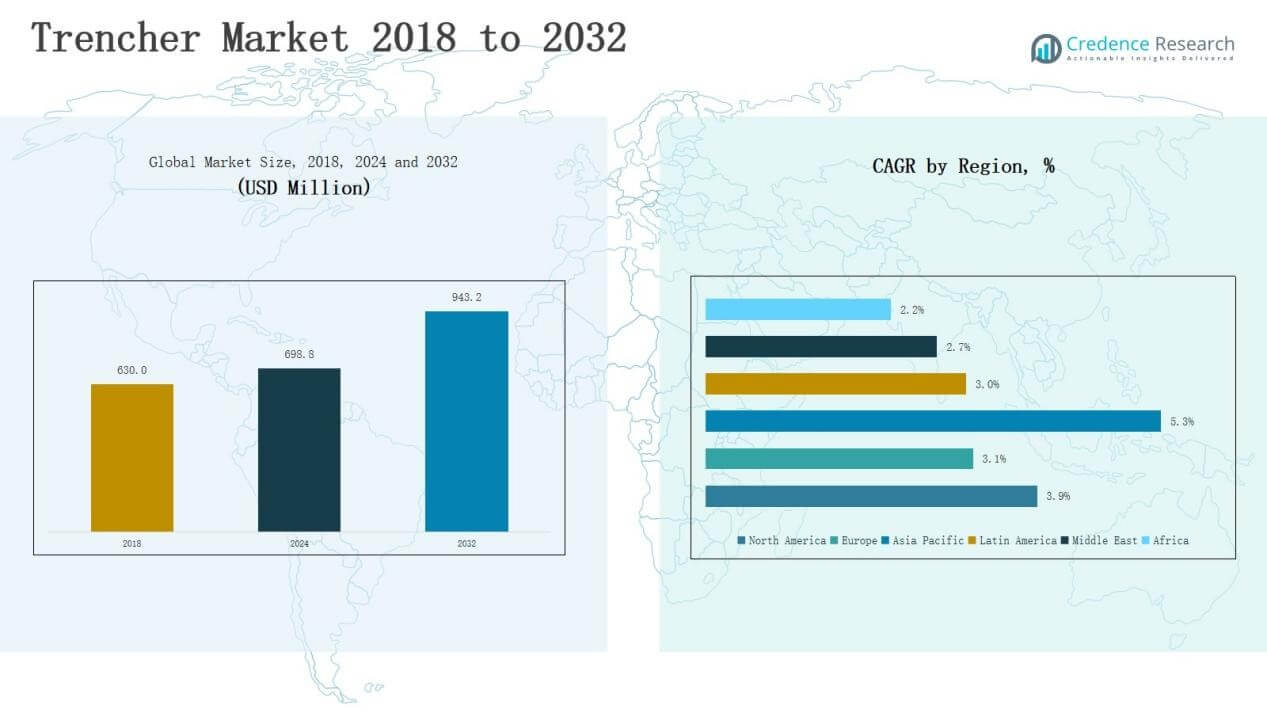

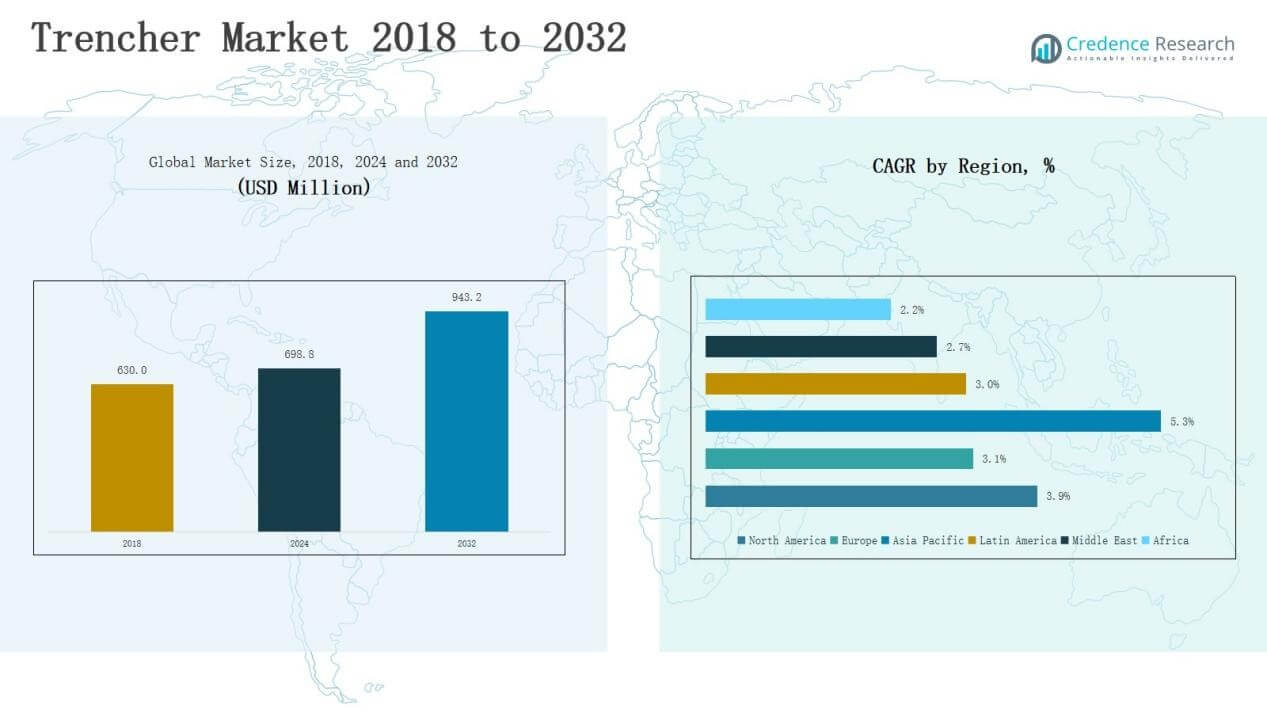

Trencher Market size was valued at USD 630.0 million in 2018 to USD 698.8 million in 2024 and is anticipated to reach USD 943.2 million by 2032, at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Trencher Market Size 2024 |

USD 698.8 Million |

| Trencher Market, CAGR |

3.9% |

| Trencher Market Size 2032 |

USD 943.2 Million |

The Trencher Market is shaped by leading players such as Ditch Witch, Vermeer Corporation, TESMEC S.p.A, The Toro Company, Barreto Manufacturing, Mastenbroek Limited, UNAC SAS, Cleveland Trencher Company, EZ-Trench LLC, and Shandong Gaotang Xinhang Machinery Co. Ltd. These companies compete through advanced product portfolios, strong distribution networks, and innovations in automation and eco-friendly designs. Global leaders focus on R&D and partnerships with telecom and utility sectors, while regional players strengthen competitiveness with cost-effective solutions tailored for local markets. North America leads the Trencher Market with a 34% share in 2024, driven by large-scale infrastructure upgrades, oil & gas pipeline projects, and rapid telecommunication expansion.

Market Insights

- The Trencher Market grew from USD 630.0 million in 2018 to USD 698.8 million in 2024, projected to reach USD 943.2 million by 2032 at 3.9% CAGR.

- Wheel trenchers led with 48% share in 2024, supported by infrastructure and utility projects, while chain trenchers held 37% share, driven by agriculture and telecommunication applications.

- Telecommunication and power cables dominated with 40% share, fueled by fiber optic expansion, while agriculture contributed 25% and oil & gas held 18% share in 2024.

- Direct sales channels accounted for 60% share, favored by large construction firms and utilities, while distribution channels served 40% share, supporting smaller contractors and agricultural users.

- North America led with 34% share in 2024, followed by Asia Pacific at 27% and Europe at 21%, reflecting strong infrastructure upgrades, telecom expansion, and urban development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

Wheel trenchers hold the dominant position with around 48% market share in 2024. Their strong adoption stems from efficiency in cutting through hard soils, rocks, and pavements, making them ideal for infrastructure and utility projects. Chain trenchers follow with 37% share, favored in agriculture and telecommunication cable laying due to their precision and flexibility. Other types contribute the remaining 15%, largely serving niche or specialized applications. Demand for wheel trenchers continues to rise, supported by urban expansion and highway development projects.

- For instance, Vermeer’s T1255III Terrain Leveler has been deployed in U.S. highway expansion projects for precise rock excavation without the need for blasting.

By Application

The telecommunication and power cables segment leads with 40% share, driven by fiber optic expansion and grid modernization. Agriculture accounts for 25%, where trenchers support irrigation systems and drainage channels. Oil & gas represents 18%, with applications in pipeline installation. Municipal utilities capture 12%, mainly for sewage and water line projects, while others make up 5%. Rising digitalization and smart city initiatives ensure telecommunication remains the largest contributor over the forecast period.

- For instance, Saudi Aramco has relied on specialized trenching equipment for its East–West Crude Oil Pipeline expansion, spanning more than 1,200 km.

By Sales Channel

The direct channel dominates with 60% share, as end-users prefer direct purchases for customized machines, after-sales support, and service contracts. Large construction firms and utility companies often negotiate directly with manufacturers to secure bulk orders and technical assurance. The distribution channel holds 40% share, supported by regional dealers catering to small contractors and agricultural users. Direct sales remain the preferred route, especially in developed markets, due to the focus on reliability and long-term partnerships.

Market Overview

Key Growth Drivers

Infrastructure Expansion and Utility Projects

Global investments in infrastructure, including roads, highways, and utility networks, significantly drive trencher demand. Governments prioritize urban development and smart city initiatives, requiring efficient trenching for power lines, drainage systems, and sewage pipelines. Wheel and chain trenchers are favored for their ability to handle diverse terrains, reducing labor costs and project timelines. Rising emphasis on upgrading old infrastructure in developed economies adds further momentum. This strong push from both public and private projects positions trenchers as vital equipment for large-scale developments.

- For instance, Vermeer Corporation has supplied trenchers for Europe’s ongoing fiber-optic broadband expansion, including Germany’s Gigabit Strategy 2030 rollout, where precise trenching supports rapid underground cabling.

Fiber Optic and Telecommunication Deployment

The rapid rollout of fiber optic networks for high-speed internet and 5G expansion is a leading growth driver. Telecom operators require precise trenching to lay underground cables with minimal surface disruption, boosting demand for chain trenchers. Governments in Asia Pacific, North America, and Europe are accelerating broadband penetration, making trenchers indispensable in meeting connectivity goals. With global digitalization and rising reliance on data centers, telecom trenching projects are expected to grow steadily, creating long-term opportunities for equipment suppliers.

- For instance, Crown Castle utilized microtrenching technology in Los Angeles to lay 3,000 feet of fiber in just one week, markedly reducing deployment time compared to traditional methods

Mechanization in Agriculture

Agriculture represents another critical growth area, where trenchers support irrigation, drainage, and water management systems. Growing adoption of mechanized farming in developing economies increases reliance on trenching machines for efficiency and crop yield improvement. Wheel and chain trenchers are used to create channels for drip irrigation and subsurface drainage, reducing manual labor dependency. Rising government initiatives to modernize farming and enhance water conservation techniques further support market growth. This trend ensures agriculture remains a consistent contributor to trencher adoption.

Key Trends & Opportunities

Shift Toward Compact and Eco-Friendly Designs

A major trend in the trencher market is the shift toward compact, fuel-efficient, and eco-friendly models. Manufacturers are introducing electric and hybrid trenchers to meet sustainability goals and stricter emission norms. Compact trenchers also appeal to small contractors and municipal users due to their versatility in urban areas with limited space. This trend opens opportunities for innovation and market differentiation, especially in Europe and North America, where environmental regulations and urban projects shape demand.

- For instance, Vermeer launched the RTX1250i2 ride-on tractor with SmartTEC performance software, improving fuel efficiency while complying with Tier 4 Final emissions.

Integration of Automation and Telematics

Automation and telematics integration are transforming trenchers into smart, connected machines. Advanced models now feature GPS-based controls, real-time performance tracking, and predictive maintenance systems. These technologies reduce downtime, optimize fuel use, and improve operator productivity. Contractors value automation for precision trenching and cost savings, particularly in telecom and oil & gas projects. The growing demand for connected construction equipment creates opportunities for manufacturers to build long-term partnerships with utility providers and infrastructure firms.

- For instance, Caterpillar’s Product Link telematics has been widely adopted across its construction equipment range—including utility trenching machines—to provide real-time fuel usage, idle time reports, and geofencing features.

Key Challenges

High Equipment Costs

The high initial investment required for trenchers remains a significant barrier, especially for small contractors and agricultural users. Advanced wheel and chain trenchers equipped with automation and eco-friendly features further increase purchase prices. Many potential users rely on rentals or second-hand equipment, which limits new unit sales. Although financing options and leasing programs are available, affordability continues to constrain adoption, particularly in developing markets where budget constraints prevail.

Operational and Maintenance Complexity

Trenchers require skilled operators and regular maintenance to function effectively, posing challenges for many end-users. Breakdowns during critical projects result in costly delays and downtime. Spare part availability and service support, especially in remote regions, further complicate ownership. Smaller firms often lack trained personnel to operate advanced models with automation or telematics. This operational complexity reduces efficiency and discourages widespread adoption among contractors and agricultural users with limited technical expertise.

Environmental and Regulatory Restrictions

Environmental regulations regarding noise, emissions, and land disruption increasingly affect trencher deployment. Governments impose restrictions on construction activities in urban and ecologically sensitive areas, limiting usage. Traditional fuel-powered trenchers face growing pressure to comply with stricter emission standards, raising compliance costs for manufacturers. Noise pollution concerns in urban projects also restrict adoption, driving demand for quieter alternatives. These regulatory hurdles create challenges for market players, pushing them to invest heavily in sustainable and compliant product development.

Regional Analysis

North America

North America leads the trencher market with a 34% share in 2024, supported by large-scale infrastructure upgrades, urban development, and telecommunication expansion. The market size grew from USD 253.4 million in 2018 to USD 278.1 million in 2024 and is projected to reach USD 374.8 million by 2032, reflecting a CAGR of 3.9%. Strong adoption of advanced wheel and chain trenchers in the U.S. and Canada underpins this growth. Rising demand for efficient equipment in oil & gas pipelines and 5G network deployment further sustains the region’s leadership.

Europe

Europe accounts for a 21% share in 2024, driven by infrastructure modernization, renewable energy installations, and utility upgrades. The market expanded from USD 161.5 million in 2018 to USD 172.0 million in 2024, and it is expected to reach USD 219.0 million by 2032, at a CAGR of 3.1%. Germany, France, and the UK dominate demand due to investments in broadband connectivity and municipal projects. Environmental regulations encourage adoption of eco-friendly and compact trenchers, particularly in urban construction zones. Europe maintains steady growth through its focus on sustainability and precision trenching technologies.

Asia Pacific

Asia Pacific holds a 27% share in 2024 and emerges as the fastest-growing region with a CAGR of 5.3%. The market increased from USD 128.5 million in 2018 to USD 150.1 million in 2024, with projections reaching USD 226.7 million by 2032. China, India, and Southeast Asia drive growth through rapid urbanization, telecom expansion, and mechanized agriculture adoption. Governments prioritize large-scale infrastructure development and rural electrification, spurring demand for trenchers. This region benefits from rising construction activity and expanding fiber optic networks, positioning it as a key growth hub for manufacturers.

Latin America

Latin America contributes a 7% share in 2024, supported by infrastructure growth, oil & gas activities, and municipal development projects. The market expanded from USD 45.4 million in 2018 to USD 49.9 million in 2024 and is projected to reach USD 63.1 million by 2032, at a CAGR of 3.0%. Brazil leads the region with investments in energy and utility networks, followed by Argentina’s push for agricultural mechanization. While the region’s growth is modest, opportunities lie in government-backed connectivity projects and the adoption of affordable compact trenchers for mid-scale contractors.

Middle East

The Middle East represents a 5% share in 2024, with moderate growth tied to oil & gas pipeline projects and municipal developments. The market grew from USD 26.6 million in 2018 to USD 27.9 million in 2024, and it is forecast to reach USD 34.3 million by 2032, at a CAGR of 2.7%. GCC countries dominate with large-scale energy infrastructure and urban construction initiatives, while Israel and Turkey show rising adoption in telecom trenching. Despite reliance on energy projects, the shift toward diversified economies sustains the region’s steady demand for trenching equipment.

Africa

Africa accounts for a 6% share in 2024, with growth led by municipal and agricultural applications. The market expanded from USD 14.6 million in 2018 to USD 20.9 million in 2024, and it is projected to reach USD 25.4 million by 2032, reflecting a CAGR of 2.2%. South Africa leads with infrastructure upgrades, while Egypt invests in utility and telecommunication networks. Adoption is slower compared to other regions due to high equipment costs and limited operator expertise. However, government focus on rural electrification and irrigation projects sustains gradual market expansion.

Market Segmentations:

By Type

- Wheel Trencher

- Chain Trencher

- Other Types

By Application

- Agriculture

- Oil & Gas

- Telecommunication & Power Cables

- Municipal

- Others

By Sales Channel

- Direct Channel

- Distribution Channel

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The trencher market features a moderately consolidated structure, with global and regional players competing on technology, product range, and service support. Leading companies such as Ditch Witch, Vermeer Corporation, TESMEC S.p.A, The Toro Company, and Barreto Manufacturing dominate through strong distribution networks and advanced product portfolios. These firms invest heavily in R&D to develop efficient, eco-friendly, and automated trenchers that meet evolving customer needs across telecom, utilities, and agriculture. Regional manufacturers, including Mastenbroek Limited, UNAC SAS, and Shandong Gaotang Xinhang Machinery, strengthen their presence by offering cost-effective models tailored for local markets. Competition is further shaped by after-sales services, rental options, and financing programs that improve accessibility for small contractors and agricultural users. Strategic partnerships with telecom operators, oil & gas firms, and municipal bodies enhance market reach. Innovation in compact, electric, and telematics-enabled trenchers is becoming a key differentiator, positioning technology-driven players to capture long-term growth opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Ditch Witch

- Vermeer Corporation

- TESMEC S.p.A

- Wolfe Equipment

- Barreto Manufacturing, Inc.

- Cleveland Trencher Company, Inc.

- Inter-Drain Sales BV

- EZ-Trench, LLC

- Port Industries

- UNAC SAS

- The Toro Company

- Guntert & Zimmerman Const. Div., Inc.

- Mastenbroek Limited

- Shandong Gaotang Xinhang Machinery Co. Ltd.

Recent Developments

- In August 2025, Ditch Witch, a division of The Toro Company, sold its Trencor trencher product line along with the American Augers auger boring category.

- In February 2025, Barreto Manufacturing revealed four new products in their lineup, including the 30RTK Track trencher, enhancing their market offering.

- In August 2024, Dover Corporation acquired Paladin Brands Holding, Inc., strengthening its infrastructure solutions with Paladin’s trencher innovations and product portfolio.

- In February 2025, GridSource Incorporated, LLC acquired B. Robinson, Inc., a Texas-based company specializing in micro-trenching, to expand its service reach across the Southeast and Southwest U.S.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for trenchers will rise with increasing investments in global infrastructure projects.

- Expansion of fiber optic and 5G networks will continue to drive equipment adoption.

- Mechanization in agriculture will create steady demand for trenchers in irrigation and drainage.

- Compact and eco-friendly trenchers will gain preference in urban and regulated markets.

- Integration of automation and telematics will enhance efficiency and operator productivity.

- Rental and leasing models will expand, supporting small contractors and agricultural users.

- Emerging economies in Asia Pacific will become key growth hubs for manufacturers.

- Partnerships with telecom and utility companies will strengthen distribution and market reach.

- After-sales services and financing support will remain critical competitive differentiators.

- Regulatory focus on emissions and noise reduction will accelerate innovation in sustainable designs.